Cheap Car Insurance for a Second Car in 2026 (Earn Savings With These 10 Companies!)

Erie, State Farm, and Farmers are our top choices for cheap car insurance for a second car. At Erie, minimum coverage averages $70/mo for two vehicles. While adding a second car to your auto insurance policy will raise your rates, it is still cheaper than purchasing two separate car insurance policies.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Licensed Insurance Agent

Scott W Johnson is an independent insurance agent in California. Principal Broker and founder of Marindependent Insurance Services, Scott brings over 25 years of experience to his clients. His Five President’s Council awards prove he uses all he learned at Avocet, Sprint Nextel, and Farmers Insurance to the benefit of his clients. Scott quickly grasped the unique insurance requirements of his...

Scott W. Johnson

Certified Financial Planner

Joel Ohman is the CEO of a private equity backed digital media company. He is a CERTIFIED FINANCIAL PLANNER™, author, angel investor, and serial entrepreneur who loves creating new things, whether books or businesses. He has also previously served as the founder and resident CFP® of a national insurance agency, Real Time Health Quotes. He has an MBA from the University of South Florida. Joel...

Joel Ohman

Updated May 2024

1,814 reviews

1,814 reviewsCompany Facts

Min. Coverage for a Second Car

A.M. Best Rating

Complaint Level

Pros & Cons

1,814 reviews

1,814 reviews 18,155 reviews

18,155 reviewsCompany Facts

Min. Coverage for a Second Car

A.M. Best Rating

Complaint Level

Pros & Cons

18,155 reviews

18,155 reviews 3,072 reviews

3,072 reviewsCompany Facts

Min. Coverage for a Second Car

A.M. Best Rating

Complaint Level

Pros & Cons

3,072 reviews

3,072 reviewsCheap car insurance for a second car can be found at Erie, State Farm, and Farmers.

Understanding your car insurance policy is paramount when it comes to insuring a second vehicle. Getting insurance coverage for a second car often comes into play for families with multiple drivers.

Our Top 10 Company Picks: Cheap Car Insurance for a Second Car

| Company | Rank | Monthly Rates | A.M. Best | Best For | Jump to Pros/Cons |

|---|---|---|---|---|---|

| #1 | $70 | A+ | Customer Service | Erie | |

| #2 | $72 | A++ | Complete Coverage | State Farm | |

| #3 | $75 | A | Family Plans | Farmers | |

| #4 | $77 | A | Multiple Discounts | American Family | |

| #5 | $78 | A | Membership Benefits | AAA |

| #6 | $80 | A+ | Vanishing Deductible | Nationwide |

| #7 | $82 | A++ | Industry Experience | Travelers | |

| #8 | $85 | A | Policy Bundling | Liberty Mutual |

| #9 | $90 | A+ | Specialized Plans | National General | |

| #10 | $95 | A | High-Risk Drivers | The General |

How much does adding a second car to insurance cost? Don’t fear; although getting a second car covered will incur some extra cost, there are still ways to help buffer the cost.

Before learning more about getting insurance coverage for a second car, enter your ZIP code above to compare car insurance rates now for FREE for households with multiple cars.

- Erie, State Farm, and Farmers have the cheapest second car insurance

- You can insure two cars if they are parked and registered at the same address

- Second car insurance will be cheaper the more reliable and inexpensive the car

#1 – Erie: Top Pick Overall

Pros

- Customer Service: Erie’s reputation for customer service is solid.

- Flexible Coverage: You can adjust coverages on each individual vehicle.

- Full Coverage Benefits: Carrying a full coverage policy comes with perks like pet injury coverage.

Cons

- Availability: You will have to check to see if Erie is in your state.

- Online Services: Erie doesn’t let customers file claims online (read more: How do you file a car insurance claim?).

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#2 – State Farm: Best for Complete Coverage

Pros

- Complete Coverage: Purchase complete coverage policies for all your vehicles. Learn more in our State Farm review.

