Best Eco-Friendly Car Insurance in 2026 (Your Guide to the Top 10 Companies)

Liberty Mutual offers the best eco-friendly car insurance, followed by Progressive and Erie. Green car insurance at Liberty Mutual costs an average of $75/mo for minimum coverage. The best green companies also offer eco-friendly discounts, such as paperless discounts or green vehicle discounts.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Insurance and Finance Writer

Luke Williams is a finance, insurance, real estate, and home improvement expert based in Philadelphia, Pennsylvania, specializing in writing and researching for consumers. He studied finance, economics, and communications at Pennsylvania State University and graduated with a degree in Corporate Communications. His insurance and finance writing has been featured on Spoxor, The Good Men Project...

Luke Williams

Licensed Insurance Agent

Scott W Johnson is an independent insurance agent in California. Principal Broker and founder of Marindependent Insurance Services, Scott brings over 25 years of experience to his clients. His Five President’s Council awards prove he uses all he learned at Avocet, Sprint Nextel, and Farmers Insurance to the benefit of his clients. Scott quickly grasped the unique insurance requirements of his...

Scott W. Johnson

Updated May 2024

3,792 reviews

3,792 reviewsCompany Facts

Full Coverage for Eco-Friendly Car

A.M. Best Rating

Complaint Level

Pros & Cons

3,792 reviews

3,792 reviews 13,283 reviews

13,283 reviewsCompany Facts

Full Coverage for Eco-Friendly Car

A.M. Best Rating

Complaint Level

13,283 reviews

13,283 reviews 1,814 reviews

1,814 reviewsCompany Facts

Full Coverage for Eco-Friendly Car

A.M. Best Rating

Complaint Level

Pros & Cons

1,814 reviews

1,814 reviewsYou will find the best eco-friendly car insurance at Liberty Mutual, Progressive, and Erie.

Can “going green” lead to savings on car insurance? Green car insurance is not just a society-wide push to reduce energy demands and prevent global environmental disasters. It is a concept to reduce the costs of consumer goods, including car insurance. Auto insurance is green when consumers spend less of their income on non-renewable sources and products by buying an eco-friendly car.

Our Top 10 Company Picks: Best Eco-Friendly Car Insurance

| Company | Rank | Multi-Vehicle Discount | A.M. Best | Best For | Jump to Pros/Cons |

|---|---|---|---|---|---|

| #1 | 25% | A | Green Initiatives | Liberty Mutual |

| #2 | 12% | A+ | Paperless Discount | Progressive | |

| #3 | 10% | A+ | Sustainable Practices | Erie |

| #4 | 20% | A++ | Green Discounts | State Farm | |

| #5 | 20% | A | Eco Options | Farmers | |

| #6 | 25% | A+ | Environmental Commitment | Allstate | |

| #7 | 8% | A++ | Conservation Efforts | Travelers | |

| #8 | 25% | A++ | Energy Efficiency | Geico | |

| #9 | 20% | A+ | Renewable Solutions | Nationwide |

| #10 | 20% | A | UBI Discount | American Family |

Continue reading to learn how green car insurance can save you money through green car insurance discounts, as well as how popular companies are working on being sustainable. You can also enter your ZIP code to receive free green car insurance quotes from multiple companies today.

- Liberty Mutual is the best green car insurance company

- Some companies now reward individuals who drive eco-friendly cars

- Make sure to read green auto insurance reviews before committing

#1 – Liberty Mutual: Top Pick Overall

Pros

- Green Initiatives: Liberty Mutual has given multiple grants focused on climate resiliency and nature-based initiatives.

- Paperless Discount: Get a discount for being environmentally friendly. Discover more by reading about Liberty Mutual discounts.

- 24/7/ Support: 24/7 support for your green car insurance policy.

Cons

- High-Risk Rates: Low-risk drivers will have the best deal on eco-friendly motor insurance policies.

- Customer Satisfaction: Customer satisfaction ratings place Liberty Mutual as just average.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#2 – Progressive: Best for Paperless Discount

Pros

- Paperless Discount: Go paperless and pay less. Learn more in our Progressive car insurance review.

- Multi-Policy Discounts: Add home or renters insurance to your eco insurance policy for lower rates.

- Name Your Price Tool: Use this free tool to see if a green insurance policy is within your budget.

