Cheap Insurance for Car Auctions in 2025 (Cash Savings With These 8 Companies!)

The top companies for cheap insurance for car auctions are Geico, USAA, and Progressive. Geico is the cheapest company, with average minimum rates of $35/mo. While there are no specific auction car insurance policies, most cars sold at auctions are classic or salvage cars that require specialized coverage.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Licensed Insurance Agent

Kristen is a licensed insurance agent working in the greater Boston area. She has over 20 years of experience counseling individuals and businesses on which insurance policies best fit their needs and budgets. She knows everyone has their own unique needs and circumstances, and she is passionate about counseling others on which policy is right for them. Licensed in Massachusetts, New Hampshire,...

Kristen Gryglik

Licensed Insurance Agent

Jeffrey Manola is an experienced insurance agent who founded TopQuoteLifeInsurance.com and NoMedicalExamQuotes.com. His mission when creating these sites was to provide online consumers searching for insurance with the most affordable rates available. Not only does he strive to provide consumers with the best prices for insurance coverage, but he also wants those on the market for insurance to ...

Jeffrey Manola

Updated May 2024

19,116 reviews

19,116 reviewsCompany Facts

Min Coverage for Car Auctions

A.M. Best Rating

Complaint Level

Pros & Cons

19,116 reviews

19,116 reviews 6,589 reviews

6,589 reviewsCompany Facts

Min Coverage for Car Auctions

A.M. Best Rating

Complaint Level

6,589 reviews

6,589 reviews 13,283 reviews

13,283 reviewsCompany Facts

Min Coverage for Car Auctions

A.M. Best Rating

Complaint Level

13,283 reviews

13,283 reviewsThe top companies that offer cheap car insurance for car auctions are Geico, USAA, and Progressive.

If you love to buy a car at auction, you may think you need special car insurance. While there is no specific auction car insurance, depending on the type of vehicle you purchase, you may need to purchase specialty car insurance, such as salvage insurance. The cheapest companies for car auction insurance, like salvage insurance, are listed below.

Our Top 8 Company Picks: Cheap Insurance for Car Auctions

| Company | Rank | Monthly Rates | Multi-Car Discounts | Best For | Jump to Pros/Cons |

|---|---|---|---|---|---|

| #1 | $35 | 25% | Online Convenience | Geico | |

| #2 | $40 | 10% | Military Families | USAA | |

| #3 | $45 | 10% | Budgeting Tools | Progressive | |

| #4 | $50 | 20% | Customer Service | State Farm | |

| #5 | $55 | 10% | Pay-Per-Mile Rates | Allstate | |

| #6 | $60 | 15% | Widespread Availability | Nationwide |

| #7 | $65 | 5% | Classic Cars | Farmers | |

| #8 | $70 | 12% | Quick Claims | Liberty Mutual |

Read on to learn more about the best insurance for car auctions. Use our tool to compare rates and find affordable car auction insurance today.

- Geico has the cheapest rates for auction vehicles

- There is no one type of insurance for cars bought at auction

- Many of these cars will require specialty insurance

#1 – Geico: Top Pick Overall

Pros

- Online Convenience: You can quickly purchase a policy for your auction car online. Learn more in our Geico insurance review.

- Military Discount: Geico offers a discounted rate to service members.

- Roadside Assistance: Useful for if your new auction car is prone to breakdowns.

Cons

- In-Person Assistance: Geico’s local agents may not be in your area.

- Discount Availability: Geico’s discounts can vary by location.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#2 – USAA: Best for Military Families

Pros

- Military Families: USAA offers affordable insurance rates to service members, veterans, and their families.

- Coverage Options: There are several coverages you can add to a policy for an auction vehicle.

- Competitive Rates: USAA generally has some of the cheapest rates available. Find out more in our review of USAA.

Cons

- Limited In-Person Assistance: You may not have access to a local agent in your area.

- Eligibility is Limited: Civilian drivers can’t buy auto insurance.

#3 – Progressive: Best for Budgeting Tools

Pros

- Budgeting Tools: Progressive offers a Name Your Price tool to help you see how much coverage you can put on your car auction vehicle.

- Coverage Options: Progressive has roadside assistance and more. Read more in our Progressive car insurance review.

- Deductible Flexibility: Adjust deductibles on each individual coverage.

Cons

- Claim Experiences: Customers have left negative reviews about claims at Progressive.

- Young Driver Rates: Teens buying vehicle auction insurance on their own should shop elsewhere.

#4 – State Farm: Best for Customer Service

Pros

- Customer Service: Part of the reason for State Farm’s high ratings is its local agent availability.

- Multi-Policy Discount: Bundling insurance types could save customers 17%.

- Financial Stability: A.M. Best gave the highest rating available. Read our State Farm insurance review to learn more.

