Best Car Insurance for Car Dealerships in 2026 (Top 10 Companies Ranked)

Compare the best car insurance for car dealerships with Progressive, Allstate, and Farmers, offering competitive rates starting as low as $22/month. These companies provide comprehensive coverage options tailored specifically to meet the diverse needs of different dealerships effectively.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Licensed Insurance Agent

Kristen is a licensed insurance agent working in the greater Boston area. She has over 20 years of experience counseling individuals and businesses on which insurance policies best fit their needs and budgets. She knows everyone has their own unique needs and circumstances, and she is passionate about counseling others on which policy is right for them. Licensed in Massachusetts, New Hampshire,...

Kristen Gryglik

Licensed Insurance Agent

Daniel Walker graduated with a BS in Administrative Management in 2005 and has run his family’s insurance agency, FCI Agency, for over 15 years (BBB A+). He is licensed as an insurance agent to write property and casualty insurance, including home, life, auto, umbrella, and dwelling fire insurance. He’s also been featured on sites like Reviews.com and Safeco. To ensure our content is accura...

Daniel Walker

Updated May 2024

13,283 reviews

13,283 reviewsCompany Facts

Full Coverage for Dealerships

A.M. Best Rating

Complaint Level

13,283 reviews

13,283 reviews 11,638 reviews

11,638 reviewsCompany Facts

Full Coverage for Dealerships

A.M. Best Rating

Complaint Level

Pros & Cons

11,638 reviews

11,638 reviews 3,072 reviews

3,072 reviewsCompany Facts

Full Coverage for Dealerships

A.M. Best Rating

Complaint Level

Pros & Cons

3,072 reviews

3,072 reviewsThe top picks for the best car insurance for car dealerships are Progressive, Allstate, and Farmers, known for their competitive rates and tailored coverage.

Car dealerships need insurance coverage for their vehicles, but it differs from personal car insurance. While individual vehicle insurance isn’t mandatory, dealerships must maintain specific overall coverage policies for their inventory.

Our Top 10 Picks: Best Car Insurance for Car Dealerships

| Company | Rank | Multi-Policy Discount | Safe Driver Discount | Best For | Jump to Pros/Cons |

|---|---|---|---|---|---|

| #1 | 10% | 30% | Competitive Rates | Progressive | |

| #2 | 10% | 25% | Wide Coverage | Allstate | |

| #3 | 20% | 15% | Fleet Discounts | Farmers | |

| #4 | 10% | 13% | Vehicle Protection | Nationwide |

| #5 | 12% | 17% | Dealership Coverage | Liberty Mutual |

| #6 | 10% | 20% | Customized Policies | American Family | |

| #7 | 25% | 10% | Assistance Benefits | AAA |

| #8 | 10% | 20% | Friendly Plans | USAA | |

| #9 | 30% | 25% | Trusted Provider | State Farm | |

| #10 | 10% | 19% | Online Convenience | Esurance |

Various types of dealership insurance exist, such as errors and omissions insurance. Each dealership’s requirements may vary based on its operations.

Keep reading to learn more about the best car insurance companies, how to save money on your car dealership insurance costs, and some questions you should ask of insurance companies before you buy. To get started, use your ZIP code to get a free quote on car insurance today.

- Progressive is the top choice for comprehensive dealership insurance

- Tailored policies to address the unique requirements of car dealerships

- Allstate and Farmers offer specialized coverage for diverse dealership needs

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Auto Dealership Insurance Rates and Requirements