Cons

- Claim Reviews: Progressive doesn’t stand out for its claim services.

- Young Driver Rates: Teens purchasing green eco car insurance independently will pay more.

#3 – Erie: Best for Sustainable Practices

Pros

- Sustainable Practices: Erie focuses on environmental sustainability by helping build community gardens and helping eco programs.

- Reduced Usage Discount: Not using your car for 90 consecutive days will earn you a discount.

- Rate Lock: Your rates will be locked in until something changes on your driving record or you change something on your policy.

Cons

- Availability: Coverage is not sold everywhere yet. Learn more in our Erie car insurance review.

- Fewer Online Tools: Erie’s online capabilities may be more limited.

#4 – State Farm: Best for Environmental Impact

Pros

- Environmental Impact: State Farm is working to reduce its environmental impact by switching to renewable energy.

- Paperless Option: Switch to paperless bills and statements at State Farm.

- Coverage Options: Personalize your policy for your eco-friendly car. Learn more in our State Farm review.

Cons

- Green Discounts: State Farm doesn’t offer green vehicle insurance discounts.

- Accident Forgiveness: It is impossible for most customers to qualify.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#5 – Farmers: Best for Eco Options

Pros

- Eco Options: Farmers offers opportunities for customers to be more eco-friendly, such as going paperless or rewards for driving less.

- CA Eco Car Discount: California drivers with alternative fuel cars will get a discount.

- Multi-Vehicle Discount: Great for owners of more than one eco-friendly car.

Cons

- High-Risk Rates: Low-risk drivers will score the best deal on eco-friendly car insurance.

- Claim Reviews: Leran more about some of the negative ratings in our Farmers review.

#6 – Allstate: Best for Environmental Commitment

Pros

- Environmental Commitment: Allstate is working to achieve zero emissions by 2030.

- Paperless Discount: Go paperless and save on your green insurance for cars.

- 24/7 Support: Contact Allstate 24/7 for help with your environmentally friendly car insurance policy.

Cons

- Green Car Discounts: Allstate doesn’t offer a discount for hybrid or electric vehicles.

- Customer Complaints: Learn about Allstate’s higher number of negative reviews in our Allstate review.

#7 – Travelers: Best for Conservation Efforts

Pros

- Conservation Efforts: One of Travelers’ initiatives focuses on reforesting.

- Hybrid/Electric Vehicle Discount: Get a discount if your vehicle is hybrid or electric.

- Paperless Options: You can easily go paperless at Travelers.

Cons

- IntelliDrive Program: Unsafe drivers may be given rate increases.

- Customer Reviews: Read about some of the negative customer reviews in our review of Travelers.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#8 – Geico: Best for Energy Efficiency

Pros

- Energy Efficiency: Geico focuses on energy efficiency with it’s initiatives.

- Paperless Options: Change your policy to a paperless one.

- Roadside Assistance: Great for tows if your electric or hybrid vehicle breaks down.

Cons

- Local Agent Availability: Most assistance is provided online. Learn more in our Geico car insurance review.

- Green Vehicle Discount: Geico doesn’t offer green vehicle insurance discounts.

#9 – Nationwide: Best for Renewable Solutions

Pros

- Renewable Solutions: Nationwide has a focus on renewable solutions for the environment.

- Paperless Discount: Get a discount for switching to virtual billing. Learn more about Nationwide discounts.

- Online Quotes: You can get free quotes for environmentally friendly motor insurance.

Cons

- Green Vehicle Discount: Nationwide doesn’t offer a discount for green vehicles.

- Claims Processing: Some customers have complained about delays.

#10 – American Family: Best for UBI Discount

Pros

- UBI Discount: Driving less and driving safely will earn you a discount.

- Roadside Assistance: Add for help if your green vehicle breaks down.

- Paperless Discount: Get a discount by going paperless at American Family. Learn more by reading our American Family review.

Cons

- Availability: You may not be able to buy a green car policy in your state.

- High-Risk Rates: Rates are cheapest for low-risk customers.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Eco-Friendly Company Rates

Green car insurance is insurance coverage for a hybrid or electric vehicle. Take a look below to see the average rates at different eco-car insurance providers.

