Best Muscle Car Insurance in 2026 (Your Guide to the Top 10 Companies)

The best muscle car insurance companies are The Hartford, American Family, and AAA. These companies offer specialty muscle car auto insurance options like agreed value and original parts replacement coverage. With rates starting at $120 per month, finding cheap muscle car insurance doesn’t have to be a challenge.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Licensed Insurance Producer

Dani Best has been a licensed insurance producer for nearly 10 years. Dani began her insurance career in a sales role with State Farm in 2014. During her time in sales, she graduated with her Bachelors in Psychology from Capella University and is currently earning her Masters in Marriage and Family Therapy. Since 2014, Dani has held and maintains licenses in Life, Disability, Property, and Casualt...

Dani Best

Insurance & Finance Analyst

Zach Fagiano has been in the insurance industry for over 10 years, specializing in property and casualty and risk management consulting. He started out specializing in small businesses and moved up to large commercial real estate risks. During that time, he acquired property & casualty, life & health, and surplus lines brokers licenses. He’s now the Senior Vice President overseeing globa...

Zach Fagiano

Updated May 2024

765 reviews

765 reviewsCompany Facts

Full Coverage for Muscle Car

A.M. Best Rating

Complaint Level

765 reviews

765 reviews 2,235 reviews

2,235 reviewsCompany Facts

Full Coverage for Muscle Car

A.M. Best Rating

Complaint Level

2,235 reviews

2,235 reviews 3,027 reviews

3,027 reviewsCompany Facts

Full Coverage for Muscle Car

A.M. Best Rating

Complaint Level

3,027 reviews

3,027 reviewsThe Hartford, American Family, and AAA have the best muscle car insurance policies, especially if your vehicle is a classic.

The Hartford takes our top spot for muscle car insurance, especially if you need the cheapest car insurance for senior drivers. If you’re a younger muscle car owner, American Family and AAA offer affordable rates.

Our Top 10 Company Picks: Best Muscle Car Insurance

| Company | Rank | Good Driver Discount | A.M. Best | Best For | Jump to Pros/Cons |

|---|---|---|---|---|---|

| #1 | 10% | A+ | Organization Discount | The Hartford |

| #2 | 12% | A | Claims Service | American Family | |

| #3 | 8% | A | Roadside Assistance | AAA |

| #4 | 10% | A | First-Responder Discount | Farmers | |

| #5 | 9% | A+ | Tight Budgets | Progressive | |

| #6 | 11% | A++ | Business Owners | State Farm | |

| #7 | 10% | A+ | Filing Claims | Erie |

| #8 | 12% | A | Add-on Options | Liberty Mutual | |

| #9 | 9% | A++ | Military Members | USAA | |

| #10 | 8% | A++ | Add-Ons | Auto-Owners |

Explore the best muscle car insurance companies below and learn how to pick the right coverage for you. Then, enter your ZIP code into our free comparison tool to find the best prices possible.

- Muscle car auto insurance usually costs more because of their powerful engines

- Most companies offer specialty coverage for muscle cars, especially for classics

- The Hartford and American Family offer the best muscle car insurance

#1 – The Hartford: Top Pick Overall

Pros

- AARP Benefits: The Hartford sells insurance primarily to AARP members over 50. If you’re an AARP member, you’ll get free coverage like new car replacement added to your policy. Learn more about The Hartford’s partnership with AARP in our review of The Hartford and AARP car insurance.

- Agreed Value Coverage: When you sign up for agreed value coverage from The Hartford, your insurance will pay a set amount rather than your car’s actual cash value (ACV) if you total your car.

- Generous Discounts: The Hartford offers a variety of ways to save, especially if you’re an AARP member.

Cons

- High Number of Complaints: According to the NAIC, The Hartford receives more customer complaints than other similarly sized companies.

- Higher Rates: The Hartford’s rates tend to be a bit above the national average for most drivers.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#2 – American Family: Best for Classic Muscle Car Insurance

Pros

- Unlimited Mileage: Many classic muscle car auto insurance companies limit how many miles you can drive, but not American Family. However, you can’t use your muscle car for daily driving and still qualify for classic car insurance.

- Good Customer Service Ratings: Most customers agree that American Family has helpful customer service representatives. See what customers have to say in our American Family car insurance review.

