Compare Kentucky Car Insurance Rates [2026]

Drivers wanting cheaper rates will need to compare Kentucky car insurance rates, as Kentucky car insurance costs more than the national average. A minimum liability insurance policy in Kentucky costs an average of $55/mo, while a full coverage insurance policy costs an average of $168/mo.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Former Licensed Insurance Producer

Laura Berry has experience as a licensed producer selling life, health, and property insurance coverage for both Allstate and State Farm. She has dedicated many hours to helping her clients understand the insurance marketplace so they could find the best car, home, and life insurance products for their circumstances. While she currently helps businesses take advantage of the federal R&D tax...

Laura Berry

Licensed Insurance Agent

Brandon Frady has been a licensed insurance agent and insurance office manager since 2018. He has experience in ventures from retail to finance, working positions from cashier to management, but it wasn’t until Brandon started working in the insurance industry that he truly felt at home in his career. In his day-to-day interactions, he aims to live out his business philosophy in how he treats hi...

Brandon Frady

Updated April 2024

- Kentucky drivers need 25/50/25 of liability car insurance

- Full coverage Kentucky car insurance costs an average of $168 per month

- Kentucky’s car insurance rates are above the national average

Because the cost of car insurance in Kentucky is higher than the national average, Kentucky drivers will benefit from learning how to compare Kentucky car insurance rates and coverages to find the best deal. If you aren’t sure where to start when learning to compare cheap car insurance in Kentucky, our guide goes over everything you need to know about Kentucky car insurance.

Then, once you have learned about all the important Kentucky car insurance laws, coverages, and more, take a look at our free quote comparison tool to get started on finding affordable Kentucky car insurance.

Kentucky Car Insurance Coverages

Are you tired of paying an insurance company without understanding why? We’ll show you how that money for your Kentucky auto insurance is used. Most of it is used for good, but unfortunately, some of it has to go to preventable problems, like fraud.

We’ll dive right in and show you exactly what coverage is required in Kentucky.

Kentucky Minimum Car Insurance Coverage

To drive in Kentucky, you must have coverage at these levels: 25/50/25. To spell it out:

- $25,000 – Bodily injury liability coverage per person

- $50,000 – Total bodily injury liability coverage per accident

- $25,000 – Property damage liability coverage

- $10,000Â – Personal Injury Protection (PIP)

Alternatively, Kentucky residents can opt for a single-limit insurance policy of $60,000.

- Car Insurance Rates in Kentucky

- Compare Somerset, KY Car Insurance Rates [2026]

- Compare Richmond, KY Car Insurance Rates [2026]

- Compare Prestonsburg, KY Car Insurance Rates [2026]

- Compare Pikeville, KY Car Insurance Rates [2026]

- Compare Oak Grove, KY Car Insurance Rates [2026]

- Compare Hodgenville, KY Car Insurance Rates [2026]

- Compare Hazard, KY Car Insurance Rates [2026]

- Compare Edgewood, KY Car Insurance Rates [2026]

- Compare Cave City, KY Car Insurance Rates [2026]

- Compare Campbellsville, KY Car Insurance Rates [2026]

- Compare Bowling Green, KY Car Insurance Rates [2026]

- Compare Beaver Dam, KY Car Insurance Rates [2026]

- Compare Arlington, KY Car Insurance Rates [2026]

Uninsured/underinsured motorist (UM/UIM) coverage is required at the level of $25,000 per person and $50,000 per accident but can be rejected in writing.

Notice that the minimum coverage required is for liability. The state-required liability coverage is known as basic coverage. If you cause an accident, your basic coverage will pay for the damage done to another party up to the limits of your policy.

If you want coverage for your own vehicle after you cause an accident or after storm damage, you’ll need to carry full coverage, which includes collision insurance and comprehensive car insurance.

Full coverage costs more than basic coverage, and it’s not worth the extra cost in all cases. If you’re leasing or financing a car, you’ll almost certainly be required to carry full coverage. If you own your car outright, you can decide what is best.

Typically, experts recommend that if the extra cost for full coverage is 10% or less annually of your vehicle’s value, it’s a good idea to carry it.

At a certain point, your vehicle loses so much value, that the increased cost for full coverage is a waste of money.

Because Kentucky is a no-fault insurance state, residents must carry personal injury protection (PIP) car insurance, which pays for each party’s own medical costs and a portion of lost wages. So, why carry bodily injury liability if each party pays for their own medical costs?

If the injuries are severe and cost more than the PIP coverage, the injured party can sue the at-fault driver, in which case bodily injury liability coverage would kick in.

The minimum coverage is required on all vehicles, even those driven seasonally. If you would like to avoid purchasing insurance year-round for a car you only drive in the summer, you’ll have to turn your plates in to the DMV before canceling insurance during the off-season.

If you don’t, you can expect penalties for not being insured.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Kentucky Car Insurance Rates as a Percentage of Income

The average percentage of income that a Kentucky resident pays for car insurance is shown next. Nationwide, the average is 2.4%, so you can see that Kentucky residents pay a bit over the national average.

| Type | Rates |

|---|---|

| Annual Full Coverage Average Premiums | $917.49 |

| Average Premiums | $76.46 |

| Annual Per Capita Disposable Personal Income | $33,237.00 |

| Monthly Per Capita Disposable Personal Income | $2,769.75 |

| Percentage of Income | 2.76% |

Kentucky Car Insurance Coverage

| Coverage Type | Kentucky Annual Average | Nationwide Annual Average |

|---|---|---|

| Liability | $529.21 | $538.73 |

| Collision | $267.91 | $322.61 |

| Comprehensive | $141.39 | $148.04 |

Additional Liability Car Insurance in Kentucky

If you cause a major accident resulting in a vehicle being declared a total loss and injuries to persons requiring extended hospitalization and rehabilitation, the minimum liability coverage levels required in Kentucky won’t be sufficient.

If you have assets or are planning for future assets that you would like to protect, please consider increasing your liability limits.

The minimum limits of personal injury protection required in Kentucky will pay 80% of your lost wages following an accident for a maximum of $200 per week.

You might consider higher limits for that as well, especially if you need to protect your income and you make considerably more than $200 a week.

One way to help you see how the insurance industry as a whole is doing is to check out loss ratios. The rates consumers pay in premiums compared to the amount that insurers pay in claims gives us the loss ratio.

Insurance providers need extra money for overhead, but a low loss ratio indicates the companies are spending too much money on overhead while too high a loss ratio suggests they may not be charging high enough premiums to stay solvent.

| Type of Insurance | Kentucky loss ratio | Countrywide average loss ratio |

|---|---|---|

| Uninsured/Underinsured Motorist Coverage | 71.27 | 67.33 |

| Personal Injury Protection | 75.04 | 69.41 |

The overall numbers for Uninsured/Underinsured Motorist Coverage and Personal Injury Protection in Kentucky are pretty healthy.

Having the added coverage for Uninsured/Underinsured motorists is one of the best supplemental protections to get. Other supplemental coverage types to consider are as follows:

- GAP insurance

- Personal Umbrella Policy (PUP)

- Rental Car Reimbursement coverage

- Emergency Roadside Assistance

- Mechanical Breakdown Insurance

- Non-owner Car Insurance

- Modified Car Insurance Coverage

- Classic Car Insurance

- Pay-as-you-drive or Usage-based Insurance

- Accident Forgiveness Car Insurance

Pay-as-you-drive coverage is becoming increasingly popular with companies such as Metromile. So far, such coverage is unavailable in Kentucky, but as its popularity grows, you might want to check back in a couple of years.

Drivers who put on less than 5,000 miles annually can save big with a pay-by-the-mile plan.

Usage-based coverage is a broader type of plan. Several companies offer plans with the option to install a telemetric device to monitor driving habits. Good driving habits will yield lower premiums.

Root Insurance only offers an app-based, driving-based plan. If you’re willing to let your driving be monitored, you may be able to find solid savings with usage-based plans. Consider each of these additional coverage options carefully when you’re shopping for an auto insurance policy.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Male Versus Female Car Rates in Kentucky

We gathered car insurance quotes for two hypothetical 25-year-olds. The two people we created had identical driving histories, education, and employment. The only difference between them was that one was male and the other female.

Like most places in the U.S., males end up paying slightly less for coverage. This discrepancy is based on the actuarial analysis done by insurance companies that place a slightly heavier risk on females.

With insurance, the more risk you present, the more money you have to pay. Check out the average rate from Geico and Progressive for a male and female 25-year-old driver below.

| Company | 25-Year-Old Male Monthly Premium | 25-Year-Old Female Monthly Premium |

|---|---|---|

| Geico | $55.49 | $63.63 |

| Progressive | $75.37 | $80.06 |

Curious what a similar study reveals for 55-year-olds? We’ll answer that next.

| Company | 55-Year-Old Male Monthly Premium | 55-Year-Old Female Monthly Premium |

|---|---|---|

| Geico | $158.15 | $186.67 |

| Progressive | $58.4 | $62.19 |

While these tables highlight the difference paid by men and women, please also compare the overall rates between Geico and Progressive. You can see how comparing quotes could save you money in your monthly premiums. A company with great rates for one person might not for another.

