Best Car Insurance for Road Trips in 2026 (Top 10 Companies)

Get the best car insurance for road trips from Progressive, Allstate, and State Farm. Examine the customized coverage choices and discounts up to 30% provided by these leading companies. Delve into detailed information to make well-informed decisions for your upcoming travels.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Licensed Insurance Producer

Dani Best has been a licensed insurance producer for nearly 10 years. Dani began her insurance career in a sales role with State Farm in 2014. During her time in sales, she graduated with her Bachelors in Psychology from Capella University and is currently earning her Masters in Marriage and Family Therapy. Since 2014, Dani has held and maintains licenses in Life, Disability, Property, and Casualt...

Dani Best

Licensed Insurance Agent

Justin Wright has been a licensed insurance broker for over 9 years. After graduating from Southeastern Seminary with a Masters in Philosophy, Justin started his career as a professor, teaching Philosophy and Ethics. Later, Justin obtained both his Property & Casualty license and his Life and Health license and began working for State Farm and Allstate. In 2020, Justin began working as an i...

Justin Wright

Updated May 2024

13,283 reviews

13,283 reviewsCompany Facts

Full Coverage for Road Trips

A.M. Best Rating

Complaint Level

13,283 reviews

13,283 reviews 11,638 reviews

11,638 reviewsCompany Facts

Full Coverage for Road Trips

A.M. Best Rating

Complaint Level

Pros & Cons

11,638 reviews

11,638 reviews 18,155 reviews

18,155 reviewsCompany Facts

Full Coverage for Road Trips

A.M. Best Rating

Complaint Level

Pros & Cons

18,155 reviews

18,155 reviewsExamine the best car insurance for road trips with Progressive, Allstate, and State Farm. Delve into their offerings, assessing rates, discounts, and tailored coverage options to ensure your journey is safeguarded by a choice that strikes the perfect balance between protection and financial prudence.

Full auto coverage also protects policyholders from having to pay for any damages that they have been deemed responsible for.

Our Top 10 Picks: Best Car Insurance for Road Trips

| Company | Rank | Multi-Vehicle Discount | Multi-Policy Discount | Best For | Jump to Pros/Cons |

|---|---|---|---|---|---|

| #1 | 12% | 10% | Online Convenience | Progressive | |

| #2 | 25% | 22% | Add-on Coverages | Allstate | |

| #3 | 20% | 30% | Many Discounts | State Farm | |

| #4 | 10% | 10% | Military Savings | USAA | |

| #5 | 20% | 10% | Usage Discount | Nationwide |

| #6 | 8% | 10% | Accident Forgiveness | Travelers | |

| #7 | 20% | 10% | Student Savings | American Family | |

| #8 | 25% | 10% | Customizable Polices | Liberty Mutual |

| #9 | 20% | 10% | Local Agents | Farmers | |

| #10 | 25% | 10% | Deductible Reduction | AAA |

Since your road trip will likely take you far away from your state of residence, having a temporary car insurance policy can save you money as well as unnecessary hassles.

Temporary comprehensive car insurance coverage is also known as short-term insurance. Type your ZIP code into the free tool above to compare car insurance quotes from multiple companies.

#1 – Progressive: Top Overall Pick

Pros

- Online Convenience: As mentioned in our Progressive car insurance review, Progressive is ranked #1 for its online convenience, making it a top choice for users who prefer a seamless and digital insurance experience.

- Maximum Multi-Policy Discount: Progressive offers a competitive multi-policy discount of up to 10%, providing savings for customers bundling multiple insurance policies.

- Maximum Low-Mileage Discount: With a maximum low-mileage discount of up to 10%, progressive caters to customers who drive less, rewarding them with potential cost savings.

Cons

- Limited Deductible Reduction: Progressive offers a deductible reduction of up to 7%, which is comparatively lower than some other companies on the list.

