Best Car Insurance Companies That Don’t Use Credit Scores in 2026 (Top 10 Providers)

Allstate, Progressive, and USAA stand out as the best car insurance companies that don’t use credit scores. Enjoy rates as low as $64 per month, ensuring fair and accessible coverage for all drivers. With their commitment to affordability and transparency, they provide peace of mind on the road.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Licensed Insurance Producer

Dani Best has been a licensed insurance producer for nearly 10 years. Dani began her insurance career in a sales role with State Farm in 2014. During her time in sales, she graduated with her Bachelors in Psychology from Capella University and is currently earning her Masters in Marriage and Family Therapy. Since 2014, Dani has held and maintains licenses in Life, Disability, Property, and Casualt...

Dani Best

Insurance Operations Specialist

Michael earned a degree in Business Management degree with an insurance focus, which led to a successful 25-year career in insurance claims operations and support. He possesses a high-level of business acumen across multiple areas of the insurance industry. Over the course of his career, he served in multiple roles supporting claims operations including: Claims Specialist, Claims Trainer, Claim Au...

Michael Leotta

Updated May 2024

11,638 reviews

11,638 reviewsCompany Facts

Full Coverage

A.M. Best Rating

Complaint Level

Pros & Cons

11,638 reviews

11,638 reviews 13,283 reviews

13,283 reviewsCompany Facts

Full Coverage

A.M. Best Rating

Complaint Level

13,283 reviews

13,283 reviews 6,589 reviews

6,589 reviewsCompany Facts

Full Coverage

A.M. Best Rating

Complaint Level

6,589 reviews

6,589 reviewsAllstate, Progressive, and USAA lead the pack as the top choices for the best car insurance companies that don’t use credit scores. Providing comprehensive coverage and prioritizing fairness, they offer accessible options for all drivers.

Securing car insurance without a credit check can be challenging, but it’s promising to see progress towards fairer practices in the industry, with six states outlawing the sole use of credit scores to set rates. This signals a positive shift towards more equitable treatment for all drivers.

Our Top 10 Picks: Best Car Insurance Companies That Don't Use Credit Scores

| Company | Rank | Multi-Policy Discount | Low-Mileage Discount | Best For | Jump to Pros/Cons |

|---|---|---|---|---|---|

| #1 | 25% | 30% | Pay-Per-Mile Rates | Allstate | |

| #2 | 10% | 15% | Online Convenience | Progressive | |

| #3 | 25% | 30% | Add-on Coverages | USAA | |

| #4 | 20% | 10% | Usage Discount | Nationwide |

| #5 | 25% | 30% | 24/7 Support | Erie |

| #6 | 13% | 10% | Accident Forgiveness | Travelers | |

| #7 | 29% | 20% | Student Savings | American Family | |

| #8 | 25% | 30% | Cheap Rates | Geico | |

| #9 | 17% | 10% | Many Discounts | State Farm | |

| #10 | 25% | 30% | Customizable Polices | Liberty Mutual |

The great news is participating in usage-based car insurance programs can lower your rates by up to 50%. If you want to find the best car insurance for bad credit, this is a good place to start.

Additionally, exploring usage-based insurance programs can lead to significant rate reductions, offering hope for those seeking affordable coverage despite credit challenges.

Read on to see bad credit car insurance rates and discounts. Enter your ZIP code to compare free car insurance quotes from top companies.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Rates From the Best Auto Insurance Companies That Don’t Check Credit

Why is my car insurance score so low? Securing car insurance without credit score considerations can be challenging, given that a majority of insurers factor credit scores into their rate determinations. Lower credit scores often result in higher premiums, reflecting a correlation between credit history and accident likelihood.