You have to compare for yourself.

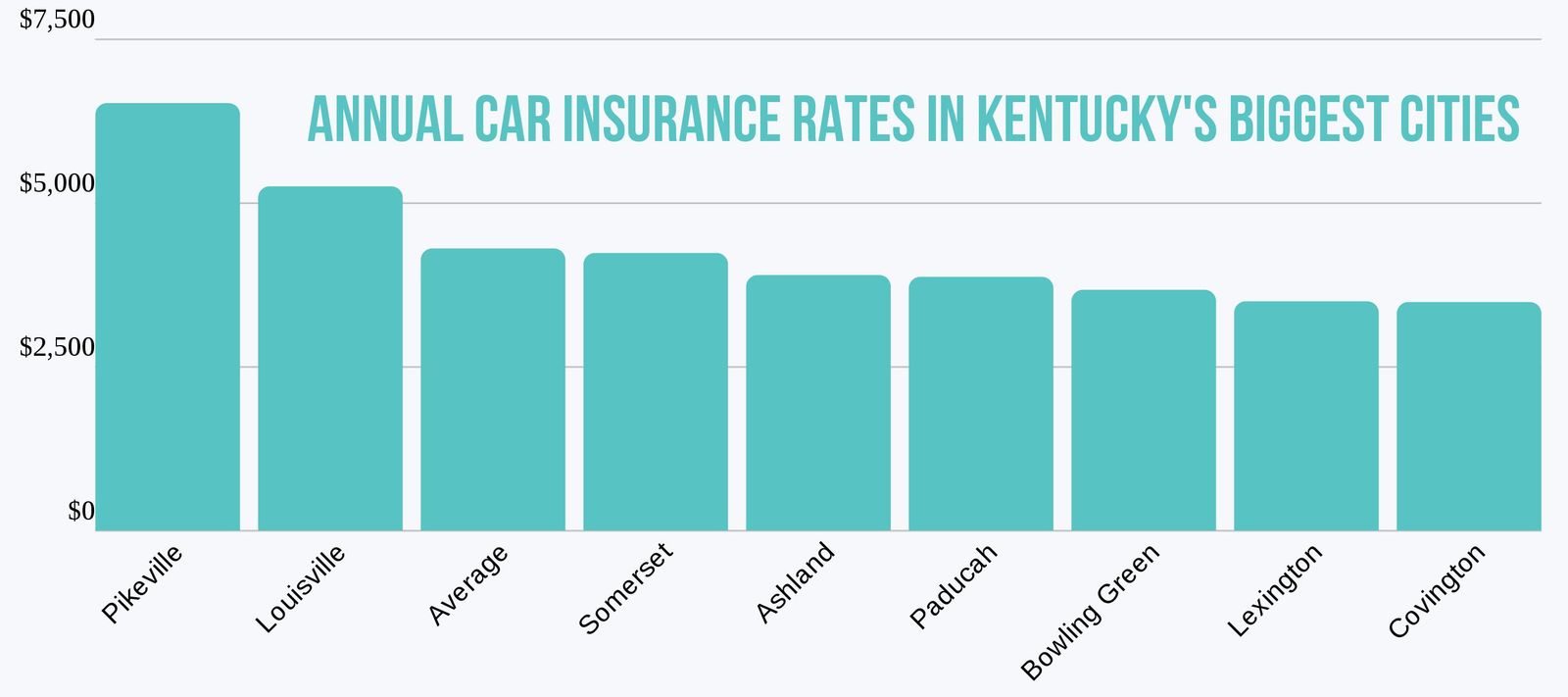

Cheapest Car Insurance in Kentucky by City

Compare Car Insurance Rates in Your City

Discover the variations in car insurance rates within Kentucky cities. Compare rates in Arlington, Edgewood, and Prestonsburg, KY, as well as other locations such as Beaver Dam, Hazard, Richmond, Bowling Green, Hodgenville, Somerset, Campbellsville, Oak Grove, Cave City, and Pikeville. Stay informed to make the best decision for your car insurance needs.

| Compare Car Insurance Rates in Your City | ||

|---|---|---|

| Arlington, KY | Edgewood, KY | Prestonsburg, KY |

| Beaver Dam, KY | Hazard, KY | Richmond, KY |

| Bowling Green, KY | Hodgenville, KY | Somerset, KY |

| Campbellsville, KY | Oak Grove, KY | |

| Cave City, KY | Pikeville, KY |

Best Kentucky Car Insurance Companies

There are a lot of companies to choose from when you’re shopping for auto insurance coverage. It can be hard to find the right one for you but don’t worry; we’ll help you know what steps to take to find the best company for your needs.

We’ll show you financial ratings, complaint information, and car insurance company customer satisfaction ratings information. Most importantly, we’ll show you which companies offer the best Kentucky car insurance.

Kentucky Car Insurance Companies’ Financial Ratings

First up, financial ratings. AM Best is an independent rating agency. They examine the financial standing of insurance companies and predict how they’ll do in the future. A good grade and a stable outlook indicate the company will remain solvent and able to pay claims.

| Company | Grade |

|---|---|

| Allstate Insurance Group | A+ |

| Geico | A++ |

| Kentucky Farm Bureau Group | A |

| Liberty Mutual Group | A |

| Nationwide Corp Group | A+ |

| Progressive Group | A+ |

| Shelter Insurance Group | A |

| State Auto Mutual Group | A- |

| State Farm Group | A++ |

| USAA Group | A++ |

All of the largest companies in Kentucky have good grades and stable outlooks, so if you go with one of these, the odds are favorable that your insurer will remain solvent and able to pay your claims.

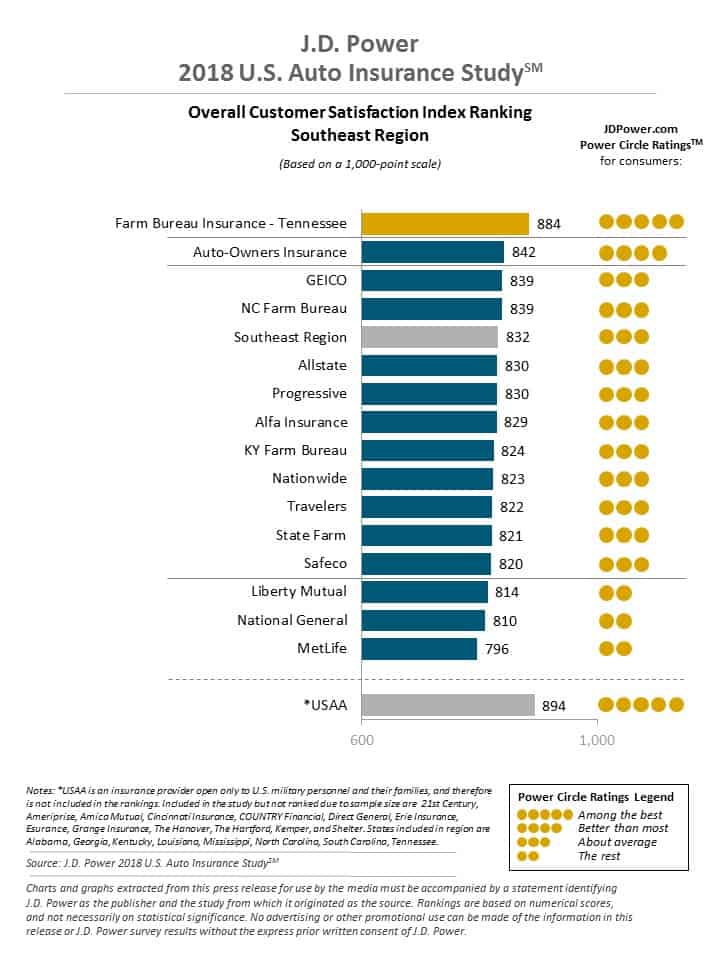

Kentucky Car Insurance Companies’ Consumer Ratings

What AM Best provides for financial ratings, J.D. Power provides for consumer ratings. Overall customer satisfaction will give you an idea of how your interaction with your insurance company will be.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

