Compare New York Car Insurance Rates [2026]

Car insurance in New York tends to be cheaper than the national average, with full coverage costing $149 per month. However, rates vary notably by ZIP code, so you might see higher New York car insurance rates. The best way to find affordable coverage is to compare New York car insurance rates.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Licensed Insurance Agent

Brandon Frady has been a licensed insurance agent and insurance office manager since 2018. He has experience in ventures from retail to finance, working positions from cashier to management, but it wasn’t until Brandon started working in the insurance industry that he truly felt at home in his career. In his day-to-day interactions, he aims to live out his business philosophy in how he treats hi...

Brandon Frady

Licensed Insurance Agent

Daniel Walker graduated with a BS in Administrative Management in 2005 and has run his family’s insurance agency, FCI Agency, for over 15 years (BBB A+). He is licensed as an insurance agent to write property and casualty insurance, including home, life, auto, umbrella, and dwelling fire insurance. He’s also been featured on sites like Reviews.com and Safeco. To ensure our content is accura...

Daniel Walker

Updated May 2024

| New York Statistics Summary | Details |

|---|---|

| Road Miles in New York | Vehicle Miles: 127.2 billion Miles of Roadway: 114,365 |

| Vehicles | Registered Vehicles: 10.3 million Motor Vehicle Thefts: 15,313 |

| State Population | 19,819,347 |

| Most Popular Vehicle in New York | Nissan Rogue |

| Percent of Motorists Uninsured | 6.10% State Rank: 50 |

| Total Driving Related Deaths | 2008-2017 Speeding Fatalities: 308 Drunk Driving Fatalities: 295 |

| Average Annual Premiums | Liability: $804.51 Collision: $385.02 Comprehensive: $171.12 |

| Cheapest Provider | Geico |

- New York car insurance costs an average of $149 per month, but some ZIP codes have higher rates

- Finding affordable car insurance in New York is hardest in New York City, where rates can cost nearly triple the state average

- To find the best car insurance in New York, drivers should compare rates, find discounts, and choose the right amount of coverage

Car insurance in New York tends to cost drivers less than the national average. At $149 per month for full coverage insurance, New York car insurance quotes can be surprisingly affordable.

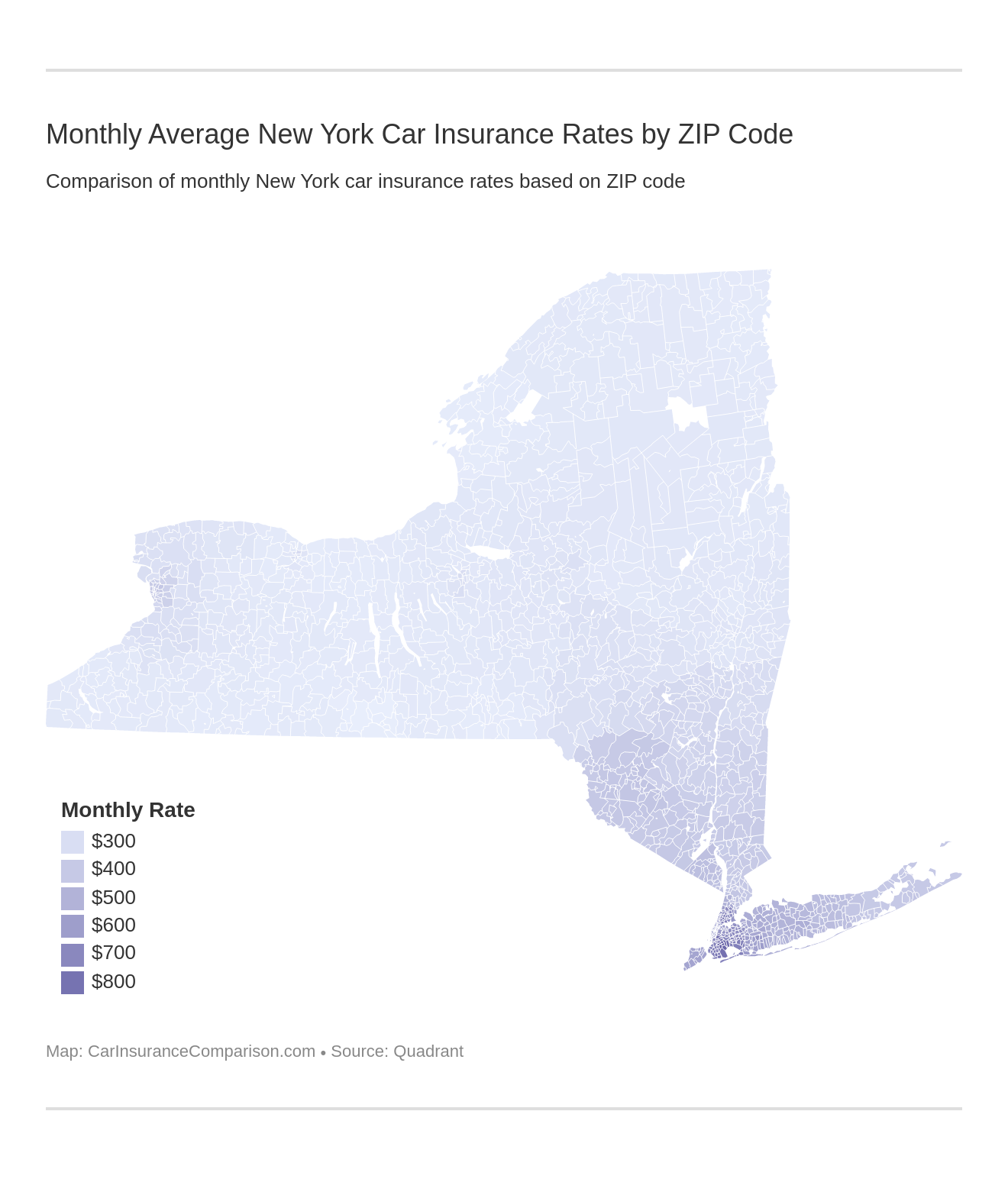

Although average New York car insurance rates are low, the amount you’ll pay depends on several factors, including your location. Some ZIP codes have higher average rates than others — for example, drivers in New York City pay an average of $281 per month.

Read on to learn the best place to find low car insurance quotes in New York, including which companies might have the lowest rates for you. Then, compare New York car insurance rates from multiple companies to find the right policy for you.

Compare New York Car Insurance Rates

If you have an idea about the minimum coverage requirements, available coverage options, and rates in your ZIP code, chances are you will be able to get a quote that’s suitable for your needs

.As we can see above, location, location, location is everything when it comes to determining your rates. Also, if you’re new to New York, you can choose a ZIP code to live in that would help you minimize the cost of premiums – we understand that’s not the sole criterion for choosing an apartment anywhere. However, in a city like Manhattan, it can save you thousands of dollars.

Now, let’s get into the details that matter the most.

- Car Insurance Rates in New York

- Compare Woodstock, NY Car Insurance Rates [2026]

- Compare Unadilla, NY Car Insurance Rates [2026]

- Compare Troy, NY Car Insurance Rates [2026]

- Compare South Salem, NY Car Insurance Rates [2026]

- Compare Schroon Lake, NY Car Insurance Rates [2026]

- Compare Schoharie, NY Car Insurance Rates [2026]

- Compare Rhinebeck, NY Car Insurance Rates [2026]

- Compare Oswego, NY Car Insurance Rates [2026]

- Compare New Hyde Park, NY Car Insurance Rates [2026]

- Compare Mount Vernon, NY Car Insurance Rates [2026]

- Compare Morris, NY Car Insurance Rates [2026]

- Compare Irving, NY Car Insurance Rates [2026]

- Compare Glen Cove, NY Car Insurance Rates [2026]

- Compare Florida, NY Car Insurance Rates [2026]

- Compare Fine, NY Car Insurance Rates [2026]

- Compare Ellenville, NY Car Insurance Rates [2026]

- Compare Clifton Park, NY Car Insurance Rates [2026]

- Compare Center Moriches, NY Car Insurance Rates [2026]

- Compare Catskill, NY Car Insurance Rates [2026]

- Best Buffalo, NY Car Insurance in 2026 (Your Guide to the Top 10 Companies)

- Compare Binghamton, NY Car Insurance Rates [2026]

- Compare Amenia, NY Car Insurance Rates [2026]

- Compare New York City, NY Car Insurance Rates [2026]

New York Car Insurance Requirements

New York is a no-fault car insurance state which means that your insurance carrier would pay for the damages in an accident irrespective of who was at fault.

The financial outlay required after an accident to cover damages is paid from the Personal Injury Protection (PIP) coverage that motorists in New York have to carry with their car insurance policy.

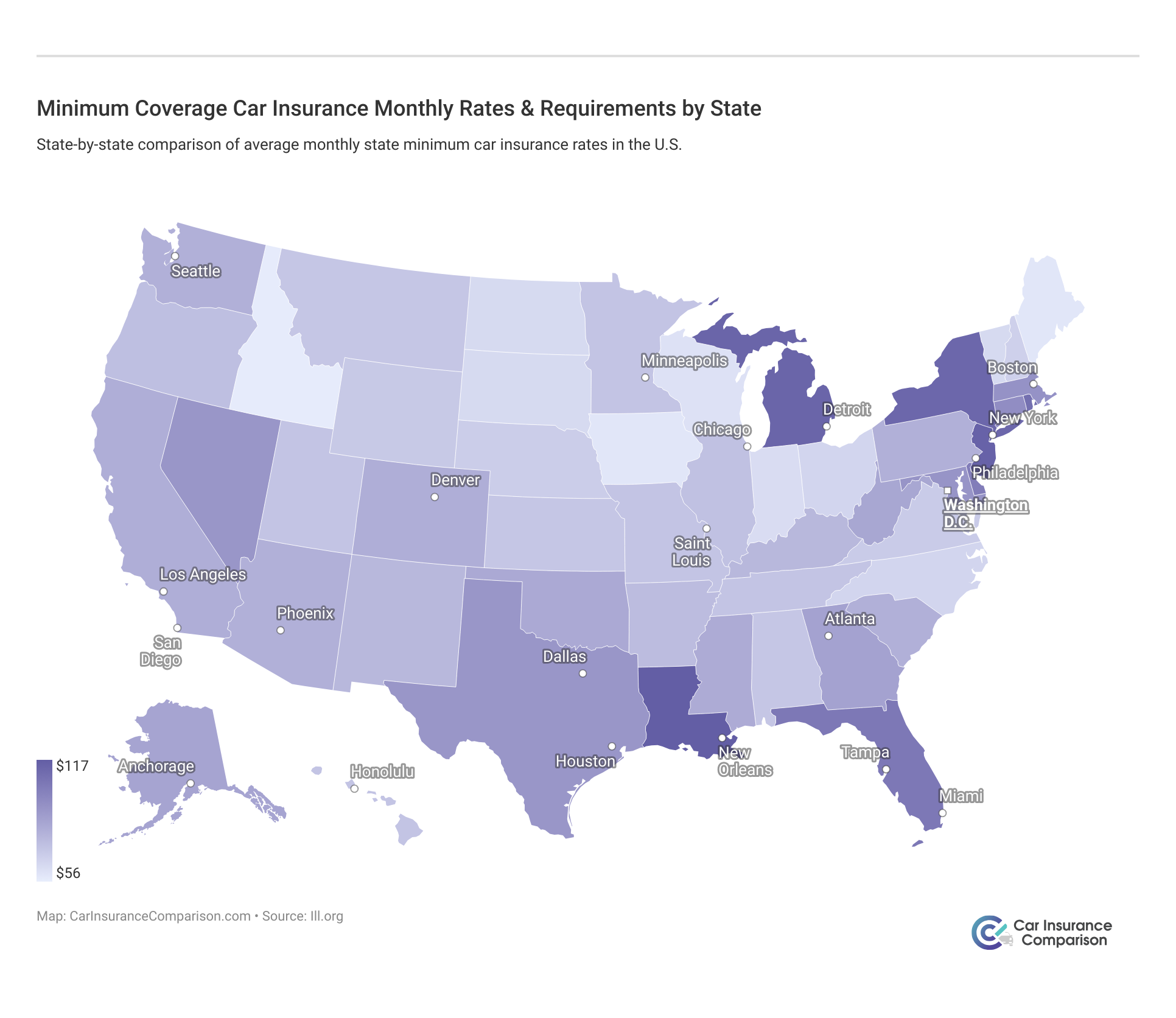

But how do the minimum car insurance costs in New York compare with its continental neighbors? See our chart below!

We would cover the different types of auto insurance coverage that you must know about, but before that, let’s look at the state-mandated coverage that you are required to buy.

- Personal injury Liability Coverage: $25,000 per person with a maximum of $50,000 per accident

- Liability Coverage for Death: $50,000 per person with a maximum of $100,000 per accident

- Property Damage Liability Coverage: $10,000 per accident

- Personal Injury Protection: $50,000 per person

- Uninsured Motorist Coverage: $25,000 per person with a maximum of $50,000 per accident

What do these coverage options mean?

- Liability Coverage: Liability car insurance covers the harm you cause in an accident that might lead to expenses on account of personal injury and property damage. In New York, there’s a higher liability limit if the accident leads to death/deaths of passengers.

- No-Fault or Personal Injury Protection Coverage: PIP pays for the medical expenses, lost earnings, and other reasonable expenses due to an injury to you or other passengers in the car or pedestrians, irrespective of your fault.

