Best Car Insurance for Home-Care Worker in 2026 (Top 10 Companies)

Discover the best car insurance for home-care workers with top picks like Progressive, USAA, and Allstate, which offer rates as low as $22 per month. These companies not only provide affordable rates but also offer comprehensive coverage tailored to the needs of Home-Care Workers, ensuring peace of mind on the road

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Published Insurance Expert

Melanie Musson is the fourth generation in her family to work in the insurance industry. She grew up with insurance talk as part of her everyday conversation and has studied to gain an in-depth knowledge of state-specific insurance laws and dynamics as well as a broad understanding of how insurance fits into every person’s life, from budgets to coverage levels. Through her years working in th...

Melanie Musson

Licensed Insurance Agent

Justin Wright has been a licensed insurance broker for over 9 years. After graduating from Southeastern Seminary with a Masters in Philosophy, Justin started his career as a professor, teaching Philosophy and Ethics. Later, Justin obtained both his Property & Casualty license and his Life and Health license and began working for State Farm and Allstate. In 2020, Justin began working as an i...

Justin Wright

Updated May 2024

13,283 reviews

13,283 reviewsCompany Facts

Full Coverage for Home-Care Workers

A.M. Best Rating

Complaint Level

13,283 reviews

13,283 reviews 6,589 reviews

6,589 reviewsCompany Facts

Full Coverage for Home-Care Workers

A.M. Best Rating

Complaint Level

6,589 reviews

6,589 reviews 11,638 reviews

11,638 reviewsCompany Facts

Full Coverage for Home-Care Workers

A.M. Best Rating

Complaint Level

Pros & Cons

11,638 reviews

11,638 reviewsExplore the best car insurance for home-care workers with the top overall choice, Progressive, offering rates as low as $39 per month. In this guide by licensed insurance agent Justin Wright, discover the tailored landscape of auto insurance for home healthcare professionals.

Find out why Progressive stands out as the optimal choice, providing affordable rates and comprehensive coverage options for home-care workers.

Our Top 10 Company Picks: Best Car Insurance for Home-Care Worker

| Company | Rank | Home-Care Worker Discount | Multi-Vehicle Discount | Best for | Jump to Pros/Cons |

|---|---|---|---|---|---|

| #1 | 10% | 15% | Policy Options | Progressive | |

| #2 | 12% | 20% | Customer Service | USAA | |

| #3 | 15% | 17% | Customizable Policies | Allstate | |

| #4 | 11% | 16% | Big Discounts | Farmers | |

| #5 | 8% | 14% | 24/7 Support | Liberty Mutual |

| #6 | 7% | 13% | Add-on Coverages | Nationwide |

| #7 | 10% | 15% | Online Convenience | Esurance | |

| #8 | 9% | 12% | Usage Discount | Travelers | |

| #9 | 11% | 14% | Bundle Discounts | American Family | |

| #10 | 10% | 18% | Cheap Rates | Safeco |

Explore our guide to compare nanny and caretaker auto insurance rates and get practical advice tailored to home-care providers, helping them secure suitable coverage and navigate roads confidently. Explore our comparison of Nanny & Caretaker Car Insurance Rates for further details.

Get the right car insurance at the best price — enter your ZIP code above to shop for coverage from the top insurers.

#1 – Progressive: Top Overall Pick

Pros

- Policy Options: Progressive car insurance review reveals a wide array of policy choices, enabling home-care workers to tailor coverage according to their individual requirements.

- Home-Care Worker Discount: Provides a competitive up to 10% discount tailored specifically for home-care professionals.

- Multi-Vehicle Discount: Further savings with a substantial up to 15% discount for those with multiple vehicles.

Cons

- Pricing Variability: While competitive, Progressive’s rates may vary based on individual factors, potentially leading to higher premiums for some.

- Customer Service Concerns: Some customers have reported concerns about the overall customer service experience with Progressive, citing communication issues and claims processing delays.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#2 – USAA: Best for Customer Service

Pros

- Customer Service: USAA car insurance review highlights its outstanding customer service, providing home-care workers with a smooth experience.

- Home-Care Worker Discount: Offers a generous up to 12% discount, acknowledging the unique needs of those in the home-care profession.

- Multi-Vehicle Discount: Additional savings with up to 20% off for those insuring multiple vehicles.

Cons

- Eligibility Criteria: Limited to military members and their families, making it inaccessible for those outside this demographic.

- Limited Availability: USAA may not be available to everyone, limiting options for potential customers.

#3 – Allstate: Best for Customizable Policies

Pros

- Customizable Policies: Allstate car insurance review showcases ample customization features for home-care workers to personalize policies to their liking.

