Compare Fort Collins, CO Car Insurance Rates [2026]

The average cost of Fort Collins, Colorado, car insurance is $282 per month or $3,388 annually. The cheapest Fort Collins, CO car insurance company is Liberty Mutual. However, your unique Fort Collins, CO car insurance rates vary depending on your age, driving record, and coverage needs. By law, all Fort Collins drivers must carry the Colorado minimum insurance levels of 25/50/15 in liability coverage.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Licensed Insurance Agent

Scott W Johnson is an independent insurance agent in California. Principal Broker and founder of Marindependent Insurance Services, Scott brings over 25 years of experience to his clients. His Five President’s Council awards prove he uses all he learned at Avocet, Sprint Nextel, and Farmers Insurance to the benefit of his clients. Scott quickly grasped the unique insurance requirements of his...

Scott W. Johnson

Commercial Lines Coverage Specialist

Michael Vereecke is the president of Customers First Insurance Group. He has been a licensed insurance agent for over 13 years. He also carries a Commercial Lines Coverage Specialist (CLCS) Designation, providing him the expertise to spot holes in businesses’ coverage. Since 2009, he has worked with many insurance providers, giving him unique insight into the insurance market, differences in ...

Michael Vereecke

Updated February 2024

- The cheapest Fort Collins, CO car insurance company is Liberty Mutual

- Severe Colorado weather patterns heavily influence your regional average Fort Collins car insurance costs.

- Fort Collins, CO car insurance rates are some of the lowest in all of Colorado

On average, Fort Collins, Colorado car insurance costs $282 per month or $3,388 per year. However, your Fort Collins, CO car insurance quotes depend on your age, driving record, and coverage needs.

Below, compare the average annual rates from the top insurance companies in Fort Collins, and learn how to secure cheap car insurance premiums.

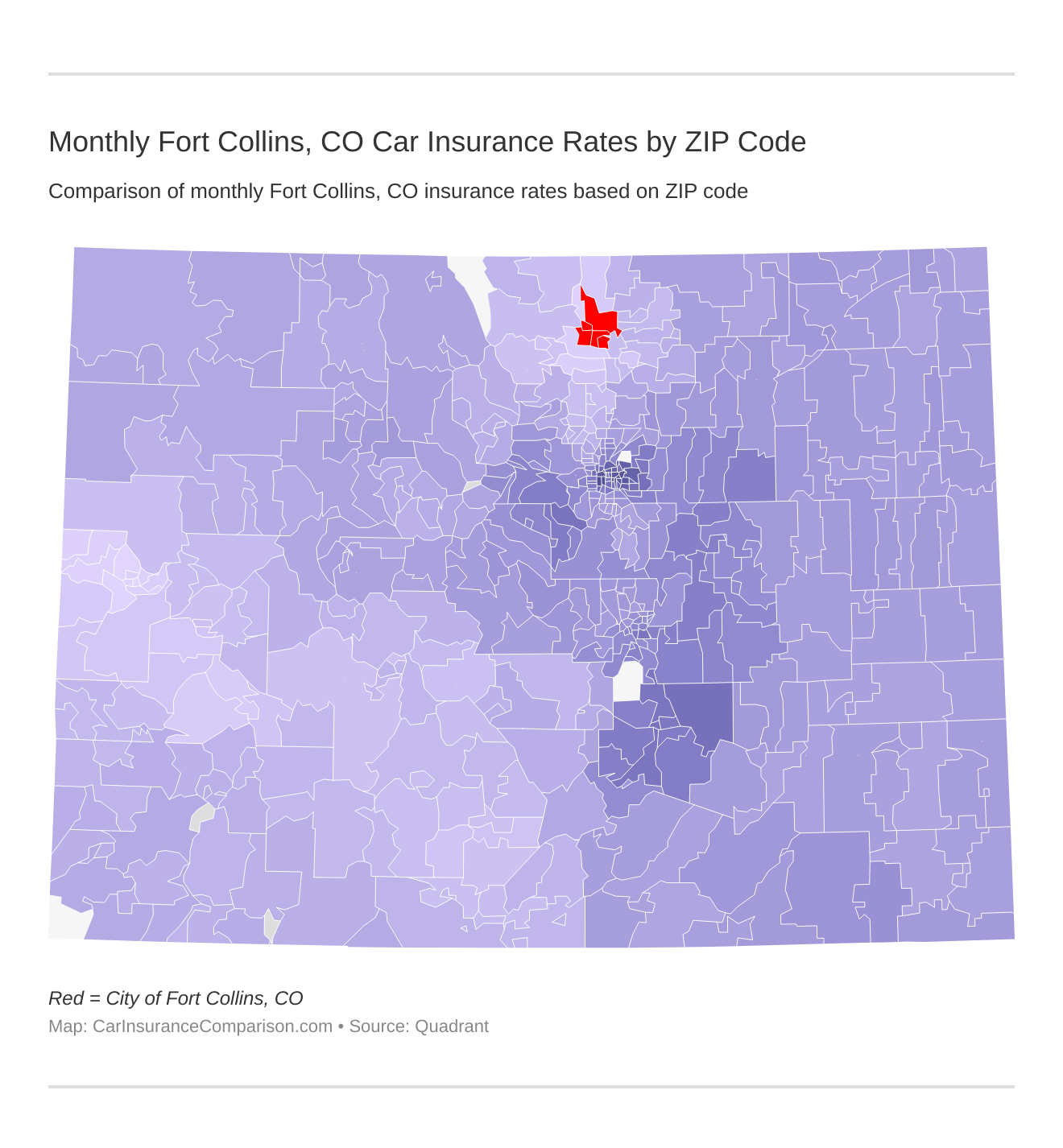

Monthly Fort Collins, CO Car Insurance Rates by ZIP Code

Find more info about the monthly Fort Collins, CO car insurance rates by ZIP Code below:

