What states have full glass coverage?

Full glass coverage allows you to make a claim for a damaged windshield while skipping your deductible — two states are required to do this by law.

Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Former Licensed Insurance Producer

Laura Berry has experience as a licensed producer selling life, health, and property insurance coverage for both Allstate and State Farm. She has dedicated many hours to helping her clients understand the insurance marketplace so they could find the best car, home, and life insurance products for their circumstances. While she currently helps businesses take advantage of the federal R&D tax...

Laura Berry

Licensed Insurance Agent

Brad Larson has been in the insurance industry for over 16 years. He specializes in helping clients navigate the claims process, with a particular emphasis on coverage analysis. He received his bachelor’s degree from the University of Utah in Political Science. He also holds an Associate in Claims (AIC) and Associate in General Insurance (AINS) designations, as well as a Utah Property and Casual...

Brad Larson

Updated February 2024

- Full glass coverage allows you to make glass claims with your comprehensive insurance without having to pay your deductible

- Only Arizona and Kentucky require insurance companies to provide full glass coverage to every comprehensive insurance customer

- Six other states allow insurance companies to sell full glass coverage as an optional add-on

From falling branches to scattered road debris, there’s a lot out there that can damage your windshield. While laws vary, states require your windshield to be relatively free of cracks and chips. This might make you wonder if a broken car window is covered by insurance. You can use your comprehensive insurance for auto glass repairs when your windshield is damaged.

Some states have full glass coverage, which means you won’t have to pay a car insurance deductible to make a glass claim. Only two states offer complete full glass coverage at no extra fee, but several others allow insurance companies to sell it as an add-on for comprehensive plans.

Read on to learn what full glass coverage is and which states offer it. Then, compare comprehensive car insurance quotes with multiple companies so you can find the most affordable glass coverage possible.

Which states have full glass coverage with no deductible?

Most states do not require insurance companies to provide full glass coverage when you buy comprehensive insurance. However, two states do:

- Arizona. Comprehensive coverage holders can replace any type of glass in their car without paying a deductible, no matter which company they use for insurance. Check out our Arizona car insurance guide for more information.

- Kentucky. Kentuckians are guaranteed not only a zero-dollar deductible for glass but for anything else deemed to be safety equipment. Check out our Kentucky car insurance guide for more information.

Unfortunately for the rest of America, these are the only two states that require insurance companies to provide zero deductibles for glass repairs to their customers. However, multiple states offer drivers a way to purchase full glass coverage.

Read More: Which states do not require car insurance?

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Are there states that offer other types of zero deductible glass coverage?

While only two states guarantee full glass coverage, a few require insurance companies to offer some glass coverage for a zero-dollar deductible. These states include:

- Connecticut. Drivers with Connecticut car insurance can add auto glass repair with no deductible to their comprehensive insurance if they want.

- Florida. Like South Carolina, Florida car insurance law does not allow for deductibles for windshield claims. However, other glass, such as your mirrors, lights, or windows, can have a deductible.

- Massachusetts. While Massachusetts car insurance companies are allowed to sell comprehensive insurance with a zero-dollar deductible for windshield repair, they aren’t required to. Drivers who choose a zero deductible will have higher rates.

- Minnesota. The newest addition to this list, Minnesota car insurance laws recently changed to allow drivers to buy full glass coverage.

- New York. New York car insurance companies can offer zero-deductible glass coverage as part of a comprehensive plan, but the state does not require them to sell it.

- South Carolina. South Carolina car insurance companies aren’t allowed to charge a deductible for repairing or replacing a windshield or other safety glass, but it doesn’t guarantee zero-deductible for tempered glass.

All other states allow car insurance companies to charge deductibles for a windshield replacement. Regardless of your state, you’ll probably have a limit to how often you can file a claim for an auto glass repair or replacement.

What is full glass coverage?

All comprehensive car insurance plans will repair or replace your windshield or windows if they are damaged by weather, vandalism, theft, animal contact, fire, or any other covered event.

When you make a comprehensive claim for your glass, you’ll have to pay your deductible before your insurance kicks in. Most insurance companies subtract your deductible from repair costs and send you the difference, so you don’t have to make an actual payment.

Full glass coverage is an optional add-on for comprehensive insurance. If you live in a state where it’s available, full glass coverage prevents you from having to pay a deductible when you need to make a glass claim.

