Best Car Insurance for Diabetics in 2026 (Find the Top 10 Companies Here!)

Progressive, USAA, and State Farm provide the best car insurance for diabetics, offering starting rates for as low as $88. These companies cater competitive pricing, specialized coverage options tailored to their unique needs, and a reputation for outstanding customer service.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Insurance and Finance Writer

Dorothea Hudson has been professionally writing in many spheres since 2013. She has written on entertainment, insurance, finance, travel, technology, AI, renewable energy, crypto, fundraising, and real estate for many websites. Her work has been published for British retailer Marks and Spencer, Kroger Magazine, the Vision Group, and more. Her passions include writing, music, running, travel, te...

Dorothea Hudson

Licensed Insurance Agent & Agency Owner

Tracey L. Wells is a licensed insurance agent and Farmers insurance agency owner with 23 years of experience. He is proud to be a local Farmers agent serving Grayson, Georgia and surrounding areas. With experience as both an underwriter and agent, he provides his customers with insight that others agents may not have. His agency offers all lines of insurance including home, life, auto, RV, busi...

Tracey L. Wells

Updated May 2024

13,283 reviews

13,283 reviewsCompany Facts

Full Coverage for Diabetic Drivers

A.M. Best Rating

Complaint Level

13,283 reviews

13,283 reviews 6,589 reviews

6,589 reviewsCompany Facts

Full Coverage for Diabetic Drivers

A.M. Best Rating

Complaint Level

6,589 reviews

6,589 reviews 18,155 reviews

18,155 reviewsCompany Facts

Full Coverage for Diabetic Drivers

A.M. Best Rating

Complaint Level

Pros & Cons

18,155 reviews

18,155 reviewsThe top pick overall for the best car insurance for diabetics are Progressive, USAA, and State Farm, offering rates as low as $88. These companies stand out for their competitive pricing, specialized coverage options tailored to the needs of diabetic drivers, and excellent customer service.

Our Top 10 Company Picks: Best Car Insurance for Diabetics

| Company | Rank | Multi-Policy Discount | Low-Mileage Discount | Best For | Jump to Pros/Cons |

|---|---|---|---|---|---|

| #1 | 12% | 20% | Online Convenience | Progressive | |

| #2 | 10% | 20% | Military Savings | USAA | |

| #3 | 17% | 30% | Many Discounts | State Farm | |

| #4 | 10% | 25% | Add-on Coverages | Allstate | |

| #5 | 15% | 25% | Usage Discount | Nationwide |

| #6 | 10% | 25% | Local Agents | Farmers | |

| #7 | 30% | 30% | Customizable Polices | Liberty Mutual |

| #8 | 10% | 25% | Policy Options | Esurance | |

| #9 | 5% | 20% | Deductible Reduction | The Hartford |

| #10 | 20% | 30% | Student Savings | American Family |

Whether you’re looking for comprehensive policies or specific discounts for proactive diabetes management, these insurers have you covered. Start comparing quotes now and ensure your peace of mind on the road with the best coverage options available.

Stop overpaying for car insurance. Our free quote comparison tool allows you to shop for quotes from the top providers near you by entering your ZIP code above.

#1 – Progressive: Top Overall Pick

Pros

- Online Convenience: Progressive stands out for its user-friendly online platform, making it convenient for customers to manage policies, file claims, and access information easily. Take a look at our comprehensive Progressive car insurance review for further details.

- Competitive Rates: With an average monthly rate of $105 for diabetic drivers, Progressive offers competitive pricing, coupled with discounts, making it an attractive option for budget-conscious diabetic drivers.

- Low Complaint Level: The low complaint level indicates customer satisfaction with Progressive’s services, suggesting a positive customer experience and efficient claims processing.

Cons

- Average Monthly Rate: While Progressive offers competitive rates, some diabetic drivers may find the average monthly rate to be relatively higher compared to other providers on the list.

- Limited Multi-Policy Discount: The maximum multi-policy discount of up to 12% may be considered relatively lower than some competitors, potentially limiting the overall discount for customers bundling multiple policies.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#2 – USAA: Best for Military Savings

Pros

- Military Savings: USAA caters to military members and their families, offering exclusive savings. For diabetic drivers with military affiliations, this can result in substantial discounts and personalized services.

- Low Complaint Level: USAA boasts a low complaint level, indicating a high level of customer satisfaction and efficient handling of customer concerns and inquiries. Explore our USAA car insurance review to gain deeper insights.

