Best Car Insurance for Company Vehicles in 2026 (Top 10 Providers)

State Farm, USAA and Progressive are the top picks for the best car insurance for company vehicles, with rates starting as low as $22 for minimum coverage. These companies excel in providing comprehensive coverage tailored specifically to meet the unique needs and usage patterns of company vehicles.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Licensed Insurance Producer

Dani Best has been a licensed insurance producer for nearly 10 years. Dani began her insurance career in a sales role with State Farm in 2014. During her time in sales, she graduated with her Bachelors in Psychology from Capella University and is currently earning her Masters in Marriage and Family Therapy. Since 2014, Dani has held and maintains licenses in Life, Disability, Property, and Casualt...

Dani Best

Licensed Insurance Agent

Kristen is a licensed insurance agent working in the greater Boston area. She has over 20 years of experience counseling individuals and businesses on which insurance policies best fit their needs and budgets. She knows everyone has their own unique needs and circumstances, and she is passionate about counseling others on which policy is right for them. Licensed in Massachusetts, New Hampshire,...

Kristen Gryglik

Updated May 2024

18,155 reviews

18,155 reviewsCompany Facts

Full Coverage for Company Vehicles

A.M. Best Rating

Complaint Level

Pros & Cons

18,155 reviews

18,155 reviews 6,589 reviews

6,589 reviewsCompany Facts

Full Coverage for Company Vehicles

A.M. Best Rating

Complaint Level

6,589 reviews

6,589 reviews 13,283 reviews

13,283 reviewsCompany Facts

Full Coverage for Company Vehicles

A.M. Best Rating

Complaint Level

13,283 reviews

13,283 reviewsWhen it comes to finding the best car insurance for company vehicles, State Farm, USAA and Progressive stands out as the top pick overall, offering competitive rates and exceptional customer service.

Providing tailored solutions to meet the unique needs of company vehicles encompasses a range of considerations, including the diverse usage patterns and operational requirements of corporate fleets.

Our Top 10 Company Picks: Best Car Insurance for Company Vehicles

| Company | Rank | Safe Driver Discount | Multi-Vehicle Discount | Best for | Jump to Pros/Cons |

|---|---|---|---|---|---|

| #1 | 15% | 10% | Comprehensive Coverage | State Farm | |

| #2 | 14% | 9% | Customer Service | USAA | |

| #3 | 12% | 8% | Tailored Coverage | Progressive | |

| #4 | 13% | 7% | Big Discounts | Allstate | |

| #5 | 11% | 6% | Safe-Driving Discounts | Nationwide |

| #6 | 14% | 8% | Bundle Discounts | Farmers | |

| #7 | 13% | 7% | Multi-Policy Discounts | Liberty Mutual |

| #8 | 12% | 9% | Customizable Coverage | Travelers | |

| #9 | 12% | 6% | Customer Service | American Family | |

| #10 | 11% | 5% | Organization Discount | AAA |

These companies offer comprehensive coverage options tailored to suit businesses of all sizes and industries. Affordable car insurance rates are just a click away. Enter your ZIP code into our free quote tool above to find the best policy for you

- State Farm as the top provider, offers competitive rates as low as $22 per month

- Ensure adequate protection for both business-related activities and personal use

- Flexible policies tailored to the diverse operational requirements of corporate fleets

#1 – State Farm: Top Overall Pick

Pros

- Comprehensive Coverage: State Farm car insurance review highlights the comprehensive coverage provided, ensuring safeguarding for diverse aspects of your vehicle and driving requirements.

- Safe Driver Discount: With a generous up to 15% safe driver discount, policyholders can enjoy reduced premiums for maintaining a good driving record.

- Multi-Vehicle Discount: State Farm provides up to 10% multi-vehicle discount, making it cost-effective for those with multiple vehicles.

Cons

- Potentially Higher Rates: While comprehensive, the coverage may come at a higher cost compared to some competitors.

- Customer Service Variances: Some users report inconsistencies in customer service experiences.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#2 – USAA: Best for Customer Service

Pros

- Exceptional Customer Service: USAA car insurance review highlights the company’s exceptional customer service, ensuring a hassle-free process for its clients.