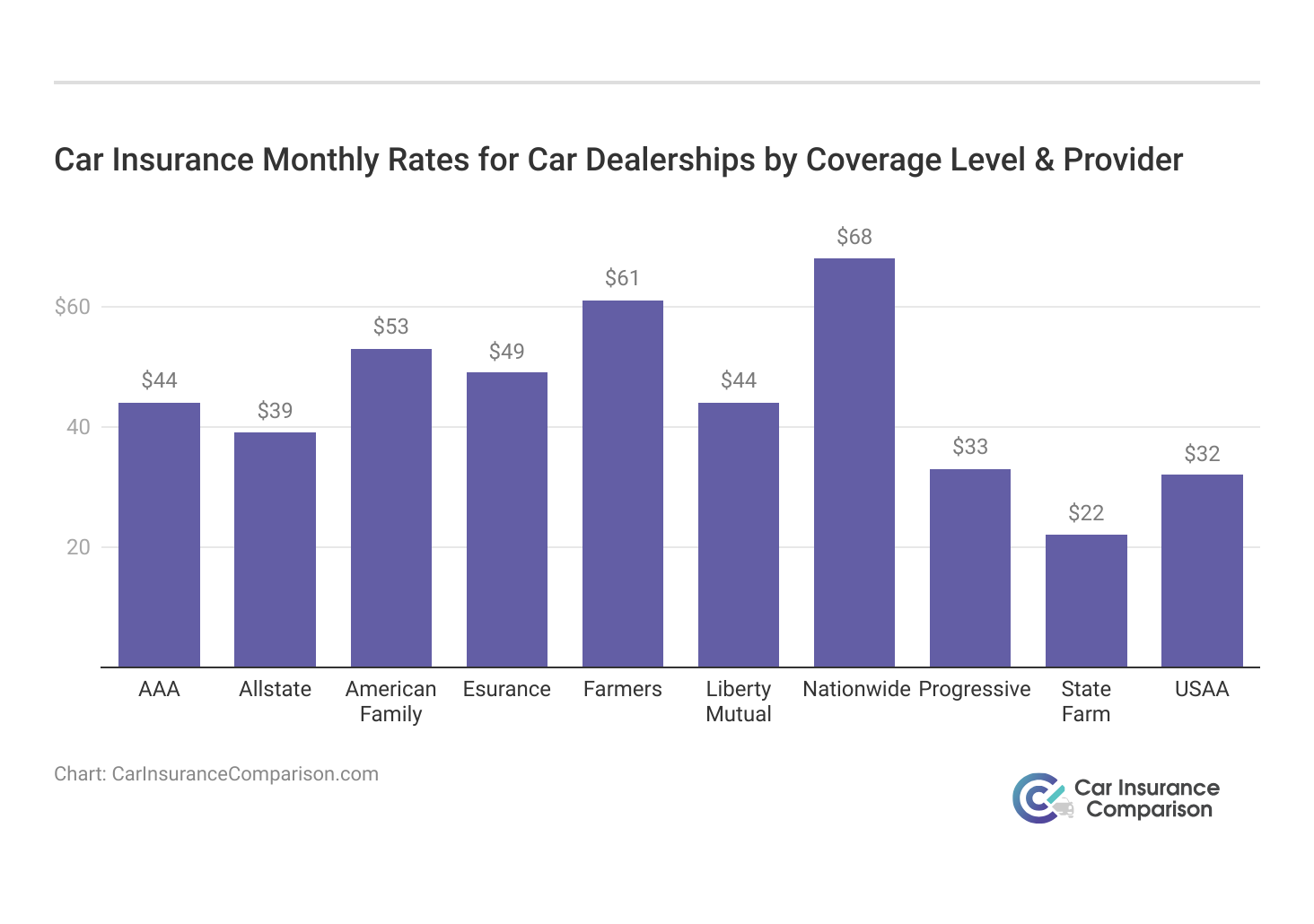

Car Insurance Monthly Rates for Car Dealerships by Coverage Level & Provider

| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| AAA | $44 | $117 |

| Allstate | $39 | $105 |

| American Family | $53 | $139 |

| Esurance | $49 | $128 |

| Farmers | $61 | $160 |

| Liberty Mutual | $44 | $115 |

| Nationwide | $68 | $174 |

| Progressive | $33 | $86 |

| State Farm | $22 | $59 |

| USAA | $32 | $86 |

What Does a Commercial Auto Policy Cover

The minimum amount of liability auto insurance coverage required is what’s needed to legally drive, and nearly every state in the country requires all vehicles to have minimum liability car insurance coverage. The purpose of this coverage is to ensure drivers are financially protected in the event of an accident.

