Best Car Insurance for 17-Year-Olds in 2026 (Top 10 Companies)

Find the best car insurance for 17-year-olds with best companies including State Farm, USAA, and Progressive offering discounts of up to 30%. State Farm stands out with its many discounts. Assess how credit score, mileage, and driving record affect rates, aiding teens in choosing suitable insurance.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Sr. Director of Content

Sara Routhier, Managing Editor and Outreach Director, has professional experience as an educator, SEO specialist, and content marketer. She has over five years of experience in the insurance industry. As a researcher, data nerd, writer, and editor she strives to curate educational, enlightening articles that provide you with the must-know facts and best-kept secrets within the overwhelming world o...

Sara Routhier

Licensed Insurance Agent

Daniel Walker graduated with a BS in Administrative Management in 2005 and has run his family’s insurance agency, FCI Agency, for over 15 years (BBB A+). He is licensed as an insurance agent to write property and casualty insurance, including home, life, auto, umbrella, and dwelling fire insurance. He’s also been featured on sites like Reviews.com and Safeco. To ensure our content is accura...

Daniel Walker

Updated May 2024

18,155 reviews

18,155 reviewsCompany Facts

Full Coverage for 17-Year-Olds

A.M. Best Rating

Complaint Level

Pros & Cons

18,155 reviews

18,155 reviews 6,589 reviews

6,589 reviewsCompany Facts

Full Coverage for 17-Year-Olds

A.M. Best Rating

Complaint Level

6,589 reviews

6,589 reviews 13,283 reviews

13,283 reviewsCompany Facts

Full Coverage for 17-Year-Olds

A.M. Best Rating

Complaint Level

13,283 reviews

13,283 reviewsGet the best car insurance for 17-year-olds with State Farm, USAA, and Progressive. State Farm is affordable with comprehensive coverage, USAA offers exclusive military family savings, and Progressive balances affordability and quality service.

Recent research has shown that many 17-year-olds lack critical mental functions such as emotional regulations, judgment, self-control, and reasoning.

Our Top 10 Company Picks: Best Car Insurance for 17-Year-Olds

| Company | Rank | Multi-Policy Discount | Low-Mileage Discount | Best For | Jump to Pros/Cons |

|---|---|---|---|---|---|

| #1 | 17% | 30% | Many Discounts | State Farm | |

| #2 | 10% | 20% | Military Savings | USAA | |

| #3 | 10% | 31% | Online Convenience | Progressive | |

| #4 | 25% | 30% | Add-on Coverages | Allstate | |

| #5 | 20% | 30% | Usage Discount | Nationwide |

| #6 | 10% | 25% | Cheap Rates | Geico | |

| #7 | 25% | 30% | Customizable Polices | Liberty Mutual |

| #8 | 25% | 30% | Local Agents | Farmers | |

| #9 | 20% | 22% | Student Savings | American Family | |

| #10 | 25% | 30% | 24/7 Support | Erie |

As a parent, your car insurance costs will rise when your teen son or daughter is licensed. Compare car insurance rates from multiple companies by entering your ZIP code above so you can be sure to pay the best price possible for the insurance coverage you need for your teenager.

- Evaluate State Farm, USAA, and Progressive for the most advantageous rates

- Factors that affect car insurance rates are credit score, mileage, and coverage level

- Top companies excel in affordability and comprehensive coverage for teen drivers

#1 – State Farm: Top Overall Pick

Pros

- Affordable Rates: State Farm offers competitive rates for 17-year-old drivers, making it an economical choice for parents. Check out our State Farm review to learn more.

- Many Discounts: With a variety of discounts, such as multi-policy and low-mileage, State Farm provides opportunities for additional savings.

- Comprehensive Coverage: Known for comprehensive coverage options, State Farm ensures peace of mind for parents concerned about their teen’s safety.

Cons

- Not Military Specific: State Farm may not offer specific benefits for military families, unlike some competitors.

- Varied Customer Service: While many customers praise State Farm’s customer service, experiences may vary based on location and individual circumstances.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#2 – USAA: Best for Military Savings

Pros

- Low Monthly Rates: USAA stands out with remarkably low monthly rates, especially for good drivers.

- Military Savings: Tailored for military families, USAA provides exclusive discounts and benefits.