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

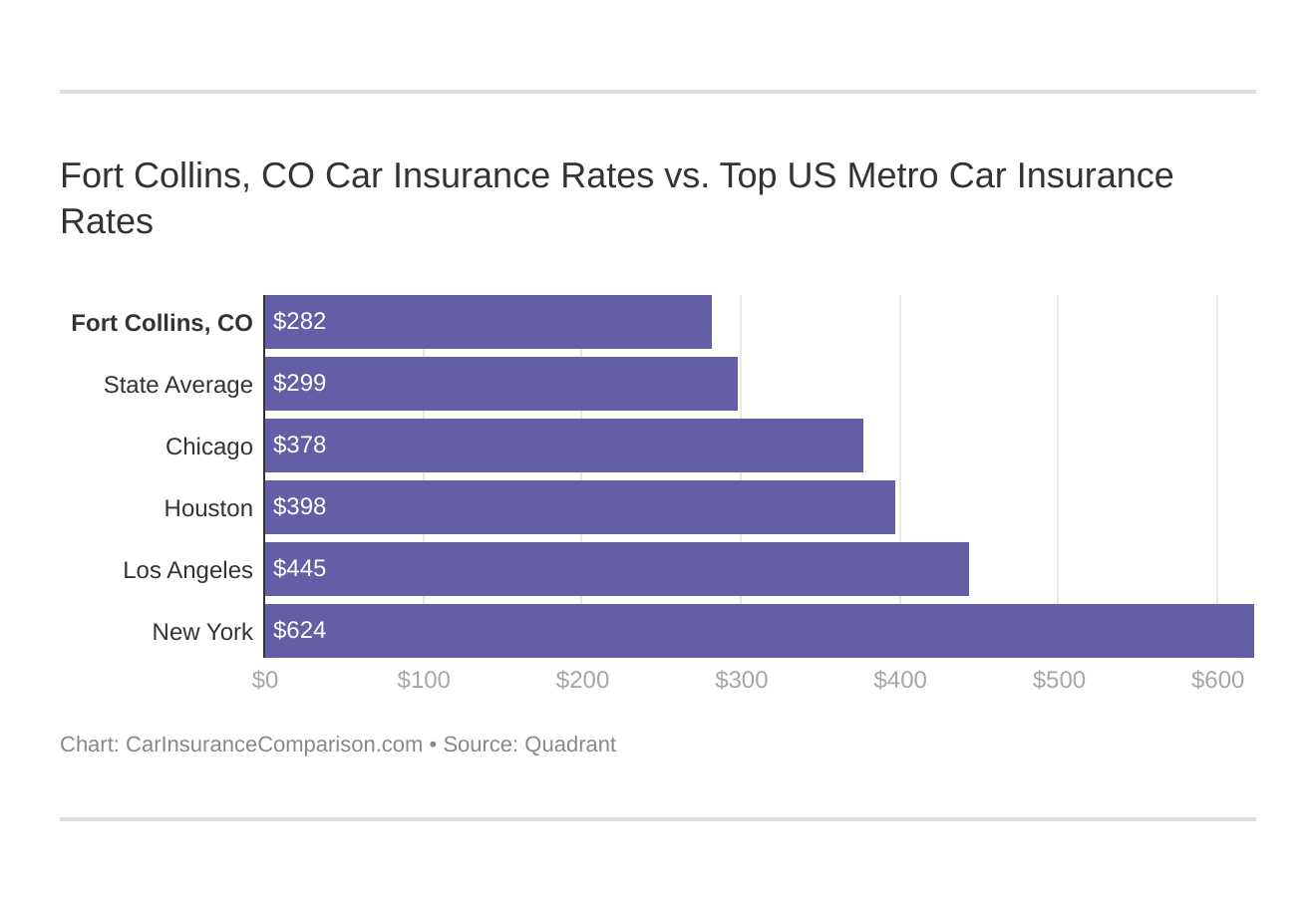

Fort Collins, CO Car Insurance Rates vs. Top US Metro Car Insurance Rates

Which city you live in will have a major affect on car insurance. That’s why it’s essential to compare Fort Collins, Colorado against other top US metro areas’ auto insurance rates.

When you’re ready to buy Fort Collins, CO car insurance, enter your ZIP code into our free quote tool above and start comparing rates.

