Best Car Insurance for Accountants in 2026 (Top 10 Companies)

Farmers, State Farm, and American Family have the best car insurance for accountants, with rates starting at $53 monthly. These companies offer specialized discounts to ensure financial stability at competitive rates, making them ideal for accountants seeking reliable car insurance.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Licensed Insurance Agent

Michelle Robbins has been a licensed insurance agent for over 13 years. Her career began in the real estate industry, supporting local realtors with title Insurance. After several years, Michelle shifted to real estate home warranty insurance, where she managed a territory of over 100 miles of real estate professionals. Later, Agent Robbins obtained more licensing and experience serving families a...

Michelle Robbins

Commercial Lines Coverage Specialist

Michael Vereecke is the president of Customers First Insurance Group. He has been a licensed insurance agent for over 13 years. He also carries a Commercial Lines Coverage Specialist (CLCS) Designation, providing him the expertise to spot holes in businesses’ coverage. Since 2009, he has worked with many insurance providers, giving him unique insight into the insurance market, differences in ...

Michael Vereecke

Updated May 2024

3,072 reviews

3,072 reviewsCompany Facts

Full Coverage for Accountants

A.M. Best Rating

Complaint Level

Pros & Cons

3,072 reviews

3,072 reviews 18,155 reviews

18,155 reviewsCompany Facts

Full Coverage for Accountants

A.M. Best Rating

Complaint Level

Pros & Cons

18,155 reviews

18,155 reviews 2,235 reviews

2,235 reviewsCompany Facts

Full Coverage for Accountants

A.M. Best Rating

Complaint Level

2,235 reviews

2,235 reviewsDiscover the best car insurance for accountants with top picks like Farmers, State Farm, and American Family, offering specialized discounts and tailored coverage. These companies provide reliable insurance with comprehensive car insurance options.

They provide a detailed comparison to help you choose the best coverage, ensuring financial stability and protection. Many basic requirements for CPAs are standard across states, despite some variations.

Our Top 10 Company Picks: Best Car Insurance for Accountants

| Company | Rank | Professional Discount | Occupation Discount | Best For | Jump to Pros/Cons |

|---|---|---|---|---|---|

| #1 | 18% | 12% | Specialized Discounts | Farmers | |

| #2 | 13% | 9% | Financial Stability | State Farm | |

| #3 | 11% | 7% | Specialized Coverage | American Family | |

| #4 | 9% | 6% | Deductible Rewards | Allstate | |

| #5 | 7% | 11% | Customized Policies | Progressive | |

| #6 | 11% | 14% | Online Accessibility | Geico | |

| #7 | 13% | 9% | Car Replacement | Liberty Mutual |

| #8 | 14% | 7% | RecoverCare Assistance | The Hartford |

| #9 | 9% | 5% | Driver Discount | Travelers | |

| #10 | 7% | 13% | Flexible Policies | Safeco |

Meeting the requirements leads to a rewarding accounting career. Accountants can find suitable insurance for professional and personal needs by examining these companies’ offerings.

Get the right car insurance at the best price — enter your ZIP code above to shop for coverage from the top insurers.

- Farmers is the top choice for accountants and offers specialized discounts

- Accountants need tailored insurance for their unique professional needs

- Monthly rates for the best car insurance for accountants start at $53

#1 – Farmers: Top Overall Pick

Pros

- Specialized Discounts: Farmers offer specialized discounts, providing potential cost savings for policyholders.

- Extensive Coverage Options: The company provides a range of coverage options to meet various needs.

- Strong Customer Service: Farmers is known for its customer service, offering support to policyholders. For more details, see our Farmers car insurance review.

Cons

- Potentially Higher Rates: Some customers may find that Farmers’ rates are comparatively higher than other providers.

- Limited Online Presence: Farmers’ online tools and resources may not be as advanced as some competitors.

<

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#2 – State Farm: Best for Financial Stability

Pros

- Financial Stability: Known for its financial stability, instilling confidence in policyholders.

- Personalized Service: The company emphasizes personalized service, with a network of local agents.

- Variety of Discounts: Offers a variety of discounts, potentially lowering premium costs. For more information, read our State Farm car insurance review.

Cons

- Rates may be Higher: Some individuals may find State Farm’s rates to be on the higher side.

