Compare Bellevue, WA Car Insurance Rates [2026]

Bellevue, Washington residents pay $281 per month or $3,376 annually on average for car insurance. The cheapest Bellevue, WA car insurance is from USAA; however, only military personnel can purchase USAA policies. Nationwide is the next most affordable Bellevue, WA car insurance company and is available to everyone. Bellevue residents must carry the Washington legal minimum auto insurance limits of 25/50/10 for liability coverage.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Insurance and Finance Writer

Luke Williams is a finance, insurance, real estate, and home improvement expert based in Philadelphia, Pennsylvania, specializing in writing and researching for consumers. He studied finance, economics, and communications at Pennsylvania State University and graduated with a degree in Corporate Communications. His insurance and finance writing has been featured on Spoxor, The Good Men Project...

Luke Williams

Insurance & Finance Analyst

Zach Fagiano has been in the insurance industry for over 10 years, specializing in property and casualty and risk management consulting. He started out specializing in small businesses and moved up to large commercial real estate risks. During that time, he acquired property & casualty, life & health, and surplus lines brokers licenses. He’s now the Senior Vice President overseeing globa...

Zach Fagiano

Updated May 2024

- The cheapest Bellevue, WA car insurance company is USAA, followed by Nationwide

- Overflow traffic from the nearby city of Seattle impacts your Bellevue, WA car insurance rates

- Average rates for car insurance in Bellevue is cheaper than in Seattle and Tacoma

Bellevue, Washington car insurance costs are cheaper on average than other major Washington cities, including Seattle and Tacoma. The average Bellevue, WA car insurance rates are $281 per month or $3,376 annually.

Fortunately, by comparing Washing car insurance rates online and shopping around, you can secure cheap car insurance premiums.

Below, see actual prices from the top insurance companies in Bellevue, and discover how to get affordable Bellevue, WA car insurance regardless of your age, driving record, and coverage needs.

