Best Car Insurance for Homemakers in 2026 (We Suggest These 10 Companies)

State Farm, USAA, and Progressive offer the best car insurance for homemakers, with rates as low as $22. These top providers offer tailored coverage, ensuring comprehensive protection at affordable prices, making them the go-to choices for homemakers seeking reliable insurance.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Licensed Insurance Agent & Agency Owner

Tracey L. Wells is a licensed insurance agent and Farmers insurance agency owner with 23 years of experience. He is proud to be a local Farmers agent serving Grayson, Georgia and surrounding areas. With experience as both an underwriter and agent, he provides his customers with insight that others agents may not have. His agency offers all lines of insurance including home, life, auto, RV, busi...

Tracey L. Wells

Licensed Insurance Agent

Kristen is a licensed insurance agent working in the greater Boston area. She has over 20 years of experience counseling individuals and businesses on which insurance policies best fit their needs and budgets. She knows everyone has their own unique needs and circumstances, and she is passionate about counseling others on which policy is right for them. Licensed in Massachusetts, New Hampshire,...

Kristen Gryglik

Updated May 2024

18,155 reviews

18,155 reviewsCompany Facts

Full Coverage for Homemakers

A.M. Best Rating

Complaint Level

Pros & Cons

18,155 reviews

18,155 reviews 6,589 reviews

6,589 reviewsCompany Facts

Full Coverage for Homemakers

A.M. Best Rating

Complaint Level

6,589 reviews

6,589 reviews 13,283 reviews

13,283 reviewsCompany Facts

Full Coverage for Homemakers

A.M. Best Rating

Complaint Level

13,283 reviews

13,283 reviewsState Farm emerges as the standout choice, providing bundle discounts and exceptional customer service, making it the go-to option for homemakers seeking reliable insurance.

Our Top 10 Company Picks: Best Car Insurance for Homemakers

| Company | Rank | Homemaker Discount | Multi-Vehicle Discount | Best For | Jump to Pros/Cons |

|---|---|---|---|---|---|

| #1 | 12% | 15% | Bundle Discounts | State Farm | |

| #2 | 10% | 20% | Customer Service | USAA | |

| #3 | 15% | 17% | Customizable Policies | Allstate | |

| #4 | 13% | 18% | Big Discounts | Allstate | |

| #5 | 8% | 14% | Policy Options | Liberty Mutual |

| #6 | 11% | 16% | Accident Forgiveness | Farmers | |

| #7 | 9% | 13% | Safe-Driving Discounts | Nationwide |

| #8 | 10% | 15% | Online Convenience | Esurance | |

| #9 | 7% | 12% | Add-on Coverages | Travelers | |

| #10 | 11% | 14% | Customizable Coverage | American Family |

With its extensive experience and customer-centric approach, State Farm sets the standard for quality coverage tailored to homemakers’ unique needs, offering peace of mind on the road.

Our free online comparison tool above allows you to compare cheap car insurance quotes instantly — just enter your ZIP code to get started.

#1 – State Farm: Top Overall Pick

Pros

- Bundle Discounts: State Farm car insurance review offers attractive bundle discounts, allowing homemakers to combine multiple insurance policies, such as home and auto, for additional savings.

- Homemaker Discount: With a homemaker discount of up to 12%, recognizes the unique needs and lower risk profile of homemakers, translating into more affordable rates.

- Multi-Vehicle Discount: Provides a multi-vehicle discount of up to 15%, making it an excellent choice for households with multiple vehicles.

Cons

- Limited Homemaker Discount: Offers a homemaker discount, it might be considered relatively modest compared to some competitors.

- Customer Service Concerns: Some customers have reported mixed reviews regarding State Farm’s customer service, indicating that experiences may vary.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#2 – USAA: Best for Customer Service

Pros

- Customer Service: USAA is renowned for its exceptional customer service, providing a dedicated and supportive experience for its members.

- Homemaker Discount: Offering a homemaker discount of up to 10%, USAA car insurance review recognizes the value of homemakers and provides cost-effective insurance options.

- Multi-Vehicle Discount: With a multi-vehicle discount of up to 20%, USAA is an ideal choice for households with multiple vehicles.

Cons

- Limited Membership Eligibility: USAA is only available to military members, veterans, and their families, limiting eligibility for some homemakers.

- Availability: Not all individuals qualify for USAA membership, potentially excluding certain homemakers from accessing their services.

#3 – Progressive: Best for Customizable Policies

Pros

- Customizable Policies: Progressive stands out for offering highly customizable policies, allowing homemakers to tailor coverage to their specific needs.

