Best Track Day Car Insurance in 2026 (Top 10 Companies)

State Farm, USAA, and Allstate are the top overall picks for the best track day car insurance. Enjoy discounts of up to 30% on tailored coverage options. These leading companies provide comprehensive protection for your track event, ensuring peace of mind while you pursue your passion for high-speed driving.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Sr. Director of Content

Sara Routhier, Managing Editor and Outreach Director, has professional experience as an educator, SEO specialist, and content marketer. She has over five years of experience in the insurance industry. As a researcher, data nerd, writer, and editor she strives to curate educational, enlightening articles that provide you with the must-know facts and best-kept secrets within the overwhelming world o...

Sara Routhier

Insurance & Finance Analyst

Laura Adams is one of the nation’s leading finance, insurance, and small business authorities. As an award-winning author, spokesperson, and host of the top-rated Money Girl podcast since 2008, millions of readers and listeners benefit from her practical advice. Her mission is to empower consumers to live healthy and rich lives by planning for the future and making smart money decisions. She rec...

Laura D. Adams

Updated May 2024

18,155 reviews

18,155 reviewsCompany Facts

Full Coverage for Track Days

A.M. Best Rating

Complaint Level

Pros & Cons

18,155 reviews

18,155 reviews 6,589 reviews

6,589 reviewsCompany Facts

Full Coverage for Track Days

A.M. Best Rating

Complaint Level

6,589 reviews

6,589 reviews 11,638 reviews

11,638 reviewsCompany Facts

Full Coverage for Track Days

A.M. Best Rating

Complaint Level

Pros & Cons

11,638 reviews

11,638 reviewsState Farm emerges as the top pick overall among the best track day car insurance, closely followed by USAA and Allstate. When you need to get car insurance fast, these providers offer tailored coverage options and exceptional service, ensuring optimal protection for your high-speed pursuits.

From comprehensive policies to innovative solutions, they cater to the diverse needs of track enthusiasts, providing peace of mind both on and off the race track.

Our Top 10 Company Picks: Best Track Day Car Insurance

| Company | Rank | Multi-Policy Discount | Low-Mileage Discount | Best For | Jump to Pros/Cons |

|---|---|---|---|---|---|

| #1 | 17% | 30% | Many Discounts | State Farm | |

| #2 | 10% | 30% | Military Savings | USAA | |

| #3 | 25% | 30% | Add-on Coverages | Allstate | |

| #4 | 10% | 30% | Online Convenience | Progressive | |

| #5 | 15% | 20% | Usage Discount | Nationwide |

| #6 | 15% | 25% | Student Savings | American Family | |

| #7 | 5% | 20% | Local Agents | Farmers | |

| #8 | 25% | 30% | Customizable Polices | Liberty Mutual |

| #9 | 13% | 10% | Accident Forgiveness | Travelers | |

| #10 | 5% | 20% | Deductible Reduction | The Hartford |

Car enthusiasts have a challenge when it comes to acquiring the right insurance cover for a track day event. Many car insurance providers do not include the track day coverage on their standard auto insurance policy while others offer no guarantee of the payment of their claims.

The insurance policies for the track day events are higher in most companies, but you would not risk getting on track without the proper coverage for your vehicle.

In most cases, the insurance companies do not provide liability coverage and third-party coverage for damages to another car. If you are looking to participate in a track event soon and need auto insurance, start comparison shopping today by entering your ZIP code above!

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Exploring Coverage Options for Track Days

Insurance companies cover the repair or replacement of an insured car taking part in a track day event. Track day policies are different from one company to another depending on the information indicated on their clauses.

