Best Car Insurance for Instacart Drivers in 2026 (Your Guide to the Top 10 Companies)

Allstate, Geico, and Travelers top the list for the best car insurance for Instacart drivers, with rates beginning at $70 monthly. These companies provide tailored policies, competitive rates, and exceptional service. They ensure comprehensive coverage and great value for Instacart drivers.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Insurance Claims Support & Sr. Adjuster

Kalyn grew up in an insurance family with a grandfather, aunt, and uncle leading successful careers as insurance agents. She soon found she has similar interests and followed in their footsteps. After spending about ten years working in the insurance industry as both an appraiser dispatcher and a senior property claims adjuster, she decided to combine her years of insurance experience with another...

Kalyn Johnson

Licensed Insurance Agent

Kristen is a licensed insurance agent working in the greater Boston area. She has over 20 years of experience counseling individuals and businesses on which insurance policies best fit their needs and budgets. She knows everyone has their own unique needs and circumstances, and she is passionate about counseling others on which policy is right for them. Licensed in Massachusetts, New Hampshire,...

Kristen Gryglik

Updated May 2024

Company Facts

Full Coverage for Instacart Drivers

A.M. Best Rating

Complaint Level

Pros & Cons

Company Facts

Full Coverage for Instacart Drivers

A.M. Best Rating

Complaint Level

Pros & Cons

Company Facts

Full Coverage for Instacart Drivers

A.M. Best Rating

Complaint Level

The top pick overall for the best car insurance for Instacart drivers is Allstate, with Geico and Travelers also highly recommended for their competitive offerings. These providers specialize in tailored policies that meet the specific needs of Instacart drivers, ensuring comprehensive car insurance and great value.

As the gig economy expands, securing the right insurance is crucial for drivers seeking protection on the road.

Our Top 10 Company Picks: Best Car Insurance for Instacart Drivers

Company Rank Multi-Vehicle Discount A.M. Best Best For Jump to Pros/Cons

![]()

#1 10% A+ Add-on Coverages Allstate

![]()

#2 7% A++ Cheap Rates Geico

#3 8% A++ Accident Forgiveness Travelers

#4 15% A+ 24/7 Support Erie

#5 12% A++ Many Discounts State Farm

#6 6% A++ Military Savings USAA

#7 9% A Local Agents Farmers

#8 10% A+ Online Convenience Progressive

#9 10% A+ Usage Discount Nationwide

#10 10% A Customizable Policies Liberty Mutual

Explore your options today to find a policy that fits your budget and delivers peace of mind while you’re on the move.

Get the right car insurance at the best price — enter your ZIP code above to shop for coverage from the top insurers.

- Allstate is the top pick for Instacart drivers

- Tailored policies cater to the unique needs of drivers

- Access up to 20% discounts on premiums

#1 – Allstate: Top Overall Pick

Pros

- Add-on Coverages: Offers various additional coverage options, which is advantageous for drivers seeking comprehensive protection.

- High Industry Rating: Holds an A+ rating from A.M. Best, indicating financial stability and reliability. Read more in our Allstate car insurance review.

- Multi-Vehicle Discount: Offers a 10% multi-vehicle discount, which can reduce costs for drivers using multiple vehicles.

Cons

- Cost: Higher premiums compared to some competitors, which might not be ideal for all drivers.

- Mixed Reviews: Some customer reviews indicate potential issues with claims services, which could impact satisfaction.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#2 – Geico: Best for Overall Value

Pros

- Cost-Effective: Known for affordable rates, which is beneficial for drivers looking to save on expenses.

- Superior Financial Rating: An A++ rating from A.M. Best assures strong financial health. Learn more in our Geico car insurance review.

- User-Friendly Services: Provides an efficient online platform and mobile app for easy management of insurance policies.

Cons

- Fewer Customization Options: May offer fewer coverage customization options compared to other insurers.

- Lower Multi-Vehicle Discount: At 7%, the discount is slightly less generous than some competitors.

#3 – Travelers: Best for Accident Forgiveness

Pros

- Accident Forgiveness: Helps prevent rate increases after the first accident, which is crucial for drivers frequently on the road.

