Best Car Insurance Companies That Offer Agreed Value in 2026 (Top 10 Providers)

State Farm, American Family, and Allstate dominate as the best car insurance companies that offer agreed value coverage, with discounts like up to 30% off for safe drivers. State Farm stands out for its extensive range of discounts, appealing to those seeking comprehensive coverage at a reasonable price.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Insurance & Finance Analyst

Zach Fagiano has been in the insurance industry for over 10 years, specializing in property and casualty and risk management consulting. He started out specializing in small businesses and moved up to large commercial real estate risks. During that time, he acquired property & casualty, life & health, and surplus lines brokers licenses. He’s now the Senior Vice President overseeing globa...

Zach Fagiano

Certified Financial Planner

Joel Ohman is the CEO of a private equity backed digital media company. He is a CERTIFIED FINANCIAL PLANNER™, author, angel investor, and serial entrepreneur who loves creating new things, whether books or businesses. He has also previously served as the founder and resident CFP® of a national insurance agency, Real Time Health Quotes. He has an MBA from the University of South Florida. Joel...

Joel Ohman

Updated May 2024

18,155 reviews

18,155 reviewsCompany Facts

Full Coverage for That Offer Agreed Value

A.M. Best Rating

Complaint Level

Pros & Cons

18,155 reviews

18,155 reviews 2,235 reviews

2,235 reviewsCompany Facts

Full Coverage for That Offer Agreed Value

A.M. Best Rating

Complaint Level

2,235 reviews

2,235 reviews 11,638 reviews

11,638 reviewsCompany Facts

Full Coverage for That Offer Agreed Value

A.M. Best Rating

Complaint Level

Pros & Cons

11,638 reviews

11,638 reviewsState Farm, American Family, and Allstate are the top picks overall for the best car insurance companies that offer agreed value car insurance coverage. With comprehensive policies tailored to individual needs, they ensure drivers have the protection they need on the road.

State Farm offers extensive discounts, American Family provides customizable policies, and Allstate offers add-on coverages, allowing drivers to find the perfect fit. The article explores comprehensive coverage’s importance and available options, empowering drivers to make informed decisions about protecting their vehicles.

Our Top 10 Picks: Best Car Insurance Companies That Offer Agreed Value

| Company | Rank | Multi-Policy Discount | Low-Mileage Discount | Best For | Jump to Pros/Cons |

|---|---|---|---|---|---|

| #1 | 17% | 30% | Many Discounts | State Farm | |

| #2 | 20% | 20% | Student Savings | American Family | |

| #3 | 25% | 30% | Add-on Coverages | Allstate | |

| #4 | 10% | 10% | Military Savings | USAA | |

| #5 | 13% | 10% | Accident Forgiveness | Travelers | |

| #6 | 25% | 20% | 24/7 Support | Erie |

| #7 | 20% | 10% | Usage Discount | Nationwide |

| #8 | 10% | 10% | Local Agents | Farmers | |

| #9 | 25% | 15% | Customizable Polices | Liberty Mutual |

| #10 | 15% | 15% | Local Agents | AAA |

We cover everything from selecting the right insurance options to managing claims and reducing costs. We also provide affordable supplementary safeguards for added peace of mind. For classic or collectible cars, learn how to buy insurance with agreed value policies that ensure a specific payout for your vehicle.

Get the right car insurance at the best price — enter your ZIP code above to shop for coverage from the top insurers.

- State Farm leads with competitive rates and tailored policies

- Save with discounts up to 30% on comprehensive coverage

- Explore top car insurance companies offering agreed value coverage

#1 – State Farm: Top Overall Pick

Pros

- Competitive Discounts: In our State Farm car insurance review, discover how you can save up to 17% on your policy.

- Substantial Savings: With a discount of up to 30%, State Farm stands out for its significant cost-saving opportunities.

- Diverse Discounts Options: State Farm provides many discounts, allowing customers to tailor their policies and maximize savings.