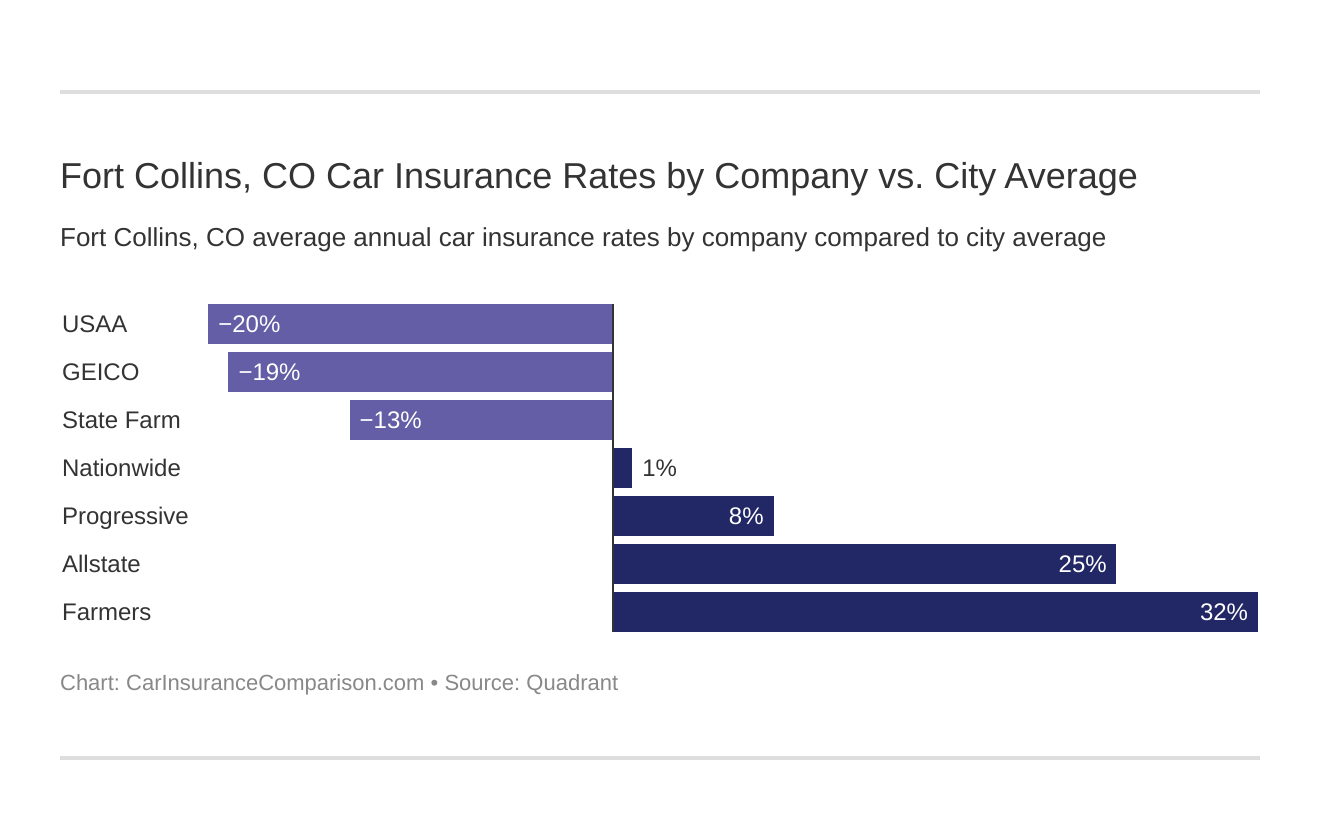

What is the cheapest car insurance company in Fort Collins, CO?

The cheapest Fort Collins, CO auto insurance company can be discovered below. You then might be asking, “How do those rates compare against the average Colorado auto insurance company rates?” We cover that as well.

The cheapest Fort Collins, CO car insurance company is Liberty Mutual. Get more details at Liberty Mutual car insurance review.

Below, compare the annual rates the top insurance providers charge Fort Collins residents on average from cheapest to most expensive:

- Liberty Mutual – $2,417.45

- USAA – $2,757.68

- Geico – $2,797.19

- State Farm – $2,964.21

- Nationwide – $3,397.44

- American Family – $3,438.88

- Progressive – $3,671.71

- Allstate – $4,352.61

- Farmers – $4,696.20

Remember to seek out more than one Colorado car insurance rate in Colorado. Every provider uses a different formula to calculate insurance costs.

Your age, driving record, and coverage needs all influence your final premiums.

Therefore, if you compare quotes from more than one of the companies listed above, you secure your best prices.