- Low Complaint Level: Our USAA car insurance review highlights the company’s low complaint level, showcasing high customer satisfaction.

Cons

- Limited Eligibility: USAA is available only to military members, veterans, and their families, limiting accessibility.

- Not the Cheapest for Everyone: While USAA is affordable for its target demographic, it may not always have the lowest rates for non-military customers.

#3 – Progressive: Best for Online Convenience

Pros

- Competitive Pricing: The Progressive car insurance review underscores the company’s reputation competitive rates for 17-year-old drivers, balancing affordability and quality.

- Online Convenience: Known for its online platform, Progressive makes it easy for customers to manage policies and claims digitally.

- Varied Discounts: With discounts like low-mileage and online convenience, Progressive caters to different customer needs.

Cons

- Not Always the Cheapest: While Progressive offers competitive rates, it may not always be the absolute cheapest option for every individual.

- Coverage Limitations: Some customers may find that Progressive’s coverage options have limitations compared to other providers.

#4 – Allstate: Best for Add-on Coverages

Pros

- Add-on Coverages: Allstate is recognized for its extensive add-on coverages, allowing customers to tailor policies to specific needs.

- Usage Discount: Offering a usage discount, Allstate appeals to drivers with low mileage.

- Financial Strength: As mentioned in our Allstate car insurance review their A.M. Best rating of A reflects Allstate’s financial stability.

Cons

- Potentially Higher Rates: Allstate’s rates may be on the higher side for some customers compared to competitors.

- Mixed Customer Service Reviews: Customer service experiences with Allstate can vary, with some customers reporting mixed reviews.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#5 – Nationwide: Best for Usage Discounts

Pros

- Usage Discount: Nationwide offers a usage discount, appealing to those with lower mileage. (Read more: Nationwide Car Insurance Discounts)

- Financial Stability: Nationwide has a strong financial standing, reflected in its A.M. Best rating.

- Many Discounts: Nationwide provides various discounts, allowing customers to save on premiums.

Cons

- Potentially Higher Rates: Some customers may find Nationwide’s rates to be higher compared to other providers.

- Customer Service Variances: While many customers have positive experiences, some may encounter variations in customer service quality.

#6 – Geico: Best for Cheap Rates

Pros

- Cheap Rates: Geico is known for offering some of the most affordable rates in the industry.

- Low Complaint Level: As mentioned in our Geico car insurance review they maintain a low complaint level, indicating high customer satisfaction.

- Varied Discounts: With discounts like multi-policy and low-mileage, Geico provides opportunities for savings.

Cons

- Limited Coverage Options: Geico may not offer as many coverage options and add-ons as some competitors.

- Not Cheapest for All: While Geico is cheap for many, it may not always provide the lowest rates for every individual.

#7 – Liberty Mutual: Best for Customizable Policies

Pros

- Customizable Policies: Liberty Mutual allows customers to tailor policies according to their needs.

- Usage Discount: Offering a usage discount, Liberty Mutual appeals to drivers with lower mileage.

- Financial Strength: Liberty Mutual has a strong financial standing, reflected in its A.M. Best rating.

Cons

- Potentially Higher Rates: Some customers may find Liberty Mutual’s rates to be on the higher side. Learn more about their rates in our Liberty Mutual car insurance review.

- Mixed Customer Reviews: Customer reviews for Liberty Mutual vary, with some customers reporting mixed experiences.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#8 – Farmers: Best for Local Agents

Pros

- Local Agents: Farmers offers the convenience of local agents for customers who prefer in-person assistance.

- Customizable Policies: Customers can customize policies with Farmers to suit their specific needs.

- Many Discounts: Farmers provides various discounts, allowing customers to maximize savings. Get more insights in our Farmers car insurance review.

Cons

- Potentially Higher Rates: Farmers’ rates may be on the higher side for some customers.

- Online Services Limitations: While Farmers has online services, it may not be as technologically advanced as some competitors.

#9 – American Family: Best for Student Savings

Pros

- Student Savings: American Family offers discounts specifically tailored for students.

- Local Agents: With local agents, American Family offers in-person assistance for customers who prefer face-to-face interactions.

