Best International Car Insurance in 2026 (Your Guide to the Top 10 Companies)

Travelers, Geico, and State Farm lead as the best international car insurance providers, starting at just $75 monthly. Offering comprehensive global coverage, these companies excel in customer satisfaction, affordability, and reliable support, making them top choices for international car insurance.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Insurance Content Team Lead

Laura Kuhl holds a Master’s Degree in Professional Writing from the University of North Carolina at Wilmington. Her career began in healthcare and wellness, creating lifestyle content for doctors, dentists, and other healthcare and holistic professionals. In 2018, she started writing for the cannabis industry. She curated news articles and insider interviews with investors and small business own...

Laura Kuhl

Insurance & Finance Analyst

Laura Adams is one of the nation’s leading finance, insurance, and small business authorities. As an award-winning author, spokesperson, and host of the top-rated Money Girl podcast since 2008, millions of readers and listeners benefit from her practical advice. Her mission is to empower consumers to live healthy and rich lives by planning for the future and making smart money decisions. She rec...

Laura D. Adams

Updated May 2024

Company Facts

Full Coverage for International Car Insurance

A.M. Best Rating

Complaint Level

Company Facts

Full Coverage for International Car Insurance

A.M. Best Rating

Complaint Level

Pros & Cons

Company Facts

Full Coverage for International Car Insurance

A.M. Best Rating

Complaint Level

Pros & Cons

The top picks for the best international car insurance are Travelers, Geico, and State Farm, renowned for their comprehensive coverage options and exceptional customer service.

Wondering if your car insurance covers international travel? If you plan to drive abroad, you’ll need worldwide coverage. Yes, you can get insurance while outside the US.

International car insurance ensures your vehicle is protected during foreign travel, saving you money on potential damages. Learn more in our “What is travel insurance?”

Our Top 10 Company Picks: Best International Car Insurance

Company Rank Multi-Vehicle Discount A.M. Best Best For Jump to Pros/Cons

![]()

#1 8% A++ Global Coverage Travelers

![]()

#2 25% A++ Competitive Rates Geico

![]()

#3 25% A+ Flexible Policies Allstate

#4 20% A++ Extensive Network State Farm

#5 20% A+ Strong Reputation Nationwide

#6 25% A Premium Services AAA

#7 25% A+ Tailored Solutions The Hartford

#8 20% A Comprehensive Coverage Farmers

#9 10% A+ Exceptional Service Erie

#10 25% A Innovative Solutions Liberty Mutual

Whether you’re getting a rental vehicle, or having your vehicle ferried with you, it’ll be better to be safe than sorry. Enter your ZIP code to compare international car insurance quotes online.

- Travelers is the top pick for the best international car insurance

- Policies that cater to the legal and practical needs of driving abroad

- Coverage includes collision, liability, and comprehensive protection

#1 – Travelers: Top Overall Pick

Pros

- High A.M. Best Rating: With an A++ rating, Travelers is highly reliable.

- Global Coverage: Specializes in broad international insurance solutions. Learn more in our Travelers car insurance review.

- Multi-Vehicle Discount: Offers a competitive 8% discount for multiple vehicles.

Cons

- Limited Discounts: Fewer discount opportunities compared to competitors.

- Higher Rates for Certain Policies: May charge more for specific coverages.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#2 – Geico: Best for Competitive Rates

Pros

- Generous Multi-Vehicle Discount: Provides a 25% discount on multiple vehicles.

- Top-tier Financial Strength: Boasts an A++ rating from A.M. Best. See more details on our Geico car insurance review.

- Cost-Effective Rates: Known for competitive pricing across many markets.

Cons

- Customer Service Variability: Experiences reported inconsistency in service.

- Policy Customization: Less flexibility in tailoring policy specifics.

#3 – Allstate: Best for Flexible Policies

Pros

- Strong Multi-Vehicle Discount: Offers a significant 25% discount for multiple cars.

- Flexible Policy Options: Wide range of options to suit different needs.

- High Financial Stability: Rated A+ by A.M. Best. More information is available about this provider in our Allstate car insurance review.

Cons

- Higher Premiums: Tends to have more expensive policies.

- Complex Discount Structures: Discounts can be difficult to qualify for.

