10 Best Car Insurance Companies for DUI Offenders in 2026

The General, Progressive, and Geico are the best car insurance companies for DUI offenders. Most major car insurance companies won't refuse to renew your policy after a DUI, but they will increase your rates for three to five years. At The General, for example, minimum coverage with a DUI averages $166/mo.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Licensed Insurance Agent

Jeffrey Manola is an experienced insurance agent who founded TopQuoteLifeInsurance.com and NoMedicalExamQuotes.com. His mission when creating these sites was to provide online consumers searching for insurance with the most affordable rates available. Not only does he strive to provide consumers with the best prices for insurance coverage, but he also wants those on the market for insurance to ...

Jeffrey Manola

Insurance Claims Support & Sr. Adjuster

Kalyn grew up in an insurance family with a grandfather, aunt, and uncle leading successful careers as insurance agents. She soon found she has similar interests and followed in their footsteps. After spending about ten years working in the insurance industry as both an appraiser dispatcher and a senior property claims adjuster, she decided to combine her years of insurance experience with another...

Kalyn Johnson

Updated May 2024

843 reviews

843 reviewsCompany Facts

Full Coverage for DUI Offenders

A.M. Best Rating

Complaint Level

843 reviews

843 reviews 13,283 reviews

13,283 reviewsCompany Facts

Full Coverage for DUI Offenders

A.M. Best Rating

Complaint Level

13,283 reviews

13,283 reviews 19,116 reviews

19,116 reviewsCompany Facts

Full Coverage for DUI Offenders

A.M. Best Rating

Complaint Level

Pros & Cons

19,116 reviews

19,116 reviewsThe best car insurance companies for DUI offenders are The General, Progressive, and Geico.

There’s no getting around the fact that having a DUI on your record will drive up your car insurance rates. That said, just how much more you could end up paying varies greatly from one provider to the next.

Our Top 10 Picks: Best Car Insurance Companies for DUI Offenders

| Company | Rank | Accident Forgiveness | A.M. Best | Best For | Jump to Pros/Cons |

|---|---|---|---|---|---|

| #1 | 15% | A | High-Risk Coverage | The General | |

| #2 | 16% | A+ | Budget Shopping | Progressive | |

| #3 | 17% | A++ | Online Convenience | Geico | |

| #4 | 13% | A++ | Customer Service | State Farm | |

| #5 | 15% | A | Safety Discounts | Farmers | |

| #6 | 15% | A+ | Vanishing Deductible | Nationwide |

| #7 | 18% | A+ | Usage-Based Discount | Allstate | |

| #8 | 15% | A | Customizable Policies | Liberty Mutual |

| #9 | 16% | A+ | AARP Members | The Hartford |

| #10 | 14% | A | Roadside Assistance | AAA |

With this guide, we’ll help you compare car insurance companies so you can find the most affordable car insurance companies that accept a DUI on your driving record.

We’ll also take a look at some other common questions about buying car insurance after a DUI, including how long a DUI affects your rates and when you need to inform your insurance provider about a DUI charge. After you’ve gotten a handle on how to buy insurance after a DUI, try using our free quote tool to compare car insurance quotes from companies that accept a DUI.

- The General has the best car insurance for DUI offenders

- Car insurance companies may refuse to renew your policy after you get a DUI

- A DUI can stay on your driving record from three to five years

#1 – The General: Top Pick Overall

Pros

- High-Risk Coverage: The General offers coverage to high-risk drivers who may be unable to get coverage elsewhere.

- Online Quotes: You can get a quick quote online to see how much DUI coverage will cost.

- Flexible Payments: The General gives several options for payments.

Cons

- Higher Average Rates: The General is more expensive because it specializes in high-risk drivers.

- Customer Reviews: Not all reviews are favorable. Learn more in our review of The General.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#2 – Progressive: Best for Budget Shopping

Pros

- Budget Shopping: Use the free Name Your Price Tool when shopping on a budget.