- Competitive Rates: Offers a good balance of cost and coverage, with reasonable monthly premiums. Learn more in our detailed Travelers car insurance review.

- Strong Financial Rating: An A++ rating from A.M. Best ensures reliability in claims handling.

Cons

- Moderate Discounts: The multi-vehicle discount is 8%, which is not the highest available.

- Limited Availability: Some coverage options and discounts may not be available in all states.

#4 – Erie: Best for 24/7 Support

Pros

- Extensive Support: Provides 24/7 customer support, which is ideal for delivery drivers who work various hours.

- High Multi-Vehicle Discount: With a 15% discount for insuring multiple vehicles, our Erie car insurance review highlights one of the most significant savings available.

- Excellent Coverage Options: Known for offering comprehensive coverage that can be tailored to individual needs.

Cons

- Higher Rates: Full coverage rates can be on the higher end, which might not fit every budget.

- Geographic Limitations: Coverage is not available nationwide, which can be a limitation for some drivers.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#5 – State Farm: Best for Discount Variety

Pros

- Variety of Discounts: Offers numerous discounts including a 12% multi-vehicle discount, which can significantly lower premiums.

- High Financial Rating: Read our State Farm car insurance review to learn why it receives an A++ rating from A.M. Best, reflecting its strong financial stability.

- Wide Coverage Availability: Available in most areas, providing a reliable option for many drivers.

Cons

- Variable Customer Service: Experiences can vary by agent and location, which might affect overall satisfaction.

- Pricing Discrepancies: Rates can vary significantly between states and based on driver profiles.

#6 – USAA: Best for Military Families

Pros

- Military Discounts: USAA is highly regarded for its commitment to military families, offering significant savings and benefits, as highlighted in our detailed USAA car insurance review.

- Highly Competitive Rates: Known for offering some of the most competitive rates in the industry.

- Top-Notch Customer Service: Frequently receives high marks for customer service and claims satisfaction.

Cons

- Eligibility Restrictions: Only available to military members, veterans, and their families, which limits accessibility for the general public.

- Coverage Options: While comprehensive, might not offer as many specialized products for non-military drivers.

#7 – Farmers: Best for Local Agent Network

Pros

- Local Agent Networks: Offers personalized service through a wide network of local agents.

- Diverse Coverage Options: Provides a range of coverage options that can be tailored to specific needs.

- Reliable Claims Process: Our comprehensive Farmers car insurance review reveals that the company is generally known for a smooth and efficient claims process.

Cons

- Higher Cost: May be more expensive compared to some other competitors.

- Inconsistent Experiences: Service quality can vary significantly depending on the local agent.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#8 – Progressive: Best for Online Tools

Pros

- Online Convenience: Highly rated for its online tools and mobile app, making insurance management straightforward.

- Customizable Policies: Progressive car insurance review highlights the company’s flexible policy options, enabling drivers to customize their coverage effectively.

- Competitive Multi-Vehicle Discount: A 10% discount helps reduce costs for those with multiple vehicles.

Cons

- Rate Increases: Some customers report rate increases after claims, which can be a concern.

- Customer Service Variability: Customer service quality can vary, potentially affecting satisfaction during the claims process.

#9 – Nationwide: Best for Usage-Based Discounts

Pros

- Usage-Based Discounts: Learn about Nationwide car insurance discounts that reward safe driving with lower premiums through their advanced telematics program.

- Comprehensive Options: Wide range of coverage options that cater to different needs.

- Solid Financial Foundation: Holds an A+ rating from A.M. Best, ensuring financial reliability.

Cons

- Pricing: Can be pricier than some competitors, depending on coverage and location.

- Customer Service: While generally good, there can be variability in service quality across different regions.

#10 – Liberty Mutual: Best for Customizable Policies

Pros

- Customizable Policies: Offers a high degree of policy customization, which is beneficial for drivers with specific needs.

- Good Discounts: Provides a 10% multi-vehicle discount, along with other potential savings.

- Global Presence: Our comprehensive Liberty Mutual car insurance review highlights this large, well-established insurer with a broad range of insurance products.

Cons

- Higher Premiums: Tends to have higher rates compared to some other companies.