- Moderate Maximum Discount Rates: While Progressive provides solid discounts, the maximum rates may not be as high as those offered by some other companies on the list.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#2 – Allstate: Best for Add-On Coverages

Pros

- Add-on Coverages: Allstate stands out for its extensive add-on coverages, making it an ideal choice for customers looking for additional protection beyond standard policies.

- Maximum Multi-Policy Discount: Allstate offers a competitive multi-policy discount of up to 10%, providing potential savings for customers bundling their insurance needs.

- High Maximum Low-Mileage Discount: With a maximum low-mileage discount of up to 22%, Allstate offers significant savings for customers who drive less.

Cons

- Online Convenience: Allstate car insurance is not ranked as high for online convenience, which may be a drawback for customers who prioritize a fully digital insurance experience.

- Limited Deductible Reduction: Allstate’s deductible reduction of up to 7% is lower compared to some other companies, potentially offering less flexibility for customers.

#3 – State Farm: Best for Many discounts

Pros

- Many Discounts: State Farm car insurance is recognized for offering a wide range of discounts, making it suitable for customers seeking various ways to save on their car insurance.

- Maximum Multi-Policy Discount: With a multi-policy discount of up to 17%, State Farm provides attractive savings for customers bundling their insurance coverage.

- High Maximum Low-Mileage Discount: State Farm offers a substantial low-mileage discount of up to 30%, making it an excellent choice for customers who drive less.

Cons

- Customization Options: State Farm’s policies may be less customizable compared to some other companies, potentially limiting flexibility for certain customers.

- Deductible Reduction: State Farm’s deductible reduction rate of up to 7% is lower than some competitors, offering less incentive for customers looking to reduce deductibles.

#4 – USAA: Best for Military savings

Pros

- Military savings: USAA is highly regarded for its commitment to military savings, offering a substantial discount of up to 25% for military members and their families.

- Maximum multi-policy discount: With a multi-policy discount of up to 10%, USAA provides additional savings for customers bundling various insurance needs.

- Solid low-mileage discount: While not the highest, the maximum low-mileage discount of up to 10% adds value for customers who drive less.

Cons

- Membership eligibility: USAA is limited to military members and their families, making it inaccessible to the general public. Learn more in our USAA car insurance review.

- Limited deductible reduction: USAA offers a deductible reduction of up to 7%, which is lower than some competitors.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#5 – Nationwide: Best for Usage Discount

Pros

- Usage Discount: Nationwide stands out with its usage-based discount, offering potential savings for customers who drive less. Learn more about their discounts in our Nationwide car insurance discounts article.

- Maximum Multi-Policy Discount: Nationwide provides a competitive multi-policy discount of up to 10%, encouraging customers to bundle their insurance needs.

- Nationwide Availability: As a national insurance provider, Nationwide is accessible to customers across the United States.

Cons

- Limited Maximum Discounts: While Nationwide offers solid discounts, the maximum rates may not be as high as those provided by some other companies on the list.

- Online Convenience: Nationwide is not specifically highlighted for online convenience, which may be a drawback for users seeking a fully digital experience.

#6 – Travelers: Best for Accident Forgiveness

Pros

- Accident Forgiveness: Travelers distinguishes itself with the inclusion of accident forgiveness, providing policyholders with peace of mind in the event of an accident.

- Maximum Multi-Policy Discount: With a multi-policy discount of up to 10%, Travelers offers additional savings for customers bundling different insurance coverages.

- Solid Low-Mileage Discount: The maximum low-mileage discount of up to 10% adds value for customers who drive less.

Cons

- Moderate Maximum Discounts: While Travelers provides competitive discounts, the maximum rates may not be as high as those offered by some other companies.

