10 Best Car Insurance Companies That Allow Spouse Exclusions in 2026

The best car insurance companies that allow spouse exclusions are Geico, Allstate, and State Farm starting at $80/mo. Each state sets its own car insurance rules. For example, Arizona, California, and Texas permit named exclusions in their policies, whereas New York strictly prohibits them.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Insurance and Finance Writer

Dorothea Hudson has been professionally writing in many spheres since 2013. She has written on entertainment, insurance, finance, travel, technology, AI, renewable energy, crypto, fundraising, and real estate for many websites. Her work has been published for British retailer Marks and Spencer, Kroger Magazine, the Vision Group, and more. Her passions include writing, music, running, travel, te...

Dorothea Hudson

Certified Financial Planner

Joel Ohman is the CEO of a private equity backed digital media company. He is a CERTIFIED FINANCIAL PLANNER™, author, angel investor, and serial entrepreneur who loves creating new things, whether books or businesses. He has also previously served as the founder and resident CFP® of a national insurance agency, Real Time Health Quotes. He has an MBA from the University of South Florida. Joel...

Joel Ohman

Updated May 2024

Company Facts

Full Coverage for Companies That Allow Spouse Exclusions

A.M. Best Rating

Complaint Level

Pros & Cons

Company Facts

Full Coverage for Companies That Allow Spouse Exclusions

A.M. Best Rating

Complaint Level

Pros & Cons

Company Facts

Full Coverage for Companies That Allow Spouse Exclusions

A.M. Best Rating

Complaint Level

Pros & Cons

Geico, Allstate, and State Farm are the best car insurance companies that allow spouse exclusions. Geico is the overall best because of its competitive rates starting at $200/mo for full coverage.

While there are some limitations on car insurance exclusions, you may be able to exclude your spouse depending on which state you live in. This can save you money over the long term but can also cost you big time if you’re not careful.

Our Top 10 Picks: Best Car Insurance Companies That Allow Spouse Exclusions

| Company | Rank | Multi-Vehicle Discount | A.M. Best | Best For | Jump to Pros/Cons |

|---|---|---|---|---|---|

| #1 | 25% | A++ | Competitive Rates | Geico | |

| #2 | 25% | A+ | Coverage Options | Allstate | |

| #3 | 20% | A++ | Customer Service | State Farm | |

| #4 | 20% | A | Nationwide Reach | Nationwide |

| #5 | 20% | A | Personalized Service | American Family | |

| #6 | 25% | A | Policy Options | Farmers | |

| #7 | 8% | A++ | Multi-Policy Discounts | Liberty Mutual |

| #8 | 20% | A++ | Coverage Flexibility | Travelers | |

| #9 | 10% | A+ | Competitive Premiums | Erie |

| #10 | 25% | A | Membership Benefits | AAA |

Curious about your rates from car insurance companies that allow spouse exclusions? Enter your ZIP code into our free quote tool to get an idea of what you can pay.

- Car exclusions are available, depending on locations

- If your state allows it, you can save money on your monthly premiums

- Car exclusions opens you up to new risks

#1 – Geico: Best Overall

Pros

- Rates Below the National Average in Most Categories: Geico’s rates are generally lower than the national average across various categories.

- Inexpensive Car Insurance: Geico offers affordable rates for drivers with clean driving records, rewarding safe driving habits with lower premiums.

- Affordable Rates: Geico provides affordable premiums for drivers with low credit scores. Check out our Geico car insurance review for more information.

Cons

- Limited Customer Service Options: Geico does not provide dedicated agents for drivers, which can be a downside for customers who prefer personalized service or need assistance with their policies.

- Inconsistent Claims Processing: Some customers report inconsistent experiences with Geico’s claims processing and delays or difficulties in receiving payouts.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#2 – Allstate: Best for Coverage Options

Pros

- Multiple Reward Options for Safe Driving: Allstate offers various reward programs, such as DriveWise and deductible rewards, to encourage safe driving practices. Explore our Allstate car insurance review for more details.

- Advanced Technological Tools: Allstate provides modern tools and technologies for drivers and staff, improving the overall insurance experience.

- Tailored Driving Training Program for Teens: Allstate offers a specialized driving training program for teenagers to reduce the risk of accidents.

Cons

- Below-Average Customer Satisfaction Ratings: According to J.D. Power’s 2023 U.S. Auto Insurance Study, Allstate scored below average in most regions, indicating that customers may not be as satisfied with their service as with other insurance providers.

