Car Insurance Calculator: Get Free Car Insurance Estimates Online

Use a car insurance calculator to get free car insurance estimates online. Most drivers pay $120 monthly for full coverage, but an auto insurance estimate calculator will use your unique driving profile to get more accurate rates. Start comparing today with the free online car insurance calculator below.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Sr. Director of Content

Sara Routhier, Managing Editor and Outreach Director, has professional experience as an educator, SEO specialist, and content marketer. She has over five years of experience in the insurance industry. As a researcher, data nerd, writer, and editor she strives to curate educational, enlightening articles that provide you with the must-know facts and best-kept secrets within the overwhelming world o...

Sara Routhier

Licensed Insurance Agent

Kristen is a licensed insurance agent working in the greater Boston area. She has over 20 years of experience counseling individuals and businesses on which insurance policies best fit their needs and budgets. She knows everyone has their own unique needs and circumstances, and she is passionate about counseling others on which policy is right for them. Licensed in Massachusetts, New Hampshire,...

Kristen Gryglik

Updated May 2024

- Car insurance calculators are tools websites use to generate quotes for potential auto insurance customers

- The more information you enter, the more accurate your car insurance quotes will be

- Your driving record and where you live will have the biggest impact on your quotes

Websites like the one you’re on right now offer car insurance calculators to get free car insurance estimates online. By entering pertinent information, such as your ZIP code and Vehicle Identification Number (VIN), the calculator can scan quotes from the best auto insurance companies in the U.S. and spit out the results for the most affordable coverage.

Car insurance cost calculators are an excellent way to find affordable insurance near you based on your driving profile. Read on to learn how to calculate car insurance quotes online from multiple companies.

How to Use a Car Insurance Calculator

Using a car insurance premium calculator is not a complicated process. You will probably be asked a few questions about the following before the insurance calculator can generate a quote for you:

- Your address

- The make and model of your car

- The age and gender of all drivers

- General driving habits

The calculator scans this information and calculates an approximate cost for each different provider. The quote you receive is only an estimate of how much you would be paying if you were approved for coverage.

