Best Car Insurance for Homeless Drivers in 2026 (Check Out These 10 Companies)

State Farm, Progressive, and Farmers offer the best car insurance for homeless drivers, with rates as low as $27. These companies understand the unique needs of homeless drivers, providing flexible policies tailored to their circumstances ensuring you're covered on the road.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Licensed Insurance Agent

Michelle Robbins has been a licensed insurance agent for over 13 years. Her career began in the real estate industry, supporting local realtors with title Insurance. After several years, Michelle shifted to real estate home warranty insurance, where she managed a territory of over 100 miles of real estate professionals. Later, Agent Robbins obtained more licensing and experience serving families a...

Michelle Robbins

Licensed Insurance Agent

Jeffrey Manola is an experienced insurance agent who founded TopQuoteLifeInsurance.com and NoMedicalExamQuotes.com. His mission when creating these sites was to provide online consumers searching for insurance with the most affordable rates available. Not only does he strive to provide consumers with the best prices for insurance coverage, but he also wants those on the market for insurance to ...

Jeffrey Manola

Updated May 2024

18,155 reviews

18,155 reviewsCompany Facts

Full Coverage for Homeless Drivers

A.M. Best Rating

Complaint Level

Pros & Cons

18,155 reviews

18,155 reviews 13,283 reviews

13,283 reviewsCompany Facts

Full Coverage for Homeless Drivers

A.M. Best Rating

Complaint Level

13,283 reviews

13,283 reviews 3,072 reviews

3,072 reviewsCompany Facts

Full Coverage for Homeless Drivers

A.M. Best Rating

Complaint Level

Pros & Cons

3,072 reviews

3,072 reviewsWith a focus on customer service, flexibility, and customizable policies, they stand out as top choices for homeless drivers seeking reliable insurance coverage.

Our Top 10 Company Picks: Best Car Insurance Companies for Homeless Driver

| Company | Rank | Homeless Discount | Multi-Vehicle Discount | Best For | Jump to Pros/Cons |

|---|---|---|---|---|---|

| #1 | 12% | 15% | Policy Options | State Farm | |

| #2 | 10% | 17% | Customer Service | Progressive | |

| #3 | 8% | 16% | Customizable Policies | Farmers | |

| #4 | 6% | 14% | Big Discounts | Liberty Mutual |

| #5 | 7% | 13% | 24/7 Support | Nationwide |

| #6 | 9% | 15% | Add-on Coverages | Esurance | |

| #7 | 6% | 12% | Online Convenience | Travelers | |

| #8 | 8% | 14% | Usage Discount | American Family | |

| #9 | 10% | 18% | Bundle Discounts | Safeco | |

| #10 | 5% | 10% | Cheap Rates | National General |

Protect yourself on the road today with the best car insurance for homeless drivers, backed by trusted providers.

Our free online comparison tool above allows you to compare cheap car insurance quotes instantly — just enter your ZIP code to get started.

#1 – State Farm: Top Overall Pick

Pros

- Homeless Driver Discount: State Farm car insurane review highlights a significant discount of up to 12% for homeless drivers, providing a cost-effective solution.

- Multi-Vehicle Discount: With a multi-vehicle discount of up to 15%, State Farm appeals to individuals with more than one vehicle, potentially reducing overall insurance costs.

- Policy Options: State Farm stands out for its diverse policy options, catering to the unique needs of homeless drivers and offering flexibility in coverage.

Cons

- Discount Limit: While the homeless driver discount is substantial, it may have a maximum limit, potentially capping the overall discount amount.

- Customer Service: While State Farm is known for its policies, customer service reviews can be mixed, and improvements in this area may enhance the overall customer experience.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#2 – Progressive: Best for Customer Service

Pros

- Homeless Driver Discount: Progressive provides a competitive discount of up to 10% for homeless drivers, contributing to potential cost savings.

- Multi-Vehicle Discount: With a multi-vehicle discount of up to 17%, Progressive caters to those with multiple vehicles, offering substantial savings.

- Customer Service: Progressive is recognized for its customer service, making it an excellent choice for individuals who prioritize a positive customer experience.

Cons

- Discount Limit: Like other companies, Progressive may have a maximum limit on the homeless driver discount, potentially restricting the overall savings.

- Policy Options: While Progressive is strong in customer service, it may offer fewer policy options compared to other providers.

Read more: Progressive Car Insurance Review

#3 – Farmers: Best for Customizable Policies

Pros

- Homeless Driver Discount: Farmers provides a reasonable discount of up to 8% for homeless drivers, contributing to potential affordability.

