Best Car Insurance for Drivers Without a College Degree in 2024 (Top 10 Companies)

Find the best car insurance for drivers without a college degree with Progressive, State Farm, and Farmers. Explore their coverage, rates, and defensive driving discounts up to 10%. This guide provides insights into key rate-influencing factors to help you make informed decisions for optimal protection.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Sr. Director of Content

Sara Routhier, Managing Editor and Outreach Director, has professional experience as an educator, SEO specialist, and content marketer. She has over five years of experience in the insurance industry. As a researcher, data nerd, writer, and editor she strives to curate educational, enlightening articles that provide you with the must-know facts and best-kept secrets within the overwhelming world o...

Sara Routhier

Licensed Insurance Agent & Agency Owner

Tracey L. Wells is a licensed insurance agent and Farmers insurance agency owner with 23 years of experience. He is proud to be a local Farmers agent serving Grayson, Georgia and surrounding areas. With experience as both an underwriter and agent, he provides his customers with insight that others agents may not have. His agency offers all lines of insurance including home, life, auto, RV, busi...

Tracey L. Wells

Updated May 2024

13,283 reviews

13,283 reviewsCompany Facts

Full Coverage for Drivers Without a College Degree

A.M. Best Rating

Complaint Level

13,283 reviews

13,283 reviews 18,155 reviews

18,155 reviewsCompany Facts

Full Coverage for Drivers Without a College Degree

A.M. Best Rating

Complaint Level

Pros & Cons

18,155 reviews

18,155 reviews 3,072 reviews

3,072 reviewsCompany Facts

Full Coverage for Drivers Without a College Degree

A.M. Best Rating

Complaint Level

Pros & Cons

3,072 reviews

3,072 reviewsThe reasoning behind this lies in the fact that statistical evidence proves that different personality traits required by various job types have an effect on how well a person drives.

Our Top 10 Best Companies: Best Car Insurance for Drivers Without a College Degree

| Company | Rank | Defensive Driving Discount | Multi-Policy Discount | Best For | Jump to Pros/Cons |

|---|---|---|---|---|---|

| #1 | 10% | 15% | Budgeting Tools | Progressive | |

| #2 | 8% | 17% | Customer Service | State Farm | |

| #3 | 10% | 15% | Policy Options | Farmers | |

| #4 | 10% | 25% | Customizable Policies | Geico | |

| #5 | 8% | 15% | Vanishing Deductible | Nationwide |

| #6 | 10% | 20% | Safe-Driving Discounts | Allstate | |

| #7 | 8% | 12% | 24/7 Support | Liberty Mutual |

| #8 | 10% | 20% | Multi-Policy Discounts | Travelers | |

| #9 | 8% | 15% | Bundle Discounts | American Family | |

| #10 | 10% | 15% | Online Convenience | Esurance |

The average annual premium for those in this category was just under $1,182 per year.

This assumes an average car, a good driving history, and a reasonable daily commute. (For more comparison, read our article called “Compare Monthly Car Insurance: Rates, Discounts, & Requirements“).

Your ZIP code is all that’s preventing you from seeing great online car insurance rates — enter it for free below now.

- Progressive stands out in offering the best rates

- Comprehensive coverage for damages from non-collision incidents

- Roadside assistance, rental car reimbursement, and gap insurance

#1 – Progressive: Top Overall Pick

Pros

- Affordability: Progressive offers competitive rates, making it budget-friendly. Learn more about their rates in our Progressive car insurance review.

- Comprehensive Coverage: Progressive provides balanced protection with various coverage options.

- Positive Customer Reviews: Low complaint levels indicate high customer satisfaction..

Cons

- Slightly Higher Rates: Rates may be slightly higher compared to some competitors.

- Limited Policy Options: Some users might find that policy options are not as extensive.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#2 – State Farm: Best for Customer Service

Pros

- Excellent Customer Service: State Farm is known for exceptional customer service.

- Competitive Rates: State Farm car insurance offers affordable rates, especially for drivers without a college degree.

- High Multi-Policy Discount: Up to 17% off for bundling insurance policies.

Cons

- Rates for Full Coverage: Rates for full coverage might be higher compared to some competitors.

- Online Presence: Online tools and services may not be as advanced as some other companies.

#3 – Farmers: Best for Policy Options

Pros

- Extensive Coverage Options: Farmers offers a wide range of coverage options.

- Low Complaint Level: Maintains a low complaint level, indicating high customer satisfaction.