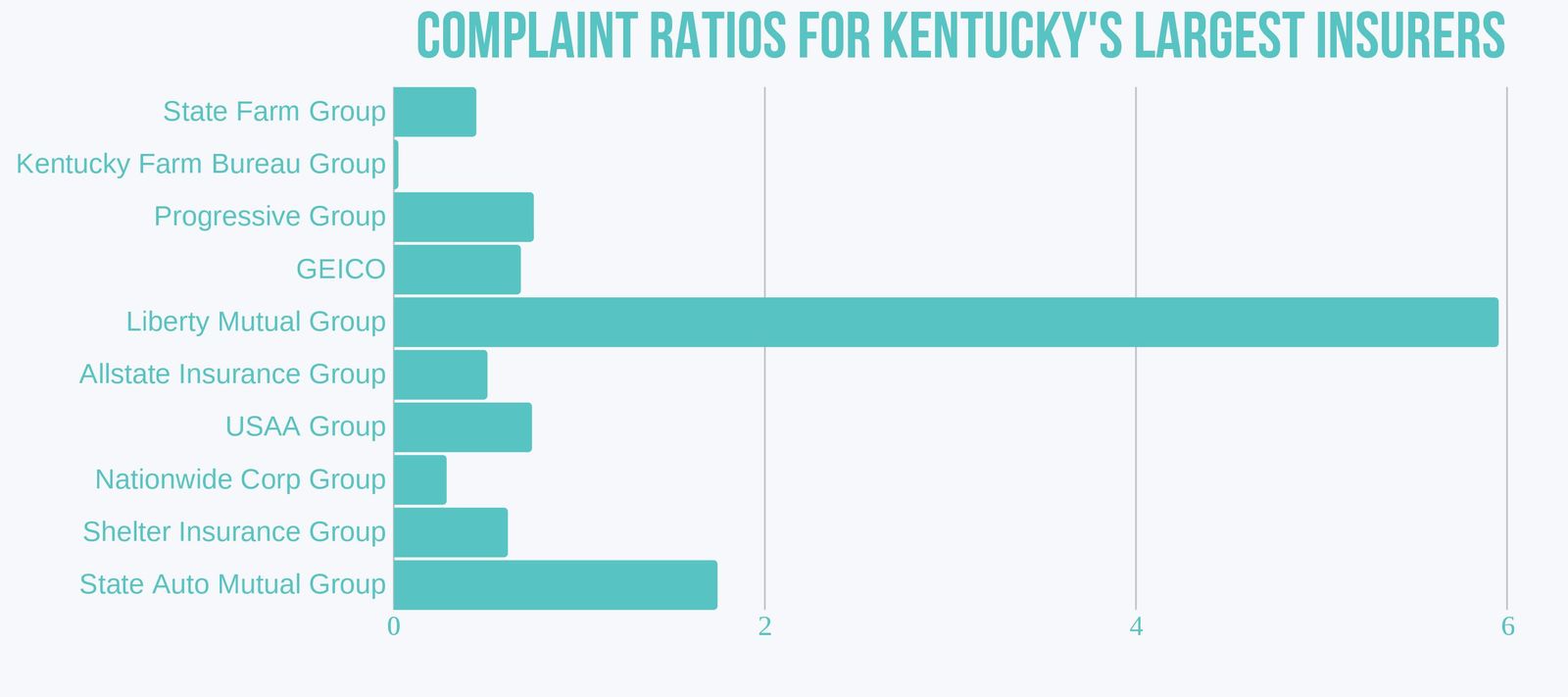

Kentucky Car Insurance Company Complaints

Kentucky Car Insurance Rates by Company

So, which auto insurance company has the lowest rates? The prices listed below are annual premiums for a 32-year-old married man.

| Cheapest Companies | Rates | Most Expensive Companies | Annual Rates |

|---|---|---|---|

| Privilege Underwriters Reciprocal Exchange | $672.13 | Nationwide General Insurance Company | $3,539.75 |

| American Select Insurance Company | $874.75 | Nationwide Property and Casualty Insurance Company | $3,522.50 |

| United Services Automobile Association | $912.75 | Trexis One Insurance Corporation | $3,431.50 |

| Erie Insurance Exchange | $946.88 | Encompass Insurance Company of America | $3,185.88 |

| USAA Casualty Insurance Company | $952.75 | Amica Property and Casualty Insurance Company | $3,178.38 |

| Auto-Owners Insurance Company | $958.63 | Permanent General Assurance Corporation of Ohio | $3,134.00 |

| Geico General Insurance Company | $1,081.50 | Trexis Insurance Corporation | $3,110.25 |

| Government Employees Insurance Company | $1,081.50 | Nationwide Mutual Insurance Company | $3,100.88 |

| State Farm Mutual Automobile Insurance Company | $1,104.50 | Encompass Indemnity Company | $3,068.00 |

| AIG Property Casualty Company | $1,133.38 | American Hallmark Insurance Company of Texas | $2,803.88 |

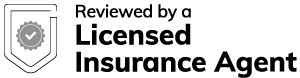

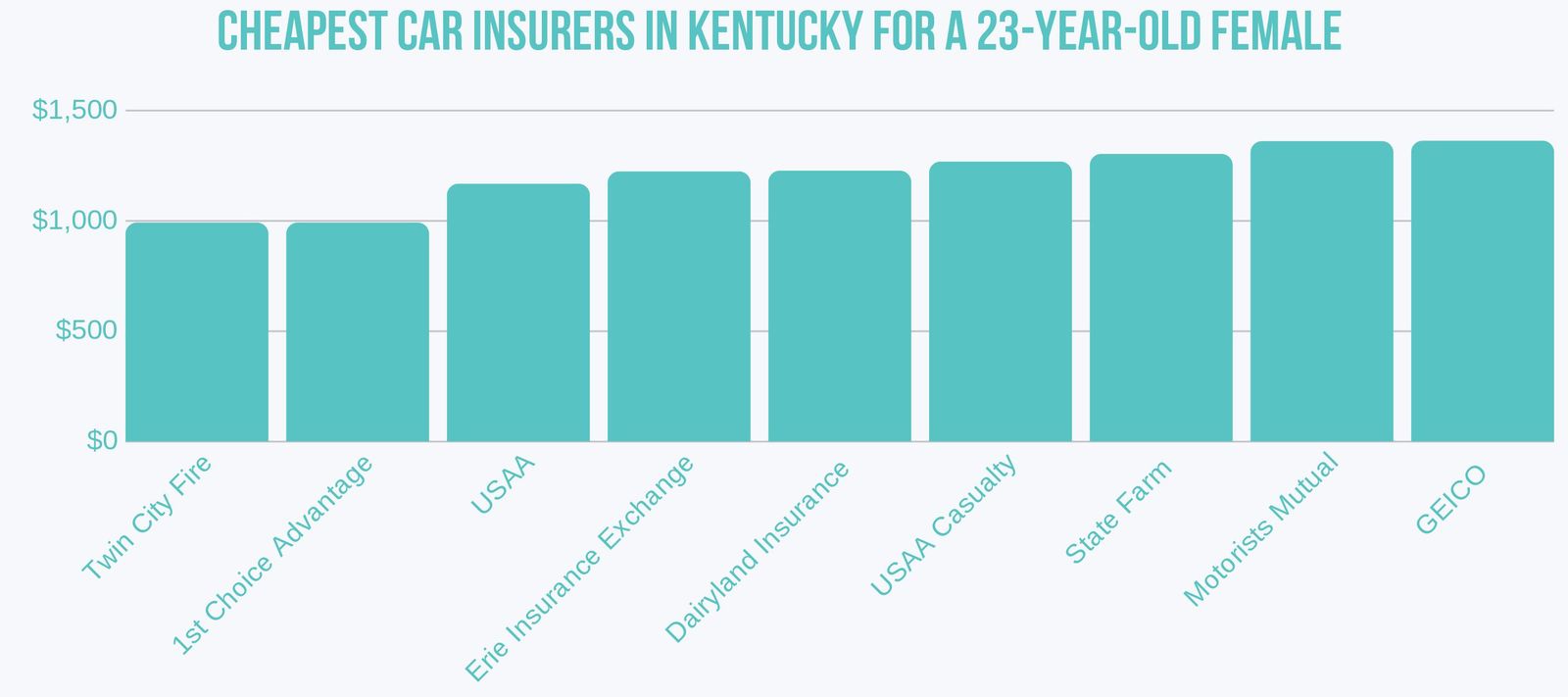

Here are the cheapest companies for a 23-year-old female:

Read more: Encompass Car Insurance Discounts

It’s plain to see that each example person gets different auto insurance quotes. The company with the lowest rate for a 23-year-old female isn’t always going to be best for a 45-year-old male.

So, whatever your age, marital status, and driving history, you need to compare personalized auto insurance rates to know which are the cheapest insurance companies for you.