- Multi-Vehicle Discount: With a multi-vehicle discount of up to 16%, Farmers caters to those with multiple vehicles, offering significant savings.

- Customizable Policies: Farmers stands out for its customizable policies, allowing homeless drivers to tailor coverage to their specific needs.

Cons

- Discount Limit: Farmers, like other companies, may have a maximum limit on the homeless driver discount, potentially restricting the overall savings.

- Big Discounts: While Farmers offers decent discounts, it may not have the same level of big discounts as some other providers in the list.

Read more: Farmers Car Insurance Review

#4 – Liberty Mutual: Best for Big Discounts

Pros

- Homeless Driver Discount: Liberty Mutual offers a reasonable discount of up to 6% for homeless drivers, contributing to potential cost savings.

- Multi-Vehicle Discount: With a multi-vehicle discount of up to 14%, Liberty Mutual caters to those with multiple vehicles, offering substantial savings.

- Big Discounts: Liberty Mutual is recognized for providing big discounts, making it an attractive option for individuals seeking significant savings.

Cons

- Discount Limit: Like other companies, Liberty Mutual may have a maximum limit on the homeless driver discount, potentially restricting overall savings.

- Customer Service: Some customer reviews suggest that Liberty Mutual’s customer service may not be as consistently high-rated as other providers.

Read more: Liberty Mutual Car Insurance Review

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#5 – Nationwide: Best for 24/7 Support

Pros

- Homeless Driver Discount: Nationwide provides a competitive discount of up to 7% for homeless drivers, contributing to potential affordability.

- Multi-Vehicle Discount: With a multi-vehicle discount of up to 13%, Nationwide caters to those with multiple vehicles, offering significant savings.

- 24/7 Support: Nationwide stands out for its 24/7 support, ensuring that customers can access assistance at any time.

Cons

- Discount Limit: Like other companies, Nationwide may have a maximum limit on the homeless driver discount, potentially restricting overall savings.

- Policy Options: Nationwide’s policy options may be less customizable compared to some other providers on the list.

#6 – Esurance: Best for Add-on Coverages

Pros

- Homeless Driver Discount: Esurance provides a generous discount of up to 9% for homeless drivers, contributing to potential cost savings.

- Multi-Vehicle Discount: With a multi-vehicle discount of up to 15%, Esurance caters to those with multiple vehicles, offering substantial savings.

- Add-on Coverages: Esurance stands out for its extensive add-on coverages, allowing customers to enhance their policies according to specific needs.

Cons

- Discount Limit: Like other companies, Esurance may have a maximum limit on the homeless driver discount, potentially restricting overall savings.

- Online Convenience: While Esurance offers online convenience, some users may find the digital-centric approach less personal compared to traditional interaction methods.

#7 – Travelers: Best for Online Convenience

Pros

- Homeless Driver Discount: Travelers offers a reasonable discount of up to 6% for homeless drivers, contributing to potential cost savings.

- Multi-Vehicle Discount: With a multi-vehicle discount of up to 12%, Travelers caters to those with multiple vehicles, offering substantial savings.

- Online Convenience: Travelers stands out for its online convenience, making it a convenient option for individuals who prefer managing their insurance digitally.

Cons

- Discount Limit: Like other companies, Travelers may have a maximum limit on the homeless driver discount, potentially restricting overall savings.

- Customer Reviews: Some customer reviews suggest that Travelers’ customer service may not be consistently high-rated, impacting the overall customer experience.

Read more: Travelers Car Insurance Review

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#8 – American Family: Best for Usage Discount

Pros

- Homeless Driver Discount: American Family offers a competitive discount of up to 8% for homeless drivers, contributing to potential affordability.

- Multi-Vehicle Discount: With a multi-vehicle discount of up to 14%, American Family caters to those with multiple vehicles, offering significant savings.

- Usage Discount: American Family stands out with a usage discount, potentially providing additional savings for customers who use their vehicles less frequently.

Cons

- Discount Limit: Like other companies, American Family may have a maximum limit on the homeless driver discount, potentially restricting overall savings.

- Policy Options: Some customers may find that American Family’s policy options are not as customizable as those offered by other providers on the list.

Read more: American Family Car Insurance Review

#9 – Safeco: Best for Bundle Discounts

Pros

- Homeless Driver Discount: Safeco provides a generous discount of up to 10% for homeless drivers, contributing to potential cost savings.