- Coverage Variety: Add or drop coverages as needed. Learn more in our Progressive car insurance review.

- Loyalty Rewards: Sticking with Progressive even after a DUI rate increase could benefit drivers in the long run.

Cons

- Snapshot Rate Increases: Demonstrating extremely poor driving skills in the program can lead to rate hikes.

- Customer Claims: Not all reviews are positive for customers’ claim experiences.

#3 – Geico: Best for Online Convenience

Pros

- Online Convenience: Almost anything can be done quickly online, whether getting a quote or removing a driver.

- Availability: You can buy auto insurance post-DUI from Geico in any state.

- Coverage Variety: Add or drop coverages as necessary. Learn more in our Geico car insurance review.

Cons

- SR-22 Filing: This service may not be offered in all states.

- Claim Handling: Some customers have remarked in their reviews that claims processing can be slower.

#4 – State Farm: Best for Customer Service

Pros

- Customer Service: Service is more personalized because of the number of local agents available.

- Financial Reputation: Financial management is highly rated. Learn more in our State Farm review.

- Roadside Assistance: An optional add-on in case of breakdowns.

Cons

- Claim Processing: Some customers claim they had slow claims processing.

- DUI Rates: May have the cheapest insurance for DUI drivers.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#5 – Farmers: Best for Safety Discounts

Pros

- Safety Discounts: Farmers offers discounts if cars have certain safety features.

- On Your Side Review: Work with an agent after a DUI charge to ensure you have the best possible high-risk driver insurance rates.

- Coverage Variety: Take a look at what is offered in our Farmers insurance review.

Cons

- SR-22 Filing: This may not be offered in all states.

- DUI Rates: Farmers may not be the cheapest option.

#6 – Nationwide: Best for Vanishing Deductible

Pros

- Vanishing Deductible: Claim-free customers will see a drop in their deductible amounts.

- Discount Variety: Read our article on Nationwide discounts to see what it offers.

- Customer Service: Rated well by the majority of reviewers.

Cons

- Availability: Not available to buy everywhere.

- DUI Rates: Rates can be pricier than the competition.

#7 – Allstate: Best for Usage-Based Discount

Pros

- Usage-Based Discount: Participate in Drivewise to potentially save. Learn more in our Allstate Drivewise review.

- Roadside Assistance: Great for owners of older, less reliable cars.

- Pay-Per-Mile Rates: Great for DUI drivers who rarely drive.

Cons

- Customer Complaints: Allstate has varying opinions on customer experience.

- DUI Rates: Allstate’s rates may not be as economical as the competition.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#8 – Liberty Mutual: Best for Customizable Policies

Pros

- Customizable Policies: Adjust coverages and deductibles to personalize your DUI auto insurance policy.

- Bundling Discount: DUI drivers may be able to reduce costs by also purchasing their home insurance from Liberty Mutual.

- Organization Discounts: Check to see if you can get a discount at Liberty Mutual based on your affiliations.

Cons

- Claim Reviews: Reviews about claims handling are mixed.

- DUI Rates: Liberty Mutuals’ rates aren’t the most competitive. Discover more in our Liberty Mutual review.

#9 – The Hartford: Best for AARP Members

Pros

- AARP Members: Earn The Hartford car insurance discounts if you are an AARP member.

- Customer Service: Most customers favorably rate The Hartford’s customer service.

- Coverage Variety: Choose from a variety of auto insurance coverages.

Cons

- Young Driver Rates: Rates are less competitive for young DUI drivers.

- Accident Forgiveness: You must be a customer for five years and claims-free to qualify.

#10 – AAA: Best for Roadside Assistance

Pros

- Roadside Assistance: AAA has a highly-rated roadside assistance program. Learn more in our AAA review.

- Bundling Discount: You can also buy home insurance.

- Customer Service: There are usually local agents available for personalized assistance.

Cons

- Annual Fee: You have to pay a small fee every year to be an AAA member.