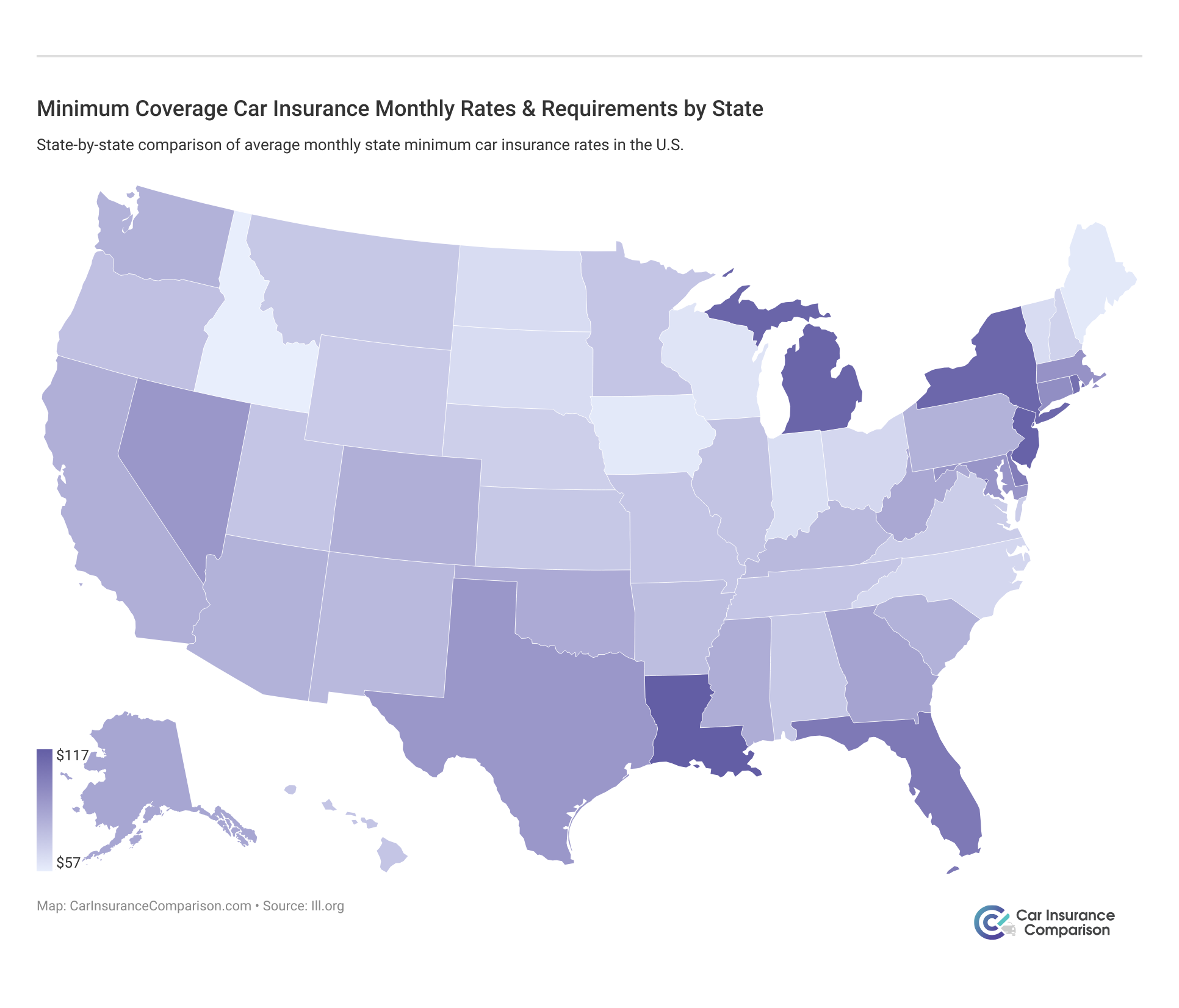

To give you an idea of what you might pay, take a look at this table for average rates by state.

Car Insurance Quotes by State

| States | Monthly Liability | Monthly Full Coverage |

|---|---|---|

| Alabama | $70 | $94 |

| Alaska | $88 | $116 |

| Arizona | $80 | $102 |

| Arkansas | $75 | $96 |

| Average | $162 | $209 |

| California | $79 | $109 |

| Colorado | $78 | $102 |

| Connecticut | $94 | $123 |

| Countrywide | $82 | $106 |

| Delaware | $101 | $129 |

| District of Columbia | $110 | $141 |

| Florida | $101 | $129 |

| Georgia | $83 | $110 |

| Hawaii | $72 | $104 |

| Idaho | $56 | $76 |

| Illinois | $71 | $96 |

| Indiana | $61 | $82 |

| Iowa | $57 | $77 |

| Kansas | $71 | $93 |

| Kentucky | $76 | $99 |

| Louisiana | $114 | $147 |

| Maine | $57 | $77 |

| Maryland | $91 | $115 |

| Massachusetts | $92 | $119 |

| Michigan | $218 | $255 |

| Minnesota | $71 | $96 |

| Mississippi | $80 | $103 |

| Missouri | $70 | $95 |

| Montana | $72 | $95 |

| Nebraska | $67 | $88 |

| Nevada | $90 | $118 |

| New Hampshire | $66 | $87 |

| New Jersey | $115 | $145 |

| New Mexico | $77 | $99 |

| New York | $111 | $141 |

| North Carolina | $64 | $83 |

| North Dakota | $64 | $85 |

| Ohio | $64 | $85 |

| Oklahoma | $82 | $106 |

| Oregon | $75 | $100 |

| Pennsylvania | $79 | $104 |

| Rhode Island | $105 | $134 |

| South Carolina | $78 | $101 |

| South Dakota | $62 | $83 |

| Tennessee | $71 | $93 |

| Texas | $89 | $117 |

| Utah | $71 | $93 |

| Vermont | $62 | $82 |

| Virginia | $70 | $92 |

| Washington | $79 | $102 |

| West Virginia | $86 | $111 |

| Wisconsin | $60 | $80 |

| Wyoming | $70 | $92 |

Keep in mind that you will still need to go through the underwriting process once you apply for coverage from a particular car insurance company, and if the insurance company discovers something about you or your vehicle that puts you in a higher risk category, it can refuse to cover you or charge a higher rate.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