Car Insurance Monthly Rates for Eco-Friendly Car by Coverage Level & Provider

| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| Allstate | $93 | $270 |

| American Family | $88 | $260 |

| Erie | $80 | $240 |

| Farmers | $90 | $263 |

| Geico | $75 | $225 |

| Liberty Mutual | $75 | $225 |

| Nationwide | $85 | $255 |

| Progressive | $85 | $260 |

| State Farm | $85 | $255 |

| Travelers | $80 | $240 |

With the popularity of green cars, such as the Toyota Prius, car insurance rates for the Prius and other similar vehicles are affected. Let’s compare Toyota Prius car insurance rates with a more expensive green car like the Tesla Model X.

Car Insurance for Tesla Model X vs. Toyota Prius: Monthly Rates by Provider

| Insurance Company | Tesla Model X | Toyota Prius |

|---|---|---|

| Allstate | $397 | $176 |

| American Family | $290 | $135 |

| Erie | $230 | $120 |

| Farmers | $410 | $143 |

| Geico | $274 | $123 |

| Liberty Mutual | $258 | $143 |

| Nationwide | $179 | $109 |

| Progressive | $192 | $142 |

| State Farm | $200 | $130 |

| Travelers | $245 | $125 |

| USAA | $147 | $94 |

Compared to the Tesla Model X, the Toyota Prius has affordable car insurance. USAA, Nationwide, and Progressive have the cheapest car insurance rates for the Tesla Model X.

Green Insurance Agency, Corp. is an independent insurance agent in South Carolina that works Progressive, while Green Insurance Consultants is a small private insurance firm.

What about companies like Esurance? Esurance’s Toyota Prius car insurance rate is $1,188 per year (or $100 per month). Your vehicle’s value determines car insurance rates. It is hard to find affordable, sustainable car insurance for Teslas because the value of a Tesla is much higher than a Toyota Prius, even with a green vehicle insurance discount for Teslas.