- Discount Availability: Some discounts will be lacking, depending on location.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Where to Buy Car Insurance for DUI Offenders

While your rates could be many times higher than those of someone of a similar background with a clean driving record, most major car insurance companies will insure you with a DUI.

There are cases where insurance companies that cover DUIs may not accept a driver, which is likely if a driver has multiple DUIs or other risk factors on their record. If a driver can't find someone to insure them, these drivers will have to get insurance through their state's high-risk program.

Brandon Frady Licensed Insurance Agent

If you find yourself in a situation where you’re unable to obtain car insurance from a large provider like Geico or State Farm, the Insurance Information Institute recommends taking one of two immediate options:

- Join a state-assigned risk pool

- Look for an insurance company for “high-risk” drivers

State-assigned risk pools are expensive and provide minimal coverage, but they are guaranteed to insure you regardless of your driving history. Contact a local insurance agent for more information on your state’s risk pool or equivalent program.

Read more: Compare Assigned Risk Car Insurance: Rates, Discounts, & Requirements

Likewise, insurance companies for “high-risk” drivers are generally more costly than mainstream options. However, if you need more comprehensive coverage than risk pools can provide, this may be your only option in the short term.

What are the most affordable car insurance companies that accept a DUI?

Depending on where you live, the most affordable car insurance option for drivers with DUIs may be a local insurance provider. Be sure to look into local insurance businesses alongside national options. We listed rates for our top providers below.