- Multi-Vehicle Discount: With a multi-vehicle discount of up to 18%, Safeco caters to those with multiple vehicles, offering substantial savings.

- Bundle Discounts: Safeco stands out with bundle discounts, providing additional savings for customers who choose to bundle multiple insurance policies.

Cons

- Discount Limit: Like other companies, Safeco may have a maximum limit on the homeless driver discount, potentially restricting overall savings.

- Customer Service: Some customer reviews suggest that Safeco’s customer service may not be consistently high-rated, impacting the overall customer experience.

Read more: Safeco Car Insurance Review

#10 – National General: Best for Cheap Rates

Pros

- Homeless Driver Discount: National General offers a discount of up to 5% for homeless drivers, contributing to potential cost savings.

- Multi-Vehicle Discount: With a multi-vehicle discount of up to 10%, National General caters to those with multiple vehicles, offering savings.

- Cheap Rates: National General is recognized for offering cheap rates, making it an attractive option for budget-conscious customers.

Cons

- Discount Limit: Like other companies, National General may have a maximum limit on the homeless driver discount, potentially restricting overall savings.

- Policy Options: Some customers may find that National General’s policy options are not as diverse or customizable as those offered by other providers on the list.

Read more: .

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Car Insurance When You Live in Your Car

Securing car insurance becomes a nuanced challenge when you find yourself living in your vehicle. Most insurance providers insist on a permanent address, creating a barrier for those without a fixed residence. Despite this obstacle, it’s essential to address the need for insurance to comply with legal requirements, making the exploration of alternative options crucial.