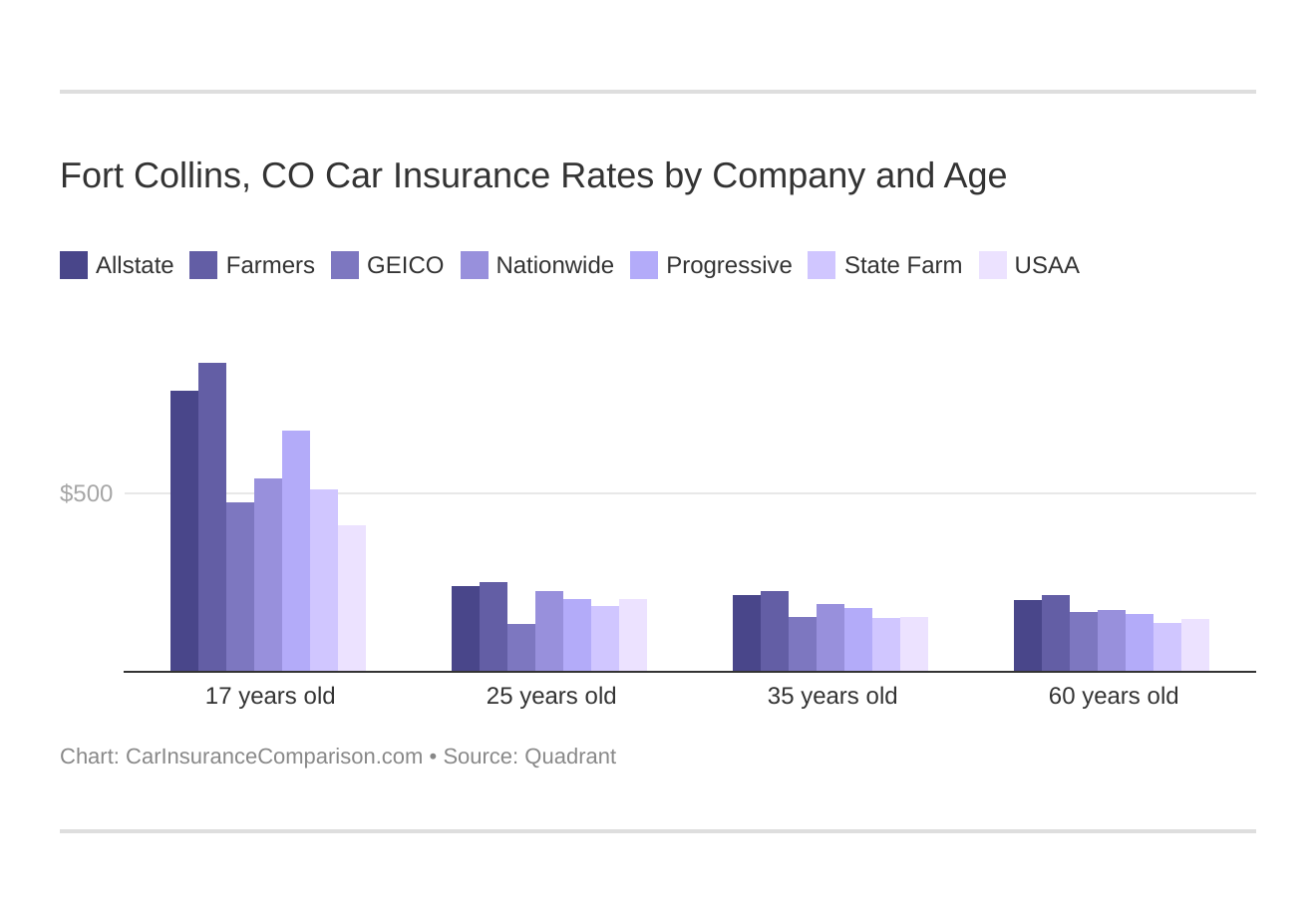

Fort Collins, Colorado auto insurance rates by company and age is an essential comparison because the top auto insurance company for one age group may not be the best company for another age group.

