Compare Virginia Car Insurance Rates [2025]

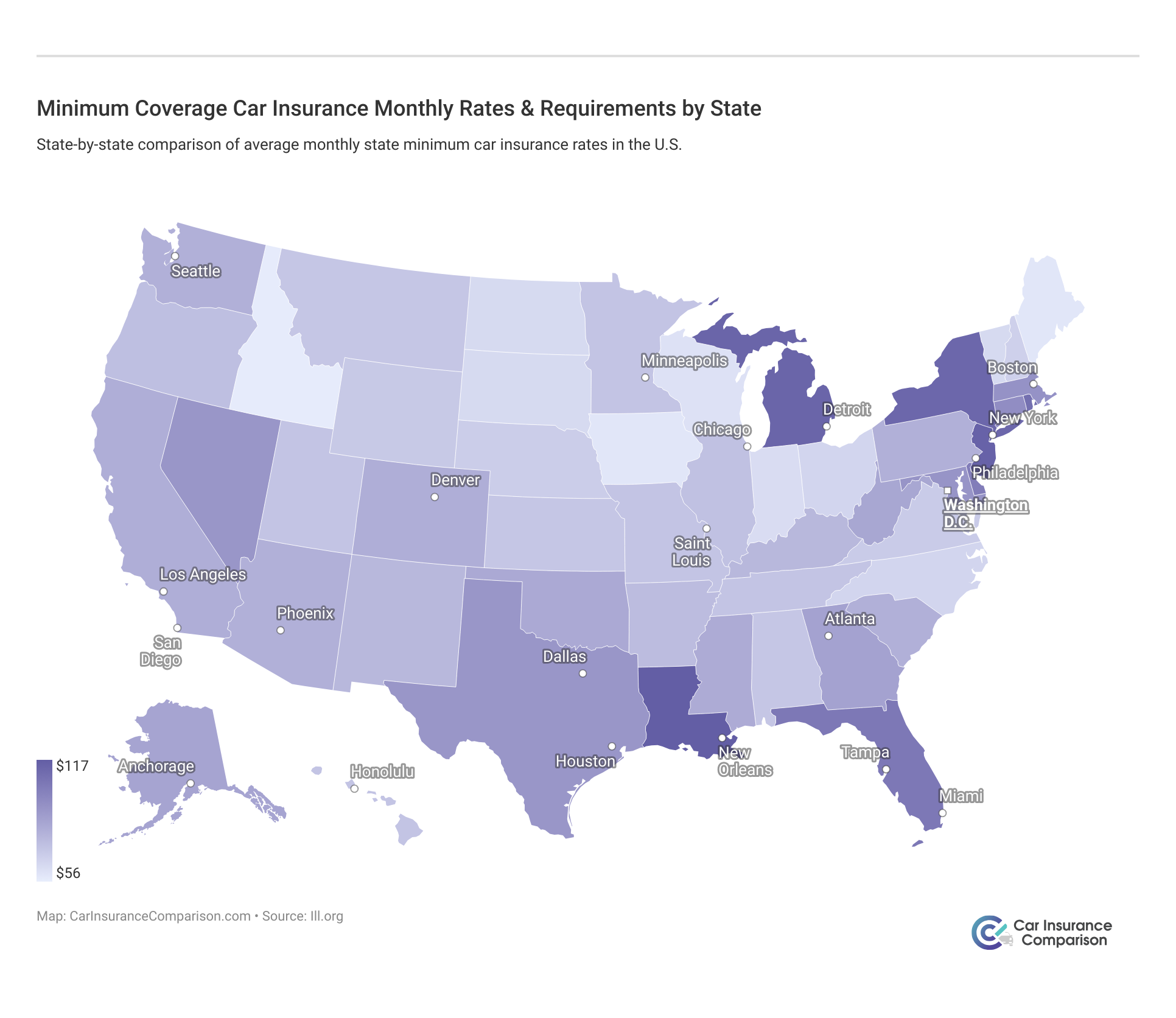

The cost of auto insurance per month in Virginia is $70 on average, and state car insurance requirements are 25/50/20 for liability coverage. Carrying full coverage will be more expensive, so compare Virginia car insurance rates across multiple companies to get the best price on your policy.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Jeffrey Manola

Licensed Insurance Agent

Jeffrey Manola is an experienced insurance agent who founded TopQuoteLifeInsurance.com and NoMedicalExamQuotes.com. His mission when creating these sites was to provide online consumers searching for insurance with the most affordable rates available. Not only does he strive to provide consumers with the best prices for insurance coverage, but he also wants those on the market for insurance to ...