- Homemaker Discount: With a homemaker discount of up to 15%, in Progressive car insurance review acknowledges the lower risk associated with homemakers, resulting in more affordable rates.

- Multi-Vehicle Discount: Progressive provides a multi-vehicle discount of up to 17%, making it an attractive option for households with multiple cars.

Cons

- Not Always the Cheapest: While Progressive offers customizable policies, it may not always be the most budget-friendly option for all homemakers.

- Online-Centric Approach: Some individuals prefer a more traditional approach to insurance, and Progressive’s strong emphasis on online services may not suit everyone’s preferences.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Cost of Car Insurance for Homemaker

A homemaker doesn’t have to commute to work. Insurance companies will assume that any driving a homemaker does will be local. This is partially the reason why homemaker car insurance rates are less than many other occupations.

Navigating car insurance as a homemaker comes with unique considerations. Discovering the most suitable coverage at the best rates is essential.

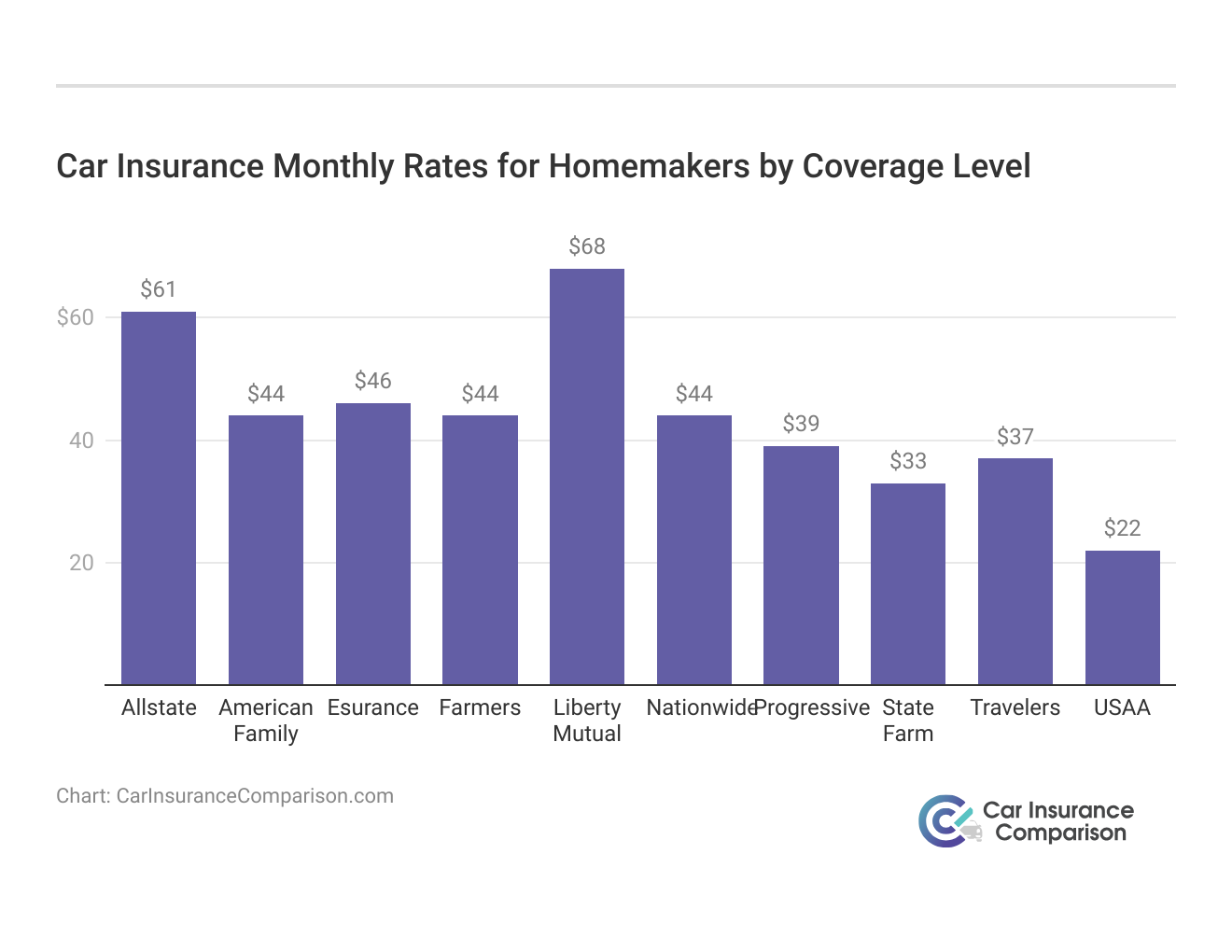

Car Insurance Monthly Rates for Homemakers by Coverage Level

| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| Allstate | $61 | $160 |

| American Family | $44 | $117 |

| Esurance | $46 | $114 |

| Farmers | $44 | $139 |

| Liberty Mutual | $68 | $174 |

| Nationwide | $44 | $115 |

| Progressive | $39 | $105 |

| State Farm | $33 | $86 |

| Travelers | $37 | $99 |

| USAA | $22 | $59 |

Homemakers benefit from favorable car insurance rates, with USAA offering the lowest at $59 for full coverage. State Farm follows at $86, and Progressive is slightly higher at $105. These rates reflect insurers recognizing safer driving habits, emphasizing the importance of tailored coverage. Comparing quotes from top providers like USAA, State Farm, and Progressive ensures homemakers secure the best and most affordable options.

Homemakers are also considered to be safer drivers overall. This will decrease the likelihood that a claim will have to be made. If there are other circumstances that require you to drive the vehicle frequently, this will likely increase your premium if the insurance company is aware of the amount you drive your car.

Factors That Affect Car Insurance Rates

Everything that car insurance companies use to determine rates is based on the risk involved with insuring each individual driver. Specifics relating to each individual that is insured will affect the insurance rate more than occupation.

The last three years of your driving history is vital when insurance companies are determining your rate. This includes:

- speeding tickets

- insurance claims

- accidents

Insurance claims are more detrimental to your rate as they represent money that has been paid out by insurance companies on your behalf.

An accident that you pay to repair yourself without the use of the insurance company will not likely increase your premium.

Age and gender may also affect your insurance rate. Drivers under the age of 25 are considered high risk and will have higher insurance premiums. In this age group, males are also expected to have higher rates than females.

Read more: Compare Car Insurance Rates for Women

Type of Car Insurance Coverage

Every person that drives has differing life circumstances which require different car insurance coverage needs. Most states require a minimum of liability insurance for any vehicle that is driven. Money can be saved by opting for this minimum coverage. This is not recommended in most cases, however.