- Solid Discounts: American Family offers an impressive 18 discounts to help drivers save.

Cons

- Limited Availability: American Family only sells insurance in 19 states.

- Average Digital Tools: While it offers a mobile app and website, American Family customers are less than impressed.

#3 – AAA: Best for Roadside Assistance

Pros

- Stated Value Coverage: Your car will be valued at a specific amount when you buy your policy. If anything happens to your vehicle, you’ll receive the stated value no matter what.

- Competitive Rates: AAA offers cheap muscle car auto insurance to its members. See how much you might pay in our AAA car insurance review.

- Roadside Assistance Plans: Choose from three roadside assistance plans so you’ll always be safe on the road.

Cons

- Vehicle Restrictions: Some muscle cars may not be eligible for AAA’s muscle autos insurance. Make sure to check with a representative to ensure you get coverage that fits your needs.

- Membership Fees: AAA charges an annual membership fee. While membership costs are usually affordable, they do add to the overall price of your insurance.

#4 – Farmers: Best for Collector Car Insurance for Muscle Cars

Pros

- Muscle Car Coverage Options: Farmers offers excellent coverage options for muscle cars, like a “no attendance” clause for auto shows and original parts replacement coverage.

- Ample Discounts: Farmers has 23 discounts that can help you find affordable American muscle car insurance. Explore every way to save in our Farmers car insurance review.

- Strong Financial Ratings: With an A from A.M. Best, you don’t have to worry about Farmers being able to pay your muscle auto insurance claims.

Cons

- Higher Rates for Some: Some owners will see higher rates, even if they drive the cheapest muscle car to insure.

- Some Options Lacking: Although Farmers has excellent coverage options, it lacks choices like gap insurance and a vanishing deductible.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#5 – Progressive: Best Digital Tools for Muscle Car Insurance Policies

Pros

- Partnership With Hagerty: Hagerty is a respected option for classic car insurance. Progressive and Hagerty have teamed up to offer the best classic car insurance.

- Muscle Car Coverage: Get roadside assistance, original parts replacement coverage, and unlimited mileage for your classic muscle car.

- Digital Tools: Progressive has a highly-rated mobile app and website to help drivers manage their policies.

Cons

- Higher Rates for Modified Vehicles: Cars designed or enhanced to increase speed will likely pay higher rates at Progressive.

- Mixed Reviews: Despite offering cheap coverage and excellent policy options, Progressive struggles to keep its customers. Learn more in our Progressive car insurance review.

#6 – State Farm: Best Muscle Car Rates

Pros

- State Farm Classic+: State Farm is another major provider that has teamed with Hagerty to offer specialized classic car insurance.

- Low Rates: State Farm only covers classic muscle cars that aren’t used for daily driving, so rates are often lower than what other companies can offer.

- Extensive Network of Agents: With a reputation for the availability of its agents, it’s easy to get insurance help from State Farm. See how State Farm agents can help you in our State Farm car insurance review.

Cons

- Strict Eligibility Requirements: State Farm doesn’t sell classic car insurance for every vehicle. To be eligible, your car should be in good condition, at least 10 years old, and not used for daily driving.

- Average Customer Satisfaction: While it doesn’t have a ton of angry drivers, State Farm’s claims process doesn’t leave much of an impression on customers.

#7 – Erie: Best Modern Muscle Car Insurance

Pros

- Coverage for Modern Cars: Unlike many companies that only offer specialty coverage for older cars, Erie has extra protection for modern vehicles that maintain their value.

- Muscle Car Discounts: Save on your classic or modern muscle car auto insurance with special discounts. For example, you’ll get discounted rates if you drive your vehicle 500 miles per year or less.

- Superb Customer Service: Erie has a reputation for excellent customer service, especially for its claims service.

Cons

- Limited Availability: Erie only sells insurance in 12 states. See if you live in one of those 12 states in our Erie car insurance review.

- No Online Quotes: If you want to purchase auto insurance for muscle cars from Erie, you’ll need to contact an agent.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#8 – Liberty Mutual: Best Coverage Options

Pros

- Coverage Options: Liberty Mutual offers a variety of coverage options for all of its policies. Explore your options in our Liberty Mutual car insurance review.