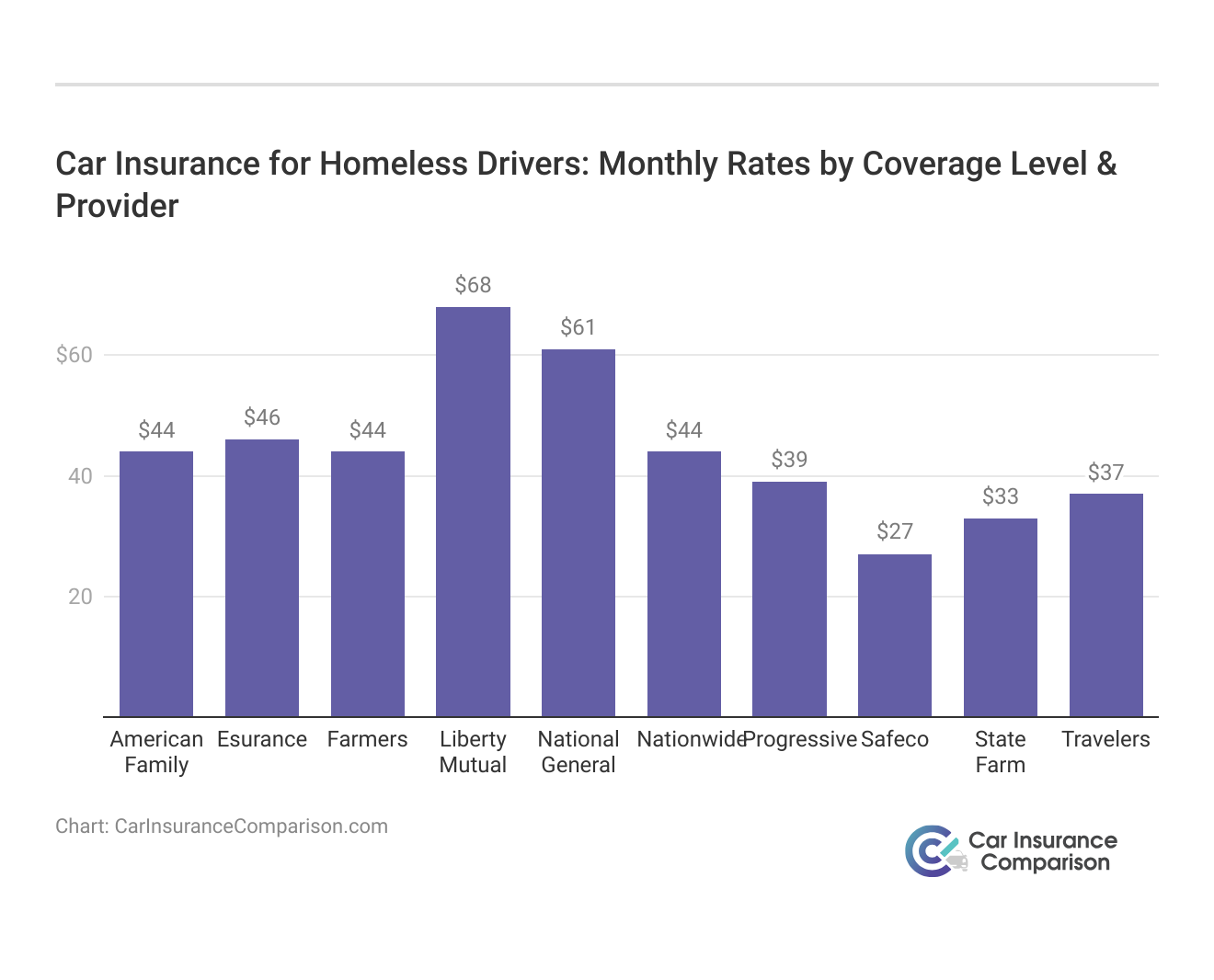

Car Insurance for Homeless Drivers: Monthly Rates by Coverage Level & Provider

| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| American Family | $44 | $117 |

| Esurance | $46 | $114 |

| Farmers | $44 | $139 |

| Liberty Mutual | $68 | $174 |

| National General | $61 | $161 |

| Nationwide | $44 | $115 |

| Progressive | $39 | $105 |

| Safeco | $27 | $71 |

| State Farm | $33 | $86 |

| Travelers | $37 | $99 |

Navigating the complexities, it’s crucial to assess available coverage rates from top companies catering to homeless drivers. State Farm car insurance review offers competitive rates, with full coverage at $86 and minimum coverage at $33. Progressive follows closely, providing full coverage at $105 and minimum coverage at $39. Farmers, another leading insurer, presents rates of $139 for full coverage and $44 for minimum coverage.

Most states require insurance if you own a vehicle. So if you’re living in your car, it will need to be insured. The problem is that insurance companies require an address to be listed on your policy. Your home address is used to determine your rates based on the level of risk the company anticipates when your vehicle is parked there.

For example, urban areas with higher vandalism and theft rates are viewed as higher risk than low-crime rural areas. Keeping a vehicle in higher-risk locations tends to lead to higher insurance rates. It isn’t only the location that is important to insurance companies, though. If you are living in your car, it is viewed as very dangerous and high-risk to the insurer, and this alone is often enough to be denied insurance coverage.

If you’re living in your car, you don’t have a current home address for your policy. Without providing a primary address where your vehicle will be parked, most insurance companies will not offer a policy at all.

So how can you get car insurance without a permanent address?

Car Insurance Options While Temporarily Homeless

If you’ve recently moved out of your previous residence and are only homeless until you move into your new home, then you may be able to use that address on your insurance policy. This may occur if you are forced to move out suddenly and your new place won’t be ready for move-in until the end of the month or later.

It’s a scenario that isn’t particularly uncommon, and in some instances, people don’t have anywhere to stay until their new home is move-in ready. Driving without insurance can lead to severe penalties, including fines, vehicle impoundment, or jail time. However, you should have some documentation confirming that is your address. If you can’t move in yet, but you have a signed lease, that is often sufficient documentation to get insurance through some insurers.

It is possible to use a P.O. Box as a mailing address for car insurance, but you cannot take out a policy with a P.O. Box as your home address.

Car Insurance Options While Parking at a Friend’s House

This option may not work with all insurance companies, but if you shop around with different insurance companies you’re likely to find one that will work with you. When it comes down to it, the primary purpose of an address on your policy is to determine your rates.

Even if you’re homeless, some insurance companies may allow you to use a friend or relative’s address if you agree to keep it parked there while you are not using it.

Read More: Can you legally use a different address to get cheaper car insurance?

You must have permission from that person to use their address, but it’s one of the few options for getting homeless car insurance.

You also have to keep in mind that if your insurance company discovers that you are not keeping your vehicle parked at this address, it is likely to stop your coverage altogether.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Key Takeaway: Homeless Car Insurance is Challenging to Get

Without a permanent address, virtually all insurance companies will refuse coverage. This is especially true if you are living in your vehicle. However, if you are fortunate enough to have a signed lease for a new residence, some insurance companies will accept this as your address.

Otherwise, you may have to shop around and get car insurance quotes from insurance companies that will provide coverage with the understanding that the vehicle remains parked at a friend or relative’s house while you are not using it.