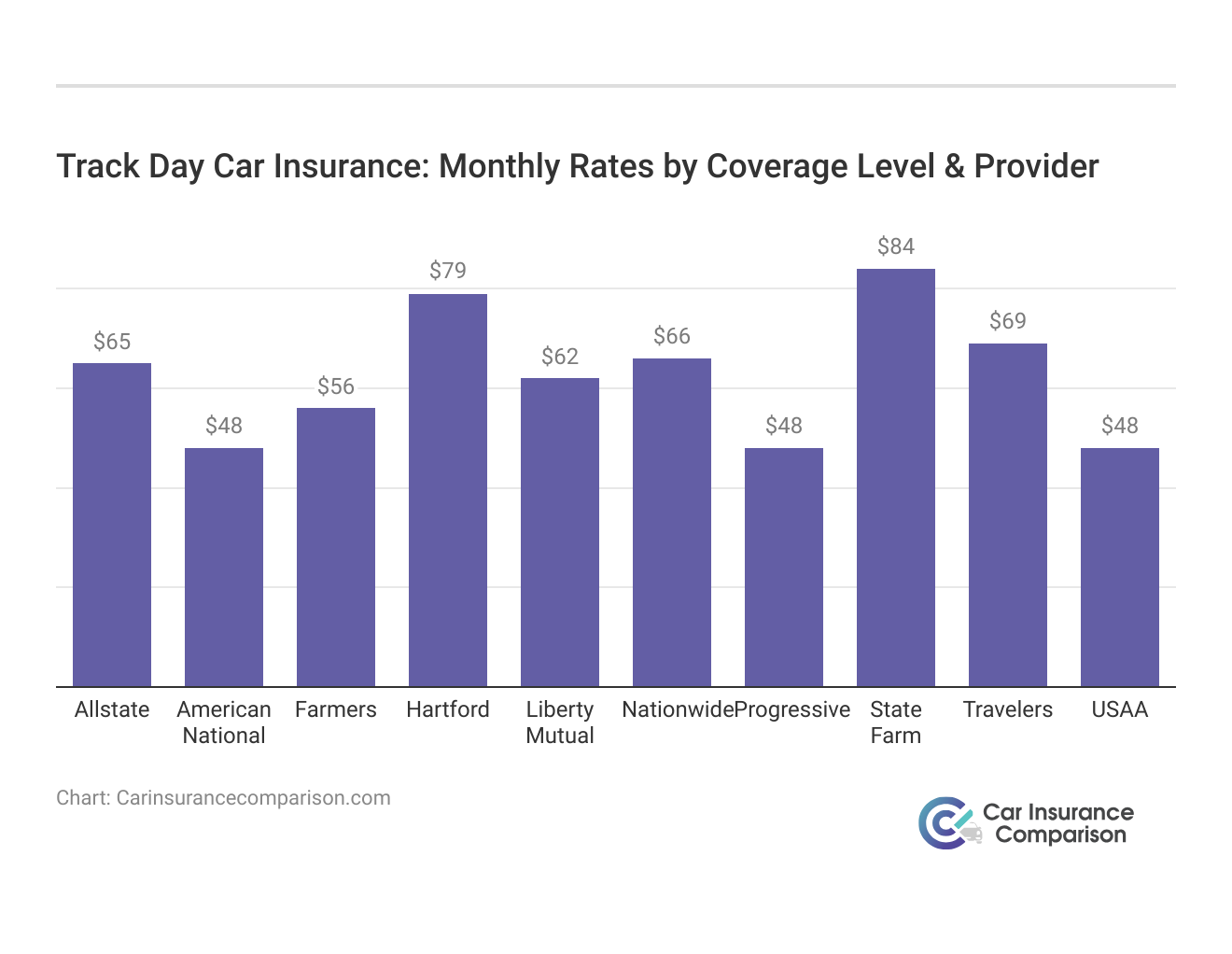

Track Day Car Insurance: Monthly Rates by Coverage Level & Provider

| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| Allstate | $65 | $177 |

| American National | $48 | $184 |

| Farmers | $56 | $152 |

| Liberty Mutual | $62 | $196 |

| Nationwide | $66 | $168 |

| Progressive | $48 | $141 |

| State Farm | $84 | $158 |

| The Hartford | $79 | $164 |

| Travelers | $69 | $178 |

| USAA | $48 | $145 |

For those seeking minimum coverage during track days, State Farm stands at $84, USAA at $48, and Allstate at $65 per month. Moving towards full coverage, State Farm offers it at $158, USAA at $145, and Allstate at $177. The spectrum widens with Progressive providing minimum coverage at $48 and full coverage at $141.