- Home-Care Worker Discount: Offers an attractive up to 15% discount specifically designed for home-care professionals.

- Multi-Vehicle Discount: Substantial up to 17% discount for those insuring multiple vehicles.

Cons

- Premium Costs: While offering customizable policies, Allstate’s premiums may be comparatively higher for some individuals.

- Discount Variability: The advertised discounts may be subject to eligibility criteria, potentially limiting accessibility for some customers.

#4 – Farmers: Best for Big Discounts

Pros

- Big Discounts: Farmers Insurance stands out with substantial discounts, offering up to 11% for home-care workers and up to 16% for multi-vehicle policies.

- Coverage Options: Farmers car insurance review highlights a range of coverage options, providing flexibility to customize policies according to individual needs.

- Local Agents: The presence of local agents can enhance the personalized service experience for customers.

Cons

- Premium Costs: While offering discounts, Farmers’ premium rates may not always be the most competitive in the market.

- Limited Online Presence: Farmers’ online tools and resources may be comparatively limited, potentially inconveniencing customers seeking digital services.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#5 – Liberty Mutual: Best for 24/7 Support

Pros

- 24/7 Support: Liberty Mutual’s commitment to 24/7 support ensures that home-care workers can access assistance at any time.

- Home-Care Worker Discount: Offers a reasonable up to 8% discount for home-care professionals.

- Multi-Vehicle Discount: Additional savings with up to 14% off for those insuring multiple vehicles.

Cons

- Premium Costs: Liberty Mutual’s rates may be on the higher side for some individuals, impacting overall affordability.

- Limited Discounts: In a Liberty Mutual car insurance review, it’s noted that while they provide support and discounts, they may offer fewer discount options compared to certain competitors.

#6 – Nationwide: Best for Add-on Coverages

Pros

- Add-on Coverages: Nationwide distinguishes itself with a focus on add-on coverages, allowing home-care workers to enhance their protection.

- Home-Care Worker Discount: Provides an up to 7% discount tailored for home-care professionals.

- Multi-Vehicle Discount: Additional savings with up to 13% off for those insuring multiple vehicles.

Cons

- Discount Levels: The discount rates provided by Nationwide car insurance discount might be marginally less than those of certain rivals, affecting potential savings.

- Online Experience: Nationwide’s online experience may not be as user-friendly or convenient as some other insurers.

#7 – Esurance: Best for Online Convenience

Pros

- Online Convenience: Esurance excels in providing a seamless online experience, making it convenient for home-care workers to manage policies and claims.

- Home-Care Worker Discount: Offers an up to 10% discount catering specifically to home-care professionals.

- Multi-Vehicle Discount: Esurance vs. Allstate Car Insurance Comparison highlights potential savings of up to 15% for insuring multiple vehicles.

Cons

- Limited Physical Presence: Esurance’s focus on online convenience may mean limited access to in-person assistance for those who prefer face-to-face interactions.

- Potential Premium Variability: While offering discounts, Esurance’s premium rates may be influenced by individual factors, impacting consistency.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#8 – Travelers: Best for Usage Discount

Pros

- Usage Discount: Travelers sets itself apart with a unique usage discount, potentially offering additional savings based on driving behavior.

- Home-Care Worker Discount: Provides an up to 9% discount tailored for home-care professionals.

- Financial Stability: Travelers Car Insurance Review highlights the company’s strong financial stability, fostering customer confidence in its ability to fulfill financial commitments.

Cons

- Discount Levels: While offering discounts, Travelers’ percentage discounts may be slightly lower compared to some competitors.

- Coverage Options: The range of coverage options may not be as extensive as some other insurers, limiting customization for specific needs.

#9 – American Family: Best for Bundle Discounts

Pros

- Bundle Discounts: American Family Car Insurance Review emphasizes the company’s attractive bundle discounts, enabling home-care workers to save on multiple policies.

- Home-Care Worker Discount: Offers an up to 11% discount catering specifically to home-care professionals.

- Local Agents: The availability of local agents enhances the personal touch in customer interactions.

Cons

- Limited Online Tools: While offering bundle discounts, American Family’s online tools and resources may be less robust compared to some digital-first insurers.

- Potential Premium Costs: Depending on individual factors, American Family’s premium rates may be comparatively higher for some.

#10 – Safeco: Best for Cheap Rates

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Pros

- Cheap Rates: Safeco is recognized for providing competitively priced rates, offering up to 10% for home-care professionals and up to 18% for multi-vehicle policies.

- Coverage Options: Safeco Car Insurance Review provides flexibility with coverage options, enabling policy customization to suit individual needs.