- Student Savings: State Farm has a discount for students with good grades.

- Agency Network: Most drivers will have access to a local agent for help insuring two cars.

Cons

- Bad Credit Rates: Having a poor credit score will increase your rates in some locations.

- Accident Forgiveness Requirements: To get accident forgiveness, you must be a customer and claim-free for almost ten years.

#3 – Farmers: Best for Family Plans

Pros

- Family Plans: Farmers is great for families shopping for multi-vehicle car insurance.

- Convenient App: Farmers’ app lets customers perform several tasks.

- Multi-Vehicle Discount: Save up to 20% with a multi-vehicle discount at Farmers.

Cons

- High-Risk Driver Rates: High-risk drivers of multiple cars may find rates less competitive. Read our Farmers insurance review for more details on rates.

- Claim Reviews: You may be less than satisfied with claim filing at Farmers, based on some reviews.

#4 – American Family: Best for Multiple Discounts

Pros

- Multiple Discounts: The cost to insure two cars can be reduced with American Family discounts.

- Gap Coverage: If your second vehicle is brand new, you may want to include gap coverage.

- Customer Service: Learn about the company’s positive customer reviews in our American Family review.

Cons

- Limited Availability: You’ll have to check to see if your state carries American Family.

- High-Risk Rates: Rates may not be as affordable for drivers deemed high-risk.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#5 – AAA: Best for Membership Benefits

Pros

- Membership Benefits: Get discounts for non-auto insurance purchases when you have an AAA membership.

- Roadside Assistance: There are several different service levels you can choose from for your cars.

- Bundling Discount: Purchase two types of insurance for a discount.

Cons

- Annual Fees: There is an annual fee required for AAA membership. Learn more about the company in our AAA car insurance review.

- Club Services Can Vary: AAA insurance operates from different clubs, so locations can vary in terms of coverage, discounts, and customer service.

#6 – Nationwide: Best for Vanishing Deductible

Pros

- Vanishing Deductible: Vanish your deductible over time by staying claim-free. Find more discounts by reading our article on Nationwide car insurance discounts.

- Pay-Per-Mile Insurance: If you rarely drive one of your cars, consider limited-use insurance.

- Online Quotes: Get a quote online at Nationwide’s website to determine your second vehicle insurance savings.

Cons

- No Rideshare Insurance: Rideshare drivers will have to get coverage from a different company.

- Rate Competitivity: High-risk drivers, such as DUI drivers, will have trouble getting affordable insurance.

#7 – Travelers: Best for Industry Experience

Pros

- Industry Experience: A.M. Best gave an A++ rating to Travelers, which is the highest possible.

- Nationwide Availability: Travelers’ auto insurance is available across the U.S. Discover more in our Travelers review.

- Gap Coverage: If your second car is brand new, insure it with gap coverage.

Cons

- Claim Reviews: There are some unsatisfied customers.

- IntelliDrive Program: While this program offers a discount, you can also accidentally earn a rate increase if you perform poorly.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#8 – Liberty Mutual: Best for Policy Bundling

Pros

- Policy Bundling: Purchase insurance for your property, business, or vehicle.

- Better Car Replacement: Get a model one year newer if you total your car.

- 24/7 Support: Learn more about the company’s customer service representation in our Liberty Mutual review.

Cons

- Poor Credit Rates: In some states, Liberty Mutual charges more for poor credit.

- Discounts Vary: Some discounts may be lower in some states.

#9 – National General: Best for Specialized Plans

Pros

- Specialized Plans: National General will work with you to create a specialized plan. Learn more in our National General review.

- Multi-Vehicle: Save up to 25% by insuring more than one car.

- Multi-Policy: National General also sells home insurance.

Cons

- High Rates for High-Risk Drivers: National General’s premiums are higher than most.

- Customer Satisfaction: National General’s service record has some poor experiences, according to reviews.

#10 – The General: Best for High-Risk Drivers

Pros

- High-Risk Drivers: Drivers who are unable to find insurance elsewhere can usually be insured by The General.