Licensed Insurance Agent

UPDATED: May 13, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance company and cannot guarantee quotes from any single company.

Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from top car companies please enter your ZIP code above to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: May 13, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance company and cannot guarantee quotes from any single company.

Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from top car companies please enter your ZIP code above to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

| Virginia Summary Statistics | Details |

|---|---|

| Road Miles | Total In State: 75,061 Vehicle Miles Driven: 81 billion |

| Vehicles | Registered In State: 6.96 million Total Stolen: 4,486 |

| State Population | 8,517,685 |

| Most Popular Vehicle | Honda CR-V |

| Uninsured Motorists | 9.90% Rank: 34th |

| Total Driving Fatalities | 2008 - 2017 Speeding: 2,031 Drunk Driving: 2,316 |

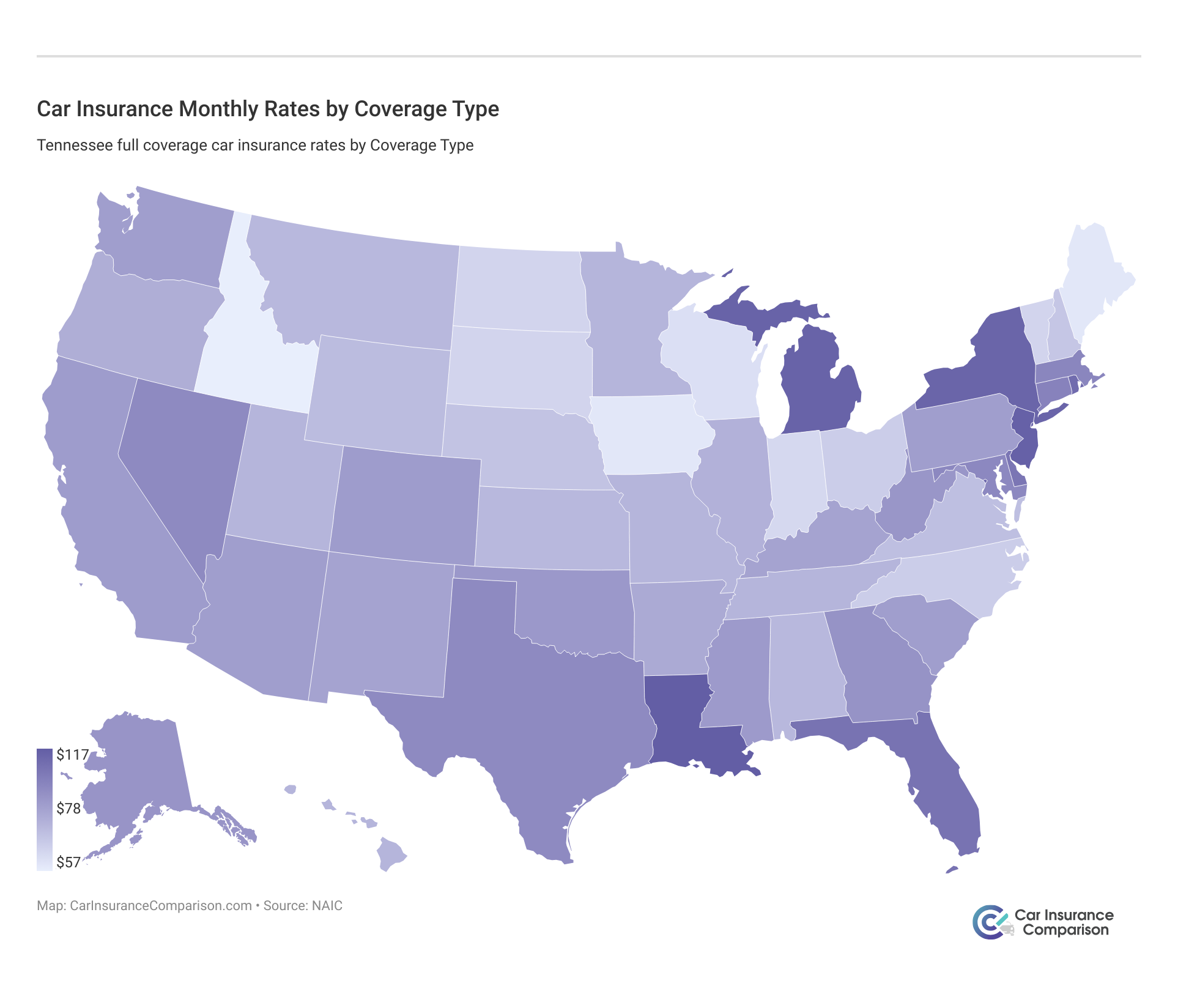

| Average Annual Premiums | Liability: $425/yr Collision: $280/yr Comprehensive: $136/yr Average Full Coverage Rates: $841/yr |