- Limited Online Quoting: The online quoting process may not be as seamless as with other companies.

#3 – American Family: Best for Specialized Coverage

Pros

- Specialized Coverage: American Family offers specialized coverage options catering to specific needs. Explore our American Family car insurance review.

- Competitive Rates: The company is known for providing competitive rates, potentially saving customers money.

- Positive Customer Feedback: American Family has received positive feedback for its customer service.

Cons

- Limited Availability: American Family’s coverage may not be available in all states.

- Limited Online Features: The online platform may lack some features compared to other providers.

#4 – Allstate: Best for Deductible Rewards

Pros

- Deductible Rewards: Allstate offers deductible rewards for safe driving behavior. See our Allstate car insurance review.

- Wide Range of Coverage: The company provides a comprehensive range of coverage options.

- User-Friendly Online Tools: Allstate’s online tools and mobile app are user-friendly.

Cons

- Relatively Higher Premiums: Premiums with Allstate may be higher compared to some competitors.

- Mixed Customer Service Reviews: Some customers have reported mixed experiences with Allstate’s customer service.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#5 – Progressive: Best for Customized Policies

Pros

- Customized Policies: Progressive is known for offering customizable policies to fit individual needs.

- Snapshot Program: The Snapshot program rewards safe driving habits with potential premium discounts.

- Strong Online Presence: Progressive’s online platform is comprehensive and user-friendly. For more information, read our Progressive car insurance review.

Cons

- Rates may Increase: Some customers have reported an increase in rates over time.

- Limited Agent Interaction: Progressive’s focus on online services may mean less face-to-face interaction.

#6 – Geico: Best for Online Accessibility

Pros

- Online Accessibility: Geico excels in online accessibility, allowing customers to manage policies and claims easily.

- Competitive Rates: Geico is often praised for providing competitive rates and potential savings. Discover our Geico car insurance review.

- User-Friendly Mobile App: The mobile app enhances the customer experience with convenient access to policy information.

Cons

- Limited Agent Interaction: Geico’s online-focused approach may result in limited face-to-face interaction with agents.

- Discounts Vary: While Geico offers various discounts, the availability and eligibility criteria may vary.

#7 – Liberty Mutual: Best for Driving Confidence

Pros

- Car Replacement Coverage: Liberty Mutual offers car replacement coverage, providing a new vehicle in the event of a total loss.

- Comprehensive Coverage Options: The company provides a range of coverage options to meet diverse needs.

- Multi-Policy Discounts: Liberty Mutual offers discounts for bundling auto and home insurance policies. In line with our Liberty Mutual car insurance review, this makes it a cost-effective choice for many policyholders.

Cons

- Potentially Higher Premiums: Some customers may find Liberty Mutual’s premiums to be on the higher side.

- Mixed Customer Service Reviews: Reviews on customer service are mixed, with some reporting less satisfactory experiences.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#8 – The Hartford: Best for Extending Support

Pros

- Recover Care Assistance: The Hartford provides RecoverCare assistance, covering essential living expenses after an accident.

- AARP Partnership: The Hartford partners with AARP, offering specialized coverage and discounts to members.

- Lifetime Renewability: Policyholders have the option of lifetime renewability, ensuring continuous coverage.

Cons

- Limited Availability: The Hartford’s coverage may not be available to everyone, as it is often associated with AARP membership.

- Potential for Higher Rates: Some individuals may find The Hartford’s rates to be higher compared to other providers. However, take a look at our review of The Hartford car insurance discounts to see how you can save.

#9 – Travelers: Best for Driver Discount

Pros

- Driver Discount Programs: Travelers offers driver discount programs, potentially lowering premiums for safe driving habits.

- Multi-Policy Discounts: Policyholders can benefit from discounts by bundling auto and home insurance. For more details, read our Travelers car insurance review.

- Strong Financial Stability: Travelers is known for its financial stability, instilling confidence in policyholders.

Cons

- Limited Local Agents: Travelers may have fewer local agents, impacting face-to-face interactions.

- Discounts Eligibility: Eligibility for certain discounts may vary, and not all customers may qualify.

#10 – Safeco: Best for Flexible Policies

Pros

- Flexible Policies: Safeco is praised for its flexible policies, allowing customers to tailor coverage to their specific needs.