- Mixed Reviews: Customer satisfaction can vary widely based on individual experiences with agents and claims.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Instacart: Convenient Grocery Delivery Directly to Your Doorstep

Instacart operates as a third-party service that delivers groceries from partnering grocery stores directly to customers’ homes. Customers select items they wish to purchase via the Instacart website or app, from the comfort of their homes. An Instacart shopper then picks up and delivers these orders directly, either immediately or at a scheduled time later in the day.

Allstate stands out as the top choice for Instacart drivers, offering tailored policies that combine affordability with comprehensive coverage.

Dani Best Licensed Insurance Producer

While there is a small fee for delivery, customers also have the option to pick up their groceries in person to avoid this charge. For those considering car insurance for delivery drivers, a complete breakdown of charges is available on the Instacart website.

Auto Insurance Monthly Rates for Instacart Drivers by Coverage Level & Provider

Insurance Company Minimum Coverage Full Coverage

Allstate $92 $161

Erie $90 $187

Farmers $84 $211

Geico $70 $168

Liberty Mutual $96 $234

Nationwide $83 $218

Progressive $87 $229

State Farm $83 $190

Travelers $80 $182

USAA $79 $201

Compare monthly auto insurance rates tailored for Instacart drivers across various coverage levels. This table outlines the minimum coverage and full coverage premiums offered by top insurance companies like Allstate, Erie, Farmers, Geico, Liberty Mutual, Nationwide, Progressive, State Farm, Travelers, and USAA. Discover the most cost-effective options to ensure adequate protection while delivering for Instacart.

Understanding Car Insurance Requirements for Instacart Drivers

Instacart does not explicitly mandate car insurance for its drivers on their website. While their basic requirements stipulate consistent access to a vehicle, they do not confirm insurance coverage. However, it’s crucial to have proper insurance before delivering for Instacart. Even if you possess personal car insurance, it won’t cover accidents during deliveries due to business use.

To ensure coverage while delivering, purchasing commercial car insurance is necessary, as Instacart does not provide it. Though commercial rates may be higher, it’s essential for delivery operations. In case of accidents, claims must be reported directly to the insurance provider, as Instacart does not offer coverage.