- Limited Additional Coverage Options: Compared to some other insurance providers, Allstate offers fewer additional coverage options, which may limit customers’ ability to customize their policies to meet their specific needs.

#3 – State Farm: Best for Customer Service

Pros

- A++ Financial Strength Rating: State Farm boasts an A++ financial strength rating from AM Best, indicating its superior ability to meet policyholder obligations.

- Usage-Based Insurance Program: State Farm offers a usage-based insurance program, which can lead to lower premiums for policyholders who demonstrate safe driving habits.

- Generous Rental Car Coverage: State Farm provides generous coverage for rental cars. Read our State Farm review to learn more.

Cons

- Fewer Add-Ons: State Farm offers fewer add-on options compared to other providers, limiting the customization of policies.

- Doesn’t Offer Gap Insurance: Unlike other insurance providers, State Farm does not offer gap insurance, which may be a drawback for customers leasing or financing a vehicle and want additional protection against depreciation.

#4 – Nationwide: Best for Nationwide Reach

Pros

- Nationwide Availability: Nationwide offers car insurance coverage in all 50 states, making it a convenient option for those who move frequently or travel often.

- Accident Forgiveness: With five years of safe driving, Nationwide automatically forgives your first at-fault accident.

- Variety of Discounts: You can save up to 50% on your insurance premium by taking advantage of Nationwide’s car insurance discounts.

Cons

- Fewer Recommendation Rates: Nationwide has received fewer recommendations compared to some other insurance providers.

- Fewer Discounts: Nationwide did not score well for discounts, suggesting that it may not offer as many or as significant discounts as some other insurance providers.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#5 – American Family: Best for Personalized Service

Pros

- Personalized Service: American Family assigns each customer a dedicated insurance agent who can provide personalized service for their unique needs. Check out our American Family review for more information.

- Many Add-On Coverage Options: American Family Insurance offers a wide range of add-on coverage options, allowing customers to customize their policies to fit their specific needs.

- A Usage-Based Insurance Program: American Family’s UBI, KnowYourDrive, allows good drivers to reduce their car insurance costs based on their driving habits.

Cons

- Limited Availability: American Family insurance is only available in 19 states, limiting options for consumers outside these areas.

- Average Score on Collision Repair Process: American Family received only an average score of a C+ on its collision repair process by collision repair professionals.

#6 – Farmers: Best for Policy Options

Pros

- Great Policy Options: Farmers Insurance offers a wide range of coverage options allowing customers to tailor their policies to fit their needs.

- Fewer Customer Complaints: Farmers Insurance receives less complaints from customers than usual regarding private passenger car insurance.

- Well-Reviewed Mobile App: Farmers Insurance has a well-reviewed mobile app that provides customers with convenient access to their policies, claims, and other insurance-related information.

Cons

- High Premiums in Some States: Farmers insurance premiums can be high in some states, which may make it less affordable for some customers. Read more in our Farmers car insurance review.

- Limited Customer Service Availability: Farmers insurance customer service is not available 24/7, which could be inconvenient for customers who require assistance outside of regular business hours.

#7 – Liberty Mutual: Best for Multi-Policy Discounts

Pros

- Numerous Discounts: Liberty Mutual offers innumerable discounts, particularly for young drivers, helping to make their policies more affordable. Find out how much you can save on your insurance in our Liberty car insurance discounts guide.

- Variety of Add-On Coverage: Liberty Mutual offers a variety of car insurance policies and add-on coverage options.

- Special Coverage for Mexico: Liberty Mutual offers special coverage through MexPro for drivers taking their cars to Mexico.

Cons

- Below-Average Scores: Liberty Mutual received a below-average score in J.D. Power’s 2023 U.S. Auto Claims Satisfaction Study.

- High Rates: Liberty Mutual’s rates can be high, which may make it less affordable for some customers. This could be a drawback for individuals looking for more cost-effective insurance options.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#8 – Travelers: Best for Coverage Flexibility

Pros

- Coverage Flexibility: Travelers offers a wide range of flexible coverage options to customize your insurance plan.

- Lower-Than-Average Annual Rates: Travelers Insurance offers lower-than-average annual rates. Learn more about Travelers rates in our Travelers car insurance review.

- Accident Forgiveness Coverage: Travelers Insurance offers accident forgiveness coverage, which means that policyholders’ rates may not increase after their first at-fault accident.

Cons

- Higher Rates: Some drivers may find Travelers’ rates to be higher compared to other providers.

- Limited Availability of Rideshare Insurance: Travelers Insurance does not offer rideshare insurance in all states.