Cons

- Limited Military Savings: State Farm does not offer specific military savings, which might be a drawback for members of the armed forces.

- Potential for Higher Base Rates: While discounts are available, some customers may find that State Farm’s base rates are relatively higher.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#2 – American Family: Best for Student Savings

Pros

- Up to 20% Student Savings: American Family offers substantial discounts of up to 20% for students, making it an attractive option for student drivers.

- Competitive Overall Discounts: With additional discounts of up to 20%, American Family provides cost-saving opportunities for a broad range of customers.

- Flexible Coverage: American Family car insurance review highlights the company’s dedication to student savings, demonstrating a commitment to meeting diverse customer needs.

Cons

- Limited Military Discounts: Similar to State Farm, American Family does not emphasize military savings, potentially excluding a specific customer segment.

- Availability Restrictions: Student savings may have eligibility criteria or restrictions that not all students can meet.

#3 – Allstate: Best for Add-On Coverages

Pros

- Up to 25% Discount: Allstate offers a competitive discount of up to 25%, providing potential savings for policyholders.

- Substantial Savings: Check out the Allstate car insurance review to learn more about the company’s remarkable 30% discount and cost-saving opportunities.

- Add-On Coverages: Allstate distinguishes itself by offering a variety of add-on coverages, allowing customers to tailor their policies to specific needs.

Cons

- Potentially Complex Coverage Structure: The availability of numerous add-on coverages may make the policy structure complex, potentially confusing some customers.

- Higher Premiums for Comprehensive Coverage: While the add-on coverages enhance customization, opting for comprehensive coverage may lead to higher premiums.

#4 – USAA: Best for Military Savings

Pros

- Up to 10% Military Savings: USAA caters specifically to military members, offering up to a 10% discount, making it an excellent choice for the military community.

- Competitive Overall Discounts: With additional discounts of up to 10%, USAA car insurance discounts provide cost-saving opportunities for a broad range of customers.

- Highly Regarded Customer Service: USAA is known for its exceptional customer service, creating a positive experience for its policyholders.

Cons

- Limited Eligibility: USAA membership is exclusive to military members and their families, limiting access to a broader customer base.

- Potential for Limited Physical Presence: While USAA has a strong online presence, customers who prefer in-person interactions may find limited local offices.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#5 – Travelers: Best for Accident Forgiveness

Pros

- Up to 13% Discount: Explore potential savings with Travelers car insurance review, offering up to a 13% discount.

- Accident Forgiveness: The inclusion of accident forgiveness is a significant advantage, allowing policyholders to maintain lower rates even after an accident.

- Flexible Coverage Options: Travelers provides various coverage options, allowing customers to tailor their policies to specific needs.

Cons

- Limited Accident Forgiveness Terms: The terms and conditions of accident forgiveness may have limitations, and not all accidents may qualify.

- Potentially Higher Premiums for Full Coverage: While accident forgiveness is beneficial, opting for full coverage may result in higher premiums.

#6 – Erie: Best for 24/7 Support

Pros

- Up to 25% Discount: In our Erie car insurance review, discover how Erie offers a competitive discount of up to 25%, providing potential savings for policyholders.

- Up to 20% Additional Savings: With an additional discount of up to 20%, Erie stands out for its significant cost-saving opportunities.

- 24/7 Support: Erie distinguishes itself by providing round-the-clock support, ensuring customers have assistance whenever needed.

Cons

- Limited Regional Presence: Erie’s coverage may be limited to certain regions, potentially excluding customers in areas where it doesn’t operate.

- Fewer Additional Features: While 24/7 support is a key feature, Erie may offer fewer additional features compared to some larger competitors.

#7 – Nationwide: Best for Usage Discount

Pros

- Up to 20% Discount: Discover the potential savings with Nationwide car insurance discounts, offering a competitive discount of up to 20%.