Car Insurance Monthly Rates for DUI Offenders by Coverage Level & Provider

| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| AAA | $57 | $148 |

| Allstate | $106 | $270 |

| Farmers | $74 | $193 |

| Geico | $82 | $216 |

| Liberty Mutual | $125 | $313 |

| Nationwide | $90 | $237 |

| Progressive | $52 | $140 |

| State Farm | $45 | $112 |

| The General | $166 | $426 |

| The Hartford | $65 | $167 |

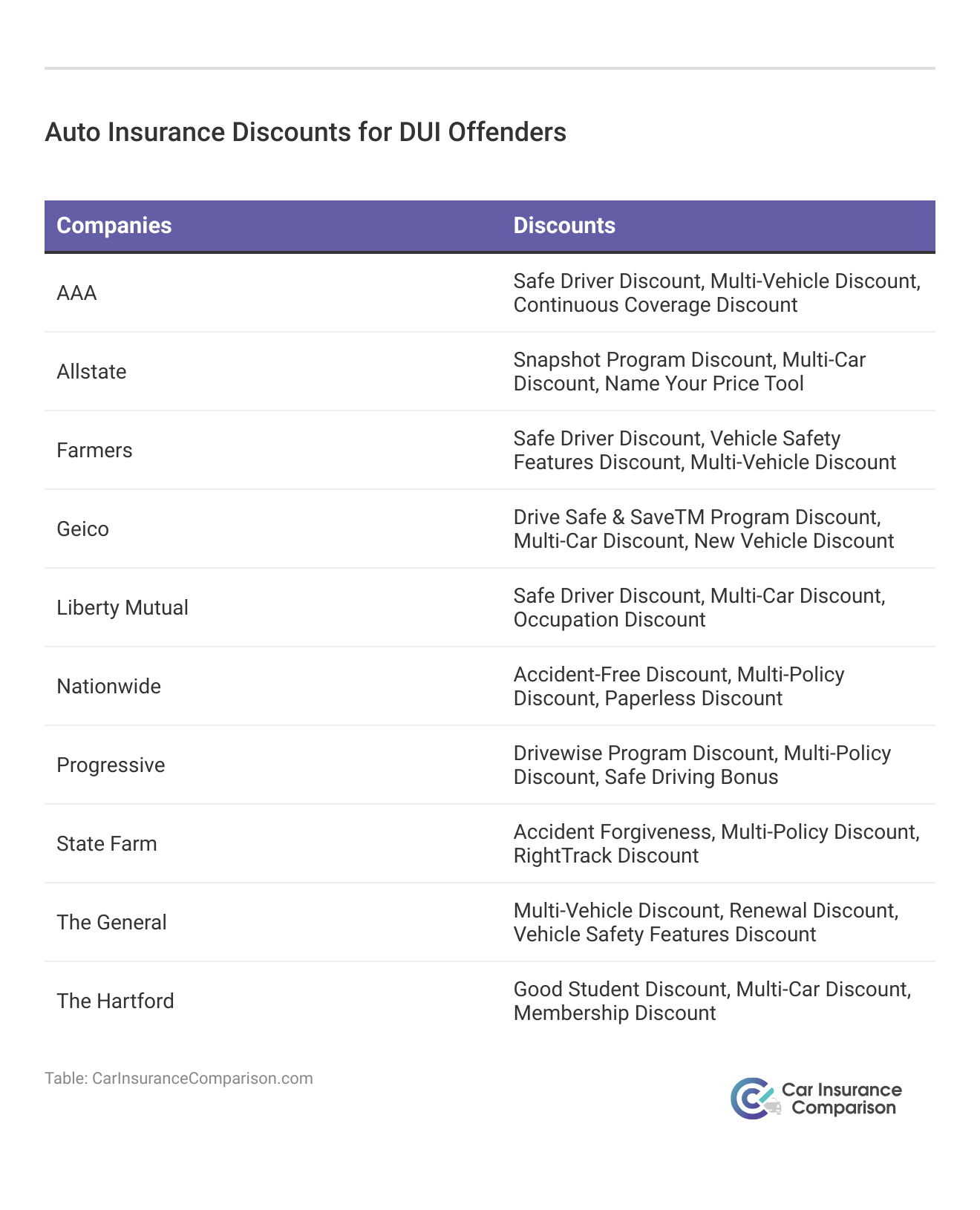

Although rates will be pricier for DUI drivers, the best DUI car insurance companies also offer discounts that may help lower rates.

With the above in mind, we consider the four companies listed below to be the cheapest options for most drivers with DUIs living in the United States:

- Progressive

- State Farm

- Esurance

- USAA

Progressive is an affordable option for drivers with a DUI for two main reasons. First, this insurer only raises rates by about 13% on average for drivers with a single DUI. Second, Progressive’s rates are on the lower end to begin with. If you’re looking at car insurance prices alone, Progressive is the best option for many drivers with a DUI. You can get a quote directly from Progressive’s website to see how much auto insurance quotes with a DUI will cost.

State Farm can be even less expensive than Progressive if you bundle home and auto policies, as they offer a discount for customers who do so. State Farm’s DUI rate increase is also modest compared to most other car insurance providers. Additionally, many customers appreciate the option to meet agents in person, which State Farm provides.

Esurance, which is owned by Allstate, is one of the less expensive options for those with DUIs because it is based primarily online. Although their DUI rate increase is greater than Progressive or State Farm’s by percentage, their low baseline rates make it so they’re still worth considering.

Read more:

Although this last provider isn’t available to everyone, USAA is one of the most affordable car insurance companies that accept a DUI if you or an immediate family member has served in the military.

How Long DUIs Affect Car Insurance Rates

Exactly how long a DUI can affect your insurance depends on the state you live in. For example, a DUI in Arizona is removed from your driving record after five years, while in Florida a DUI remains on your record for a full seventy-five years.

Read more: What are the DUI insurance laws in Arizona?

Other states will never remove a DUI from your driving record, but that doesn’t mean insurance companies will always charge you increased rates. In general, insurers will look at the past 3 – 5 years, and if you haven’t had a DUI in that time, you may not see a rate increase.

Keep in mind that even though a DUI may be removed from your driving record (and thereby stop affecting your car insurance rates), it could remain on your criminal record.