- Affordable Rates: With an average monthly rate of $90 for diabetic drivers, USAA provides affordable options for diabetic drivers, aligning with their budgetary considerations.

Cons

- Membership Eligibility: USAA is only available to military members and their families, limiting eligibility for the general public. Diabetic drivers without military connections may need to explore alternative providers.

- Limited Multi-Policy Discount: While USAA offers a multi-policy discount of up to 10%, it might be lower than what some competitors provide, potentially impacting the overall savings for customers bundling multiple policies.

#3 – State Farm: Best for Many Discounts

Pros

- Many Discounts: State Farm car insurance review stands out for offering a variety of discounts, including a maximum multi-policy discount of up to 17% and a low-mileage discount of up to 30%, providing substantial savings for diabetic drivers.

- Low Complaint Level: State Farm maintains a low complaint level, reflecting a high level of customer satisfaction and effective customer service.

- Financial Stability: With an A+ rating from A.M. Best, State Farm demonstrates strong financial stability, assuring customers of its ability to meet financial obligations, including claim settlements.

Cons

- Higher Average Monthly Rate: State Farm’s average monthly rate of $98 for diabetic drivers, which may be higher compared to some competitors, potentially impacting budget-conscious diabetic drivers.

- Complex Coverage Options: While State Farm offers many discounts, the wide range of coverage options may be overwhelming for some customers, requiring careful consideration and potentially leading to confusion during the selection process.

#4 – Allstate: Best for Add-On Coverages

Pros

- Add-On Coverages: Allstate stands out for its extensive range of add-on coverages, allowing diabetic drivers to tailor their policies to specific needs. This flexibility can be beneficial for those seeking comprehensive coverage.

- Reputation for Customer Service: Allstate has a reputation for excellent customer service, which can be reassuring for diabetic drivers looking for responsive support in the event of a claim or inquiry. Investigate our Allstate car insurance review to uncover more insights.

- Maximum Low-Mileage Discount: With a maximum low-mileage discount of up to 25%, Allstate offers substantial savings for diabetic drivers who drive fewer miles, promoting safe driving habits.

Cons

- Higher Average Monthly Rate: Allstate’s average monthly rate of $110 for diabetic drivers. This might be perceived as relatively higher compared to some competitors, potentially affecting the decision-making of budget-conscious customers.

- Limited Maximum Multi-Policy Discount: The maximum multi-policy discount of up to 10% might be considered lower than what some competitors offer, impacting the overall savings for customers bundling multiple policies.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#5 – Nationwide: Best for Usage Discount

Pros

- Usage Discount: Nationwide offers a usage discount of up to 15%, incentivizing diabetic drivers to drive responsibly and potentially lower their insurance premiums based on their driving habits.

- Maximum Low-Mileage Discount: With a maximum low-mileage discount of up to 25%, Nationwide provides significant savings for diabetic drivers who maintain low mileage, promoting safer driving practices.

- Variety of Discounts: Nationwide provides diabetic drivers with various discount options, allowing them to maximize savings. This includes a range of discounts beyond just multi-policy and low-mileage.

Cons

- Average Monthly Rate: Nationwide’s average monthly rate of $95 for diabetic drivers, which might be considered higher by some customers when compared to other providers on the list.

- Customer Satisfaction Concerns: Some customer reviews indicate concerns about Nationwide’s customer service, highlighting potential areas for improvement in addressing customer inquiries and claims efficiently.

#6 – Farmers: Best for Local Agents

Pros

- Local Agents: Farmers’ use of local agents provides a personalized touch for diabetic drivers, allowing them to interact with a local representative for guidance and assistance, fostering a sense of community support.

- Maximum Low-Mileage Discount: Farmers offers a maximum low-mileage discount of up to 25%, encouraging safe driving habits and providing substantial savings for diabetic drivers who drive less. Delve into our Farmers car insurance review to discover valuable insights.

- Customizable Policies: Farmers allows customers to customize their policies, providing flexibility in coverage options. This can be advantageous for diabetic drivers seeking tailored insurance solutions.

Cons

- Average Monthly Rate: With an average monthly rate of $102 for diabetic drivers, Farmers’ rates might be considered relatively higher compared to some competitors, influencing the decision-making process for budget-conscious customers.

- Mixed Customer Reviews: While Farmers has strengths in local agent support, some customer reviews suggest mixed opinions about the overall customer experience, indicating room for improvement in certain areas.