Opting for the minimum coverage will not cover any damages to your vehicle if you are involved in an accident that is deemed to be your fault.

The same may also apply for medical expenses as a result of an injury in an accident. This can vary based on state and the minimum requirements in place. You will need to determine what is necessary for your situation. One thing to consider is how much you drive. Another important consideration is how many people are in your household.

If you have kids that ride with you when you drive, then your insurance company will recommend a higher coverage amount for medical or personal injury protection. These medical coverages will be limited to an agreed-upon coverage amount per person. So a higher limit might be wise.

The protection of your family may be the most important thing to consider when determining the amount of coverage you want to insure your vehicle for.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Obtaining Online Quotes for Homemakers

For homemakers looking to secure the best car insurance rates, obtaining online quotes is a straightforward and efficient process. You can instantly access a range of quotes from top providers tailored to your specific needs. This method allows you to conveniently compare coverage options, premiums, and discounts from the comfort of your home.

Online tools also often provide additional resources, such as customer reviews and detailed policy breakdowns, helping homemakers make informed decisions about their car insurance. Whether you’re looking for comprehensive coverage or specific add-ons, online quotes can help you find the most affordable and suitable options quickly and easily.

Tips to Save Money on Car Insurance Rates

Car insurance carriers will have various discounts available to motorists. If you are looking for a discount on your current policy, contact your agent to find out what discounts you may qualify for. Here are a few more tips to help you save on car insurance:

- Maintain a good driving record. Insurance companies often offer discounts to drivers with clean driving records. Avoid accidents and traffic violations to keep your premiums low.

- Increase your deductible. A higher deductible typically means lower premiums. Just make sure you have enough savings to cover the deductible in case of an accident.

- Drive less. Some insurers offer discounts for low-mileage drivers. If you don’t drive much, you may qualify for this discount.

- Improve your credit score. In many states, insurance companies use credit scores to determine premiums. Maintaining good credit can help you get better rates.

- Choose your car wisely. Certain cars are cheaper to insure than others. Before purchasing a vehicle, research insurance costs for different makes and models.

- Ask about additional discounts. Insurance companies may offer discounts for things like being a member of certain organizations, having a good student in the household, or installing anti-theft devices.

- Review and update your policy annually. As your circumstances change, your insurance needs may change too. Review your policy annually to make sure you’re still getting the best rate.

Remember to shop around and compare quotes from different insurers to ensure you’re getting the best deal. This tips may allow you to save money in the long run on your car insurance premium.