- Solid Discounts: Get cheap muscle car auto insurance by taking advantage of Liberty Mutual’s 17 discounts.

- RightTrack: If your muscle car is for daily use, you can lower your rates by up to 30% by enrolling in the usage-based insurance (UBI) program RightTrack.

Cons

- Limited Online Information: Liberty Mutual sells specialty coverage, but you’ll need to speak with an agent to discuss your options.

- Higher Premiums: You won’t always find the cheapest muscle car auto insurance at Liberty Mutual, as rates are often on the high side.

#9 – USAA: Best for Military Families

Pros

- American Collectors Partnership: USAA has teamed up with American Collectors for over 30 years to provide the best muscle car auto insurance for its members.

- Low Rates: No matter who you are or where you live, USAA likely has the cheapest classic car insurance rates.

- Excellent Customer Service: USAA consistently scores well on its customer service experience.

Cons

- Eligibility Requirements: USAA membership is only open to active or retired military members and their families. Learn more about USAA’s military coverage in our USAA car insurance review.

- Fewer Coverage Options: Whether you have a regular car or a classic, USAA doesn’t have a list of coverage options as long as some of its competitors.

#10 – Auto-Owners: Best for High-End Muscle Cars

Pros

- Luxury Car Insurance: Auto-Owners specializes in coverage for expensive vehicles. If you need high-end muscle vehicle insurance, Auto-Owners might be right for you.

- Solid Coverage Options: Auto-Owners earns its spot as one of the best muscle car insurance companies with its valuable list of coverage options. See what you can add to your policy in our Auto-Owners car insurance review.

- Good Customer Service Ratings: Most customers agree that Auto-Owners offers a good deal, valuable coverage, and an enjoyable insurance experience.

Cons

- Higher Prices: Auto-Owners doesn’t try to be the cheapest car insurance company. Instead, drivers should only consider Auto-Owners if they have some wiggle room in their budget.

- Limited Availability. A car insurance policy from Auto-Owners is only available in 26 states.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Muscle Car Insurance Rates

Whether you have one of the best muscle cars in 2024 or a vintage classic, muscle car insurance typically costs a little more than coverage for a standard car. Take a look below to see how much you might pay for your muscle car insurance.