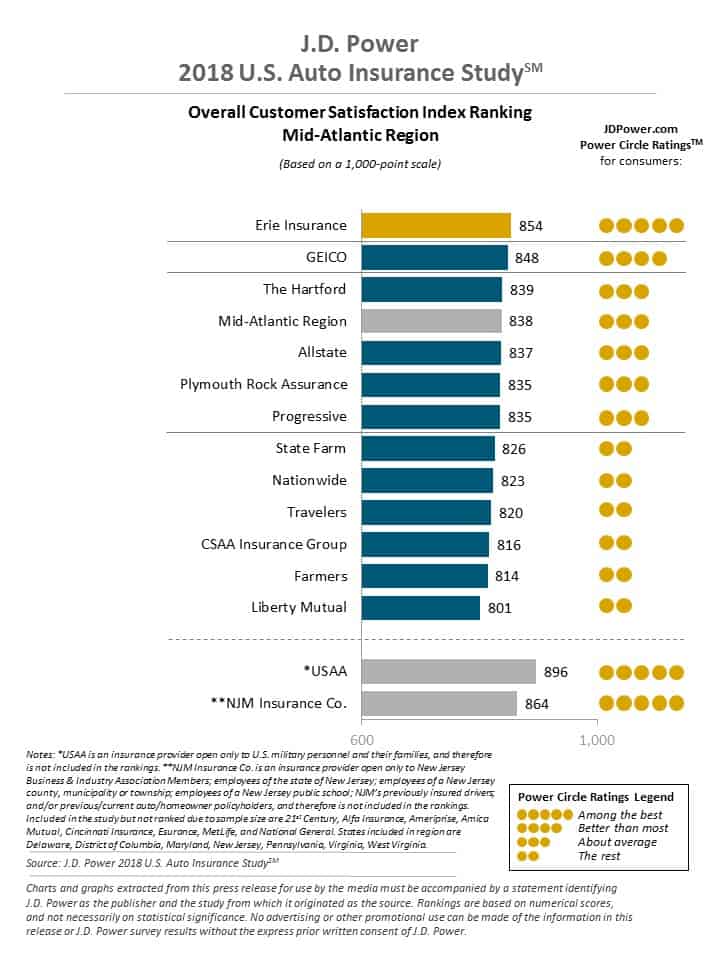

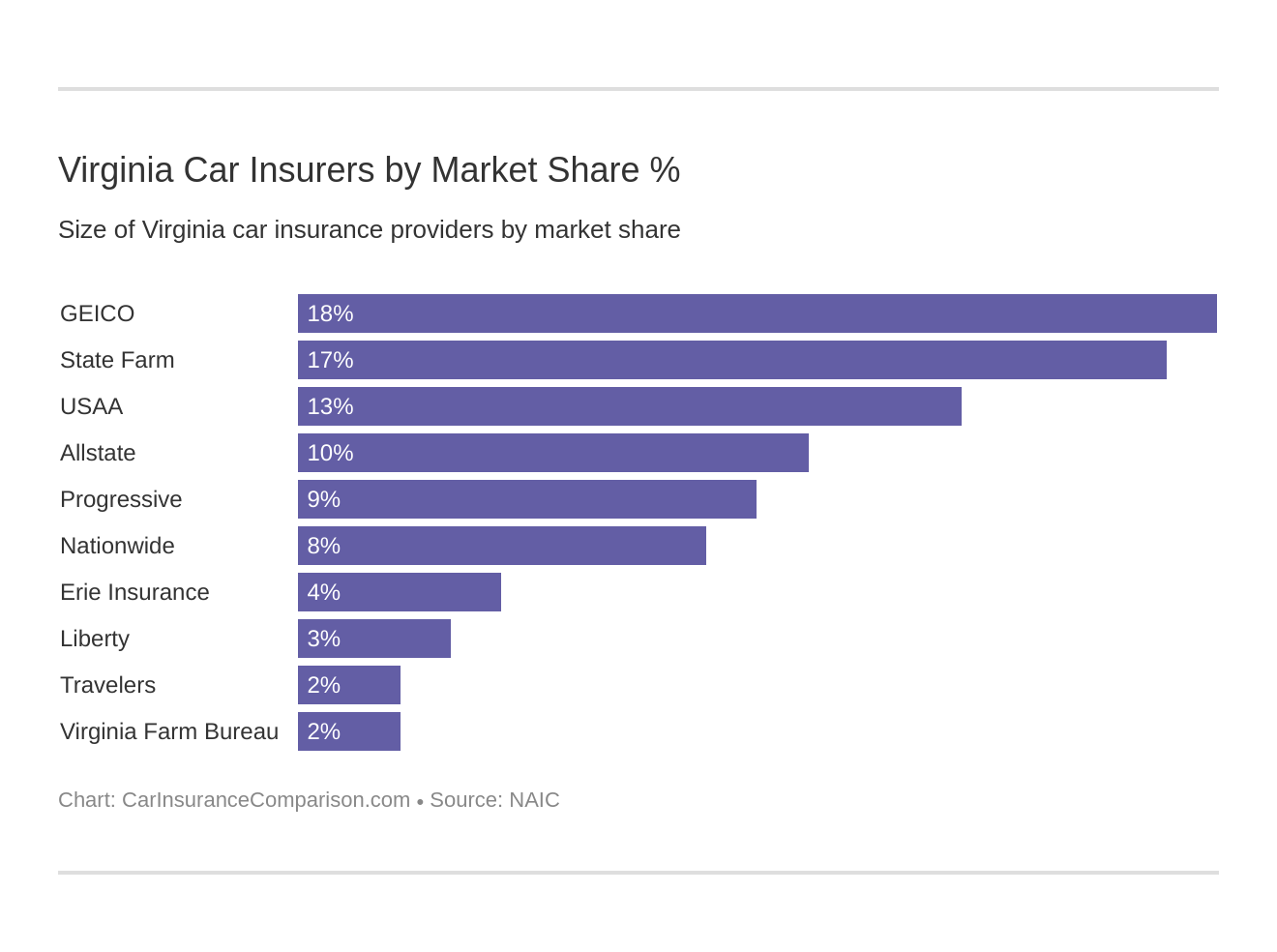

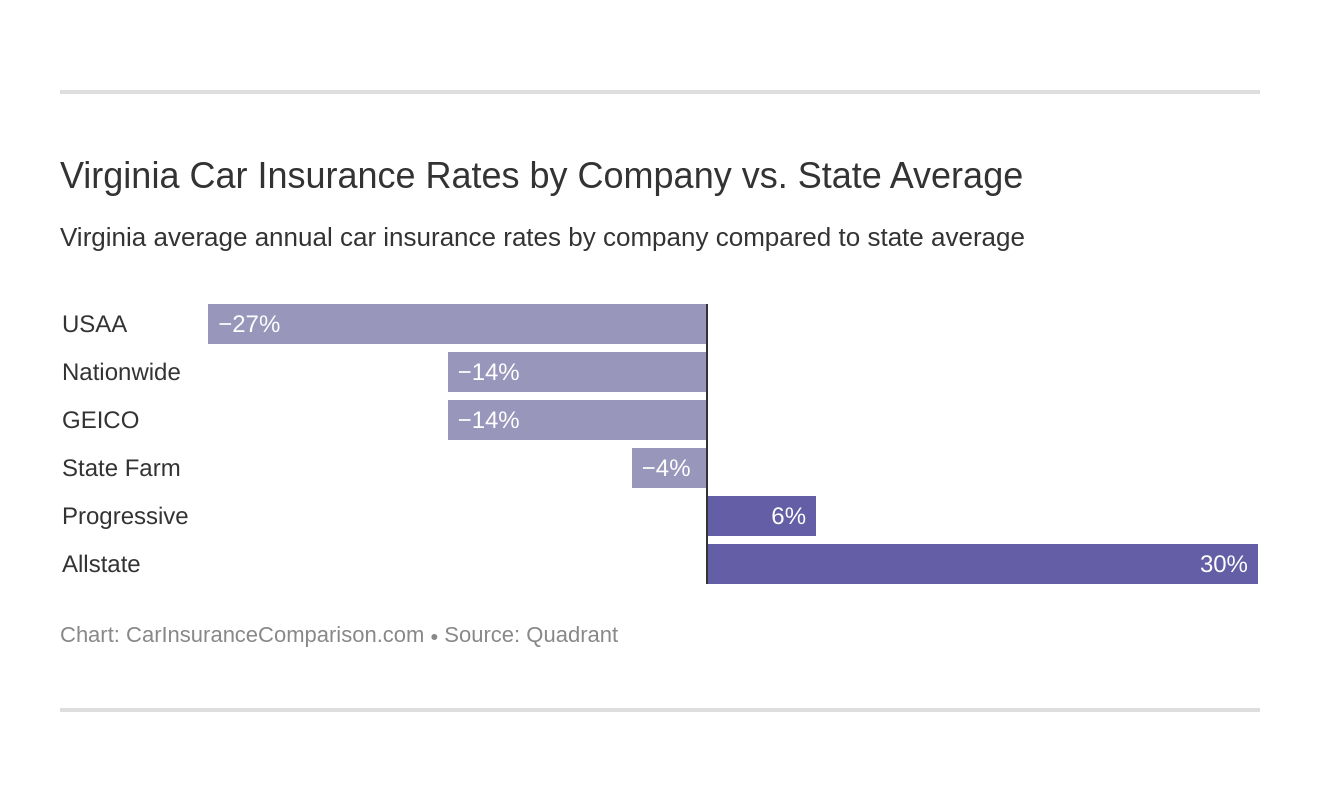

| Cheapest Providers | Nationwide and USAA |

Virginia may be for lovers, but there’s nothing to love about high car insurance rates. Auto insurance isn’t required in Virginia, and insured drivers often suffer the consequences by paying more for coverage.