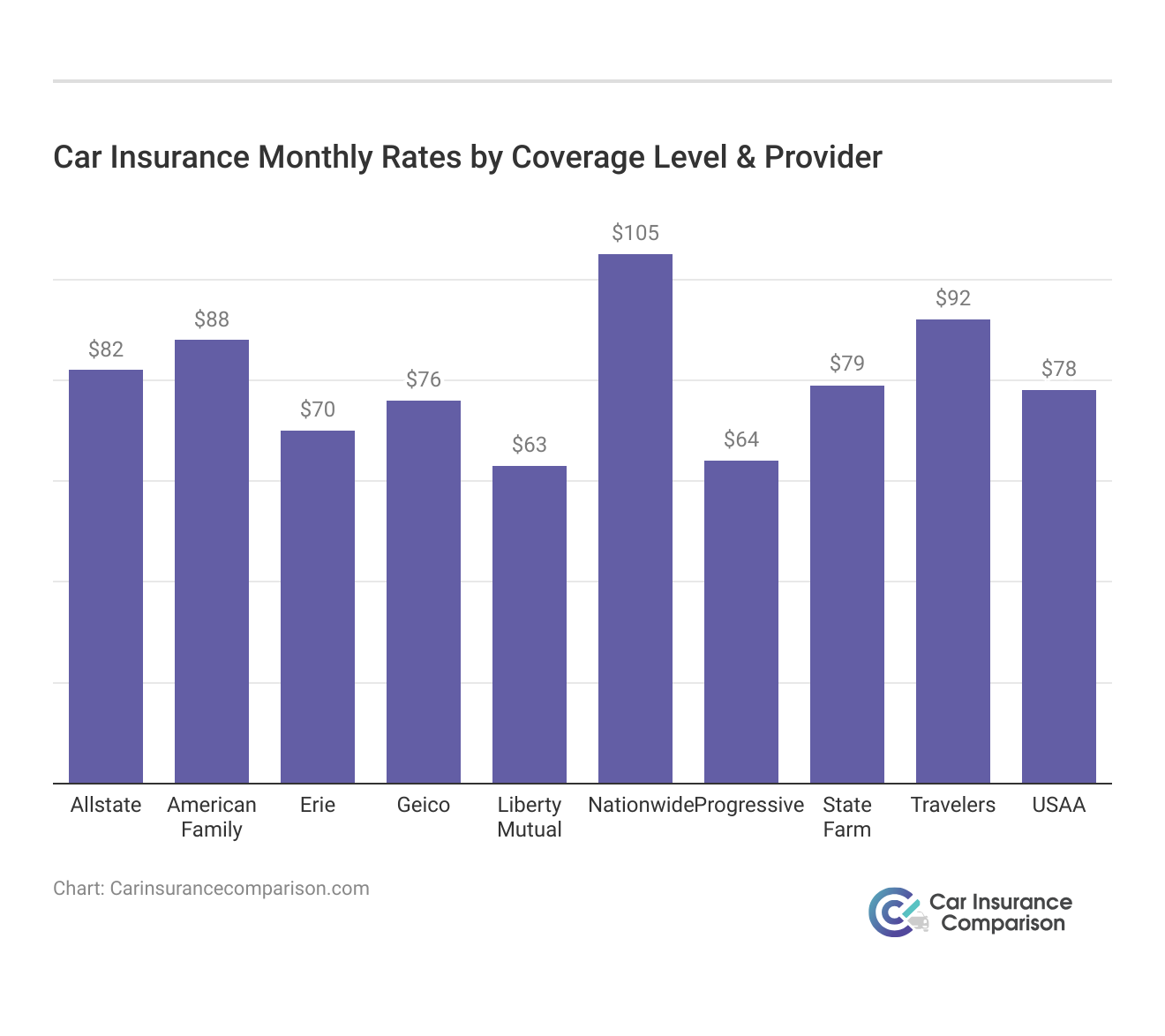

Car Insurance Monthly Rates by Coverage Level & Provider

| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| Allstate | $82 | $165 |

| American Family | $88 | $240 |

| Erie | $70 | $198 |

| Geico | $76 | $215 |

| Liberty Mutual | $63 | $195 |

| Nationwide | $105 | $185 |

| Progressive | $64 | $155 |

| State Farm | $79 | $220 |

| Travelers | $92 | $225 |

| USAA | $78 | $175 |

In terms of minimum coverage, Allstate, Progressive, and USAA offer competitive rates of $82, $64, and $78 per month, respectively. These companies prioritize essential coverage, meeting legal requirements affordably.

