10 Best Companies for Bundling Home and Car Insurance in 2026

AAA, Allstate, and Farmers stand out as top choices for the 10 best companies for bundling home and car insurance, offering rates as low as $58 per month. These insurers provide cost-effective and comprehensive coverage, catering to individuals seeking discounts and dependable protection suited to their driving requirements.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Licensed Insurance Agent

Scott W Johnson is an independent insurance agent in California. Principal Broker and founder of Marindependent Insurance Services, Scott brings over 25 years of experience to his clients. His Five President’s Council awards prove he uses all he learned at Avocet, Sprint Nextel, and Farmers Insurance to the benefit of his clients. Scott quickly grasped the unique insurance requirements of his...

Scott W. Johnson

Insurance Claims Support & Sr. Adjuster

Kalyn grew up in an insurance family with a grandfather, aunt, and uncle leading successful careers as insurance agents. She soon found she has similar interests and followed in their footsteps. After spending about ten years working in the insurance industry as both an appraiser dispatcher and a senior property claims adjuster, she decided to combine her years of insurance experience with another...

Kalyn Johnson

Updated April 2024

Company Facts

Full Coverage for Bundling Home and Car Insurance

A.M. Best Rating

Complaint Level

Company Facts

Full Coverage for Bundling Home and Car Insurance

A.M. Best Rating

Complaint Level

Pros & Cons

Company Facts

Full Coverage for Bundling Home and Car Insurance

A.M. Best Rating

Complaint Level

Pros & Cons

AAA stands out as the ultimate choice for the best company for bundling home and car insurance, providing competitive rates starting at just $58 per month for complete coverage.

Together with Allstate and Farmers, they offer affordable rates and comprehensive coverage options that cater to your driving needs.

Our Top 10 Picks: Best Companies for Bundling Home and Car Insurance

Company Rank Bundling Discount A.M. Best Best For Jump to Pros/Cons

#1 20% A Personalized Service AAA

![]()

#2 17% A+ Bundling Benefits Allstate

![]()

#3 12% A Affordable Bundle Farmers

#4 15% A Comprehensive Coverage Liberty Mutual

#5 19% A+ Customizable Policies Progressive

#6 15% A+ Extensive Discounts Nationwide

#7 7% A Customer Support American Family

#8 19% A+ Local Presence Erie

#9 10% A++ Exclusive Savings Travelers

#10 8% A++ Military Benefits USAA

We’ll help you find the best company for bundling home and car insurance by discussing necessary coverages, typical rates, and offering a free quote comparison tool by entering your ZIP code.

- AAA provides competitive pricing, commencing from $58 monthly

- Combining home and safer car can decrease expenses with premier insurers

- Selections and markdowns ensure optimal car and home insurance coverage

#1 – AAA: Top Overall Pick

Pros

- Customized Policies: AAA offers tailored coverage options for vehicles.

- Competitive Rates: AAA provides budget-friendly pricing. Begin your affordability exploration with our AAA auto insurance review.

- Discount Options: AAA provides various discount opportunities, including those for vehicles.

Cons

- Limited Access to Local Agents: AAA mainly operates through local agents, which may not be widely available.

- Coverage Limitations: Some policy enhancements may not fully meet the needs of vehicles.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#2 – Allstate: Best for Bundling Benefits

Pros

- Discount Opportunities: Allstate offers customized discount options for individuals.

- Financial Security: Allstate benefits from the backing of a financially sound corporation.

- Outstanding Customer Support: Allstate is well-known for its quick and easily accessible service.

Cons

- Coverage Restrictions: Certain additional policy features may not fully meet individual needs. Consult our Allstate auto insurance review for guidance.

- Claims Processing: Individuals may experience delays or difficulties during the claims process.

#3 – Farmers: Best for Affordable Bundle

Pros

- Customized Policies: Farmers, as highlighted in our Farmers auto insurance review, customizes coverage to suit individual needs.

- Affordable Premiums: Farmers offers competitively priced car insurance.

- Discount Opportunities: Farmers presents various discounts, including those for auto insurance.

Cons

- Restricted Accessibility: Farmers primarily operates through local agents, which could be unavailable in certain regions.

- Coverage Restrictions: Certain additional coverage options may not fully align with specific requirements.

#4 – Liberty Mutual: Best for Comprehensive Coverage

Pros

- Tailored Policies: Liberty Mutual offers personalized coverage options for automobile insurance.

- Competitive Prices: Liberty Mutual provides affordable rates.

- Exceptional Customer Service: Liberty Mutual is widely recognized for its prompt and user-friendly service.

Cons

- Restricted Membership: Liberty Mutual membership is limited to military personnel, veterans, and their families.