Nationwide caters to minimum coverage seekers at $66, with full coverage available at $168. American National offers minimum coverage at $48 and full coverage at $184. Farmers stands at $56 for minimum coverage and $152 for full coverage, while Liberty Mutual provides minimum coverage at $62 and full coverage at $196.

Travelers caters to those seeking minimum coverage at $69, and full coverage at $178. Hartford offers minimum coverage at $79 and full coverage at $164, providing a diverse range of options to suit varying needs.

State Farm emerges as the top choice for track day insurance, offering tailored coverage options, competitive rates, and a commitment to meeting diverse customer profiles.

Brad Larson Licensed Insurance Agent

Other items that they may cover besides the accidental damage include fires following an accident, destruction of the bad engines, and modifications to the vehicles.

Few insurance providers include the coverage for track events on the personal insurance policy while others provide the track day coverage independently.

Therefore, conducting a track day insurance comparison among different companies is crucial to understand the varying costs and services they provide.

Some companies may exclude the coverage for damage to:

- The engine

- Brake pads

- Fluids

- Towing

- Modifications from the track day insurance policy

Other instances when you may not get track day coverage include when you use your car in a race, competition, or arena. The track day insurance provider assumes that you will be purchasing a cover for the time the car is on the racetrack.

Therefore, you will need to inform the broker or insurer of your intentions to cover a track event lest you risk denial of compensation while making a claim. It’s important to note that track day insurance is typically designed for track events and may not extend to other activities such as road trips or race car usage.

Factors Determining Your Coverage Status

Before the track day event, a driver may take part in simple instructions known as a “drivers’ education” event.

Some insurers will repay you for an accident which occurs at such a time, but that depends on how the driver and instructor answer the questions from an insurance adjuster.

The presence of an instructor on the vehicle during commercial safe driving courses, where speeds do not exceed 100kph, increases the chances of obtaining coverage and helps determine your coverage status.

The Insurance Terms

Some insurance policies explicitly refuse coverage for any accident happening on a racetrack. Therefore, it is important to go through the clause or seek help from an insurance agent. Remember that an insurance agent may not have a clear understanding of the insurance policies in a particular company and may end up giving you general information.

Insurance coverage may be unavailable if the instructor characterizes the event as a competition or mentions racing to an adjuster. Additionally, securing coverage can be challenging for heavily modified cars with enhancements like full slicks and roll-cages.

Some insurers, however, may offer an Agreed Valuation clause for protection. Timing of events is crucial, as insurance typically doesn’t cover accidents if organizers time drivers, making it a risky endeavor.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Securing Car Insurance for Track Days

Getting insurance coverage for the track day is very simple and fast for the standard cars.

However, it is ideal to obtain the coverage two to three days before the track day to avoid any inconveniences and allow the insurers to finalize the paperwork. You need to identify the day that the competition will take place before completing an online application.

You will then make the payment, after which the insurance company will send you the policy instantly to your email address.

A policyholder should consider giving the insurer a call if they need more exceptions added to their coverage. They should also contact the insurance company in case of changes on the track day.

Obtaining Track Day Car Insurance

Insurance for track days is higher with most insurance companies, but some companies, including Geico and State Farm, offer track day insurance. However, you can also explore options with smaller car insurance companies for this kind of protection.

Therefore, it is crucial to seek out affordable options with attractive rates online or enlist the assistance of an experienced insurance broker who can facilitate finding cheap track day insurance.

Some insurers use the total value of the car to calculate their premiums.

In this case, they may charge 0.6 percent to one percent of the total value, our source reports.