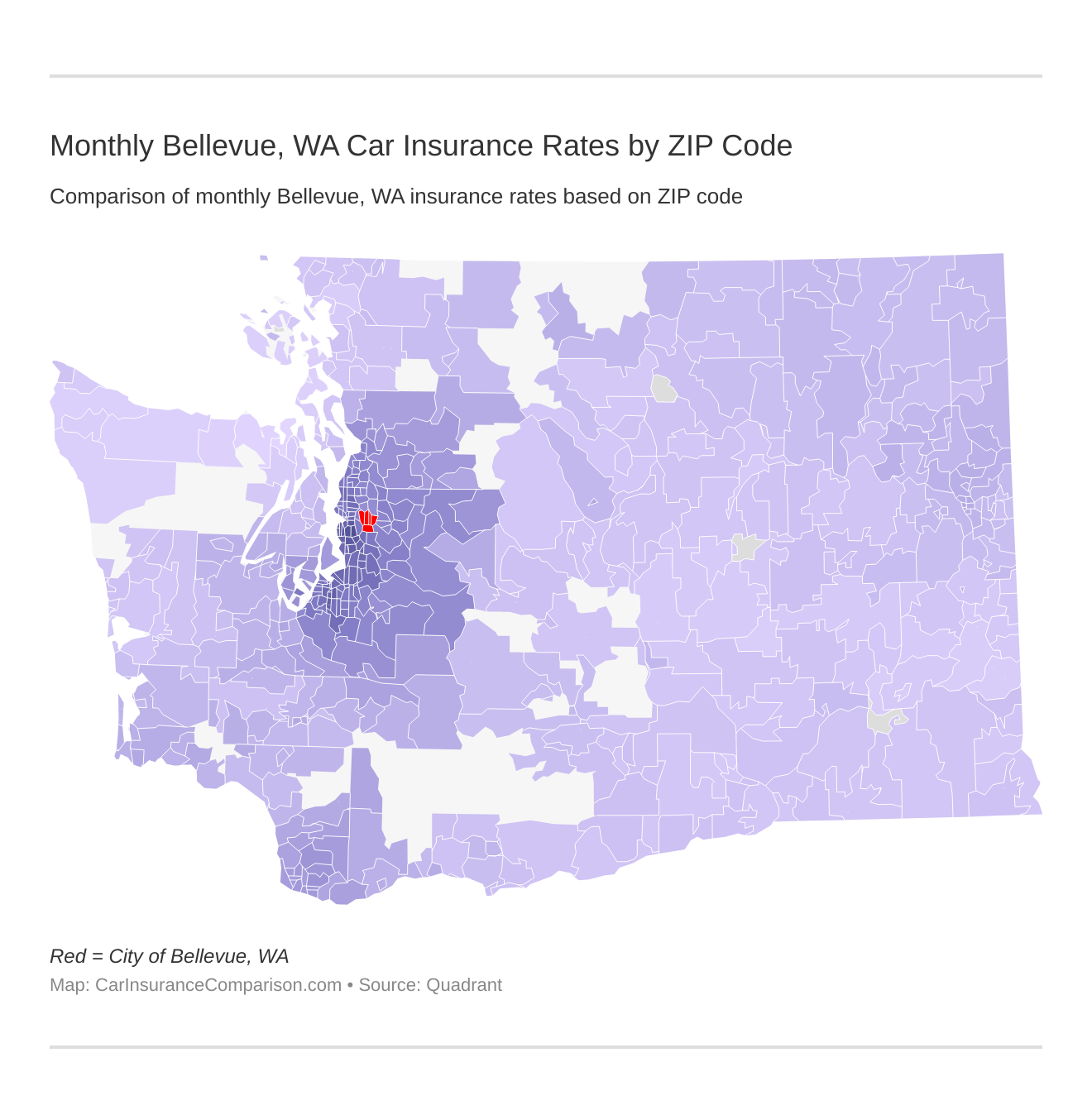

Monthly Bellevue, WA Car Insurance Rates by ZIP Code

What factors affect car insurance rates? ZIP codes will play a major role in your car insurance rates because factors like crime and traffic are calculated by ZIP code. Check out the monthly Bellevue, Washington auto insurance rates by ZIP Code below:

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

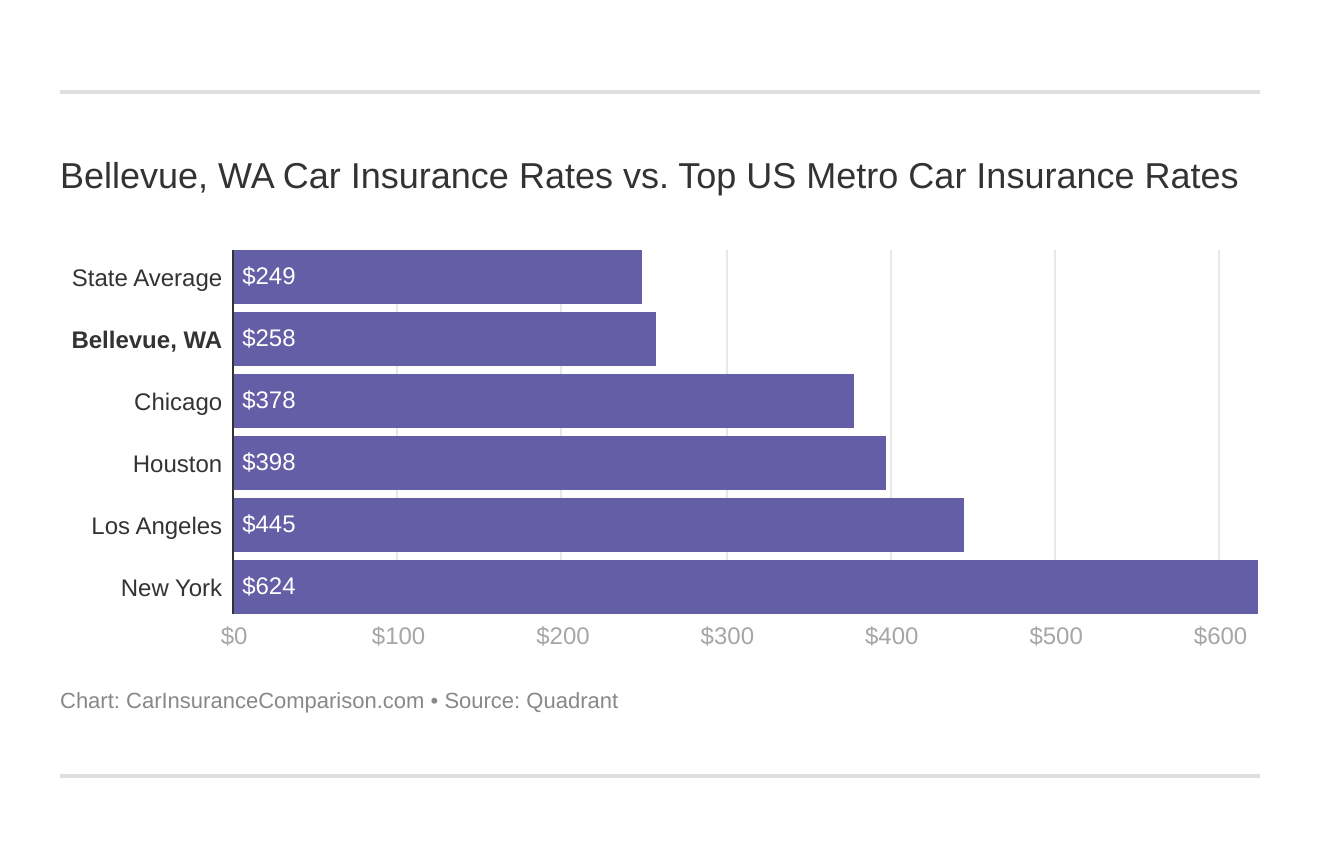

Bellevue, WA Car Insurance Rates vs. Top US Metro Car Insurance Rates

You might find yourself asking how does my Bellevue, Washington stack up against other top US metro areas’ auto insurance rates? We’ve got your answer below.