#4 – State Farm: Best for Extensive Network

Pros

- Diverse Coverage: Wide array of options tailored for different needs. Read up on the State Farm car insurance review for more information.

- High Low-Mileage Discount: Significant savings for low-mileage drivers.

- Substantial Multi-Vehicle Discount: 20% discount for multi-car policies.

Cons

- Limited Multi-Policy Discount: Less competitive than other insurers.

- Higher Premium Costs: This may be more expensive at certain coverage levels.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#5 – Nationwide: Best for Strong Reputation

Pros

- Strong Reputation: Known for dependable service and coverage.

- Solid Financial Rating: Holds an A+ rating from A.M. Best. Check out insurance savings in our complete Nationwide car insurance discounts.

- Multi-Vehicle Discount: A 20% discount offers savings for multiple cars.

Cons

- Pricing Flexibility: Less competitive in pricing adjustments.

- Discount Availability: Some discounts are not as accessible as competitors.

#6 – AAA: Best for Premium Services

Pros

- Specialized Premium Services: Known for high-quality offerings and support.

- High Multi-Vehicle Discount: Provides a 25% discount on multiple vehicles.

- Strong Industry Rating: Rated A by A.M. Best. Discover more about offerings in our AAA car insurance review.

Cons

- Membership Requirement: Services require AAA membership.

- Higher Cost: Premium services come at a higher price.

#7 – The Hartford: Best for Tailored Solutions

Pros

- Customized Solutions: Offers specifically tailored insurance solutions. Access comprehensive insights into our The Hartford car insurance discounts.

- Generous Multi-Vehicle Discount: A 25% discount encourages multiple-car policies.

- Strong Financial Stability: A+ rating from A.M. Best ensures reliability.

Cons

- Niche Market Focus: Best suited for specific demographics, like seniors.

- Policy Cost: This can be more expensive for non-targeted customers.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#8 – Farmers: Best for Comprehensive Coverage

Pros

- Extensive Coverage Options: Provides a wide range of comprehensive plans.

- Significant Multi-Vehicle Discount: 20% discount on multi-car policies.

- Solid Financial Rating: Maintains an A rating from A.M. Best. Delve into our evaluation of Farmers car insurance review.

Cons

- Costly Premiums: Generally higher premiums compared to others.

- Discount Limitations: Some discounts have specific qualification criteria.

#9 – Erie: Best for Exceptional Service

Pros

- Outstanding Service: Known for superior customer support.

- Focused Multi-Vehicle Discount: 10% discount for multiple cars.

- Excellent Financial Stability: Rated A+ by A.M. Best. Unlock details in our Erie car insurance review.

Cons

- Limited Geographic Reach: Services not available nationwide.

- Less Competitive Rates: Slightly higher rates in some regions.

#10 – Liberty Mutual: Best for Innovative Solutions

Pros

- Innovative Policy Solutions: Continuously introduces new insurance products.

- Strong Multi-Vehicle Discount: 25% discount on multiple vehicles.

- Solid Financial Strength: Rated A by A.M. Best. Discover insights in our Liberty Mutual car insurance review.

Cons

- Variable Customer Feedback: Mixed reviews on customer service experiences.

- Pricing Strategy: Can be more expensive for less common coverage options.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Comparative Monthly Rates for International Car Insurance

When selecting international car insurance, understanding the monthly rates for different levels of coverage is crucial. This section breaks down the cost variations between minimum and full coverage across several insurance providers.

International Car Insurance Monthly Rates by Coverage Level

Insurance Company Minimum Coverage Full Coverage

AAA $75 $225

Allstate $90 $300

Erie $75 $225

Farmers $100 $300

Geico $75 $200

Liberty Mutual $90 $300

Nationwide $90 $265

State Farm $75 $225

The Hartford $85 $265

Travelers $75 $225

The table below highlights the monthly rates for both minimum and full coverage. Companies like AAA, Erie, and State Farm offer minimum coverage at $75 and full coverage at $225, providing a balanced cost for comprehensive protection. Geico stands out with the lowest full coverage rate at $200, despite the same minimum coverage rate of $75. See more details on our “Compare Monthly Car Insurance: Rates, Discounts, & Requirements.”