- Multi-Car Discounts: Safeco offers discounts for insuring multiple vehicles, potentially reducing overall costs. For more information, see our Safeco car insurance review.

- 24/7 Claims Assistance: Customers have access to 24/7 claims assistance for quick and efficient claims processing.

Cons

- Limited Coverage Options: Safeco may not provide as extensive coverage options as some other competitors.

- Potential for Rate Increases: Some customers have reported rate increases over time, impacting affordability.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

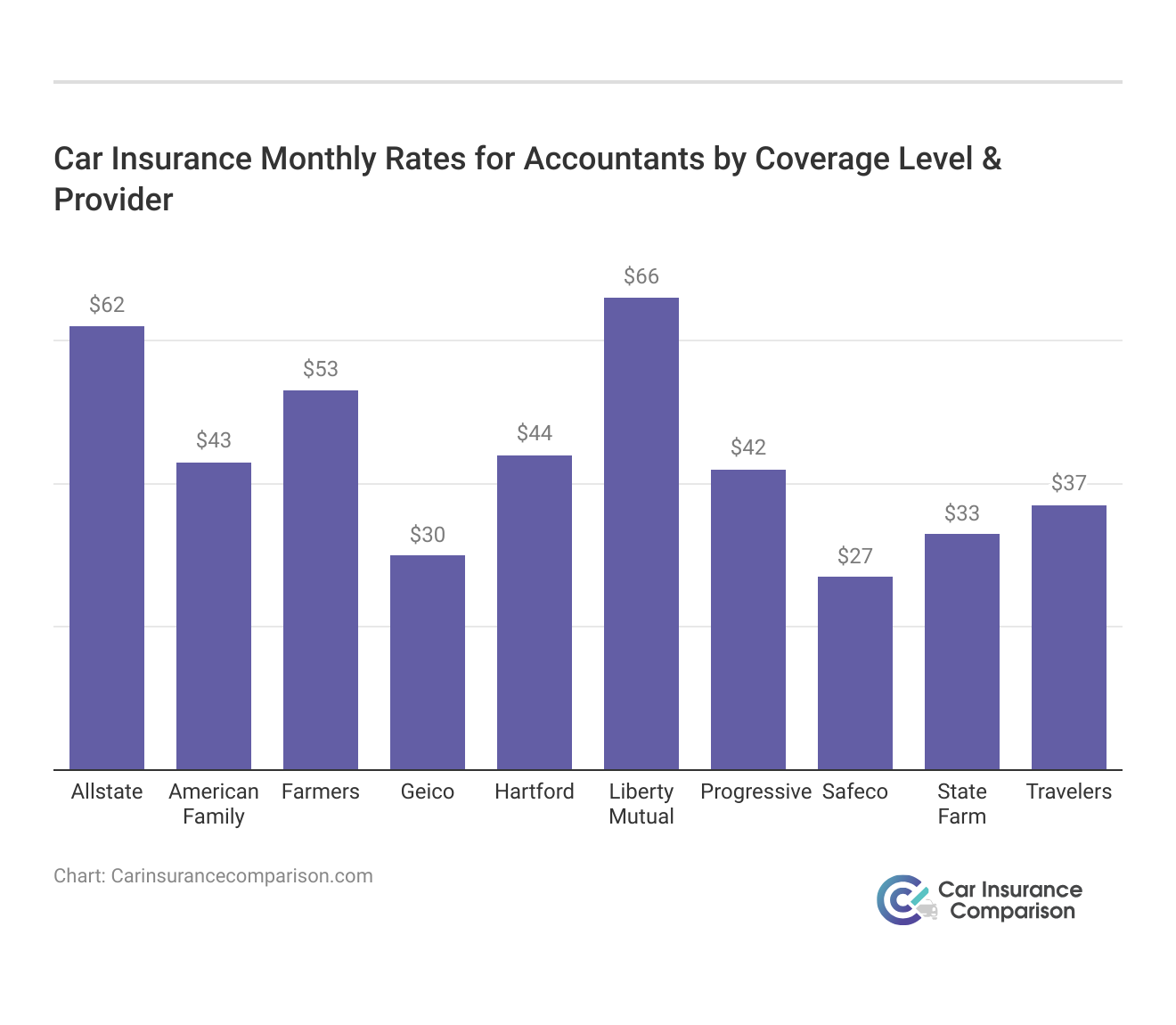

Coverage Rate for Accountant and Comptroller Car Insurance

In this analysis of coverage rates designed for accountants and comptrollers, we explore the minimum and full coverage car insurance options offered by leading insurance companies.