When you’re ready to buy Bellevue, WA car insurance, enter your ZIP code into our free quote tool above and immediately compare rates from reputable companies near you.

What is the cheapest car insurance company in Bellevue, WA?

USAA is the cheapest Bellevue, WA car insurance company, but only military personnel and their families can use its services.

Nationwide is the next most affordable provider in Bellevue and is available to everyone.

Which Bellevue, WA car insurance company has the best rates? And how do those rates compare against the average Washington car insurance company rates? We’ve got the answers below.

Below, see a list of the best car insurance companies in Bellevue organized from least expensive annual rates to most expensive:

- USAA – $2,440.72

- Nationwide – $2,458.19

- Geico – $2,836.25

- State Farm – $2,945.05

- Farmers – $3,296.44

- Progressive – $3,659.73

- Allstate – $4,017.37

- Liberty Mutual – $4,353.62

- American Family – $4,381.95

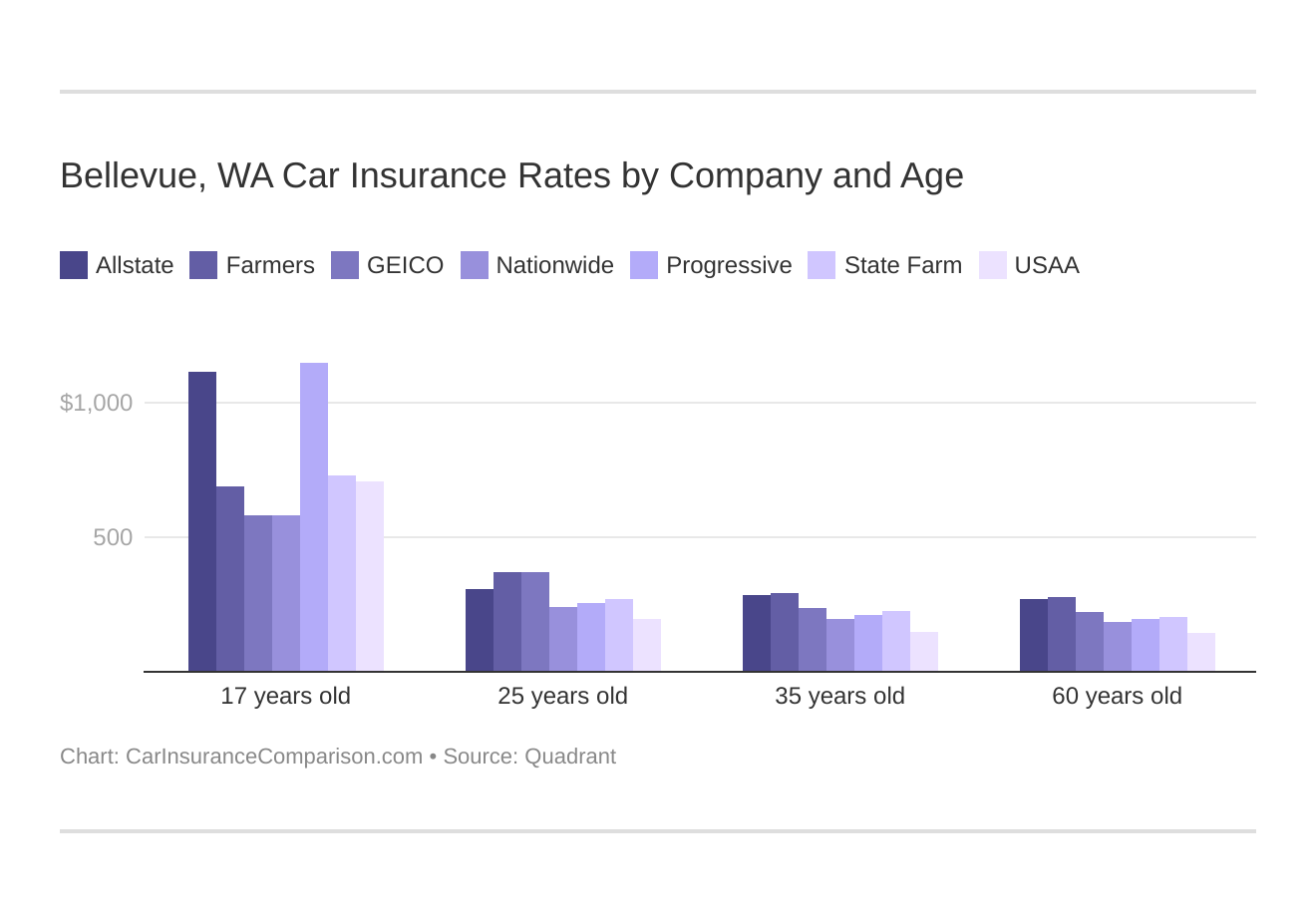

Many different factors influence your car insurance rates. Your age, driving record, the part of the city you live in, and the coverage you require all impact your premiums.