- Online Quotes: Quickly see how much The General would charge for insurance for second cars.

- SR-22 Assistance: The General will help you file an SR-22 form. Learn more in our review of The General.

Cons

- High Rates: Because The General specializes in high-risk drivers, rates are more expensive.

- Coverage Options: The General doesn’t have as many coverages as other popular companies.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Cost of Adding a Second Car to Insurance

Is it cheaper to have two cars on insurance? It’s, without a doubt, cheaper to insure two vehicles on one policy rather than have two separate policies.

Take a look at the rates below to see how much does it cost to add a second car to insurance at the cheapest companies.

Car Insurance Monthly Rates for a Second Car by Coverage Level & Provider

| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| AAA | $78 | $185 |

| American Family | $77 | $190 |

| Erie | $70 | $170 |

| Farmers | $75 | $180 |

| Liberty Mutual | $85 | $195 |

| National General | $90 | $210 |

| Nationwide | $80 | $185 |

| State Farm | $72 | $175 |

| The General | $95 | $215 |

| Travelers | $82 | $200 |

If your rates are high, we recommend getting quotes from cheap companies like Erie.

Bear in mind that part of what influences your rate increases is what vehicle you are adding. Expensive vehicles will cost more to insure, even though insuring your new vehicle with your other car is still the cheapest way to insure two cars. For example, a sports car will cost more to insure than a minivan.