Cons

- High-Risk Rates: State Farm’s rates are best for good drivers.

- Accident Forgiveness Qualifications: State Farm has more extensive qualifications for accident forgiveness.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#5 – Allstate: Best for Pay-Per-Mile Rates

Pros

- Pay-Per-Mile Rates: Great for auction vehicles that are rarely driven after purchase.

- Claim Satisfaction Guarantee: Allstate gives some unhappy customers a discounted policy period.

- Discount Variety: Every customer should be able to qualify for at least one or two discounts.

Cons

- Customer Complaints: There are slightly more complaints against Allstate than at other car insurance companies.

- High-Risk Rates: Avoid Allstate if you have a DUI or several at-fault accidents on your record. Learn more about rates at Allstate in our Allstate review.

#6 – Nationwide: Best for Widespread Availability

Pros

- Widespread Availability: You will be able to get coverage in the majority of states.

- Vanishing Deductible: Deductibles will drop for claims-free customers. Read more about Nationwide discounts.

- Coverage Options: Choose minimum or full coverage for your auction vehicle policy.

Cons

- High-Risk Rates: High-risk drivers will have less affordable car auction rates.

- Customer Satisfaction: Nationwide’s customer satisfaction falls slightly below average, according to J.D. Power.

#7 – Farmers: Best for Classic Cars

Pros

- Classic Cars: Farmers offers great insurance for any classic cars you may purchase at a classic car auction.

- Online Management: Most tasks can be completed online, such as adding a new driver.

- Various Discounts: Save on your car auction auto insurance with discounts. Find out more by reading our Farmers review.

Cons

- High-Risk Rates: Shop elsewhere if you have a very poor driving record.

- Claim Experience: There are some complaints about customer service when filing claims.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#8 – Liberty Mutual: Best for Quick Claims

Pros

- Quick Claims: You can file a claim online at any time. Read our Liberty Mutual review for more information about the company.

- Add-On Coverages: Get unique coverages for your auction car at Liberty Mutual.

- Military Discount: Service members can get a discounted rate on their auction insurance.

Cons

- Poor Credit Rates: Drivers with poor credit scores may see an increase in their policy rates.

- Discount Amounts Vary: Discounts may be based on performance or limited by location.

Cost of Car Auction Insurance

The insurance cost for cars from auction will depend partly on the type of coverage and provider you choose.

Car Auctions Car Insurance: Monthly Rates by Coverage Level & Provider

| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| Allstate | $55 | $135 |

| Farmers | $65 | $145 |

| Geico | $40 | $115 |

| Liberty Mutual | $70 | $150 |

| Nationwide | $60 | $140 |

| Progressive | $45 | $120 |

| State Farm | $50 | $130 |

| USAA | $35 | $105 |

Full coverage car insurance costs more, but if you frequently drive your auction car, full coverage will provide the best protection (learn more: Best Full Coverage Car Insurance). Make sure to grab quotes from companies like Geico to see how much full coverage will cost for your auction vehicle.