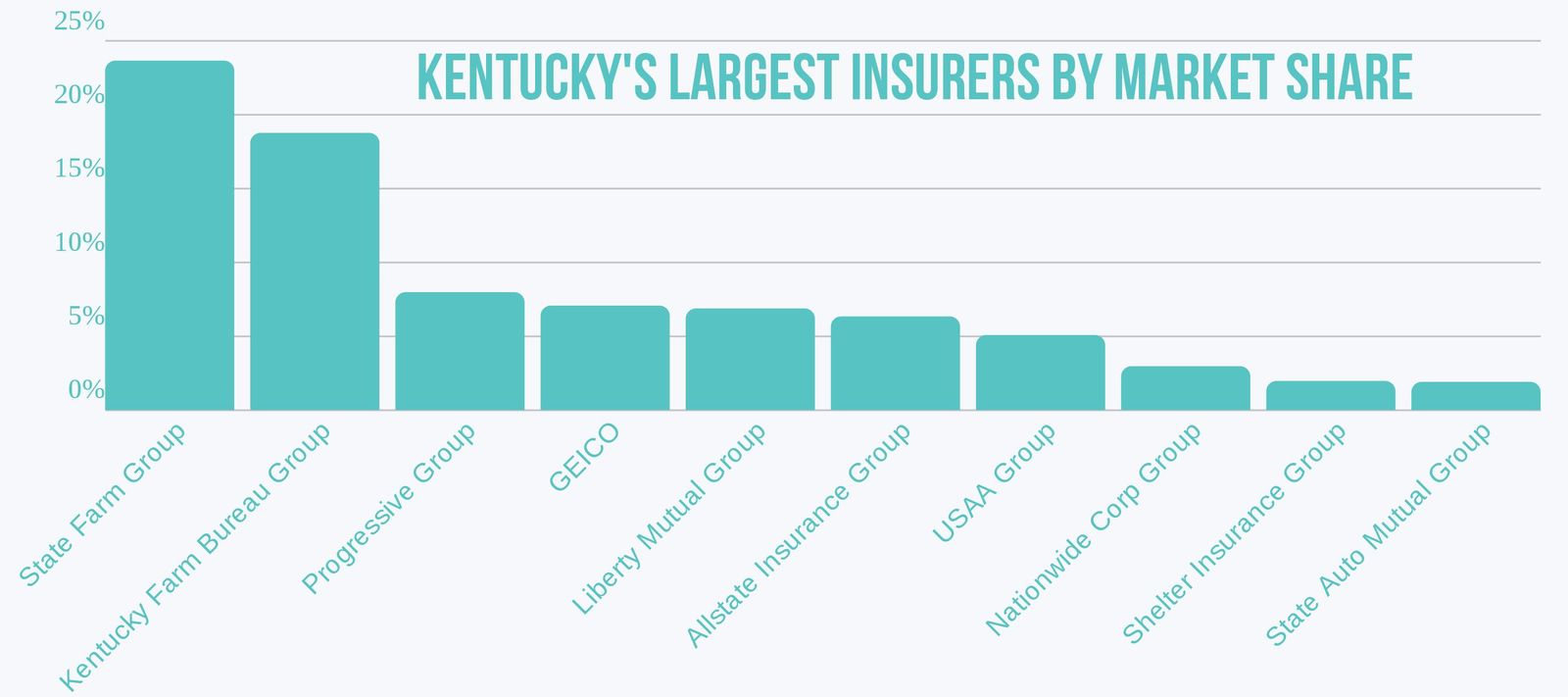

Largest Car Insurance Companies in Kentucky

| Company Name | Direct Premiums Written | Loss Ratio | Market Share |

|---|---|---|---|

| Allstate Insurance Group | $190,422 | 50.09% | 6.28% |

| Geico | $212,468 | 74.56% | 7.01% |

| Kentucky Farm Bureau Group | $566,603 | 75.94% | 18.70% |

| Liberty Mutual Group | $206,822 | 59.60% | 6.82% |

| Nationwide Corp Group | $88,331 | 57.90% | 2.91% |

| Progressive Group | $240,000 | 58.90% | 7.92% |

| Shelter Insurance Group | $57,753 | 63.96% | 1.91% |

| State Auto Mutual Group | $56,056 | 72.38% | 1.85% |

| State Farm Group | $714,964 | 65.70% | 23.59% |

| USAA Group | $152,259 | 76.42% | 5.02% |

| State Total | $3,030,463 | 67.00% | 100.00% |

There are 900 foreign insurance companies licensed in Kentucky and seven domestic insurers.

If you have a bad credit score or a bad driving record, make sure to look for auto insurance discounts. Most major insurers offer various discounts, including the safe driving discount, good student discount, multi-policy discount (for bundling a car insurance policy with homeowners insurance or renters insurance), automatic payments discount, and the defensive driving course discount.

When shopping around for the best insurance premiums, don’t forget to note which companies offer the best discounts.

Don’t let the slightly higher auto insurance costs prevent you from getting the necessary coverage. A minimum liability insurance policy may be cheapest, but it doesn’t offer a lot of coverage.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Kentucky State Car Insurance Laws

The type of driver you are has a big impact on your premiums. Knowing the laws can help you follow the laws. Have you looked at a codebook lately? There are a lot of laws! You won’t be able to memorize all of them, but we’ll point out some of the most important laws related to driving.

We’ll start by examining how Kentucky makes car insurance laws, and then we’ll get into the rules of the road.

Kentucky Insurance Laws

Insurers in Kentucky don’t have free reign to charge whatever they want. If the rate jumps up or down by 25% or more, prior approval must be given. Forms for prior approval must be filed no less than 60 days before delivery. The Commissioner may extend 30 days with notice.

Kentucky High-Risk Insurance

If you’ve had your license suspended for committing a major traffic offense, you may be considered a high-risk insurance customer. In many states, the insurance company for a high-risk driver is required to fulfill future financial responsibility requirements, such as filing an SR-22.

Kentucky does not require such a filing. The high-risk individual is still required to purchase insurance; they don’t have to file additional paperwork.

If you’re unable to find insurance from the general market, you may need to look into the Kentucky Automobile Insurance Plan (KAIP). This plan offers basic liability insurance to people denied coverage from the voluntary market.

Kentucky Windshield Coverage

Kentucky law requires insurance to provide deductible- and fee-free windshield replacement for customers carrying comprehensive coverage. It’s one of the few states that stipulates this. That’s great news if you have comprehensive coverage and need a new windshield.

Aftermarket parts may be used. If the consumer prefers factory parts, he or she may be required to pay the difference in cost.

Kentucky Car Insurance Fraud

Insurance fraud matters because it drives your premiums up. There’s soft fraud and hard fraud. Soft fraud is the “white lies” in insurance. If you’ve stretched the truth about your annual mileage or where you park your car, you’re guilty of soft fraud.

Hard fraud is deliberately lying to an insurance company by falsifying claims or staging accidents (like in the video above).

Committing insurance fraud in Kentucky is a crime, and the state has formed a fraud bureau whose sole job is to investigate insurance fraud. Also, insurers are mandated to have a fraud plan.

Kentucky’s Department of Insurance Fraud Division has been cracking down on those who commit fraud and ordered over $3 million in restitution in 2016. They publish monthly reports with the names of the offenders and the amount of money ordered for restitution.

Those who suspect insurance fraud are welcome to submit a report to the state.

Kentucky Car Insurance Statute of Limitations

After an accident, you have a specific amount of time to file a claim. Past that timeframe, you are totally out of luck. There’s no reason to wait to file a claim, do it right away.

- Property Damage – Two years

- Personal Injury – One year

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Kentucky Vehicle Licensing Laws

If you don’t have your vehicle registered and insured, you’re going to get into trouble. The state legislature has mandated a crackdown on those who drive uninsured.

Penalties for Driving Without Insurance in Kentucky

| Penalty | First Offense | Second Offense in Five Years |

|---|---|---|

| Fine | $500–$1000 | $1000–$2000 |

| Imprisonment | Up to 90 days (imprisonment may be in place of or in addition to the fine) | Up to 180 days (imprisonment may be in place of or in addition to the fine) |

| Registration | Registration will be revoked and license plates suspended for one year or until proof of insurance can be shown | Registration will be revoked and license plates suspended for one year or until proof of insurance can be shown |

Law enforcement may access information regarding your car’s insurance through AVIS. If you purchased insurance within the past 45 days and it’s not reflected in AVIS, you may show your insurance card (paper or electronic) as proof of insurance.

Vehicles registered in Kentucky must be insured by a company licensed to sell insurance in the state, even if they’re not being driven. The only exceptions to this are as follows:

- You may cancel insurance if you’ve already turned the vehicle’s plates into the County Clerk’s Office

- You may cancel insurance if you’re a college student and have insurance licensed in the state where you’re from or where you’re attending

- Active duty military may stay with insurance from another state

- People temporarily working out of state may purchase insurance in the state where they are working

Read More: What is the penalty for driving without insurance in Kentucky?

Kentucky Teen Driver Laws

| Restrictions | Permit | Intermediate License | Unrestricted License |

|---|---|---|---|

| Age | Minimum age 16 | After having a permit for six months (minimum age 16 years six months). If convicted of a traffic offense, the teen must begin the six-month period again | After holding an intermediate license for six months (minimum age 17) or age 18 |

| Hours of Driving | Minimum 60 hours, 10 of which must be at night | Must have completed the permit requirement | Must have completed the permit requirement |

| Time | Cannot drive between 12:00 a.m. and 6:00 a.m. without good cause | Cannot drive between 12:00 a.m. and 6:00 a.m. without good cause | No restrictions |

| Passenger | One unrelated passenger under 20 years old limit except when supervised by a driving training instructor | One unrelated passenger under 20 years old limit except when supervised by a driving training instructor | No restrictions |

Out-of-state permit holders must be 16 years old to drive in Kentucky.