- Uninsured Motorist Coverage: If you’re hit by a motorist who isn’t covered by insurance, then your uninsured coverage would pay for the damages in that accident.

In most of the states — that follow the at-fault system — motorists aren’t required to buy PIP coverage. This might save you some money on a monthly basis, however, in the event of an accident, PIP really saves your day.

As New York follows the no-fault system, motorists aren’t allowed to bring a lawsuit against the at-fault party in an accident, unless they sustain a serious injury as defined in the New York Insurance Law §5102(d).

What is considered a serious injury that would allow someone to sue the at-fault party?

- Death

- Dismemberment

- Broken Bone

- Fetus Loss

- Major Disfigurement

- Losing the ability to use a body organ permanently

If your injury falls in one of the above categories, only then you can file a suit to claim damages for your pain and suffering. Lawsuits can also be brought if the expenses of damages are more than the coverage limit.

Important Note: Since auto insurance is mandatory in New York, make sure that you continuously maintain car insurance coverage as the New York Department of Motor Vehicles uses a system known as the Insurance Information and Enforcement System (IIES) to monitor the coverage status of registered vehicles.

Forms of Financial Responsibility in New York

In case you cause an accident, you’re legally responsible for paying the damages that may arise from the aftermath. Buying insurance coverage would absolve you from any financial responsibility, as your car insurance carrier would be liable to settle the damages.

But what if you don’t want to buy insurance coverage? You have a few alternatives to car insurance coverage.

- You can keep a security deposit of $150,000 with the New York DMV

- You can also keep a surety bond that covers the minimum state coverage requirement

- Those who own 25 or more vehicles can insure themselves through a self-insurance policy along with proof of their financial ability to pay off damages in an accident

Although these options are available to motorists, it’s usually much easier and less expensive to buy car insurance coverage instead.

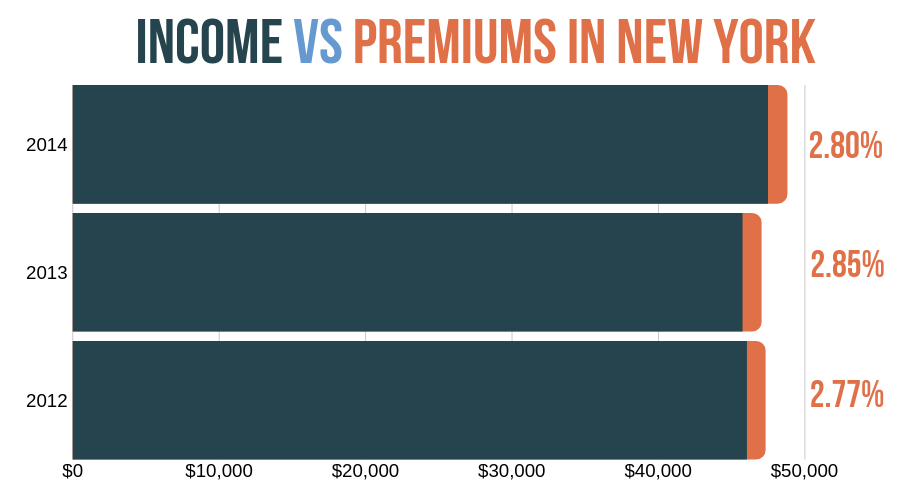

Compare New York Car Insurance Rates as a Percentage of Income

From 2012, the ratio of premiums to income has increased from 2.77 percent to 2.80 percent in New York. In it’s adjacent state of New Jersey, motorists had to spend around 2.76 percent of their income on premiums in 2014.

Knowing about the percentage that you would spend on premiums helps you to budget for auto insurance costs in advance.

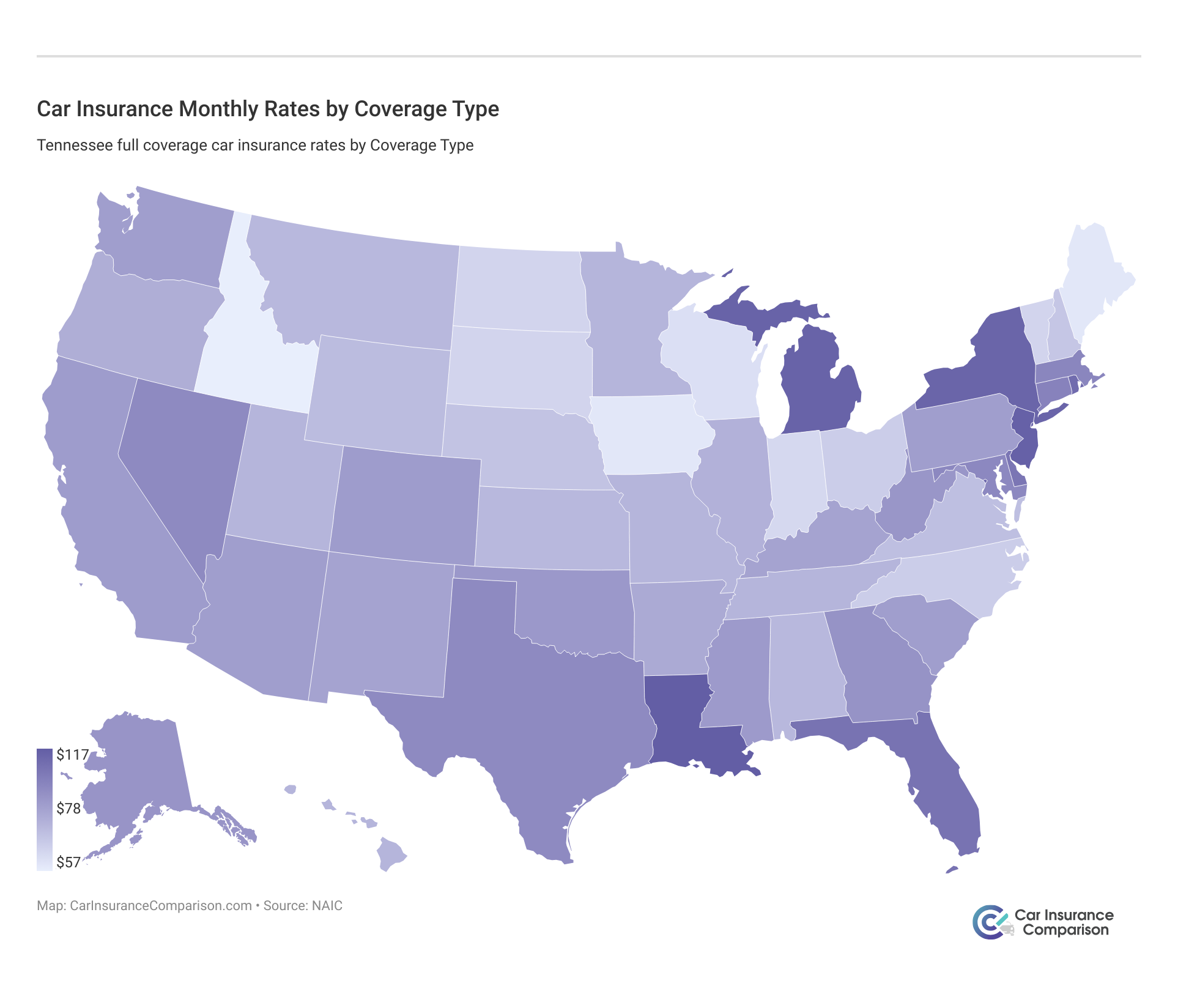

Compare New York Car Insurance Rates by Coverage

What is the average cost of car insurance in New York?

The chart above illustrates the average annual premiums that New Yorkers paid for auto insurance in 2015. For liability coverage, the average premium was $804, which is much higher than the collision and comprehensive coverage of $385 and $171, respectively.

Liability coverage pays for personal injury and property damages to the third party when you cause an accident, while collision and comprehensive cover damages only in specific circumstances that may not lead to significant expenses.

What are Collision and Comprehensive coverage, and how are those useful?

If you hit an object or another car, collision coverage kicks in, provided you have opted for it, and your insurance carrier will pay the damages. Comprehensive coverage, on the other hand, covers damages that were caused by circumstances out of your control, such as fire, vandalism, storms, floods, or any other acts of nature.

While liability coverage is a must-have legal requirement to drive in New York, collision and comprehensive coverage can also save you a lot of money if your car gets damaged while driving.

Additional Liability Coverage in New York

| Loss Ratio | 2015 | 2014 | 2013 |

|---|---|---|---|

| Medical Payments | 76.50% | 63.73% | 56.96% |

| Personal Injury Protection | 72.66% | 70.58% | 72.29% |

| Uninsured/Underinsured Motorist | 58.85% | 55.91% | 57.09% |

The above table illustrates the loss ratio of insurance companies for a period of three years. The percentage shows the ratio of premiums that the insurers have settled as claims.

Let’s try to understand loss ratio with an example – If an insurer has earned $100 in premiums and the loss ratio is 76 percent, then the insurance company has paid $76 in claims settlement.

Medical payments cover medical and funeral expenses for the passengers and pedestrians from an auto accident irrespective of fault. It tends to augment the amount required for medical expenses if the accident was severe.

Though many consider medical payments as an unnecessary expense, the benefits can outweigh the expenditure if you are involved in a major crash. Nonetheless, it’s advisable to assess your personal situation before adding medical payments to your coverage.

The state law of New York requires everyone to carry uninsured motorist coverage, which helps to pay damages if you’re hit by a motorist who’s uninsured or underinsured.

In New York, around 6.10 percent motorists were uninsured in 2015 as per the Insurance Information Institute. Thankfully, the percentage of uninsured motorists in New York is the second-lowest amongst all the states in America.

Still, if you’re hit by an uninsured motorist, chances of which are low in New York, your coverage would pay damages over and above what the at-fault motorist can pay if he has any insurance at all.

Add-ons, Endorsements, and Riders in New York

What else can you buy to protect yourself from unforeseen circumstances?

Insurance companies offer many add-ons and riders, which you should take a look at before buying coverage.

- Guaranteed Auto Protection (GAP)

- Personal Umbrella Policy (PUP)

- Rental Reimbursement

- Emergency Roadside Assistance, such as towing

- Mechanical Breakdown Insurance

- Non-Owner Car Insurance

- Modified Car Insurance Coverage

- Classic Car Insurance

Pay-As-You-Drive or Usage-Based Insurance

Are you tired of paying a high auto premium in New York?

And do you think that insurance companies should reward good driving behavior by way of lower premiums?

Well, if the answer to those questions is a yes, then you should look at usage-based insurance.

In usage-based insurance, also known as “pay-how-you-drive,” “pay-as-you-drive,” or “pay-as-you-go car insurance”, insurers record your driving behavior and offer discounts on premiums if you drive within the speed limit, rarely slam breaks, or have low daily mileage.

With the advent of the Internet of Things, insurance companies have started installing telematics devices in motor vehicles that keep a track of your driving pattern and relays the data to your insurer.

Interestingly, the state of New York encourages insurance carriers to explore the benefits of telematics devices for consumers and actively seeks applications from insurers to implement this new-age technology across the state.

If you want to understand usage-based insurance in detail, you can watch this quick video.

Since pay-as-you-go has gained traction in the last couple of years only, your insurance agent may not remember to mention this to you. While taking a quote, don’t forget to ask if your insurance company offers usage-based discounts.

Compare New York Car Insurance Rates by Age and Gender

| Insurance Company | Married 35-year old female Annual Rate | Married 35-year old male Annual Rate | Married 60-year old female Annual Rate | Married 60-year old male Annual Rate | Single 17-year old female Annual Rate | Single 17-year old male Annual Rate | Single 25-year old female Annual Rate | Single 25-year old male Annual Rate |

|---|---|---|---|---|---|---|---|---|

| Allstate | $3,193.78 | $2,980.04 | $3,012.93 | $3,052.97 | $9,411.78 | $10,059.13 | $3,106.83 | $3,110.26 |

| Geico | $1,775.96 | $1,709.98 | $1,723.35 | $1,698.04 | $3,737.26 | $5,542.24 | $1,598.20 | $1,640.87 |

| Liberty Mutual | $4,808.02 | $4,808.02 | $4,476.84 | $4,476.84 | $9,371.20 | $14,468.63 | $4,808.02 | $5,108.28 |

| Nationwide | $3,003.69 | $3,003.69 | $2,829.30 | $2,829.30 | $5,431.46 | $8,143.12 | $3,003.69 | $3,859.22 |

| Progressive | $2,317.74 | $2,134.30 | $1,831.64 | $1,867.64 | $7,736.99 | $8,515.77 | $2,948.94 | $2,816.17 |

| State Farm | $2,838.51 | $2,838.51 | $2,481.13 | $2,481.13 | $8,316.70 | $10,504.50 | $3,126.63 | $3,289.54 |

| Travelers | $3,320.74 | $3,298.93 | $3,020.14 | $3,202.94 | $7,651.80 | $9,050.23 | $3,491.99 | $3,593.56 |

| USAA | $1,961.37 | $1,928.07 | $1,776.70 | $1,780.28 | $7,919.49 | $9,428.85 | $2,515.85 | $2,782.87 |

When you look at the premium rates for different age groups and gender, you would notice that for single 17-year-old males, the rates are much higher than their female counterparts.

In other age groups, the rates are more or less the same for males and females. This just bolsters the fact that as you grow older, insurance companies tend to incorporate other personal factors into rate calculation, and a person’s gender takes a backseat.