What You Need to Calculate Car Insurance Quotes

Car insurance premium calculators help you discover what you will most likely pay for auto insurance, but you’ll need to decide on the types and levels of coverage you want before getting quotes:

- Liability car insurance is required by the state and covers bodily injury and property damage that occurs to someone else because of an accident for which you are found at fault.

- Collision car insurance will pay for your car’s damage regardless of who is at fault.

- Comprehensive car insurance covers your car’s damage due to non-collision-related incidents.

- Uninsured/underinsured motorist coverage pays out when the at-fault driver in an accident does not have coverage in place.

- Personal injury protection (PIP) covers medical bills and lost income if you’re injured in a collision.

Depending on where you live, you may be required to have a certain level of car insurance coverage in place. In most parts of the United States, drivers must have third-party liability insurance to drive legally. Take a look at this chart to see the minimum required insurance in each state.

Along with the car insurance required under state law, consumers can choose from different types of optional coverage available on the market.

- Collision coverage protects a driver’s own vehicle from losses resulting from striking another vehicle or object.

- Comprehensive car insurance coverage provides protection from losses other than collisions, such as fire, flooding, and vandalism.

- Gap insurance is required by leases and lessors if you haven’t paid off your vehicle in full.

You will need to decide if you want liability only, or a policy with collision, comprehensive, uninsured motorist, and personal injury protection. You will also need to decide if you are getting only state-mandated coverage or higher limits.

Once you know what the main type of car insurance and the level of coverage you need, you can use this knowledge to evaluate online car insurance quotes properly and make the right buying decision for you.

Read more: Is it cheaper to purchase car insurance online?

Factors That Determine Car Insurance Quotes

There are several factors the insurance company will consider when working up a quote for insurance and a final price for your policy. These include:

- Driving history: If your driving record includes an accident or two and moving violations, you will be considered a higher risk than someone with a clean record. High-risk drivers always pay higher rates.

- Location: Customers who live in urban areas with a lot of cars on the road and a higher likelihood of being involved in a car accident will be paying more for their coverage than people who live in rural areas.

- Gender: Most men pay higher premiums than women do.

- Age: Young drivers pay more than middle-aged drivers, and teen male drivers have some of the highest rates. Compare car insurance rates by age and gender.

- Claims history: The number of claims you’ve made over the past few years could raise your insurance rates, especially if you were at fault for an accident.

- Credit score: Those with bad credit will pay more for car insurance.

- Annual mileage: The more time you spend behind the wheel and the more miles you put on your car, the greater the risk of loss.

- VIN: The year, make, and model of your car will impact how you pay for car insurance. Compare car insurance rates by vehicle make and model.

This is not an exhaustive list of factors car insurance companies consider when adjusting your rates, but these are some of the main ones to keep in mind. Read our guide on the factors that affect car insurance rates to learn more.

Read More: How do you get car insurance fast?

Getting Cheaper Car Insurance Quotes

Price is not the only important consideration when looking for car insurance. If you choose a provider only because of its cheaper premiums, you may find that you do not have enough coverage when you need it.

Always look at the coverage details as well as the price when comparing quotes to get the best price on the car insurance you need.

Dani Best Licensed Insurance Producer

As you increase the limits of your car insurance and add more coverage options, your rates will increase. However, there are ways you can reduce your overall car insurance costs:

- Modify your deductible.

- Add safety and security features.

- Have multiple cars or policies with the same insurance company.