Kentucky has a zero-tolerance law for alcohol and drivers under 21. Drivers under 21 may not drive with a blood alcohol content at or above 0.02%.

Driving privileges may be suspended for a driver under 18 who accumulates more than six points and a driver over 18 who accumulates 12 or more points.

Kentucky students who are 16 and 17 years old and wish to drive must obtain a School Compliance Verification Form. If a student drops out of high school or receives non-passing grades, he or she will not be allowed driving privileges.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Kentucky Vehicle Registration Procedures

When renewing your license in person, be prepared with the following items:

- Photo ID

- Kentucky certificate of registration

- Current original (not a copy) proof of Kentucky insurance effective date within 45 days

- Money for fees and applicable taxes (check with your County Clerk’s office for accepted forms of payment)

You may also renew online if all of the following points apply to your situation, according to the state of Kentucky website:

- A list of eligible plates is available online.

- Vehicles registered in separate counties to the current owner must be renewed separately.

- Leased vehicles cannot be renewed online.

- The vehicle(s) renewed must have unexpired registration(s).

- The owner of the vehicle(s) cannot have overdue property taxes on any other vehicles they own.

- The vehicle(s) must be insured for at least 45 days with the same insurance company for database verification.

Kentucky License Renewal Procedures

Previously, Kentucky driver’s licenses needed to be renewed every four years. The time between renewals has been increased to eight years

.Anyone wishing to renew their license must do so in person. The only exception is for military personnel who may renew by mail.

New Residents in Kentucky

New residents need to be aware of the following guidelines:

- New residents in Kentucky have 30 days to get a Kentucky license.

- To get a license, you must be a U.S. citizen or permanent resident.

- You will need to bring your out-of-state license and social security card to the Circuit Court Clerk’s office (photocopies are not accepted). If your name is different than that on your birth certificate, you may need to show a marriage license or court-ordered name change.

- Those under the age of 18 must present a School Compliance Verification Form signed by the out-of-state school.

- Out-of-state permit holders must transfer their permit to Kentucky before applying for a license.

College Students in Kentucky

A college student may drive on their valid out-of-state license and is not required to transfer that license to Kentucky if:

- They are a citizen of the United States;

- They are enrolled as a full-time or part-time student at a university, college, or technical college located in Kentucky; and

- They must have a student identification card from the university, college, or technical college located in Kentucky in their immediate possession at all times when driving in Kentucky.

REAL ID in Kentucky

Kentucky is working to get REAL ID compliant. If you have a standard Kentucky driver’s license as your only form of ID, you won’t be able to fly after October 2020. Between March and May 2019, the state will roll out licenses, permits, and personal IDs, which are REAL ID compliant.

You can still opt for a standard driver’s license, but remember, it won’t be enough for you to fly domestically after October 2020.

Kentucky Car Insurance Points System

Points on your license stay for two years from the conviction date—not the infraction date.

Infractions stay on your record for five years, but the points come off after two. Insurance companies have access to three years of your driving infractions.

Accumulating 12 points in two years may result in a license suspension. For those under 18, accumulating seven points may result in a license suspension.

| Three-point Offenses | Three-point Offenses | Four-point Offenses | Five-point Offenses | Six-point Offenses | Hearing — Possible Suspension |

|---|---|---|---|---|---|

| Careless driving | 11–15 mph over speed limit on limited access highway | Reckless driving | Improper passing | 16–25 mph over speed limit on any road or highway | 26 mph over speed limit on any road or highway |

| Improper lane usage | 15 mph or less over speed limit on any non-limited access highway | Following too close | – | Failure to stop for church or school bus | Attempting to elude police officer |

| Improper use of left lane/limited access highway | Failure to yield | Driving on wrong side of roadway | – | Committing a moving hazardous violation involving an incident | Racing |

| Failure to illuminate headlights or failure to dim headlights | Failure to yield right-of-way to funeral procession | Changing drivers in a motor vehicle | – | Committing two or more moving hazardous violations in any continuous occurrence | – |

| Failure to comply with Instructional Permit requirements | Stop violation (traffic signal, railroad crossing, stop sign) | Vehicle not under control | – | – | – |

| Any other moving hazardous violation | Wrong way on a one-way street | Failure to yield to emergency vehicle | – | – | – |

| Texting while driving | Too fast or too slow for road conditions | – | – | – | – |

| – | Improper driving, improper start, or improper turn | – | – | – | – |

If your infraction was for 10 mph or less over the speed limit on a limited access highway, the points are zero.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Kentucky Rules of the Road

Next up — driving laws you need to know about. We’ll cover everything from headlights to DUIs.

Kentucky Car Insurance Fault Versus No-fault

Kentucky is a choice, no-fault state. Drivers may opt out of no-fault coverage (PIP) in writing. If you don’t opt out, you must purchase PIP coverage, and each party must pay for their own medical bills following an accident regardless of who is at fault.

The victim may sue the at-fault party if the medical costs exceed $1,000 or if the accident caused the claimant’s permanent disfigurement, fracture of a weight-bearing bone; compound, compressed, or displaced fracture of any bone; any permanent injury, or any permanent loss of a body function.

For minor accidents, your own PIP coverage will pay for your medical expenses and a portion of your lost wages.

The at-fault party will still be responsible for property damage.

Kentucky Keep Right and Move Over Laws

Have you ever been on a four-lane (or more) highway, and even though there’s no heavy traffic, you’re stuck going under the speed limit because some idiot is just lolly-gagging in the left lane and totally impeding the flow of traffic? Yeah, it’s frustrating! But guess what…it’s also illegal!

In Kentucky, you must drive in the right lane unless you are passing or turning left. Now, if everyone would abide by that, it would surely open up the roadways!

As for “move over” laws, in Kentucky, they require motorists to move to the lane not adjacent to an emergency vehicle if safe and possible to do so. If impossible or unsafe to do so, the law requires motorists to slow down and use caution while passing emergency vehicles.

Kentucky Headlight Law

Headlights can only be white, and this restriction applies to cars registered in other states that are traveling through Kentucky. Not only does the bulb have to be white, but there cannot be a colored film or tint put on the headlights.

Kentucky Sharing the Roadway

Bicyclists and motorists don’t always get along in perfect harmony. A new law in Kentucky requires vehicles to stay at least three feet from bicycles when passing. Motorists may cross a double line to safely pass a bicyclist if safe to do so.Speed Limits

| Road Type | Speed Limits |

|---|---|

| Rural Interstates | 65; 70 on specified segments of road |

| Urban Interstates | 65 |

| Other Limited Access Roads | 65 |

| Other Roads | 55 |

Kentucky Seatbelt and Car Seat Laws

| Kentucky's Child Safety Laws | Fines | Car Seat | Adult Belt | Additional Fines |

|---|---|---|---|---|

| Who is covered? In what seats? | Maximum base fine first offense, additional fees may apply | Must be in child safety seat | Adult belt permissible | Maximum base fine first offense, additional fees may apply |

| 7 and younger and more than 57 inches in all seats; 8+ in all seats | $25 | 40 inches or less in a child restraint; 7 and younger who are between 40 and 57 inches tall in a booster seat | taller than 57 inches | $50 child restraint; $30 booster seat |

Seatbelt and car seat violations are primary offenses in Kentucky. You can be pulled over for just that violation. In states where it’s a secondary offense, you can be ticketed for it, but there has to be another reason to be pulled over by law enforcement.

If you’re curious whether or not you can ride in the cargo area of a pickup truck, you can. It’s not safe, but there aren’t any laws against it in Kentucky.

Kentucky Ridesharing

There are several companies that offer rideshare car insurance in Kentucky.

- Geico

- Allstate

- Erie Insurance

- USAA

- State Farm

Kentucky residents can participate in a ridesharing program called “Slugging.” Drivers pick up passengers (slugs) who have the same destination as themselves. Money is not exchanged. The slug gets a ride while the driver gets to travel in the HOV lane.

Standard ridesharing services such as Uber and Lyft have rules to abide by. They have to:

- Apply to operate in Kentucky

- Renew applications each year

- Carry $1 million in insurance while transporting passengers

- Be insured while waiting for customers

Kentucky Automation on the Road

According to the Insurance Institute for Highway Safety, Kentucky has “regulated platooning technology, which allows groups of individual trucks or buses to travel together with set distances between them at electronically coordinated speeds.”

While Kentucky hasn’t passed legislation governing autonomous vehicles, lawmakers focused on future planning are looking into how to embrace autonomous technology wisely.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Kentucky Safety Laws

Driving is a serious task. To be a safe driver, you cannot be under the influence of drugs alcohol. Here’s how Kentucky cracks down on impaired driving.

Kentucky DUI Laws

Bourbon whiskey and Kentucky — a match made in heaven. When you live in the state that produces 95% of the world’s bourbon, you’re probably going to have access to some fabulous distilleries.

Even so, there are 39 dry counties in the state prohibiting the sale of alcohol.