- Many Discounts: As outlined in our American Family car insurance, the company provides various discounts, allowing customers to save on premiums.

Cons

- Potentially Higher Rates: Some customers may find American Family’s rates to be on the higher side.

- Limited Availability: American Family may not be available in all regions, limiting accessibility for some customers.

#10 – Erie: Best for 24/7 Support

Pros

- 24/7 Support: Erie stands out with 24/7 customer support, ensuring assistance at any time.

- Many Discounts: Erie provides various discounts, allowing customers to save on premiums. Learn more about their premiums in our Erie car insurance review.

- Usage Discount: Erie offers a usage discount, appealing to those with lower mileage.

Cons

- Limited Availability: Erie may not be available in all regions, limiting accessibility for some customers.

- Potentially Higher Rates: Some customers may find Erie’s rates to be on the higher side compared to competitors.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

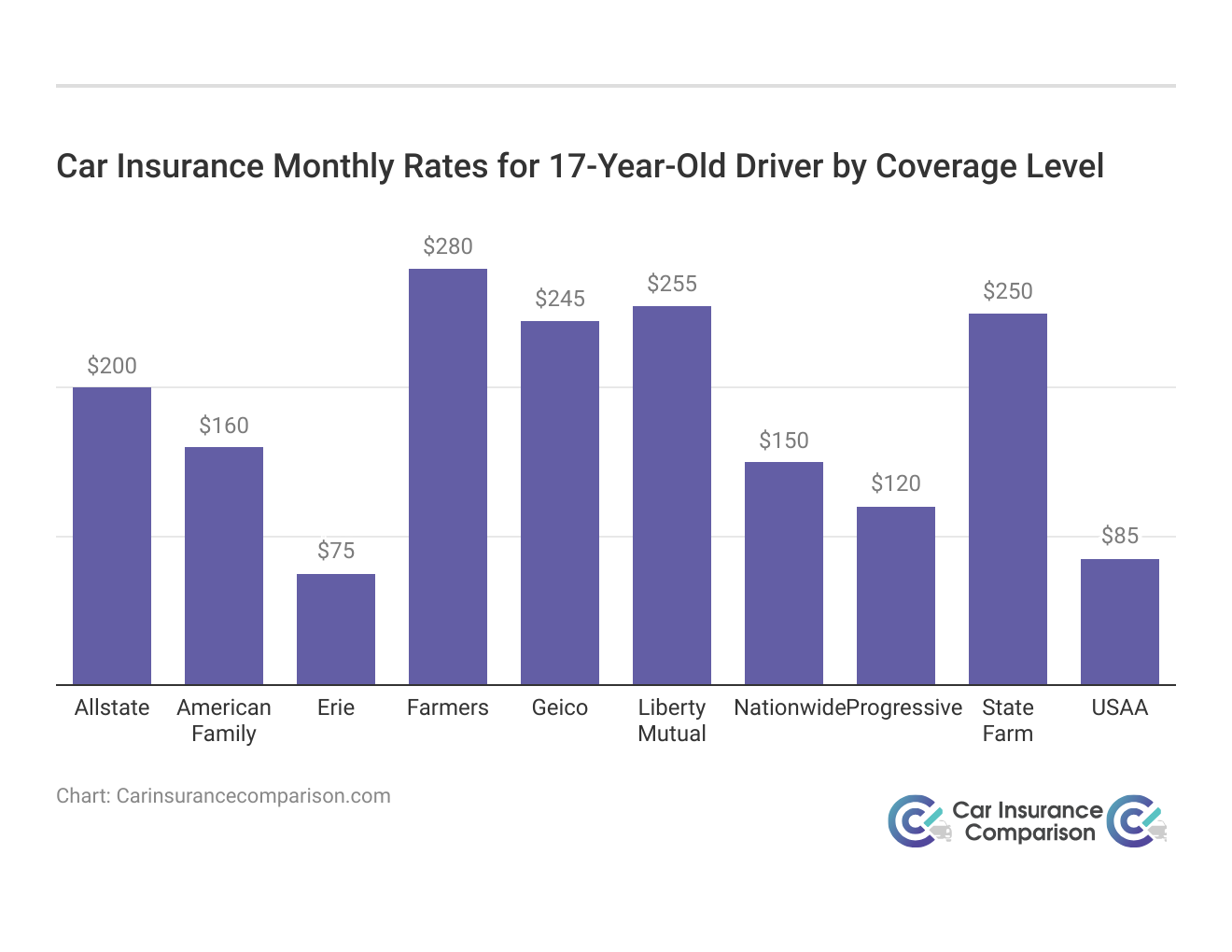

Comparison of Best Companies’ Premiums for 17-Year-Old Driver Car Insurance Rates