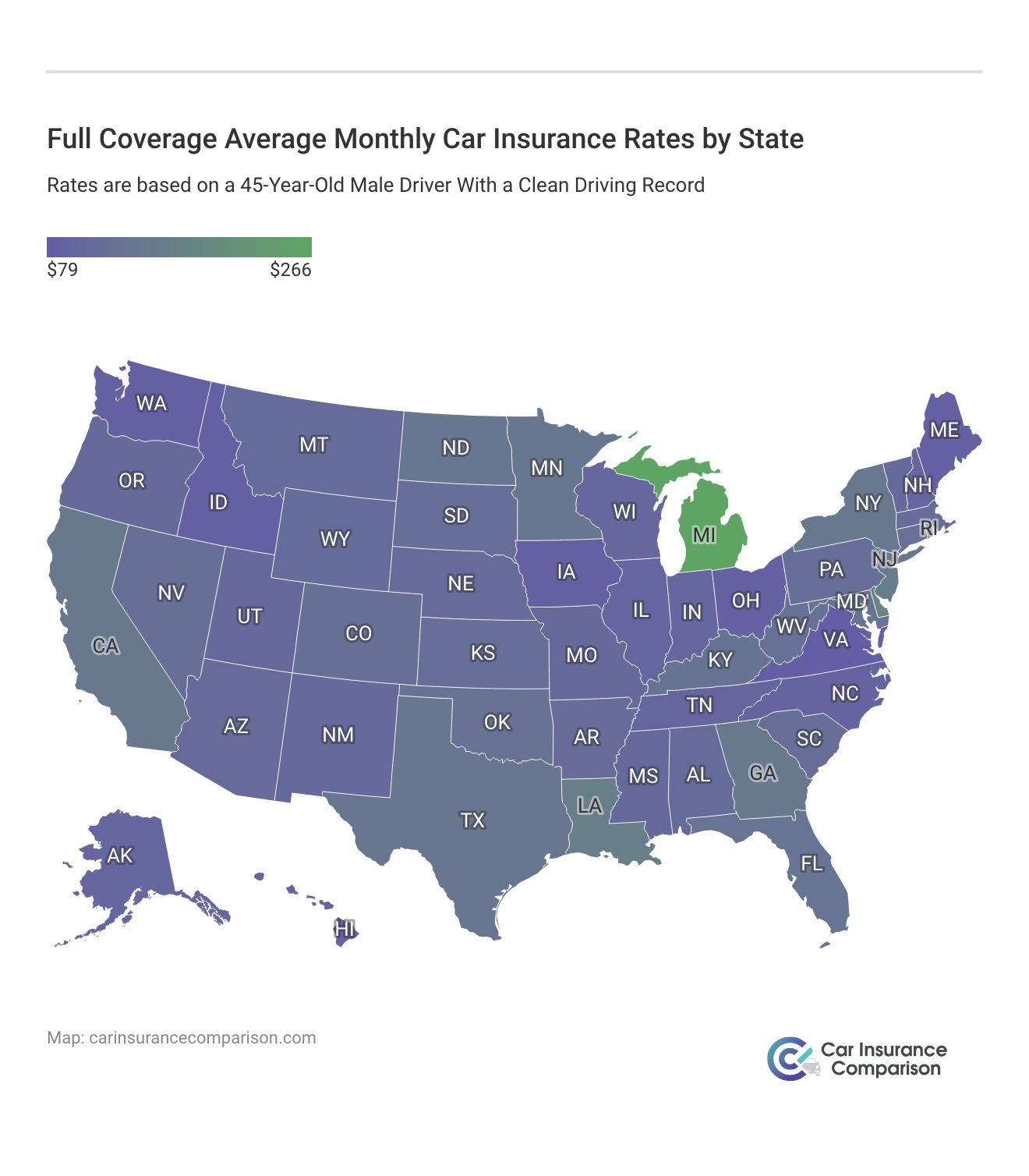

Here’s a look at how annual full coverage car insurance rates compare to minimum coverage rates for some of the top auto insurance companies in the U.S.

If you live in Kentucky or Arizona, there’s no need to worry about buying full glass coverage — insurance companies cannot charge you a deductible for replacing or repairing auto glass if you have comprehensive coverage.

Is full glass coverage worth it?

While you might think that paying for full glass coverage is a waste of money, it usually pays for itself after you make your first claim.

Confused about how a single claim might pay for your full glass coverage? The typical deductible for comprehensive insurance is between $250 and $500, which you need to pay before your policy pays for anything.

Full glass coverage usually costs $5 to $10 a month. Skipping the deductible on one glass claim makes up for several years of paying for full glass.

If you don’t have full glass coverage, it’s often cheaper to pay for your windshield repairs yourself. For example, if the cost to replace a windshield is $250 and your deductible is $500, there’s no point in filing a claim.

Having full glass coverage can save you a lot of money. It also makes it easier to replace a cracked or chipped windshield since you won’t have to pay out-of-pocket.