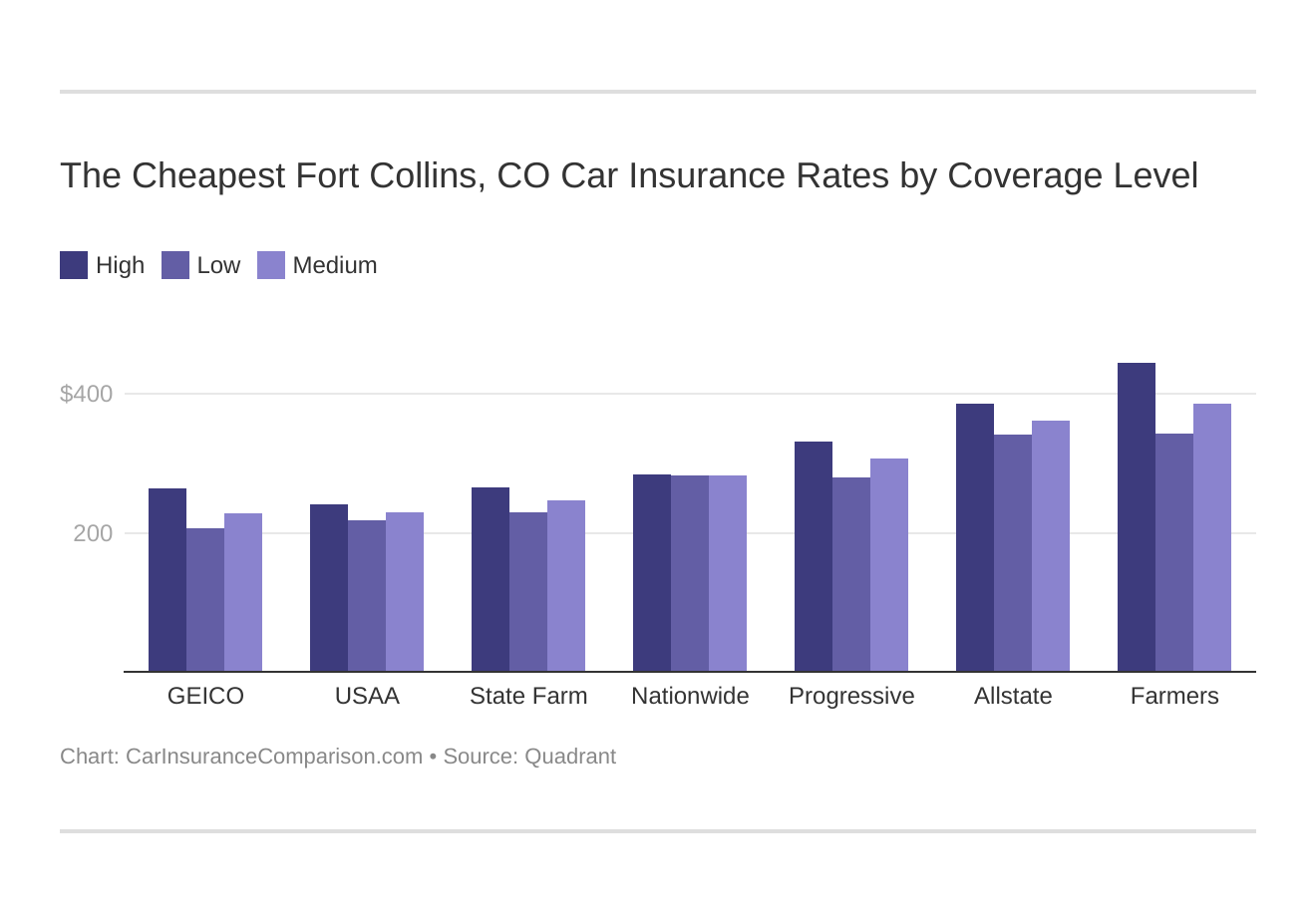

Your coverage level will play a significant role in your Fort Collins, CO auto insurance rates. Before deciding, though, it’s a good idea to understand the types of car insurance and what is and isn’t covered under each.

Find the cheapest Fort Collins, Colorado auto insurance rates by coverage level below:

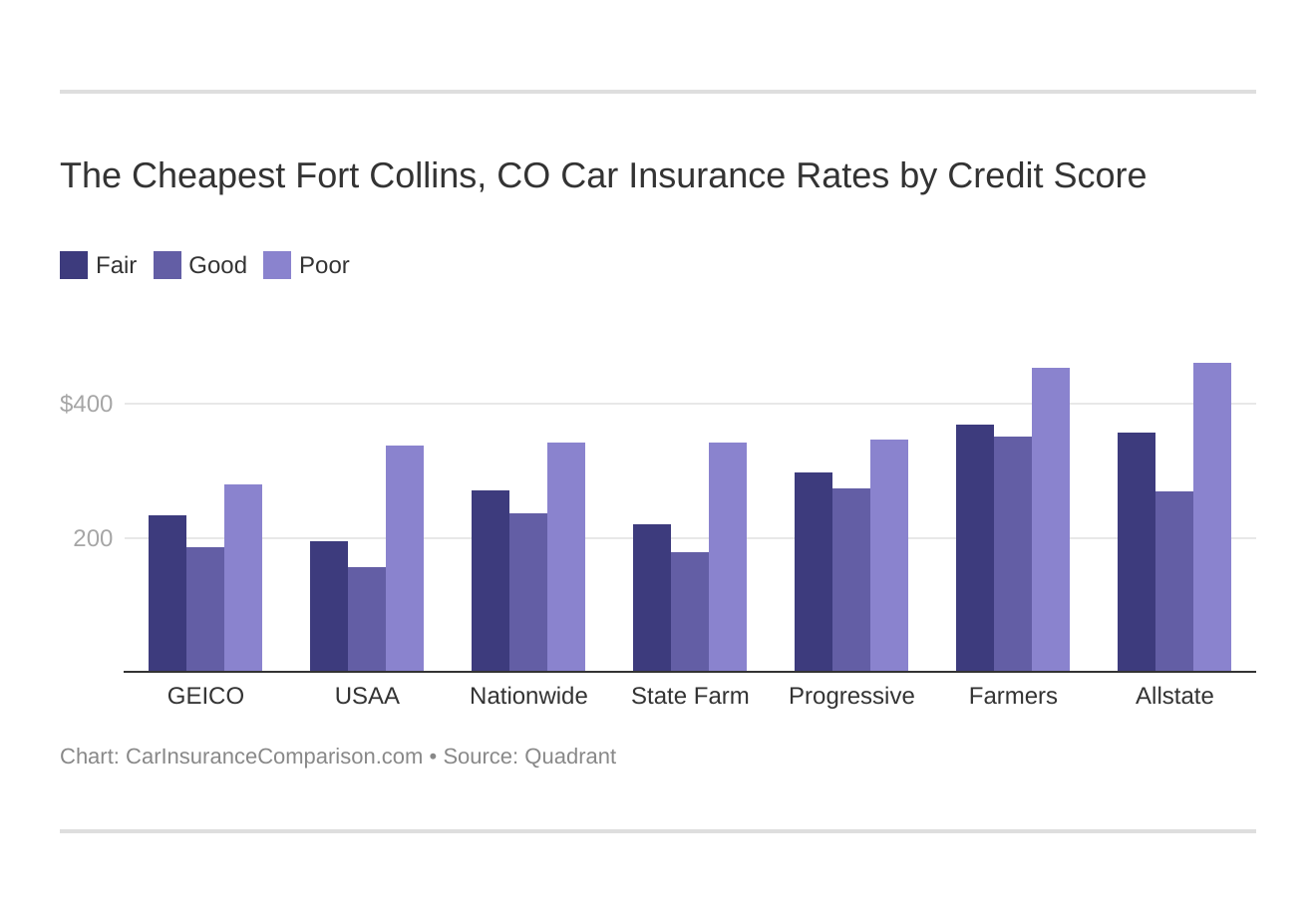

Your credit score will play a major role in your Fort Collins, CO auto insurance rates unless you live in these states where discrimination based on credit is not allowed: California, Hawaii, and Massachusetts. Find the cheapest Fort Collins, Colorado auto insurance rates by credit score below.