Muscle Car Insurance Monthly Rates by Coverage Level & Provider

| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| AAA | $120 | $180 |

| American Family | $130 | $190 |

| Auto-Owners | $125 | $185 |

| Erie | $115 | $175 |

| Farmers | $135 | $195 |

| Liberty Mutual | $130 | $190 |

| Progressive | $125 | $185 |

| State Farm | $130 | $190 |

| The Hartford | $140 | $200 |

| USAA | $110 | $170 |

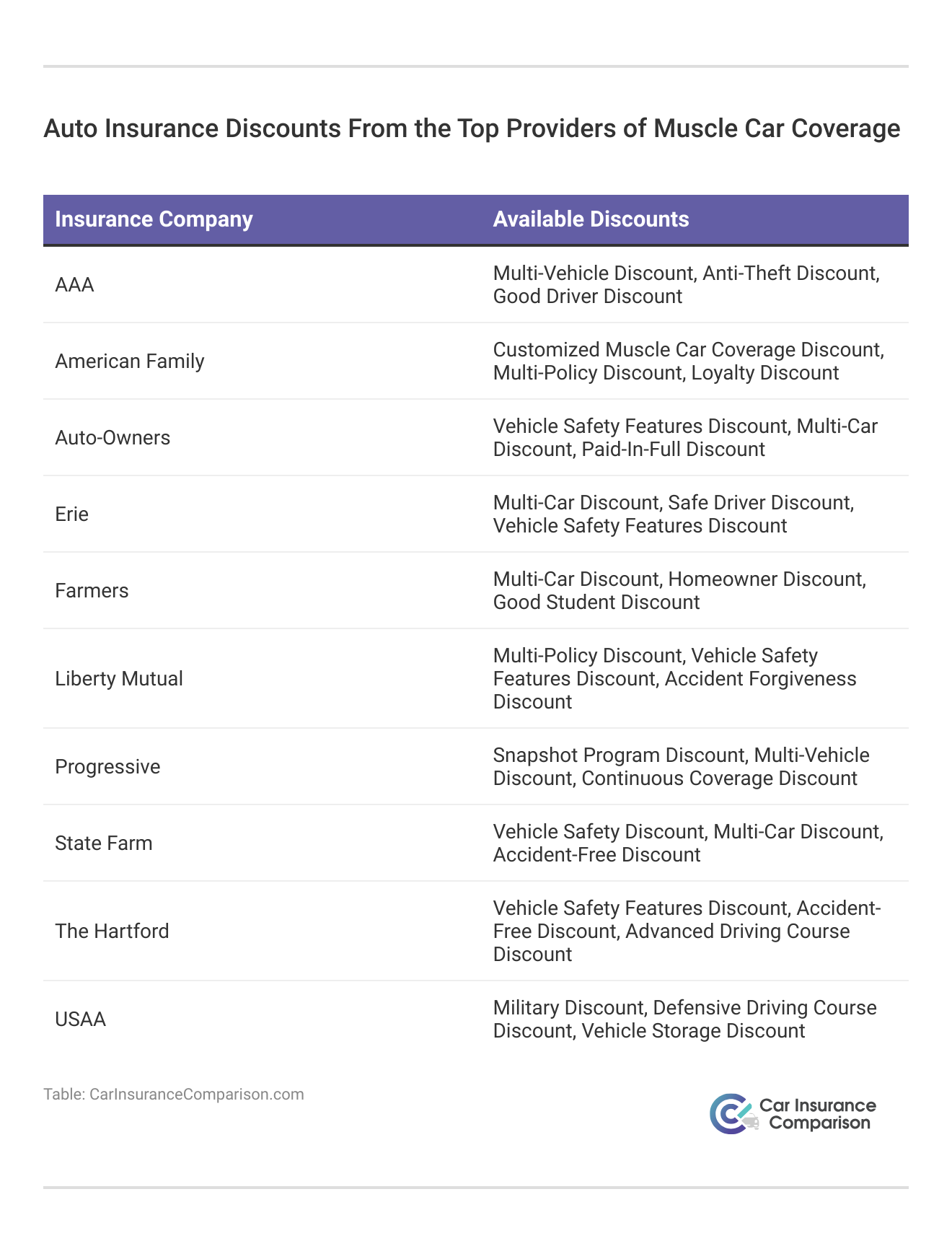

As you can see, auto insurance for a muscle car can be pricy and is usually about $50 more expensive per month than standard coverage. However, you can lower your monthly average car insurance rates by finding discounts. Check below to see how many discounts our biggest insurance companies offer.

Other options to save on your insurance include lowering your coverage, increasing your deductible, and keeping your driving record clean.

Understanding Muscle Car Insurance

Muscle cars are typically mid-sized cars with a V8 engine. Unlike their more expensive counterparts, muscle cars were intended to be generally affordable cars with the ability to go fast.

As high-performance cars evolved, some full-size cars were able to get classified as muscle cars. Additionally, when some compact cars rolled out with high-performance engines they were considered muscle cars as well.

Some high-performance cars cannot be counted as muscle cars because they are either too expensive or too unique — most muscle cars are intended to be for the everyday driver.

An example of a mid-sized muscle car is the Dodge Charger R/T version. The Pontiac Firebird is a compact muscle car, but only if it has a 400+ cid engine. For a full-size muscle car, check out the Chevy Impala SS.

Cars that do not count as muscle cars include:

- Buick Riviera

- Pontiac Grand Prix

Some cars that are classics may be misconstrued as muscle cars, such as the Ford Thunderbird or the Chevy Monte Carlo. These vehicles will require the best classic car insurance.

Your #classic #car deserves custom coverage: #Insurance #Protect #Prepare https://t.co/qtiUjrszMM pic.twitter.com/sLBOCDhoU3

— The Hartford (@TheHartford) May 26, 2016

Other cars can be both muscle cars and classics. If you’re unsure of what type of insurance would best suit your vehicle, a representative can help.

The Muscle Car Insurance Debate

Are muscle cars expensive to insure? While muscle cars were intended to be affordable, high-performance cars that were based on production models, they are viewed differently by many car insurance companies.