Choosing the right car insurance is crucial for 17-year-old drivers, ensuring peace of mind and financial security. To aid in making an informed decision, let’s explore and compare the leading insurance options, considering average monthly rates for both minimum coverage and full coverage. (For more comparison, read our “Compare Monthly Car Insurance: Rates, Discounts, & Requirements“).

Car Insurance Monthly Rates for 17-Year-Old Driver by Coverage Level

| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| Allstate | $200 | $589 |

| American Family | $160 | $461 |

| Erie | $75 | $379 |

| Farmers | $280 | $822 |

| Geico | $245 | $675 |

| Liberty Mutual | $255 | $700 |

| Nationwide | $150 | $422 |

| Progressive | $120 | $315 |

| State Farm | $250 | $784 |

| USAA | $85 | $212 |

Among the top contenders, State Farm stands out for its comprehensive coverage with a monthly rate of $250 for minimum coverage and $784 for full coverage. Following closely, USAA offers a remarkable balance of affordability and quality, presenting rates at $85 for minimum coverage and $212 for full coverage.

State Farm emerges as the top choice for 17-year-old drivers, offering economical rates and comprehensive coverage.

Dani Best Licensed Insurance Producer

Noteworthy for its competitive pricing and customer satisfaction is Progressive, with rates set at $120 for minimum coverage and $315 for full coverage. These top three choices provide varied options, allowing individuals to tailor their insurance selection based on specific needs, whether prioritizing comprehensive coverage or budget considerations for their 17-year-old drivers.

Average Cost of Car Insurance for 17-Year-Olds

The cost to insure a teen varies greatly depending on which state you live in. We compiled real quotes from three top insurance companies in the most expensive insurance state for which rates were available, Florida, and the cheapest insurance state, Maine.

The car insurance rates listed below are for basic coverage and do not include comprehensive or collision protection. For more coverage options rate information, check out our data sheet below.

Car Insurance for 17-Year-Olds: Monthly Rates by Provider & State

| Driver | Geico | Progressive |

|---|---|---|

| 17-Year-Old Male in Florida | $260 | $527 |

| 17-Year-Old Female in Florida | $235 | $511 |

| 17-Year-Old Male in Maine | $207 | $293 |

| 17-Year-Old Female in Maine | $197 | $271 |

Typically, rates are higher for males than female teen drivers because a young female driver is statistically less likely to be in an accident. (For more information, read our “Compare Young Female Driver Car Insurance Rates“).

This table should really show the importance of comparison shopping for car insurance! It’s obvious how much price varies between just these two insurance companies.

Read more: Car Insurance for New Drivers

Saving on Teen Car Insurance: Effective Strategies

Still, you can lower your insurance costs. The insights below will help you save money when your 17-year-old gets a driver’s license:

- Increase your deductible. According to insurance industry experts, you should increase your deductible in order to lower your premiums. When your child reaches the driving age, increasing your deductible can lower your premiums by as much as 40 percent.

- Take driver’s education. Enrolling your teen in driver’s education can save you up to 20 percent off your premiums. Most insurance companies have instructional booklets and videos on safe driving and may offer discounts to customers who use them.

- Keep your teen’s grades up. Most insurers give discounts of up to 25 percent to 17-year-olds who maintain high GPA scores, as these students are considered more responsible than those with average scores.

- Don’t purchase new cars. Understandably, some parents want their 17-year-olds to have cars with the latest safety features or want to replace their current cars with new ones. However, if you do not want your premiums to rise, avoid buying a new car for your teen or yourself.

Another money-saving option involves taking your teen driver off your policy completely. Take your 17-year-old off the policy when he goes to college. This is only realistic if:

- You are confident your child will not drive when he’s away

- He won’t have access to his own car

Otherwise, you will be putting your family in a great financial risk. If your teen is not insured and causes a fatal accident, you could be taken to court end up in financial ruin.