On the higher end, Allstate, Farmers, and Liberty Mutual charge $90 for minimum coverage and escalate to $300 for full coverage. Nationwide and The Hartford offer a middle ground with full coverage rates at $265, slightly above their minimum coverage rate of $90.

These figures illustrate the diverse pricing strategies adopted by insurers to cater to varying customer needs for international car insurance.

International Travel and Car Insurance

You’re planning a big trip overseas and you plan to drive while you’re in-country, rather than relying on public transportation. You’re probably wondering, “Does my car insurance cover me in another country?

If not, do other countries have auto insurance? What kind of car insurance coverage do I need? What are the best international car insurance companies?” Keep reading to learn the answers to these and other questions about auto insurance across the world.

Read more: Compare the Best Car Insurance Companies in Canada

What Is International Car Insurance

International car insurance is exactly what it sounds like car insurance coverage you can purchase that will ensure you’re protected when driving overseas. Depending on where you’re going, how long you plan to be there, and what you’ll be driving, this may be voluntary or required. So what does overseas car insurance cover? It depends entirely on the amount of coverage you purchase.

We’ll discuss this further later, but in many cases, you can purchase similar coverage to what is offered in the U.S. It’s necessary to acquire insurance coverage that meets the minimum requirements of the country you plan to visit. For detailed information, you can contact the country’s embassy, the tourism office of the foreign government, or a local car rental company. Additionally, consider to compare foreign driver car insurance rates.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Do I Need to Buy International Car Insurance

You probably will only need to purchase international auto insurance if you plan to spend an extended period overseas and will be bringing your vehicle (or purchasing one while you’re there). Otherwise, rental car insurance in the country you’re planning to visit will likely provide the coverage you need.

Even though not every country requires you to have auto insurance or overseas auto insurance, it is always a smart idea to have that protection in case you have an accident. You will find that there are companies in the U.S. that sell international auto insurance policies. Even if your company is one of them, your standard policy won’t provide you with coverage if you travel outside of the country.

The exception might be if you are traveling to Canada or Mexico. Before you make the decision to travel, you need to review your car insurance policy to ensure that you are covered in these two countries.

With certain companies, while your existing policy may not cover you in Canada or Mexico, you may not need to purchase a policy that covers you worldwide. Direct Auto Insurance (read our “Direct Auto Car Insurance Review” for more information) company, for example, sells policies specifically for U.S. drivers who find themselves traveling to Mexico.

Travelers sets the gold standard for international car insurance with its robust global coverage options.

Brad Larson Licensed Insurance Agent

You may be wondering what sort of situation might come up where you would be able to take your vehicle to another country. One example is that from time to time business travelers find that they need to stay for an extended time working outside of the U.S. If you find yourself in this situation of driving abroad, having your vehicle with you can save you a great deal of frustration, and possibly even cost when it comes to getting around.

Many countries, such as England, require you to maintain auto insurance on any vehicle on the road. They have similar requirements to the U.S., which means at the very least you will be required to carry liability insurance abroad. This is also the case throughout Europe. In general, you’ll be able to purchase international liability car insurance, along with collision and comprehensive car insurance for driving abroad, in most countries.

These coverages may not be required internationally like they are in the U.S. but having this additional coverage may give you peace of mind when you’re driving in an alien environment. It’s important to note that if you do plan to ship your vehicle overseas and purchase international coverage, you’ll need to be prepared for the cost of shipping your car.

This includes both getting your vehicle to a port from which it will be shipped and then the actual cost of shipping. To give you an idea of some of the costs associated with this, take a look at this table, in which we provided some average rates for shipping vehicles to various countries.

Average Cost to Ship Vehicles Overseas

| Shipment Destination | Average Cost |

|---|---|

| Australia | $1,500 |

| Brazil | $1,600 |

| Canada | $1,100 |

| Germany | $1,200 |

| Japan | $1,350 |

| New Zealand | $1,800 |

| South Africa | $1,700 |

| South Korea | $1,450 |

| United Arab Emirates | $1,250 |

| United Kingdom | $1,000 |

These costs are strictly the transportation from port-to-port, and do not include transportation to and from the ports, port fees or taxes, etc. As you can see, this can get pricey, so only you can decide if this is the right choice for you.