- Discount Variety: Alongside cheap rates, Safeco provides substantial discounts, ensuring potential for significant savings.

Cons

- Limited Local Presence: Safeco’s local presence may be limited, potentially impacting in-person service accessibility for some customers.

- Customer Service: While competitive in rates, Safeco’s customer service may not match the level of personalized assistance offered by some other insurers.

Car Insurance for Home-Care Workers

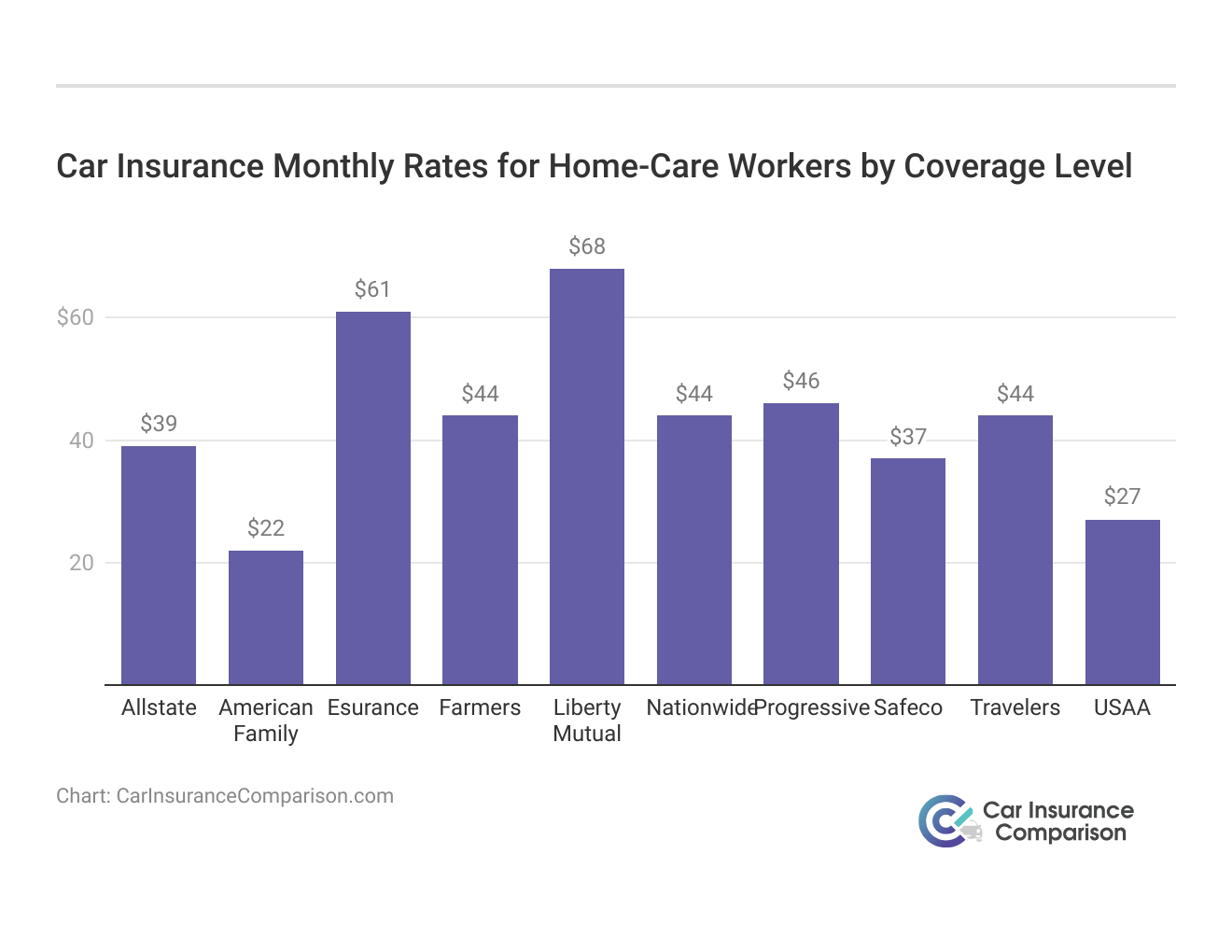

Car Insurance Monthly Rates for Home-Care Workers by Coverage Level

| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| Allstate | $39 | $105 |

| American Family | $22 | $59 |

| Esurance | $61 | $160 |

| Farmers | $44 | $139 |

| Liberty Mutual | $68 | $174 |

| Nationwide | $44 | $115 |

| Progressive | $46 | $114 |

| Safeco | $37 | $99 |

| Travelers | $44 | $117 |

| USAA | $27 | $71 |

Progressive leads with competitive rates, offering full coverage at $105 and minimum coverage at $39. USAA, recognized for exceptional service, provides even more affordable options, with full coverage at $59 and minimum coverage at $22.