Insurance companies see the speed factor and the potential theft factor when they look at muscle cars. You’ll get answers right away about the price of insurance at any given company when you start filling out a quote request form.

Most owners keep their muscle cars in pristine condition and they are frequently sought after, making them more valuable. This mental conditioning tends to boost car insurance premiums.

Rare muscle cars that are in excellent shape that date back to the seventies are classics that may appear in car shows. These types of cars may need additional insurance beyond the typical total coverage.

If you are buying a muscle car for general driving, then you should only need to pay for liability and, of course, collision and comprehensive coverage to pay for any damages that may occur to your car.

However, insurance companies may charge more for your high-powered car, so you should shop around to make sure you are getting the best rate.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Muscle Car Insurance: Types of Insurance

Determining the types of insurance you need to protect your muscle car is imperative. In order to legally drive your muscle car, you need to buy liability insurance for it.

This insurance will cover bodily injury and property damage for which you are liable. Unfortunately, if you only have liability and you are responsible for an accident, your car will not be covered unless you have collision insurance.

Tracey L. Wells Licensed Insurance Agent & Agency Owner

If your car has any market value at all, you need collision insurance and comprehensive insurance.

- Collision car insurance will pay for the damages to your car from an accident.

- Comprehensive car insurance will pay for your car damages that result from non-vehicular accident-related incidents.

Classic car insurance is available for collector cars, classic cars, and even muscle cars that you may be showing. Collector car insurance can offer you maximum coverage for the value of your muscle car.

It can also save you money if you do not need liability or collision insurance if you are not actually driving your car.

All other insurance components that are optional can be added to your muscle car insurance rates as needed. Uninsured motorist and underinsured motorist coverage are common additions, as is rental and towing.

Rather than take a chance on driving your muscle car without sufficient coverage, shop around for different quotes from car insurance providers. If you are driving your muscle car as your everyday car then there is no reason you cannot have everyday insurance for it.

Car insurance quotes do take the make and model of a car into consideration when they quote a premium, but they also look at a number of other factors, including:

- Your age

- Where you live

- Your marital status

- Your driving record

You can also add other types of insurance meant for classic muscle cars, like original parts replacement coverage.

Find the Best Muscle Car Insurance Today

Whether you need the best sports car insurance for a modern muscle car or coverage for a classic, you can find the right coverage by comparing rates.

Don’t get penalized for having a muscle car. You can find the best rates in your area by entering your ZIP code below into our free comparison tool today.

Frequently Asked Questions

What is a muscle car?

Muscle cars are powerful mid-sized cars with a V8 engine designed for everyday driving.

Is liability insurance enough for my muscle car?

Liability might cover your car insurance requirements depending on which state you live in, but experts agree that muscle cars should have more coverage. Consider the best full coverage car insurance to keep your muscle car safe on the road.

How much does muscle car insurance cost?

For minimum insurance, the average driver pays about $126 for muscle car insurance. Full coverage costs more, with the average driver paying about $155 per month.

Are muscle cars expensive to insure?

Yes, muscle cars can have higher insurance premiums due to their high performance and theft risk.

What types of insurance do I need for my muscle car?

You need liability, collision, and comprehensive coverage. Classic car insurance is also available for collector and show cars.

Which companies have the cheapest muscle car insurance?

While it depends on several factors, the cheapest car insurance companies for muscle cars are USAA, Erie, and AAA.

How much would insurance be for a 16-year-old with a muscle car?

Finding the cheapest car insurance for new drivers is already difficult, but it’s even harder when they have a muscle car.

Is J.C. Taylor Insurance the best for classic muscle cars?

While J.C. Taylor is a great option, our research shows that The Hartford, American Family, and AAA have the best insurance for classic muscle cars.

Do muscle cars have higher insurance rates?

While many factors affect car insurance rates, muscle cars typically have higher rates because they have more powerful engines than standard vehicles. Insurance companies charge more for cars, which can encourage drivers to speed and drive recklessly.

Which muscle car is the cheapest to insure?

Generally speaking, the Ford Mustang and Chevy Camaro have some of the cheapest rates for muscle car insurance. However, you’ll need to compare rates to make sure you’re getting the lowest prices, no matter what you drive. Enter your ZIP code into our free tool to see how much your muscle car insurance might cost.

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.