Learn more by reading our guide: Compare Car Insurance for Traveling in Canada: Rates, Discounts, & Requirements

What Should I Look for When Buying International Car Insurance

When you are looking for a company that offers worldwide auto insurance, there are some things that you need to consider. Some considerations are similar to those you’d keep in mind when purchasing auto insurance strictly for the U.S., such as cost, coverage types, and the company’s reputation. You will also want to ask the following questions:

- Do you understand your policy? Some international auto insurance companies aren’t based in the U.S. Before you agree to a policy, read through and see if you understand everything about the policy.

- How are claim benefits paid? If you have an accident, how is the insurance company going to pay you? Typically, you will want to choose a company that pays your claim in U.S. dollars, not in the currency of the country in which you are traveling.

- Do your rates change as you travel? This question is important because some insurance companies will charge you based on the exchange rate, which changes daily. Such rates will typically only happen with a company that isn’t based in the U.S., but not every non-U.S. company will do this.

- Can you change your policy without penalties? Sometimes things happen as you are traveling and you want to make a change. Perhaps you want to reduce the amount of coverage you have or maybe your significant other joins you and you want to add them to the policy. In any case, you want to be able to make changes to your policy with the same ease as you can in the U.S.

- How easy is it to make a claim? With most U.S.-based policies, you can make a claim online 24/7 and expect to hear from an agent very quickly after an accident. See more details on how do you file a car insurance claim.

You may have your concerns with buying international travel auto insurance. Before you make a purchase, make sure you have all of your questions addressed.

How Much Does International Car Insurance Cost

Much like buying regular car insurance, many factors go into the decision of cost for international car insurance. One of the biggest factors, however, is where you are going to be driving. Getting insurance for driving in Canada, for example, is far less expensive than buying insurance for traveling in Germany.

With the exception of insurance for driving in Canada, you will find that worldwide car insurance is typically more expensive than insurance you can purchase in the U.S.

Part of the reason for this is that you are going to be driving in an unfamiliar country with unfamiliar laws, which means you stand a higher chance of having a car accident. Your U.S. driving history may not transfer, so you may be regarded as a new driver in the country in which you’ll be driving.

For those needing dependable worldwide car insurance, Travelers is unmatched in its comprehensive offerings.