Not Telling Your Insurance About Your DUI

Is not telling my insurance provider about DUI an option? This is a question with an answer that tends to change depending on the exact circumstances of a particular DUI. In general, if you get into an accident and have to make a claim, expect a claims adjuster to ask you about the accident. In this situation, always be honest about the DUI, as trying a DUI insurance trick by not telling your insurer could result in a denied claim.

On the other hand, if you’re pulled over while under the influence and are charged with a non-accident DUI, your insurance provider may not be notified, depending on the state.

If you lived in Utah, for example, your insurer would need to request a copy of your driving record in order to find out about a DUI that wasn’t related to an accident. Depending on how far off your policy renewal date is, your insurer may not increase your rates based on your DUI for a number of months.

View this post on Instagram

Of course, this shouldn’t be viewed as a foolproof DUI insurance trick since your state may require you to contact your insurance provider about any DUI charge—and it’s always possible that an insurer will demand additional payment for any months where you had a DUI on your record but neglected to notify them about it.

The Final Word on the Best Car Insurance for DUI Offenders

Let’s recap: Before you decide where to buy car insurance if you have a DUI, see what local options are available to you. For many drivers, Progressive, State Farm, and Esurance will be the most affordable car insurance around. If you or an immediate family member is a retired or active-duty veteran, USAA is also a great choice (read more: USAA Car Insurance Review).

If you have multiple DUIs and are unable to purchase insurance from any of the companies listed above, decide if a state-assigned risk pool or a “high-risk” driver insurance policy is better for you. Regardless of how your driving record looks right now, it probably wouldn’t hurt to purchase a safe vehicle and take a defensive driving course to lower your rates for both personal and commercial insurance.

To help you start your search for insurance companies that people with DUIs can afford, use our free quote tool to compare car insurance quotes from insurance companies that accept DUIs.

Frequently Asked Questions

What car insurance companies accept a DUI?

Most major car insurance companies accept drivers with a DUI, although rates may increase. Some insurance companies for DUI drivers specialize in providing coverage for high-risk drivers.

What are the most affordable car insurance companies that accept a DUI?

Progressive, State Farm, Esurance, and USAA (for military members) offer affordable car insurance with DUIs.

How long does a DUI affect my insurance?

The duration varies by state. Insurers typically look at the past 3 to 5 years of your driving history, and if you haven’t had a DUI in that time, rates may not increase.

How does company vehicle insurance with a DUI work?

As with personal car insurance, your commercial car insurance rates could go up after a DUI. Since insuring a company vehicle is often more expensive than purchasing personal insurance in the first place, this could mean a considerable increase in your transportation expenses.

If you drive a vehicle for business purposes and you have a DUI on your record, consider purchasing a safer vehicle and/or taking a state-approved defensive driving course to reduce your car insurance costs.

Is not telling my insurance provider about a DUI an option?

It is generally not advisable to withhold information about a DUI. Consult your state’s requirements and insurance provider for specific guidelines. If you are worried about your rates becoming too expensive, compare rates with our free tool to find cheap DUI insurance.

What is the best car insurance for someone with a DUI?

Minimum coverage will be the cheapest auto insurance after DUIs, but it doesn’t provide much financial protection in an accident. Full coverage isn’t as affordable for DUI drivers, but it does provide the best protection (learn more: Best Full Coverage Car Insurance).

Is Progressive cheaper than The General?

On average, Progressive has lower average rates for cheap car insurance with DUIs. However, The General accepts more high-risk drivers than Progressive, so it is better for DUI drivers who can’t find insurance elsewhere.

Why is The General so expensive?

The General is more expensive because it provides insurance to high-risk drivers. However, while its rates are higher, it does have some of the best insurance for DUI offenders.

Is Geico cheaper than The General?

On average, Geico’s DUI insurance rates are cheaper. Read more about the two companies in our Geico vs. The General car insurance comparison.

How can I save on DUI car insurance?

DUI rates are more expensive, but there are a few things you can do to try and lower your rates, such as comparing DUI car insurance quotes. You should also keep a clean driving record after your DUI and apply for discounts.

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.