- Competitive Safe Driver Discount: With up to 14% safe driver discount, USAA provides significant savings for those maintaining a clean driving record.

- Tailored for Military Members: USAA caters specifically to military members, providing specialized services and discounts.

Cons

- Restricted Membership: USAA eligibility is limited to military members and their families.

- Limited Organization Discounts: Similar to State Farm, USAA might not be the ideal choice for those seeking organization-related discounts.

#3 – Progressive: Best for Tailored Coverage

Pros

- Tailored Coverage Options: Progressive shines in offering customizable coverage options, allowing policyholders to tailor plans to their specific needs.

- Competitive Safe Driver Discount: With up to 12% safe driver discount, Progressive rewards good driving habits with reduced premiums.

- Multi-Vehicle Discount: Progressive car insurance review reveals a cost-effective option for individuals with multiple vehicles, thanks to its multi-vehicle discount of up to 8%.

Cons

- Potential Rate Increases: This trend has sparked concern among policyholders who have noticed incremental hikes in their insurance costs.

- Customer Service Variances: Progressive may offer a spectrum of customer service experiences, ranging from exemplary to less-than-ideal.

#4 – Allstate: Best for Big Discounts

Pros

- Big Discounts: Allstate is known for its substantial discounts, making it appealing for those seeking significant savings.

- Safe Driver Discount: Allstate car insurance review highlights the insurer’s commitment to promoting safe driving behaviors by offering policyholders a generous discount of up to 13% for their safe driving record.

- Bundling Options: Allstate provides opportunities for bundle discounts, allowing customers to save by combining various insurance policies.

Cons

- Potentially Higher Premiums: Some users find Allstate’s premiums to be on the higher side.

- Mixed Customer Service Reviews: Customer service experiences may vary, with some users reporting less-than-optimal interactions.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#5 – Nationwide: Best for Safe-Driving Discounts

Pros

- Safe-Driving Discounts: Nationwide offers up to 11% safe-driving discounts, making it a favorable choice for those with clean driving records.

- Multi-Vehicle Discount: Nationwide car insurance discounts offers discounts on car insurance, with savings of up to 6% for households that insure multiple vehicles.

- Nationwide Network: With a broad network, Nationwide ensures accessibility and convenience for policyholders.

Cons

- Customer Service Variances: Several customers have raised concerns regarding inconsistencies in their experiences with customer service.

- Limited Comprehensive Coverage Options: Nationwide’s array of comprehensive coverage options may appear more limited when juxtaposed with those offered by certain competitors in the insurance market.

#6 – Farmers: Best for Bundling Benefits

Pros

- Bundle Discounts: Farmers offers up to 14% in bundle discounts, making it a cost-effective choice for those combining multiple policies.

- Competitive Multi-Vehicle Discount: Farmers car insurance review highlights the opportunity for savings, offering an up to 8% discount for households owning multiple vehicles.

- Tailored Coverage: Farmers ensures coverage options that can be customized to meet individual needs.

Cons

- Customer Service Variances: Several users have voiced concerns regarding the inconsistency they encounter in their interactions with customer service.

- Potentially Higher Premiums: Premiums, the costs associated with insurance coverage, can vary significantly depending on various factors such as demographics and location.

#7 – Liberty Mutual: Best for Multi-Policy Discounts

Pros

- Multi-Policy Discounts: Liberty Mutual offers up to 7% multi-policy discounts, providing savings for those bundling various insurance policies.

- Competitive Safe Driver Discount: Liberty Mutual car insurance review, policyholders benefit from a safe driver discount of up to 13%, encouraging and acknowledging their commitment to safe driving practices.

- Nationwide Presence: Liberty Mutual’s wide-reaching network ensures accessibility and convenience for customers.

Cons

- Potentially Higher Premiums: Some users find Liberty Mutual’s premiums to be on the higher side.

