Compare Ford Fiesta Car Insurance Rates [2026]

Average Ford Fiesta car insurance rates cost $101 per month ($1,212 per year). Finding Ford Fiesta teenager insurance rates can cost on average $4,430 a year, so shop around to find cheap coverage.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Insurance & Finance Analyst

Laura Adams is one of the nation’s leading finance, insurance, and small business authorities. As an award-winning author, spokesperson, and host of the top-rated Money Girl podcast since 2008, millions of readers and listeners benefit from her practical advice. Her mission is to empower consumers to live healthy and rich lives by planning for the future and making smart money decisions. She rec...

Laura D. Adams

Insurance & Finance Analyst

Laura Adams is one of the nation’s leading finance, insurance, and small business authorities. As an award-winning author, spokesperson, and host of the top-rated Money Girl podcast since 2008, millions of readers and listeners benefit from her practical advice. Her mission is to empower consumers to live healthy and rich lives by planning for the future and making smart money decisions. She rec...

Laura D. Adams

Updated May 2024

Key takeaways:

- Full coverage costs around $1,212 a year or $101 each month

- A liability-only policy costs around $486 a year or $41 each month

- Highest rates are for teenage drivers at around $4,430 a year or $369 each month

- Good drivers can save as much as $500 a year by earning policy discounts

- Ford Fiesta insurance costs around $307 less per year than the average vehicle

Ford Fiesta insurance rates average $307 less per year than other cars with full coverage costing around $1,212 a year or $101 a month. The highest rates are for teens who’ll pay about $4,430 a year or $369 a month. Good drivers save up to $500 a year in policy discount on their Ford Fiesta insurance. Let’s take a look at Ford Fiesta insurance rates, insurance losses, and more.

You can start comparing quotes for Ford Fiesta car insurance rates from some of the best car insurance companies by using our free online tool now.

What’s the Ford Fiesta insurance cost?

The average Ford Fiesta auto insurance costs are $1,212 a year or $101 a month.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Are Ford Fiestas expensive to insure?

The chart below details how Ford Fiesta insurance rates compare to other subcompact cars like the Ford Focus ST and Kia Rio.

| Vehicle | Comprehensive | Collision | Liability | Total |

| Ford Fiesta | $242 | $422 | $390 | $1,212 |

| Ford Focus ST | $282 | $536 | $398 | $1,374 |

| Kia Rio | $244 | $506 | $450 | $1,380 |

Read more: Compare Kia Car Insurance Rates

However, there are a few things you can do to find the cheapest Ford insurance rates online.

What impacts the cost of Ford Fiesta insurance?

Even though the average annual rate for the Ford Fiesta is $1,212, your policy can be higher or lower depending upon your profile. Those factors include your age, home address, driving history, and the model year of your Ford Fiesta.

Age of the vehicle

Older Ford Fiesta models generally cost less to insure. For example, car insurance rates for a 2019 Ford Fiesta are $1,212, while 2011 Ford Fiesta rates are $1,058, a difference of $154.

| Model Year | Comprehensive | Collision | Liability | Total |

| 2019 Ford Fiesta | $242 | $422 | $390 | $1,212 |

| 2018 Ford Fiesta | $232 | $418 | $398 | $1,206 |

| 2017 Ford Fiesta | $224 | $408 | $416 | $1,206 |

| 2016 Ford Fiesta | $216 | $390 | $430 | $1,194 |

| 2015 Ford Fiesta | $204 | $378 | $442 | $1,182 |

| 2014 Ford Fiesta | $196 | $350 | $452 | $1,156 |

| 2013 Ford Fiesta | $188 | $330 | $456 | $1,132 |

| 2012 Ford Fiesta | $180 | $296 | $460 | $1,094 |

| 2011 Ford Fiesta | $168 | $272 | $460 | $1,058 |

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Driver age

Driver age can have a significant effect on Ford Fiesta auto insurance rates. For example, 30-year-old drivers pay $53 more for Ford Fiesta auto insurance than 40-year-old drivers.