For comprehensive protection, USAA leads with a monthly rate of $175, followed by Geico at $215 and State Farm at $220, providing extensive coverage, including collision and comprehensive insurance, ensuring peace of mind on the road.

In the minimum coverage category, Erie stands out with a budget-friendly $70 monthly rate, while Travelers and American Family offer competitive options at $92 and $88. These companies balance affordability and essential coverage. For those seeking full coverage, Liberty Mutual offers a compelling option at $195 per month, joined by Nationwide and Allstate at $185 and $165, respectively.

Allstate stands out as the top choice for tailored solutions and winning strategies among car insurance companies that don't use credit scores.

Dani Best Licensed Insurance Producer

The Top 5 car Insurance companies provide comprehensive protection at reasonable rates, offering value for a complete insurance package. Despite the prevalence of credit score considerations in rate settings, alternatives exist for those seeking car insurance without a credit check.

Car Insurance Providers Tailored for Drivers With Bad Credit

the leading insurance firms in the financial sector, our aim is to assist you in securing the most affordable car insurance despite having poor credit. Bad credit encompasses three categories:

- Good Credit (670-739)

- Fair Credit Score (580-669)

- Poor Credit Score (300-579)

By understanding where your credit falls within these ranges, you can estimate the potential impact on your insurance rates with various companies.

Full Coverage Car Insurance Monthly Rates by Credit Score & Provider

Insurance Company Poor Credit Fair Credit Good Credit

Allstate $188 $134 $113

Farmers $273 $148 $132

Geico $140 $101 $87

MetLife $354 $194 $141

Nationwide $148 $127 $112

Progressive $206 $149 $115

State Farm $211 $124 $103

Travelers $208 $143 $127

USAA $122 $78 $74

In general, the companies that offer the cheapest rates for drivers with bad credit are USAA, Nationwide, Geico, and American Family but since so many other factors go into determining your rate, it’s good to get multiple quotes. However, also important to consider is which companies increase rates more for drivers with bad credit.

The companies that are easier on drivers with bad credit as compared to those with good credit are Travelers, Progressive, Farmers, and Nationwide. Bad credit raises your car insurance rates by $165.39/month on average. Companies often look at particular parts of your credit report rather than basing their decision on only the score.

Read more: Progressive vs. Travelers Car Insurance Comparison

Understanding the State-by-State Impact of Credit on Car Insurance Rates

The ability of a car insurance company to check your credit score is determined by your state’s insurance commissioner. In most states, it is perfectly legal for an insurance company to check your credit. That’s why it’s difficult to find car insurance without a credit check.

In the states where it isn’t legal, such as California, insurance companies don’t run your credit to determine your rates. There are additional credit-check car insurance laws in Michigan, Hawaii, Oregon, Utah, and Massachusetts. For all other states, expect a difference in rates for drivers with good credit and bad credit.