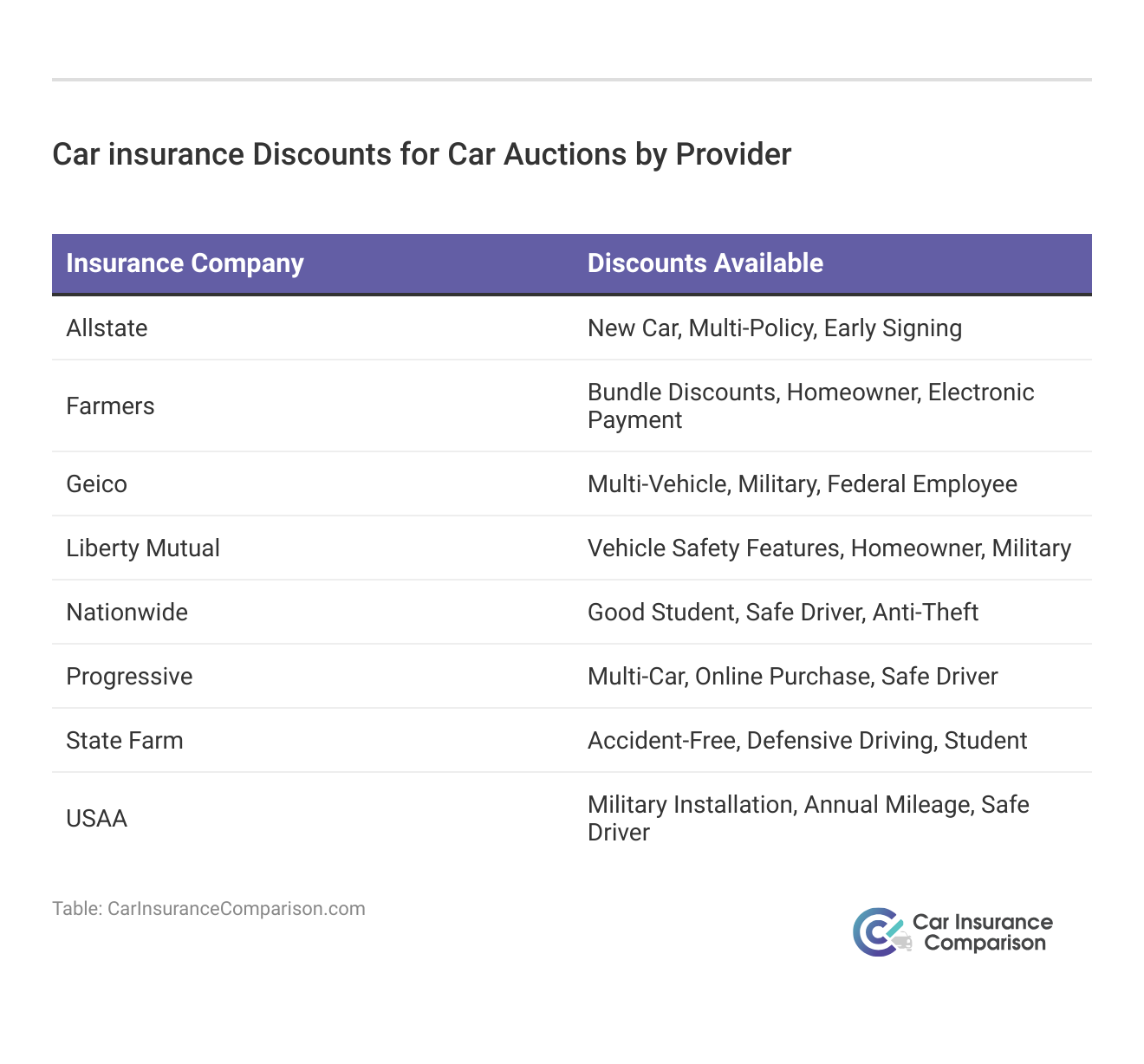

How to Save on Car Auction Insurance

Saving on a car auction insurance policy is the same as saving on any car insurance policy. Besides shopping for quotes at the cheapest car auction insurance companies, we recommend checking out available discounts.

One of the best discounts is a good driver discount. If you don’t qualify, a multi-policy discount also offers great savings.

View this post on Instagram

Ask your insurance company if any discounts aren’t being applied to your policy, and don’t forget to get quotes every year to ensure you’re still getting the best deal.

Types of Car Insurance Auctions

In the past, if you went to a car auction, you weren’t sure what you might be getting. Often, the person running a car auction would sell cars that were seized by the government or police, damaged by flooding, repossessed vehicles, and so on. You weren’t allowed to look at the vehicle beforehand or get a mechanic’s opinion.

You wouldn’t even be privy to whether or not the vehicles had clean titles before the auction took them in. If it turned out to be little more than a salvage vehicle, that was your bad luck. While these types of auctions still exist today, there are other types of auctions as well, such as:

- Licensed Dealer Auctions: Licensed dealers will sometimes conduct auctions of vehicles on their lot to reduce stock. Dealer auctions tend to give you more leeway. You’re able to get information on the vehicles, looking at actual damages, the titles behind them, and what would need to be done in order to fix them up.

- Classic Car Auctions: There are also classic car auctions for people with a lot of money to spend on their cars (read more: The Best Classic Car Auctions). Classic car insurance is even available for these purchases.

- eBay Auctions: You also can’t exclude sites like eBay from the car auction list. It is a fact that eBay has become a go-to source for people looking to find a good deal on their next vehicle. In fact, not only are individuals using eBay to sell their used cars, but car dealerships also use eBay regularly in an effort to sell their vehicles to the highest bidder.

- Police Auctions: Police auctions offer seized vehicles and ex-police cars for sale. For more information, read our article on the best police car auctions online.

Before purchasing a vehicle, make sure you do your research into what insurance you will need to carry.

Classic Car Auction Insurance

Classic cars are actually a different sort of animal in the insurance world. In order for an insurance company to view it as a classic car, it must be certified as such. Consider these points when buying a classic car at auction:

- If you purchase a classic car at an out-of-state auction, you must consider your shipping needs. Most car shipping companies cover your vehicle if it is damaged while being shipped, but you don’t want to leave this to chance. Anything can happen between the two locations, so ensure you’re protected.

- Any registered vehicle is required to carry auto insurance, and your classic car is no exception. If you purchase a classic car with the intention of not driving it, you should check your state’s laws regarding storing a registered vehicle.

- You may want to consider coverage regardless because a classic car has such a high dollar value (read more: Best Classic Car Insurance).