Other factors that influence insurance rates are:

- The Circuit: If a particular course reported very low incidences in the previous track day events, then anyone participating in the race might obtain a lower insurance rate.

- Additional Drivers: Some drivers have had a record of causing more accidents. Therefore, the inclusion of other drivers on your policy may lead to a great increase in your premiums.

- Age: Just like the other insurance policies, age plays a crucial role while determining the ideal coverage for the track day.

- The Model of the Car: The expensive, fast, and exotic cars may have higher premiums than the standard car.

When securing track day car insurance, consider factors like the circuit’s safety record, additional drivers, age, and car model. Explore options from insurers like Geico and State Farm, as well as smaller companies, to find affordable coverage. Consulting insurance brokers can also be beneficial in this process.

Remember, thorough research and consideration of your specific needs are key to securing the right track day car insurance.

Understanding Track Day Insurance

Some insurance companies do not cover the driver or any other passenger on the vehicle. Therefore, you should ask whether they include liability insurance and their limits while shopping for an ideal cover.

You should also consider checking other requirements from the insurance provider such as the overall state of the car. You should identify the coverage you need to lower your rates.

Remember, getting insurance coverage is not a license to drive recklessly since some mistakes are very costly to insure.

The best thing about this type of policy is that it’s customizable. You can pay the insurance premiums for your first day, and then not use it for the next race. You can buy track insurance for cars for 6, 9, or 12 days and get a discount on the per-day cost.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Case Studies: Tailored Track Day Insurance Scenarios

Exploring real-life scenarios can shed light on the effectiveness of various insurance providers in catering to specific needs. Here, we delve into three case studies showcasing how State Farm, USAA, and Allstate offer tailored solutions for different types of track day enthusiasts.

- Case Study #1 – Tailored Coverage for Low-Risk Drivers: John, a State Farm policyholder, benefits from tailored coverage designed for low-risk drivers. State Farm offers competitive rates and comprehensive coverage options, ensuring John’s track day events are adequately protected while maintaining affordability.

- Case Study #2 – Military-Focused Service Excellence: Emily, a passionate track day enthusiast and USAA member, experiences exceptional service tailored to military personnel. USAA’s specialized coverage for military families provides Emily with peace of mind during her track events.

- Case Study #3 – Innovative Protection for High-Performance Vehicles: Mark, an avid car enthusiast with a high-performance vehicle, finds the ideal coverage with Allstate’s innovative solutions. Allstate’s comprehensive coverage ensures Mark’s high-performance car is adequately protected during track days.

These case studies highlight how State Farm, USAA, and Allstate go above and beyond to meet the diverse needs of track day enthusiasts. Whether it’s tailored coverage for low-risk drivers, military-focused service excellence, or innovative protection for high-performance vehicles, these providers showcase their commitment to ensuring peace of mind during track day events.

State Farm leads the pack in track day insurance, boasting tailored coverage, competitive rates, and a commitment to customer satisfaction with a remarkable 92% approval rating.

Tracey L. Wells Licensed Insurance Agent & Agency Owner

Consider your own insurance needs for track day events or other specialized situations, these case studies offer valuable insights into how different providers approach coverage. Whether you prioritize affordability, specialized service, or innovative solutions, there’s a provider out there ready to meet your needs and ensure you can enjoy your track day experiences with confidence.

Track Day Insurance Essentials: Safeguarding High-Speed Adventures

Safeguarding your track day adventures, particularly with a high-performance vehicle, necessitates the right insurance coverage, ensuring peace of mind and protection from potential risks. Understanding track day insurance nuances, such as coverage options and rates, is crucial for enthusiasts.

The track insurance cost fluctuates depending on variables such as the frequency of track events and the type of vehicle. Customizing insurance to individual requirements ensures thorough coverage during track day experiences, promoting confidence and enjoyment.

If you are looking to insure your car before a track event, start comparing auto insurance rates by entering your ZIP code below!