Read more: Compare 18-Year-Old Driver Car Insurance Rates

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Teen Driver Safety: Essential Tips for Parents

If you are looking to reduce your premiums over time, you have to take measures that will also help to keep your teenager alive. They include:

- Restricting nighttime driving. According to the Insurance Institute for Highway Safety, for every mile driven, the fatal crash rate for teens at night is nearly four times higher than it is during the day. There is also a greater risk of drunken fatalities during the night.

- Increasing supervised driving. Today, over 14 states require teenage drivers to undergo more than 50 hours of driving instruction. Many of them require the instructions to cover nighttime driving for more than 10 hours.

- Limiting passengers. Teens face a higher risk of fatality when they are driving packed cars, so young drivers need to be mindful of this if they plan to carpool.

- Not tolerating traffic rules violations. In some states, 17-year-olds who get a ticket or violate other restrictions in the state lose their driver’s license. The offenders have to take driving lessons afresh. Some violations such as driving while drunk are considered so serious that the teen driver may be denied a driver’s license for more than a year.

- Talk to your teen about distracted driving. Tell your teens that using their phone or talking too much to passengers in the car is very dangerous. According to the Centers for Disease Control (CDC), eight people are killed in the United States every day as a result of distracted driving.

Read more: How old do you have to be to own a car?

Finding the Best Teen Car Insurance

Finding the best car insurance provider for your 17-year-old is simply a matter of shopping around.

You have to compare and get competitive quotes from different insurers to get a good deal.

Use our free search tool to compare multiple quotes in your area. Simply enter your ZIP code and access hundreds of car insurance quotes in seconds!

Buying Cheap 17-Year-Old Car Insurance Online: Where to Look

17-year-old drivers are at a higher risk of accidents, so adding a 17-year-old to your car insurance may double your current rates. Shop around to find affordable car insurance rates for 17-year-old teen drivers.

- Cheap car insurance is difficult to find for teenage drivers.

- It is cheaper for you to add your teen to your own policy rather than purchasing a separate policy.

- Teenage drivers are considered high-risk drivers because of their lack of experience.

- Find out the ways to save on car insurance for teenagers.

- For a complete guide to navigate how gender and age affects insurance rates, check out our complete guide.

Ahhh, you are on the age-old quest of finding cheap car insurance for a young driver. The bad news is cheap car insurance and the word teen just don’t go hand in hand. The good news is that there are ways to save money on your insurance, but you have to be willing to shop around.

One of the most expensive types of drivers to insure today is a teen driver. They simply lack the experience and the understanding of their mortality to make insurance companies comfortable when it comes to providing insurance for this age group.

While a 17-year-old driver may be less to insure if they have had 2 years of driving experience, assuming they started driving at 15 years of age, they still won’t find much in the way of cheap car insurance. The most you can hope for is finding more affordable car insurance.

Read more: Is it cheaper to purchase car insurance online?

Enter your ZIP code now and get your online car insurance quotes today!

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Understanding High Car Insurance Costs for 17-Year-Olds

It isn’t just 17-year-old teens that face the high cost of car insurance, it is teen drivers in general.

While a teen will see a reduction in price when they turn 19, the real changes don’t start occurring until you are in your early to mid 20’s.

The bottom line is, as mentioned above, a 17-year-old doesn’t have the driving experience necessary to place them in the safe driver category, even if they have, to date, been a safe driver.

What’s more, most teens really don’t understand the concept of being able to die, which usually makes them a little more reckless behind the wheel of a car.

When you look at statistics for car accidents, teen drivers are unequivocally responsible for the highest levels of deaths for any car accident type.

In addition, the highest percentage of every type of accident, including drunk driving accidents, are caused by teens; it’s no wonder that car insurance companies are leery when it comes to providing insurance to this age group.

What’s worse is that male drivers are statistically worse drivers than female drivers are. This means if you have a teen boy who is 17, you will be paying more for your insurance than your neighbor who has a teen girl who is 17.