- Up to 10% Additional Savings: With an additional discount of up to 10%, Nationwide stands out for its cost-saving opportunities.

- Usage Discount: Nationwide provides a usage-based discount, allowing customers to save based on their driving habits.

Cons

- Limited Availability of Usage Discount: The usage discount may have eligibility criteria or restrictions, limiting its availability to all customers.

- Potentially Higher Base Rates: While discounts are available, some customers may find that Nationwide’s base rates are relatively higher.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#8 – Farmers: Best for Local Agents

Pros

- Up to 10% Discount: Farmers offer a competitive discount of up to 10%, providing potential savings for policyholders.

- Up to 10% Additional Savings: Check out the Farmers car insurance review to learn about their additional discount of up to 10% and other cost-saving opportunities.

- Local Agents: Farmers stand out by offering the support of local agents, providing in-person assistance and personalized service.

Cons

- Limited Regional Presence: Farmers may have a more limited regional presence compared to larger national insurers.

- Possibly Higher Premiums for Certain Coverages: While local agents offer personalized service, opting for specific coverages may result in higher premiums.

#9 – Liberty Mutual: Best for Customizable Policies

Pros

- Up to 25% Discount: Learn about Liberty Mutual’s competitive discount of up to 25% in our Liberty Mutual car insurance review.

- Up to 15% Additional Savings: With an additional discount of up to 15%, Liberty Mutual stands out for its cost-saving opportunities.

- Customizable Policies: Liberty Mutual distinguishes itself by offering highly customizable policies, allowing customers to tailor coverage to their unique needs.

Cons

- Potential for Complex Policy Structure: The availability of extensive customization options may make the policy structure complex, potentially confusing some customers.

- Higher Premiums for Comprehensive Coverage: While customization is a strength, opting for comprehensive coverage may lead to higher premiums.

#10 – AAA: Best for Local Agents

Pros

- Up to 15% Discount: AAA offers a competitive discount of up to 15%, providing potential savings for policyholders.

- Up to 15% Additional Savings: AAA Car Insurance Review showcases cost-saving opportunities with an additional discount of up to 15%.

- Local Agents: AAA stands out by offering the support of local agents, providing in-person assistance and personalized service.

Cons

- Membership Requirement: AAA insurance may require membership, limiting access to those who are part of the AAA club.

- Possibly Higher Premiums for Certain Coverages: While local agents offer personalized service, opting for specific coverages may result in higher premiums.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Unlocking Discounts: Exploring Agreed Value Coverage Options

For individuals seeking car insurance with agreed-value coverage, understanding the pricing structures of different insurance companies is paramount. Agreed value coverage ensures that in the event of a total loss, policyholders receive a predetermined amount agreed upon at the start of the policy.