Car Dealership Insurance Summary

| Summary Details | From the Experts |

|---|---|

| Car dealerships (like other businesses) are required to carry insurance coverage for their business and their assets. | National Federation of Independent Businesses |

| There are options for auto dealer insurance, including garage keepers liability, garage liability, general liability, and dealer plate insurance | International Risk Management Institute, Investopedia |

| Different states have different requirements for minimum coverage for car dealerships | State Business Sites |

However, personal auto coverage does not provide the coverage necessary for businesses. Instead, the first thing car dealership owners must do is purchase a commercial auto insurance policy, rather than a personal one, for the business. Ultimately the reason for this commercial coverage is the same as it is for personal car insurance coverage: it provides financial protection in the event of an accident, incident, etc.

What does a commercial auto policy cover? While the coverage is similar to personal coverage, there are some differences, primarily based on how vehicles are used. Take a moment to watch this video to learn a bit more about commercial car insurance (For more information, read our “Compare Commercial Car Insurance: Rates, Discounts, & Requirements”).

Because vehicles on a dealership’s lot can be driven off the lot before purchase (for example, during a test drive), dealerships must have some kind of insurance coverage that protects every vehicle on the lot.

Generally, at a minimum, dealerships should be covered by third-party liability insurance that includes the vehicles on the property. Third-party car insurance will typically include property and casualty coverage, similar to the most common liability types of coverage for personally owned vehicles.

Read more: Does car insurance cover dealer damage?

What Dealership Insurance Coverage Do Dealers Need

Insurance for car dealerships is not considered standard car insurance coverage or personal vehicle coverage. It’s also different from the commercial auto insurance we just discussed, which is typically how businesses insure the vehicles owned by and used in the course of performing work for that business (recall the video you just watched). So what is dealer coverage?

Auto dealer insurance for car dealerships is a bit different than general business insurance coverage (though many dealerships are required to have some version of this as well) because dealerships have specific and unique coverage needs.

Auto dealer insurance is the kind of insurance car dealerships need. Auto dealer insurance is tailored specifically to the needs of dealerships. The auto dealer insurance requirements coverage types that you can include as a part of auto dealership insurance (and in some cases are required to include, which we’ll discuss in greater detail later) are listed below:

Commercial General Liability Insurance

According to the Insurance Information Institute, Commercial General Liability protects companies from incidents that can occur involving customers or other individuals on the property who do not work for the business.

This coverage includes property and casualty coverage, as well as things like libel, slander, and copyright infringement by providing financial coverage for legal, medical, and other costs that result from incidents. The exact amount of coverage depends on your policy. Take a look at this video to learn more.

Employment Practices Liability Insurance

According to the Insurance Information Institute, Employment Practices Liability Insurance (EPLI) protects employers in the event of accusations or occurrences of employment issues like harassment, discrimination, retaliation, wrongful termination, and more. Watch this video to learn more.

Errors and Omissions Insurance

Errors and Omissions (E&O) Insurance protects businesses like dealerships that offer advice as a part of performing business (for example, recommending vehicles) by offering coverage if errors or omissions are made by employees when performing a service as a part of normal business operations.

Business Income Insurance

According to Irmi, Business Income Insurance protects businesses when natural and man-made disasters occur by offering financial coverage to help cover expenses (particularly for damages resulting from the disasters), payroll, and other costs that occur when income is lost as a result of a disaster. There are different variations of this coverage, so you’ll need to determine the right fit for your business.

Worker’s Compensation Insurance

Worker’s Compensation Insurance protects businesses by covering the costs of medical expenses that can result from employees being injured or becoming ill as a result of the job. Take a look at this video to learn more about workers’ compensation for car dealers.

Garage Keeper’s Liability Insurance

Garage Keeper’s Liability protects businesses if a customer’s vehicle is damaged while it is under the care of the business (being repaired, for example) by covering the costs of the damage (including as the result of fire, vandalism, collision, or weather). This coverage also often covers vehicle theft if a customer’s vehicle is stolen while under the care of the business.

Garage Liability Insurance

Garage Liability Insurance protects garage businesses (which we’ll talk about in more detail later) by covering the cost of any property damage or bodily injury that occurs as the result of business operations. Watch this video to learn more.