Bellevue, WA car insurance rates by company and age is an essential comparison because the top car insurance company for one age group may not be the best company for another age group.

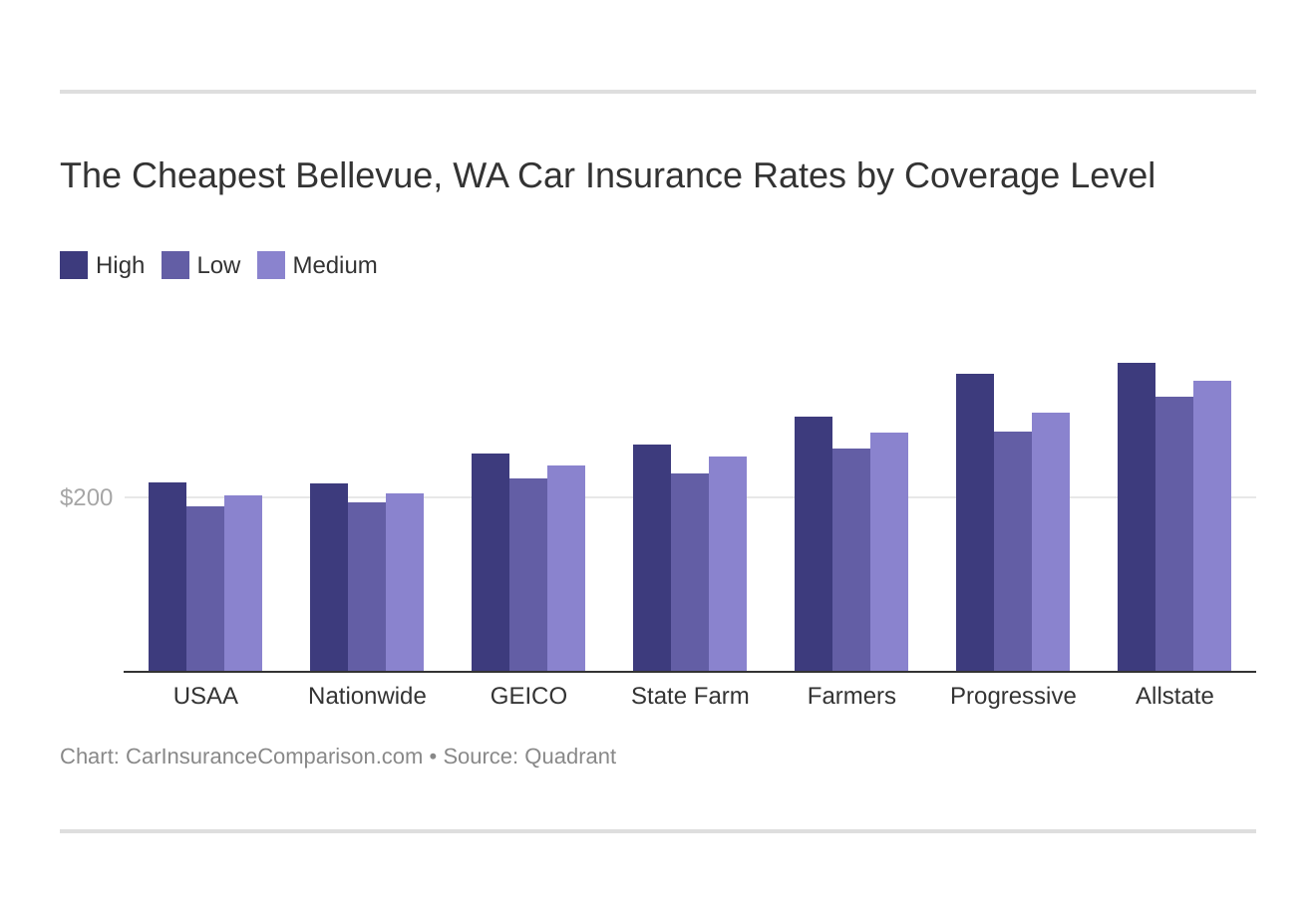

Your coverage level will play a major role in your Bellevue car insurance rates. Find the cheapest Bellevue, WA car insurance rates by coverage level below:

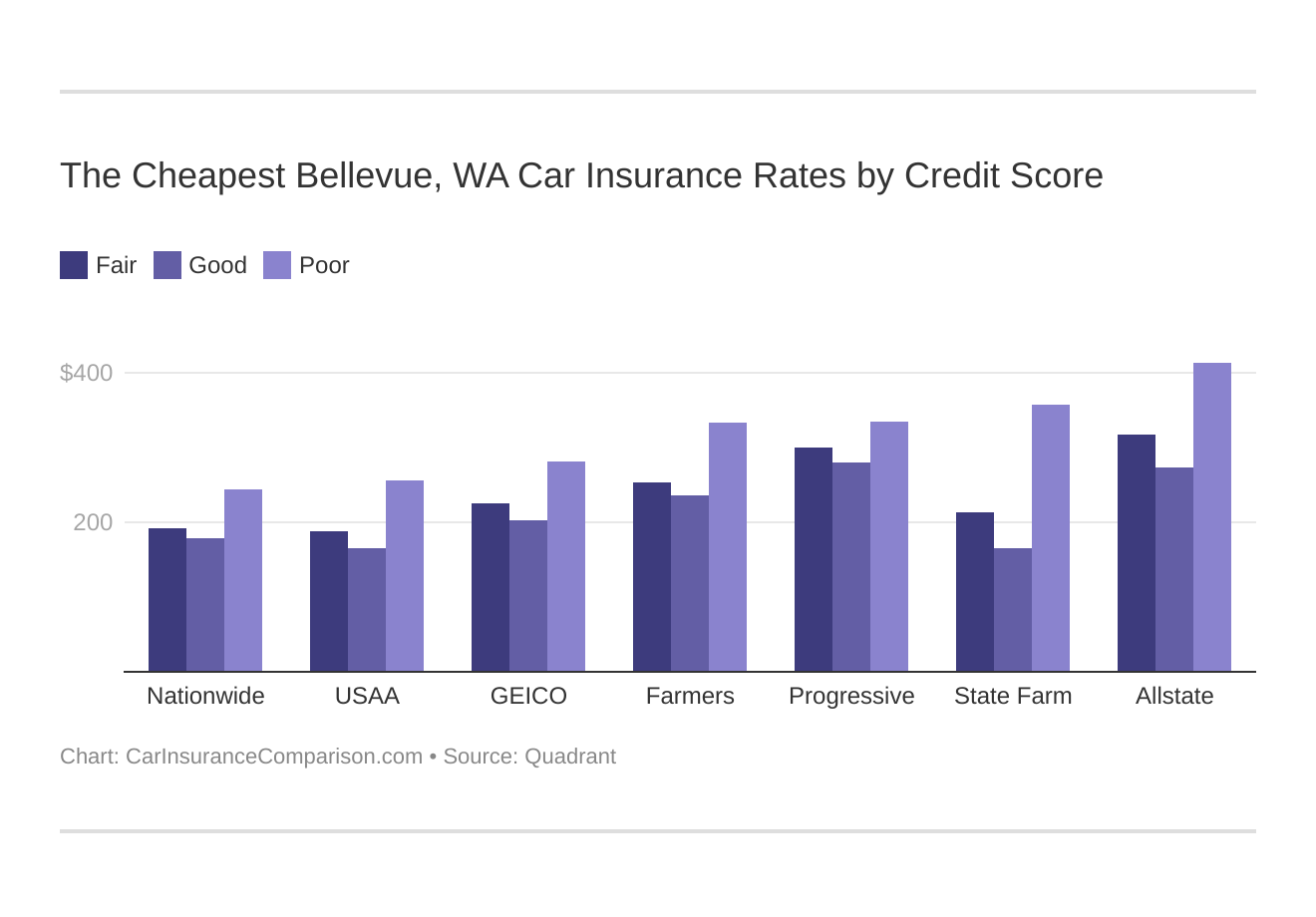

Your credit score will play a significant role in your Bellevue car insurance rates unless you live in these states where discrimination based on credit is not allowed: California, Hawaii, and Massachusetts. For more specific details check out which car insurance companies don’t use credit scores?

Find the cheapest Bellevue, WA car insurance rates by credit score below.