- Limited Availability: The availability of Liberty Mutual’s services may vary by location. Refer to our Liberty Mutual auto insurance review for more details.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#5 – Progressive: Best for Customizable Policies

Pros

- Customized Policies: In our Progressive car insurance review, customized coverage options cater to car.

- Robust Rates: Progressive provides affordable pricing.

- Price Reduction: Progressive offers various discount opportunities, including those specific to seniors.

Cons

- Claims Processing: Individuals may encounter delays or complications during the claims process.

- Limited Discount Options: Progressive may not offer as wide a range of discounts as some of its competitors.

#6 – Nationwide: Best for Extensive Discounts

Pros

- Discount Opportunities: Nationwide provides various discount options.

- Financial Stability: Nationwide is backed by a financially strong company.

- Outstanding Customer Support: Nationwide is recognized for its responsive and user-friendly service.

Cons

- Claims Handling: Individuals may encounter delays in claims processing, as noted in our Nationwide car insurance review.

- Limited Discount Options: Nationwide may not offer as diverse a range of discounts as some of its competitors.

#7 – American Family: Best for Customer Support

Pros

- Advanced Coverage Options: American Family provides unique coverage options like Accident Forgiveness and Deductible Rewards, adding value to their policies.

- User-Friendly Digital Tools: With intuitive mobile apps and online platforms, American Family simplifies policy management and claims processing for customers.

- Solid Financial Foundation: American Family’s strong financial stability ensures policyholders have a dependable and secure insurance provider.

Cons

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#8 – Erie: Best for Local Presence

Pros

- Customized Coverage: Erie provides personalized coverage options for car insurance policies.

- Competitive Pricing: Erie offers affordable rates compared to other insurers.

- Outstanding Customer Support: Erie is renowned for its quick and user-friendly service.

Cons

- Membership Restrictions: Erie membership is restricted to military members, veterans, and their families.

- Availability Limitations: Erie’s availability may differ depending on the location. For more information, refer to our Erie car insurance review.

#9 – Travelers: Best for Exclusive Savings

Pros

- Affordable Rates: Our Travelers car insurance review highlights their competitive and budget-friendly pricing.

- Versatile Coverage Options: Travelers offers customizable policies to suit individual needs.

- Discount Opportunities: Travelers provides a variety of discounts, including those specifically tailored for automobiles.

Cons

- Limited Agent Presence: Travelers primarily operates through online channels and phone services, with fewer local agents available.

- Coverage Restrictions: Some policy enhancements may not fully address the requirements of classic cars.

#10 – USAA: Best for Military Benefits

Pros

- Reserved for Military Personnel: USAA exclusively caters to military members and their families, providing specialized coverage.

- Highly-Rated Customer Service: USAA consistently receives acclaim for its exceptional customer service, placing members’ needs at the forefront.

- Competitive Pricing: USAA often offers competitive rates, appealing to budget-conscious policyholders.

Cons

- Restricted Qualification: Our USAA insurance review notes that eligibility is limited to military personnel and their families, excluding the general public.

- Limited Brick-And-Mortar Presence: USAA prioritizes online and phone-based services, resulting in fewer physical branch locations.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Benefits of Bundling Home and Car Insurance

Insurers Benefiting from Offering Combined House and Car Insurance Policies

Insurance companies offer deep discounts for combined insurance policies because the more you insure with them, the longer you probably will stay with them.

It costs the companies money to continually lose clients and process new ones.