In Louisville, alcohol can be served from 6:00 a.m. until 4:00 a.m. Monday through Saturday and 1:00 p.m. through 4:00 a.m. on Sundays. The rest of the state closes down alcohol service at 2:00 a.m.In Kentucky, a DUI includes driving under the influence of the following substances which impair driving ability:

- Alcohol

- Over-the-counter medication

- Prescription drugs

- Illegal drugs

- Inhalants

The first three offenses within ten years are considered misdemeanors, while the fourth and subsequent offenses within 10 years are considered felonies.

| Penalty | First Offense | Second Offense | Third Offense | Fourth Offense |

|---|---|---|---|---|

| Suspended License | 30–120 days | 12–18 months | 24–36 months | 60 months |

| Imprisonment | Two to 30 days | Seven days to six months | 30 days–12 months | Minimum 120 days without probation |

| Fine | $200–$500 | $350–$500 | $500–$1000 | N/A |

| Program Attendance | 90 days of alcohol or substance abuse program | One year alcohol or substance abuse treatment | One year alcohol or substance abuse treatment | One year alcohol or substance abuse treatment |

| Community Service | Possible 48 hours–30 days of community labor | 10 days to six months community labor | 10 days–12 months community labor | N/A |

| Mandatory Ignition Interlock Device | No (Yes, if BAC is over 0.15) | Yes | Yes | Yes |

Kentucky has harsher penalties for high blood alcohol concentration (BAC) of 0.15% or greater. Statistics prove that the risk of being involved in a crash raises greatly. At 0.15% BAC, you’re over 1000% more likely to be in an accident than when you’re sober.

Read more: What are the DUI insurance laws in Kentucky?

Kentucky Distracted Driving Laws

Drivers under 18 may not use a handheld electronic device, like a cell phone, while driving. If you’re over 18, you can talk on a cell phone but are banned from texting. Texting and driving is a primary offense in Kentucky, so you can be pulled over just for that violation.

Kentucky Can’t-Miss Facts

You may be interested in the statistics related to driving in Kentucky, but there’s a lot of data to sift through to find what’s relevant. We’ll help you out and show you some of the most interesting information, from vehicle thefts to fatalities to EMS response times to commute times right here in one place.

Vehicle Theft in Kentucky

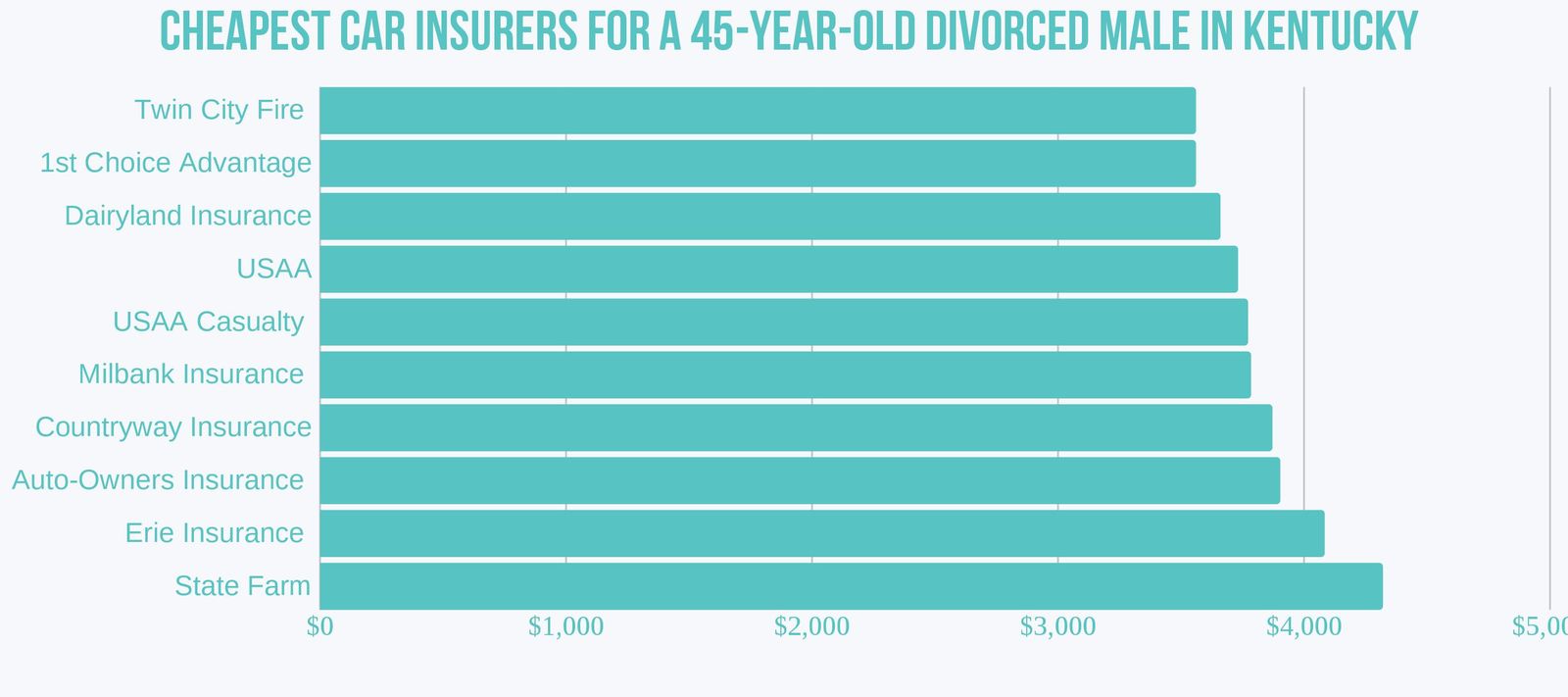

Chevy pickup trucks are popular with Kentucky car thieves. Check out the other popular models:

Kentucky Vehicle Theft by City

Urban areas have a higher population density than rural areas, and as a result of more people, they have more crimes. It’s not a surprise that Kentucky’s largest city, Louisville, has the highest number of stolen vehicles.

| City | Motor Vehicle Thefts |

|---|---|

| Bowling Green | 125 |

| Covington | 158 |

| Florence | 73 |

| Frankfort | 59 |

| Henderson | 59 |

| Lexington | 831 |

| Louisville Metro | 2,025 |

| Newport | 56 |

| Owensboro | 106 |

| Shively | 77 |

Kentucky Driving Risky and Harmful Behavior

Driving is a convenience that is hard to live without, but please don’t forget the risk involved. Don’t become a statistic. Drive carefully!

Kentucky Fatality Rates by City

| City/Area | Total Killed (Pedestrian and Vehicle Occupants) | Fatality Rate per 100,000 Population |

|---|---|---|

| Louisville/Jefferson County Metro | 87 | 14.12% |

| Lexington-Fayette Urban County | 50 | 15.7% |

Kentucky Traffic Fatalities by County

| County | 2013 | 2014 | 2015 | 2016 | 2017 |

|---|---|---|---|---|---|

| Boone | 9 | 5 | 15 | 14 | 19 |

| Fayette | 18 | 28 | 27 | 50 | 35 |

| Hardin | 20 | 16 | 22 | 16 | 16 |

| Jefferson | 88 | 78 | 85 | 99 | 107 |

| Kenton | 5 | 9 | 17 | 9 | 17 |

| Laurel | 13 | 10 | 8 | 11 | 18 |

| Muhlenberg | 6 | 2 | 2 | 6 | 12 |

| Nelson | 8 | 5 | 15 | 13 | 14 |

| Pike | 20 | 21 | 14 | 16 | 12 |

| Warren | 18 | 17 | 13 | 23 | 26 |

| Top Ten Counties | 223 | 220 | 246 | 284 | 276 |

| All Other Counties | 415 | 452 | 515 | 550 | 506 |

| All Counties | 638 | 672 | 761 | 834 | 782 |

Kentucky Traffic Fatalities Rural Versus Urban

| Type of Roadway | 2013 | 2014 | 2015 | 2016 | 2017 |

|---|---|---|---|---|---|

| Rural | 494 | 517 | 593 | 607 | 510 |

| Urban | 144 | 155 | 168 | 226 | 271 |

Kentucky Fatalities by Person Type

| Occupant/Non-occupant | 2013 | 2014 | 2015 | 2016 | 2017 |

|---|---|---|---|---|---|

| Passenger Car | 269 | 278 | 314 | 353 | 326 |

| Light Truck – Pickup | 92 | 115 | 120 | 116 | 126 |

| Light Truck – Utility | 84 | 84 | 99 | 88 | 90 |

| Light Truck – Van | 20 | 21 | 25 | 32 | 32 |

| Light Truck – Other | 0 | 0 | 0 | 0 | 1 |

| Large Truck | 10 | 9 | 9 | 16 | 10 |

| Other/Unknown Occupants | 15 | 17 | 24 | 23 | 15 |

| Total Occupants | 490 | 524 | 591 | 628 | 600 |

| Total Motorcyclists | 87 | 86 | 91 | 111 | 90 |

| Pedestrian | 55 | 57 | 67 | 81 | 83 |

| Bicyclist and Other Cyclist | 3 | 4 | 7 | 9 | 7 |

| Other/Unknown Nonoccupants | 3 | 1 | 5 | 5 | 2 |

| Total Nonoccupants | 61 | 62 | 79 | 95 | 92 |

| Grand Total | 638 | 672 | 761 | 834 | 782 |

Kentucky Fatalities by Crash Type

| Crash Type | 2013 | 2014 | 2015 | 2016 | 2017 |

|---|---|---|---|---|---|

| Total Fatalities (All Crashes) | 638 | 672 | 761 | 834 | 782 |

| Single Vehicle | 355 | 395 | 400 | 451 | 413 |

| Involving a Large Truck | 78 | 68 | 81 | 100 | 89 |

| Involving Speeding | 125 | 125 | 140 | 138 | 138 |

| Involving a Rollover | 157 | 200 | 229 | 216 | 203 |

| Involving a Roadway Departure | 410 | 456 | 499 | 529 | 472 |

| Involving an Intersection (or Intersection Related) | 116 | 119 | 122 | 152 | 179 |