You can also take a look at the ranks of different insurance carriers by the premium rates.

| Company | Demographic | Average Annual Rate | Rank |

|---|---|---|---|

| Liberty Mutual | Single 17-year old male | $14,468.63 | 1 |

| State Farm | Single 17-year old male | $10,504.50 | 2 |

| Allstate | Single 17-year old male | $10,059.13 | 3 |

| USAA | Single 17-year old male | $9,428.85 | 4 |

| Allstate | Single 17-year old female | $9,411.78 | 5 |

| Liberty Mutual | Single 17-year old female | $9,371.20 | 6 |

| Travelers | Single 17-year old male | $9,050.23 | 7 |

| Progressive | Single 17-year old male | $8,515.77 | 8 |

| State Farm | Single 17-year old female | $8,316.70 | 9 |

| Nationwide | Single 17-year old male | $8,143.12 | 10 |

| USAA | Single 17-year old female | $7,919.49 | 11 |

| Progressive | Single 17-year old female | $7,736.99 | 12 |

| Travelers | Single 17-year old female | $7,651.80 | 13 |

| Geico | Single 17-year old male | $5,542.24 | 14 |

| Nationwide | Single 17-year old female | $5,431.46 | 15 |

| Liberty Mutual | Single 25-year old male | $5,108.28 | 16 |

| Liberty Mutual | Married 35-year old female | $4,808.02 | 17 |

| Liberty Mutual | Married 35-year old male | $4,808.02 | 17 |

| Liberty Mutual | Single 25-year old female | $4,808.02 | 17 |

| Liberty Mutual | Married 60-year old female | $4,476.84 | 20 |

| Liberty Mutual | Married 60-year old male | $4,476.84 | 20 |

| Nationwide | Single 25-year old male | $3,859.22 | 22 |

| Geico | Single 17-year old female | $3,737.26 | 23 |

| Travelers | Single 25-year old male | $3,593.56 | 24 |

| Travelers | Single 25-year old female | $3,491.99 | 25 |

| Travelers | Married 35-year old female | $3,320.74 | 26 |

| Travelers | Married 35-year old male | $3,298.93 | 27 |

| State Farm | Single 25-year old male | $3,289.54 | 28 |

| Travelers | Married 60-year old male | $3,202.94 | 29 |

| Allstate | Married 35-year old female | $3,193.78 | 30 |

| State Farm | Single 25-year old female | $3,126.63 | 31 |

| Allstate | Single 25-year old male | $3,110.26 | 32 |

| Allstate | Single 25-year old female | $3,106.83 | 33 |

| Allstate | Married 60-year old male | $3,052.97 | 34 |

| Travelers | Married 60-year old female | $3,020.14 | 35 |

| Allstate | Married 60-year old female | $3,012.93 | 36 |

| Nationwide | Married 35-year old female | $3,003.69 | 37 |

| Nationwide | Married 35-year old male | $3,003.69 | 37 |

| Nationwide | Single 25-year old female | $3,003.69 | 37 |

| Allstate | Married 35-year old male | $2,980.04 | 40 |

| Progressive | Single 25-year old female | $2,948.94 | 41 |

| State Farm | Married 35-year old female | $2,838.51 | 42 |

| State Farm | Married 35-year old male | $2,838.51 | 42 |

| Nationwide | Married 60-year old female | $2,829.30 | 44 |

| Nationwide | Married 60-year old male | $2,829.30 | 44 |

| Progressive | Single 25-year old male | $2,816.17 | 46 |

| USAA | Single 25-year old male | $2,782.87 | 47 |

| USAA | Single 25-year old female | $2,515.85 | 48 |

| State Farm | Married 60-year old female | $2,481.13 | 49 |

| State Farm | Married 60-year old male | $2,481.13 | 49 |

| Progressive | Married 35-year old female | $2,317.74 | 51 |

| Progressive | Married 35-year old male | $2,134.30 | 52 |

| USAA | Married 35-year old female | $1,961.37 | 53 |

| USAA | Married 35-year old male | $1,928.07 | 54 |

| Progressive | Married 60-year old male | $1,867.64 | 55 |

| Progressive | Married 60-year old female | $1,831.64 | 56 |

| USAA | Married 60-year old male | $1,780.28 | 57 |

| USAA | Married 60-year old female | $1,776.70 | 58 |

| Geico | Married 35-year old female | $1,775.96 | 59 |

Compare New York Car Insurance Rates by ZIP Code

This is what we were talking about at the beginning of the guide – you can check the premium rates by ZIP code and city name.

| 25 Most Expensive Zip Codes in New York | City | Average Annual Rate by Zip Code | Most Expensive Company | Most Expensive Annual Rate | 2nd Most Expensive Company | 2nd Most Expensive Annual Rate | Cheapest Company | Cheapest Annual Rate | 2nd Cheapest Company | 2nd Cheapest Annual Rate |

|---|---|---|---|---|---|---|---|---|---|---|

| 11212 | BROOKLYN | $10,751.24 | Liberty Mutual | $17,558.88 | Travelers | $11,880.71 | Geico | $5,780.57 | USAA | $8,278.50 |

| 11233 | BROOKLYN | $10,703.01 | Liberty Mutual | $17,558.88 | Travelers | $11,775.55 | Geico | $5,780.57 | USAA | $8,278.50 |

| 11213 | BROOKLYN | $10,646.36 | Liberty Mutual | $17,558.88 | Travelers | $11,775.55 | Geico | $5,780.57 | Progressive | $8,079.76 |

| 11207 | BROOKLYN | $10,606.21 | Liberty Mutual | $17,558.88 | Travelers | $11,880.71 | Geico | $5,780.57 | Progressive | $7,402.08 |

| 11225 | BROOKLYN | $10,427.03 | Liberty Mutual | $17,558.88 | State Farm | $11,586.05 | Geico | $5,780.57 | USAA | $7,853.79 |

| 11216 | BROOKLYN | $10,399.95 | Liberty Mutual | $17,558.88 | State Farm | $11,586.05 | Geico | $5,780.57 | Progressive | $7,438.55 |

| 11221 | BROOKLYN | $10,399.36 | Liberty Mutual | $17,558.88 | State Farm | $11,617.80 | Geico | $5,780.57 | Progressive | $7,402.08 |

| 11239 | BROOKLYN | $10,287.12 | Liberty Mutual | $17,558.88 | Allstate | $11,528.93 | Geico | $5,780.57 | Progressive | $7,489.08 |

| 11203 | BROOKLYN | $10,251.67 | Liberty Mutual | $17,558.88 | Travelers | $11,880.71 | Geico | $5,300.14 | Progressive | $8,079.76 |

| 11236 | BROOKLYN | $10,242.23 | Liberty Mutual | $17,558.88 | Travelers | $11,880.71 | Geico | $5,300.14 | USAA | $8,278.50 |

| 11208 | BROOKLYN | $10,105.99 | Liberty Mutual | $17,558.88 | State Farm | $11,613.31 | Geico | $5,780.57 | Progressive | $7,844.91 |

| 11206 | BROOKLYN | $9,964.09 | Liberty Mutual | $17,558.88 | State Farm | $11,642.66 | Geico | $5,780.57 | Progressive | $6,585.30 |

| 11226 | BROOKLYN | $9,920.06 | Liberty Mutual | $17,558.88 | State Farm | $11,144.66 | Geico | $5,300.14 | Progressive | $8,159.70 |

| 11234 | BROOKLYN | $9,739.93 | Liberty Mutual | $15,452.41 | Travelers | $11,651.31 | Geico | $5,300.14 | Progressive | $7,716.90 |

| 11235 | BROOKLYN | $9,670.87 | Liberty Mutual | $15,452.41 | Travelers | $11,115.43 | Geico | $5,300.14 | Progressive | $8,066.79 |

| 11210 | BROOKLYN | $9,652.77 | Liberty Mutual | $15,452.41 | Travelers | $11,651.31 | Geico | $5,300.14 | Progressive | $7,955.87 |

| 11237 | BROOKLYN | $9,602.92 | Liberty Mutual | $17,558.88 | State Farm | $11,621.22 | Geico | $4,510.55 | Progressive | $7,437.15 |

| 11238 | BROOKLYN | $9,569.83 | Liberty Mutual | $17,558.88 | State Farm | $11,586.05 | Geico | $4,187.43 | Progressive | $7,438.55 |

| 11223 | BROOKLYN | $9,458.27 | Liberty Mutual | $15,452.41 | Travelers | $11,115.43 | Geico | $5,300.14 | Progressive | $8,066.79 |

| 11230 | BROOKLYN | $9,440.17 | Liberty Mutual | $15,452.41 | Travelers | $11,115.43 | Geico | $5,300.14 | Progressive | $8,066.79 |

| 11241 | BROOKLYN | $9,410.20 | Liberty Mutual | $17,558.88 | State Farm | $10,797.26 | Geico | $3,457.75 | Progressive | $7,489.08 |

| 11243 | BROOKLYN | $9,410.20 | Liberty Mutual | $17,558.88 | State Farm | $10,797.26 | Geico | $3,457.75 | Progressive | $7,489.08 |

| 11229 | BROOKLYN | $9,387.51 | Liberty Mutual | $15,452.41 | Travelers | $11,115.43 | Geico | $5,300.14 | Progressive | $7,716.90 |

| 11205 | BROOKLYN | $9,370.09 | Liberty Mutual | $17,558.88 | State Farm | $11,180.76 | Geico | $4,510.55 | Progressive | $6,126.60 |

| 11242 | BROOKLYN | $9,364.53 | Liberty Mutual | $17,558.88 | State Farm | $10,797.26 | Geico | $3,457.75 | Progressive | $7,489.08 |

If you live in Brooklyn, your premium rates are going to be steep.

| 25 Least Expensive Zip Codes in New York | City | Average Annual Rate by Zip Codes | Most Expensive Company | Most Expensive Annual Rate | 2nd Most Expensive Company | 2nd Most Expensive Annual Rate | Cheapest Company | Cheapest Annual Rate | 2nd Cheapest Company | 2nd Cheapest Annual Rate |

|---|---|---|---|---|---|---|---|---|---|---|

| 14830 | CORNING | $2,729.59 | Liberty Mutual | $3,958.87 | Allstate | $3,194.85 | Geico | $1,814.79 | Progressive | $2,084.94 |

| 14845 | HORSEHEADS | $2,753.21 | Liberty Mutual | $3,932.34 | Allstate | $3,194.85 | Geico | $1,756.70 | Progressive | $2,041.98 |

| 14814 | BIG FLATS | $2,757.47 | Liberty Mutual | $3,932.34 | Allstate | $3,194.85 | Geico | $1,756.70 | Progressive | $2,084.94 |

| 14870 | PAINTED POST | $2,761.36 | Liberty Mutual | $3,958.87 | Allstate | $3,194.85 | Geico | $1,814.79 | Progressive | $2,367.49 |

| 14903 | ELMIRA | $2,761.81 | Liberty Mutual | $3,932.34 | Allstate | $3,194.85 | Geico | $1,756.70 | Progressive | $2,084.94 |

| 14905 | ELMIRA | $2,786.89 | Liberty Mutual | $3,932.34 | Allstate | $3,194.85 | Geico | $1,756.70 | Progressive | $2,254.47 |

| 14904 | ELMIRA | $2,788.48 | Liberty Mutual | $3,932.34 | Allstate | $3,194.85 | Geico | $1,756.70 | Progressive | $2,254.47 |

| 14871 | PINE CITY | $2,789.24 | Liberty Mutual | $3,958.87 | Allstate | $3,194.85 | Geico | $1,756.70 | Progressive | $2,297.44 |

| 14894 | WELLSBURG | $2,790.81 | Liberty Mutual | $3,932.34 | Allstate | $3,194.85 | Geico | $1,756.70 | Progressive | $2,254.47 |

| 14901 | ELMIRA | $2,791.14 | Liberty Mutual | $3,932.34 | Allstate | $3,194.85 | Geico | $1,756.70 | Progressive | $2,254.47 |

| 14821 | CAMPBELL | $2,812.94 | Liberty Mutual | $3,958.87 | Allstate | $3,317.92 | Geico | $1,814.79 | Nationwide | $2,385.41 |

| 13850 | VESTAL | $2,833.83 | Liberty Mutual | $3,888.71 | Allstate | $3,268.98 | Geico | $2,002.78 | Progressive | $2,247.71 |

| 14816 | BREESPORT | $2,873.78 | Liberty Mutual | $3,932.34 | State Farm | $3,505.38 | Geico | $1,756.70 | Nationwide | $2,385.41 |

| 13795 | KIRKWOOD | $2,878.91 | Liberty Mutual | $3,888.71 | Travelers | $3,337.03 | Geico | $2,002.78 | Progressive | $2,428.42 |

| 13748 | CONKLIN | $2,880.00 | Liberty Mutual | $3,888.71 | Travelers | $3,337.03 | Geico | $2,002.78 | Progressive | $2,428.42 |

| 13603 | WATERTOWN | $2,881.06 | Liberty Mutual | $4,420.81 | Allstate | $3,496.52 | Geico | $1,921.00 | USAA | $2,165.68 |

| 13612 | BLACK RIVER | $2,881.46 | Liberty Mutual | $4,420.81 | Allstate | $3,496.52 | Geico | $1,921.00 | USAA | $2,165.68 |

| 13616 | CALCIUM | $2,882.15 | Liberty Mutual | $4,420.81 | Allstate | $3,496.52 | Geico | $1,921.00 | USAA | $2,165.68 |

| 13606 | ADAMS CENTER | $2,884.39 | Liberty Mutual | $4,420.81 | Allstate | $3,496.52 | Geico | $1,921.00 | USAA | $2,165.68 |

| 13601 | WATERTOWN | $2,885.27 | Liberty Mutual | $4,420.81 | Allstate | $3,496.52 | Geico | $1,921.00 | USAA | $2,165.68 |

| 13685 | SACKETS HARBOR | $2,886.18 | Liberty Mutual | $4,420.81 | Allstate | $3,496.52 | Geico | $1,921.00 | USAA | $2,165.68 |

| 13656 | LA FARGEVILLE | $2,887.98 | Liberty Mutual | $4,420.81 | Allstate | $3,496.52 | Geico | $1,921.00 | USAA | $2,165.68 |

| 13640 | WELLESLEY ISLAND | $2,888.38 | Liberty Mutual | $4,420.81 | Allstate | $3,496.52 | Geico | $1,921.00 | USAA | $2,165.68 |

| 13634 | DEXTER | $2,888.57 | Liberty Mutual | $4,420.81 | Allstate | $3,496.52 | Geico | $1,921.00 | USAA | $2,165.68 |

| 13607 | ALEXANDRIA BAY | $2,888.77 | Liberty Mutual | $4,420.81 | Allstate | $3,496.52 | Geico | $1,921.00 | USAA | $2,165.68 |