#9 – Erie: Best for Competitive Premiums

Pros

- Vanishing Deductibles: Erie offers a unique feature where your deductible decreases each year you go without filing a claim.

- Competitive Premiums: Erie’s rates are generally lower compared to other providers, making it a great option for those looking to save on their premiums.

- Rental Car Reimbursement: If your vehicle is in the shop for repairs, Erie will reimburse you for the cost of a rental car.

Cons

- Limited Availability: Erie is not available in all states. Find out whether Erie is available in your state in our Erie car insurance review.

- No Usage-Based Insurance Option: Erie does not offer a usage-based insurance option.

#10 – AAA: Best for Membership Benefits

Pros

- Membership Benefits: AAA offers a variety of membership benefits, including roadside assistance and discounts on travel and entertainment.

- Multiple Policy Discounts: AAA also offers discounts for bundling multiple insurance policies together.

- Multiple Insurance Products Offered: AAA provides a range of insurance products beyond auto insurance, including home, renters, and life insurance.

Cons

- Insurance Products Vary by Location: AAA’s insurance products and coverage options can vary depending on where you live, which may limit the availability of certain coverages or discounts.

- AAA Membership Requirement: AAA car insurance may require a AAA membership. Learn more: AAA Car Insurance Review

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Car Insurance Companies that Allow Spouse Exclusions

The insurers that allow you to exclude your spouse from your insurance will largely depend on the state you live in, as is the case with a lot of car insurance regulations.

Read more: Can married couples have separate car insurance policies?

Some states allow freedom to select exclusions, some allow them with limitations, and some states have banned them altogether.

When you exclude someone from your policy, you’re guaranteeing that they won’t ever be behind the wheel of your vehicle.

This has the added benefit of potentially lowering your premiums if the named driver has a bad driving history that would be viewed as risky.

Car Insurance Monthly Rates by Coverage Level & Providers That Allow Spouse Exclusions

| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| AAA | $89 | $209 |

| Allstate | $90 | $210 |

| American Family | $82 | $202 |

| Erie | $84 | $204 |

| Farmers | $92 | $212 |

| Geico | $80 | $200 |

| Liberty Mutual | $95 | $215 |

| Nationwide | $88 | $208 |

| State Farm | $85 | $205 |

| Travelers | $87 | $207 |

While you might be curious about finding a company that lets you exclude your spouse, it would make a lot more sense to first examine the local exclusion policies for your state. This can save you the headache of looking for a company in a state that doesn’t allow exclusions at all.