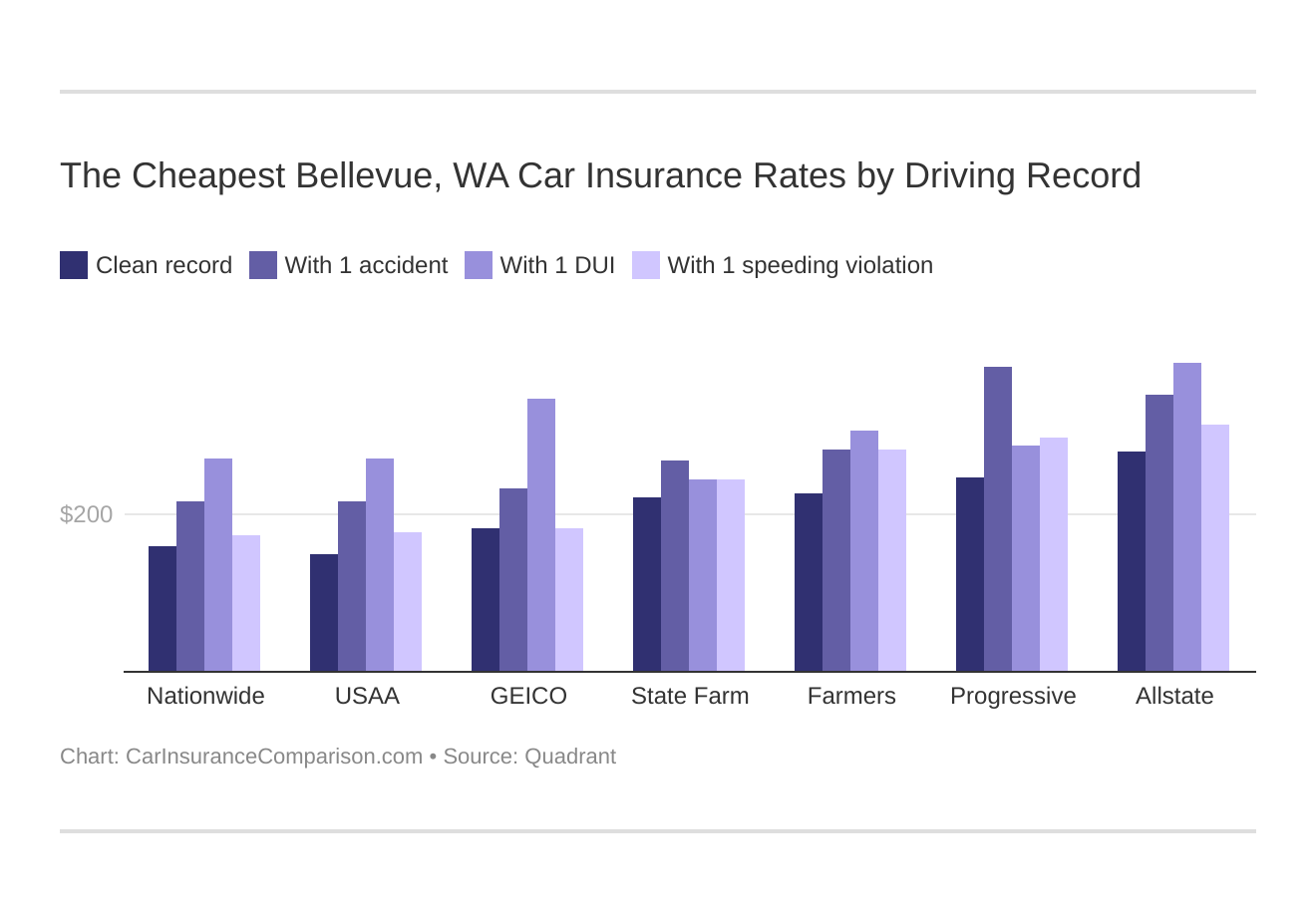

Your driving record will play a major role in your Bellevue car insurance rates. For example, other factors aside, a Bellevue, WA DUI may increase your car insurance rates 40 to 50 percent. For more information, see bad driving record car insurance.

Find the cheapest Bellevue, WA car insurance rates by driving record.