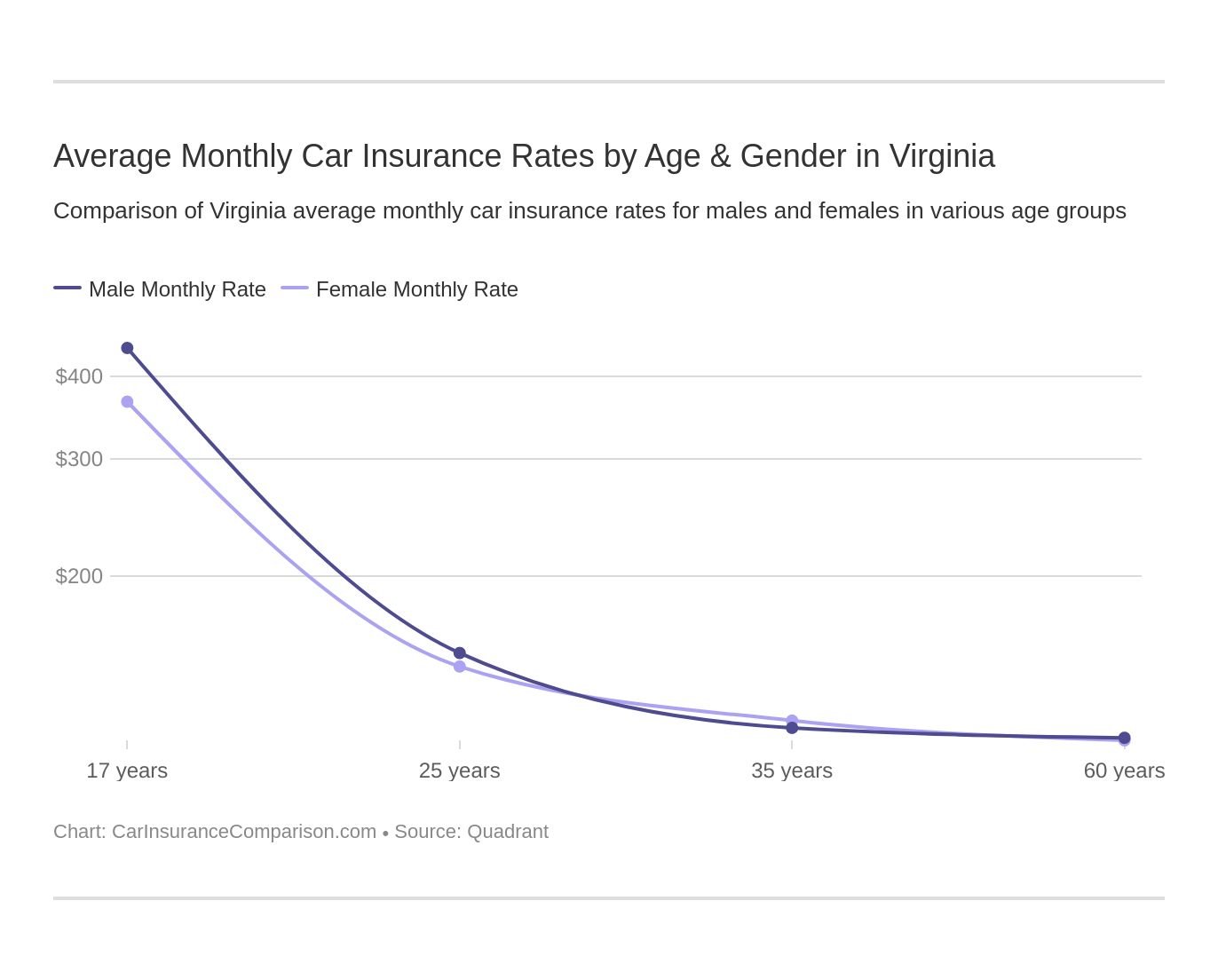

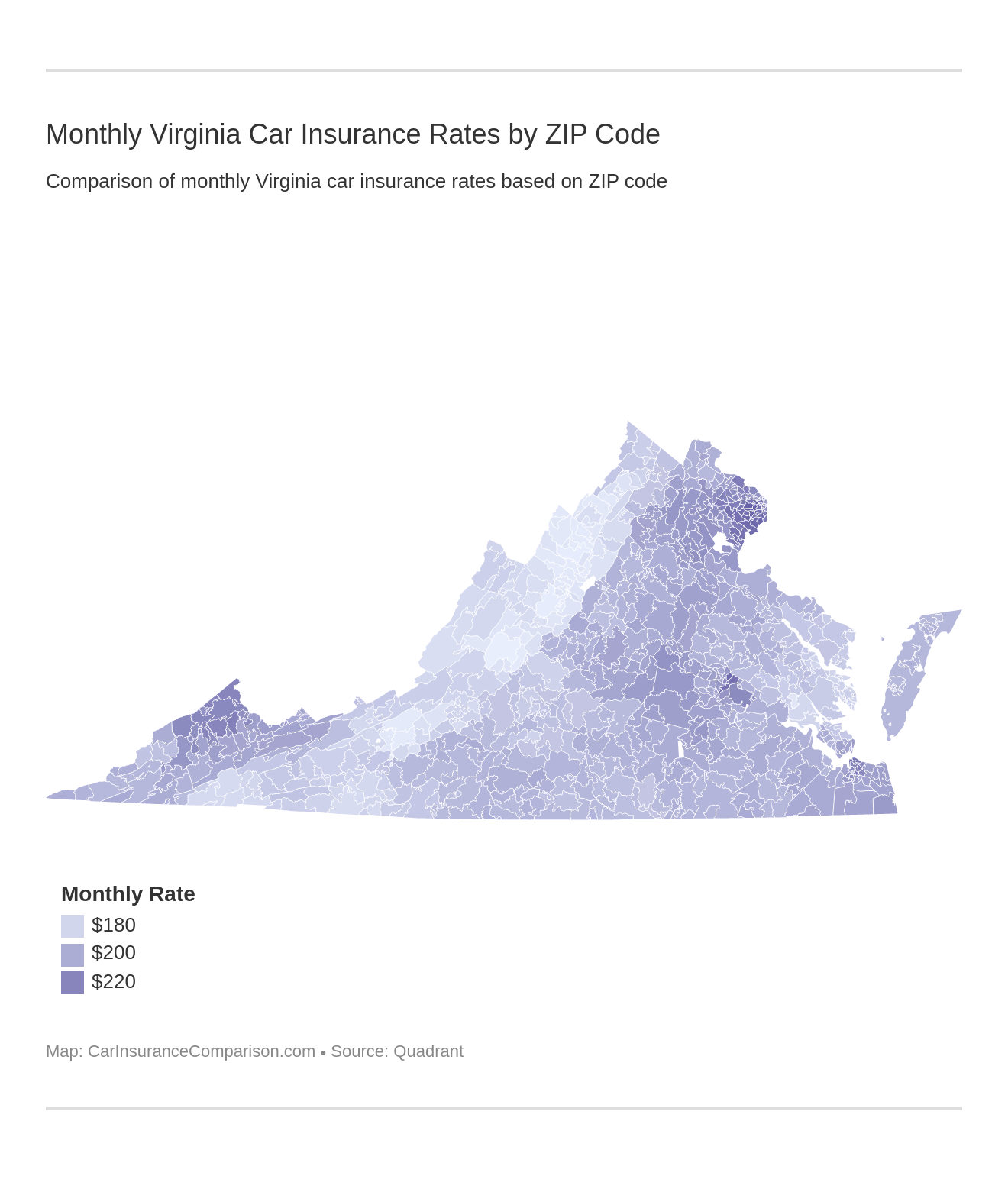

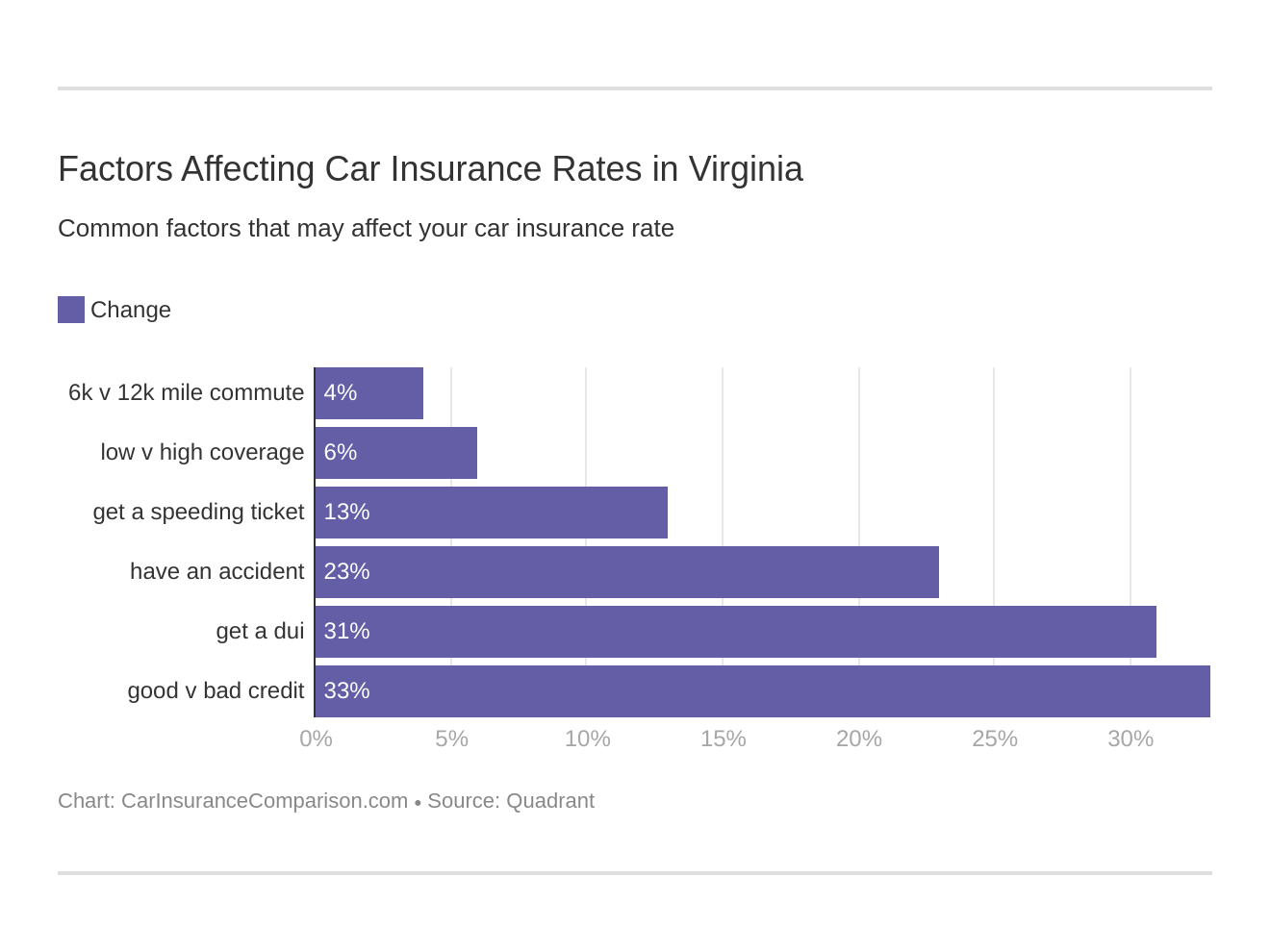

You can buy liability insurance in Virginia for around $70 per month, but comparing Virginia car insurance rates from multiple companies will get you the best price possible. Where you live is one of the factors that affect car insurance rates, so compare quotes by city or ZIP code to get the most affordable Virginia insurance.

Everything you need to know about buying cheap car insurance in Virginia, including how to compare Virginia car insurance rates, is in this comprehensive guide.