Car Insurance Monthly Rates for Accountants by Coverage Level & Provider

| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| Allstate | $62 | $160 |

| American Family | $43 | $117 |

| Farmers | $53 | $139 |

| Geico | $30 | $80 |

| Hartford | $44 | $113 |

| Liberty Mutual | $66 | $174 |

| Progressive | $42 | $105 |

| Safeco | $27 | $71 |

| State Farm | $33 | $86 |

| Travelers | $37 | $99 |

Professionals in these fields can gain valuable insights into average monthly rates, aiding them in making informed decisions about their car insurance. Among the featured insurers, Farmers offers a minimum coverage rate of $53 and a full coverage rate of $139, while State Farm provides rates of $33 for minimum coverage and $86 for full coverage.

American Family, another top contender, presents minimum coverage at $43 and full coverage at $117. These rates extend across other prominent companies such as Allstate, Progressive, Geico, Liberty Mutual, Hartford, Travelers, and Safeco.

This comprehensive overview empowers accountants and comptrollers to choose insurance options that best align with their budget and coverage requirements, ensuring a tailored decision-making process.

Impact of Financial Professions on Car Insurance Rates

Whether you are a CPA, a comptroller, or an accountant, the car insurance industry will consider your occupation when setting your car insurance rates. Even though people in these positions have been shown to be responsible drivers, the fact that their income bracket is slightly higher than some occupations put their car insurance rates in the medium to high range.

Essential Insurance Coverage for Accounting Firms

If you have an accounting firm, you’ll need business insurance. A business insurance policy typically includes professional liability insurance for legal costs if you’re sued for an accounting mistake, covering bodily injury and property damage liability. Additionally, consider liability car insurance to protect your business vehicles and drivers.

It also includes advertising injury coverage for lawsuits related to libel, slander, and copyright infringement, workers compensation coverage for medical costs from work-related injuries, cyber liability insurance for legal defense costs related to hacks or data breaches, and errors and omissions insurance for legal protection from job-related errors.

Among the top choices for accountants and comptrollers, Farmers Insurance stands out with specialized discounts, tailored coverage, and competitive rates, making it the optimal choice for financial professionals.

Dani Best Licensed Insurance Producer

All accounting businesses should have business insurance. If you’re unsure about coverage, consult an insurance agent. Professional liability policies are available from most major insurance providers.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

How Occupation Influences Car Insurance Rates

Car insurance companies ask about your occupation to gauge risk factors. They rate drivers by assessing the risk they take on when insuring them. Knowing a driver’s profession helps them understand this risk better. For example, if you are a doctor, insurers know you have a high education level.

If you are a realtor, they may assume you have a higher commute and carry passengers. If you are a bartender, they might infer you have irregular, late hours and are susceptible to riskier driving conditions, making it important to consider car insurance for high-risk drivers.

The table provides a comparison of average monthly car insurance rates for accountants and comptrollers across various companies. It highlights the cost differences for full coverage policies, allowing professionals to identify the most cost-effective options. By evaluating these rates, you can choose the best coverage that fits your budget and needs.

Updating Your Car Insurance After a Job Change

If you get a promotion or a slight change within your current job field, your car insurance company may not rate you any differently. However, if you have a complete job change, you should contact your car insurance company to update them on your new job to ensure you still have fast car insurance.

Impact of Your Job on Car Insurance Rates

Your job can affect your car insurance rates. Stressful jobs, high commutes, and late hours indicate higher risk, while teachers and retirees are considered low-risk, honest, and low-mileage drivers. Some companies, like Geico, offer professional group discounts, which means your profession could save you money on car insurance.

For instance, Geico provides specific rates for CPAs, potentially offering lower premiums for drivers with clean records and coverages above the state minimum requirements.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Best Auto Insurance Rates by Profession

No matter your profession, you want the best coverage from your auto insurance company at the lowest rate. Unless you carry goods or people for your profession or have other needs requiring commercial car insurance, you can save on car insurance by considering mileage and available discounts.