Teenagers don’t always know what’s best for themselves. They often think about how much fun something would be instead of thinking about whether or not it’s safe. If you’re worried about your teenage son or daughter making poor decisions while behind the wheel, talk to him/her about why it might be better to wait until after graduation before taking the keys away. You could also encourage them to get their license at 18 rather than 19.

Getting Car Insurance for 17-Year-Olds: Challenges and Solutions

While insurance companies don’t really like ensuring teens, that doesn’t mean that they won’t insure them. The good news is that most major and many small insurance companies sell car insurance policies to any age group.

You do need to be aware, however, that the cost of insuring a 17-year-old will generally be at least two times the cost of your own insurance and it could be more.

If you allow your teen to drive your personal vehicle and you have a full coverage insurance policy, then you will be paying a high premium for your child’s car insurance.

What’s more, if you drive a nice vehicle or worse, a sports car, then you can really expect to pay more for your car insurance.

Sports cars and teens are a terrible combination as far as car insurance companies are concerned and they will ensure that you pay for the privilege of letting your 17-year-old drive your expensive car!

Affordable Car Insurance for 17-Year-Olds: Tips and Tricks

While you may not be able to find cheap car insurance for your teen, it is possible that you could find car insurance that is a bit more affordable than double your current insurance rates; but you may have to make some changes to make that happen. Here are some pointers:

- The first thing that you really want to consider is having your teen in their own car and keeping them off of your insurance policy altogether. Buying your teen their own vehicle may be the furthest thing from your mind, but if they have their own car that doesn’t require high levels of insurance, then you will save money.

- Another thing you should consider is a high deductible for your child’s insurance policy. For parents that can’t afford a $1000 deductible, make your teen open an account to keep that money in.

- Most insurance companies offer discounts for drivers of any age that take defensive driving courses. Not only is this a good idea to save money, but it is a good idea in general for all teen drivers.

Implementing these strategies can help alleviate financial burdens and ensure their safety on the road. Remember to explore options such as separate insurance policies, higher deductibles, and defensive driving courses to optimize savings and provide peace of mind.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Maximizing Savings on Teen Car Insurance

The biggest thing that will help lower the car insurance premium of a teenager is time. Once the young driver turns 25, they will be considered a safer adult driver and their insurance rates will decrease.

Until that time, there are a few things that will help keep a teenager’s insurance rate lower.

Many car insurance companies will offer discounts to help you save money on your premiums, and some of them benefit young drivers.

If your teenager is a good student and gets a “B” average or greater, they will usually be able to take advantage of a good student discount.

The reason for this is because insurance companies equate good students with those who are responsible drivers, so their chances of being in an car accident are lower. The good student discount is one of the most common discounts you’ll find when it comes to insurance for teens.

Read more: Compare Student Driver Car Insurance Rates

While you’re signing up for that good student discount, make sure you’re taking advantage of any other discounts offered by your insurer, such as the multi-car discount, discounts for safety ratings on your vehicle, and the safe driving discount. If you’re eligible for multiple discounts, you could lower your car insurance premium significantly.

Lastly, you need to ensure that you shop around for your 17-year old’s car insurance. Get car insurance quotes from multiple companies. This is the only way to ensure that you are getting the lowest price for your child’s car insurance.

The older your teenager is when he or she starts driving, the cheaper their insurance will be. For most teenagers, the thought of waiting even longer to drive is unbearable, but if they are willing to (or if they are paying for their own insurance), they may choose to put off driving for a year or so in order to save a little money.

The type of vehicle the teenager drives may also help save money. A vehicle with anti-theft and safety features may help them save a bit on their premium.

Case Studies: Navigating Car Insurance for 17-Year-Old Drivers

Exploring real-life scenarios can provide valuable insights into the effectiveness of different car insurance options for 17-year-old drivers. Let’s delve into three case studies showcasing how families and young drivers navigate the complexities of insurance choices to find solutions that align with their unique needs and preferences.

- Case Study #1 – The Budget-Conscious Family With State Farm: The Smith family, living on a tight budget, has a 17-year-old son eager to hit the road. Concerned about the potential spike in insurance costs, they turned to State Farm for an affordable solution. With State Farm’s competitive rates and a range of discounts, the Smiths found a policy that suited their financial constraints.