- Mixed Customer Service Reviews: Customer service experiences may vary, with some users reporting less-than-optimal interactions.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#8 – Travelers: Best for Crafting Coverage

Pros

- Customizable Coverage: Travelers stands out for providing customizable coverage options, allowing policyholders to tailor plans to their specific needs.

- Competitive Multi-Vehicle Discount: With up to 9% multi-vehicle discount, Travelers offers savings for households with multiple vehicles.

- Safe Driver Rewards: Travelers car insurance review offers incentives with safe driver discounts of up to 12%, acknowledging and rewarding prudent driving behaviors.

Cons

- Customer Service Variances: Several users have expressed encountering discrepancies and irregularities in their interactions with customer service.

- Potentially Higher Premiums: Premiums, the monetary backbone of insurance, often exhibit fluctuations influenced by an array of factors.

#9 – American Family: Best for Flexibility

Pros

- Customer Service Focus: American Family is recognized for its emphasis on customer service, ensuring a positive experience for policyholders.

- Competitive Safe Driver Discount: American Family car insurance review highlights substantial savings with a generous safe driver discount of up to 12%, benefiting customers with commendable driving histories.

- Flexible Coverage Options: American Family provides coverage options that can be tailored to meet individual needs.

Cons

- Potentially Higher Premiums: American Family’s premiums are sometimes perceived as being on the higher side by certain users.

- Limited Multi-Vehicle Discounts: American Family might not offer as substantial of a multi-vehicle discount compared to certain competitors.

#10 – AAA: Best for Drive Affordability

Pros

- Organization Discount: AAA car insurance review highlights the appeal of AAA’s offerings with discounts of up to 5% for specific affiliated organizations, enhancing its attractiveness for eligible groups.

- Competitive Safe Driver Discount: With up to 11% safe driver discount, AAA rewards policyholders for maintaining safe driving habits.

- Multi-Service Benefits: AAA provides additional benefits beyond car insurance, including roadside assistance and travel services.

Cons

- Limited Multi-Vehicle Discounts: AAA may not provide as high a multi-vehicle discount as some competitors.

- Potentially Higher Premiums: Premiums may be on the higher side for certain demographics or locations.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Car Insurance Providers for Company Vehicles

Having a company car can be a huge benefit, especially if your company allows you to drive the vehicle for personal use. However, the car insurance your company provides might not cover you when not driving for work. Personal car insurance doesn’t cover using a vehicle for business. As a result, you’ll need a commercial car insurance policy.