Kentucky Fatalities Involving Speeding by County

| County Name | Fatalities Per 100K Population 2015 | 2016 | 2017 |

|---|---|---|---|

| Adair | 5.18 | 0 | 10.26 |

| Allen | 4.84 | 9.65 | 0 |

| Anderson | 0 | 0 | 0 |

| Ballard | 0 | 0 | 12.44 |

| Barren | 2.3 | 0 | 4.57 |

| Bath | 16.4 | 0 | 0 |

| Bell | 0 | 0 | 11.15 |

| Boone | 2.35 | 3.1 | 2.29 |

| Bourbon | 24.88 | 9.97 | 4.99 |

| Boyd | 6.18 | 0 | 0 |

| Boyle | 6.73 | 0 | 3.34 |

| Bracken | 12.08 | 0 | 0 |

| Breathitt | 0 | 7.58 | 7.72 |

| Breckinridge | 5.01 | 0 | 0 |

| Bullitt | 3.81 | 2.52 | 3.74 |

| Butler | 0 | 0 | 7.79 |

| Caldwell | 7.84 | 0 | 7.91 |

| Calloway | 0 | 5.16 | 2.57 |

| Campbell | 1.09 | 6.52 | 0 |

| Carlisle | 0 | 0 | 20.64 |

| Carroll | 0 | 0 | 0 |

| Carter | 10.93 | 3.67 | 7.37 |

| Casey | 0 | 0 | 6.35 |

| Christian | 4.1 | 5.58 | 0 |

| Clark | 0 | 2.79 | 5.55 |

| Clay | 9.53 | 4.83 | 0 |

| Clinton | 0 | 0 | 9.73 |

| Crittenden | 0 | 10.91 | 0 |

| Cumberland | 0 | 0 | 14.91 |

| Daviess | 2.01 | 4.01 | 3.99 |

| Edmonson | 0 | 0 | 16.36 |

| Elliott | 0 | 0 | 0 |

| Estill | 0 | 0 | 0 |

| Fayette | 0.95 | 3.45 | 2.48 |

| Fleming | 0 | 6.89 | 0 |

| Floyd | 2.66 | 0 | 13.79 |

| Franklin | 0 | 0 | 3.96 |

| Fulton | 0 | 0 | 0 |

| Gallatin | 0 | 0 | 22.79 |

| Garrard | 0 | 0 | 0 |

| Grant | 4.04 | 0 | 0 |

| Graves | 13.45 | 5.38 | 0 |

| Grayson | 0 | 3.83 | 3.79 |

| Green | 0 | 0 | 0 |

| Greenup | 0 | 2.79 | 0 |

| Hancock | 0 | 11.45 | 0 |

| Hardin | 4.71 | 0.94 | 1.85 |

| Harlan | 0 | 3.7 | 0 |

| Harrison | 0 | 5.38 | 0 |

| Hart | 10.87 | 16.19 | 0 |

| Henderson | 2.16 | 2.16 | 0 |

| Henry | 6.42 | 0 | 0 |

| Hickman | 0 | 0 | 0 |

| Hopkins | 8.68 | 6.56 | 2.2 |

| Jackson | 0 | 0 | 7.45 |

| Jefferson | 1.7 | 2.74 | 3.63 |

| Jessamine | 0 | 3.83 | 1.87 |

| Johnson | 4.32 | 0 | 0 |

| Kenton | 2.44 | 0 | 0 |

| Knott | 0 | 0 | 0 |

| Knox | 9.55 | 3.19 | 0 |

| Larue | 0 | 0 | 0 |

| Laurel | 1.67 | 3.33 | 4.99 |

| Lawrence | 0 | 0 | 0 |

| Lee | 0 | 0 | 0 |

| Leslie | 0 | 0 | 9.68 |

| Letcher | 0 | 4.4 | 0 |

| Lewis | 14.72 | 22.26 | 7.5 |

| Lincoln | 0 | 0 | 12.27 |

| Livingston | 10.76 | 21.7 | 0 |

| Logan | 0 | 0 | 0 |

| Lyon | 12.03 | 12.37 | 24.75 |

| Madison | 3.4 | 3.35 | 2.19 |

| Magoffin | 7.83 | 7.89 | 15.95 |

| Marion | 5.21 | 5.22 | 5.16 |

| Marshall | 3.22 | 3.2 | 3.19 |

| Martin | 0 | 0 | 0 |

| Mason | 0 | 5.83 | 5.82 |

| McCracken | 7.7 | 3.06 | 3.06 |

| McCreary | 11.19 | 0 | 0 |

| McLean | 0 | 21.41 | 10.87 |

| Meade | 14.41 | 3.57 | 3.55 |

| Menifee | 0 | 0 | 0 |

| Mercer | 0 | 4.67 | 0 |

| Metcalfe | 0 | 0 | 0 |

| Monroe | 0 | 0 | 0 |

| Montgomery | 3.63 | 0 | 3.58 |

| Morgan | 0 | 0 | 0 |

| Muhlenberg | 0 | 6.44 | 0 |

| Nelson | 11.09 | 6.59 | 8.76 |

| Nicholas | 0 | 14.16 | 14.03 |

| Ohio | 0 | 4.13 | 0 |

| Oldham | 0 | 0 | 0 |

| Owen | 0 | 18.76 | 18.58 |

| Owsley | 0 | 0 | 0 |

| Pendleton | 0 | 0 | 0 |

| Perry | 3.66 | 14.72 | 7.53 |

| Pike | 6.47 | 3.31 | 3.4 |

| Powell | 8.17 | 8.13 | 0 |

| Pulaski | 1.57 | 3.12 | 1.55 |

| Robertson | 0 | 0 | 0 |

| Rockcastle | 5.91 | 5.93 | 11.98 |

| Rowan | 4.06 | 4.1 | 4.08 |

| Russell | 5.66 | 0 | 0 |

| Scott | 3.84 | 0 | 1.82 |

| Shelby | 0 | 0 | 2.11 |

| Simpson | 5.59 | 5.56 | 0 |

| Spencer | 0 | 5.48 | 5.4 |

| Taylor | 7.81 | 0 | 7.85 |

| Todd | 16.1 | 0 | 0 |

| Trigg | 7.03 | 0 | 13.85 |

| Trimble | 0 | 0 | 11.68 |

| Union | 0 | 20.28 | 0 |

| Warren | 0 | 3.17 | 2.33 |

| Washington | 8.33 | 0 | 8.25 |

| Wayne | 29.12 | 9.64 | 0 |

| Webster | 0 | 0 | 0 |

| Whitley | 13.85 | 5.54 | 11.05 |

| Wolfe | 13.8 | 13.86 | 0 |

| Woodford | 7.75 | 0 | 0 |

Read more: Mercer Insurance Group Car Insurance Review

Kentucky Fatalities Involving an Alcohol-impaired Driver by County

| County Name | 2015 | 2016 | 2017 |

|---|---|---|---|

| Adair | 0 | 1 | 3 |

| Allen | 2 | 3 | 2 |

| Anderson | 0 | 1 | 0 |

| Ballard | 0 | 0 | 0 |

| Barren | 2 | 1 | 1 |

| Bath | 2 | 1 | 1 |

| Bell | 3 | 1 | 2 |

| Boone | 1 | 5 | 3 |

| Bourbon | 0 | 1 | 2 |

| Boyd | 0 | 0 | 2 |

| Boyle | 1 | 0 | 2 |

| Bracken | 2 | 0 | 0 |

| Breathitt | 0 | 1 | 1 |

| Breckinridge | 1 | 0 | 0 |

| Bullitt | 3 | 3 | 4 |

| Butler | 0 | 1 | 0 |

| Caldwell | 0 | 0 | 0 |

| Calloway | 0 | 3 | 1 |

| Campbell | 4 | 3 | 4 |

| Carlisle | 0 | 0 | 0 |

| Carroll | 1 | 0 | 0 |

| Carter | 3 | 1 | 2 |

| Casey | 2 | 2 | 2 |

| Christian | 2 | 5 | 2 |

| Clark | 2 | 0 | 1 |

| Clay | 4 | 0 | 1 |

| Clinton | 0 | 0 | 0 |

| Crittenden | 1 | 0 | 0 |

| Cumberland | 1 | 0 | 0 |

| Daviess | 0 | 4 | 5 |

| Edmonson | 0 | 0 | 1 |

| Elliott | 0 | 0 | 1 |

| Estill | 1 | 0 | 1 |

| Fayette | 8 | 13 | 12 |

| Fleming | 0 | 3 | 1 |

| Floyd | 3 | 2 | 1 |

| Franklin | 0 | 0 | 4 |

| Fulton | 1 | 0 | 1 |

| Gallatin | 2 | 1 | 0 |

| Garrard | 2 | 0 | 0 |

| Grant | 1 | 0 | 0 |

| Graves | 4 | 5 | 2 |

| Grayson | 4 | 2 | 2 |

| Green | 1 | 0 | 1 |

| Greenup | 1 | 0 | 1 |

| Hancock | 0 | 0 | 0 |

| Hardin | 5 | 1 | 1 |

| Harlan | 1 | 1 | 0 |

| Harrison | 0 | 0 | 0 |

| Hart | 2 | 5 | 0 |

| Henderson | 2 | 0 | 0 |

| Henry | 0 | 2 | 1 |

| Hickman | 0 | 0 | 0 |

| Hopkins | 0 | 0 | 2 |

| Jackson | 0 | 1 | 2 |

| Jefferson | 27 | 20 | 26 |

| Jessamine | 2 | 3 | 0 |

| Johnson | 0 | 0 | 0 |

| Kenton | 6 | 1 | 7 |

| Knott | 0 | 2 | 1 |

| Knox | 2 | 0 | 0 |

| Larue | 0 | 0 | 1 |

| Laurel | 2 | 1 | 7 |

| Lawrence | 0 | 0 | 1 |

| Lee | 0 | 0 | 0 |

| Leslie | 0 | 0 | 0 |

| Letcher | 0 | 0 | 2 |

| Lewis | 2 | 3 | 0 |

| Lincoln | 3 | 0 | 2 |

| Livingston | 3 | 0 | 0 |

| Logan | 0 | 0 | 0 |

| Lyon | 2 | 0 | 2 |

| Madison | 6 | 4 | 2 |

| Magoffin | 0 | 1 | 1 |

| Marion | 1 | 2 | 0 |

| Marshall | 0 | 1 | 1 |

| Martin | 1 | 0 | 1 |

| Mason | 0 | 0 | 1 |

| McCracken | 2 | 0 | 0 |

| McCreary | 1 | 1 | 3 |

| McLean | 1 | 0 | 1 |

| Meade | 4 | 4 | 3 |

| Menifee | 0 | 3 | 0 |

| Mercer | 1 | 0 | 2 |

| Metcalfe | 0 | 1 | 0 |

| Monroe | 1 | 0 | 0 |

| Montgomery | 2 | 0 | 0 |