Driver location

Where you live can have a large impact on Ford Fiesta insurance rates. For example, drivers in Jacksonville may pay $727 a year more than drivers in Indianapolis.

Your driving record

Your driving record can have an impact on the cost of Ford Fiesta car insurance. Teens and drivers in their 20’s see the highest jump in their Ford Fiesta car insurance with violations on their driving record.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Ford Fiesta safety ratings

Your Ford Fiesta auto insurance rates are tied to the Ford Fiesta’s safety ratings. See the breakdown below:

| Test Type | Rating |

| Small overlap front: driver-side | Marginal |

|---|---|

| Small overlap front: passenger-side | Not Tested |

| Moderate overlap front | Good |

| Side | Good |

| Roof strength | Good |

| Head restraints and seats | Good |

| Source: Insurance Institute for Highway Safety | |

Ford Fiesta crash test ratings

The crash test ratings of the Ford Fiesta can impact your Ford Fiesta car insurance rates.

| Vehicle Tested | Overall | Frontal | Side | Rollover |

| 2019 Ford Fiesta 5 HB FWD | 4 stars | 4 stars | 4 stars | 4 stars |

| 2019 Ford Fiesta 4 DR FWD | 4 stars | 4 stars | 4 stars | 4 stars |

| 2018 Ford Fiesta 5 HB FWD | 4 stars | 4 stars | 4 stars | 4 stars |

| 2018 Ford Fiesta 4 DR FWD | 4 stars | 4 stars | 4 stars | 4 stars |

| 2017 Ford Fiesta 5 HB FWD | 4 stars | 4 stars | 5 stars | 4 stars |

| 2017 Ford Fiesta 4 DR FWD | 4 stars | 4 stars | 5 stars | 4 stars |

| 2016 Ford Fiesta 5 HB FWD | 4 stars | 4 stars | 5 stars | 4 stars |

| 2016 Ford Fiesta 4 DR FWD | 4 stars | 4 stars | 5 stars | 4 stars |

| 1-5 Star Rating Scale, N/R = No Rating | Source: National Highway Traffic Safety Administration | ||||

|---|---|---|---|---|

Ford Fiesta safety features

The numerous safety features of the Ford Fiesta help contribute to lower insurance rates. The 2020 Ford Fiesta has the following safety features:

- Driver Air Bag

- Passenger Air Bag

- Front Head Air Bag

- Rear Head Air Bag

- Front Side Air Bag

- 4-Wheel ABS

- Front Disc/Rear Drum Brakes

- Brake Assist

- Electronic Stability Control

- Daytime Running Lights

- Child Safety Locks

- Traction Control

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Ford Fiesta insurance loss probability

Another contributing factor that affects Ford Fiesta car insurance rates is the loss probability for each type of coverage.

| Insurance Coverage Category | Loss Rate |

| Collision | -4% |

|---|---|

| Property Damage | -9% |

| Comprehensive | -27% |

| Personal Injury | 15% |

| Medical Payment | 23% |

| Bodily Injury | 13% |

| Source: Insurance Institute for Highway Safety | |

What’s the Ford Fiesta finance and insurance cost?

When financing a Ford Fiesta, most lenders will require your carry higher Ford Fiesta coverage options including comprehensive coverage and collision coverage, so be sure to shop around and compare Ford Fiesta car insurance rates from the best insurance carriers using our FREE tool below.

How to save money on Ford Fiesta insurance?

You can save more money on your Ford Fiesta auto insurance rates by employing any of the following five strategies.

- Check Reviews and State Complaints Before You Choose an Insurer

- Start Searching for New Ford Fiesta Car Insurance a Month Before Your Renewal

- Compare Insurance Companies After Moving

- Move to the Countryside

- Consider Ford Fiesta Insurance Costs Before Buying a Ford Fiesta

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

What are the top Ford Fiesta insurance companies?