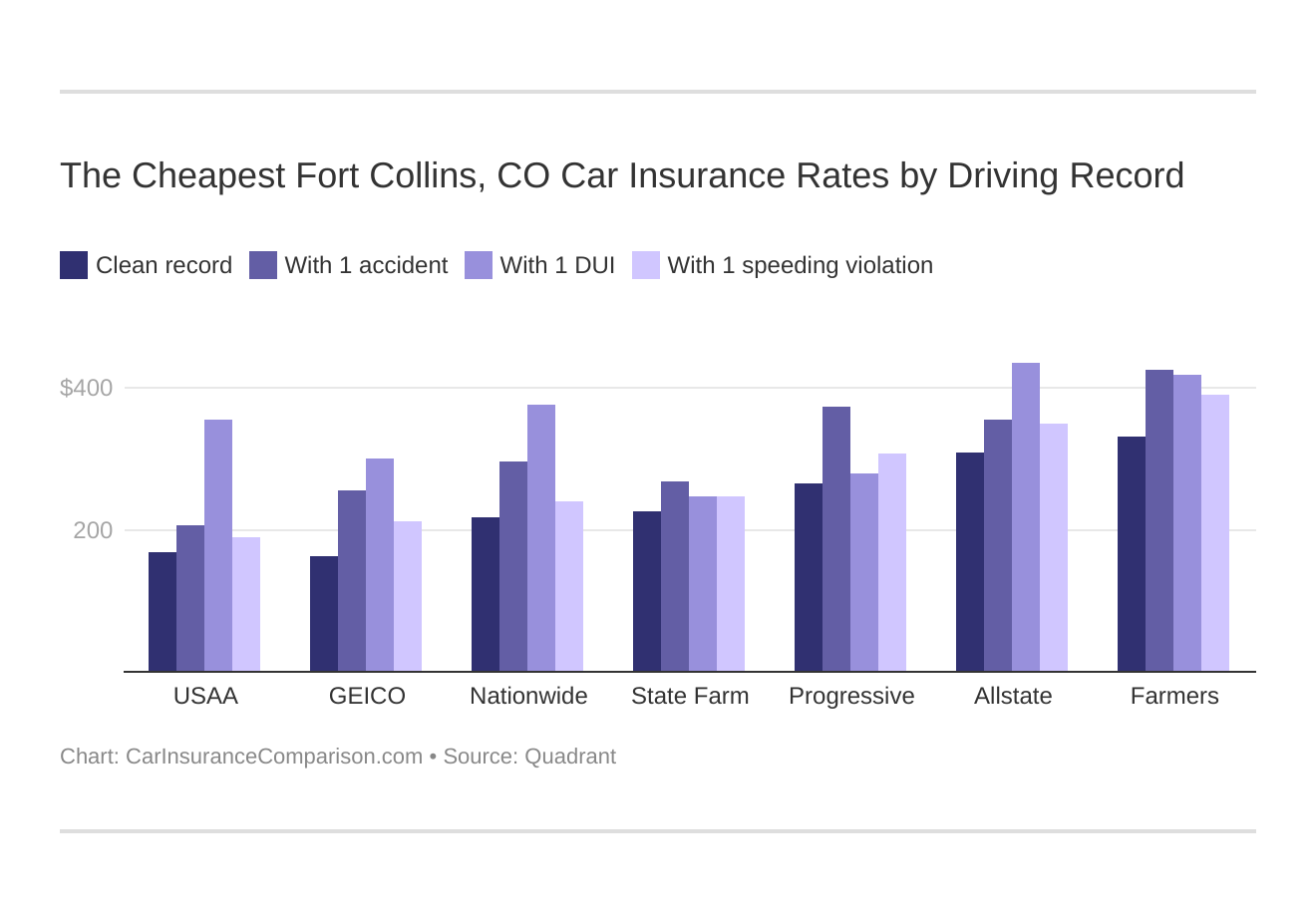

Your driving record will affect your Fort Collins auto insurance rates. Plus, each state sets different laws for traffic violations – including DUIs. Take a look at the DUI insurance laws in Colorado.

For example, a Fort Collins, Colorado DUI may increase your auto insurance rates 40 to 50 percent. Find the cheapest Fort Collins, Colorado auto insurance rates by driving record.

Read more: What are the DUI insurance laws in Colorado?