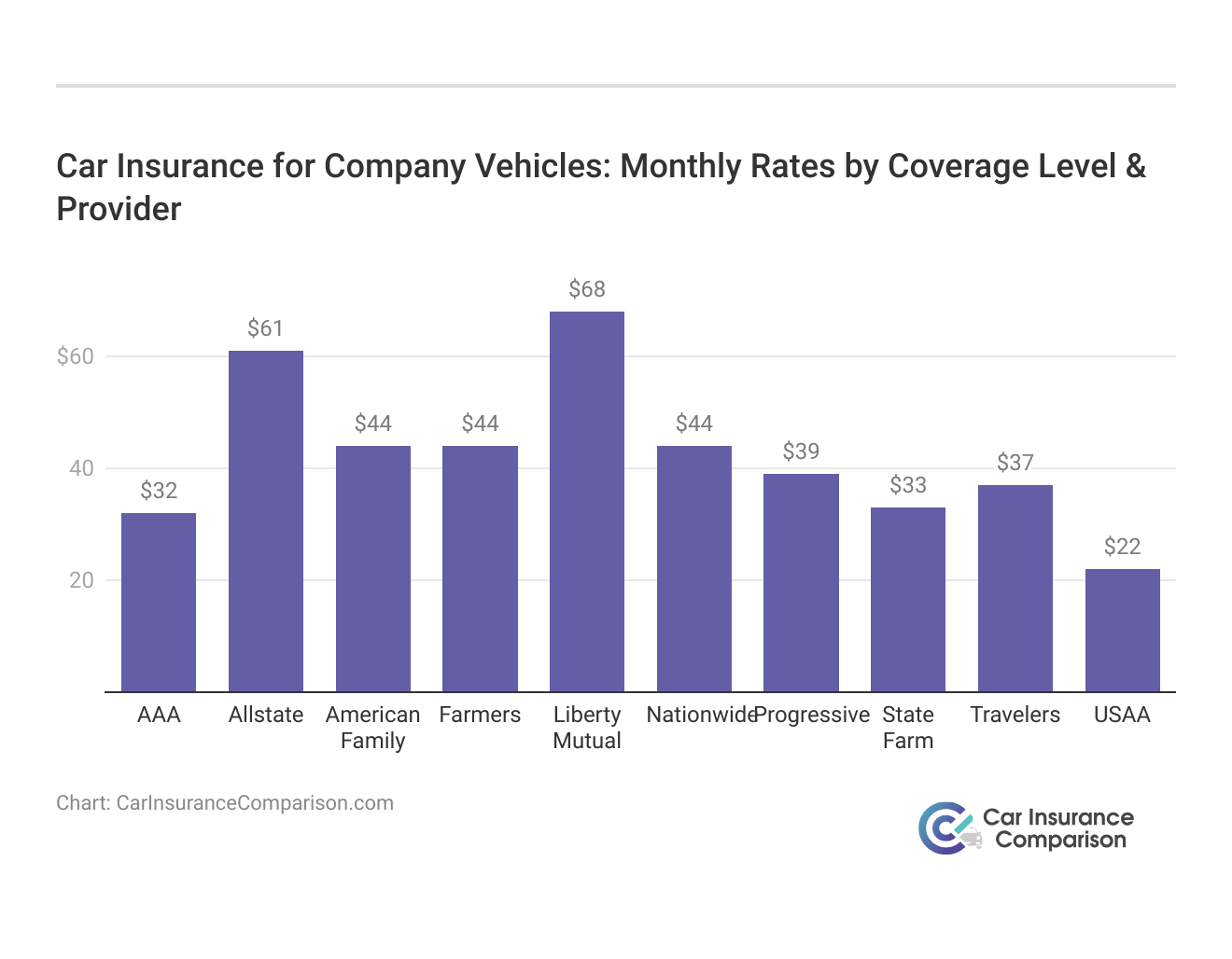

Car Insurance for Company Vehicles: Monthly Rates by Coverage Level & Provider

| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| AAA | $32 | $86 |

| Allstate | $61 | $160 |

| American Family | $44 | $117 |

| Farmers | $44 | $139 |

| Liberty Mutual | $68 | $174 |

| Nationwide | $44 | $115 |

| Progressive | $39 | $105 |

| State Farm | $33 | $86 |

| Travelers | $37 | $99 |

| USAA | $22 | $59 |

When it comes to securing car insurance for company cars, understanding the specific coverage rates is crucial. Among the top contenders, State Farm offers competitive rates, with full coverage averaging at $86 per month and minimum coverage at $33. USAA stands out with even more affordable options, boasting an average monthly rate of $59 for full coverage and $22 for minimum coverage.

Progressive, recognized for its tailored coverage, presents a moderate option with a monthly rate of $105 for full coverage and $39 for minimum coverage. On the other end of the spectrum, Liberty Mutual offers comprehensive coverage at $174 per month, while Travelers provides customizable coverage at an average rate of $99 monthly.

State Farm stands out for its exemplary customer service and affordable rates, making it the top choice for those seeking comprehensive coverage for company cars.

Brad Larson Licensed Insurance Agent

These variations in rates allow consumers to make informed decisions based on their budget and coverage needs, ensuring that they find the most suitable car insurance for their company vehicles. On the other hand, a commercial policy may not cover personal use either. Many car insurance companies offer coverage options for both personal and company vehicles.

You can typically add coverage for your company car easily. This table shows average car insurance rates from top companies for different types of coverage. It will give you an idea of what a personal policy costs.

In some cases, you might not even be aware of what your company car insurance covers. Therefore, it makes sense to add car insurance so you’re covered no matter what. The good news is that major car insurance companies that accept company cars and trucks are easy to find. Most companies will allow you to add coverage that extends to your personal use of a company vehicle.