Dealer Plate Insurance

Dealer Plate Insurance protects vehicles and drivers out on the road test-driving. Dealer place insurance coverage is particularly important because car insurance is typically required to drive a vehicle. At the time of a test drive, the vehicle is owned by the dealership, not the driver. With this coverage, vehicles available for test drivers are marked with unique license plates that indicate the necessary protection is in place for drivers to test unregistered and uninsured (in the traditional sense) vehicles.

Which Businesses Are Required to Maintain This Car Dealership Insurance

Any business that is considered garage-related is required to maintain basic auto dealer insurance coverage. Car garage and dealership insurance can offer similar coverage depending on the needs of your business.

So what are garage-related businesses? Ultimately any business that sells a motor vehicle of any kind, conducts any kind of car repair, detailing, maintenance, and more is considered a garage-related business. Businesses fitting this description must carry auto dealer insurance.

The below list includes some examples of garage-related businesses that are required to carry some form of auto dealer insurance coverage.

- Motorcycle Dealers

- Trailer Dealers

- Farm Equipment Dealers

- Vehicle Detailing Shops

The graphic at the beginning of this section includes a more comprehensive, though still incomplete, list.

What Types of Dealer Auto Insurance Coverage Does a Dealership Need

Similar to the personal minimum liability coverage requirements, specific auto dealership coverage requirements vary from state to state. However, there are a couple of insurance coverage types that are usually required.

For example, worker’s compensation coverage is mandatory in nearly every state in the country for all businesses (not just automotive). Employers need to know what happens if an employee gets hurt while performing work at your dealership. Who is at fault? Who pays for the medical expenses that may result?

Worker’s compensation coverage ensures that medical expenses from work-related injuries are covered, as are any lost wages the employee(s) experience as a result. It also offers you protection in the event the employee(s) decide to sue the business because they were injured on the job.

Each state will also have its laws regarding car dealership insurance requirements. For example, used car dealer insurance in California will not be the same as dealer plate insurance in New Jersey.

As the data in the table shows, for the states we looked at, worker’s compensation is required, and most require garage liability. General liability is also commonly required. To find out the exact requirements in your state, if it’s not listed in the below table, you should speak with a licensed auto dealership insurance broker.

However, it is important to keep in mind that there are specific things that you should consider purchasing coverage to include, even if the coverage is not actually legally required, like:

- Vehicles owned by customers that are on your lot for maintenance

- Vehicles on loan

- Inventory vehicles (which are vehicles that have not yet been purchased but are listed in your system)

- Newly acquired vehicles (which are vehicles that are not yet registered in your system but you plan to incorporate into your car lot)

- Accidents caused by customers or employees while driving a lot of vehicle

- Accidents caused by employees driving customer vehicles (such as testing for maintenance issues)

Ultimately any additional insurance coverage options (beyond those required by your state) are up to you, based on your needs and the risks you face.

How Much Does Insurance for Car Dealers Cost

Car dealership insurance costs vary based on several factors, so we can’t tell you how much you might pay. The amount and type of coverage you need will affect your rates. The higher the limit on your policy, the higher the cost of that coverage.

Beyond the amount of coverage you need, some primary factors can have a significant effect on the coverage rates for your dealership. These include, but are not limited to:

- Where your dealership is located

- The size of the dealership (in terms of square footage, total business value, the number of vehicles for sale, etc.)

- The number of people employed at the dealership

- The types of policies you choose to purchase

- How many insurance policies you choose to purchase

What about used cars? How much does insurance cost for a used car dealership? Used car dealer insurance costs can also vary just as much, if not more than dealerships selling new cars. Get in touch with your local car dealership insurance company to get a more accurate auto dealer insurance quote.

Read More: Compare Best Car Insurance Companies That Beat Quotes

Can I Get a Discount on My Dealer Car Insurance

You probably know that for personal car insurance, there are numerous car insurance discounts available for personal insurance, which help make the cost of coverage more affordable, some of which we have listed in the below table.