How do you find out if your insurance covers windshield damage?

A variety of insurance types cover windshield damage, and the one that will help you depends on how your glass was damaged. These include:

- Comprehensive. Comprehensive car insurance covers damage from things like animal contact, road debris, or weather. Full glass is an add-on specifically for comprehensive insurance.

- Collision. If your windshield was damaged in an accident you caused, collision insurance will pay for it.

- Uninsured/underinsured motorist. Although most states require drivers to carry insurance, not all do. If a driver with inadequate insurance damages your windshield, uninsured motorist insurance will cover it.

The easiest way to see what your plan covers is to check your policy online, where your coverages will be listed. You can also speak with an insurance representative to find out exactly how much windshield coverage you have.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Should you file a claim to get your windshield repaired?

Drivers with full glass coverage — or those who live in Kentucky or Arizona and have comprehensive insurance — should feel free to make glass claims as needed. However, you might want to check with an insurance representative to see how filing a car insurance claim will affect your rates.

If you don’t have full glass coverage, it might be better to skip using your insurance. As explained above, comprehensive deductibles often cost more than a windshield repair or replacement. When an auto glass shop is going to charge you less than your deductible, there’s no reason to make a claim.

Will a windshield claim raise your rates?

Typically speaking, insurance companies do not raise rates for small comprehensive claims like windshield repairs. Windshields and other glass are easily damaged through no fault of your own and usually don’t cost much to fix.

However, all insurance companies are different, and yours might have unique rules about what increases your rates. If you’re unsure how a glass claim might affect your rates, you should speak with an insurance representative before filing your claim.

Find the Right Full Glass Coverage Today

As long as you live in a state that has it, full glass coverage can save you time and money when you need windshield repairs. You’ll have to pay a little extra for full glass coverage, but having it can save you hundreds of dollars.

Although full glass coverage is generally affordable, you’ll need comprehensive insurance to qualify. You can find the best price for comprehensive insurance by comparing quotes with multiple companies.

Case Studies: What states have full glass coverage?

Case Study 1: Full Glass Coverage in Kentucky

Sarah, a resident of Kentucky, was relieved to have full glass coverage included in her comprehensive insurance policy. When a rock hit her windshield and caused a crack, she was able to get it repaired without having to pay a deductible. This case study highlights the benefit of living in a state that offers full glass coverage as part of the insurance policy.

Case Study 2: Zero-Deductible Glass Coverage in Arizona

Michael, a driver in Arizona, also enjoyed the advantages of zero-deductible glass coverage. When his car’s rear window was shattered due to severe weather, he was able to get it replaced without any out-of-pocket expenses. This case study demonstrates the benefit of living in a state that requires insurance companies to offer zero deductibles for glass repairs.

Case Study 3: Adding Full Glass Coverage as an Add-On

Emily, a driver in Connecticut, chose to add full glass coverage as an optional add-on to her comprehensive insurance policy. When a stray baseball cracked her windshield, she was relieved that she didn’t have to pay a deductible for the repair. This case study showcases the option available in certain states to purchase full glass coverage as an add-on to the insurance policy.:

Frequently Asked Questions

How much is a comprehensive deductible for a windshield repair?

The typical deductible for comprehensive is anywhere from $250 to $2,000 and applies to any claim, no matter how small it is. You can skip your deductible for windshield repairs if you have full glass coverage or live in a state with zero deductibles.

What is covered by comprehensive insurance?

Comprehensive covers damage that happens outside of car accidents. This usually includes fire, weather, vandalism, theft, or animal contact. If your windshield is damaged in a covered event, your comprehensive insurance will replace or repair it.

What is the $200 cash back windshield replacement in Florida?

Many glass repair companies offer a cash incentive if you use your insurance to get your windshield replaced with them. Usually, auto glass shops offer you money because they can repair your damaged windshield later and resell it. If you take advantage of such an offer, Florida and your insurance are not paying for it — the money comes strictly from the repair shop.

Will a windshield claim raise your rates?

Generally, insurance companies do not raise rates for small comprehensive claims like windshield repairs. Windshields and other glass items can be easily damaged through no fault of your own and are typically inexpensive to fix. However, it’s recommended to check with your insurance representative to understand how a glass claim might impact your rates, as policies may vary.

How much does full glass coverage typically cost?

The cost of full glass coverage can vary depending on the insurance company and your location. On average, it ranges from $5 to $10 per month as an add-on to your comprehensive insurance policy.

Does full glass coverage have any limitations on the number of claims I can make?

Yes, most insurance policies have limitations on the frequency of glass claims. It’s important to review your policy or speak with your insurance provider to understand any specific limitations or restrictions.

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.