Choosing the Right Car Insurance for Company Vehicles

Adding car insurance to a company car can be done through a non-owners car insurance policy. Non-owner car insurance offers liability-only coverage to a car that you don’t own. Liability insurance covers damage to another vehicle if you cause an accident. A non-owner policy is similar in costs to liability car insurance coverage. This table shows the average cost of liability coverage by state.

Liability Car Insurance Monthly Rates by State

| State | Rates |

|---|---|

| Alabama | $373 |

| Alaska | $547 |

| Arizona | $489 |

| Arkansas | $381 |

| California | $463 |

| Colorado | $477 |

| Connecticut | $634 |

| Delaware | $777 |

| District of Columbia | $628 |

| Florida | $289 |

| Georgia | $845 |

| Hawaii | $490 |

| Idaho | $458 |

| Illinois | $337 |

| Indiana | $431 |

| Iowa | $372 |

| Kansas | $293 |

| Kentucky | $342 |

| Louisiana | $519 |

| Maine | $727 |

| Maryland | $334 |

| Massachusetts | $599 |

| Michigan | $588 |

| Minnesota | $722 |

| Mississippi | $440 |

| Missouri | $437 |

| Montana | $399 |

| Nebraska | $388 |

| Nevada | $349 |

| New Hampshire | $647 |

| New Jersey | $393 |

| New Mexico | $866 |

| New York | $462 |

| North Carolina | $785 |

| North Dakota | $358 |

| Ohio | $283 |

| Oklahoma | $376 |

| Oregon | $442 |

| Pennsylvania | $553 |

| Rhode Island | $495 |

| South Carolina | $720 |

| South Dakota | $498 |

| Tennessee | $398 |

| Texas | $498 |

| Utah | $471 |

| Vermont | $341 |

| Virginia | $413 |

| Washington | $567 |

| West Virginia | $501 |

| Wisconsin | $360 |

| Wyoming | $323 |

| U.S. Average | $516 |

Read more: Compare Alaska Car Insurance Rates

Liability coverage only costs around $43 a month and provides the extra coverage you need on a company car. It’s important to remember that a non-owner policy won’t cover damages to the car you’re driving. You would still be responsible for those costs.

Consequences of Insufficient Coverage for Company Vehicles

Your standard personal car insurance policy won’t cover the business use of a vehicle. This means that you need to add specific insurance in order to be covered while driving your company car. It’s important to find car insurance companies that accept company trucks and cars and allow you to add coverage for personal use.

If your company’s car insurance doesn’t cover you for personal use and you are in an accident, you’re essentially driving without insurance. According to the Insurance Information Institute, driving without car insurance can lead to fines, driver’s license suspension, the vehicle being impounded, and jail time.

If you aren’t completely sure what car insurance coverage is offered by your company, you should add your own car insurance. That way, there are no surprises, and you can be sure you’re covered

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Case Studies: Optimal Car Insurance Solutions for Company Vehicles

Selecting the best car insurance for company vehicles is not just a matter of regulatory compliance; it’s a strategic decision that can profoundly influence a business’s financial health and operational success.

- Case Study #1 – Comprehensive Shield: Sarah, a business professional, finds the perfect balance of comprehensive coverage and affordability with State Farm for her company car. With a monthly premium of $86 and discounts of up to 15% for safe driving and up to 10% for multi-vehicle policies, State Farm offers peace of mind without breaking the bank.

- Case Study #2 – Smooth Drive With Exceptional Service: Mark, a military service member, chooses USAA for his car insurance needs. With premiums starting at $22 monthly for minimum coverage and $59 for full coverage, he benefits from tailored discounts of up to 14% for safe driving and 9% for multi-vehicle policies. USAA’s excellent customer service and military focus provide Mark with a seamless insurance experience.

- Case Study #3 – Tailored Coverage Experience: Emily, a young professional, finds tailored insurance at Progressive, offering customizable coverage starting at $39 per month. With discounts of up to 12% for safe driving and up to 8% for multiple vehicles, Progressive aligns with Emily’s needs for personalized and cost-effective coverage.