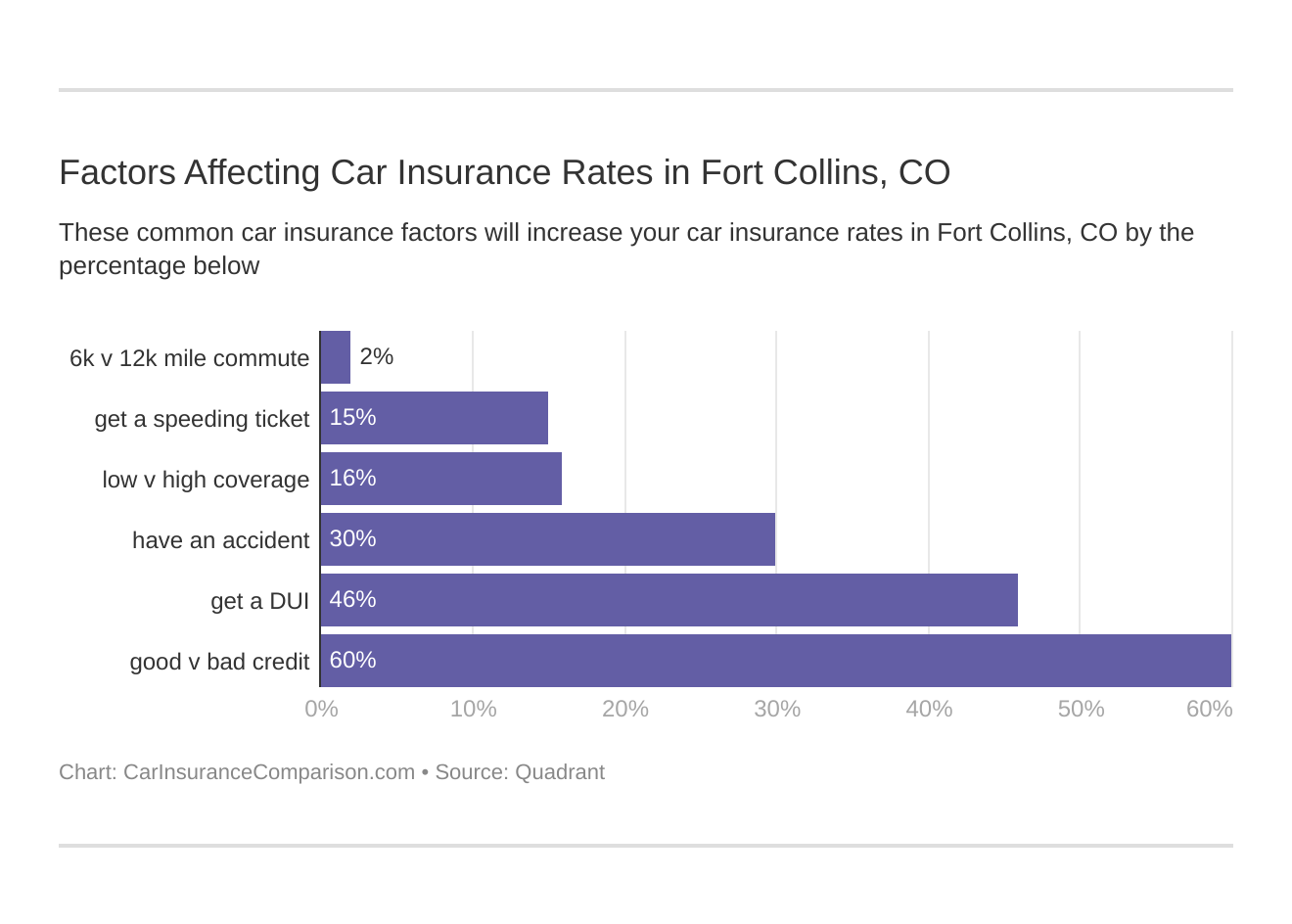

Factors affecting auto insurance rates in Fort Collins, CO may include your commute, coverage level, tickets, DUIs, and credit. Controlling these risk factors will ensure you have the cheapest Fort Collins, Colorado auto insurance.