#7 – Liberty Mutual: Best for Customizable Polices

Pros

- Customizable Policies: Liberty Mutual offers customizable policies, allowing diabetic drivers to tailor their coverage to specific needs. This flexibility can be valuable for those seeking personalized insurance solutions.

- Maximum Multi-Policy Discount: With a maximum multi-policy discount of up to 30%, Liberty Mutual provides significant savings for diabetic drivers bundling multiple policies, promoting cost-effectiveness.

- High Maximum Low-Mileage Discount: Liberty Mutual offers a high maximum low-mileage discount of up to 30%, encouraging safe driving habits and providing substantial savings for diabetic drivers who drive less. Examine our Liberty Mutual car insurance review to learn more.

Cons

- Higher Average Monthly Rate: Liberty Mutual’s average monthly rate of $97 for diabetic drivers, which might be considered relatively higher compared to some competitors, potentially influencing budget-conscious customers.

- Mixed Customer Reviews: While Liberty Mutual has strengths in customization and discounts, some customer reviews indicate mixed opinions about the claims process and overall customer service, highlighting areas for improvement.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#8 – Esurance: Best for Policy Options

Pros

- Policy Options: Esurance provides a range of policy options, catering to the diverse needs of diabetic drivers. This variety allows customers to choose coverage that aligns with their specific requirements. Review our resource titled “How do you get an Esurance car insurance quote?“

- Maximum Low-Mileage Discount: Esurance offers a maximum low-mileage discount of up to 25%, encouraging safe driving practices and providing potential savings for diabetic drivers who drive fewer miles.

- Convenient Online Platform: Esurance stands out for its user-friendly online platform, making it convenient for customers to manage policies, file claims, and access information with ease.

Cons

- Average Monthly Rate: With an average monthly rate of $93 for diabetic drivers, some diabetic drivers may find Esurance’s rates relatively higher compared to other providers on the list, influencing their decision-making.

- Customer Service Concerns: While the online platform is convenient, some customer reviews express concerns about the efficiency of Esurance’s customer service, indicating a need for improvement in addressing customer inquiries and claims.

#9 – The Hartford: Best for Deductible Reduction

Pros

- Deductible Reduction: The Hartford offers a unique advantage with a deductible reduction, providing diabetic drivers with potential cost savings in the event of a claim, which can be particularly beneficial for those managing a budget.

- Reputation for Stability: With a strong financial stability and backing, as reflected in its A+ rating from A.M. Best, The Hartford assures diabetic drivers of its ability to meet financial obligations, including claim settlements.

- Maximum Low-Mileage Discount: The Hartford provides a maximum low-mileage discount of up to 20%, encouraging safe driving habits and offering potential savings for diabetic drivers who drive less.

Cons

- Limited Multi-Policy Discount: The maximum multi-policy discount of up to 5% may be considered relatively lower compared to some competitors, potentially limiting the overall discount for customers bundling multiple policies.

- Availability and Eligibility: The Hartford may not be available or accessible to all customers, and eligibility criteria might limit its reach, influencing diabetic drivers’ choices based on their specific circumstances.

#10 – American Family: Best for Student Savings

Pros

- Student Savings: American Family offers student savings, providing potential discounts for diabetic drivers who are students. This can be a significant benefit for young drivers managing the costs of insurance and education. Browse through our American Family car insurance review to find out more.

- Maximum Low-Mileage Discount: With a maximum low-mileage discount of up to 30%, American Family encourages safe driving habits, potentially resulting in substantial savings for diabetic drivers who drive less.

- Variety of Discounts: American Family provides a range of discounts, including a maximum multi-policy discount of up to 20%, allowing diabetic drivers to maximize their savings based on various qualifying factors.

Cons

- Average Monthly Rate: American Family’s average monthly rate of $88 for diabetic drivers, which might be perceived as relatively higher compared to some competitors, potentially impacting the decision-making of budget-conscious customers.