- Defensive Driving Discount: Up to 10% discount for defensive driving.

Cons

- Higher Rates: Farmers’ rates, especially for full coverage, are slightly higher compared to some competitors.

- Lack of Rate Transparency: As mentioned in our Farmers car insurance review, some customers may find that Farmers lacks transparency in communicating rate increases.

#4 – Geico: Best for Customizable Policies

Pros

- Affordability: Geico car insurance is known for competitive rates, making it an attractive option for budget-conscious drivers.

- Customizable Policies: Geico allows customers to customize their policies, tailoring coverage to individual needs.

- Defensive Driving Discount: Up to 10% discount for defensive driving.

Cons

- Customer Service: Some customers have reported mixed experiences with Geico’s customer service.

- Limited Local Agents: Geico primarily operates online, and customers seeking face-to-face interactions may find this limitation.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#5 – Nationwide: Best for Vanishing Deductible

Pros

- Vanishing Deductible: Nationwide’s vanishing deductible feature rewards safe driving behavior over time.

- Multi-Policy Discount: Up to 15% off for bundling multiple policies.

- Defensive Driving Discount: Up to 8% discount for defensive driving.

Cons

- Higher Rates: Nationwide’s rates, especially for full coverage, may be higher than some competitors.

- Limited Discounts: While offering some discounts, Nationwide may not have as many options as some other companies. Learn more about their discounts in our Nationwide car insurance discounts.

#6 – Allstate: Best for Safe-Driving Discounts

Pros

- Safe-Driving Discounts: Allstate offers up to 20% off for safe-driving discounts, rewarding good driving habits.

- Bundle Discounts: Allstate provides up to 20% off for bundling multiple policies.

- Defensive Driving Discount: Up to 10% discount for defensive driving.

Cons

- Higher Rates: Allstate car insurance‘s rates, especially for full coverage, may be on the higher side.

- Limited Local Agents: Some customers might prefer more local agent support, which Allstate may lack.

#7 – Liberty Mutual: Best for 24/7 Support

Pros

- Multi-Policy Discounts: Liberty Mutual offers up to 12% off for bundling multiple policies.

- 24/7 Support: As mentioned in our Liberty Mutual car insurance review, they provide 24/7 customer support ensures assistance is available at any time.

- Defensive Driving Discount: Up to 8% discount for completing defensive driving courses.

Cons

- Slightly Limited Discounts: Liberty Mutual may have fewer discount options compared to some competitors.

- Rates: Some customers may find Liberty Mutual’s rates to be relatively higher.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#8 – Travelers: Best for Multi-Policy Discounts

Pros

- Multi-Policy Discounts: Travelers offers up to 20% off for bundling insurance policies.

- Defensive Driving Discount: Up to 10% discount for completing defensive driving courses.

- Customizable Policies: Travelers allows customers to tailor their policies according to individual needs.

Cons

- Customer Service: Some customers may have mixed experiences with Travelers’ customer service.

- Limited Local Presence: Travelers car insurance may have a limited local agent presence compared to other companies.

#9 – American Family: Best for Bundle Discounts

Pros

- Bundle Discounts: American Family offers up to 15% off for bundling multiple policies.

- Defensive Driving Discount: Up to 8% discount for completing defensive driving courses.

- Multi-Policy Discounts: American Family provides savings for combining various insurance policies.

Cons

- Rates: Some customers may find American Family’s rates to be slightly higher. Learn more in our American Family car insurance review.

- Limited Availability: American Family may have limited availability in certain regions.

#10 – Esurance: Best for Online Convenience

Pros

- Online Convenience: Esurance excels in providing online convenience for policy management. (Read more: How do you get an Esurance car insurance quote?)

- Defensive Driving Discount: Up to 10% discount for completing defensive driving courses.

- Multi-Policy Discounts: Esurance offers savings for bundling multiple insurance policies.

Cons

- Customer Service: Some customers may experience challenges with Esurance’s customer service.