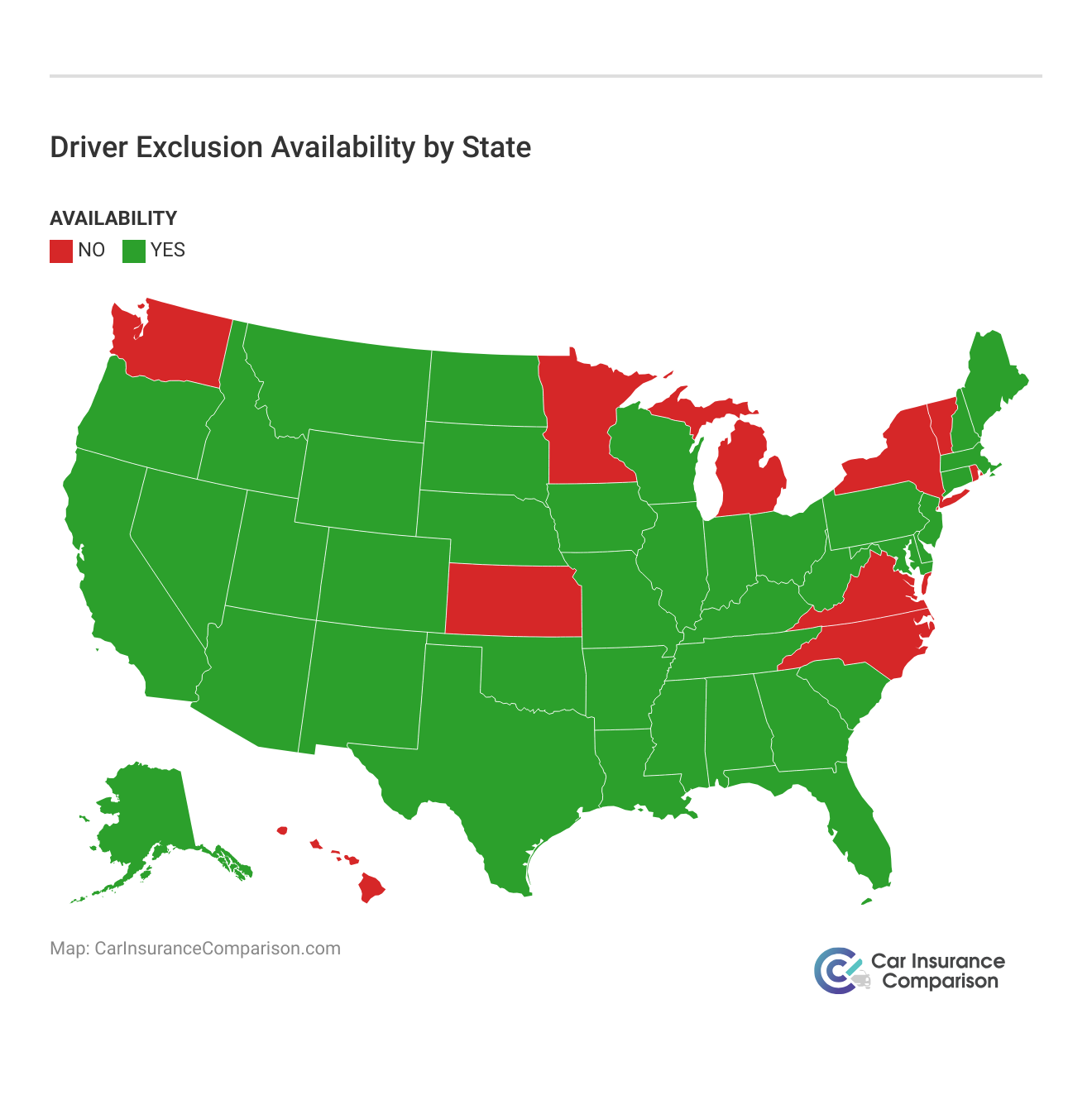

States That Allow Driver Exclusion

Each state will have different rules regarding car insurance regulations, mostly due to the fact that roads and driving conditions differ across the country. Some states like Arizona, California, and Texas all allow for named exclusions, while states like New York don’t allow them at all. Compare New York car insurance rates in our comprehensive guide.

The table below shows which states allow driver exclusions:

Just like the III shows, car insurance requirements change vastly between states. So it follows that each state would make up its own mind about excluding spouses from car insurance.

Car Insurance Companies That Don’t Allow Spouse Exclusions

Each state will limit who can be excluded from a car insurance policy. Most car insurers offer some kind of exclusions that limit what they’ll cover due to negligence or facts that come to light during the investigation.

If an insurer does offer an exclusion, the named person cannot have access to vehicles under that policy. If they crash or are crashed into while driving the vehicle, it’s almost certain that the insurance will not cover your vehicle or the damages done to that person.

Furthermore, the person who was driving your vehicle isn’t insured and you may be found financially responsible when your vehicle is the cause of an accident. This could put the person in financial jeopardy on top of having to repair a damaged vehicle.

In states that don’t allow exclusions, that person would most likely be covered under “permissive use” which extends your coverage to them when they borrow your vehicle. That being said, this can raise your rates a good bit.

If you live in an area that doesn’t allow for driver exclusions, you might be worried about the state’s most reckless drivers and wish to avoid the hassle that an exclusion process might bring.

Read more: Compare Best Car Insurance Companies That Don’t Require Spouses To Be on the Same Policy

Excluded Driver Explained

You might be wondering, “What is an excluded driver?”

A named exclusion is when you guarantee to your insurance company that a specified person won't have access to your vehicles.

Daniel Walker Licensed Insurance Agent

This is typically done to let an insurer know that one or more high-risk drivers that live with you won’t have access to your vehicle.

Since insurers consider the chance of accident when deciding how much to charge you per month, it makes sense that you’d want to minimize that risk by leaving off the drivers that don’t have access to your vehicle.

Read More: Does car insurance cover excluded drivers?

Otherwise, an insurer might view your proximity to that person as a heightened risk.

In states that don’t allow those exclusions, your rates are based on everyone who lives with you. This can transfer to higher rates if you have any younger or risky drivers under your roof.

How a Car Insurance Exclusion Can Save You Money

If you’re going to exclude a driver due to young age or risky driving history, you’re likely to save money on your monthly premiums.

When you remove the risk that person poses by guaranteeing they’re not going to be driving your vehicle, your insurability will improve.