Who is the top auto insurance company for Ford Fiesta insurance rates? While the actual rates you pay will depend on many factors, here are some of the top companies offering Ford Fiesta auto insurance coverage (ordered by market share). Many of these companies offer discounts for security systems and other safety features that the Ford Fiesta offers.

Such driver discounts for Ford Fiesta models include: passive restraint systems, anti-lock brakes, anti-theft devices.

| Rank | Company | Volume | Market Share |

| 1 | State Farm | $65,615,190 | 9.3% |

| 2 | Geico | $46,106,971 | 6.6% |

| 3 | Progressive | $39,222,879 | 5.6% |

| 4 | Liberty Mutual | $35,600,051 | 5.1% |

| 5 | Allstate | $35,025,903 | 5.0% |

| 6 | Travelers | $28,016,966 | 4.0% |

| 7 | USAA | $23,483,080 | 3.3% |

| 8 | Chubb | $23,388,385 | 3.3% |

| 9 | Farmers | $20,643,559 | 2.9% |

| 10 | Nationwide | $18,442,145 | 2.6% |

| Source: Insurance Information Institute | |||

How to compare free Ford Fiesta insurance quotes online

Save on your Ford Fiesta car insurance rates by taking advantage of our FREE comparison tool.

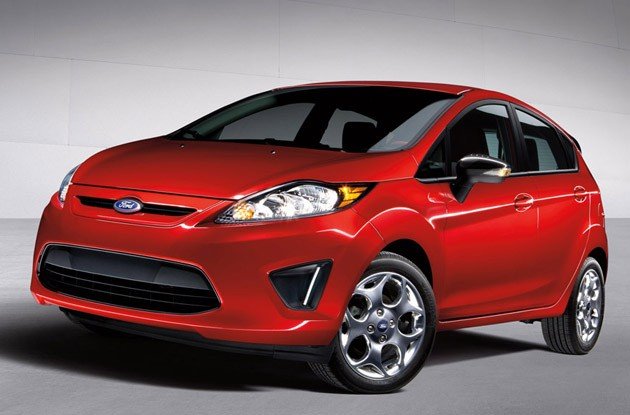

The Ford Fiesta is an economy car that is available as a hatchback or a sedan. A bonus to the Ford Fiesta being an inexpensive car with good gas mileage is that it is also one of the cheapest cars to insure.

The price difference between the hatchback and sedan is only a couple thousand dollars.

If you prefer a hatchback, then you can expect to pay somewhere between $14,500 and $17,100. A sedan will save you some money over the hatchback style, ranging between $12,800 and $16,300.

The gas mileage on the Ford Fiesta is the same on every model. You can expect to average 28 miles per gallon in the city and 37 miles per gallon on the highway. Since the cost of gas keeps rising, having a car with this kind of gas mileage makes it very economical.

Enter your ZIP code above to receive car insurance quotes from multiple companies!

How does the Ford Fiesta fare in safety ratings?

According to Edmunds, the 2012 Ford Fiesta model has not yet been rated for safety by the National Highway Traffic Safety Administration (NHTSA).

However, the Insurance Institute for Highway Safety (IIHS) has done their tests and gives the Fiesta good marks all the way around.

Testing was done for front and side impact, roof strength in case of a rollover, head restraints, and a rear impact.

It’s important to note that safety ratings do have an impact on the total cost of car insurance. Insurers consider safety because they are providing bodily injury coverage for passengers in the vehicle.

The safer a car is, the more likely that an accident will result in minor injuries.

The less safe a vehicle is, the more serious injuries can be — which ultimately adds risk to the insurance company. The IIHS ratings are just one of the many resources insurance companies use to assess the safety of a particular vehicle.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Does the Ford Fiesta have any specific safety features or equipment?

The Ford Fiesta has quite a few features insurance companies love to see in new cars.

For starters, it has an all-wheel anti-lock braking system, dual side air bags, and head air bags for both front and rear. Just these three features alone have a very significant impact on car insurance rates because they do wonders for passenger safety.