Case Studies: Navigating Homemaker Car Insurance

These case studies illustrate how different homemaker car insurance needs can be met through various providers, emphasizing factors such as savings, customer service, and tailored coverage.

- Case Study #1– Bundle Discounts: A homemaker prioritized affordable coverage and chose State Farm for its bundle discounts, combining home and auto insurance for significant savings. With discounts of up to 12% for homemakers and 15% for multi-vehicle policies, they secured comprehensive coverage without exceeding their budget.

- Case Study #2– Exceptional Customer Service: Seeking hassle-free service, a homemaker turned to USAA for their renowned customer support. Their experience exceeded expectations, with personalized assistance and quick responses tailored to their needs, showcasing USAA’s commitment to exceptional service.

- Case Study #3– Tailored Coverage: In search of customizable policies, a homemaker found Progressive’s offerings suited their specific needs. With tailored coverage options and discounts of up to 15% for homemakers and 17% for multi-vehicle policies, they achieved comprehensive coverage without compromising affordability.

This demonstrate that homemaker car insurance needs can vary widely, from a focus on savings to personalized service and tailored coverage. Check out our relevant guide “Does car insurance cover all the drivers in a single home?” for more insight.

State Farm emerges as the top choice for homemakers, offering bundle discounts that maximize savings on comprehensive coverage.

Dani Best Licensed Insurance Producer

By understanding their priorities and preferences, homemakers can find insurance providers that best meet their individual needs and offer the right balance of cost, service, and coverage.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

The Bottom Line in Navigating Car Insurance for Homemakers

Frequently Asked Questions

How do insurance companies determine car insurance rates for homemakers?

Insurance companies assess various factors to determine rates, including driving history, claims history, age, gender, and occupation. Homemakers often benefit from lower rates due to their typically lower-risk profile.

Learn more information about rates in this comprehensive guide “Compare Monthly Car Insurance: Rates, Discounts, & Requirements“

What discounts are commonly available for homemakers in car insurance?

Common discounts for homemakers include homemaker discounts, multi-vehicle discounts, safe-driving discounts, and bundle discounts. Providers like State Farm, USAA, and Progressive offer specific discounts tailored for homemakers.

Get the minimum car insurance coverage you need to drive legally by entering your ZIP code into our free quote comparison tool below.

Are there specific coverage options that homemakers should consider in their car insurance policies?

Coverage needs vary, but homemakers may consider comprehensive coverage, liability insurance, and options like accident forgiveness. The choice depends on individual circumstances, such as the frequency of driving and the number of household members.

How can I save money on my car insurance rates as a homemaker?

To save money on car insurance, homemakers can explore discounts offered by insurance providers, bundle multiple policies for additional savings, maintain a clean driving record, and regularly compare quotes to ensure they are getting the best rates available.

Can being a homemaker affect my car insurance rates positively?

Yes, being a homemaker can positively influence car insurance rates. Insurance companies often consider homemakers as lower-risk drivers, leading to potential discounts and more favorable premium rates.

Check thoroughly our guide “What Is a Car Insurance Premium“

Do I need to inform my insurance company if I start working outside the home as a homemaker?

It’s typically a good idea to inform your insurance company of any significant changes in your circumstances, such as starting a new job outside the home. While it may not directly impact your rates as a homemaker, it’s essential for accurate policy information.

Will my car insurance rates change if I have a child who starts driving?

Adding a teenage driver to your policy can often increase rates due to the higher risk associated with inexperienced drivers. However, specific rates may vary depending on factors such as the teenager’s driving record, the type of vehicle they drive, and available discounts.

To gain more information, read our “Compare Teen Driver Car Insurance Rates“.

Can I still get car insurance if I don’t have a traditional job as a homemaker?

Yes, you can still get car insurance as a homemaker even if you don’t have a traditional job. Insurance companies consider various factors beyond employment status when determining rates, so being a homemaker shouldn’t prevent you from obtaining coverage.

Are there special considerations for homemakers who occasionally use their vehicles for work-related tasks?

If you occasionally use your vehicle for work-related tasks, it’s essential to inform your insurance company to ensure you have the appropriate coverage. Depending on the nature of the work and frequency of use, you may need additional coverage options.

What should I do if my insurance needs change, such as if I start working outside the home or if my driving habits change significantly?

If your insurance needs change, such as starting a new job or altering your driving habits, it’s crucial to review your policy with your insurance provider. They can help you adjust your coverage to ensure it meets your current needs and circumstances.

Explore your car insurance options by entering your ZIP code below and finding which companies have the lowest rates.

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.