- Limited Deductible Reduction: As mentioned in our Travelers car insurance review, they offer a deductible reduction of up to 7%, which is lower compared to some competitors.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Types of Accidents Covered by Temporary Car Insurance

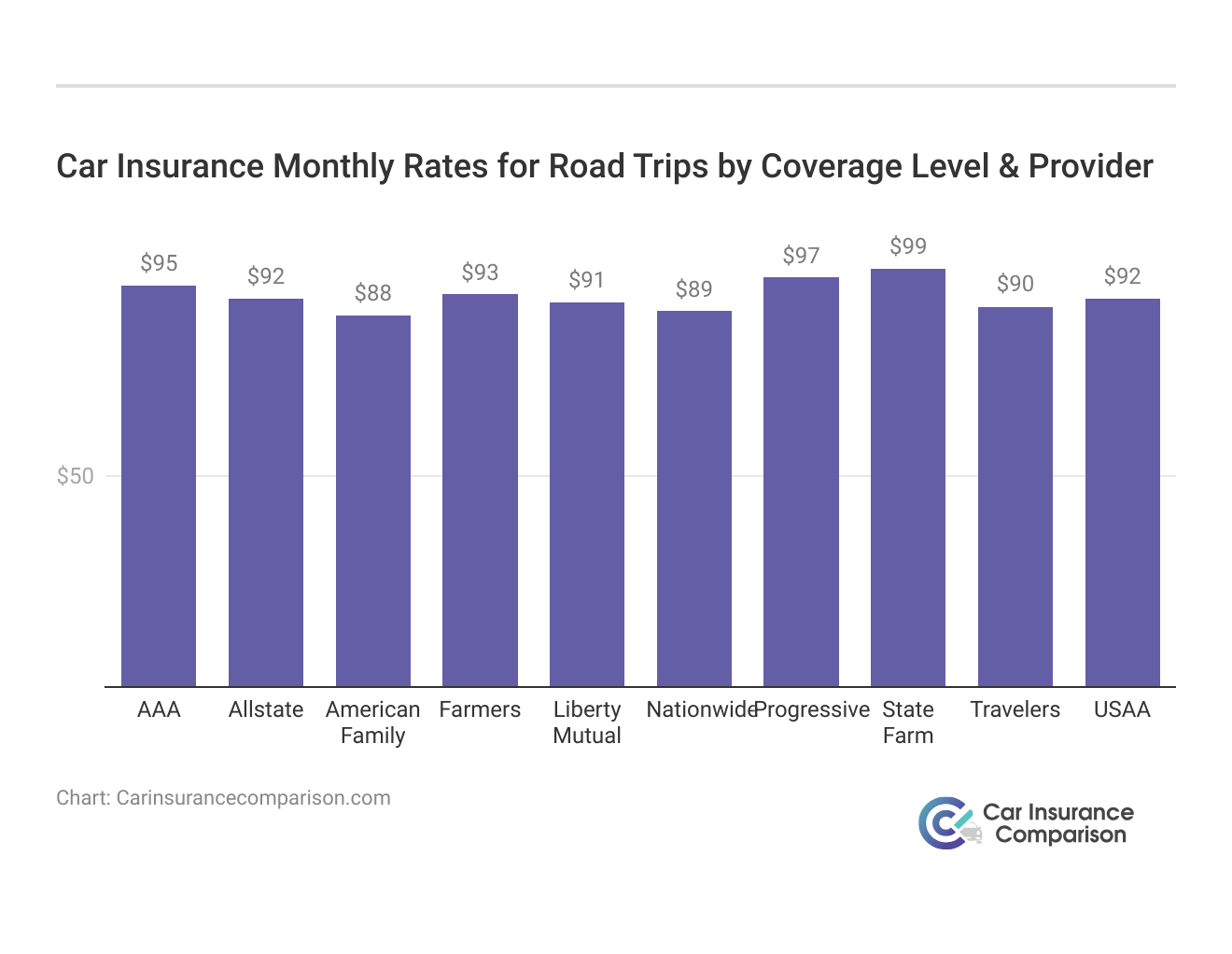

When planning a road trip, the importance of securing suitable insurance coverage cannot be overstated. Here’s a snapshot of the average monthly car insurance rates from the best car insurance for road trips.