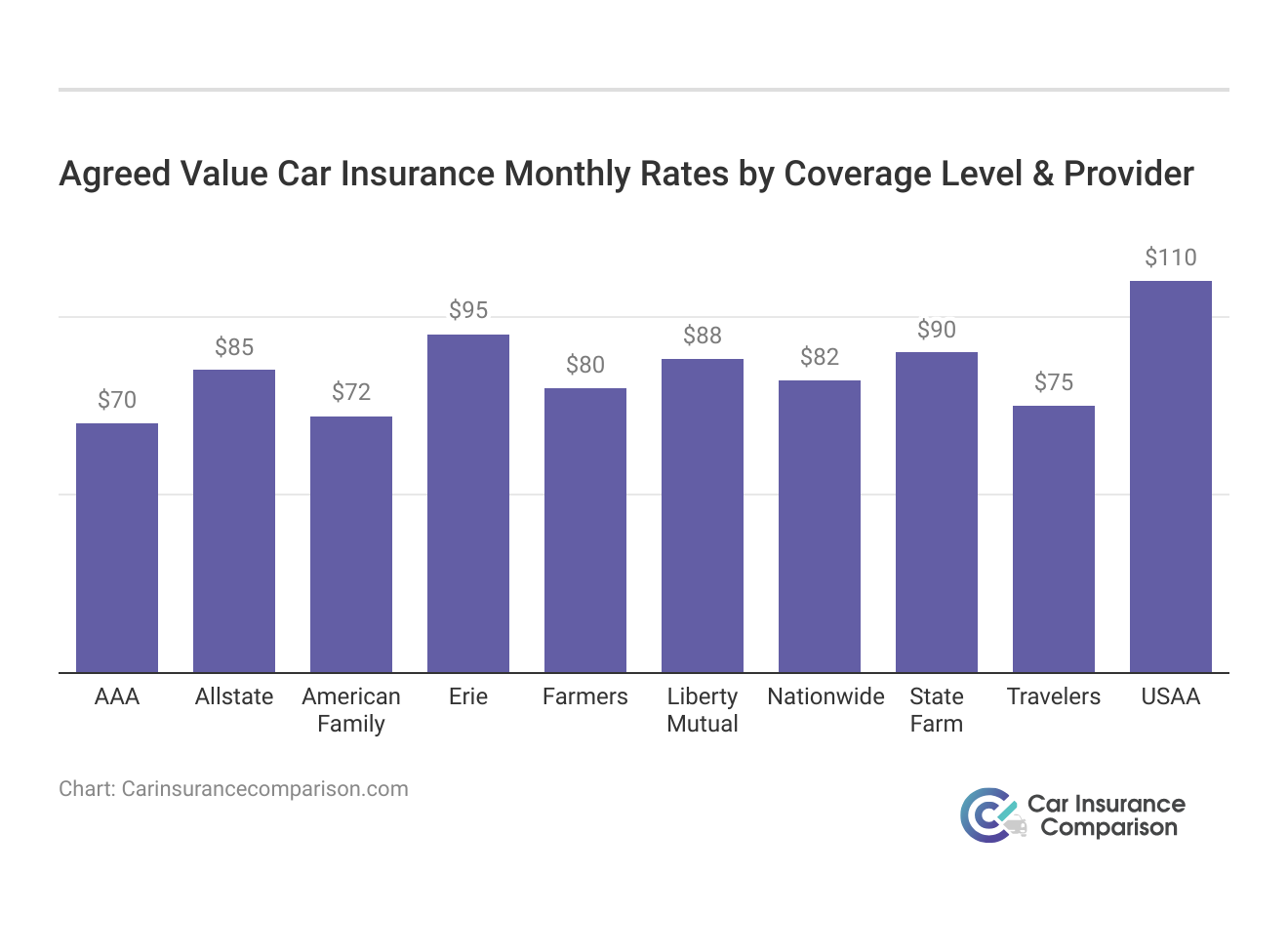

Agreed Value Car Insurance Monthly Rates by Coverage Level & Provider

| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| AAA | $70 | $205 |

| Allstate | $85 | $190 |

| American Family | $72 | $168 |

| Erie | $95 | $230 |

| Farmers | $80 | $225 |

| Liberty Mutual | $88 | $235 |

| Nationwide | $82 | $245 |

| State Farm | $90 | $180 |

| Travelers | $75 | $210 |

| USAA | $110 | $200 |

The table above outlines the average monthly car insurance rates for companies providing agreed-value coverage, offering insights into both minimum and full coverage options. This information allows consumers to make informed decisions based on their specific coverage needs and financial considerations.

If you own an exotic, classic, or collectible car, you may want an agreed value car insurance policy. Agreed value car insurance policies typically cost more than traditional insurance. Some companies even offer restoration coverage as a policy add-on if you’re restoring an older vehicle. You may use a car insurance company that doesn’t offer agreed value policies itself but instead partners with a classic car provider.