Compare Virginia Car Insurance Rates and Coverage

The median household income in Virginia in 2017 was over $71,535, and drivers, on average paid over $843 for car insurance. There’s certainly nothing to love about that. We think consumers in the Old Dominion State are spending way too much money on car insurance. There has to be a better way to find cheap car insurance.

Minimum Coverage Requirements in Virginia

Below, we have provided information and helpful advice so you can get the best coverage options for your needs.

| INSURANCE REQUIRED | MINIMUM LIMITS: 25/50/20 |

|---|---|

| Bodily Injury Liability | $25,000 per person $50,000 per accident |

| Property Damage Liability | $20,000 |

- Car Insurance Rates in Virginia

- Compare Woodstock, VA Car Insurance Rates [2025]

- Compare Woodford, VA Car Insurance Rates [2025]

- Compare Williamsburg, VA Car Insurance Rates [2025]

- Compare South Hill, VA Car Insurance Rates [2025]

- Compare Salem, VA Car Insurance Rates [2025]

- Compare Rocky Mount, VA Car Insurance Rates [2025]

- Compare Honaker, VA Car Insurance Rates [2025]

- Compare Henrico, VA Car Insurance Rates [2025]

- Compare Floyd, VA Car Insurance Rates [2025]

- Compare Duffield, VA Car Insurance Rates [2025]

- Compare Chesterfield, VA Car Insurance Rates [2025]

- Compare Charlottesville, VA Car Insurance Rates [2025]

- Compare Bristol, VA Car Insurance Rates [2025]

- Compare Blacksburg, VA Car Insurance Rates [2025]

- Compare Abingdon, VA Car Insurance Rates [2025]

- Compare Hampton, VA Car Insurance Rates [2025]

- Compare Richmond, VA Car Insurance Rates [2025]

The basic coverage requirements in Virginia which all motorists must have for liability insurance are:

- $25,000 to cover the death or injury per person

- $50,000 to cover the total death or injury per accident

- $20,000 to cover property damage per accident

Liability car insurance pays all individuals (drivers, passengers, pedestrians, etc.) who are owed compensation for property damage and/or injuries resulting from a car accident that you or anyone under your policy causes. If you cause a wreck, liability insurance pays everyone affected by the accident.

Required Forms of Financial Responsibility in Virginia

What is financial responsibility? Basically, financial responsibility is proof that you have Virginia’s minimum liability coverage.

How much car insurance do you need? State law requires every driver and owner of a vehicle to have proof of financial security at all times. Here are a few acceptable forms of proof of financial security in Virginia:

- Valid Insurance ID Card

- Electronic proof on a smartphone

- Proof that you paid the UMV fee

According to the Virginia DMV, the $500 Uninsured Motor Vehicle (UMV) fee only allows you to drive an uninsured vehicle at your own risk.

It expires with your registration and must be paid at renewal. You might be wondering, “Can I drive an uninsured car on my insurance policy? If you are driving an uninsured vehicle and are involved in an accident, the other driver may notify the DMV that your vehicle is uninsured as part of reporting the accident.

Premiums as Percentage of Income in Virginia

In Virginia, the per capita disposable income is $43,904. On average, residents spend $843 a year on car insurance. To put this amount in perspective, the countrywide, annual average for car insurance is $981. This means people in Virginia pay less than the countrywide average and less than neighboring states, New York and Pennsylvania who pay yearly amounts of $1,328 and $953, respectively.

You can also use our calculator to know how much you’re spending on premiums. Compare monthly car insurance for more information.

Frequently Asked Questions

What is the average cost of car insurance in Virginia?

Average rates are $841 per year or $70 per month.

What is the recommended car insurance coverage in Virginia?

The minimum requirements are 25/50/20 for bodily injury and property damage coverage.

How can I compare Virginia car insurance rates?

Use our free quote tool to compare quotes from top companies and save. Just enter your ZIP code to get started.

What forms of financial responsibility are acceptable in Virginia?

Proof of insurance or payment of the $500 Uninsured Motor Vehicle (UMV) fee.

How do Virginia car insurance rates compare to other states?

Virginia residents pay less than the national average for car insurance.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

Jeffrey Manola

Licensed Insurance Agent

Jeffrey Manola is an experienced insurance agent who founded TopQuoteLifeInsurance.com and NoMedicalExamQuotes.com. His mission when creating these sites was to provide online consumers searching for insurance with the most affordable rates available. Not only does he strive to provide consumers with the best prices for insurance coverage, but he also wants those on the market for insurance to ...

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.