Frequently Asked Questions

What is State Farm track day insurance, and how does it differ from regular auto insurance?

State Farm track day insurance is specialized coverage designed for enthusiasts who participate in track events. Unlike regular auto insurance, it provides coverage specifically tailored to the unique risks associated with track days, offering peace of mind during high-speed pursuits.

For more in-depth understanding, refer to our extensive handbook named “Direct Auto Car Insurance Review” for additional insights.

How can I get a track day insurance quote?

You can obtain a track day insurance quote by contacting insurance providers like Geico, Progressive, or specialized track day insurance companies directly. They will assess your needs and provide a quote based on factors such as event frequency, vehicle type, and coverage preferences.

Get the minimum car insurance coverage you need to drive legally by entering your ZIP code into our free quote comparison tool below.

Where can I find the cheapest track day insurance?

While State Farm, Geico, and Progressive offer track day insurance, smaller insurance companies may provide more affordable options. It’s advisable to compare quotes from multiple providers to find the cheapest track day insurance that meets your requirements.

For further insights, delve into our extensive guide on business vehicle insurance entitled “How do you compare multiple car insurance quotes online?” where you can find valuable information.

How does track day insurance compare to regular car insurance?

Track day insurance differs from regular car insurance in that it provides coverage specifically for track events, whereas regular car insurance covers day-to-day driving activities. It’s essential to have both types of insurance to ensure comprehensive coverage for all scenarios.

For further exploration, consult our comprehensive analysis titled “Compare Comprehensive Car Insurance: Rates, Discounts, & Requirements,” providing deeper insights into the subject matter.

Does car insurance cover track days, or do I need separate track day insurance?

Most standard car insurance policies do not cover track day events, so it’s necessary to purchase separate track day insurance for adequate coverage. While some insurers offer add-on track day cover, it’s crucial to check your policy or speak with your insurer to confirm coverage.

To gain a comprehensive comprehension, consult our in-depth examination entitled “Understanding Your Car Insurance Policy” which provides valuable insights and knowledge to enhance your understanding.

How much does track day insurance cost, and what factors influence the premiums?

The cost of track day insurance varies depending on factors such as the track event frequency, vehicle type, and coverage limits. Insurance providers like Geico and Progressive offer competitive rates, but it’s essential to compare quotes and coverage options to find the best deal for your needs.

Feel free to delve into our in-depth guide titled “Compare Car Insurance Rates by Vehicle Make and Model” for further insights and information.

What is the best track day insurance for high-performance vehicles?

Several insurance providers offer specialized coverage for high-performance vehicles participating in track events. Companies like State Farm, Geico, and Progressive may provide suitable options, but it’s essential to compare policies to find the best track day insurance for your specific vehicle and needs.

To broaden your understanding, consult our extensive manual titled “Compare High-Performance Vehicle Insurance Rates” for further insights and information.

Does progressive offer track day insurance, and how does it compare to other providers?

Yes, Progressive offers track day insurance for enthusiasts seeking coverage during high-speed pursuits. While Progressive may provide competitive rates and comprehensive coverage options, it’s advisable to compare their offerings with other providers like State Farm and Geico to ensure you get the best deal.

By entering your ZIP code above, you can get instant car insurance quotes from top providers.

Can I get cover for track days with my classic car insurance policy?

Some classic car insurance policies may offer track day cover as an optional add-on, but it’s essential to check with your insurer to confirm coverage. Additionally, specialized track day insurance providers may offer tailored coverage specifically for classic cars participating in track events.

For comprehensive insights, refer to our comprehensive handbook titled “Best Classic Car Insurance” for expertise in securing the best coverage for your classic vehicle.

Do I need track day insurance if I’m only participating in occasional track events?

Even if you’re participating in occasional track events, it’s advisable to have track day insurance to protect yourself and your vehicle from potential risks. While the cost of insurance may vary based on event frequency, having coverage ensures peace of mind and financial protection during track days.

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.