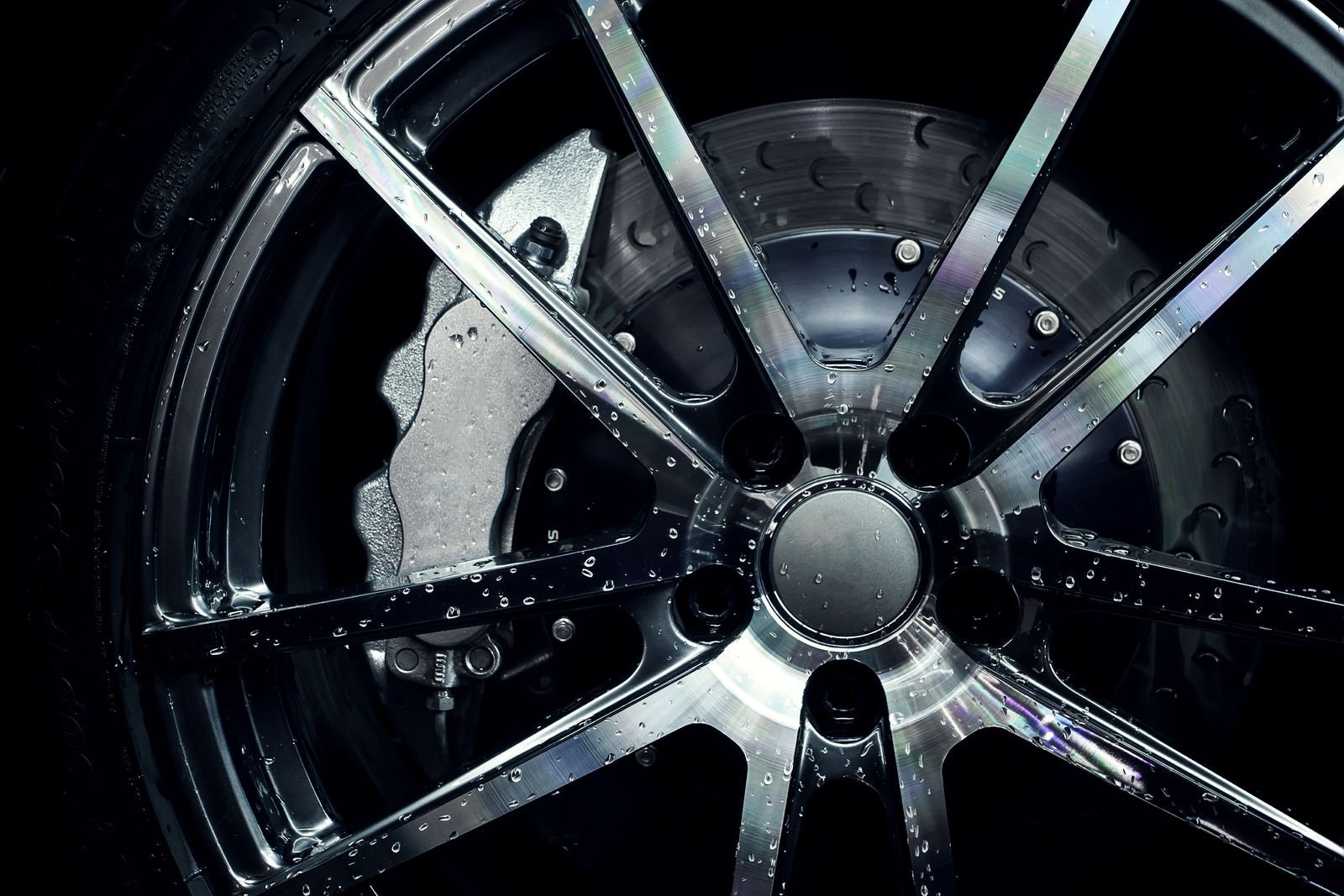

Does car insurance cover stolen wheels and tires?

If you need to know whether or not stolen rims and tires are covered by insurance, only vehicles with comprehensive coverage will be covered. However, there are also coverage exclusions, so always double check your policy.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Sr. Director of Content

Sara Routhier, Managing Editor and Outreach Director, has professional experience as an educator, SEO specialist, and content marketer. She has over five years of experience in the insurance industry. As a researcher, data nerd, writer, and editor she strives to curate educational, enlightening articles that provide you with the must-know facts and best-kept secrets within the overwhelming world o...

Sara Routhier

Licensed Insurance Agent

Daniel Walker graduated with a BS in Administrative Management in 2005 and has run his family’s insurance agency, FCI Agency, for over 15 years (BBB A+). He is licensed as an insurance agent to write property and casualty insurance, including home, life, auto, umbrella, and dwelling fire insurance. He’s also been featured on sites like Reviews.com and Safeco. To ensure our content is accura...

Daniel Walker

Updated November 2023

- The details of your policy will determine whether or not your insurance will cover stolen rims and tires

- Custom parts sometimes cause issues for car insurance companies because they cause the cash value to vary

- If you only purchase only minimum liability coverage, stolen rims and tires will not be covered under that policy

If you’ve put custom tires and rims on your car, and they end up being stolen, you may be wondering whether or not your car insurance will pay to replace them.

The truth is, it depends on several factors including the details of your policy, whether or not you can prove you paid for the tires and rims, and whether or not a police report detailing the theft was filed.

Know ahead of time exactly what your car insurance policy covers before you invest money in custom parts. Having the complete details of your policy at hand will help you should you find yourself requiring replacements for stolen parts.