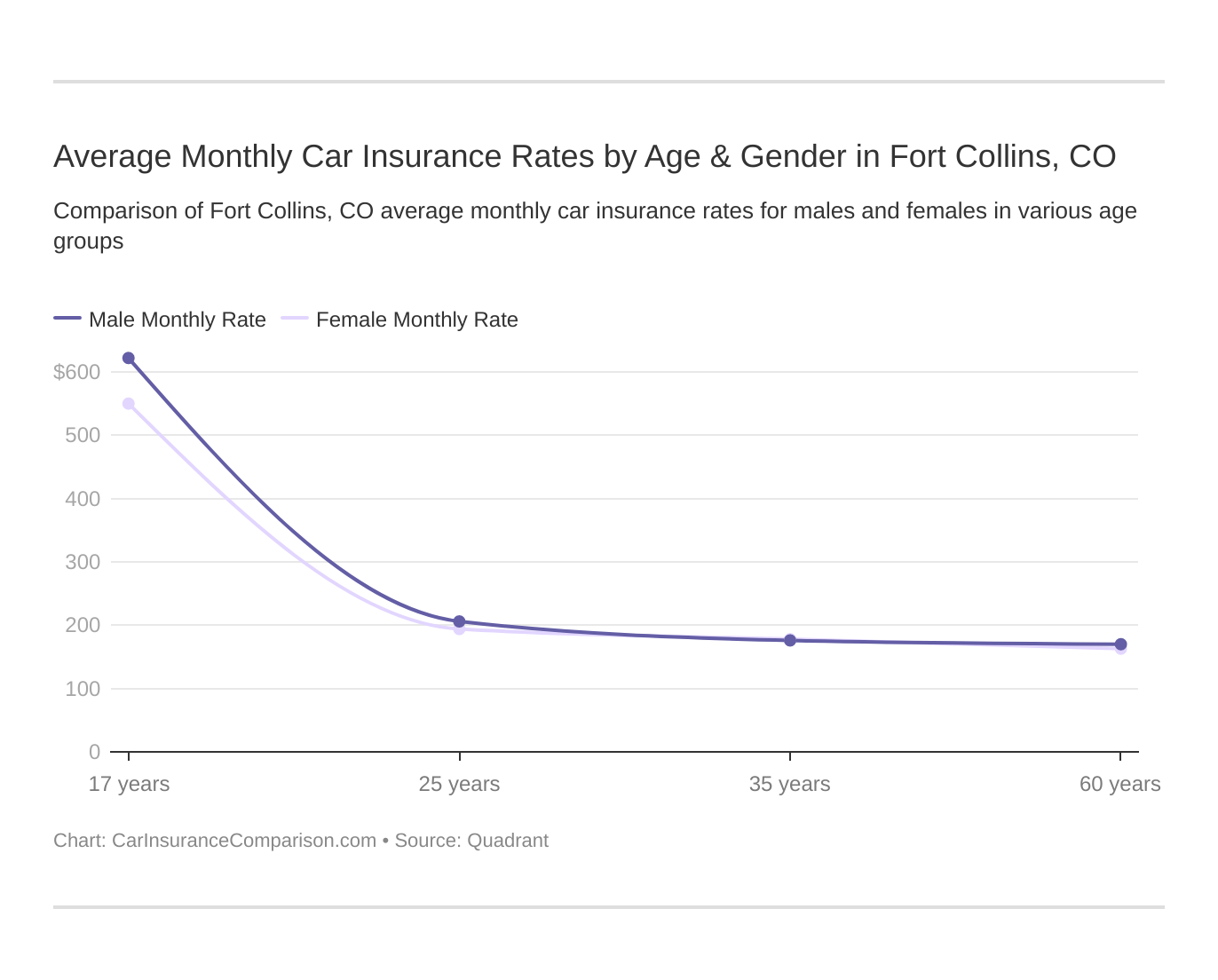

These states no longer use gender to calculate your auto insurance rates — Hawaii, Massachusetts, Michigan, Montana, and North Carolina, Pennsylvania. But age is still a big factor because young drivers are considered high-risk drivers in Fort Collins. Colorado does use gender, so check out the average monthly auto insurance rates by age and gender in Fort Collins, CO.

For more information, see male vs. female car insurance rates in Colorado.

What car insurance coverage is required in Fort Collins, CO?

By law, all Fort Collins drivers must carry at least the Colorado minimum car insurance limits. And those minimum requires are different from state to state. For more information, see what is the minimum car insurance required by each state?

What is the penalty for driving without car insurance in Colorado? You face potential fines, community service hours, and SR-22 insurance requirements for up to three years.

What is SR-22 car insurance? A form that acts as proof of financial responsibility so you can legally drive on the roads again after a license suspension.

Read more: Compare SR-50 Car Insurance: Rates, Discounts, & Requirements

Currently, Colorado requires residents to purchase the following levels of car insurance:

- $25,000 per person and $50,000 per incident in bodily injury liability coverage

- $15,000 in property damage liability coverage

Colorado is an at-fault or tort state. If you cause an accident, your liability car insurance coverage pays for the damages to the other driver involved.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

What affects car insurance rates in Fort Collins, CO?

Severe Colorado weather patterns heavily impact the regional average cost of Fort Collins car insurance.

Fortunately, little to no traffic congestion and lower than average vehicle theft statistics help slightly off-set the increases caused by the weather.

Driving often in heavy traffic causes car insurance rates to go up. While no data exists for Fort Collins specifically, INRIX ranks the nearby city of Boulder as the 56th most congested city in America.

According to City-Data, the average commute time for Fort Collins drivers is only 18.8 minutes.

Your city also experiences fewer auto thefts than the rest of the state. The Federal Bureau of Investigation (FBI) recorded 207 car thefts in Fort Collins in 2017, a rate of only 123.5 stolen cars per 100,000 people.

Snowy Fort Collins, CO weather in the winter and damaging hail, tornadoes, and flash flooding during the warmer months heavily impact your insurance prices.

To insurance companies, dangerous weather means dangerous roads. To mitigate the risk, premiums in your city cost more than in regions with mild, temperate conditions.

Fort Collins, CO Car Insurance: The Bottom Line

Fort Collins car insurance prices are some of the lowest in the state. By comparison, Denver car insurance costs average over $300 each month.

By comparing quotes from multiple different companies online and asking about car insurance discounts, you’ll quickly secure affordable Fort Collins, CO car insurance quotes.

Don’t wait to start shopping. Enter your ZIP code into our free quote tool below to immediately receive Fort Collins, CO car insurance rates from reputable companies near you.

Frequently Asked Questions

What is the average cost of car insurance in Fort Collins, CO?

The average cost of car insurance in Fort Collins, Colorado is $282 per month or $3,388 annually.

Which is the cheapest car insurance company in Fort Collins, CO?

The cheapest car insurance company in Fort Collins, CO is Liberty Mutual.

Do car insurance rates in Fort Collins vary?

Yes, car insurance rates in Fort Collins, CO vary depending on factors such as your age, driving record, and coverage needs.

What are the Colorado minimum insurance requirements for Fort Collins drivers?

By law, all Fort Collins drivers must carry the Colorado minimum insurance levels of 25/50/15 in liability coverage.

How can I compare car insurance quotes in Fort Collins, CO?

You can compare car insurance quotes from top companies in Fort Collins, CO by using a free quote tool. Enter your ZIP code to get started.

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.