- Unlike modern vehicles, classic cars don’t necessarily have a VIN. However, due to unique serial numbers and parts put into specific vehicles, there are other ways of identifying what has happened to classic cars in the past.

You can purchase a totaled classic car and get insurance for it as long as it has classic car certification. Insurance companies recognize that a classic car can still have high value even if it is totaled.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

How To Insure an Auction Vehicle

Every vehicle in the country has a VIN (Vehicle Identification Number). This VIN is unique to each vehicle and when a vehicle is manufactured, it is assigned a VIN that is placed in a national database.Here are some tips regarding your purchase and that VIN number:

- Each time a vehicle is in an accident, the insurance company, the police department and possibly the company that tows the vehicle all write down that VIN number in their paperwork. This information is also placed in a national database associated with that VIN. (For more information, read our guide on The National Database for Car Insurance).

- No matter what type of auction you are buying a vehicle from, you are, by law, allowed to ask for the VIN. The car dealer or auctioneer is under no obligation to provide you with any other information, but you can typically find out what you need to know from that simple number.

- Typically, you are going to have to pay for something like a CARFAX report. CARFAX is a company that can provide you with information on any VIN that you type into the system. Some of the minimal information is free, but you will have to pay for a full report.

The benefit of using a service like CARFAX is that it lists every reported accident and/or claim made on a vehicle.While you could probably find out this information for free, most auctions are time sensitive and a CARFAX report–or something similar–can provide you with the information that you need instantly.This will also let you know what an insurer will see if you try to purchase insurance using the VIN.

CARFAX is not the only company that provides this service, but many car dealers consider it the premier service. They use it to determine whether a car is worth buying.

Many insurance companies will not provide coverage for vehicles that have been declared totaled by an insurance company. For example, a vehicle that has been in a fire or a flood may be uninsurable.

Brandon Frady Licensed Insurance Agent

It depends on the insurance company and the extent of the damage and whether you will have difficulty buying a car insurance policy.

The Final Word on Cheap Car Insurance For Car Auctions

Understanding companies’ insurance methods is just the first step in purchasing your auto insurance. Tell them what you’re doing and check to see if it falls within their guidelines. You want to ensure that you get the best rate by comparing quotes and checking out car insurance discounts. Since there are so many policy service options, and so many types of cars to choose from, you’ll want to connect the two in a way that suits your budget but also keeps you safe.

Using a comparison tool to compare the rates between car insurance companies is the fastest and easiest way to accomplish this. You can compare car insurance rates from multiple companies right now with just your zip code!

Frequently Asked Questions

When do I need salvage insurance?

Salvage insurance is needed when you purchase a vehicle with serious damage from accidents, floods, or fires. However, there are many automobile insurers that won’t even write a salvage insurance policy and will declare your car a total loss (learn more: How Car Insurance Companies Determine Salvage Value).

It is in your best interest to check some of your local insurance companies to see if you can insure this type of vehicle before you purchase one. If you purchased the vehicle for parts, for example, then you won’t need to purchase car insurance at all. As long as you don’t drive or register the vehicle, you wouldn’t need to protect it from the harsh treatment of being on the road.

How can I insure an auction vehicle?

Each vehicle has a unique VIN. Use services like CARFAX to check its history and determine insurability. Some insurers may not cover totaled, fire-damaged, or flood-damaged vehicles.

Do I need specialty insurance for a classic car from an auction?

Classic cars require special insurance. Ensure the vehicle is certified as a classic and inform the insurer about your purchase to get appropriate coverage.

Can I buy a car from an auction without insurance?

If you don’t plan to drive or register the vehicle, you may not need insurance. However, it’s advisable to protect the vehicle from potential risks if it is on the road with the right types of car insurance (learn more: Compare Car Insurance by Coverage Type).

How can I find the best insurance rates for auction-bought cars?

Use a comparison tool to compare rates from multiple insurance companies based on your ZIP code. This helps you find the best coverage options that fit your budget.

Why are auction cars so cheap?

Auction cars are usually cheap because they aren’t in great condition. If you have an auction car, consider carrying tow and breakdown insurance in case your auction car breaks down (learn more: Does car insurance cover towing?).

How reliable are cars from auction?

You can expect to put some work into fixing up auction cars, but reliability will depend on what you purchased and what issues the auction disclosed.

What are the best car auction sites?

Popular car auction sites are Copart and eBay Motors.

Can I drive a car I just bought from Copart?

You can only drive a car you bought if you insure it first. Otherwise, you could be penalized for driving without insurance (learn more: How long can I drive my new car without insurance?).

Is flipping cars from auction worth it?

It depends on the vehicle and how much you must put into repairs. We advise you to do your research before trying to flip auction cars.

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.