- Take a defensive driving course.

- Maintain a good driving record.

- Keep good grades if you are a student.

- Park your car in a locked garage.

Read more: Where To Get Multiple Car Insurance Quotes

One of the best ways to save money on your car insurance is simply by comparing rates from different car insurance companies. During the comparison process, you’ll see not only the overall cost of the policy but how that money is being applied in the following areas:

- Deductible amounts

- Types of coverage

- Extra features a policy offers

You can modify these coverage amounts to see how your car insurance quotes change. It is also imperative to include any qualifying condition that may make you eligible for auto insurance discounts in order to bring down your premiums.

For example, multi-policy car insurance discounts are available to drivers who bundle two or more types of insurance with the same company, such as car insurance and homeowners/renters insurance. Take a look at this table for a list of major car insurance carriers that offer a variety of discount types.

Car Insurance Discount Availability by Provider

| Discount Name | Allstate | American Family | Farmers | Geico | Liberty Mutual | Nationwide | Progressive | State Farm | Travelers | USAA |

|---|---|---|---|---|---|---|---|---|---|---|

| Adaptive Cruise Control | NA | NA | 10% | 10% | 5% | 3% | NA | 7% | 10% | NA |

| Adaptive Headlights | 15% | 15% | 10% | 5% | 5% | 10% | 15% | 5% | 5% | 15% |

| Anti-lock Brakes | 10% | 10% | 10% | 5% | 5% | 5% | 10% | 5% | NA | NA |

| Anti-Theft | 10% | NA | NA | 23% | 20% | 25% | 20% | 15% | NA | NA |

| Claim Free | 35% | 10% | 15% | 26% | 15% | 10% | 15% | 15% | 23% | 12% |

| Continuous Coverage | NA | 10% | 10% | NA | 15% | 15% | 10% | 10% | 15% | 5% |

| Daytime Running Lights | 2% | NA | 2% | 3% | 5% | 5% | 7% | 3% | NA | NA |

| Defensive Driver | 10% | 10% | NA | 10% | 10% | 5% | 10% | 5% | 10% | 3% |

| Distant Student | 35% | 15% | 30% | 30% | 20% | 10% | 20% | 20% | 7% | NA |

| Driver's Ed | 10% | 10% | 8% | NA | 10% | 8% | 10% | 15% | 8% | 3% |

| Driving Device/App | 20% | 40% | 20% | NA | 30% | 40% | 20% | 50% | 30% | 5% |

| Early Signing | 10% | 12% | 15% | 15% | 8% | 8% | 8% | 15% | 10% | 12% |

| Electronic Stability... | 2% | 3% | 3% | 2% | 5% | NA | 5% | NA | 3% | 2% |

| Emergency Deployment | 5% | NA | 20% | 25% | NA | NA | NA | NA | 20% | 25% |

| Engaged Couple | 10% | 10% | 5% | NA | 5% | 10% | 5% | NA | NA | 10% |

| Family Legacy | NA | 10% | NA | 5% | 10% | 5% | 5% | NA | 5% | 10% |

| Family Plan | 20% | NA | 15% | NA | 10% | 25% | NA | 15% | 15% | NA |

| Farm Vehicle | 10% | NA | 10% | NA | 10% | 5% | NA | 5% | 10% | NA |

| Fast 5 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA |

| Federal Employee | 13% | 15% | NA | 12% | 10% | 16% | NA | 15% | NA | NA |

| Forward Collision Warning | 5% | 10% | 5% | 10% | 5% | NA | 5% | 5% | 5% | 10% |

| Full Payment | 10% | 10% | 8% | NA | $50 | 8% | 10% | NA | 8% | NA |

| Further Education | NA | NA | NA | NA | 10% | 15% | NA | NA | NA | NA |

| Garaging/Storing | NA | NA | NA | NA | NA | NA | NA | NA | NA | 90% |

| Good Credit | 10% | NA | 5% | 10% | 5% | NA | 10% | NA | 10% | NA |

| Good Student | 20% | 23% | NA | 15% | 23% | 10% | 8% | 25% | 8% | 3% |

| Green Vehicle | 10% | NA | 5% | NA | 10% | NA | NA | 10% | 10% | NA |

| Homeowner | 3% | 3% | 5% | NA | 5% | 5% | NA | 3% | 5% | NA |

| Lane Departure Warning | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA |

| Low Mileage | 30% | 30% | 25% | 25% | 30% | 25% | NA | 25% | 30% | 25% |

| Loyalty | 5% | 15% | 5% | NA | 15% | 5% | 15% | 15% | 5% | NA |

| Married | 5% | NA | 5% | NA | NA | NA | 5% | NA | NA | NA |

| Membership/Group | NA | 7% | NA | NA | 10% | 7% | NA | NA | NA | 7% |

| Military | NA | NA | 15% | 15% | 4% | 10% | NA | NA | NA | 30% |

| Military Garaging | NA | NA | NA | NA | NA | NA | NA | NA | NA | 15% |

| Multiple Drivers | 25% | 20% | 20% | NA | NA | 25% | NA | NA | 25% | NA |

| Multiple Policies | 10% | 29% | 20% | 10% | 20% | 10% | 12% | 17% | 13% | NA |

| Multiple Vehicles | NA | 10% | 8% | 25% | 10% | 20% | 10% | 20% | 8% | NA |

| New Address | NA | 5% | NA | NA | 5% | 5% | NA | 5% | NA | NA |

| New Customer/New Plan | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA |

| New Graduate | 5% | 15% | 10% | NA | 5% | 15% | 10% | 5% | 15% | 10% |

| New Vehicle | 30% | NA | 30% | 15% | 40% | NA | 40% | 10% | 12% | NA |

| Newly Licensed | NA | NA | NA | NA | 5% | NA | NA | NA | NA | NA |

| Newlyweds | 10% | NA | 5% | 5% | 5% | NA | 10% | NA | 10% | NA |

| Non-Smoker/Non-Drinker | NA | NA | 10% | NA | 10% | 10% | NA | NA | NA | 10% |

| Occasional Operator | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA |

| Occupation | NA | NA | NA | NA | 10% | 15% | NA | NA | NA | NA |

| On-Time Payments | 5% | 10% | NA | 10% | 10% | 15% | 15% | NA | 15% | NA |

| Online Shopper | 10% | NA | NA | NA | 10% | NA | 7% | NA | 10% | NA |

| Paperless Documents | 10% | 5% | NA | 5% | 5% | 5% | $50 | 10% | 5% | 10% |

| Paperless/Auto Billing | 5% | 5% | NA | NA | 3% | $30 | NA | $20 | 3% | 3% |

| Passive Restraint | 30% | 30% | NA | 40% | NA | 20% | NA | 40% | NA | NA |

| Recent Retirees | NA | NA | NA | NA | 4% | NA | NA | NA | NA | NA |

| Renter | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA |

| Roadside Assistance | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA |

| Safe Driver | 45% | NA | NA | 15% | NA | 35% | 31% | 15% | 23% | 12% |

| Seat Belt Use | NA | NA | NA | 15% | NA | NA | NA | NA | NA | NA |

| Senior Driver | 10% | NA | NA | NA | NA | NA | NA | NA | NA | NA |

| Stable Residence | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA |

| Students & Alumni | NA | NA | NA | NA | 10% | 7% | NA | NA | NA | NA |

| Switching Provider | NA | NA | NA | NA | 10% | NA | NA | NA | NA | NA |

| Utility Vehicle | 15% | NA | NA | NA | NA | NA | NA | NA | NA | NA |

| Vehicle Recovery | 10% | NA | NA | 15% | 35% | 25% | NA | 5% | NA | NA |

| VIN Etching | NA | NA | NA | NA | 5% | NA | NA | NA | NA | NA |

| Volunteer | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA |

| Young Driver | NA | NA | NA | NA | NA | NA | NA | NA | NA | $75 |

As you can see, different discounts are available from different companies. This can also be a factor in deciding which company is right for you.