Case Studies: Homeless Driver Car Insurance Solutions

These case studies shed light on the challenges faced by homeless individuals in obtaining car insurance and how different insurance providers offer solutions tailored to their needs. Here’s a summary of the key points:

- Case Study #1– Overcoming Obstacles With State Farm: John, homeless and without a permanent address, struggled to find car insurance. State Farm’s flexible policies allowed him to use a friend’s address, securing coverage with their up to 12% homeless driver discount.

- Case Study #2– Safeco’s Bundle Discounts: Emily, also homeless, needed affordable car insurance. Safeco’s bundle discounts and willingness to accept a friend’s address provided her with cost-effective coverage, saving her money with their up to 10% homeless driver discount.

- Case Study #3– Online Convenience With Travelers: Mike, prioritizing online convenience, faced barriers due to his homeless status. Travelers’ online platform enabled him to easily manage his insurance, securing coverage with their up to 6% homeless driver discount, showcasing the importance of catering to diverse customer needs in the digital age.

Understanding the unique circumstances of homeless individuals and providing flexible solutions, whether through alternative address options, bundle discounts, or online convenience, proved crucial in overcoming barriers to obtaining car insurance.

State Farm stands out as the top choice, offering up to 12% homeless driver discount, policy flexibility, and a willingness to work with alternative addresses, providing a tailored solution for individuals facing challenges in obtaining car insurance without a permanent address.

Melanie Musson Published Insurance Expert

These case studies demonstrate how insurance providers can adapt their offerings to better serve diverse customer needs, ensuring access to essential services for all individuals, regardless of their housing situation. Explore our comprehensive resource auto insurance laws.

Bottom Line: Navigating Car Insurance for Homeless Drivers

A detailed exploration of car insurance options tailored for homeless individuals, addressing the challenges they face due to the requirement for a permanent address. It highlights major insurance companies such as State Farm, Progressive, and Farmers, which offer flexible policies specifically designed for those without stable housing.

The piece delves into alternative solutions, such as using a friend’s address or a temporary residence, to meet the insurance criteria. Furthermore, it emphasizes the importance of understanding how location affects insurance rates and provides insights into obtaining coverage even in unconventional living situations.

Discover your options and find the right car insurance coverage that suits your needs and budget. Finding cheap car insurance quotes is easy. When you’re ready to see how much you can save on your car insurance, enter your ZIP code below into our free comparison tool.

Frequently Asked Questions

Can I get car insurance if I am homeless or living in my car?

Obtaining car insurance as a homeless individual can be challenging due to the requirement for a permanent address on the policy.

Explore our guide to the “Best Car Insurance Companies” and make informed decisions to secure reliable coverage for your needs.

Why do insurance companies need an address for car insurance?

Insurance companies use the address to assess risk and set rates. The location where a vehicle is parked influences the perceived risk.

Explore your car insurance options by entering your ZIP code below and finding which companies have the lowest rates.

Can I use a P.O. Box as my home address for car insurance?

No, a P.O. Box cannot be used as a home address for car insurance. Insurance companies require a physical address to assess risk accurately.

What if I’m temporarily homeless due to moving? Can I use my new address?

If you have a signed lease for a new residence, some insurers may accept it as your address for car insurance, especially if your new home is not ready for move-in.

Can I use a friend’s address if I park my car there?

Some insurance companies may allow you to use a friend or relative’s address if your vehicle is parked there when not in use.

Check out relevant guide titled “Can I insure my friend’s car?“

What documentation do I need to provide if I’m temporarily homeless but have a new address?

Documentation such as a signed lease for a new residence may be necessary to provide to the insurance company if you’re temporarily homeless but have a new address.

How do insurance companies determine coverage if I don’t have a permanent address?

Insurance companies may use alternative solutions such as temporary addresses or friend’s addresses to determine coverage for individuals without a permanent address.

Will insurance rates be higher if I’m living in my car?

Insurance rates may be influenced by factors like the location where your vehicle is parked and the perceived risk associated with it.

Learn more information about rates in this comprehensive guide “Compare Monthly Car Insurance: Rates, Discounts, & Requirements“

Are there specific insurance companies that cater to homeless individuals?

Some insurance companies may offer tailored solutions or discounts for homeless individuals, but specific providers may vary.

What are the consequences if I provide false information about my address to obtain car insurance?

Providing false information about your address to obtain car insurance can result in consequences such as canceled coverage or legal penalties.

Get the minimum car insurance coverage you need to drive legally by entering your ZIP code into our free quote comparison tool below.

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.