Compare New York Car Insurance Rates by City

Surprisingly, New York, New York is not one of the most expensive cities in the state for car insurance.

| 10 Most Expensive Cities in New York | Average Annual Rate by City | Most Expensive Company | Most Expensive Annual Rate | 2nd Most Expensive Company | 2nd Most Expensive Annual Rate | Cheapest Company | Cheapest Annual Rate | 2nd Cheapest Company | 2nd Cheapest Annual Rate |

|---|---|---|---|---|---|---|---|---|---|

| Brooklyn | $9,347.06 | Liberty Mutual | $17,558.88 | State Farm | $10,797.26 | Geico | $3,940.28 | Progressive | $6,859.27 |

| Saint Albans | $9,000.94 | Liberty Mutual | $12,883.56 | Travelers | $10,495.31 | Geico | $5,686.55 | USAA | $7,089.23 |

| Rosedale | $8,885.68 | Liberty Mutual | $12,883.56 | State Farm | $9,995.10 | Geico | $5,287.14 | USAA | $7,089.23 |

| South Ozone Park | $8,881.66 | Liberty Mutual | $12,883.56 | Travelers | $10,607.53 | Geico | $5,686.55 | USAA | $7,089.23 |

| Springfield Gardens | $8,874.63 | Liberty Mutual | $12,883.56 | State Farm | $9,906.69 | Geico | $5,287.14 | USAA | $7,089.23 |

| South Richmond Hill | $8,831.46 | Liberty Mutual | $12,883.56 | Travelers | $10,607.53 | Geico | $5,287.14 | USAA | $7,089.23 |

| Jamaica | $8,826.92 | Liberty Mutual | $12,883.56 | Travelers | $10,241.08 | Geico | $5,386.99 | USAA | $7,089.23 |

| Arverne | $8,802.18 | Liberty Mutual | $12,883.56 | State Farm | $9,799.24 | Geico | $5,287.14 | USAA | $7,089.23 |

| Woodhaven | $8,773.94 | Liberty Mutual | $12,883.56 | Travelers | $10,302.35 | Geico | $5,096.98 | USAA | $7,089.23 |

| Howard Beach | $8,739.15 | Liberty Mutual | $12,883.56 | Travelers | $9,817.66 | Geico | $5,287.14 | USAA | $7,089.23 |

Brooklyn is the most expensive city. Let’s now see which cities are the cheapest.

| 10 Least Expensive Cities in New York | Average Annual Rate by City | Most Expensive Company | Most Expensive Annual Rate | 2nd Most Expensive Company | 2nd Most Expensive Annual Rate | Cheapest Company | Cheapest Annual Rate | 2nd Cheapest Company | 2nd Cheapest Annual Rate |

|---|---|---|---|---|---|---|---|---|---|

| Corning | $2,729.58 | Liberty Mutual | $3,958.87 | Allstate | $3,194.85 | Geico | $1,814.79 | Progressive | $2,084.94 |

| Big Flats | $2,757.50 | Liberty Mutual | $3,932.34 | Allstate | $3,194.85 | Geico | $1,756.70 | Progressive | $2,070.62 |

| Coopers Plains | $2,761.36 | Liberty Mutual | $3,958.87 | Allstate | $3,194.85 | Geico | $1,814.79 | Progressive | $2,367.49 |

| Elmira | $2,788.83 | Liberty Mutual | $3,932.34 | Allstate | $3,194.85 | Geico | $1,756.70 | Progressive | $2,254.47 |

| Pine City | $2,789.24 | Liberty Mutual | $3,958.87 | Allstate | $3,194.85 | Geico | $1,756.70 | Progressive | $2,297.44 |

| Wellsburg | $2,790.81 | Liberty Mutual | $3,932.34 | Allstate | $3,194.85 | Geico | $1,756.70 | Progressive | $2,254.47 |

| Campbell | $2,812.93 | Liberty Mutual | $3,958.87 | Allstate | $3,317.92 | Geico | $1,814.79 | Nationwide | $2,385.41 |

| Vestal | $2,833.83 | Liberty Mutual | $3,888.71 | Allstate | $3,268.98 | Geico | $2,002.78 | Progressive | $2,247.71 |

| Breesport | $2,873.77 | Liberty Mutual | $3,932.34 | State Farm | $3,505.38 | Geico | $1,756.70 | Nationwide | $2,385.41 |

| Kirkwood | $2,878.90 | Liberty Mutual | $3,888.71 | Travelers | $3,337.03 | Geico | $2,002.78 | Progressive | $2,428.42 |

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Car Insurance Companies in New York

When you buy car insurance, what exactly do you expect from your insurance carrier?

Some people might say that they want their insurer to settle claims as soon as possible in the event of an accident, and others would want an insurer that offers the convenience of digital interactions.

Everyone has different needs, so why buy coverage by just looking at the premium rates?

The decision to buy car insurance coverage must be a well-thought out process and involve thorough investigation of an insurer’s financial ratings, customer reviews, complaints data, market standing, etc.

We have done the research for the best car insurance companies in New York that would help in making the purchase decision easy for you.

Financial Ratings of Leading Insurance Companies in New York

Financial ratings were devised to help consumers understand the long-term financial viability of companies because everyone can’t understand balance sheets like a financial analyst.

To give you an idea about the financial standing of leading insurers in New York, we would assess their A.M.Best Ratings, the leading name in financial ratings.

How to understand A.M.Best Ratings?

A.M.Best evaluates insurance companies on their financial strength and the ability to meet their insurance obligations in the future. For this purpose, the credit rating agency assigns alphabetical ratings starting from A+ to S. Any rating of A+, A, and A- falls under the category of excellent.

For your convenience, we are sharing the A.M.Best Ratings of the leading insurance companies in New York.

| Leading Insurance Companies | A.M.Best Rating |

|---|---|

| Geico | A++ |

| Allstate Insurance Group | A+ |

| State Farm Group | A++ |

| Progressive Group | A+ |

| Liberty Mutual Group | A |

| Travelers Group | A++ |

| USAA Group | A++ |

| NYCM Insurance Group | A |

| Nationwide Corp Group | A+ |

| Amtrust NGH Group | A- |

Car Insurance Companies with Best Customer Reviews in New York

As consumers, you always check reviews online before buying anything, from PlayStation to mobile phones. Then, why do you rely on mere quotes to buy a car insurance policy?

Checking customer satisfaction surveys and online reviews should be a part of your car insurance buying process, as it’s important to choose a reliable insurer who will respond to you instantly if you get involved in an accident.

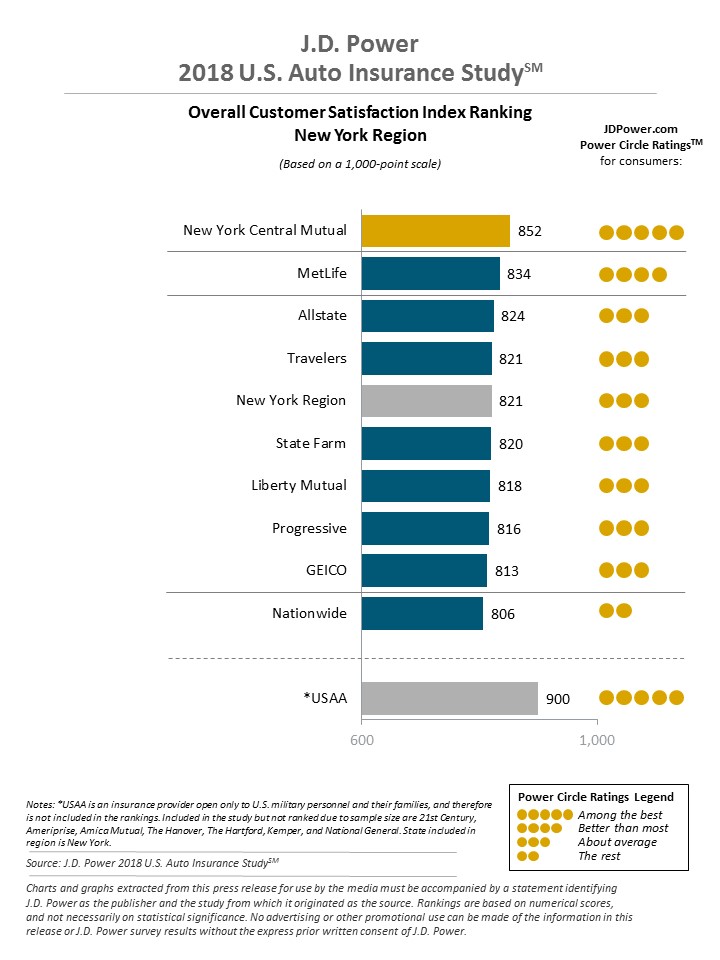

As per a recent customer satisfaction survey by a trusted source in auto insurance ratings, J.D.Power, consumers these days are more satisfied with their car insurers despite the continuously rising premiums.

The survey found that frequent interactions with consumers through digital channels have contributed to the high satisfaction level among consumers. Cost might be the determining factor in choosing an insurer, but the continuity of impeccable service wins in the end.

Now, let’s look at which insurance carrier has bagged the most popular award from consumers in New York.

The power ratings suggest that New York Central Mutual is the most favored car insurance carrier in New York. These ratings assessed insurers on five factors; interaction, policy offerings, price, billing process & policy information, and claims.

Complaint Data of Leading Car Insurers in New York

| Leading Insurance Companies | Number of Complaints (2017) |

|---|---|

| Geico | 333 |

| Allstate Insurance Group | 163 |

| State Farm Group | 1482 |

| Progressive Group | 120 |

| Liberty Mutual Group | 222 |

| Travelers Group | 2 |

| USAA Group | 296 |

| NYCM Insurance Group | 3 |

| Nationwide Corp Group | 25 |

| Amtrust NGH Group | 2 |

Another data that would really help you in making a decision faster is the number of complaints against the insurance carriers. Since customer ratings are based on a sample group of customers, the complaint data offers a more realistic measure of customer satisfaction.