Scott W. Johnson Licensed Insurance Agent

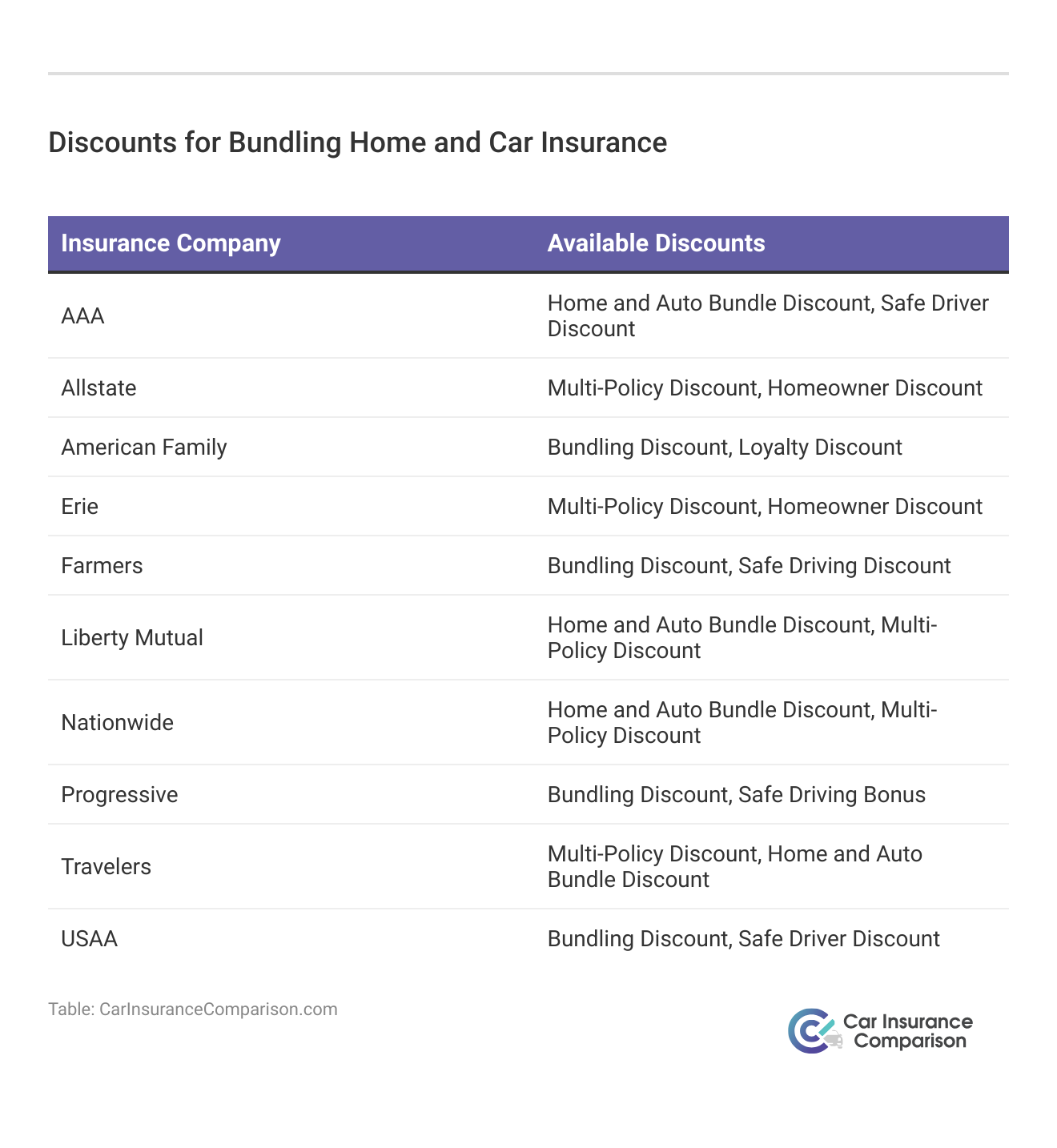

Insurance Companies Offering the Best Insurance Bundles

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Bundling my Home and Car Insurance Policies

Downsides of Bundling Insurance Policies

Case Studies: Bundling Policies for Auto and Home Insurance

Bundling home and auto insurance policies can save money and simplify coverage, including insurance for a classic car. Let’s explore three case studies showcasing the benefits of bundling with reputable insurers, providing insights into maximizing savings and coverage.

- Case Study 1 – Saving on Premiums With Unity Insurance Company: Sarah Thompson bundled her auto and home insurance with Unity Insurance Company, saving 15% on premiums while enjoying convenience and comprehensive coverage.

- Case Study 2 – Streamlining Coverage With Shield Insurance Group: John Reynolds streamlined his insurance with Shield Insurance Group by bundling his auto and home policies, resulting in a 10% premium reduction and peace of mind.

- Case Study 3 – Maximizing Discounts With Secure Coverage Assurance: Mary Johnson in New York optimized her coverage with Secure Coverage Assurance, bundling her auto and home policies for a 20% premium reduction, ensuring comprehensive protection at an affordable price.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Bundling Insurance Policies: The Bottom Line

Frequently Asked Questions

What are the benefits of bundling home and auto insurance?

Bundling home and auto insurance can lead to savings through multi-policy discounts offered by insurance companies.

What is insurance bundling?

How can I bundle my insurance?

To bundle your insurance, you can check with your current insurance company to see if they offer discounts for multiple policies. Additionally, you can compare quotes from different companies to find the best rates for bundled insurance. Enter your ZIP code now.

Which insurance companies offer the best insurance bundles?

The best insurance bundle options vary depending on individual circumstances and the specific insurance needs. It is recommended to research and compare quotes from several insurance companies to determine the best deal for you.

Should I bundle my home and auto insurance policies?

Should I buy house and car insurance policies just to save money?

It’s important to find a balance between affordability and quality coverage. Cheaper insurance policies may come with limitations and less reliable service. Enter your ZIP code for further details.

What are the benefits of bundling home and auto insurance?

How do insurers benefit from offering combined house and car insurance policies?

Which insurance companies offer the best insurance bundle?

Should I bundle my home and auto insurance policies?

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.