Common Types of Car Insurance Discounts

| Vehicle Discounts | Driver/Customer Discounts | Personal Discounts |

|---|---|---|

| Active Disabling Device | Claim Free | Emergency Deployment |

| Adaptive Cruise Control | Continuous Coverage | Family Legacy |

| Adaptive Headlights | Defensive Driver | Family Plan |

| Anti-lock Brakes | Driver's Education | Federal Employee |

| Audible Alarm | Driving Device/App | Further Education |

| Automatic Braking | Early Signing | Good Student |

| Blind Spot Warning | Full Payment | Homeowner |

| Daytime Running Lights | Good Credit | Life Insurance |

| Economy Vehicle | Loyalty | Married |

| Electronic Stability Control | Multiple Policies | Membership/Group |

| Farm/Ranch Vehicle | Multiple Vehicles | Military |

| Forward Collision Warning | New Customer/New Plan | New Address |

| Garaging/Storing | Occasional Operator | New Graduate |

| Green/Hybrid Vehicle | Online Shopper | Non-smoker/Non-drinker |

| Lane Departure Warning | On-Time Payments | Occupation |

| Newer Vehicle | Paperless/Auto Billing | Recent Retirees |

| Passive Restraint | Paperless Documents | Stable Residence |

| Utility Vehicle | Roadside Assistance | Student Away |

| Vehicle Recovery | Safe Driver | Student or Alumni |

| VIN Etching | Seat Belt Use | Volunteer |

So what about commercial coverage for car dealerships? Do these discounts apply? Unfortunately, commercial coverage for car dealerships does not qualify for the standard personal car insurance discounts. However, there are things you can do that may lower your rates. These include the following:

- Conduct a background check on employees. Insurance companies like it when you do an extensive background check on your employees. This ensures that you don’t hire individuals with a criminal background or with other issues, which may save you money on your insurance.

- Provide mandatory training for employees. Many insurance companies provide you with a list of approved training courses for dealership employees regarding safety with customers and while driving. In addition, some will allow you to develop your program, which may result in a discount for your company.

- Stick to a test drive route. By requiring that all test drives occur on a predetermined route, not only do you decrease the risk of accidents due to familiarity, but some insurance companies may consider offering you a discount if you do.

- Check the driving history of customers. As a dealership, you can run driving background checks on potential drivers. By making background checks standard practice, insurance companies consider you a lower risk and may reduce your insurance costs.

- Secure your property. Keeping your property safe from theft is very important. The more security features you have, the deeper your discounts may be. Some insurance companies require specific security measures to insure a car dealership because they are often the target of theft and vandalism.

These actions have the potential to lower your rates because, just like for personal car insurance coverage, insurers adjust rates for commercial insurance based on what is being covered and the perceived risks associated with the business.

By taking these steps, you can demonstrate to your insurer that you present a lower risk, which may, in turn, result in lower rates. Contact your auto dealer insurance company for more information on what car dealership insurance discounts might be available in your area.

Most Common Car Dealership Insurance Questions

Many of the same questions you would ask of your car insurance agent, you should ask your commercial auto dealership insurance agent. You should be able to fill out a used car dealer insurance application online from some companies, but others may require in-person applications.

The most important thing to speak with your insurance agent about is how much and what kind of insurance you need (not just what is required, but what is recommended to ensure you have the protection you need for your business).

Other questions to consider asking your insurance agent include:

- What (if any) discounts do we qualify for?

- What are your rates?

- Do you specialize in dealership insurance?

- How easy is it to change or cancel a policy?

We recommend making a list of all your questions before speaking with an insurance agent, so you’re prepared to obtain all the information you need to make an informed decision about your auto dealership insurance coverage.

As a part of your research, you may also consider speaking with other dealerships in your area to find out who their insurers are and what questions they recommend asking of potential insurers.

Once you’ve determined what you need in terms of coverage by doing your research, speaking to licensed insurers, etc., you should shop around. That way, you’ll be able to determine which insurers offer the best deal for the coverage you need. Learn more on our “How do you get competitive quotes for car insurance?”

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Case Studies: Compare Car Insurance for Dealerships

Navigating the field of car insurance for dealerships requires tailored solutions that align with specific business environments and customer needs. This discussion delves into three distinct case studies, each highlighting how dealerships in different settings have successfully identified and partnered with insurance providers that best meet their unique requirements.