- Case Study #2 – Military Family Savings With USAA: Meet the Johnsons, a military family with a 17-year-old daughter ready to start driving. Being eligible for USAA, they explored the exclusive benefits tailored for military members. USAA’s low monthly rates, military savings, and low complaint level made it a natural choice for the Johnsons. Learn more in our USAA car insurance review.

- Case Study #3 – Online Convenience for the Tech-Savvy Teen With Progressive: Emily, a tech-savvy 17-year-old, sought insurance that aligned with her preferences for online services. Progressive became her choice due to its competitive pricing, online convenience, and customizable policies. This emphasizes how Progressive’s digital approach resonates with younger drivers, offering them the flexibility to manage their policies online while maintaining affordability.

As families and young drivers continue to explore insurance options, these insights serve as valuable guides in making informed decisions that ensure both financial security and peace of mind on the road. Enter your ZIP code for your free car insurance quotes today.

Frequently Asked Questions

How much does car insurance for a 17-year-old driver typically cost?

The cost of car insurance for a 17-year-old driver can vary significantly. On average, you can expect an increase of 50-200 percent when adding a teen driver to your policy. Factors such as location, driving history, and the chosen insurance provider play crucial roles in determining the final cost.

Which car insurance companies offer the most affordable rates for 17-year-old drivers?

Based on affordability and favorable reviews, State Farm, USAA, and Progressive emerge as top choices. State Farm provides competitive rates, USAA offers low monthly premiums tailored for military families, and Progressive balances affordability with quality service and online convenience.

Finding cheap car insurance quotes is easy. Just enter your ZIP code into our free comparison tool below to instantly compare quotes near you.

How can I save money on car insurance for my 17-year-old?

To save money on car insurance for a 17-year-old, consider taking advantage of discounts offered by insurance providers. Companies like State Farm, USAA, and Progressive provide various discounts such as multi-policy, low-mileage, and military savings. Additionally, maintaining a clean driving record and exploring usage discounts can contribute to cost savings.

(For more information, Read our “Car Insurance Discounts: Compare the Best Discounts“)

Is it hard to get car insurance for a 17-year-old?

While it’s not necessarily hard to get car insurance for a 17-year-old, it can be expensive due to the increased risk associated with inexperienced drivers. Insurance companies may consider factors like the teen’s driving record, credit score, and location when determining rates. Shopping around and exploring discounts can help find more affordable options.

Why is car insurance so expensive for 17-year-olds?

Car insurance for 17-year-olds tends to be expensive due to the increased risk they pose. Statistics show that teen drivers are more prone to accidents. Insurance companies factor in this higher risk, leading to elevated premiums. Additionally, 17-year-olds may lack driving experience, contributing to the overall cost.

What is the average cost of car insurance for a 17-year-old?

The average cost of car insurance for a 17-year-old can vary significantly depending on factors such as location, driving record, and the chosen insurance provider. On average, adding a teen driver to a policy can lead to an increase of 50-200 percent in premiums.

How can you save money on your teen’s car insurance?

Saving money on your teen’s car insurance can be achieved through various strategies. Taking advantage of discounts offered by insurance providers, such as multi-policy discounts or good student discounts, can help lower premiums. Additionally, maintaining a clean driving record and comparing quotes from multiple insurers can contribute to cost savings.

Find cheap car insurance quotes by entering your ZIP code below.

How can you keep your teen safe on the road?

To keep your teen safe on the road, it’s essential to implement measures that promote responsible driving behavior. Setting clear rules and expectations, limiting nighttime driving and passenger restrictions, and encouraging the use of seat belts and avoiding distractions like texting while driving are crucial. Additionally, practicing driving with your teen in different conditions and leading by example with responsible driving habits can help ensure their safety.

How do you find the best teen car insurance company?

Finding the best car insurance company for a teen driver involves researching and comparing quotes from multiple insurers. Consider factors such as coverage options, discounts available for young drivers, customer service reputation, and pricing when making your decision.

Read more: Compare the Best Car Insurance Companies

Where can I buy cheap 17-year-old car insurance rates online?

You can buy cheap car insurance rates for 17-year-olds online from various insurance companies’ websites or through insurance comparison websites. It’s essential to compare quotes from multiple sources to find the most affordable option that meets your coverage needs.

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.