For example, some national providers offer agreed value policies to drivers at a low cost. However, those policies are technically underwritten by a third-party insurer. Similarly, other major insurers work with a specialist in classic car policies.

One of the well-known classic car insurance providers, especially for drivers needing agreed value policies, is notable in the industry. If you’re only finding affordable car insurance options that don’t offer agreed value, then consider looking into local agencies that specialize in classic car insurance.

Understanding Agreed Value Car Insurance

Agreed value car insurance policies have a payout amount that both you and the provider agree upon. So if your vehicle is totaled, you receive the agreed value as your payout instead of the actual cash value (ACV). To qualify for classic car insurance, drivers usually must be 25 years old with at least ten years of driving experience. However, there are exceptions:

Your driving record must also typically be clean for three to five years.

For insurance for luxury cars, qualifications include the car’s age, condition, use, and storage. Classic cars typically range from 10-20 years old, and antiques are 25 or older, but newer luxury vehicles may also qualify. Owners must appraise these cars and provide the results to their insurance provider, who may also conduct their own assessment.

You may need agreed value pricing for your car if it does not have a traditional value representing the car’s worth. Similarly, fixing a classic car usually requires specialized mechanics, which standard insurance policies likely do not cover. Also, most cars lose value year after year, but some rare vehicles increase in value over time. The cost of your agreed value policy varies heavily depending on the kind of car you own and how you use it.

State Farm, American Family, and Allstate stand out as the top choices for agreed value coverage, offering unparalleled customization and protection for classic and high-value cars.

Brad Larson Licensed Insurance Agent

For example, most providers put a cap on how many miles you can drive your car annually if you use an agreed value policy. Therefore, expect agreed value car insurance for a daily driver to be more expensive. But if you only use your car for pleasure or car shows, this may help lower the cost of your policy. Finally, how you store the car matters, some companies do not write agreed value policies for cars parked in public locations.

So if you keep getting car insurance quotes from companies that don’t offer agreed value, it may be because of where you park your car. So keep it in a private, secure garage to earn the lowest possible rates.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Understanding Agreed Value vs Actual Cash Value

Agreed value insurance differs from actual cash value or stated value in how the value is determined. Actual cash value (ACV) accounts for age and depreciation, commonly used in traditional car insurance policies.

At the time of claim filing, ACV is calculated, excluding damage costs. Your agreed value remains constant unless the car is reevaluated, unlike ACV, which shifts with time. You can negotiate ACV with your provider if you disagree with the adjustor’s assessment, advised by Nolo. It’s wise to establish your car’s worth in advance for classic cars.

Finally, stated value insurance policies payout whatever is cheapest between the ACV and agreed value of a vehicle. You can even purchase agreed value insurance for things besides your car, including jewelry, antiques, or commercial property.

But remember, if you buy car insurance from companies that don’t offer agreed value policies but need one, never hesitate to switch providers. Just secure your new policy before canceling your old one to avoid a coverage lapse.

Case Studies: Tailored Agreed Value Coverage for Individuals

Explore how leading car insurance providers safeguard the dreams of car enthusiasts through tailored coverage. These case studies highlight the importance of agreed-upon value policies in preserving automotive legacies, nurturing passions, and safeguarding valuable collections.

- Case Study #1 –Preserving a Legacy: State Farm preserved Sarah Thompson’s classic car legacy after a devastating incident. Their tailored agreed value coverage ensured a payout reflecting the true value of her cherished possession. This showcases State Farm’s excellence in providing customized coverage for classic car insurance owners.

- Case Study #2 – Nurturing a Student’s Automotive Passion: American Family proved ideal for nurturing Alex Rodriguez’s automotive passion. His vintage vehicle, protected by their agreed value coverage, received a payout after significant damage, enabling restoration. This case showcases American Family’s dedication to supporting classic car enthusiasts.