Learn more: Best Car Insurance for Sports Cars

How to Save on Your Second Car Insurance Cost

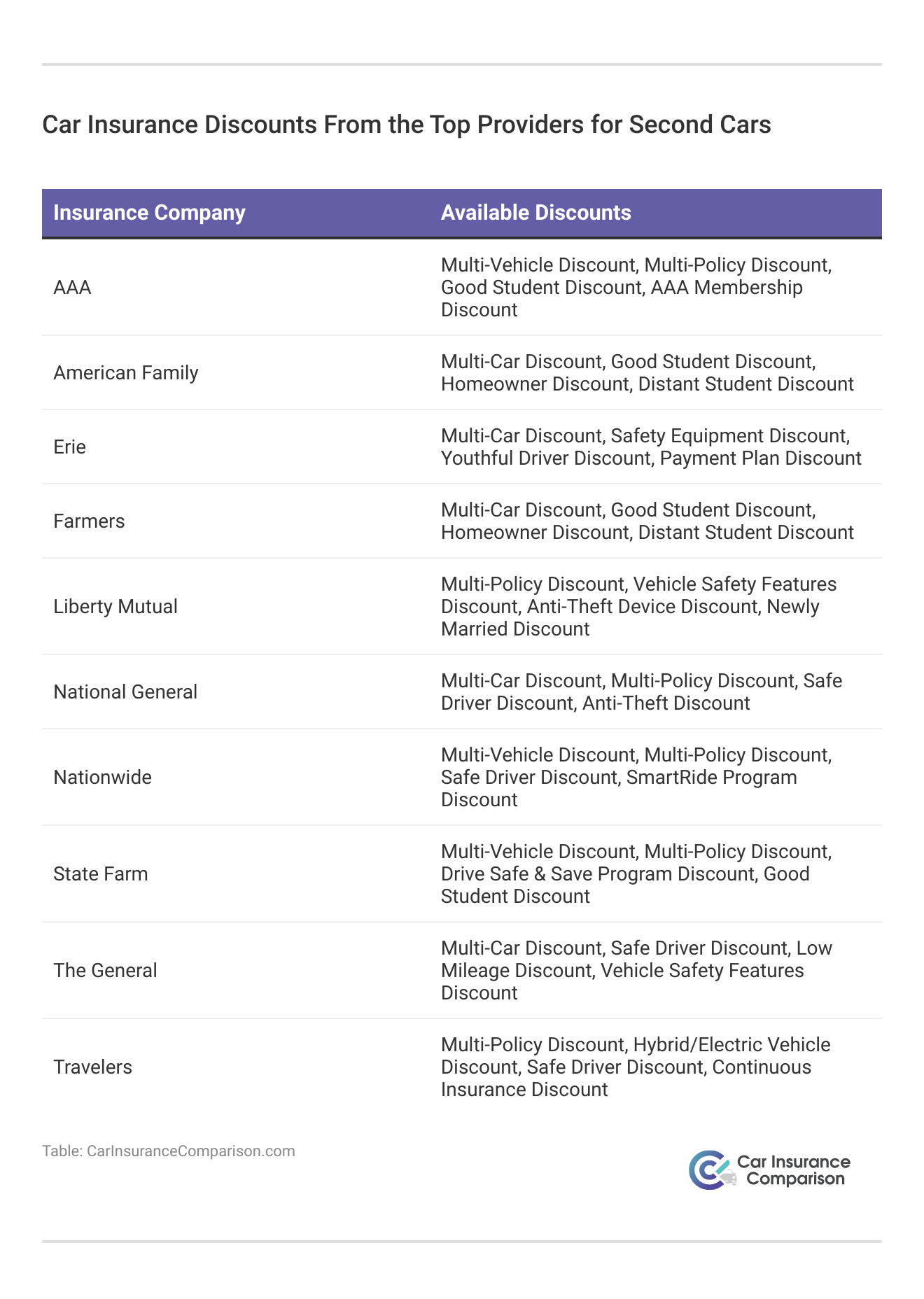

The ways to lower the cost of your car insurance are many. When you do pick up the phone and call your current insurance provider, find out if they have car insurance discounts like:

- Multi-car insurance discounts

- Family discounts

- Good student discounts

- Safe driving discounts, etc.

Is it cheaper to put two cars on one policy? The table below shows which companies offer multi-vehicle discounts and what percentage off you can get for it.

Multi-Vehicle Car Insurance Discount by Company

| Insurance Company | Discount Percentage |

|---|---|

| 21st Century | NA |

| AAA | NA |

| Allstate | NA |

| American Family | NA |

| Ameriprise | NA |

| Amica | 15% |

| Country Financial | 15% |

| Esurance | NA |

| Farmers | NA |

| Geico | 25% |

| Liberty Mutual | 10% |

| MetLife | NA |

| Nationwide | 20% |

| Progressive | 10% |

| Safe Auto | 15% |

| Safeco | 15% |

| State Farm | 20% |

| The General | 15% |

| The Hanover | 5% |

| The Hartford | 5% |

| Travelers | 8% |

| USAA | NA |

There are many other types of programs you can look into that can lower the cost of putting a second car on your policy. For example, you can receive discounts for being within certain mileage limits. By having this sort of insurance, one can drastically reduce adding a second car to his current policy.

While adding a second car will raise your premiums a bit overall, you may be surprised that depending on how you cover one or both vehicles may not put such a large dent in your wallet as you initially thought. For example, if your first car is getting older, you may want to raise the car insurance deductible, which in turn will lower your premiums overall. You could have one car strictly with liability while the other car that has full coverage. Again, this is a good idea with not only older cars but cars that are losing their value.

The Insurance Information Institute lists these requirements by state, but again these minimum requirements don’t cover your vehicle, only damages to a car you might be at-fault for damaging. If you can pay completely in cash for the second car, you won’t have to get comprehensive coverage, which is usually required in most states if you finance a vehicle. However, we do recommend carrying comprehensive coverage if you can afford to do so.

Comprehensive coverage will provide reimbursement for damages due to animal collisions, weather, falling objects, and more.

Dani Best Licensed Insurance Producer

And if you have a younger or at risk driver, make sure you only put him on one car’s policy, this again will lower you overall premiums compared if you allowed him access to both vehicles.

Moreover, if this is a second car to run errands with or for your teenager to drive, buy a reliable car and not some snazzy red sports car. The more reliable and inexpensive the car, the less your premiums become. For cars that are barely driven, some car insurance policies have a way to track their mileage by mounting a GPS system to the car and have a “pay as you go” approach to the insurance coverage.