- Limited Availability: American Family’s availability might be limited to specific regions, potentially influencing diabetic drivers’ choices based on their location and eligibility for coverage.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

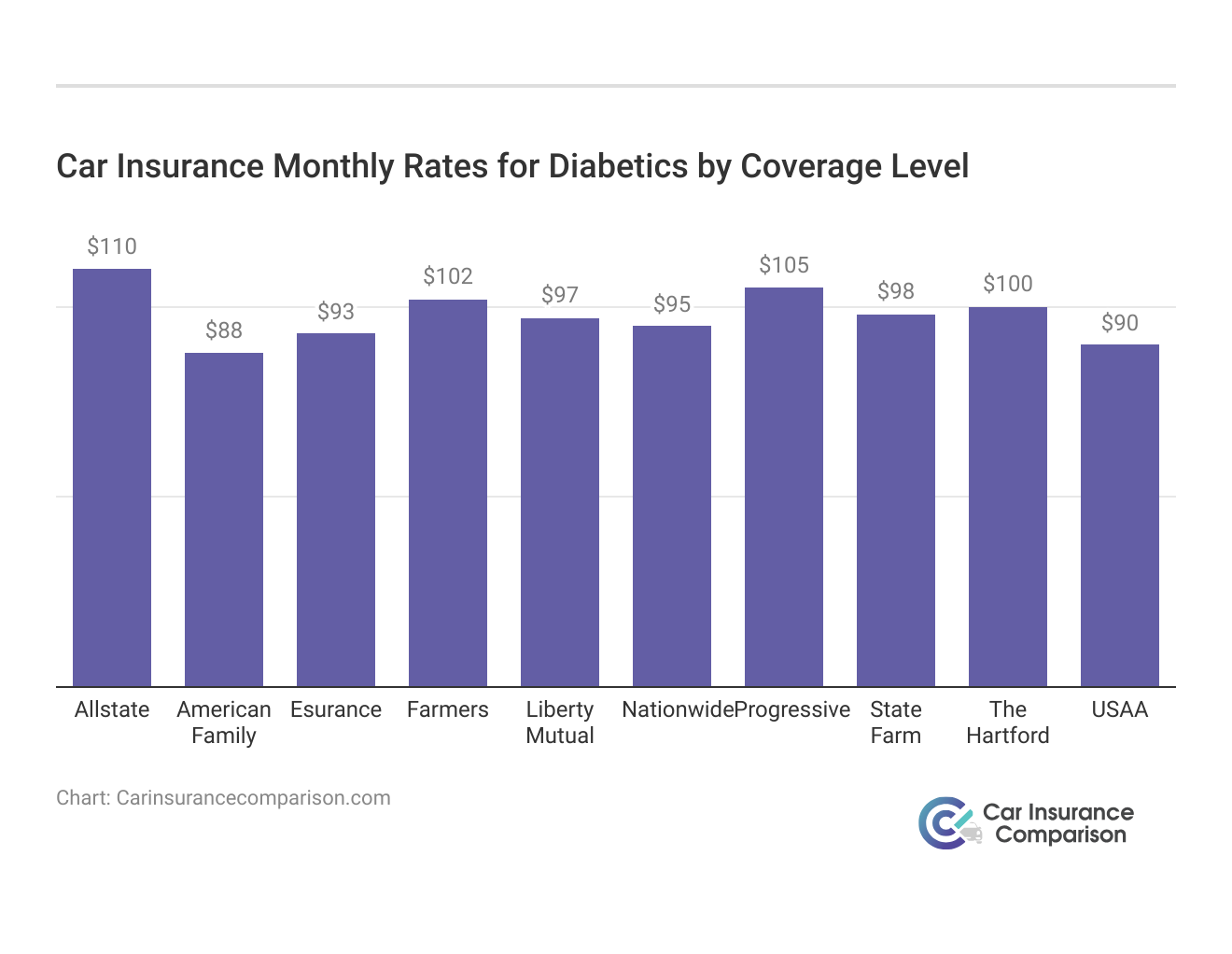

Illustrating Top 10 Car Insurance Providers for Diabetic Drivers

Among the top 10 car insurance companies catering to diabetic drivers, Progressive stands out with a monthly rate of $105 for minimum coverage and $205 for full coverage. USAA, recognized for its commitment to military personnel, offers competitive rates at $90 for minimum coverage and $185 for full coverage.

Car Insurance Monthly Rates for Diabetics by Coverage Level

| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| Allstate | $110 | $210 |

| American Family | $88 | $200 |

| Esurance | $93 | $220 |

| Farmers | $102 | $225 |

| Liberty Mutual | $97 | $230 |

| Nationwide | $95 | $215 |

| Progressive | $105 | $205 |

| State Farm | $98 | $190 |

| The Hartford | $100 | $215 |

| USAA | $90 | $185 |

State Farm, a well-established insurance giant, provides diabetic drivers a monthly rate of $98 for minimum coverage and $190 for full coverage. Allstate and Nationwide, both prominent names in the industry, present rates of $110/$210 and $95/$215 per month, respectively. For those seeking higher coverage, Farmers offers a full coverage rate of $225, while Liberty Mutual stands at $230.