By comprehensively grasping the unique requirements of their vehicle fleet and harnessing customized insurance solutions, companies can effectively steer through future challenges, protecting their assets and providing assurance to all stakeholders.

USAA shines as the beacon of unparalleled service and comprehensive coverage, making it the undisputed leader for insuring company vehicles.

Dani Best Licensed Insurance Producer

This proactive approach not only safeguards against potential risks but also fosters a sense of security and confidence in the company’s operations, ensuring smooth and efficient fleet management. To gain further insights, consult our comprehensive guide titled “Compare Fleet Car Insurance: Rates, Discounts, & Requirements.”

The Bottom Line: Car Insurance for Company Vehicles

If your car insurer doesn’t cover company vehicles for business use, consider a non-owner policy, extending liability coverage for personal use of company cars, but be sure to compare rates for the best deal. For additional details, explore our comprehensive resource titled “Compare Liability Car Insurance: Rates, Discounts, & Requirements.”

This ensures peace of mind, allowing you to drive confidently knowing you’re adequately protected. Keep in mind that rates vary among providers, so it’s essential to compare options diligently to secure the coverage you need at the most competitive rates available.

Finding cheap car insurance quotes is easy. Just enter your ZIP code into our free comparison tool below to instantly compare quotes near you.

Frequently Asked Questions

What type of car insurance is cheapest?

Typically, fully comprehensive insurance is the least expensive, though prices are influenced by individual circumstances.

Can felons obtain car insurance for company vehicles?

Felons may be able to obtain car insurance for company vehicles, depending on the policies of individual insurance companies. It’s recommended for felons to explore insurance options from providers specializing in accommodating unique circumstances.

See if you’re getting the best deal on car insurance by entering your ZIP code below.

What is the best full coverage car insurance?

Nationwide, State Farm, Geico, USAA and American Family Insurance are our top five picks for affordable full-coverage insurance policies. The best way to find the cheapest full-coverage insurance for your needs is to compare quotes from a few different providers.

Check out our ranking of the top providers: Best Full Coverage Car Insurance

What is engine protect in car insurance?

An engine protector cover is an add-on that protects you from the financial risk associated with the engine of the car. These risks include leakage in lubricating oil, water ingression, hydrostatic lock, physical damages to gearbox, pistons, connecting rods, etc. It is not included in the basic coverage of the policy.

Can felons obtain car insurance for company vehicles?

Yes, some car insurance companies may provide coverage to individuals with felony convictions. It’s essential to inquire directly with insurers to understand their specific policies regarding coverage for felons.

What is the most expensive car insurance company?

According to our rate averages, the most expensive car insurance often comes from The Hanover Insurance Group. The company’s average rates for both liability and full-coverage insurance can be more than 400% higher than the national average.

Discover our collection of the top-rated providers: Best Full Coverage Car Insurance

What are the top 10 car insurances?

The top 10 car insurance providers can vary depending on factors such as coverage options, customer service, and pricing. It’s advisable to research and compare companies like State Farm, Geico, Progressive, Allstate, and others to find the best fit for your needs.

Which car insurance companies offer coverage for company cars?

Many car insurance providers offer coverage options specifically tailored for company vehicles. Some of the top options include State Farm, USAA, Progressive, Allstate, Nationwide, and others, each providing varying levels of coverage and benefits for corporate fleets.

What age is car insurance most expensive?

Young drivers ages 16 to 24 tend to have the most expensive car insurance. Drivers in this age group are often inexperienced and are more likely to get into car accidents and file insurance claims. As a result, car insurance companies often charge higher premiums to young drivers.

Explore our compilation of the leading companies: Compare Young Driver Car Insurance Rates

How can I ensure proper coverage for a fleet of company cars?

Ensuring proper coverage for a fleet of company cars involves researching and selecting reputable insurance providers known for offering tailored coverage options for corporate fleets. It’s essential to consider factors such as coverage limits, deductibles, and additional benefits when choosing the right insurance for company vehicles.

By entering your ZIP code below, you can get instant car insurance quotes from top providers.

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.