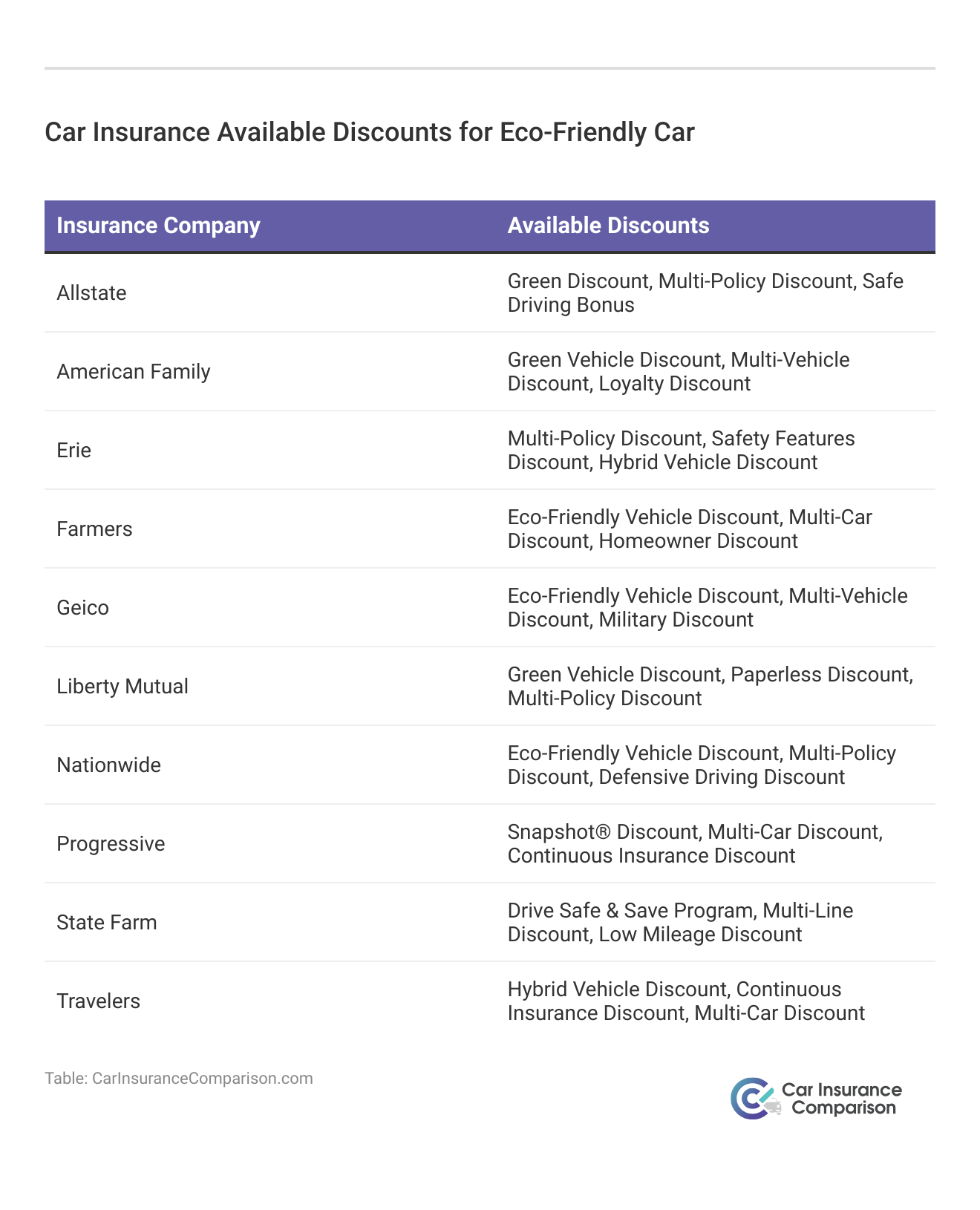

How to Save at Green Insurance Companies

Green vehicle insurance discounts are offered at some companies. They may also offer paperless discounts.

Even if green discounts aren’t offered at your favorite company, there are still plenty of other discounts that customers can apply for to save on their eco-friendly car. Make sure to also get quotes from the best companies, like Liberty Mutual, to see who offers the best deal.

Why Insurance Companies are Joining Eco-Friendly Green Movements

The initial idea is better gas mileage in hopes of saving our planet. But what effect does going green with a vehicle choice have on car insurance? After all, an insurer’s bottom line is not influenced by environmental changes, or is it?

- More and stronger storms increase the likelihood of damage that will be incurred by a vehicle.

- Floods increase the chances that a car will be swept away and damage the property of another person, the vehicle itself, and perhaps even the driver.

- As the planet warms, drivers will experience physiological effects that, in turn, affect their ability to drive. The elderly are especially vulnerable to drastic changes in temperature. If they have a heat stroke while driving, then the car insurance company will likely have to pay out on an expensive claim.

- With entire areas being wiped out — like New Orleans after Hurricane Katrina — the fewer customers insurance companies will have. Natural disasters have terrible consequences on the car insurance business. Market share decreases, claims increase, and entire economies are shattered.

Compare the best green car insurance companies‘ quotes right now. Enter your ZIP code in the free comparison tool to begin.

How Car Insurance Companies Responded

According to Green America, green car insurance has become a new concept of our time and is based on the vested profit interests of the insurance companies. Several companies are offering five to ten percent premium discounts for customers driving eco-friendly vehicles. Companies are enticing consumers to their green motor insurance products with tokens of appreciation.

Many insurers offer discounts for vehicles that don’t gas-guzzle. Such discounts include: hybrid vehicle premium discounts, endorsements that allow hybrid replacement, alternative fuel premium discounts, pay as you drive (PAYD) programs.

View this post on Instagram

Some provide 100 percent cost offsets based on vehicle emissions. If your vehicle emits 20 percent fewer harmful particles than the average, then your insurance rate will reflect that in savings. Further, some companies ensure the customer that an ample percent of the profits they earn is donated to charities.

How Companies View Green Vehicles

It’s a strange day we live in. Twenty years ago, at the beginning of the green car movement, insurance companies prided themselves on how well they were able to profit from their clients. Today, being green or eco-friendly is essential to a car insurance company’s image. For consumers, the time is now to take advantage of the low rates available.

Over the past decades, car companies have invested heavily in creating production model vehicles that are environmentally friendly. Early concepts were impractical, to say the least.

Their driving range hardly got someone to work and back. The vehicles were smaller than the Geo Metro, and finding a mechanic to fix one was as likely as finding a $100 bill on the street. Fast-forwarding to the past ten years, automakers from around the world have moved from producing the concept to having entire fleets with green functionality. At first, it was just the motor. General Motors promoted Flex Fuel designs to burn gasoline mixed with ethanol or vegetable-based fuel.