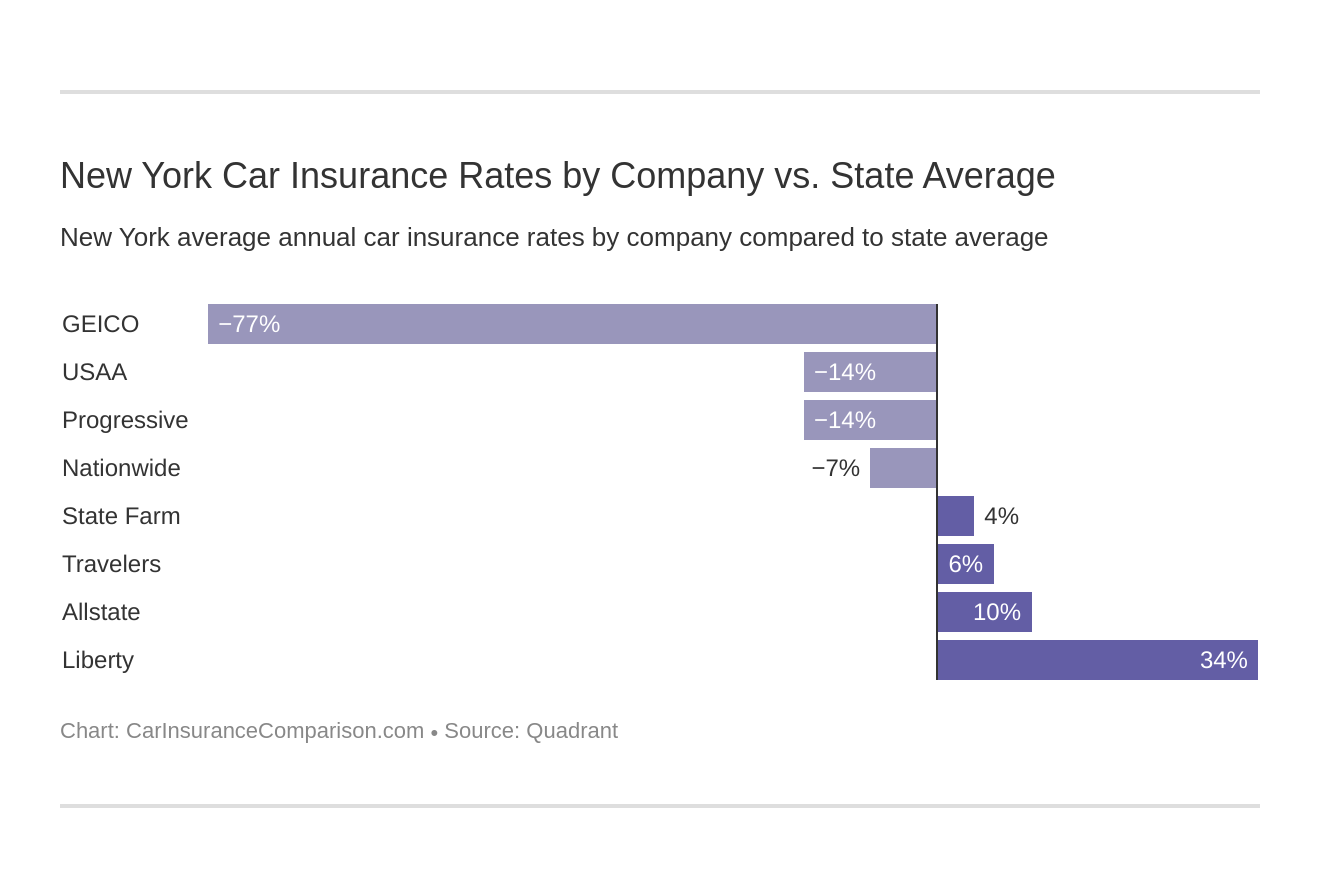

Compare New York Car Insurance Rates by Carrier

| Insurance Company | Average Annual Rate | Compared to State Average (+/-) | Percentage Change (+/-) |

|---|---|---|---|

| Allstate | $4,740.96 | $451.08 | 9.51% |

| Geico | $2,428.24 | -$1,861.65 | -76.67% |

| Liberty Mutual | $6,540.73 | $2,250.85 | 34.41% |

| Nationwide | $4,012.93 | -$276.95 | -6.90% |

| Progressive | $3,771.15 | -$518.74 | -13.76% |

| State Farm | $4,484.58 | $194.70 | 4.34% |

| Travelers | $4,578.79 | $288.91 | 6.31% |

| USAA | $3,761.69 | -$528.20 | -14.04% |

Compare New York Car Insurance Rates by Annual Commute

| Insurance Company | Commute and Annual Mileage | Average Annual Rate |

|---|---|---|

| Liberty Mutual | 25 miles commute. 12000 annual mileage. | $6,726.83 |

| Liberty Mutual | 10 miles commute. 6000 annual mileage. | $6,354.63 |

| Allstate | 25 miles commute. 12000 annual mileage. | $4,806.77 |

| Allstate | 10 miles commute. 6000 annual mileage. | $4,675.15 |

| Travelers | 25 miles commute. 12000 annual mileage. | $4,578.79 |

| Travelers | 10 miles commute. 6000 annual mileage. | $4,578.79 |

| State Farm | 25 miles commute. 12000 annual mileage. | $4,646.86 |

| State Farm | 10 miles commute. 6000 annual mileage. | $4,322.30 |

| Nationwide | 25 miles commute. 12000 annual mileage. | $4,012.93 |

| Nationwide | 10 miles commute. 6000 annual mileage. | $4,012.93 |

| Progressive | 25 miles commute. 12000 annual mileage. | $3,771.15 |

| Progressive | 10 miles commute. 6000 annual mileage. | $3,771.15 |

| USAA | 25 miles commute. 12000 annual mileage. | $3,799.64 |

| USAA | 10 miles commute. 6000 annual mileage. | $3,723.73 |

| Geico | 25 miles commute. 12000 annual mileage. | $2,498.03 |

| Geico | 10 miles commute. 6000 annual mileage. | $2,358.45 |

If your daily commute is around 10 miles, then you might get discounts on your premium rates. As you can see in the table, there are a few insurance carriers who offer a lower rate for low mileage.

Annual mileage is among the more minor factors that affect your rates.

Compare New York Car Insurance Rates by Coverage Level

| Insurance Company | Coverage Type | Average Annual Rate |

|---|---|---|

| Liberty Mutual | High | $6,864.04 |

| Liberty Mutual | Medium | $6,520.87 |

| Liberty Mutual | Low | $6,237.28 |

| Allstate | High | $5,134.16 |

| Allstate | Medium | $4,716.54 |

| Allstate | Low | $4,372.19 |

| Travelers | High | $4,904.29 |

| Travelers | Medium | $4,522.76 |

| Travelers | Low | $4,309.32 |

| State Farm | High | $4,702.24 |

| State Farm | Medium | $4,511.46 |

| State Farm | Low | $4,240.05 |

| Nationwide | High | $4,310.54 |

| Nationwide | Medium | $3,975.76 |

| Nationwide | Low | $3,752.51 |

| Progressive | High | $4,008.45 |

| Progressive | Medium | $3,745.62 |

| Progressive | Low | $3,559.37 |

| USAA | High | $3,899.63 |

| USAA | Medium | $3,741.21 |

| USAA | Low | $3,644.21 |

| Geico | High | $2,580.54 |

| Geico | Medium | $2,416.55 |

| Geico | Low | $2,287.62 |

Compare New York Car Insurance Rates by Credit Score

| Insurance Company | Credit History | Average Annual Rate |

|---|---|---|

| Liberty Mutual | Poor | $9,156.87 |

| Liberty Mutual | Fair | $5,985.24 |

| Liberty Mutual | Good | $4,480.08 |

| Allstate | Poor | $6,865.50 |

| Allstate | Fair | $3,961.90 |

| Allstate | Good | $3,395.49 |

| Travelers | Poor | $6,396.79 |

| Travelers | Fair | $3,944.57 |

| Travelers | Good | $3,395.01 |

| State Farm | Poor | $6,331.07 |

| State Farm | Fair | $3,970.78 |

| State Farm | Good | $3,151.89 |

| Progressive | Poor | $6,065.81 |

| Progressive | Fair | $3,041.52 |

| Progressive | Good | $2,206.11 |

| USAA | Poor | $5,800.63 |

| USAA | Fair | $2,913.64 |

| USAA | Good | $2,570.78 |

| Nationwide | Poor | $4,012.93 |

| Nationwide | Fair | $4,012.93 |

| Nationwide | Good | $4,012.93 |

| Geico | Poor | $3,042.53 |

| Geico | Fair | $2,235.78 |

| Geico | Good | $2,006.40 |

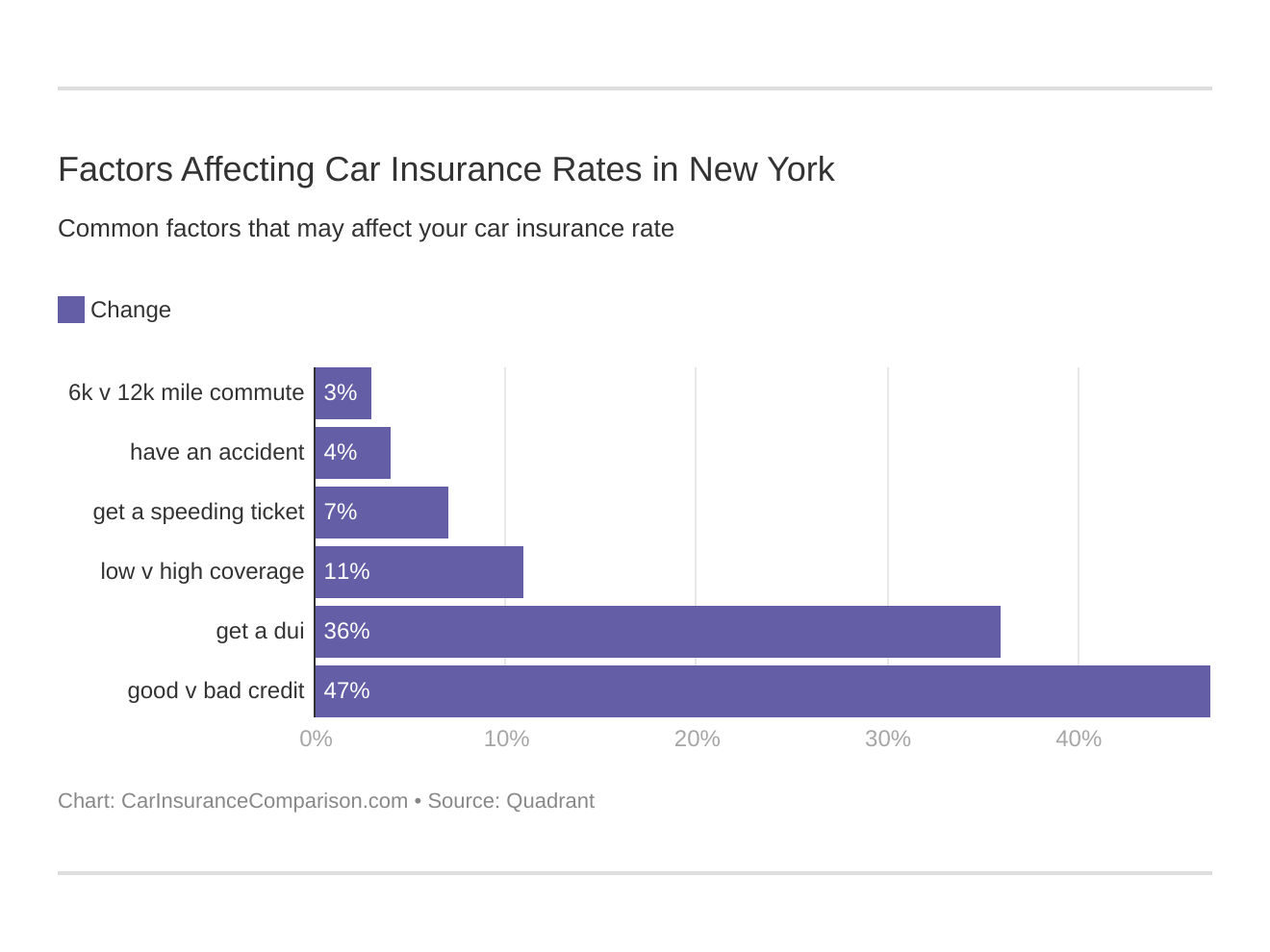

Credit history has a major impact on your premium rates. A poor credit rating means an inability to meet your premium payment obligations, hence, insurers penalize you with higher premiums to cover any future losses.

Compare New York Car Insurance Rates by Driving Record

| Insurance Company | Driving Record | Average Annual Rate |

|---|---|---|

| Liberty Mutual | With 1 DUI | $10,569.55 |

| Liberty Mutual | With 1 speeding violation | $5,197.79 |

| Liberty Mutual | With 1 accident | $5,197.79 |

| Liberty Mutual | Clean record | $5,197.79 |

| Nationwide | With 1 DUI | $6,853.01 |

| Nationwide | With 1 speeding violation | $3,113.84 |

| Nationwide | With 1 accident | $3,042.44 |

| Nationwide | Clean record | $3,042.44 |

| Allstate | With 1 DUI | $5,884.41 |

| Allstate | With 1 speeding violation | $5,070.67 |

| Allstate | With 1 accident | $4,004.39 |

| Allstate | Clean record | $4,004.39 |

| Travelers | With 1 DUI | $4,964.33 |

| Travelers | With 1 speeding violation | $4,552.21 |

| Travelers | With 1 accident | $4,896.91 |

| Travelers | Clean record | $3,901.71 |

| State Farm | With 1 DUI | $4,701.32 |

| State Farm | With 1 speeding violation | $4,701.32 |

| State Farm | With 1 accident | $4,267.85 |

| State Farm | Clean record | $4,267.85 |

| Progressive | With 1 DUI | $4,066.27 |

| Progressive | With 1 speeding violation | $3,688.99 |

| Progressive | With 1 accident | $3,664.67 |

| Progressive | Clean record | $3,664.67 |

| USAA | With 1 DUI | $4,893.09 |

| USAA | With 1 speeding violation | $3,402.69 |

| USAA | With 1 accident | $3,402.69 |

| USAA | Clean record | $3,348.28 |

| Geico | With 1 DUI | $3,860.07 |

| Geico | With 1 speeding violation | $1,894.00 |

| Geico | With 1 accident | $2,064.88 |

| Geico | Clean record | $1,894.00 |

If you have a driving under the influence (of alcohol) record on your license, insurance companies would charge a comparatively higher premium from you.

Any record of DUI is taken more seriously than speeding violations and accidents due to the reckless nature of drunk driving. Most of the insurance carriers levy a much higher rate for such carelessness.

How Much Auto Insurance Costs in New York

Explore auto insurance rates in various New York cities – Amenia, Binghamton, Buffalo, Catskill, Clifton Park, Ellenville, New York City, and more. Gain insights into the dynamics shaping car insurance rates for informed decision-making.