Tracey L. Wells Licensed Insurance Agent & Agency Owner

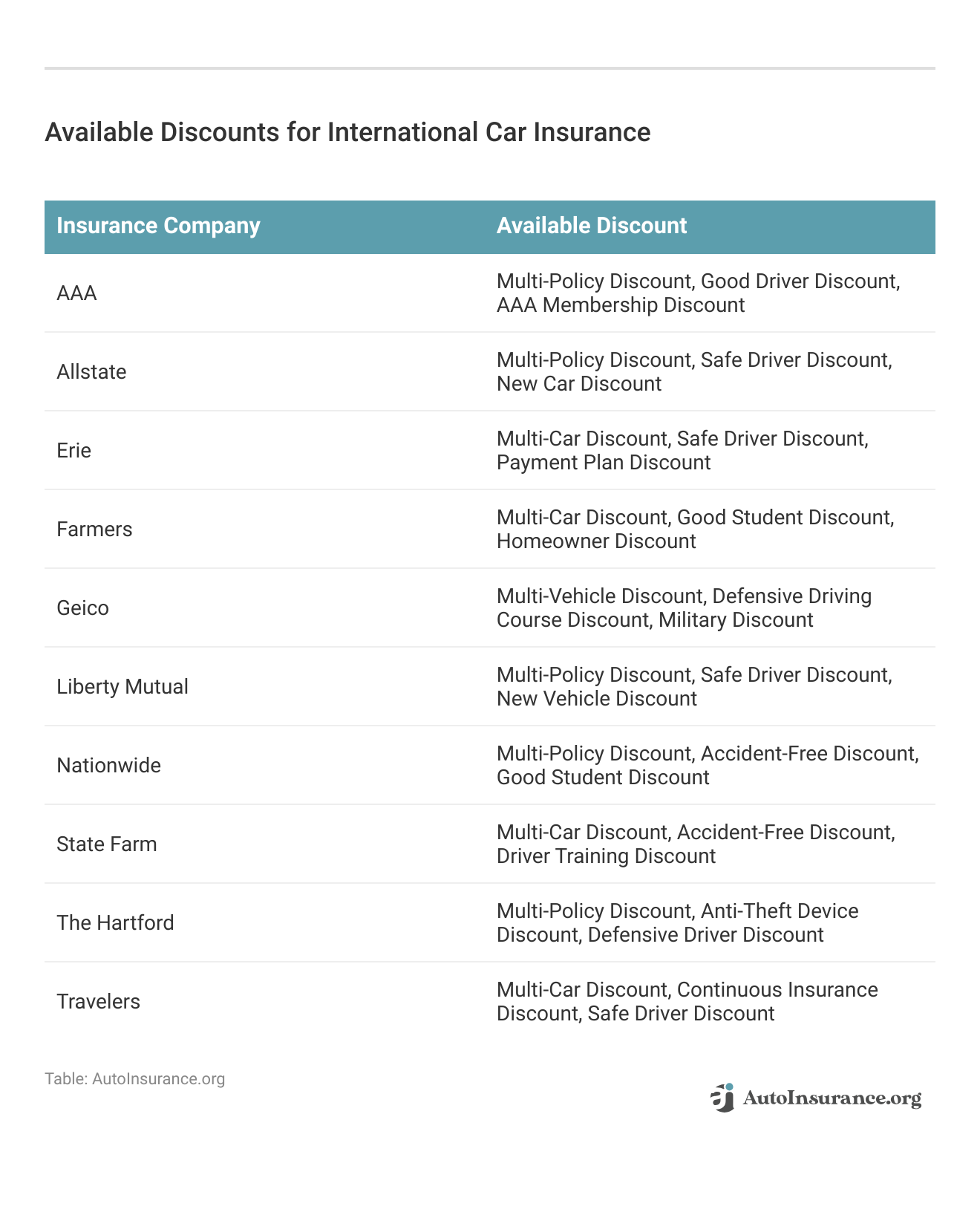

However, you can get some of the same discounts on international car insurance as you can with U.S. insurance (read our “Export Car Insurance: Rates, Discounts, & Requirements” for more information). Driving a safe car, having a good driving record (if it transfers), taking driver safety courses, and so on can all help reduce the cost of your worldwide car insurance.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

How Do I Find Companies That Sell International Car Insurance

Not every company sells worldwide car insurance and some of those that do choose outside companies to underwrite those policies. This isn’t a problem; you just need to be aware that even if a big-name company like Geico offers you overseas auto insurance, they may not be underwriting it themselves. Here are some tips:

- When you purchase worldwide car insurance, the insurance company doesn’t have to be licensed to sell insurance in your state. This makes it easier for you to find a wider selection of insurance companies from which to choose.

- Shopping around is the best way to ensure you get the lowest rates for your international auto insurance, so make sure you don’t accept the first quote you get.

- Before you purchase any worldwide car insurance coverage, you should start by using a free quote tool. A free quote tool allows you to compare the rates of several reputable companies in a single location, taking the guesswork out of your purchase (which you can do on this page).

Companies other than the big names in the U.S. also offer the coverage you may be looking for. Examples include Clements Worldwide auto insurance, Grundy Worldwide Auto Insurance, and Response Worldwide Direct Auto Insurance.

After shopping around, another way to help narrow down your choices is to look at worldwide car insurance reviews to see how different companies stack up.

Read more: Compare Car Insurance for Shipping Cars Overseas: Rates, Discounts, & Requirements

The Bottom Line for International Car Insurance

When you’re planning to travel internationally and are looking to buy an international auto insurance policy, there are a few things to keep in mind:

- Driving abroad is not always the same as driving in your hometown

- Even if it’s not required, it’s always a good idea to have some type of international vehicle insurance

- When driving abroad, it’s best to have collision and comprehensive coverage

- international car insurance companies are not always based in the United States, so you’ll need to pay extra attention to the terms of the policy to be sure you understand the nuances

You’ll also need to consider whether it makes sense to ship your vehicle overseas, purchase one in-country, or rent a vehicle.