Esurance, The Hartford, and American Family round out the list with varying rates, providing diabetic drivers coverage at $93/$220, $100/$215, and $88/$200 per month, respectively. The average monthly car insurance rates for diabetic drivers not only showcase a spectrum of pricing options but also emphasize the importance of considering the overall value of the coverage provided.

While cost is a significant factor, it’s essential for individuals with diabetes to assess customer service, claims processing, and specific coverage options tailored to their needs.

Driver’s License for Diabetics

Driving is a crucial part of people’s daily lives. The ability to drive offers personal freedom and lets you get to schools, job, and stores. Most individuals with diabetes can drive motor vehicles safely.

However, there are situations where diabetes-related symptoms and complications might make it hard to drive safely. Certain precautions should be taken by people with diabetes to ensure safety while driving. Check here for more information on this.

The licensing rules for people with different medical conditions vary from state to state. Some states apply these regulations to all diabetic drivers.

Others apply them only if the diabetic driver has these symptoms or medications:

- Insulin use

- Hypoglycemia [low blood sugar]

- Loss of consciousness

- Seizures

- Vision problems

- Foot problems

It is important to learn your state laws and policies and know what affects you. In some states, you will be required to produce a medical report before you are issued a learner permit or drivers license. Your treating doctor or diabetes specialist is the one who should give this report, stating that he/she has performed a medical report and that you have been rated as fit to drive. .

In most cases, individuals who manage their diabetes by insulin will be required to produce a medical examination report after every two years; while those who manage it by tablet to produce theirs every five years.

Even those who manage their diabetes by exercise and diet alone are still expected to inform the authorities. Failure to notify the authorities could get you charged with driving offenses in the case of an accident.

Driving Tips for Diabetics

Whether you are prone to hypoglycemia or not, it advisable to always measure the levels of your blood glucose before you drive. This way, you will be able to adjust the sugar level in advance and prevent unplanned accidents.

Always tend to your symptoms before beginning your journey.

Also, maintain a logbook to help you keep track of the triggers and blood levels throughout your day to help improve your health for safe driving.

If you suffer from hypoglycemia, it is important always to carry an emergency kit in the front seat. An emergency kit will come in handy if you need an insulin injection boost. You can also eat sugary foods to maintain your blood sugar levels.

Please note that your insulin, as well as the test strips, should be kept in a temperature-controlled container or bag to avoid radical temperature change. If you feel sick or suspect early signs of hypoglycemia, just pull over immediately and tend to your symptoms before you continue with your journey.

In some states, diabetic drivers are offered individual driver licenses and license plates so that law enforcement staff can quickly spot the driver as a person with diabetes experiencing a hypoglycemic episode and are in need of emergency assistance. If your state doesn’t offer this, it may be helpful to place a sign on your back bumper and windshield about your medical condition.

Putting a sign on your car is a good idea, because when you are displaying the symptoms of hypoglycemia, the law enforcement personnel may assume that you are under the influence of alcohol or drugs and that you are uncooperative.

In such circumstances, they might not see your diabetes necklace or bracelet. Instead of helping you seek emergency treatment, they might end up treating you roughly. To gain more insight read our relevant guide best car insurance for emergency service workers.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Best Car Insurance for Diabetics

People with diabetes are fit to drive their vehicles as long as they have it kept under control. Hypoglycemia can make it impossible for you to drive safely. Always ensure you carry a carbohydrate snack in your car and pull over immediately if you feel that your blood sugar is getting low.

If you have heart problems, nerve damage, or impaired vision, it is good to talk to your doctor about the probable effects on your driving.

Remember, driving as a person with diabetes comes with a lot of legal and personal responsibilities and liabilities. As long as your insurer is aware of your condition, they should not have a problem especially when you are filing your claims.

It is advisable that you inform your insurance company if you develop diabetes and if at all you will have any change in your condition or treatment.

Auto insurance companies have different models of calculating their premiums. The best way to get a favorable deal is to shop around and compare quotes from various insurers.

Case Studies: Navigating Car Insurance for Diabetic Drivers

These case studies shed light on the challenges faced by diabetic drivers in navigating the realm of car insurance and law enforcement. Each story highlights different aspects of the issue, from the struggle to find appropriate insurance coverage to misunderstandings and prejudices encountered on the road.