Understanding coverage nuances is crucial for home-care professionals. Allstate offers full coverage at $160 and minimum coverage at $61, empowering informed decisions for both legal compliance and comprehensive protection, particularly for car insurance for nurses and carers car insurance.

Cost of Car Insurance for Home-Care Workers

Home health insurance rates vary for several reasons. All insurance companies consider several factors when developing rates for their clients.

Progressive stands out as the top choice for home-care workers, offering competitive rates, full coverage at $105, and minimum coverage at $39

Dani Best Licensed Insurance Producer

Because of this, some care workers may be considered high risk because of the stress their job can cause, when and where they drive, or how often they drive at night.

There are additional factors that impact most people’s car insurance rates. Some of these factors include:

- Coverage Types

- Age

- Driving History

- Vehicle

- Claims History

- ZIP Code

- Occupation

- Gender

- Marital Status

- Annual Mileage

The average amount home health workers pay for auto insurance per month is around $172. However, this number fluctuates as some home-care employees pay nearly $250 a month for coverage while others pay less than $100. Refer to our guide for insights into how your occupation impacts auto insurance, various car insurance options available, and the significance of personal injury protection (PIP) insurance.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

How Home-Care Providers Can Get Cheaper Auto Insurance

One of the best ways to find cheap car insurance coverage is to ask about specific car insurance discounts. Depending on how long you’ve been with your insurance company, the type of car you drive, and more, you may be able to find discounts that help you save a great deal on coverage.

Some of the most common auto insurance discounts available include:

- Bundling and Multi-Policy

- Loyalty

- Paid-in-Full

- Automatic Draft

- Paperless

- Good Driving

- Defensive Driving

- Low-Mileage

- Good Student

- Military

- Safety Devices

If you believe one or more of these discounts apply to you, speak to your current auto insurance provider and ask whether you’re eligible. Some companies also provide occupational discounts. You will have to contact your provider to see if they have an occupational discount that applies to you. Unfortunately, your current provider may not offer much in terms of discount options. In that case, you may want to consider switching providers.

How Home-Care Providers Can Find Coverage

Before buying car insurance as a nurse or a home-based worker, it’s essential to research and compare quotes from various insurance providers in your area to find the best car insurance for nurses and best car insurance for work from home.When conducting a comparison of car insurance quotes, you can identify companies in your vicinity offering the coverage options you require, as well as prices that fit your budget.

This process can be particularly useful when seeking to compare home care and support worker car insurance options. You can also call and speak to a representative with any company you consider. Ask about discounts that could work for you, and ensure the quoted price won’t change with hidden fees.

When you consider purchasing an auto insurance policy, it can take a while to find the best option. Don’t worry if you feel like you’re spending a lot of time hunting for the perfect policy. You’ll be happy you did when you find the best car insurance for home health care workers.

To explore further, contact a representative or visit the company website for a quote. Comparing quotes from different companies can help you decide on your next insurance provider, particularly when considering compare healthcare worker car insurance rates or compare taxi cab insurance rates.

Case Studies: Real Stories of Home-Care Workers and Car Insurance

Embark on a journey into the world of home-care workers and their encounters with car insurance. Through illuminating case studies, we delve deep into the intricacies of their insurance experiences, shedding light on the challenges they encounter and the strategies they employ to ensure adequate coverage.

- Case Study 1 – Budget-Friendly Coverage: Maria, a dedicated home-care worker, sought budget-friendly car insurance for home care workers without compromising coverage. She found Safeco to be the ideal fit, offering full coverage at $71 and minimum coverage at $27. This story underscores the significance of accessible car insurance for healthcare workers like Maria.

- Case Study 2 – Military Advantage: John, a home-care professional with a military background, sought car insurance that recognized his service, comparing military personnel car insurance rates. USAA emerged as the perfect choice, offering full coverage at $59 and minimum coverage at $22. This narrative highlights the importance of finding the best car insurance for home care workers like John.

- Case Study 3 – Customizable Protection: Sarah, a home-care worker, sought a customizable policy with Allstate. Full coverage at $160 and minimum coverage at $61 provided the flexibility she needed. Now, Sarah has tailored coverage that meets her needs as a home-care professional, highlighting the importance of care car insurance for support workers.