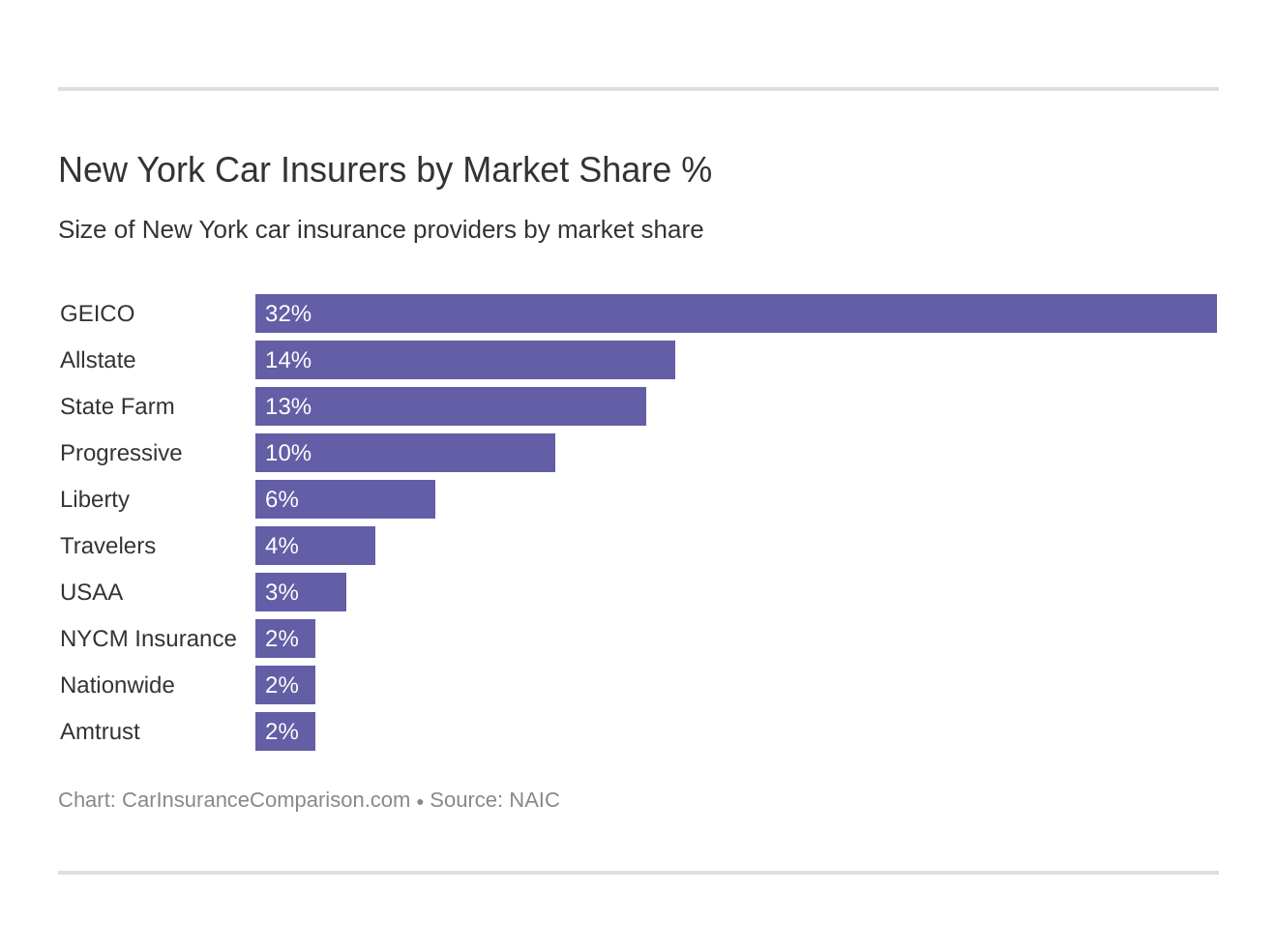

Leading Insurance Carriers in New York

Now that you have a fair idea about insurance carriers and their rates in different categories, let’s see which companies have the largest market share in New York.

| Insurance Company | Direct Written Premiums | Market Share |

|---|---|---|

| Geico | $4,233,525 | 31.93% |

| Allstate Insurance Group | $1,843,730 | 13.90% |

| State Farm Group | $1,758,370 | 13.26% |

| Progressive Group | $1,284,132 | 9.68% |

| Liberty Mutual Group | $731,396 | 5.52% |

| Travelers Group | $529,676 | 3.99% |

| USAA Group | $392,346 | 2.96% |

| NYCM Insurance Group | $327,366 | 2.47% |

| Nationwide Corp Group | $302,854 | 2.28% |

| Amtrust NGH Group | $291,750 | 2.20% |

Number of Insurance Carriers in New York

| Type of Insurer | Number |

|---|---|

| Foreign | 709 |

| Domestic | 173 |

State Laws in New York

Without laws in place, it would be difficult for law enforcement officers to manage traffic on roads or for the Department of Motor Vehicles to issue driving licenses.

Knowing about coverage and the best insurance carriers would help you in making the right buying decision, but it’s really important to be safe on the road. Also, if you follow the law, you would rarely get involved in accidents or speeding violations, which in turn would keep your premium rates low.

Let’s look at the laws that govern driving on the roads.

Car Insurance Laws in New York

Without car insurance laws, the oversight of insurance carriers wouldn’t be possible, which would lead to unfair practices in the market.

Car insurance laws not only help consumers by reducing the overall cost they might have to bear if involved in an accident but also provide a framework to operate for insurance carriers.

Windshield Coverage Laws in New York

Cracked, chipped, or broken windshields can be hazardous to driving as they block visibility and may shatter if hit by loose gravel or other objects. The state law of New York strictly prohibits driving with a cracked windshield that distorts visibility.

To replace a windshield, automobile owners can get an aftermarket part that is similar in quality and finish.

High-Risk Drivers in New York

If you have multiple records of speeding violations and accidents to your credit, there’s a high probability that your coverage application will be rejected by most of the insurers in New York.

Why high-risk drivers can’t get coverage in the voluntary insurance market?

Insurance carriers collect premiums from all motorists to make a pool from which they settle claims whenever there’s an accident. Through this process, insurers aim to gain from the remaining premiums after paying off claims.

If a driver tends to get involved in accidents time and again, insurers might have to bear losses on account of frequent claims settlements. As a result, they refuse coverage to those who are high-risk drivers.

How can high-risk drivers obtain coverage?

Driving without auto insurance is illegal in New York, hence every motorist must obtain coverage. The state of New York offers an auto plan known as the New York Automobile Insurance Plan (NYAIP) to offer coverage to high-risk drivers.

Who offers coverage to high-risk drivers?

You must be wondering who exactly offers coverage to these high-risk drivers who accumulate losses for insurers.

Every insurer who is licensed to operate in New York has to offer coverage to a certain percentage of high-risk drivers directly proportionate to its market share.

Motorsists enrolled in the NYAIP are randomly distributed among different insurers based on a pre-decided quota. Needless to say, these motorists are required to pay a significantly high premium.

Automobile Insurance Fraud in New York

Auto insurance frauds increase the premiums of New Yorkers by millions of dollars every year as it’s an enormous problem in the state.

There are two sides to car insurance fraud – one where the motorists furnish incorrect information knowingly to gain from the claim settlement amount and the other wherein medical providers pad costs to earn from procedures that were not performed.

The auto insurance system of New York is massive, with 300 auto insurers vying for their share in the state’s $10 billion in premiums, according to the Insurance Information Institute. Touted as the fourth largest system in America, the state has around nine million insured motor vehicles.

With such a large system in place, the state has witnessed many fraudulent medical practitioners and attorneys who work together to defraud auto insurance companies.

On the other side of the spectrum, motorists also participate in raising premiums for everyone by making fraudulent claims. Misrepresentation of facts on insurance applications, staging an accident, and inflating insurance claims are some of the unfair practices prevalent in the state.

Penalties: Motorists who are caught by the state committing insurance fraud are penalized through fines and prison time-varying in degree depending on the severity of the crime committed.

Statute of Limitations for Car Accidents in New York

The statute of limitations restricts the time period until which you can bring a lawsuit against the at-fault party after an accident.

In New York, if you are unable to bring a lawsuit within a period of three years from the crash, most probably your case would be rejected by the court system, unless some rare circumstance allows the extension of your deadline.

Vehicle Licensing Laws in New York

Is your driver’s license Real ID compliant? Do you know what’s the minimum age to get a learner’s permit in New York? Does the state of New York allow license renewals online?

Every state has different laws for licensing, so whether you’re new to New York or a long-time resident — you must know about the licensing laws in your state.

Real ID Compliance in New York

The Real ID Act was established as a security measure and governs the issuance of driver’s licenses and other identification cards in compliance with the law’s minimum standards.

If your license is Real ID compliant, you would be allowed entry into Federal facilities, nuclear power plants, and commercial aircraft by showing your driver’s license. New York is a Real ID compliant state.

Motorists in New York can get three types of driver’s licenses – Standard, Enhanced, and Real ID.

Important Note: Your standard license won’t be accepted as proof of identification for travel by air or entry into federal buildings after October 1, 2020. If you wish to use your driver’s license for those purposes after the above-mentioned date, you would have to apply for a Real ID-compliant license.

In case you want to know more about Real ID, you can watch this short video on the matter.

Penalties for Driving without Insurance in New York

In New York, owning a motor vehicle without insurance is undoubtedly unsafe, and it can lead to hefty fines along with license revocation.

The fines for driving without insurance could be up to $1,500, along with the possibility of jail time for 15 days. Also, your license would be immediately revoked for a year.

That’s not it, though. At the end of your license suspension period, you would be required to pay $750 to the DMV for the restoration of your license.

What if there’s a lapse in insurance?

If you don’t plan to buy insurance because you won’t drive in the near future, you should cancel your vehicle registration and surrender your number plates. At no point in time you are allowed to keep a registered vehicle without insurance coverage.

If you’re caught driving without insurance – your vehicle could be impounded, you could be arrested, and your license & registration would be revoked by the DMV.

Proof of Auto Insurance: Insurance ID cards are accepted in both paper and electronic forms as proof of insurance in New York and can be presented when asked by the DMV during vehicle registration, by police at a traffic stop, or by a judge during summons.

Teen Driver Laws in New York

We know how restless you get when your teenage children start driving — their inexperience makes you fidgety.

Inculcating good driving habits from the beginning is vital for everyone’s safety on the roads, and that’s why you should lead by example.

Don’t be that parent who looks at their mobile phone while driving!

Most of the crashes where a teenager is involved, the chief reasons for accident are speeding, distracted driving, failure to yield, inexperience, and not maintaing enough distance from vehicles.

As parents, you should ensure that your children understand the importance of safe driving. Please refer to the Parent’s Guide to Teen Driving by the NY DMV to prepare better.

Monitor your Teen Driver (TEENS): The DMV offers The Teen Electronic Event Notification Service (TEENS) in which parents receive electronic notifications when a specific event — tickets, traffic violations, license suspensions — is added to the driving record of their children.

If you feel that your kid’s driving behavior is unsafe, you can withdraw their driving privileges by submitting a withdrawal of consent form to the DMV.

Now, we would look at the licensing restrictions for teenagers.

Learner’s Permit: At age 16, teens can apply for a learner’s permit and start driving by passing a vision and knowledge test. You can find the nearest DMV location to write the test and prepare by studying the DMV Driver Manual and taking practice tests.

Teens with a learner’s permit must abide by certain restrictions to ensure the safety of everyone.

- You’re allowed to drive a vehicle only with a supervising adult who’s 21 or older and has a valid license.

- You aren’t allowed to drive on the following roads in New York:

- Streets that are inside a park in New York City.

- Bridges or tunnels under the jurisdiction of the Triborough Bridge and Tunnel Authority.

- Parkways in Westchester County – Hutchinson River Parkway, Cross County Parkway, Saw Mill River Parkway, and Taconic State Parkway.

- There are certain restrictions on nighttime driving as well that vary across the three different regions i.e. New York City, Long Island, and Upstate New York. Driving at night comes with risks like falling asleep at the wheel. (For more information, read our “Does car insurance cover falling asleep at the wheel?“)

Junior License: If a teen driver has successfully completed six months, he/she is eligible to get a junior license by passing the road test. The teen must have completed supervised driving of 50 hours with nighttime driving of 15 hours under the learner’s permit.

Keeping in mind the safety of everyone, junior license holders have to abide by certain restrictions.

- New York City restrictions: Under any circumstance, if you hold a junior license, you aren’t allowed to drive in New York City.

- Upstate New York restrictions: Driving with a junior license is allowed in Upstate New York, but you may not drive with any passengers under 21 unless they are family members. Between 9 PM to 5 AM, you can only drive between your home to school and your place of work.

- Long Island restrictions: To drive in Suffolk and Nassau counties, you need to be under the supervision of either a parent or guardian, or driving school instructor, or someone authorized by your parents. Without a supervising adult, you’re allowed to drive between your home and a few places authorized by the state.

Unrestricted License: Those who complete a driver’s education without any record can apply for an unrestricted license at the age of 17.

License Renewal Procedure in New York

In New York, motorists are required to renew their licenses every eight years. Renewals by mail and online renewals are permitted for everyone, irrespective of age.

Important Note: If you renew your New York standard license online, your new license will not be Real ID compliant and show “not for federal purposes”. After October 2020, this standard license wouldn’t be accepted in federal buildings or for domestic travel by commercial flights.

Rules of the Road in New York

If you don’t follow the rules while driving, you will get a ticket in New York instantly.