Your annual mileage significantly affects your car insurance rates, with lower mileage often resulting in lower premiums. Exploring discounts related to your profession can also help reduce costs, ensuring you get the best rate possible.

How Annual Mileage Influences Car Insurance Rates

Car insurance companies consider how much you drive because they assume the more you are on the road, the higher the likelihood of being involved in an accident. If you spend a lot of time commuting, finding a company that doesn’t rate as high for longer commutes can save you money.

Auto Insurance Monthly Rates for Accountants by Annual Mileage & Provider

| Insurance Company | 6,000 Miles | 12,000 Miles |

|---|---|---|

| Allstate | $404 | $411 |

| American Family | $284 | $291 |

| Farmers | $348 | $351 |

| Geico | $264 | $272 |

| Liberty Mutual | $500 | $513 |

| Nationwide | $287 | $289 |

| Progressive | $336 | $337 |

| State Farm | $265 | $279 |

| Travelers | $367 | $372 |

| USAA | $207 | $216 |

Nationwide and Progressive have the lowest rate difference for higher commutes, while State Farm and Liberty Mutual have two of the highest rate differences for longer commutes.

Car Insurance Discounts for CPAs, Accountants, and Comptrollers

Unless you work with a larger company that offers a group rate for car insurance, the best car insurance discounts will be offered directly by your car insurance company.

Common Types of Car Insurance Discounts

| Vehicle Discounts | Driver/Customer Discounts | Personal Discounts |

|---|---|---|

| Active Disabling Device | Claim Free | Emergency Deployment |

| Adaptive Cruise Control | Continuous Coverage | Family Legacy |

| Adaptive Headlights | Defensive Driver | Family Plan |

| Anti-lock Brakes | Driver's Education | Federal Employee |

| Audible Alarm | Driving Device/App | Further Education |

| Automatic Braking | Early Signing | Good Student |

| Blind Spot Warning | Full Payment | Homeowner |

| Daytime Running Lights | Good Credit | Life Insurance |

| Economy Vehicle | Loyalty | Married |

| Electronic Stability Control | Multiple Policies | Membership/Group |

| Farm/Ranch Vehicle | Multiple Vehicles | Military |

| Forward Collision Warning | New Customer/New Plan | New Address |

| Garaging/Storing | Occasional Operator | New Graduate |

| Green/Hybrid Vehicle | Online Shopper | Non-smoker/Non-drinker |

| Lane Departure Warning | On-Time Payments | Occupation |

| Newer Vehicle | Paperless/Auto Billing | Recent Retirees |

| Passive Restraint | Paperless Documents | Stable Residence |

| Utility Vehicle | Roadside Assistance | Student Away |

| Vehicle Recovery | Safe Driver | Student or Alumni |

| VIN Etching | Seat Belt Use | Volunteer |

Most car insurance companies provide a variety of discounts that can be applied to your policy, ranging from company loyalty to safety features in your car. It’s essential to review available discounts with your provider to ensure all applicable discounts are applied to your policy, maximizing your savings.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Pathways to Becoming a Financial Professional

Becoming a financial professional, such as a CPA, comptroller, or accountant, requires specific education and experience. A Certified Public Accountant (CPA) needs a four-year bachelor’s degree in accounting or a related field from an accredited college, with at least 24 semester hours in accounting and 24 in business.

Afterward, two years of accounting work experience under a licensed CPA are necessary, followed by passing the state CPA exam and an ethics course test. CPAs handle larger clients and provide overall financial direction. A comptroller, overseeing the accounting division of a business, generally requires a four-year degree and relevant experience.

Comptrollers supervise accounting procedures and financial reporting, often reporting to the Chief Financial Officer. The role has evolved, with similar positions now termed accounting manager, audit executive, or financial manager, incorporating technological and legal responsibilities.

An accountant handles invoices, billings, accounts payable and receivable, tax information, and payroll. A degree can enhance job prospects and salary. Accountants may also manage employee benefits and payroll deductions and can make car insurance tax deductible.

Rates for Accountant & Comptroller: Real Case Studies

Financial professionals, finding the right car insurance can be crucial for both personal and professional peace of mind. The following case studies illustrate how three individuals from different financial backgrounds navigated their way to the best insurance options tailored to their specific needs.