| Morgan | 0 | 0 | 1 |

| Muhlenberg | 0 | 1 | 1 |

| Nelson | 5 | 2 | 1 |

| Nicholas | 0 | 0 | 0 |

| Ohio | 0 | 1 | 1 |

| Oldham | 0 | 1 | 0 |

| Owen | 1 | 1 | 2 |

| Owsley | 1 | 2 | 0 |

| Pendleton | 0 | 0 | 2 |

| Perry | 3 | 6 | 1 |

| Pike | 6 | 2 | 3 |

| Powell | 1 | 1 | 0 |

| Pulaski | 3 | 3 | 3 |

| Robertson | 0 | 0 | 0 |

| Rockcastle | 0 | 0 | 1 |

| Rowan | 0 | 2 | 3 |

| Russell | 1 | 1 | 2 |

| Scott | 2 | 2 | 0 |

| Shelby | 1 | 4 | 1 |

| Simpson | 1 | 0 | 2 |

| Spencer | 1 | 0 | 1 |

| Taylor | 1 | 0 | 0 |

| Todd | 2 | 0 | 1 |

| Trigg | 0 | 1 | 2 |

| Trimble | 0 | 0 | 1 |

| Union | 0 | 4 | 1 |

| Warren | 2 | 4 | 4 |

| Washington | 2 | 1 | 1 |

| Wayne | 1 | 1 | 0 |

| Webster | 2 | 0 | 0 |

| Whitley | 3 | 5 | 2 |

| Wolfe | 1 | 2 | 0 |

| Woodford | 1 | 1 | 0 |

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Kentucky Teen Drinking and Driving

In 2016, law enforcement in Kentucky made 66 arrests for drunk driving by individuals under 18 years old. Since Kentucky has just over a million residents under 18, that puts the arrests per million people at 65.31.

The national average for under 21 alcohol-impaired driving fatalities per 100.000 population is 1.2. Kentucky comes in under that average at 0.9.

Kentucky EMS Response Time Rural Versus Urban

| Population Density | Time of Crash to EMS Notification | EMS Notification to EMS Arrival | EMS Arrival at Scene to Hospital Arrival | Time of Crash to Hospital Arrival |

|---|---|---|---|---|

| Urban | 4 | 12 | 37.56 | 49.51 |

| Rural | 4.2 | 11.58 | 37.56 | 49.51 |

Kentucky Transportation

The average Kentucky household has two cars. Most drive themselves to work and the average commute time is 22.4 minutes compared to the 25.3-minute average countrywide.

Public transportation isn’t a huge factor in the average Kentucky resident’s commute. Here’s how car ownership compares with the rest of the U.S. Kentucky is represented by orange, and the U.S. average is represented by gray.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Kentucky Car Ownership

According to the U.S. Census Bureau’s American Community Survey (ACS), 42.3% of households in Kentucky owned two cars in 2018.

Kentucky Commute Time

The ACS also found that in 2018, Kentucky workers spent an average of 22.5 minutes on their daily commute compared to a national average of 25.7 minutes. Furthermore, 2.05% of Kentuckians had “super commutes” of longer than 90 minutes.

Kentucky Commuter Transportation

The majority of Kentucky workers, 82.4%, drove alone to work. That’s compared to only 9.36 of Kentuckians who carpooled.

Kentucky Traffic Congestion

While the Louisville and Lexington metro areas definitely have some traffic congestion, at least it’s not like Los Angeles! If you’re sitting in traffic in Kentucky, getting aggravated with those around you, remind yourself of that.

| City | Hours spent in congestion | Percent spent in congestion – PEAK | Percent spent in congestion – DAYTIME | Percent spent in congestion – OVERALL |

|---|---|---|---|---|

| Louisville | 19 | 10% | 6% | 6% |

| Lexington | 17 | 10% | 6% | 6% |

Now, with all this information, you can consider yourself an informed driver!

Remember, as a driver, car insurance is vitally important. You shouldn’t overpay for the coverage you need, though. Enter your ZIP code into our free tool below to compare rates and find the coverage that’s right for you!

Frequently Asked Questions

What are the minimum car insurance requirements in Kentucky?

In Kentucky, the minimum car insurance requirements are 25/50/25 for bodily injury and property damage liability, and $10,000 in personal injury protection (PIP) coverage.

What is the average cost of car insurance in Kentucky?

The average car insurance rates in Kentucky are around $77 per month.

Should I get basic coverage or full coverage for my car in Kentucky?

The decision between basic coverage and full coverage depends on your personal circumstances. Basic coverage is the minimum required by law and covers liability only. Full coverage includes collision and comprehensive insurance, which provide additional protection for your own vehicle. Consider factors such as your car’s value, financing/leasing requirements, and your budget when deciding on the coverage type.

Are there any additional coverage options I should consider in Kentucky?

Additional coverage options to consider in Kentucky include uninsured/underinsured motorist coverage, higher liability limits, and supplemental coverage such as pay-as-you-drive or usage-based coverage.

Which are the best car insurance companies in Kentucky?

The best car insurance company for you will depend on your specific needs and preferences. It’s recommended to compare quotes from multiple companies to find the best rates and coverage. Some well-known insurance companies in Kentucky include Geico, Progressive, State Farm, and Allstate. It’s also important to consider factors like financial ratings, consumer satisfaction, and complaint ratios when choosing a company.

Who has the cheapest car insurance in Kentucky?

Which Kentucky car insurance company offers the cheapest rates will depend on your coverage needs, driving record, and more. However, some companies that are usually cheaper are USAA, State Farm, and Geico.

What is the average cost of car insurance in Kentucky?

Kentucky car insurance is an average of $$55 per month for a minimum liability policy, while a full coverage insurance policy costs an average of $168 per month.

Why is Kentucky car insurance so expensive?

Average Kentucky car insurance rates are more expensive due to state factors, such as the number of drivers, average crashes, weather, and more. The best way to find cheap Kentucky car insurance is to shop around for quotes.

What is the cheapest Kentucky minimum car insurance?

Minimum car insurance in Kentucky costs an average of $55 per month.

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.