Especially in New York City, you must strictly follow the speed limits, car seat laws, move-over laws, etc., to avoid getting stopped by the police.

Fault vs No-Fault

New York is amongst the twelve states in the US that follow the no-fault system allowing motorists to file claims with their own insurance company in the event of an accident, irrespective of fault.

To overcome the inefficiencies and delay in claim settlement under the fault system, New York adopted the no fault system in the 1970s which aimed to expedite the process of claims settlement after a crash.

Seat Belt and Car Seat Laws in New York

In New York, front-seat passengers are required to wear seat belts. Children under 16 must wear seat belts irrespective of their position in the car, and those who are under four must be put inside a child restraint system.

The child safety seats and restraint system must comply with the Federal Motor Vehicles Safety Standard 213. If you aren’t sure about the fitting of child seat, you can visit one of the child safety seat inspection sites in New York.

How to choose the correct child safety seat?

The state of New York recommends motorists carefully assess the dimensions and weight capacity for car seats available in the market and select one that’s suitable for their children.

There are certain basic rules to follow for child safety seats:

- All children below the age of eight must be put inside a child restraint system

- The restraint system should meet the weight and height requirements as per the Federal standards

- The car safety seat cannot be placed in the front seat

- The restraint system can mean a harness, booster seat, or child seat that is attached to the car seat

Keep Right and Move Over Laws in New York

If you’re going slower than the normal traffic speed, the law in New York states that you should move to the right lane unless you’re taking a left turn or passing traffic.

While driving, if you notice an authorized emergency stationary vehicle with flashing lights, you should move further from the vehicle to the next lane if it’s safe to do so.

Speed Limits in New York

| Type of Road | Speed Limit |

|---|---|

| Freeways and Interstates | 65 mph |

| Default Speed Limit | 55 mph |

| Divided Roads | 45 mph |

| Residential Areas | 25-45 mph |

| Slow Zones in NYC | 20 mph |

| School Zones | 15-30 mph |

The table illustrates the speed limits across New York, but it’s recommended to be careful and look for posted limits while driving, especially in the NYC area.

Ridesharing Laws in New York

Ridesharing companies, technically known as Transportation Network Companies (TNC), work on a contractual basis with their drivers, wherein the drivers aren’t direct employees of these companies. Drivers should look into rideshare insurance.

Since the TNC doesn’t own the vehicles being operated by the drivers which means they can’t be held responsible for accidents, the state government has mandated TNC’ to cover the drivers under a group policy.

The statutory limit that requires TNC to offer coverage includes:

- When the ridesharing driver is online or waiting for a pick-up request: Coverage limits for personal injury liability are $50,000 per person/$100,000 per accident, along with property damage liability of $25,000. The coverage also includes PIP of $50,000 and uninsured/underinsured (UM/UIM) coverage of $25,000/$50,000.

- When the driver is riding to pick up a person/during the ride: Drivers are covered by liability and UM/UIM coverage of $1.25 million each and PIP coverage of $50,000.

Automation on the Road in New York

As per a Gallup poll, around 59 percent of Americans have shown their discomfort towards self-driving cars although people like autonomus features such as self-parking, emergency braking, and lane change assistance.

The state of New York allows testing of autonomous vehicles though there have been obstacles in the adoption of this emerging technology. The law requires a licensed driver to be behind the wheel when an autonomous vehicle is being tested, which should have insurance coverage of $5 million.

Safety Laws in New York

The reason behind most of the accidents is distracted driving or driving under the influence of alcohol and other substances. Naturally, there are strict laws to curb such behavior.

DUI Laws in New York

What are the DUI insurance laws in New York? If you’re caught drinking and driving in New York, you could lose your driving privileges and face substantial fines along with jail time.

Driving While Intoxicated (DWI): Motorists driving with a Blood Alcohol Content (BAC) of .08 or more can be booked for a DWI violation. Commercial drivers are in violation of the law if their BAC is .04 or more.

Zero Tolerance Law: If you’re under 21, a BAC level between .02 and .07 falls under the purview of a DWI violation.

Let’s look at the consequences of a DWI violation.

| Offense | Mandatory Fine | Maximum Prison Term | Mandatory Driver's License Suspension |

|---|---|---|---|

| First DWI | $500 - $1,000 | 1 year | Revocation for a minimum of six months |

| Second DWI within 10 years | $1,000 - $5,000 | 4 years | Revocation for a minimum of one year |

| Third DWI within 10 years | $2,000 - $10,000 | 7 years | Revocation for a minimum of one year |

Distracted Driving Laws in New York

Under the state laws of New York, the use of hand-held mobile devices for texting and calling is banned for everyone.

The fines for violations can range from $50 to $450, depending on the number of offenses you commit. In addition, the violation would add five points to your record.

While driving, you should refrain from using cell phones as it can lead to disastrous accidents

.https://www.youtube.com/watch?v=y4aXCsOQ7i0

Road Dangers in New York

We are sure that you’re updated about all the state laws in New York with respect to driving and car insurance by now.

Let’s face some facts and figures that would tell you about the reasons behind accidents, fatality rates, vehicle theft data, and much more.