- Limited Local Agents: Esurance primarily operates online, lacking face-to-face interactions for those who prefer them.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

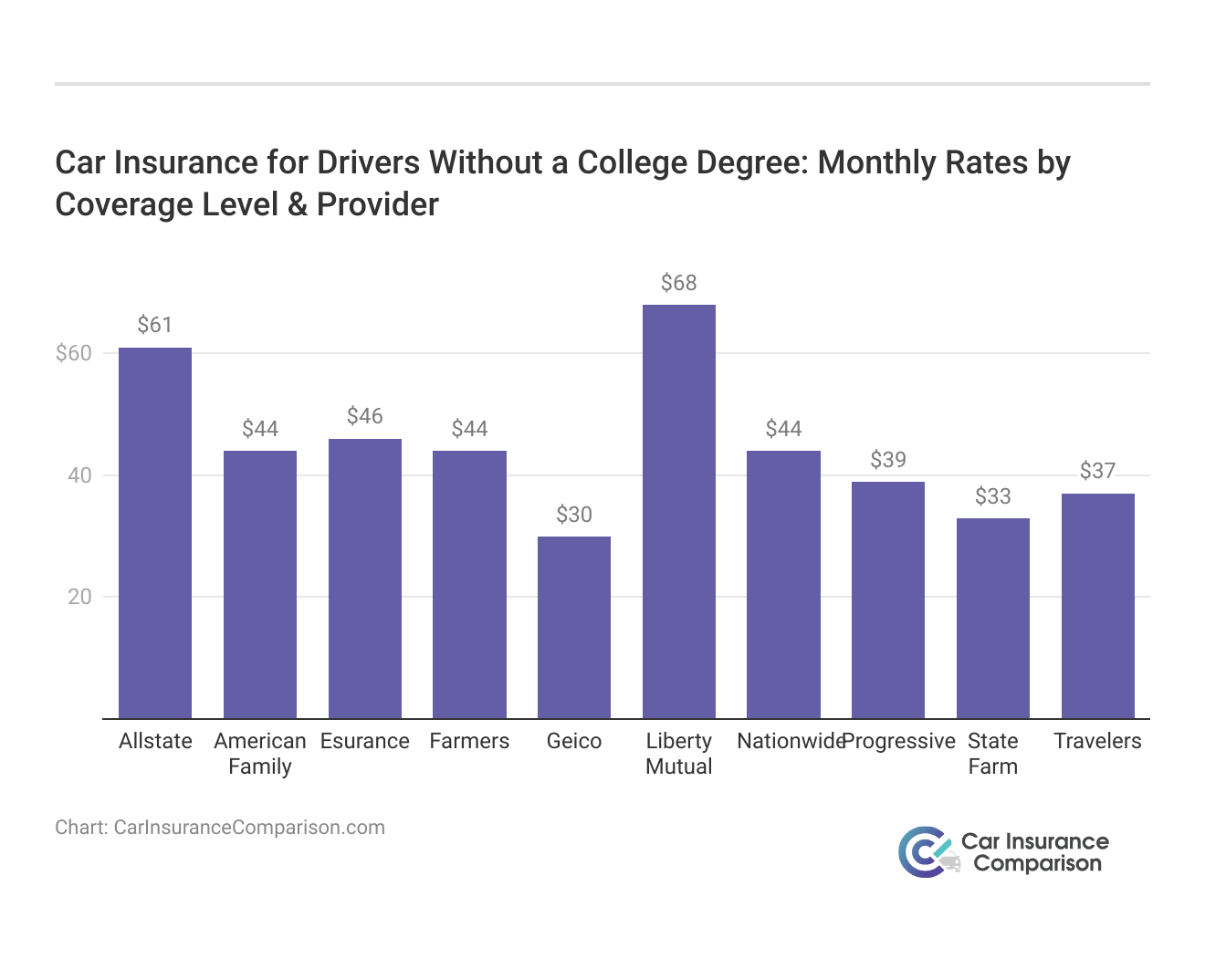

Comparing Car Insurance Rates With the Industry Leaders for Drivers Without a College Degree

For individuals without a college degree, finding affordable car insurance becomes a critical aspect of financial planning. A careful comparison of rates among the industry leaders reveals insights into the top choices and the reasons behind their prominence.

Car Insurance for Drivers Without a College Degree: Monthly Rates by Coverage Level & Provider

| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| Allstate | $61 | $160 |

| American Family | $44 | $117 |

| Esurance | $46 | $114 |

| Farmers | $44 | $139 |

| Geico | $30 | $80 |

| Liberty Mutual | $68 | $174 |

| Nationwide | $44 | $115 |

| Progressive | $39 | $105 |

| State Farm | $33 | $86 |

| Travelers | $37 | $99 |

Progressive emerges as a standout choice, offering a compelling blend of comprehensive coverage and affordability. With rates of $105 for full coverage and $39 for minimum coverage, Progressive caters to individuals seeking balanced protection without breaking the bank. Following closely is State Farm, known for its competitive rates—$86 for full coverage and $33 for minimum coverage.