- Case Study #3 – Safeguarding Collector’s Dream: Allstate ensures comprehensive protection for collectors like James Mitchell. His diverse collection benefits from specialized agreed value coverage, guaranteeing payouts based on agreed-upon values. When damage occurred, Allstate’s policy facilitated restoration with a payout reflecting the agreed value.

These case studies exemplify the dedication of State Farm, American Family, and Allstate in providing customized coverage for classic car owners and collectors.

State Farm boasts an impressive customer review rating of 95%, reflecting their commitment to customer satisfaction.

Diego Anderson Licensed Real Estate Agent

Whether preserving legacies, nurturing passions, or safeguarding dreams, these insurers ensure that car enthusiasts receive the protection they need for their cherished possessions.

Car Insurance Companies That Offer Agreed Value: The Bottom Line

Many providers offer agreed value car insurance for classic, collectible, or exotic luxury cars. If standard insurers don’t meet your needs, consider specialty companies that offer insurance for exotic cars. This ensures you receive the full agreed value in case of a total loss.

Save money on your classic car insurance by earning safe driver, low-mileage, multi-car, and multi-policy discounts.

Ready to shop around for the best car insurance company? Enter your ZIP code below and see which one offers the coverage you need.

Frequently Asked Questions

Who offers agreed value insurance and how do I find them?

You can find companies offering agreed value insurance by comparing quotes from reputable insurers like State Farm, American Family, and Allstate.

To enhance your comprehension, delve into our exhaustive guide on insurance coverage titled “Agreed Value Car Insurance: Explained Simply,” and equip yourself with valuable insights.

What are the best agreed value car insurance companies?

The best agreed value car insurance companies include State Farm, American Family, and Allstate, known for their tailored coverage options and competitive rates.

See how much you’ll pay for car insurance by entering your ZIP code below into our free comparison tool.

Is agreed value car insurance available for daily drivers?

Yes, some insurers offer agreed value car insurance for daily drivers. Companies like State Farm and American Family provide coverage tailored to your driving habits.

For an in-depth examination, consult our comprehensive guide titled “Top 10 Usage-Based Auto Insurance Providers,” offering valuable insights into the leading companies in this category.

How does guaranteed value car insurance differ from agreed value?

Guaranteed value car insurance typically offers a fixed payout amount in the event of a total loss, while agreed value insurance allows policyholders to agree upon a specific payout amount with the insurer.

Can I get agreed value auto insurance for my classic car?

Yes, many insurers, including State Farm and Allstate, offer agreed value auto insurance for classic cars, providing comprehensive coverage for your prized possessions.

Refer to our exhaustive report titled “Best Affordable Classic Cars” for in-depth insights, and discover the perfect vintage vehicle for you.

How can I get personalized jewelry insurance quotes?

To get personalized jewelry insurance quotes, you can use online comparison tools or contact insurers directly, specifying your coverage needs.

For a deeper comprehension, delve into our extensive guide on business insurance titled “Free Car Insurance Comparison,” offering valuable insights to optimize your coverage decisions.

Which companies provide stated value insurance policies?

Insurers like State Farm, American Family, and Allstate offer stated value insurance policies, allowing policyholders to specify the value of their vehicle.

What are the key factors to consider when comparing car insurance quotes?

When comparing car insurance quotes, consider factors such as coverage options, premiums, deductibles, discounts, and the insurer’s reputation for customer service.

By entering your ZIP code below, you can get instant car insurance quotes from top providers.

Can I get cheap car insurance quotes without sacrificing coverage?

Yes, by comparing quotes from multiple insurers and taking advantage of discounts, you can find cheap car insurance quotes without compromising on coverage quality.

For an extensive examination, delve into our comprehensive guide titled “Cheap Car Insurance Companies That Beat Quotes,” offering invaluable insights to aid your search for affordable coverage.

Do I need to provide personal information to get a car insurance quote?

Yes, most insurers require basic personal information such as your ZIP code, age, driving history, and vehicle details to provide accurate car insurance quotes.

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.