Full Coverage Car Insurance Monthly Rates by Credit & State

State Good Credit Poor Credit Percentage Increase

Alabama $247 $397 38%

Alaska $193 $279 31%

Arizona $246 $417 41%

Arkansas $283 $423 33%

Colorado $256 $413 38%

Connecticut $304 $496 39%

Delaware $380 $664 43%

District of Columbia $284 $492 42%

Florida $285 $534 47%

Georgia $324 $540 40%

Idaho $192 $303 37%

Illinois $216 $354 39%

Indiana $230 $344 33%

Iowa $201 $307 34%

Kansas $237 $347 32%

Kentucky $333 $573 42%

Louisiana $379 $600 37%

Maine $173 $277 38%

Maryland $287 $509 44%

Minnesota $278 $515 46%

Mississippi $240 $393 39%

Missouri $213 $369 42%

Montana $214 $345 38%

Nebraska $226 $361 37%

Nevada $310 $525 41%

New Hampshire $204 $345 41%

New Jersey $350 $605 42%

New Mexico $249 $343 27%

New York $263 $497 47%

North Carolina $245 $337 27%

North Dakota $268 $463 42%

Ohio $191 $295 35%

Oklahoma $271 $446 39%

Pennsylvania $271 $423 36%

Rhode Island $355 $505 30%

South Carolina $250 $408 39%

South Dakota $255 $436 42%

Tennessee $238 $392 39%

Texas $251 $432 42%

Vermont $192 $379 49%

Virginia $163 $241 33%

Washington $203 $312 35%

West Virginia $266 $437 39%

Wisconsin $200 $315 36%

Wyoming $202 $315 36%

In New Mexico, North Carolina, and Rhode Island, drivers with bad credit will pay car insurance rates that are up to only 30 percent higher than those that have good credit. In Minnesota, Florida, New York, and Vermont, drivers with bad credit will pay car insurance rates that are approaching 50 percent higher than those that have good credit.

If you aren’t sure whether this is a legal practice in your state, you can do a search for your state’s department of insurance on the National Association of Insurance Commissioners website, under the States & Jurisdictions map.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Strategies to Lower Car Insurance Costs With Poor Credit

Despite poor credit impacting car insurance rates, there are ways to mitigate the extra expense. Firstly, communicate directly with your insurer to inquire about potential discounts, such as car insurance discount for being a good driver, having a good student, holding multiple policies, or paying upfront.

These may include incentives for being a good driver, having a good student, holding multiple policies, or paying upfront. For instance, a multi-policy discount applies if you have two or more policies with the same insurer, while paying in advance often yields a discount. Additionally, maintaining good grades for teenage drivers can qualify for a good student discount, reflecting responsible behavior on the road.

Exploring Usage-Based Car Insurance Costs for Drivers With Bad Credit

Usage-based car insurance is an excellent way to prove to insurance companies that people with bad credit aren’t necessarily bad drivers. Many car insurance companies offer a discount program that bases your car insurance rates on either driving habits or how much you drive. Some companies have both.

Usage-Based Car Insurance Discount by Provider

Insurance Company Discount Percentage

Allstate 30%

American Family 30%

Esurance 20%

Liberty Mutual 30%

MetLife 20%

Nationwide 40%

Progressive 20%

Safeco 30%

State Farm 30%

The Hartford 20%

Travelers 30%

USAA 30%

You can participate in these programs by simply plugging their device into your car or downloading and using their driving app.

Understanding the Impact of Credit Scores on Car Insurance Rates

Car insurance companies assess risk meticulously, considering various factors like age, gender, driving history, and increasingly, credit scores. While some insurers advertise policies without credit checks, they often come with higher premiums, targeting riskier demographics.

Navigating this landscape can be challenging for drivers seeking affordable coverage without credit scrutiny. However, resources like state insurance regulatory commission websites or toll-free numbers can offer insights into providers offering no-credit-check policies.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Understanding the Relationship Between Credit and Car Insurance Rates

Credit scores are used by most companies to set rates. Credit scores have a strong correlation with a person’s likelihood to make insurance claims. In fact, people with poor credit scores are much more likely than those with good credit scores to make claims.

Since statistical evidence of this fact came to light, more insurance companies have considered credit scores as one of the factors when determining how much a client will pay for car insurance coverage. Some industry experts state that more than 90% of companies now use credit scores in determining rates.

Deciphering the Influence of Credit Scores on Car Insurance Rates

Each insurance company weighs rating factors differently. While your driving record is the factor that is considered first, the other factors each have their own weight, which is assigned by the underwriters of each individual insurance company. This contributes to the variation in insurance price quotes from one company to another.