Summary Stats

| Things to Know | Source |

|---|---|

| Your U.S. car insurance policy probably won't cover you if you drive abroad (though Canada and Mexico are sometimes exceptions) | U.S. Department of State |

| Even if you find your policy does cover you overseas (you'll need to speak with them to find out), if it doesn't meet the country's minimum requirements you'll still need to purchase additional coverage | U.S. Department of State |

| To be prepared and improve your safety on road when you're driving internationally, you need to research local road laws, road culture, road conditions, and travel options | Association for Safe International Road Travel |

In the case of the first two, international car insurance is likely necessary.

Travelers sets the gold standard for international car insurance with its robust global coverage options.

Scott W. Johnson Licensed Insurance Agent

But if you’re renting a vehicle, you may be able to obtain appropriate coverage through the rental company instead. Unlock details in our “Travel Car Insurance: Rates, Discounts, & Requirements.”

Just enter your ZIP code and get online car insurance quotes for your next international trip today.

Frequently Asked Questions

Does my car insurance cover me internationally?

No, your standard car insurance policy in the United States does not provide coverage for driving abroad. You will need to purchase international car insurance for coverage outside the country.

To find out more, explore our guide titled “The Top 5 Car Insurance Companies.”

What do I need to know about driving overseas?

Car accidents are among the leading causes of death worldwide. In fact, according to the Association for Safe International Road Travel:

“Road crashes are the single greatest annual cause of death in healthy U.S. citizens traveling abroad.”

With this in mind, it’s important to find out everything you can about road conditions, driving laws, road culture, vehicle safety considerations, local emergency numbers, and more. The U.S. Department of State has a number of resources for international travelers, including tips on where to find this information, how to get the appropriate driving permits, information on personal security and safety during international travel, and more.

What is the cheapest car insurance in the world?

In the United States, the answer to this question is typically USAA or Geico. However, it ultimately depends on personal factors like driving history, location, age, credit score, and more. For some average rates by company, take a look at this table.

On the international level, answering this question is less simple. The cheapest car insurance in the world will vary depending on where you’re going, what you’re driving, the amount of coverage you purchase, and numerous other factors. Your best bet is to shop around when searching for the most affordable worldwide auto insurance company.

What insurance company is the best for auto?

In the U.S., the answer is dependent on what, specifically, you’re looking for in auto insurance coverage, but some good options include Amica Mutual, State Farm, Progressive, The Hartford, Geico, or USAA.

Internationally, the answer is again more complicated and will be dependent on the country you’re planning to visit, how long you’ll be there, the coverage you’re looking to purchase, and more.

How much does international car insurance cost?

The cost of international car insurance can vary depending on several factors, including the country you’ll be driving in and the coverage limits you choose. Generally, international car insurance tends to be more expensive than insurance in the United States due to unfamiliar driving conditions and potentially higher accident risks. Discounts, such as having a safe driving record or taking driver safety courses, may help reduce the cost.

Learn more in our “Factors That Affect Car Insurance Rates.”

What does car insurance worldwide cover?

Car insurance worldwide typically covers liability, collision, and comprehensive damages, ensuring protection across different countries according to local laws and regulations.

How much is car insurance for international travel?

The cost of car insurance for international travel varies based on destination, coverage length, and insurance provider, but generally, it tends to be higher than domestic insurance due to the broader coverage required.

What should I look for in international auto insurance coverage?

When choosing international auto insurance coverage, consider the minimum legal requirements of your destination country, the extent of coverage including liability, theft, and collision, and whether the policy covers all areas you plan to visit.

Can I get international automobile insurance for a rental car?

Yes, you can obtain international automobile insurance for a rental car, which is often offered directly through the rental company or as a separate policy from insurance providers that specialize in international coverage.

See more details on our “Compare Rental Car Insurance: Rates, Discounts, & Requirements.”

What is Worldwide Car Insurance?

Worldwide car insurance protects your vehicle when you drive in multiple countries, covering damages, theft, and liability according to international standards.

How can I protect my car worldwide?

What to look for when choosing your international automobile insurance?

What are the coverage and benefits of global car insurance?

What does physical damage & reimbursement cover in international policies?

Why is worldwide coverage important in car insurance?

What is Transit Coverage in an insurance policy?

Does my policy Cover Towing and Labor Reimbursement?

How does Political Violence Coverage protect me?

What is Protection Against Uninsured Motorists?

How can I get reimbursed for Home Country Rental Car Insurance Expenses?

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.