Of course, their concept wasn’t new or difficult to produce. Henry Ford originally intended for vehicles to run on ethanol. Other automakers, like Toyota, are promoting hybrid motors that use gasoline to charge batteries. The batteries, once charged, take overpowering the vehicle down the road.

There are many safe and protective reasons behind insurance companies reducing auto insurance premiums on green vehicles.

- Vehicles that do not rely on fossil fuels have a reduced chance of fire during an accident.

- Most green vehicles have been produced within the past five years and are subject to new government guidelines in production, which have increased the safety of the cars.

According to Forbes, eco-friendly cars have brighter lights, are more impact-resistant, and tend to have side-impact airbags. So, if you want to reduce your carbon footprint and thus save money on car insurance coverage, you can take some actions that make your driving habits more sustainable.

Many insurance companies use mileage as a factor in determining car insurance rates, so driving less can help the environment and save you money. You can always take public transportation when available, thus dramatically cutting off the number of miles you drive in a year.

Brandon Frady Licensed Insurance Agent

Some insurers also offer premium discounts for hybrid vehicles and alternative fuel discounts for cars that use alternative energy sources such as electricity, hydrogen, natural gas, ethanol, and biodiesel.

The Final Word on the Best Green Company Car Insurance

Most car insurance companies now focus on reducing their environmental impact, and part of that is rewarding drivers who drive eco-friendly vehicles. The best car insurance green companies may offer paperless discounts, green vehicle discounts, or low mileage discounts. By taking the time to read green insurance reviews and compare monthly car insurance rates, you can make sure you are getting the best deal possible.

If you’re ready to compare and buy green car insurance right now, enter your ZIP code below to receive car insurance rates from multiple companies today.

Frequently Asked Questions

Are there limitations or requirements for green car insurance?

Green car insurance policies may have limitations or requirements, such as providing proof of eco-friendly vehicle ownership or adhering to specific mileage limits for hybrid or electric cars. It’s important to read and understand the terms and conditions of a green car insurance policy before purchasing to ensure it meets your expectations and aligns with your vehicle usage.

Can I switch to green car insurance if I already have an insurance policy?

Yes, you can switch to green car insurance even if you already have an existing insurance policy. To make the switch, compare quotes from different green insurance providers using our free quote comparison tool, select the policy that best suits your needs, and follow the new insurer’s policy switch procedures.

Are there government incentives or discounts for green car insurance?

Some regions offer government incentives or car insurance discounts for owning eco-friendly vehicles, which can extend to car insurance. It’s recommended to check with local authorities or research government websites to see if any discounts or benefits are available in your area.

How can I qualify for green car insurance rates?

To qualify for green car insurance rates, you typically need to own or lease an eco-friendly vehicle, such as a hybrid or electric car. Different insurance providers may offer specific discounts or incentives for these vehicles, so it’s important to shop around and compare quotes to find the best rates.

Are electric cars considered green cars?

Yes, electric cars are considered green cars. Electric cars, as well as hybrid cars, are energy-efficient vehicles that can qualify for cheaper car insurance rates due to their environmentally friendly features.

What factors affect green car insurance rates?

Factors that can affect green car insurance rates include your driving record, age, location, coverage options, deductible, and the specific make and model of your eco-friendly vehicle (learn more: Factors That Affect Car Insurance Rates). It’s advisable to obtain quotes from multiple insurance companies to determine which one offers the most favorable rates based on your individual circumstances.

What is “auto insurance green?”

People who are searching for green auto insurance are looking for affordable insurance for vehicles considered to be eco-friendly. “Auto insurance green” is the same as green auto/car insurance.

Where can I find a green insurance company?

A green insurance company with car insurance is just about any top insurance company in the United States. Auto insurance companies like Economical Select Insurance Company offer special rates for eco-friendly vehicles.

Do companies charge more for green car insurance?

No. You can save hundreds more on an eco-friendly vehicle because the vehicle produces less carbon than older vehicles.

What is the most economical car insurance company?

USAA, Geico, State Farm, and Progressive are the most economical car insurance companies in the United States (learn more: Cheapest Car Insurance in the World).

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.