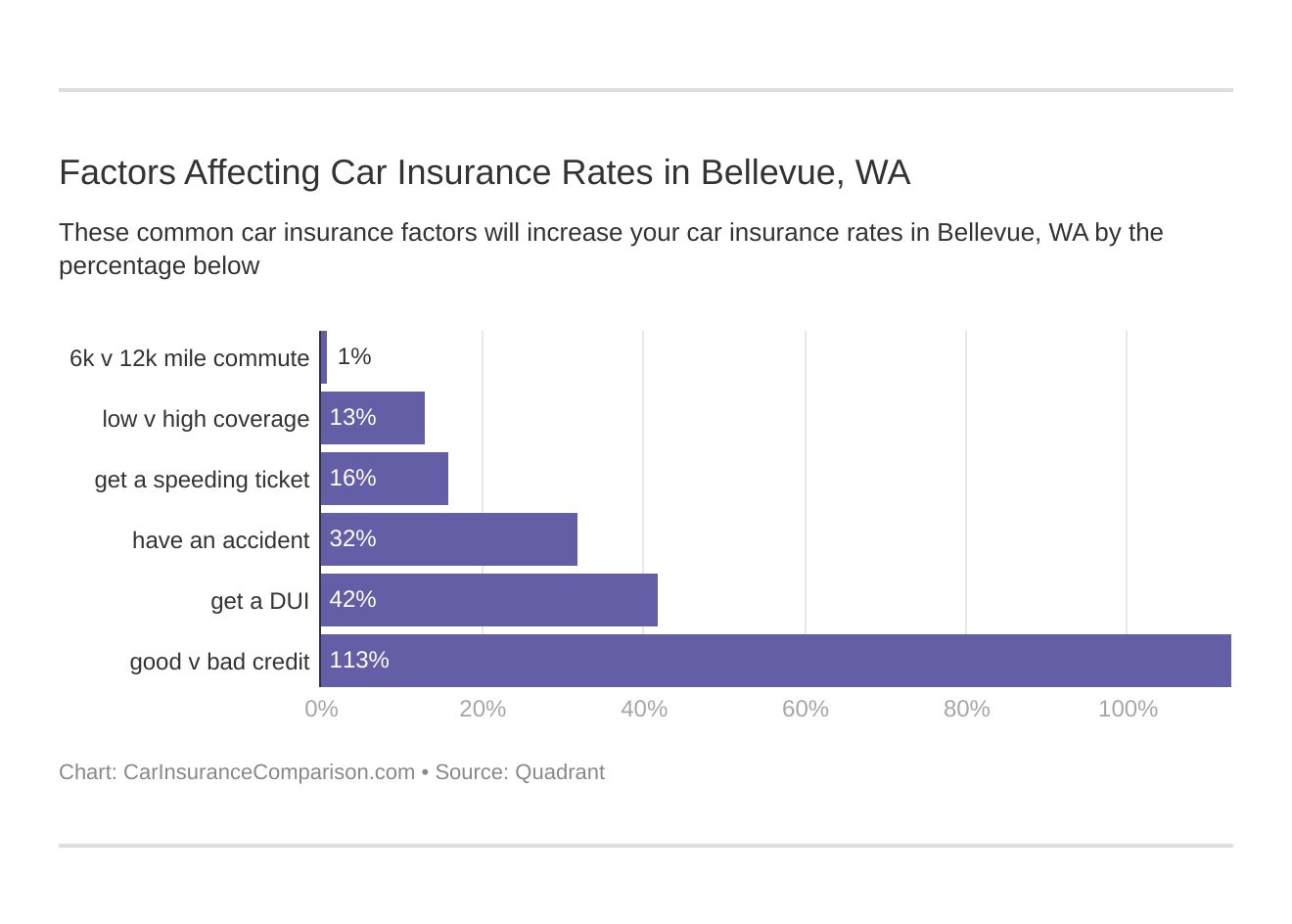

Factors affecting car insurance rates in Bellevue, WA may include your commute, coverage level, tickets, DUIs, and credit. Controlling these factors will help you maintain cheap Bellevue,Washington car insurance.