Car Insurance Monthly Rates for Road Trips by Coverage Level & Provider

| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| AAA | $95 | $185 |

| Allstate | $92 | $210 |

| American Family | $88 | $205 |

| Farmers | $93 | $205 |

| Liberty Mutual | $91 | $215 |

| Nationwide | $89 | $205 |

| Progressive | $97 | $200 |

| State Farm | $99 | $200 |

| Travelers | $90 | $185 |

| USAA | $92 | $185 |

Progressive offers a minimum coverage option at $97 per month, while full coverage is available at $200. Allstate provides a minimum coverage plan for $92 monthly and full coverage at $210. State Farm stands at $99 per month for minimum coverage and $200 for full coverage. The rates continue with other notable insurers, such as USAA, Nationwide, Travelers, American Family, Liberty Mutual, Farmers, and AAA.

Temporary Car Insurance Policy Expiration Date

If you know the exact date of your road trip, you can buy a temporary comprehensive car insurance policy for the period of time you will be traveling.

However, most companies offer a policy term of at least six-month, or even a year. Even though you may find some insurers advertising short-term coverage, they may not offer the best coverage suited to your needs.

Read more: Compare Three-Month Car Insurance: Rates, Discounts, & Requirements

Some road trips are completely unplanned, but you will still be able to buy temporary insurance at any point.

Unlike traditional car coverage that is purchased in advance for a specific period of time, your temporary auto insurance can last for as long as you want it to.

If you want to buy a car insurance policy for less than six months, you may need to cancel your standard auto insurance policy mid-term. However, there are still options to get temporary insurance coverage outside the typical six or 12-month policy period.

When renting a vehicle, comprehensive coverage is nearly always needed.

You can choose to purchase a temporary comprehensive insurance policy directly via your car rental agency or you can buy separate full coverage through an independent car insurance company.

The Insurance Information Institute states that consumers who rent cars don’t always need to buy additional coverage.

However, drivers who have liability only car insurance policies are usually not able to rent cars with their existing insurance policies.

Car rental companies need to be certain that their customers will not cause them to incur a financial loss in case they get into accidents.

Read more: Compare Car Insurance for Shipping Cars Overseas: Rates, Discounts, & Requirements

Case Studies: Car Insurance for Road Trips

Embarking on a road trip is an exhilarating experience, filled with the promise of adventure and discovery. However, amidst the excitement, ensuring adequate insurance coverage is essential for a smooth and worry-free journey. In this section, we explore three compelling case studies that highlight the importance of selecting the right insurance provider and coverage tailored to individual travel needs.

- Case Study #1 – Smooth Road Trip With Progressive: Emily, a frequent traveler, was planning a cross-country road trip and wanted to ensure she had the right insurance coverage. She turned to Progressive after reading about its online convenience.

- Case Study #2 – Allstate’s Additional Coverages for a Memorable Journey: John and Sarah were planning a family road trip with their kids. They were concerned about potential risks and wanted extra coverage beyond the basics.

- Case Study #3 – State Farm’s Discounted Road Adventure: Mike, an avid road tripper, was looking for an insurance provider that offered various discounts to make his travels more cost-effective.

As demonstrated by these insightful case studies, choosing the right insurance coverage can significantly enhance the road trip experience. Whether it’s the seamless online convenience offered by Progressive, the additional coverages for added peace of mind with Allstate, or the attractive discounts provided by State Farm, each case underscores the importance of thorough research and personalized solutions.

Read more: Travel Car Insurance: Rates, Discounts, & Requirements

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Understanding the Coverage of Temporary Car Insurance

Traditional car insurance often can be used by drivers who are not listed on the policy.

When insured motorists drive a vehicle that they do not own, their auto insurance companies will often extend coverage to that vehicle as well.

However, temporary car insurance usually only provides protection for the policyholder and the vehicles listed at the time of purchase.

If you decide to drive a different car while on your road trip, you can buy a new temporary insurance policy or even add it to your current insurance plan.