If you’ve looked into your complete coverage terms and have found you’d rather look elsewhere for coverage, enter your ZIP code above to start your search for the best available car insurance quotes.

What Car Insurance Policies Cover

Every state requires minimum liability insurance coverage or proof of ability to pay for damages. Insurance coverage protects against bodily injury and property damage.

State minimum auto insurance coverage options will never cover the cost of stolen rims or tires.

Comprehensive or full coverage, which usually includes collision, fire, and theft, may or may not offer reimbursement costs for stolen rims and tires. It will all depend on the specific policy that a driver has.

If your comprehensive coverage doesn’t offer any protection against rim or tire replacement due to theft, you may want to consider talking to your insurance company before anything happens. Make sure you ask about any additional exclusions to your policy, and then see what type of coverage will help you in the event of a theft.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Why do car insurance companies balk over custom parts?

Car insurance companies tend to be reluctant about covering many custom and high-performance parts because it’s difficult to determine the cash value of a car when taking these things into consideration.

If your car is totaled or stolen, it’s nearly impossible for your insurance provider to determine cash value simply by looking at the Kelley Blue Book.

The process of determining the car’s value, along with your custom parts, tends to be a no-win situation for your insurance company.

Many comprehensive policies will cover custom parts up to a certain point. But that point is different among insurance providers.

If your car already has custom or performance parts installed, inform your insurance company when purchasing a new policy.

Take photographs and videos as proof that the parts do exist, and if you have receipts, they are helpful documentation as well.

Can I purchase extra insurance to cover my tires and rims?

If your current comprehensive policy does not cover the cost of your custom tires and rims, you may be able to purchase a rider that will provide such coverage.

As stated earlier, the more documentation that can prove you paid for and installed such parts, the more likely it is to be able to procure a rider to cover them.

If your current insurance company will not provide you the proper coverage, you’re always free to shop around for one that will.

However, that insurance coverage for custom and high-performance parts is going to cost you some money.

For every dollar the insurance company will potentially have to pay in the event of a claim, you will be charged a certain amount on your insurance policy.

The more expensive and valuable your custom parts, the higher the risk to the insurance company, and the more they’re going to charge you. Having an expensive, custom car on the road is often seen as being high-risk to a lot of companies, and so while the benefits include having your custom parts protected, the downside is an increase in what you’ll pay.

What if the whole car is stolen, not just the rims and tires?

In the event the entire car was stolen, your only hope of financial recourse is through a comprehensive policy which includes theft coverage.

If all you have is minimum liability, that will not be enough, as that particular coverage has a limit to what is protected. Should you not have a fully covered vehicle under your insurance policy, you may be facing high out-of-pocket costs. Whether you choose to replace the stolen equipment will be entirely up to you. Some drivers may not think the replacement costs are worth it, and may end up scrapping the entire vehicle.

If you do have a comprehensive policy that will cover the theft, and the car is recovered some time after your insurance company has paid your claim, you may have to surrender the car to them as it will become their legal property.

Unfortunately, at the end of the day, some of your custom parts may not be covered regardless of what you do. This is why it’s best to know what your coverage details are before modifying your vehicle, so that while you’re on the road, you’re completely covered.

To find the best car insurance rates, enter your ZIP code into our FREE search tool below.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Case Studies: Car Insurance Coverage for Stolen Wheels and Tires

Case Study 1: Comprehensive Coverage Protection

John owns a car with comprehensive coverage. Unfortunately, his custom wheels and tires are stolen. John contacts his insurance company, provides the necessary documentation, including proof of payment and a police report, and files a claim. His insurance company reimburses him for the cost of replacing the stolen wheels and tires, within the policy’s limits and after deductibles are considered.

Case Study 2: Limited Coverage Limitations

Sarah has comprehensive coverage, but her policy has specific limitations regarding coverage for custom wheels and tires. When her wheels and tires are stolen, Sarah files a claim with her insurance company. However, she discovers that her policy only covers a portion of the replacement cost, and she is responsible for the remaining expenses.

Case Study 3: Insufficient Coverage

David has minimum liability coverage, which does not protect against the theft of wheels and tires. When his wheels are stolen, David realizes that his insurance policy does not provide any reimbursement for the stolen items. He incurs out-of-pocket costs for replacing the stolen wheels and tires.

Frequently Asked Questions

Does car insurance typically cover stolen wheels and tires?.

Yes, in most cases, car insurance policies provide coverage for stolen wheels and tires. However, it’s important to review your specific policy and check with your insurance provider to understand the extent of coverage and any limitations that may apply

What type of coverage includes stolen wheels and tires?

Comprehensive coverage is the insurance component that typically covers stolen wheels and tires. Comprehensive coverage protects against various non-collision incidents, including theft, vandalism, and natural disasters.

How does comprehensive coverage work for stolen wheels and tires?

When you have comprehensive coverage, if your wheels and tires are stolen, your insurance provider will reimburse you for the cost of replacing them, up to the policy’s limits and after accounting for any deductibles you may have.

Are there any limitations to coverage for stolen wheels and tires?

Yes, limitations can vary between insurance policies. Some common limitations may include a maximum coverage limit, a deductible that needs to be paid before coverage applies, or specific requirements for the type of wheels and tires that are covered. It’s crucial to review your policy or consult your insurance provider to understand the specific limitations that apply.

Will car insurance cover custom or aftermarket wheels and tires?

Car insurance can cover custom or aftermarket wheels and tires, but it depends on your policy. Some insurance providers offer coverage for such modifications, while others may require additional endorsements or riders to extend the coverage. Review your policy or contact your insurance provider to determine if your custom or aftermarket wheels and tires are protected.

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.