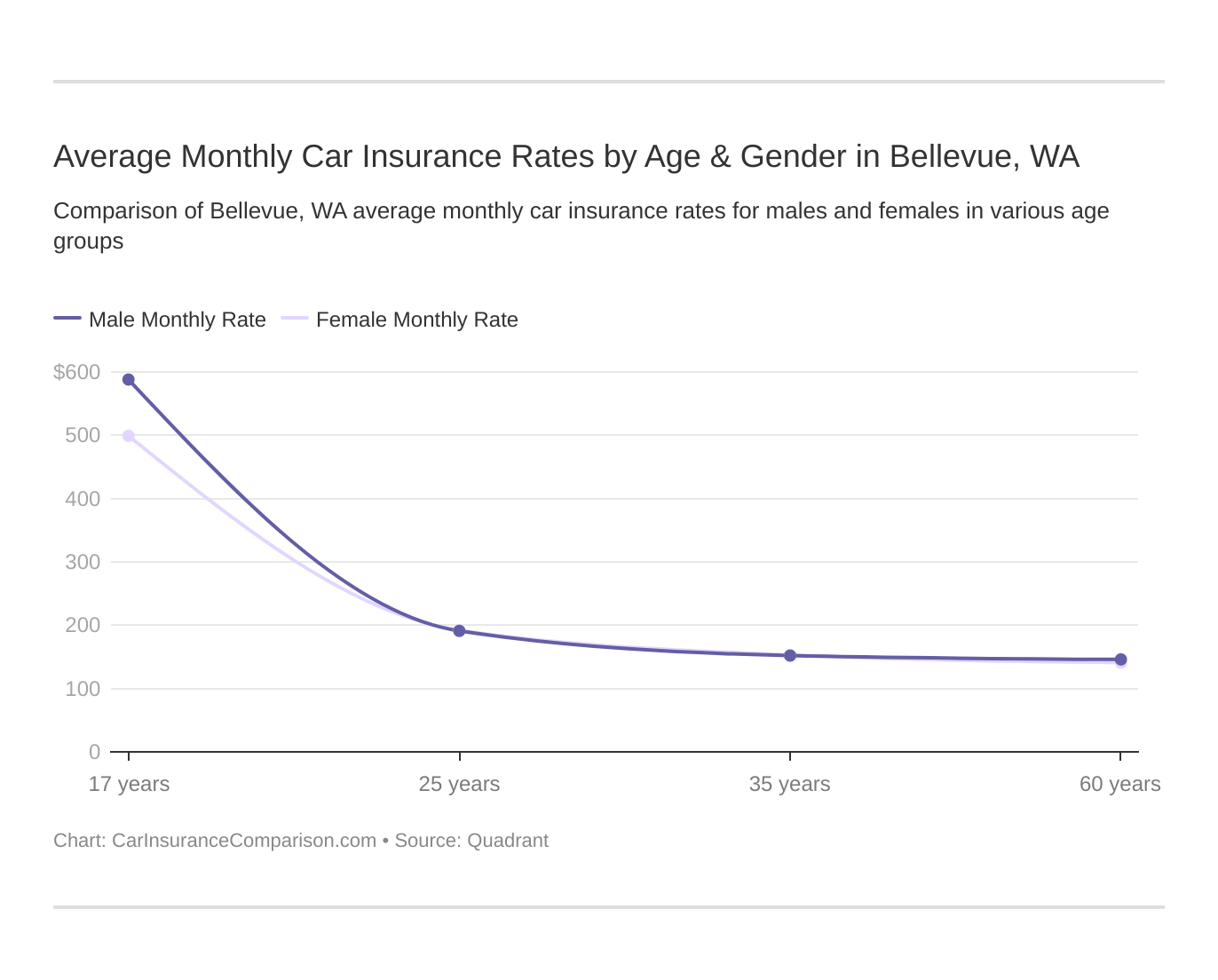

These states are no longer using gender to calculate your car insurance rates — Hawaii, Massachusetts, Michigan, Montana, North Carolina, and Pennsylvania. But age is still a major factor because young drivers are often considered high-risk. You can use a few tips for finding car insurance for young drivers to help offset some of the cost.

WA does use gender, so check out the average monthly car insurance rates by age and gender in Bellevue, WA.

What car insurance coverage is required in Bellevue, WA?

All Bellevue residents must purchase at least the Washington state legal car insurance minimums.

Washington legally requires drivers to carry the following limits:

- $25,000 per person and $50,000 per incident in bodily injury liability coverage

- $10,000 in property damage liability coverage

Washington is an at-fault or tort state. If you cause an accident, you must use your liability car insurance coverage to pay for the damages to the other party involved. For more information, compare liability car insurance.

Experts recommend that you carry more than your state minimum requirements for better coverage. Don’t forget to research what is the state minimum car insurance required by each state, as it does vary.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

What affects car insurance rates in Bellevue, WA?

Bellevue is a bustling city located only nine miles from Seattle. The overflow traffic can lead to higher car insurance rates.

According to the INRIX traffic report, Seattle is the 15th most congested city in America. The congestion also impacts Bellevue drivers.

City-Data reports that the average commute time for Bellevue residents is 22.5 minutes.

Vehicle theft rates also influence car insurance costs in your city. The Federal Bureau of Investigation (FBI) recorded 309 motor vehicle thefts in 2017 in Bellevue. That’s a rate of 215 thefts per every 100,000 people. See where Washington ranks among the 15 states with the highest vehicle theft rates.

The often rainy Bellevue, WA weather can also cause costs to increase. Wet road conditions lead to more traffic incidents.

Bellevue, WA Car Insurance: The Bottom Line

Fortunately, Bellevue car insurance rates are not the highest in Washington. For example, car insurance options for Seattle costs tend to be the most expensive, depending on the ZIP code.

By researching companies ahead of time, seeking out car insurance discounts, and comparing rates online, you’ll easily be able to secure cheap Bellevue, WA car insurance quotes.

Enter your ZIP code into our free quote tool below to receive rates from the top Bellevue, WA car insurance companies right now.

Frequently Asked Questions

What factors affect car insurance rates in Bellevue, WA?

Several factors can influence car insurance rates in Bellevue, WA. These factors include your driving record, age, gender, type of vehicle, location, coverage options, deductibles, and credit history.

How can I compare car insurance rates in Bellevue, WA?

To compare car insurance rates in Bellevue, WA, you can follow these steps:

- Gather necessary information: Note down details about your vehicle, driving history, and desired coverage.

- Research insurance companies: Look for reputable insurance providers that offer coverage in Bellevue, WA.

- Obtain quotes: Contact insurance companies directly or use online comparison tools to request quotes.

- Compare rates and coverage: Review the quotes you receive, comparing the rates, coverage options, deductibles, and any additional features.

- Consider customer reviews and ratings: Read customer reviews and ratings to assess the reputation and customer service of each insurance provider.

- Make an informed decision: Select the insurance policy that best suits your needs and budget.

Are car insurance rates higher in Bellevue, WA compared to other areas?

Car insurance rates can vary depending on various factors, including location. Bellevue, WA, being a city with a higher population and traffic density, may have different insurance rates compared to rural areas or smaller towns. It’s best to obtain quotes from multiple insurance providers to determine the specific rates in Bellevue and compare them to other areas.

Are there any discounts available on car insurance in Bellevue, WA?

Yes, many insurance companies offer discounts that can help lower your car insurance premiums in Bellevue, WA. These discounts can include safe driver discounts, multi-vehicle discounts, bundling discounts (if you have multiple policies with the same insurer), good student discounts, and discounts for having certain safety features in your vehicle. It’s advisable to ask insurance providers about the discounts they offer to see if you qualify for any.

Can I change my car insurance provider if I find a better rate?

Yes, you have the option to change your car insurance provider if you find a better rate in Bellevue, WA. However, before switching, it’s important to consider a few factors:

- Check if there are any penalties or fees for canceling your current policy.

- Ensure there is no gap in coverage when transitioning between policies.

- Review the terms and conditions, coverage options, deductibles, and customer reviews of the new insurance provider.

- Notify your previous insurer and provide the necessary information to cancel your policy.

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.