Adding Teen Drivers To Second Car Insurance

You promised your child that if he passed the driving test he would get a car. And knowing that all vehicles in the U.S. have to be insured, how much does adding a second car to insurance cost?

You have heard daunting tales of woe of how putting your 16 or 17-year-old teen driver on your insurance as well as a second car is second only to saving up for college, which is a mere one to two years away. The price of car insurance for a 16-year-old is notoriously high. Covering a second car on your car insurance policy certainly adds cost, but rest assured, you can find cheap car insurance for young drivers.

Read more: Can I have two car insurance policies on one car?

Adding a new driver and a second car to your insurance policy is a bit of a double whammy. While we understand that young drivers (and higher risk drivers) add to the cost of your insurance plan, adding a second car alone does not have to become such a financial setback for you.

View this post on Instagram

If you are simply adding a new vehicle to your existing policy, but the drivers of that vehicle are neither new or at-risk drivers, then there are a number of ways you can control the hike in monthly payments, such as getting quotes from the cheapest companies.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

The Final Word on Second Car Insurance

You don’t have to stay with your current insurance provider when you buy a second car. Maybe the person who you are going to insure the car for is a high-risk or younger driver, and you are able to find a more competitive rate than what even your own insurance company is willing to provide.

In that case, shopping around is one of the best ways to save on insuring your second car (learn more: 16 Ways to Lower the Cost of Your Insurance). Look for reviews, customer service, and satisfaction rankings to make an informed decision about cheap car insurance for a second car.

If you’re thinking about getting insurance coverage on a second vehicle added to your policy, take the time now to compare free car insurance quotes from reputable insurance providers to get cheap second car insurance.

Frequently Asked Questions

What is the cheapest way to insure two cars?

Most drivers want to know the answer to “is second car insurance cheaper.” It is generally cheaper to insure two vehicles on one policy rather than having two separate policies. You can also look for multi-vehicle discounts offered by insurance companies.

How much does it cost to add a second car to your insurance?

Adding a second car to your insurance policy will increase your rates, but the cost depends on factors such as your driving record and the age and driving record of other drivers on your policy. Enter your ZIP into our free comparison tool to get 2nd car insurance quotes.

Can I add a second car to my insurance policy?

To add another car to your insurance, contact your current insurance provider and inquire about the process. They will guide you through adding the second car to your policy. Because your car insurance company wants to keep your business, they try to make this process as seamless as possible for you.

Usually, you can do everything right over the phone, and they will fax or email a temporary policy for your second car (read more: How can I add a car to my insurance policy?).

Can I have two cars insured at the same time?

Yes, you can have two cars insured at the same time. When adding a second car to your insurance policy, the cost will depend on factors such as the driver’s age and risk profile.

Should I insure a second car separately or add it to my existing policy?

Adding a second car to your existing policy is usually cheaper than insuring it separately. It can qualify you for multi-vehicle discounts and lower your overall premiums. Check with your insurance provider for the best option.

Is insuring a second car cheaper?

Wondering is it cheaper to add a second car to insurance? The answer is almost always yes, as insurance companies offer multi-vehicle discounts. To find out how much does it cost to insure two cars at your company, get a free quote (learn more: How do you get competitive quotes for car insurance?).

What companies have cheap 2nd car insurance?

If you are insuring a second car, the best companies are Erie, State Farm, and Farmers. To find out how much does it cost to add another car to insurance at these companies, compare quotes.

Is it cheaper to have more people on car insurance?

More people on your car insurance policy will cost more, but it is cheaper than buying two separate policies.

How much does adding a second car affect insurance?

You will have to pay more to insure a second car, and you will have to pick what coverages you want to put on your second car (learn more: Compare Car Insurance by Coverage Type).

How big is a multi-car discount?

Multi-car discounts vary by company, but some companies offer up to 25% off.

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.