The use of credit scores for insurance rating is newer than other factors and therefore is not treated uniformly by all insurance companies.

Distinguishing Between Credit Scores and Credit-Based Insurance Scores

Credit scores and credit-based insurance scores are two entirely different things. To any entity that looks at your credit score, even if it’s not a car insurance company, the credit score is only a prediction to show how likely it is you will go three months without paying your bills in the next two years.

Allstate's commitment to tailored coverage and competitive rates makes them the standout choice for drivers seeking insurance without credit score considerations.

Justin Wright Licensed Insurance Agent

Credit-based insurance scores, on the other hand, are designed to predict whether or not you’re likely to file an insurance claim, so insurance companies likely look at the individual items on your credit report.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Decoding Car Insurance Companies’ Credit Report Criteria

Car insurance companies may look for particular things on your credit report rather than the entire credit score to determine your credit-based insurance score.

Car insurance companies like to see the following on your credit report:

- Long-established credit history

- No late payments or past-due accounts

- Open accounts in good standing

Car insurance companies don’t want to see the following on your credit report:

- Past-due payments

- Accounts in collection

- A high amount of debt

- The number of accounts

- comparing total loans against your available credit

- Not enough credit or history

- Multiple credit inquiries

Other things they may see but not necessarily hold against you:

- Bankruptcy

- Foreclosure

- Repossession

As anyone who’s familiar with credit scores knows, there is a huge range of possible scores a consumer can have. Therefore, underwriters have a wide variety of possibilities to consider, including how bankruptcy affects car insurance. Car insurance companies not only assess good versus bad credit but also delve into the specifics of your credit history, typically obtained from one of the credit reporting bureaus.

Two companies have designed models to help insurers use credit information for insurance scoring. ChoicePoint and FICO have made it easier for many insurance companies to use your personal credit score, and some companies have their own system in place. However, before they can access your information, they must get your permission.

Strategies for Elevating Your Credit Score and Lowering Car Insurance Costs

There are several simple ways to improve your credit score, although most of them take a long time to help. The first way is to make any loan or credit card payments that you have on time. Most credit cards have set payment amounts that are fairly low, so making the payments on time will help raise your credit score.

Another way to help raise your credit score is to keep a low balance on your credit cards. If you have a large credit limit on your cards, it shows that you are responsible for your finances and your credit, and therefore will help keep your credit score high. By taking small steps to ensure that you’re responsible with your finances, you can save money on your car insurance rates.

You may be asking, can my driving history lower my car insurance rates? In short, yes, and you can keep them low even if you have bad credit. Most car insurance companies will look very favorably on a safe driving record, and it may even offset any increase in cost from a poor credit rating. If you haven’t had any accidents or moving violations over the previous three years, you’re considered a good driver.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Case Studies: Car Insurance Choices Without Credit Score Consideration

In the diverse landscape of car insurance, individualized solutions tailored to specific needs can make all the difference. Let’s explore three compelling case studies where insurance providers went above and beyond to meet the unique requirements of their policyholders.

- Case Study #1 – Tailored Excellence for a Low-Risk Profile: Sarah, a meticulous driver with an exceptional credit score, found her perfect match with Allstate. Recognizing her stellar credit and spotless driving record, Allstate tailored a coverage plan that not only acknowledged her low-risk profile but also provided competitive rates.

- Case Study #2 – Empowering John, the Young Driver: John, a young driver with a limited credit history, sought affordable yet comprehensive coverage. Progressive stepped in with its customized insurance options, focusing on factors beyond traditional credit scores. Despite John’s credit history being a work in progress, Progressive’s approach empowered him with a policy that suited his needs.

- Case Study #3 – Honoring Mark’s Military Service With Competitive Rates: Mark, a military veteran, valued USAA’s commitment to personalized excellence. Despite fluctuations in his credit due to deployments, USAA’s top-performing strategies ensured that Mark received competitive rates. USAA’s recognition of Mark’s military service showcased the company’s dedication to serving those who have served their country.