Learn More:

- Allstate Car Insurance Discounts

- USAA Car Insurance Discounts

- Safe Driver Car Insurance Discounts

- Anti-Theft Car Insurance Discounts

Top Tips For Getting The Best Car Insurance Estimates Online

Each driver has their own objectives they want to achieve when shopping for rates. If you want to use a car insurance calculator to get the best car insurance estimates online, take the following steps:

- Identify the coverage requirements you want

- Identify the highest deductible you can afford

- Read consumer reviews

Then, compare only the same insurance products with each other, and choose a mix of familiar companies and those you may not know much about. A lesser-known company may be able to offer you coverage at a better price.

Read more: Is it possible to get instant online car insurance?

Many car insurance companies offer free car insurance quotes calculators directly from their websites, which makes getting this valuable information a quick and easy process. But to make sure you're not paying too much for coverage, use a third-party car insurance calculator to get free car insurance estimates online.

Kalyn Johnson Insurance Claims Support & Sr. Adjuster

To find the lowest insurance rate and the best company to work with, you certainly want to get as many quotes as possible. Using an insurance rate comparison site like this one will get you the auto insurance estimates you need to make the right decision. Get started with our free car insurance price calculator above.

Frequently Asked Questions

What is a car insurance calculator?

A car insurance calculator is an online tool that helps individuals estimate the cost of car insurance premiums based on various factors such as the type of car, driver’s age, location, driving history, and coverage options. It provides an approximate quote to give users an idea of how much they might expect to pay for car insurance.

How does a car insurance calculator work?

Car insurance calculators typically require users to input specific information about their vehicle and driving profile. This information is used to determine the level of risk associated with insuring the individual and their car. The calculator uses complex algorithms and data from insurance providers to generate an estimated premium based on the provided details.

How are car insurance amounts calculated?

Car insurance calculators use your driving profile (age, gender, location, and driving record) as well as your vehicle type to calculate a car insurance rate estimate.

How many car insurance quotes are enough to make a good comparison?

Most insurance experts recommend a minimum of three quotations to make a sound financial decision. You should have enough information with three quotes to make a reasonably good decision.

Are the estimates provided by a car insurance calculator accurate?

While car insurance calculators strive to provide accurate estimates, they are based on general assumptions and average rates. The final premium may vary depending on additional factors considered by insurance companies during the underwriting process. It’s always recommended to obtain quotes directly from insurance providers for precise figures.

Why is it important to learn how insurance companies calculate premiums?

During your research for car insurance, it’s important to know the science behind how car insurance companies calculate their premiums. Understanding the specific factors, like age and written premiums, will help you make a better call on the company you want to buy insurance coverage from.

Can I purchase car insurance directly through a car insurance calculator?

No, car insurance calculators provide estimates and quotes but do not facilitate the purchase of insurance policies. Once you have obtained an estimate, you will need to contact the insurance company directly or use their online platform to complete the purchase process.

Is using a car insurance calculator mandatory?

No, using a car insurance calculator is not mandatory, but it can be a helpful tool when researching and comparing car insurance rates. It allows you to quickly estimate car insurance premiums and compare different coverage options and providers before making a decision.

Are car insurance calculators free to use?

Yes, most car insurance calculators are available for free on insurance company websites or third-party insurance comparison platforms. You can use them as many times as you need to compare quotes and explore different coverage scenarios.

What information do I need to use a car insurance calculator?

The information required may vary slightly between calculators, but common details include your vehicle’s make, model, year of manufacture, estimated annual mileage, your age, driving history, location, and the desired coverage levels. Providing accurate information will result in more precise estimates.

How much car insurance do I need?

Is $100 a month too much for car insurance?

Does credit score affect car insurance?

How do state regulatory agencies affect insurance rates?

Why do insurance companies use third-party car insurance calculators?

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.