- Case Study #1 – City Cars Galore: City Cars Galore, a bustling urban dealership, faced the challenge of balancing affordability with comprehensive insurance coverage. With a diverse range of vehicles and constant urban traffic, the dealership needed a provider that offered competitive rates and flexibility. Progressive emerged as the optimal choice, providing budget-friendly options and comprehensive coverage.

- Case Study #2 – Suburban Auto Haven: Suburban Auto Haven, a family-oriented dealership in the suburbs, sought insurance coverage tailored to its unique requirements. The dealership, dealing with a variety of customers and vehicles, prioritized comprehensive coverage over cost. Allstate became the preferred choice, offering extensive coverage options and a reputation for reliability. The dealership embraced Allstate’s multi-policy discounts, streamlining insurance needs and emphasizing safety for additional incentives.

- Case Study #3 – Rural Trucks & More: Rural Trucks & More, a dealership specializing in trucks and agricultural vehicles, faced the challenge of finding tailored solutions with a focus on fleet coverage. Dealing with specific industry needs, the dealership required customization options and fleet discounts. Farmers Insurance proved to be the perfect fit, offering unique discounts and flexibility in policy customization.

These case studies demonstrate the importance of choosing the right insurance partner for car dealerships, whether they operate in urban, suburban, or rural settings. By carefully selecting insurers that offer the flexibility, coverage, and financial benefits suited to their specific circumstances, dealerships can ensure optimal protection and customer satisfaction. See more details on our “How do I change car insurance agents?”

Before you go, take a moment to use your ZIP code for a free quote on car insurance.

Frequently Asked Questions

What type of insurance do car dealerships need?

Car dealerships need auto dealer insurance, which includes coverage such as commercial general liability, employment practices liability, errors and omissions, business income, worker’s compensation, garage keeper’s liability, and garage liability insurance.

For additional details, explore our comprehensive resource titled “How do you file a car insurance claim?“

What are the insurance requirements for car dealerships?

Each state has its own requirements, but common requirements include worker’s compensation and garage liability insurance. General liability coverage is also often required.

How much does car dealership insurance cost?

The cost of car dealership insurance varies based on factors such as coverage needs, limits, and risk factors specific to the business.

Are there discounts available for car dealership insurance?

Commercial coverage for car dealerships does not qualify for standard personal car insurance discounts. However, there are actions you can take to potentially lower rates, such as implementing safety measures and maintaining a good loss history.

Am I insured by car dealership insurance while test driving a car?

Technically, no. Since the vehicle you are test driving is unregistered and your personal car insurance does not cover it, you are not insured by the car dealership’s insurance.

To find out more, explore our guide titled “How far back do car insurance companies look?“

How much does insurance for a used car dealership typically cost?

Insurance costs for used car dealerships vary based on coverage extent, location, and risk factors but generally start from several thousand dollars annually.

What is the typical cost for dealer plate insurance?

Dealer plate insurance costs can range widely but typically start at a few hundred dollars per year, depending on state regulations and the number of plates.

What does auto dealer insurance usually cost?

Auto dealer insurance costs vary, starting from about $800 per year for basic coverage, with premiums increasing with more comprehensive policies.

To learn more, explore our comprehensive resource on “Compare Comprehensive Car Insurance: Rates, Discounts, & Requirements.”

What does car dealership insurance typically cover?

Car dealership insurance generally covers liability, property damage, inventory loss, and employee-related risks, with options for additional specialized coverage.

What is insurance for dealer plates, and why is it necessary?

Insurance for dealer plates covers vehicles driven with dealer plates for test drives and transit, protecting against liability and damage, which is mandatory in most regions to comply with legal requirements.

Explore your car insurance options by entering your ZIP code below and finding which companies have the lowest rates.

What does used car dealer insurance in California typically entail?

What types of insurance are essential for a car dealership?

How can I contact American Family Insurance?

Is it possible to have only liability insurance on a financed car?

Is it advisable to buy car insurance through a dealership?

What is the cheapest car insurance available in Georgia?

What does commercial insurance for car dealerships cover?

What is dealer license insurance?

What is dealer plate insurance in Ontario?

Are dealers required to be self-insured or have insurance for their vehicles?

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.