Vehicle Theft in New York

| Make and Model | Most Stolen Model Year | Number of Vehicles Stolen |

|---|---|---|

| Honda Accord | 1997 | 724 |

| Honda Civic | 1998 | 707 |

| Toyota Camry | 2014 | 500 |

| Nissan Altima | 2015 | 374 |

| Dodge Caravan | 2000 | 368 |

| Ford Econoline E350 | 2011 | 339 |

| Nissan Maxima | 1998 | 328 |

| Honda CR-V | 1997 | 283 |

| Toyota Corolla | 2010 | 280 |

| Jeep Cherokee/Grand Cherokee | 2015 | 263 |

Vehicle Theft by City in New York

| City | Motor vehicle theft |

|---|---|

| Adams Village | 0 |

| Addison Town and Village | 1 |

| Akron Village | 0 |

| Albany | 142 |

| Albion Village | 5 |

| Alfred Village | 0 |

| Allegany Village | 0 |

| Amherst Town | 32 |

| Amityville Village | 6 |

| Amsterdam | 15 |

| Arcade Village | 1 |

| Ardsley Village | 1 |

| Asharoken Village | 0 |

| Attica Village | 1 |

| Auburn | 6 |

| Avon Village | 2 |

| Baldwinsville Village | 1 |

| Ballston Spa Village | 0 |

| Batavia | 2 |

| Bath Village | 2 |

| Bedford Town | 3 |

| Bethlehem Town | 4 |

| Binghamton | 57 |

| Black River | 0 |

| Blooming Grove Town | 7 |

| Bolivar Village | 0 |

| Bolton Town | 0 |

| Boonville Village | 0 |

| Brant Town | 2 |

| Brewster | 0 |

| Briarcliff Manor Village | 0 |

| Brighton Town | 28 |

| Brockport Village | 4 |

| Bronxville Village | 3 |

| Brownville Village | 0 |

| Buffalo | 957 |

| Cairo Town | 0 |

| Cambridge Village | 1 |

| Camden Village | 0 |

| Camillus Town and Village | 5 |

| Canandaigua | 8 |

| Canastota Village | 1 |

| Canisteo Village | 0 |

| Canton Village | 1 |

| Cape Vincent Village | 0 |

| Carmel Town | 9 |

| Carroll Town | 0 |

| Carthage Village | 1 |

| Cattaraugus Village | 0 |

| Cayuga Heights Village | 0 |

| Cazenovia Village | 1 |

| Central Square Village | 2 |

| Chatham Village | 0 |

| Cheektowaga Town | 73 |

| Chester Town | 0 |

| Chittenango Village | 1 |

| Cicero Town | 2 |

| Clarkstown Town | 28 |

| Clyde Village | 1 |

| Cobleskill Village | 0 |

| Coeymans Town | 4 |

| Cohoes | 15 |

| Colonie Town | 51 |

| Cooperstown Village | 0 |

| Corning | 4 |

| Cornwall-on-Hudson Village | 0 |

| Cornwall Town | 0 |

| Cortland | 4 |

| Crawford Town | 0 |

| Croton-on-Hudson Village | 2 |

| Cuba Town | 2 |

| Dansville Village | 8 |

| Deerpark Town | 0 |

| Delhi Village | 2 |

| Depew Village | 5 |

| Deposit Village | 0 |

| Dewitt Town | 12 |

| Dexter Village | 0 |

| Dobbs Ferry Village | 2 |

| Dolgeville Village | 1 |

| Dryden Village | 0 |

| Dunkirk | 1 |

| East Aurora-Aurora Town | 2 |

| Eastchester Town | 1 |

| East Fishkill Town | 6 |

| East Greenbush Town | 7 |

| East Hampton Town | 7 |

| East Hampton Village | 2 |

| East Rochester Village | 3 |

| East Syracuse Village | 7 |

| Eden Town | 0 |

| Ellenville Village | 0 |

| Ellicott Town | 0 |

| Elmira | 13 |

| Elmira Heights Village | 2 |

| Elmira Town | 0 |

| Endicott Village | 11 |

| Evans Town | 6 |

| Fairport Village | 3 |

| Fallsburg Town | 1 |

| Fishkill Town | 5 |

| Floral Park Village | 12 |

| Florida Village | 0 |

| Fort Plain Village | 2 |

| Frankfort Town | 1 |

| Frankfort Village | 1 |

| Franklinville Village | 0 |

| Fredonia Village | 0 |

| Freeport Village | 67 |

| Friendship Town | 0 |

| Fulton City | 6 |

| Garden City Village | 10 |

| Gates Town | 34 |

| Geddes Town | 8 |

| Geneseo Village | 0 |

| Geneva | 3 |

| Germantown Town | 0 |

| Glen Cove | 3 |

| Glen Park Village | 0 |

| Glens Falls | 5 |

| Glenville Town | 11 |

| Gloversville | 15 |

| Goshen Village | 0 |

| Gowanda Village | 2 |

| Granville Village | 0 |

| Great Neck Estates Village | 2 |

| Greece Town | 46 |

| Greenburgh Town | 22 |

| Greene Village | 0 |

| Green Island Village | 4 |

| Greenport Town | 2 |

| Greenwood Lake Village | 2 |

| Groton Village | 1 |

| Guilderland Town | 1 |

| Hamburg Town | 21 |

| Hamburg Village | 0 |

| Hammondsport Village | 0 |

| Harrison Town | 4 |

| Hastings-on-Hudson Village | 2 |

| Haverstraw Town | 13 |

| Hempstead Village | 122 |

| Herkimer Village | 0 |

| Highland Falls Village | 0 |

| Homer Village | 1 |

| Hoosick Falls Village | 2 |

| Hornell | 0 |

| Horseheads Village | 0 |

| Hudson | 1 |

| Hudson Falls Village | 0 |

| Huntington Bay Village | 1 |

| Hyde Park Town | 5 |

| Ilion Village | 1 |

| Irondequoit Town | 33 |

| Irvington Village | 0 |

| Jamestown | 30 |

| Johnson City Village | 10 |

| Johnstown | 14 |

| Jordan Village | 0 |

| Kenmore Village | 5 |

| Kent Town | 5 |

| Kings Point Village | 1 |

| Kingston | 10 |

| Kirkland Town | 1 |

| Lackawanna | 35 |

| Lake Placid Village | 2 |

| Lake Success Village | 1 |

| Lakewood-Busti | 2 |

| Lancaster Town | 9 |

| Larchmont Village | 2 |

| Le Roy Village | 0 |

| Lewiston Town and Village | 8 |

| Liberty Village | 3 |

| Little Falls | 1 |

| Liverpool Village | 1 |

| Lloyd Harbor Village | 0 |

| Lloyd Town | 3 |

| Lockport | 6 |

| Long Beach | 18 |

| Lowville Village | 4 |

| Lynbrook Village | 18 |

| Lyons Village | 3 |

| Macedon Town and Village | 2 |

| Malone Village | 3 |

| Malverne Village | 1 |

| Mamaroneck Town | 1 |

| Mamaroneck Village | 8 |

| Manchester Village | 0 |

| Manlius Town | 3 |

| Marcellus Village | 0 |

| Marlborough Town | 3 |

| Massena Village | 0 |

| Mechanicville | 4 |

| Medina Village | 2 |

| Menands Village | 1 |

| Middleport Village | 2 |

| Middletown | 33 |

| Monroe Village | 3 |

| Montgomery Town | 1 |

| Montgomery Village | 0 |

| Monticello Village | 5 |

| Moravia Village | 0 |

| Moriah Town | 1 |

| Mount Hope Town | 1 |

| Mount Kisco Village | 0 |

| Mount Morris Village | 1 |

| Mount Pleasant Town | 3 |

| Mount Vernon | 147 |

| Newark Village | 2 |

| New Berlin Town | 0 |

| Newburgh | 63 |

| Newburgh Town | 28 |

| New Castle Town | 2 |

| New Hartford Town and Village | 4 |

| New Paltz Town and Village | 4 |

| New Rochelle | 69 |

| New Windsor Town | 12 |

| New York | 7,434 |

| New York Mills Village | 1 |

| Niagara Falls | 112 |

| Niagara Town | 14 |

| Niskayuna Town | 8 |

| Nissequogue Village | 1 |

| North Castle Town | 3 |

| North Greenbush Town | 2 |

| Northport Village | 4 |

| North Syracuse Village | 3 |

| North Tonawanda | 17 |

| Northville Village | 0 |

| Norwich | 3 |

| Ogdensburg | 4 |

| Ogden Town | 8 |

| Old Brookville Village | 10 |

| Old Westbury Village | 4 |

| Olean | 9 |

| Oneida | 9 |

| Oneonta City | 4 |

| Orangetown Town | 14 |

| Orchard Park Town | 12 |

| Oriskany Village | 0 |

| Ossining Village | 5 |

| Oswego City | 14 |

| Owego Village | 4 |

| Oxford Village | 0 |

| Oyster Bay Cove Village | 0 |

| Painted Post Village | 2 |

| Palmyra Village | 1 |

| Peekskill | 8 |

| Pelham Manor Village | 3 |

| Pelham Village | 1 |

| Penn Yan Village | 1 |

| Perry Village | 1 |

| Piermont Village | 0 |

| Pine Plains Town | 2 |

| Plattekill Town | 1 |

| Plattsburgh City | 8 |

| Pleasantville Village | 0 |

| Port Byron Village | 0 |

| Port Chester Village | 22 |

| Port Dickinson Village | 0 |

| Port Jervis | 3 |

| Portville Village | 0 |

| Potsdam Village | 5 |

| Poughkeepsie | 9 |

| Poughkeepsie Town | 11 |

| Pound Ridge Town | 0 |

| Pulaski Village | 1 |

| Quogue Village | 1 |

| Ramapo Town | 13 |

| Red Hook Village | 0 |

| Rensselaer City | 7 |

| Rhinebeck Village | 1 |

| Riverhead Town | 33 |

| Rochester | 609 |

| Rockville Centre Village | 18 |

| Rome | 35 |

| Rosendale Town | 0 |

| Rotterdam Town | 20 |

| Rye Brook Village | 2 |

| Sag Harbor Village | 1 |

| Salamanca | 12 |

| Sands Point Village | 1 |

| Saranac Lake Village | 5 |

| Saratoga Springs | 8 |

| Saugerties Town | 0 |

| Scarsdale Village | 7 |

| Schenectady | 153 |

| Schodack Town | 2 |

| Schoharie Village | 0 |

| Scotia Village | 0 |

| Seneca Falls Town | 5 |

| Shandaken Town | 1 |

| Shawangunk Town | 0 |

| Shelter Island Town | 0 |

| Sherburne Village | 0 |

| Sherrill | 0 |

| Shortsville Village | 0 |

| Sidney Village | 3 |

| Skaneateles Village | 0 |

| Sleepy Hollow Village | 2 |

| Sodus Village | 0 |

| Solvay Village | 6 |

| Southampton Town | 49 |

| Southampton Village | 4 |

| South Glens Falls Village | 2 |

| Southold Town | 2 |

| Spring Valley Village | 16 |

| Stillwater Town | 2 |

| St. Johnsville Village | 0 |

| Stony Point Town | 6 |

| Suffern Village | 1 |

| Syracuse | 394 |

| Tarrytown Village | 4 |

| Ticonderoga Town | 0 |

| Tonawanda | 2 |

| Tonawanda Town | 27 |

| Troy | 87 |

| Trumansburg Village | 2 |

| Tuckahoe Village | 1 |

| Tupper Lake Village | 2 |

| Tuxedo Park Village | 0 |

| Ulster Town | 2 |

| Utica | 82 |

| Vestal Town | 9 |

| Walden Village | 5 |

| Wallkill Town | 26 |

| Walton Village | 0 |

| Warsaw Village | 0 |

| Washingtonville Village | 2 |

| Waterford Town and Village | 1 |

| Waterloo Village | 2 |

| Watertown | 43 |

| Watervliet | 21 |

| Watkins Glen Village | 2 |

| Waverly Village | 4 |

| Webster Town and Village | 7 |

| Weedsport Village | 0 |

| Wellsville Village | 3 |

| Westhampton Beach Village | 3 |

| West Seneca Town | 20 |

| Whitehall Village | 1 |

| White Plains | 21 |

| Whitesboro Village | 1 |

| Whitestown Town | 3 |

| Woodbury Town | 3 |

| Woodridge Village | 0 |

| Woodstock Town | 0 |

| Yonkers | 236 |

| Yorktown Town | 2 |

Fatal Crashes by Weather Conditions in New York

| Weather Condition | Daylight | Dark, but Lighted | Dark | Dawn or Dusk | Other / Unknown | Total |

|---|---|---|---|---|---|---|

| Normal | 409 | 238 | 128 | 36 | 1 | 812 |

| Rain | 34 | 28 | 14 | 4 | 0 | 80 |

| Snow/Sleet | 12 | 5 | 4 | 0 | 0 | 21 |

| Other | 2 | 0 | 6 | 0 | 0 | 8 |

| Unknown | 4 | 2 | 3 | 1 | 2 | 12 |

| TOTAL | 461 | 273 | 155 | 41 | 3 | 933 |

Fatalities by County in New York

| County Name | 2013 | 2014 | 2015 | 2016 | 2017 |

|---|---|---|---|---|---|

| Albany County | 10 | 25 | 22 | 24 | 19 |

| Allegany County | 5 | 2 | 4 | 5 | 2 |

| Bronx County | 52 | 35 | 40 | 49 | 40 |

| Broome County | 13 | 11 | 15 | 18 | 9 |

| Cattaraugus County | 11 | 4 | 7 | 5 | 11 |

| Cayuga County | 7 | 4 | 8 | 11 | 8 |

| Chautauqua County | 11 | 10 | 10 | 13 | 9 |

| Chemung County | 7 | 3 | 11 | 5 | 5 |

| Chenango County | 9 | 4 | 6 | 5 | 6 |

| Clinton County | 8 | 6 | 3 | 9 | 4 |

| Columbia County | 9 | 6 | 8 | 8 | 11 |

| Cortland County | 9 | 6 | 6 | 4 | 5 |

| Delaware County | 9 | 6 | 8 | 2 | 7 |

| Dutchess County | 30 | 22 | 26 | 20 | 19 |

| Erie County | 57 | 47 | 44 | 50 | 43 |

| Essex County | 1 | 8 | 2 | 3 | 3 |

| Franklin County | 1 | 6 | 6 | 3 | 3 |

| Fulton County | 5 | 7 | 6 | 0 | 6 |

| Genesee County | 8 | 5 | 7 | 5 | 14 |

| Greene County | 12 | 3 | 10 | 7 | 6 |

| Hamilton County | 2 | 0 | 0 | 1 | 0 |

| Herkimer County | 6 | 7 | 4 | 8 | 10 |

| Jefferson County | 12 | 8 | 12 | 9 | 4 |

| Kings County | 87 | 78 | 69 | 53 | 56 |

| Lewis County | 6 | 4 | 4 | 3 | 5 |

| Livingston County | 1 | 9 | 3 | 7 | 6 |

| Madison County | 8 | 7 | 9 | 3 | 6 |

| Monroe County | 37 | 43 | 33 | 45 | 45 |

| Montgomery County | 7 | 3 | 5 | 5 | 5 |

| Nassau County | 83 | 81 | 95 | 80 | 78 |

| New York County | 45 | 39 | 28 | 48 | 38 |

| Niagara County | 27 | 18 | 18 | 17 | 15 |

| Oneida County | 21 | 15 | 12 | 22 | 18 |

| Onondaga County | 30 | 25 | 33 | 27 | 34 |

| Ontario County | 11 | 16 | 16 | 9 | 8 |

| Orange County | 35 | 36 | 28 | 32 | 35 |

| Orleans County | 7 | 4 | 0 | 4 | 11 |

| Oswego County | 22 | 20 | 19 | 17 | 16 |

| Otsego County | 5 | 4 | 7 | 4 | 6 |

| Putnam County | 4 | 7 | 9 | 5 | 7 |

| Queens County | 99 | 86 | 78 | 61 | 59 |

| Rensselaer County | 11 | 10 | 9 | 8 | 9 |

| Richmond County | 12 | 12 | 26 | 19 | 14 |

| Rockland County | 17 | 17 | 15 | 11 | 18 |

| Saratoga County | 18 | 11 | 18 | 19 | 18 |

| Schenectady County | 4 | 6 | 10 | 7 | 9 |

| Schoharie County | 2 | 4 | 2 | 2 | 2 |

| Schuyler County | 3 | 1 | 2 | 3 | 3 |

| Seneca County | 5 | 5 | 7 | 4 | 5 |

| St. Lawrence County | 16 | 9 | 11 | 10 | 10 |

| Steuben County | 12 | 12 | 7 | 10 | 3 |

| Suffolk County | 145 | 123 | 168 | 139 | 121 |

| Sullivan County | 14 | 13 | 13 | 9 | 6 |

| Tioga County | 1 | 5 | 3 | 7 | 3 |

| Tompkins County | 8 | 8 | 13 | 10 | 8 |

| Ulster County | 24 | 12 | 16 | 14 | 23 |

| Warren County | 6 | 9 | 2 | 2 | 6 |

| Washington County | 8 | 8 | 10 | 8 | 3 |

| Wayne County | 10 | 10 | 13 | 12 | 9 |

| Westchester County | 52 | 27 | 51 | 37 | 32 |

| Wyoming County | 2 | 5 | 7 | 3 | 5 |

| Yates County | 3 | 4 | 2 | 1 | 0 |

Traffic Fatalities by Road Type in New York

| Type of Road | 2008 | 2009 | 2010 | 2011 | 2012 | 2013 | 2014 | 2015 | 2016 | 2017 |

|---|---|---|---|---|---|---|---|---|---|---|

| Total | 1,238 | 1,158 | 1,201 | 1,171 | 1,180 | 1,202 | 1,041 | 1,136 | 1,041 | 999 |

| Rural | 622 | 582 | 571 | 534 | 618 | 630 | 390 | 455 | 463 | 472 |

| Urban | 616 | 576 | 630 | 637 | 562 | 572 | 651 | 681 | 578 | 527 |

Fatalities by Person Type in New York

| Person Type | 2013 | 2014 | 2015 | 2016 | 2017 |

|---|---|---|---|---|---|

| Passenger Car | 423 | 375 | 368 | 330 | 339 |

| Light Truck - Pickup | 59 | 49 | 49 | 70 | 47 |

| Light Truck - Utility | 93 | 90 | 113 | 91 | 119 |

| Light Truck - Van | 41 | 26 | 41 | 33 | 33 |

| Large Truck | 16 | 14 | 15 | 11 | 13 |

| Other/Unknown Occupants | 16 | 17 | 20 | 10 | 7 |

| Total Occupants | 648 | 574 | 611 | 545 | 560 |

| Bus | 0 | 3 | 4 | 0 | 1 |

| Light Truck - Other | 0 | 0 | 1 | 0 | 1 |

| Total Motorcyclists | 170 | 148 | 163 | 136 | 145 |

| Pedestrian | 336 | 264 | 311 | 307 | 242 |

| Bicyclist and Other Cyclist | 40 | 46 | 36 | 39 | 46 |

| Other/Unknown Nonoccupants | 8 | 9 | 15 | 14 | 6 |

| Total Nonoccupants | 384 | 319 | 362 | 360 | 294 |

| Total | 1,202 | 1,041 | 1,136 | 1,041 | 999 |

Fatalities by Crash Type in New York

| Crash Type | 2013 | 2014 | 2015 | 2016 | 2017 |

|---|---|---|---|---|---|

| Total Fatalities (All Crashes) | 1,202 | 1,041 | 1,136 | 1,041 | 999 |

| Single Vehicle | 784 | 674 | 709 | 660 | 602 |

| Involving a Large Truck | 118 | 98 | 126 | 106 | 121 |

| Involving Speeding | 359 | 322 | 347 | 314 | 308 |

| Involving a Rollover | 160 | 144 | 160 | 144 | 127 |

| Involving a Roadway Departure | 580 | 509 | 513 | 471 | 450 |

| Involving an Intersection (or Intersection Related) | 467 | 377 | 419 | 385 | 373 |

Fatalities Trend for the Top 10 Counties in New York

| Top Counties in New York (2017) | 2013 | 2014 | 2015 | 2016 | 2017 |

|---|---|---|---|---|---|

| Suffolk County | 145 | 123 | 168 | 139 | 121 |

| Nassau County | 83 | 81 | 95 | 80 | 78 |

| Queens County | 99 | 86 | 78 | 61 | 59 |

| Kings County | 87 | 78 | 69 | 53 | 56 |

| Monroe County | 37 | 43 | 33 | 45 | 45 |

| Erie County | 57 | 47 | 44 | 50 | 43 |

| Bronx County | 52 | 35 | 40 | 49 | 40 |

| New York County | 45 | 39 | 28 | 48 | 38 |

| Orange County | 35 | 36 | 28 | 32 | 35 |

| Onondaga County | 30 | 25 | 33 | 27 | 34 |

| Top Ten Counties | 692 | 595 | 639 | 594 | 549 |

| All Other Counties | 510 | 446 | 497 | 447 | 450 |

| All Counties | 1,202 | 1,041 | 1,136 | 1,041 | 999 |

Fatalities Involving Speeding by County in New York

| County Name | 2013 | 2014 | 2015 | 2016 | 2017 |

|---|---|---|---|---|---|

| Albany County | 1 | 7 | 7 | 3 | 5 |

| Allegany County | 2 | 0 | 0 | 3 | 0 |

| Bronx County | 12 | 13 | 10 | 11 | 12 |

| Broome County | 1 | 4 | 5 | 4 | 4 |