Temporary policies also cover different types of vehicles, such as those designed for recreational use.

Since most states require people to have insurance on jet skis, mopeds, and even golf carts, rate comparisons for temporary insurance policies are readily available on and off the internet.

You will need to submit a car insurance quote application to see how much money it will cost you to cover the vehicle you will be taking on your road trip.

While some companies may advertise low short-term car insurance rates, you will undoubtedly pay more if you want full coverage on your vehicle.

As soon as you know when and where your road trip will take place, start comparing temporary comprehensive car insurance rates.

Short-term coverage options do not always offer the best protection against accidents, so you might end up paying for damages out of pocket.

Enter your ZIP code below to receive car insurance quotes from multiple companies today.

Frequently Asked Questions

Do I need special car insurance for road trips?

Generally, your existing car insurance policy should cover you for road trips. However, it’s crucial to review your policy to ensure it provides adequate coverage for the duration and distance of your road trip. If you have any concerns or specific requirements, it’s best to contact your insurance provider to discuss your options.

What factors should I consider when comparing car insurance for road trips?

When comparing car insurance for road trips, there are factors that affect car insurance rates such as your coverage needs, the duration of your trip, and the distance you’ll be traveling. Additionally, take into account your driving record, any specific discounts or incentives for road trips, and whether temporary coverage options are available for your travel plans.

Are there any specific discounts for road trips?

Insurance providers may offer specific discounts or incentives for road trips. These can include low-mileage discounts, usage-based insurance programs, or discounts for bundling your car insurance with other policies. To maximize potential savings, it’s advisable to inquire with your insurance provider about any available discounts that align with your road trip plans.

See if you’re getting the best deal on car insurance by entering your ZIP code below.

What should I do in case of an accident during my road trip?

If you are involved in an accident during your road trip, follow these steps:

- Ensure Safety: Move to a safe location if possible.

- Exchange Information: Exchange contact and insurance details with the other party involved.

- Document the Scene: Take photos of the accident scene and gather witness information.

- Contact Authorities: Report the accident to the local authorities if required.

- Inform Your Insurance Provider: Notify your insurance provider about the accident as soon as possible to initiate the claims process.

It’s very important to follow these simple steps to avoid further issues when you are in an accident.

How do I ensure I have adequate coverage for my road trip?

It’s essential to review your existing car insurance policy to ensure it provides sufficient coverage for the duration and distance of your road trip. Consider factors such as liability limits, comprehensive and collision coverage, and roadside assistance options.

Can I add temporary coverage for my road trip?

In some cases, you may be able to add temporary coverage for your road trip. This can be done through a policy endorsement or by purchasing a separate short-term car insurance policy. Contact your insurance provider to inquire about options for temporary coverage and any associated costs.

Read more: Best Temporary Car Insurance

Are there any specific discounts available for long-distance travel?

Some insurance companies offer discounts specifically tailored to road trips, such as low-mileage discounts or special rates for extended travel. Be sure to inquire with your insurer about any available discounts that could apply to your journey.

Are rental car insurance policies suitable for road trips?

While rental car insurance may provide coverage for short-term travel, it’s essential to carefully review the terms and conditions of the policy. Ensure that the coverage limits are sufficient for your needs and that any restrictions on mileage or destinations are acceptable for your road trip plans. If you’re on a budget and you travel more often, read our budget rental car insurance review.

Can I temporarily suspend my regular car insurance policy during a road trip?

While some insurers may offer options to temporarily suspend coverage for specific periods, it’s crucial to discuss this with your insurance provider beforehand. Keep in mind that driving without insurance is illegal in most states, so alternative arrangements may be necessary.

What types of coverage should I consider for a road trip involving multiple states?

When planning a road trip that crosses state lines, it’s essential to ensure your insurance coverage meets the minimum requirements of each state you’ll be traveling through. Additionally, consider adding coverage for potential roadside emergencies and towing services.

Ready to find cheaper car insurance coverage? Enter your ZIP code below to begin.

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.