- Case Study #1– Balancing Blood Sugar Levels and Safe Driving: Emily, proactive research and open communication were key in finding a suitable insurance provider. This underscores the importance of advocating for oneself and seeking out companies that specialize in accommodating specific medical conditions.

- Case Study #2– Overcoming Prejudice and Law Enforcement Misunderstanding: James’ experience highlights the urgent need for greater awareness among law enforcement about diabetes and its potential effects on driving. His initiative to display a sign on his car and advocate for specialized licenses and plates is commendable.

- Case Study #3– Shaping Policies for Diabetic Drivers: Sarah’s story demonstrates the power of advocacy in effecting policy change. By actively engaging with policymakers and advocating for more inclusive licensing rules, she was able to contribute to a systemic shift that benefits all diabetic drivers insurance record in her state.

Overall, this emphasize the importance of education, communication, and advocacy in addressing the unique challenges faced by diabetic drivers and ensuring their rights and safety are protected on the road.

Progressive emerges as the top choice for diabetic drivers, offering pioneering online convenience, competitive rates, and tailored coverage.

Melanie Musson Published Insurance Expert

By emphasizing education, communication, and advocacy, these case studies demonstrate how proactive initiatives at both individual and systemic levels can address the unique challenges faced by diabetic drivers and ensure their rights and safety are protected on the road.

Summary: Navigating Car Insurance for Diabetic Drivers

This comprehensive guide offers invaluable insights into comparing car insurance rates for diabetic drivers, highlighting the top 10 insurance companies known for competitive pricing and tailored coverage options.

The guide not only presents average monthly rates but also emphasizes the importance of understanding state regulations, managing diabetes while driving, and informing insurers about medical conditions. With case studies illustrating real-life challenges and proactive measures, the guide serves as an indispensable resource for diabetic drivers seeking reliable coverage while ensuring road safety and legal compliance.

Navigate your options and find the right car insurance coverage that suits your needs and budget. Finding cheap car insurance quotes is easy. Just enter your ZIP code into our free comparison tool below to instantly compare quotes near you.

Frequently Asked Questions

How does diabetes affect car insurance rates, and which providers offer the best rates for diabetic drivers?

Diabetes can impact rates; Progressive, USAA, and State Farm are top providers.

Explore our guide to the “Best Car Insurance Companies” and make informed decisions to secure reliable coverage for your needs.

What should diabetic drivers consider regarding their driver’s license and state regulations?

Follow state-specific rules; inform authorities and comply with regulations.

Instantly compare car insurance quotes from the top providers by entering your ZIP code into our free comparison tool below.

Are there specific driving tips for diabetic drivers to ensure safety on the road?

Measure blood glucose, tend to symptoms, carry emergency kit, and inform authorities.

How does having diabetes impact car insurance coverage, and what responsibilities do diabetic drivers have when it comes to insurance?

Manage condition, inform insurer, and shop around for favorable quotes.

Are there any specific discounts or considerations for diabetic drivers when purchasing car insurance?

Some insurers offer discounts for proactive diabetes management; inquire about available discounts and tailor coverage accordingly.

Explore our relevant guide titled “Compare Liability Car Insurance: Rates, Discounts, & Requirements”.

What types of car insurance should diabetic drivers consider?

Diabetic drivers may want to look into medical payments coverage or personal injury protection, which can help cover medical costs related to accidents, including diabetes management.

How can diabetic drivers ensure fair treatment from insurance companies?

Be honest about your diabetes when getting insurance. Also, know your rights under the law so you aren’t treated unfairly because of your condition.

To broaden your understanding, explore our comprehensive resource on insurance coverage titled “auto insurance laws” and gain clarity on regulations.

Are there driving restrictions for diabetic drivers?

It varies by state, but generally, as long as you manage your diabetes well and it doesn’t affect your driving, you’re okay. Some states may have extra rules, though.

Can diabetic drivers get discounts on car insurance?

Some insurance companies offer discounts if you’re good at managing your health, including your diabetes. Ask insurers about any discounts they offer.

What should diabetic drivers do if they have a medical emergency while driving?

If you feel sick while driving, pull over safely, treat your symptoms, and get help if you need it. Also, let your insurance company know if you have any accidents because of a medical emergency.

Take the first step toward cheaper car insurance rates. Enter your ZIP code below to see how much you could save.

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.