Read more: Progressive vs. Farmers Car Insurance Comparison

State Farm’s affordability, especially for drivers without a college degree, makes it a reliable option. Farmers, though slightly higher in cost at $139 for full coverage and $44 for minimum coverage, compensates with extensive coverage options, making it an attractive choice for those prioritizing comprehensive protection.

Deciding between savings or quality insurance? Treat yourself—Farmers customers can choose both. #FarmersInsurance pic.twitter.com/4wZbMSuuq1

— Farmers Insurance (@WeAreFarmers) April 16, 2024

Ultimately, the decision among these industry leaders depends on individual preferences, coverage needs, and budget considerations.

Expanding the Scope for Drivers Without a College Degree

There are so many different factors in this category that we are not surprised it falls closer to the middle than one of the edges. Think of it this way: Having no college degree is, in itself, not even a job.

So right away, including this category among 59 other job categories would seem to put it at either end of the spectrum. But that’s not the case. One possible reason for this is the incredibly broad scope of the classification.

Think of it another way: In the list of 60 specific job categories we found in the survey, you could realistically have workers in all those categories that have no college degree. It’s unlikely, but still possible. (Read more: Can I get car insurance without having a job?)

So in this category of not having a college degree, you have the broadest spectrum of individual drivers possible.

With the number of people without degrees growing every year, the category simply gets bigger and bigger in terms of sheer volume.

Potential Considerations for Drivers Without a College Degree

Based on the vast number of different jobs that could fall under this category, we can only guess at the possible considerations insurance companies apply to this group of people.

It is possible that their formulas consider people without degrees to be less likely to drive safely and legally.

If so, this would be based on a broad assumption that going to college and earning a degree somehow demonstrates one’s level of responsibility. Sadly, that’s not a true indicator.

It could also be a reflection of the fact that people without degrees tend to have lower paying jobs than their degreed counterparts.

With lower-paying jobs, there is the possibility that drivers will be more apt to make claims when they really don’t have to, and we know that the more claims made among any group of individuals, the higher their insurance rates will be.

Read more: How Occupation Affects Car Insurance Rates

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Navigating Insurance Rates and Your Future

If you are a young person beginning the process of considering college, don’t put too much weight on your car insurance premiums in determining your future career choice.

The difference between the highest and the lowest in our survey was only a matter of a couple of hundred dollars — certainly not enough money to suggest you pursue something you’re not interested in just to save a little money on your car insurance.

You’re far better off doing what you love and paying your premiums accordingly.

If you’ve already graduated and you’re now looking for a job, you also shouldn’t put too much stock in these rankings. Within the group of jobs ranked 30 through 35, the difference in rates went up by only a few dollars with each successive rank.

The truth is, these job classifications that land somewhere in the middle of the survey are going to consist of workers who are pretty average and stable.

Choose a job based on your earnest desire of what you want in your life, not how much you pay for insurance.

Finally, when all is said and done, the single biggest factor in determining how much you will pay for car insurance is how safely you drive as an individual.

Progressive stands out as the top choice for drivers without a college degree, offering a compelling blend of comprehensive coverage and affordability.

Dani Best Licensed Insurance Producer

Regardless of any other person in your job category, your rates will be most heavily influenced by your accidents, violations, and any other claims of loss.

If you drive legally and responsibly, then you will be given the lowest rates possible. And even if you’re not getting the rates you think you should, you always have the freedom to shop around for something better.

Case Studies: Tailoring Car Insurance for Drivers Without a College Degree

In this section, we present three case studies highlighting how car insurance can be tailored to meet the specific needs of drivers without a college degree. From budget-conscious commuters to family-oriented households and comprehensive coverage seekers, these case studies shed light on the diverse options available to this demographic.

- Case Study #1 – The Budget-Conscious Commuter: Meet Alex, a 28-year-old without a college degree working in a city where commuting is a daily challenge. Alex needs reliable car insurance that doesn’t break the bank. Progressive, known for its budgeting tools, becomes the top choice. With competitive rates and a defensive driving discount, Alex can navigate the city streets with peace of mind.