- Case Study 4 – Comprehensive Safety: James, a home-care worker valuing round-the-clock support, sought comprehensive auto insurance with a focus on safety. Opting for Liberty Mutual, he found a provider prioritizing his safety. Liberty Mutual’s 24/7 support complemented James’s dedication. This underscores the importance of auto insurance for healthcare workers like James, including auto insurance for nurses.

- Case Study 5 – Discounts and Savings: Emily, a budget-conscious home-care worker, sought savings on car insurance. Farmers’ significant discounts, with full coverage at $139 and minimum coverage at $44, provided affordable rates and savings opportunities. This narrative emphasizes the importance of insurance for home care workers and insurance car comparison.

Join us as we uncover the nuanced relationship between home-care work and car insurance, offering valuable insights for both caregivers and insurers alike.

Finding cheap car insurance quotes is easy. Just enter your ZIP code into our free comparison tool below to instantly compare quotes near you.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Auto Insurance for Home-Care Workers: The Bottom Line

Taking care of another person is an enormous responsibility. As a home health care provider, you may find that your career is a bit stressful, and the last thing you want is to add more stress when it comes to car insurance. Explore our guide on “How to Get Help Paying for Car Insurance” for further details on accessing assistance with covering car insurance expenses.You can purchase a full coverage policy as a home-care worker to ensure you’re safe and protected in virtually every circumstance.

In addition, you may want to consider PIP and MedPay options, primarily if you regularly transport patients or clients.Though you may have low rates with your current car insurance company, the only way to know is to shop around and compare quotes from other providers. In the end, your best option is the company that works with you to provide helpful coverage at a price you can afford. Explore your car insurance options by entering your ZIP code below and finding which companies have the lowest rates.

Frequently Asked Questions

How much does car insurance cost for home-care workers on average?

The average monthly cost for car insurance for home-care workers is around $172. However, individual rates can vary based on factors such as driving history, coverage needs, and the insurance provider.

Which insurance companies offer the most competitive rates for home-care professionals?

Progressive, USAA, and Allstate are among the top insurance companies offering competitive rates for home-care workers. Rates may vary based on factors like credit score, driving record, and coverage levels. Explore our guide on ‘How do you find competitive car insurance rates‘ for additional insights.

What types of coverage should home-care workers consider in their car insurance policies?

Home-care workers should consider essential coverages such as collision, comprehensive, liability, personal injury protection (PIP), and medical payments (MedPay). The coverage needs may vary based on individual circumstances and job responsibilities.

How can home-care providers find cheaper auto insurance?

To find cheaper auto insurance, home-care providers can explore specific discounts offered by insurance companies. Safe driver discounts, multi-policy discounts, and occupational discounts are common options. Additionally, comparing quotes from different providers can help identify cost-effective coverage.

Is it worth switching insurance providers for better rates?

It can be worth switching insurance providers if you find a company that offers better rates and coverage options. Before making a switch, compare quotes, consider available discounts, and ensure the new policy meets your specific needs as a home-care worker.

What is bizsure and how does it relate to business car insurance for carers?

Bizsure is a term that may refer to a specific insurance product or service related to business car insurance for carers. It could be a platform or provider specializing in offering insurance solutions tailored to the needs of carers who use their vehicles for business purposes.

Do carers need specific business car insurance coverage for their vehicles?

Yes, carers may need specific business car insurance coverage for their vehicles if they use them for work-related purposes. Standard personal car insurance policies may not provide adequate coverage for business use, so it’s essential for carers to obtain appropriate coverage to protect themselves and their vehicles.

What types of insurance are available for care workers?

Insurance options available for care workers may include liability insurance, workers’ compensation insurance, professional liability insurance (malpractice insurance), and business property insurance, depending on the nature of their work and the risks involved.

What does caregiver insurance coverage typically include?

Caregiver insurance coverage typically includes liability coverage, which protects caregivers in case they are sued for injury or property damage while providing care to others. It may also include coverage for medical expenses, legal fees, and damages awarded in lawsuits.

Are there carer discounts available specifically for carers when purchasing insurance?

Carer discounts are special offers or price reductions available to individuals working as carers when purchasing insurance. These discounts may vary among insurance providers but are designed to help carers save money on their insurance premiums.

How can I obtain carers insurance quotes to compare rates?

Where can I find the cheapest carers insurance rates?

Are there healthcare worker car insurance discounts available?

What factors determine the cost of home care agency insurance?

How much does home care liability insurance typically cost?

What options are available for home care worker insurance?

How does homecare cover comparison help in choosing the right insurance policy?

Do insurance companies like State Farm offer nurse discounts?

Do I need business car insurance as a carer, and why?

What are the benefits of commercial auto insurance for home health care professionals?

Where can nurses find cheap auto insurance tailored to their profession?

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.