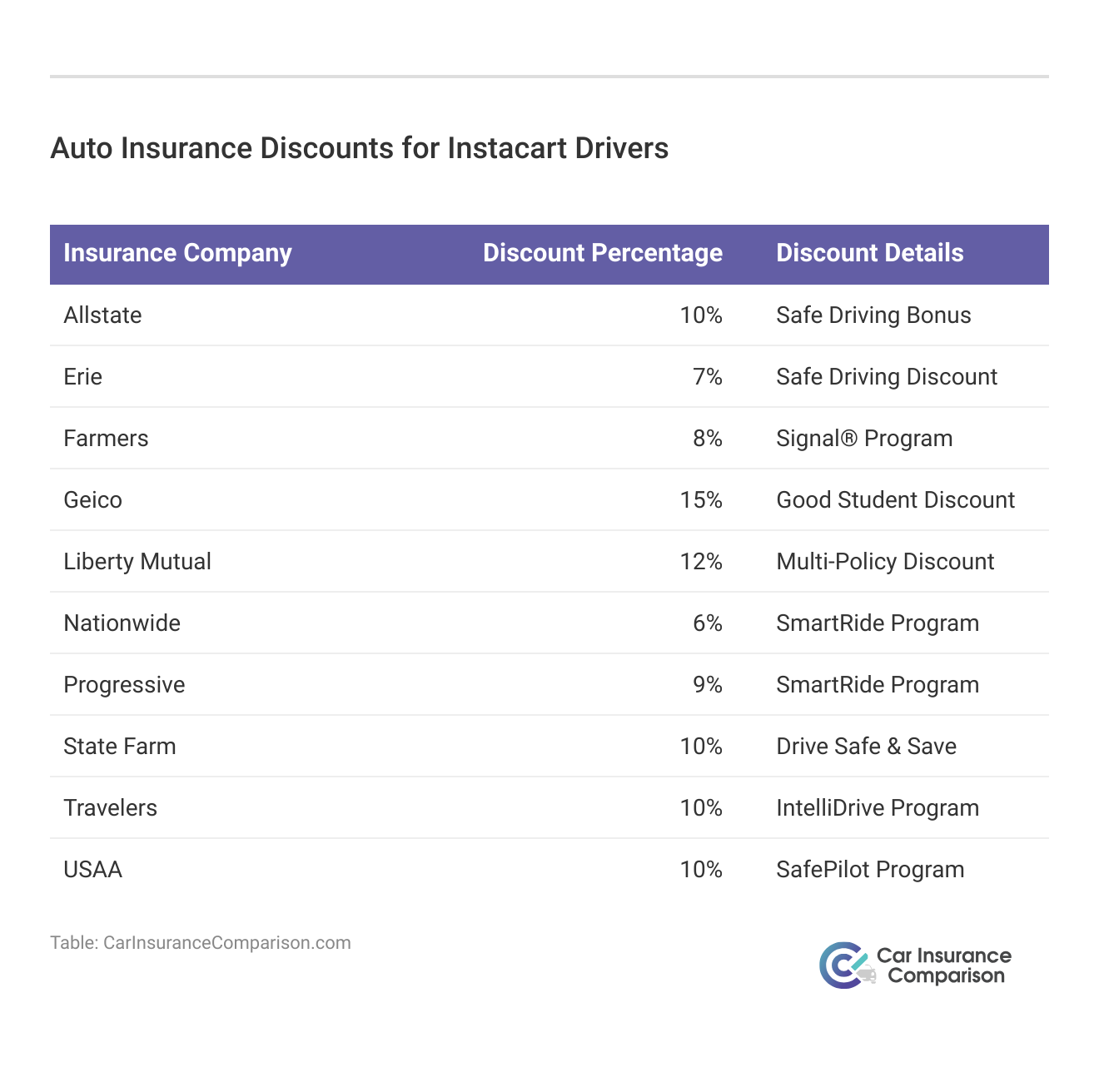

Explore auto insurance discounts tailored for Instacart drivers with this comprehensive table. Featuring 10 top insurance companies, including Allstate, Erie, Farmers, Geico, Liberty Mutual, Nationwide, Progressive, State Farm, Travelers, and USAA, this table showcases the discount percentages and details offered.

From safe driver car insurance discounts to good student discounts and multi-policy savings, discover the various ways Instacart drivers can save on their auto insurance premiums.

Maximize Savings: Instacart Insurance Comparison

To save on Instacart auto insurance, consider comparing quotes online from multiple providers. While there are typically no specific discounts for food delivery drivers, on how do you get competitive quotes for car insurance can help you find the best rates.

Reviewing three to four quotes from different companies allows you to secure the most affordable deal. Utilize a car insurance comparison chart for further information and assistance in your search.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Insights into Instacart Driver Insurance: Real-Life Case Studies

Navigating auto insurance as an Instacart driver presents unique challenges. In the following case studies, we explore real-life scenarios faced by Instacart drivers regarding insurance coverage, shedding light on the importance of understanding and securing the right insurance protection.

- Case Study #1 – Instacart Driver Insurance Dilemma: Sarah, an Instacart driver, faced a minor accident while delivering groceries. Her personal car insurance didn’t cover accidents during business use, so she purchased commercial car insurance. She also learned how much a minor accident affects car insurance rates.

- Case Study #2 – Max’s Insurance Savings Journey: Max, an Instacart driver, diligently compared quotes from various providers and discovered significant rate differences. By reviewing three to four quotes and leveraging discounts like safe driving bonuses and multi-policy savings, Max secured a cost-effective insurance plan tailored for Instacart drivers.

- Case Study #3 – Instacart Driver’s Quest for Coverage: Alex, an aspiring Instacart driver, was uncertain about insurance requirements. Despite Instacart’s vague stance, Alex understood the necessity of coverage. Through research, he learned that personal policies didn’t suffice for deliveries. Alex opted for commercial car insurance, ensuring comprehensive protection during his shifts.