- Case Study #1 – Navigating Financial Roads With Precision: John Mitchell, a CPA in California, uses the Farmer’s Insurance quote tool and gets a $53 monthly rate for minimum coverage and $139 for full coverage. Farmers offers specialized discounts and meets the minimum car insurance requirements by state. John chose Farmers Insurance.

- Case Study #2 – Steering Towards Stability: Emily Rodriguez, a Comptroller in Illinois, seeks car insurance reflecting her responsible nature. She explores State Farm’s car insurance and receives a quote of $33 per month for minimum coverage and $86 for full coverage. Impressed by the competitive rates and emphasis on financial stability, Emily chooses State Farm for her car insurance.

- Case Study #3 – Crafting Coverage for Accountants: Sarah Thompson, an accountant in Wisconsin, seeks car insurance tailored to her needs. She explores American Family Insurance and receives a quote of $43 per month for minimum coverage and $117 for full coverage. Impressed by the specialized coverage options and competitive rates, Sarah chooses American Family for her car insurance.

These case studies highlight the importance of making informed decisions when selecting car insurance.

Farmers Insurance excels with a 95% customer satisfaction rating, providing accountants with unmatched specialized discounts and tailored coverage.

Daniel Walker Licensed Insurance Agent

By aligning coverage with their professional standards and needs, these professionals ensured optimal protection and financial security.

Frequently Asked Questions

Which insurance cover is best for car?

Comprehensive car insurance covers many risks, including accidental damage, loss due to theft, vandalism, as well as damage or injury you may cause to another person or their property. Comprehensive cover is perfect for first-time car owners or individuals that are buying their vehicles brand new.

For more information, check out our in-depth resource titled “Does car insurance cover vandalism?” for a detailed guide.

Which company gives the cheapest car insurance?

State Farm is the cheapest large auto insurance company in the nation for good drivers, according to NerdWallet’s analysis of minimum coverage rates.

Enter your ZIP code below into our free comparison tool to see how much car insurance costs in your area.

What is the most basic car insurance coverage?

Basic car insurance is a policy that only includes liability coverage. It helps cover the damage you may cause to other people and their property. That can include medical bills, repair or replacement of property and legal fallout. Almost every state has minimum basic auto insurance limits for their drivers.

For an in-depth look, refer to our report titled “Is basic car insurance coverage a smart choice?” for insights.

What are the 4 recommended type of insurance?

Four types of insurance that most financial experts recommend include life, health, auto, and long-term disability.

For a thorough understanding, refer to our detailed analysis titled “Types of Car Insurance Coverage” for more insights.

What is the best and affordable car insurance?

The top 10 cheapest car insurance companies are Nationwide, Geico, State Farm, Travelers, Progressive, AAA, Allstate, Chubb, Farmers and USAA.

For more information, explore our comprehensive resource titled “Cheapest Car Insurance in the World” for a detailed guide.

What age is car insurance most expensive?

Young drivers, from ages 16 to 24, often face the highest average costs. Once you’re 25, however, you can typically expect your costs to go down. Progressive, for example, states that rates drop about 9% on average for its customers once they turn 25.

For profound insights, consult our extensive guide titled “Compare Young Driver Car Insurance Rates” for further details.

What is the best insurance for first time car owners?

Of the nation’s leading insurance providers, we found that State Farm, USAA, Geico, Erie Insurance and Liberty Mutual offer the best insurance options for new drivers.

What is the most expensive car insurance?

Our analysis showed that, on average, Dodge and Tesla have the most expensive car insurance among 17 popular brands. Full coverage on Dodge vehicles costs an average of $354 per month or $4,242 per year, while full coverage on a Tesla vehicle averages to $251 per month or $3,007 per year.

What is the most popular type of insurance?

Auto insurance is designed to help protect you financially against vehicle damage and injury, depending on your coverage for home insurance, renters insurance, and life insurance.

To expand your knowledge, refer to our comprehensive handbook titled “Understanding Car Accidents” for more details.

What is the collision insurance?

Collision Insurance is coverage that pays the cost of repairing or replacing your vehicle if it is damaged in an accident, regardless of who is at fault. This includes collisions with another vehicle or an object, like a guardrail or a tree.

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.