People That Can Be Excluded

In the states that allow car insurance exclusions, anyone you name can be excluded from receiving coverage on your policy, but make sure it’s someone you can guarantee won’t be behind the wheel of your vehicle. This includes considerations around uninsured motorist property damage, which covers you if an uninsured driver hits your car, but doesn’t apply if the driver was excluded.

If an excluded driver does get behind the wheel and gets into an accident, your insurance coverage goes out the window.

You and the excluded person will be personally financially responsible for any damages to property, vehicles, or people done by the driver’s negligence.

Car Insurance Companies That Don’t Allow Spouse Exclusions: The Bottom Line

Deciding to exclude someone from your policy can save you a fair amount of money each month on your premiums. That being said, you’ll have to guarantee that the named person will never get behind the wheel of your vehicle, or else you’ll be paying out of pocket for the damages.

Read more: Best Car Insurance for Married Couples on Separate Policies

To get a quote from car insurance companies that don’t allow spouse exclusions, enter your ZIP code into our free quote tool to get an idea of what you can pay.

Frequently Asked Questions

What is a spouse exclusion in car insurance?

A spouse exclusion policy insurance is a provision in a car insurance policy that allows the policyholder to exclude their spouse from coverage. This means that if the excluded spouse drives the insured vehicle and gets into an accident, the insurance company will not provide coverage for any damages or injuries. Learn more: Does car insurance follow the car or the driver?

Can I exclude a family member from my car insurance?

Yes, it is possible to exclude a family member from your car insurance policy. However, it is important to note that this means they will not be covered under your policy and will need to find their own coverage.

Do married couples have to be on the same car insurance policy?

No, married couples do not have to be on the same car insurance policy. They can each have their own individual policies or choose to be on the same policy together. It is important to compare rates and coverage options for both options to determine the best fit for your situation.

What states allow driver exclusion?

Excluding spouse from your car insurance policy is allowed in the following states: Arizona, California, Delaware, Mississippi, Georgia and Texas. Compare Texas car insurance rates in our guide.

Why would someone want to exclude their spouse from car insurance coverage?

Why add an excluded driver? There are several reasons why someone may want to exclude their spouse from car insurance coverage. For example, if the spouse has a poor driving record or a history of accidents, excluding them from the policy can help prevent an increase in insurance premiums. Additionally, if the spouse has their own separate car insurance policy, excluding them from the other policy can help avoid duplication of coverage.

Are all car insurance companies willing to provide spouse exclusions?

No, not all car insurance companies allow spouse exclusions. Each insurance company sets its own policies and guidelines regarding spouse exclusions, so it’s important to check with individual providers to determine if this option is available.

Which car insurance companies are known to allow spouse exclusions?

Geico, Allstate, and State Farm are known to allow spouse exclusions. Other insurance companies may also offer this option, so it is best to check with your specific insurer.

How can I find the best car insurance company that allows spouse exclusions?

To find the auto insurance with driver exclusions, consider the following steps:

- Research and compare multiple insurance providers. Look for companies that offer spouse exclusions and compare their coverage options, prices, customer reviews, and financial stability.

- Assess your specific needs. Determine what coverage options are important to you and ensure that the insurance company you choose can meet those needs.

- Get quotes. You can find free car insurance quotes online or by contacting insurance agents directly.

- Evaluate the quotes. Compare the quotes you receive, taking into account the coverage limits, deductibles, and any additional benefits or discounts offered.

- Consider customer service. Read reviews and consider the reputation of each insurance company in terms of customer service, claims handling, and responsiveness.

- Make an informed decision. Based on your research, quotes, and overall assessment, choose the car insurance company that best fits your needs and budget while allowing spouse exclusions.

When you choose the right car insurance that allows spouse exclusions can ensure you get the coverage you need while potentially saving on your insurance rates.

How do I exclude my husband from car insurance?

To exclude your husband from your car insurance policy, you will need to contact your insurance provider and inform them that you wish to add a driver exclusion. They will likely require written consent from both parties and may ask for additional documentation.

Does Progressive allow excluded drivers?

Yes, Progressive does allow excluded drivers on their car insurance policies. However, they may have specific requirements and restrictions for this option, so it is best to check with them directly.

Is your spouse automatically covered on your car insurance?

Does marital status matter for car insurance?

Can I remove my wife from car insurance?

Do I have to add my spouse to my car insurance with Progressive?

Can an excluded driver drive my car?

Can I exclude my own car insurance?

What happens if an excluded driver gets in an accident?

Is removing a driver from my car insurance policy the same as excluding them?

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.