These case studies underscore the crucial role of the best insurance for Instacart drivers. Whether addressing coverage gaps, optimizing savings, or ensuring adequate protection, each driver’s journey highlights the significance of being informed and proactive.

Allstate is the premier option for Instacart drivers, with a remarkable 95% customer satisfaction rating that underscores its excellence in coverage and service.

Jeffrey Manola Licensed Insurance Agent

By learning from these experiences, Instacart drivers can make well-informed decisions to safeguard their livelihoods on the road.

Securing Your Instacart Drive: Navigating Auto Insurance Essentials

In summary, Instacart does not offer auto insurance coverage for its drivers. While not mandated, having proper coverage is essential before delivering for the service. Commercial car insurance is necessary for adequate protection, as personal policies usually don’t cover delivery accidents.

Claims should be reported directly to the insurance provider. To find affordable rates, compare quotes from multiple providers using car insurance comparison websites. Being proactive about insurance coverage is crucial for Instacart drivers to protect their livelihoods on the road.

Stop overpaying for car insurance. Our free quote comparison tool allows you to shop for quotes from the top providers near you by entering your ZIP code below.

Frequently Asked Questions

What is the cheapest insurance for delivery drivers?

State Farm offers the most affordable car insurance for delivery drivers, with monthly rates starting as low as $93 for a full coverage policy. For an additional 15%–20%, you can include rideshare insurance to extend your coverage while working.

To learn more, explore our comprehensive resource titled “Cheapest Car Insurance in the World,” which provides detailed insights in a concise format.

Is there a maximum for Instacart?

There is no limit on pickup orders. There is a $250 limit for delivery orders, which includes all countable items. For example, a customer can have 250 units of the same product or 250 units of a mix of products. Be aware that large orders might result in increased latency or possible timeouts.

See if you’re getting the best deal on car insurance by entering your ZIP code below.

What is the best car insurance for Uber Eats?

Best for Food Delivery Progressive Progressive’s rideshare insurance covers drivers with passengers, but it also provides coverage to drivers who use their personal vehicles to deliver food through companies like DoorDash, Uber Eats, and Grubhub.

For a thorough understanding, refer to our detailed analysis titled “Does car insurance cover food delivery vehicles?” which provides all necessary information in a concise format.

Where is Instacart the highest paying?

The highest paying cities for delivery drivers in the US San Francisco, CA. $27.19 per hour. San Francisco Bay Area, CA. $29.06 per hour. San Diego, CA. $24.76 per hour.

Can you make $300 a day with Instacart?

This value can go up to $300, assuming that they work in the top cities, get higher tips, work overtime, and make extra effort for the clients. The willingness to put in the effort and hard work will easily earn any Instacart shopper hundreds of dollars in just a day or two.

Are delivery drivers safe?

Delivery drivers are an essential part of the modern economy, and yet it’s one of the most dangerous jobs, with a unique set of safety challenges. Data from the US Bureau of Labor Statistics, for example, shows that 887 delivery and truck drivers died at work during 2020, and that’s not even counting injuries.

To expand your knowledge, refer to our comprehensive handbook titled “Best Car Insurance for High-Risk Drivers” for essential insights and tips.

Can you make $1,000 a week with Instacart?

It does require some extra effort to get your weekly Instacart earnings above $1,000, but if you get serious about the job and create and execute an effective strategy, you can get there.

Is Instacart worth the money?

Both Hindert and Gagarin agree that, depending on your situation and how frequently you use the service, having an Instacart membership is worth it. “Saving money using grocery delivery services is largely dependent on how much your time is worth,” says Gagarin.

Ready to shop around for the best car insurance company? Enter your ZIP code below and see which one offers the coverage you need.

How much do you make with Instacart?

Average Instacart shoppers hourly pay ranges from approximately $17/hr to $24/hr.

To explore further, consult our comprehensive guide titled “Best Car Insurance for Delivery Drivers” for detailed insights.

Does Instacart pay for gas?

Instacart doesn’t reimburse shoppers for gas money or give them a credit card to pay for gas. According to Instacart, as a shopper, you are an “independent contractor. Therefore, you use your own vehicle to handle deliveries, and you pay for your own maintenance and fuel.”

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.