- Case Study #2– The Family-Oriented Household: The Johnsons, a family without college degrees, prioritize family-oriented coverage. As mentioned in our State Farm car insurance review, they stand out for them due to its exceptional customer service and competitive rates, especially tailored for drivers without a college degree. With multiple vehicles to insure, the Johnsons benefit from State Farm’s multi-policy discounts while enjoying personalized and reliable service.

- Case Study #3 – The Comprehensive Coverage Seeker: Sarah, a tech-savvy professional without a college degree, values extensive coverage options. Farmers, known for offering a wide range of coverage options, becomes Sarah’s go-to choice. With a focus on peace of mind, Farmers provides Sarah with comprehensive coverage and a user-friendly online platform for policy management.

By understanding their unique requirements and exploring available discounts and coverage options, drivers without a college degree can make informed decisions to safeguard themselves and their vehicles on the road. With the right insurance partner, peace of mind and financial security become attainable goals for every driver, regardless of educational background.

Use our free search tool to find the best car insurance rates for workers in your job classification, by entering your ZIP code below.

Frequently Asked Questions

How does having no college degree impact car insurance rates?

Insurance companies may consider various factors, and while not having a college degree is just one of them, it may influence rates based on statistical assumptions about driving habits and financial stability. Rates are also affected by other key factors like driving history and coverage needs.

Read more: How much do school grades affect car insurance rates?

What are the advantages of car insurance tailored for drivers without a college degree?

Tailored insurance for this demographic often takes into account unique needs and challenges. Companies like Progressive, State Farm, and Farmers offer competitive rates, discounts, and coverage options suitable for individuals without a college degree, providing a balance of affordability and protection.

See how much you’ll pay for car insurance by entering your ZIP code below into our free comparison tool.

Are there specific discounts for drivers without a college degree?

Yes, many insurance providers offer discounts such as defensive driving discounts, multi-policy discounts, and more. Progressive, for example, provides budgeting tools, and State Farm emphasizes customer service, both beneficial for drivers without a college degree.

How do I choose the right car insurance company without a college degree?

Consider factors like affordability, coverage options, and customer satisfaction. Companies like Farmers, with extensive coverage options, and State Farm, known for competitive rates, make them suitable options for drivers without a college degree.

Can I still get affordable car insurance without a college degree?

Absolutely. Your insurance rates are influenced by various factors, and companies like Geico, Nationwide, and Esurance offer affordable options for drivers without a college degree. It’s crucial to shop around, compare quotes, and find a company that aligns with your specific needs and budget.

Read more: How do you get competitive quotes for car insurance?

Do insurance companies consider other factors besides a college degree when determining car insurance rates for individuals without one?

Yes, insurance companies take into account various factors besides educational attainment when calculating car insurance rates. These factors may include driving history, age, gender, location, type of vehicle, annual mileage, and even credit score. While not having a college degree may be one factor, insurers assess multiple variables to determine individualized rates.

What steps can drivers without a college degree take to lower their car insurance premiums?

Drivers without a college degree can take several steps to potentially lower their car insurance premiums. These include maintaining a clean driving record, completing defensive driving courses, bundling policies (such as auto and home insurance) with the same insurer, opting for higher deductibles, and exploring available discounts offered by insurance companies.

Are there specific insurance companies that specialize in providing affordable coverage for drivers without a college degree?

While many insurance companies offer coverage to drivers without a college degree, some may specialize in providing affordable options tailored to this demographic. Progressive, State Farm, Farmers, Geico, Nationwide, and Esurance are among the insurers known for offering competitive rates and discounts suitable for individuals without a college degree.

Ready to find affordable car insurance? Get started today by entering your ZIP code below into our free comparison tool.

Are there any specific resources or educational programs available to help drivers without a college degree better understand car insurance and coverage options?

Some insurance companies offer resources or educational programs aimed at helping drivers without a college degree better understand car insurance and coverage options. These resources may include online articles, FAQs, webinars, or in-person seminars designed to provide information about insurance terminology, policy types, coverage limits, and ways to save on premiums. Drivers can inquire with their insurance provider or search online for available educational resources.

Read more: Understanding Your Car Insurance Policy (Complete Guide)

How does the location of residence impact car insurance rates for individuals without a college degree?

The location of residence can significantly influence car insurance rates for individuals without a college degree. Urban areas or regions with higher rates of accidents, theft, or vandalism may result in higher premiums compared to rural or suburban areas. Additionally, state-specific regulations and average claim costs can also impact insurance rates.

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.