These case studies exemplify the importance of personalized care in the realm of car insurance. By understanding and addressing the unique circumstances of their policyholders, insurance providers like Allstate, Progressive, and USAA demonstrate their commitment to delivering exceptional service and support.

Allstate's tailored coverage and competitive rates make them a top choice, earning a customer review rating of 92%.

Brad Larson Licensed Insurance Agent

It’s evident that the relationship between insurance providers and their policyholders extends far beyond simple coverage. It’s about trust, understanding, and a genuine commitment to meeting individual needs. Through these stories, we see that when insurance companies prioritize personalized excellence, everyone benefits – from meticulous drivers to young motorists and military veterans alike.

In Review: Car Insurance Without Credit Scores

Car insurance providers that don’t use credit scores, offering comprehensive coverage and fair pricing. While securing car insurance without credit score considerations can be challenging due to industry norms, participating in usage-based insurance programs can lead to significant rate reductions.

Despite the impact of poor credit on insurance rates, strategies such as maintaining a clean driving record and exploring discounts can help mitigate costs. Overall, understanding the relationship between credit and insurance rates is crucial for navigating the insurance landscape and finding the most suitable coverage for individual needs.

When you’re ready to see how much you can save on your car insurance, enter your ZIP code below into our free comparison tool.

Frequently Asked Questions

Which car insurance companies do not use credit scores?

Car insurance companies such as Allstate, Progressive, and USAA are known for not primarily relying on credit scores to determine rates.

Why do car insurance companies check credit?

Car insurance companies may check credit to assess a driver’s financial responsibility and predict the likelihood of future insurance claims.

Explore your car insurance options by entering your ZIP code below and finding which companies have the lowest rates.

How does credit affect car insurance premiums?

Credit can impact car insurance premiums as insurers may use credit information to determine rates, with lower credit scores often resulting in higher premiums.

To expand your knowledge, refer to our comprehensive handbook titled “Compare Monthly Car Insurance: Rates, Discounts, & Requirements” for further information

What are the best options for no-credit-check car insurance?

Some of the best options for no-credit-check car insurance include companies like Allstate, Progressive, and USAA, which prioritize factors other than credit scores in rate determinations.

Is car insurance a hard or soft credit check?

Car insurance inquiries typically result in soft credit checks, which do not impact credit scores, allowing drivers to obtain quotes without affecting their credit.

Do I need to unfreeze my credit to get a quote?

Generally, no; obtaining a car insurance quote typically does not require unfreezing credit, as insurance inquiries are often soft checks that do not require access to frozen credit files.

To gather further information, you can delve into our thorough guide named “How long does a car insurance quote last?” to guarantee you possess all the necessary details.

Does having car insurance build credit?

Having car insurance typically does not directly build credit, as insurance payments are not reported to credit bureaus. However, maintaining a history of timely payments can indirectly reflect positively on creditworthiness.

What is the cheapest car insurance for bad credit?

Geico offers the cheapest widely available auto insurance for drivers with bad credit. The average annual cost of $257 per month for full coverage is $5 per month cheaper than Farm Bureau.

For a thorough understanding, refer to our detailed analysis titled “Best Car Insurance Companies for Bad Credit” for comprehensive insights

What is a credit risk for insurance companies?

Credit risk is the risk that an insurance company will incur losses because the financial standing of the credit granted company has deteriorated to the point that the value of an asset (including off-balance-sheet assets) is reduced or extinguished.

Get the minimum car insurance coverage you need to drive legally by entering your ZIP code into our free quote comparison tool below.

What is a low insurance score?

Insurance scores range between a low of 200 and a high of 997. Insurance scores of 770 or higher are favorable, and scores of 500 or below are poor. Although rare, there are a few people who have perfect insurance scores. Scores are not permanent and can be affected by different factors.

To gain further insights, consult our comprehensive guide titled “Why is my car insurance score so low?” for a deeper understanding of how credit impacts car insurance rates.

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.