Throw in extra features like stability control, traction control, child safety locks on the doors, and anchors for child car seats, and you have a four-door sedan which is considered extremely safe for passengers.

There are some other features car insurance companies will look for regarding theft — like alarm systems, a locking steering wheel, and security keys.

But these things don’t apply to most economy class vehicles like the Ford Fiesta.

Cars that do include them will enjoy a lower rate for comprehensive insurance that covers against theft. If you don’t carry comprehensive insurance, these extra features won’t have an impact on your annual premiums. Be sure to do your research to save on Ford Fiesta car insurance costs.

Can young drivers afford to insure a Ford Fiesta?

Young drivers are great candidates for the Ford Fiesta. The car is relatively inexpensive, and with its great gas mileage, it’s an excellent choice for the new driver, college student, or young adult who is just getting married or starting a family.

The Ford Fiesta seats four people comfortably, so it can be a car that you keep for a long time. In addition to all of its safety features, it was awarded a five-star rating from the National Highway Traffic Safety Administration.

If you are a young driver looking to buy a new car that you can keep as you get older, the Ford Fiesta is a sensible choice.

If you are a driver under 25 years of age, you may not be able to get your own insurance policy on it unless you have already been listed on someone else’s policy for a few years.

How does a young driver insure a Ford Fiesta?

As soon as you start driving, you need to be covered by insurance.

Young drivers are very expensive to insure and are practically impossible to put on a policy by themselves for the first time.

Most parents of new drivers take on the responsibility of adding their teenagers to their car insurance policy. The cost of the premiums increases when you add a young driver to your insurance, but it is unavoidable.

As soon as your young driver turns twenty-five, the cost of your insurance premiums should decrease. By the time your child is twenty-five, however, he is already an adult and may very well be in college or living in his own place.

If your young adult buys a Ford Fiesta, he should be able to insure it as long as he has been covered on your policy previously. Before he buys the car, he should make sure he can get insurance for it.

It is possible to buy the insurance policy under your name and list the young driver as one of the insured parties. Just make sure the car insurance company knows who the primary driver is so that there will be no question if there is a claim.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

How can a mature driver insure a Ford Fiesta?

No matter how old you are, the Ford Fiesta is a sensible choice for many people. If you are a mature driver, and you decide to buy a Ford Fiesta, getting insurance for it should be relatively easy.

If you already have a car, and you are replacing it with the Ford Fiesta, you only need to tell your agent to write you a new policy for your new car.

Your premiums will change based on the make and model of the car as well as the age and mileage. If the Ford Fiesta is newer than your current car, you may have to pay more than what you were paying.

A Ford Fiesta should not cost too much to insure since it is a subcompact car. It is not rated as one of the hottest cars subject to theft nor is it a collector’s car. You should be able to get liability, collision, and comprehensive car insurance for a reasonable rate.

You may want to consider adding other coverage to your car insurance policy as well. As either a young driver or as a mature driver, you may want to add medical insurance to your policy.

If you do not have a health care policy that covers emergency room visits, hospital stays, X-rays, or surgery, then you may need to pay for your own bodily injury expenses out of your own pocket.

Medical insurance will cover your expenses if you are at fault for the accident.

Enter your ZIP code to receive car insurance quotes from providers in your area today!

Frequently Asked Questions

What’s the average cost of Ford Fiesta car insurance?

On average, Ford Fiesta car insurance costs $1,212 per year or $101 per month.

Are Ford Fiestas expensive to insure?

Ford Fiesta insurance rates are generally lower compared to other subcompact cars.

What factors affect the cost of Ford Fiesta insurance?

Factors such as the age of the vehicle, driver age, driver location, and driving record can impact the cost of Ford Fiesta insurance.

What safety features does the Ford Fiesta have?

The Ford Fiesta comes with safety features like anti-lock brakes, airbags, stability control, and traction control.

How can I save money on Ford Fiesta insurance?

You can save money on Ford Fiesta insurance by comparing quotes, maintaining a good driving record, and taking advantage of discounts offered by insurance companies.

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.