Best Car Insurance for Managers and Directors in 2026 (Top 10 Companies)

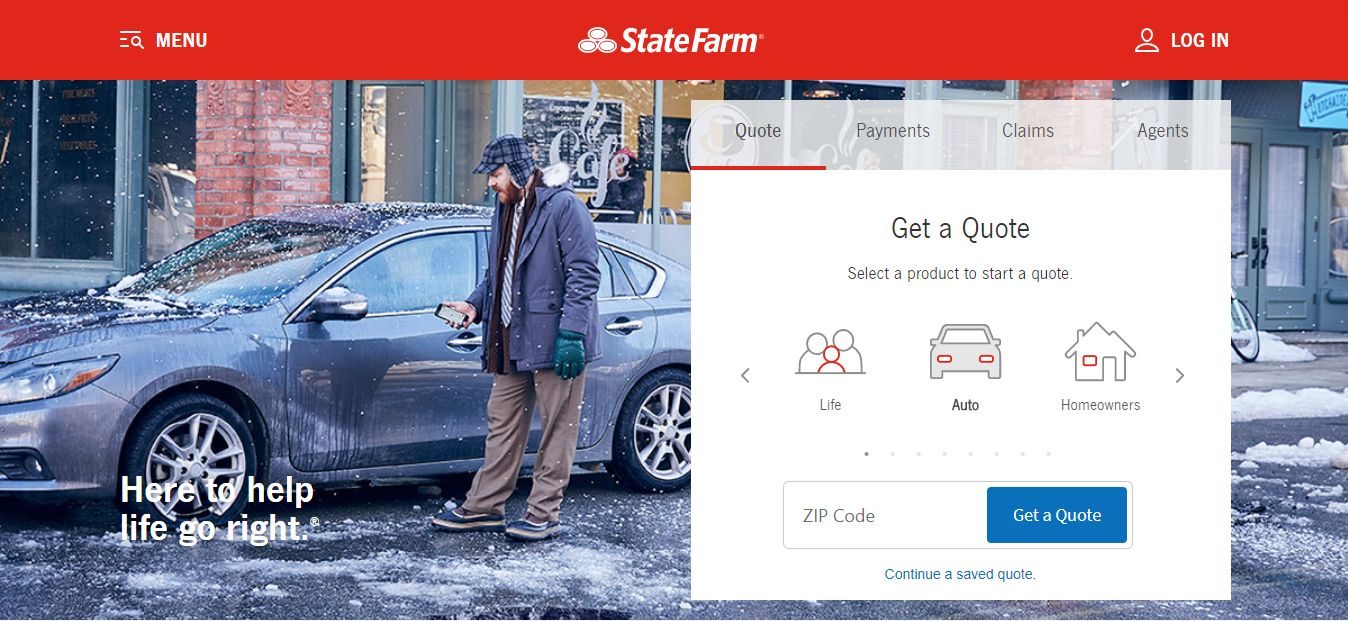

Explore the premier choices for the best car insurance for managers and directors, boasting an enticing up to 17% discount with State Farm, USAA, and Allstate leading the pack. With unbeatable comprehensive coverage and competitive rates, it is perfectly suited for professionals in high-stress roles.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Licensed Insurance Agent

Michelle Robbins has been a licensed insurance agent for over 13 years. Her career began in the real estate industry, supporting local realtors with title Insurance. After several years, Michelle shifted to real estate home warranty insurance, where she managed a territory of over 100 miles of real estate professionals. Later, Agent Robbins obtained more licensing and experience serving families a...

Michelle Robbins

Insurance Content Team Lead

Tonya Sisler has been a technical insurance writer for over five years. She uses her extensive insurance and finance knowledge to write informative articles that answer readers' top questions. Her mission is to provide readers with timely, accurate information that allows them to determine their insurance needs and choose the best coverage. Tonya currently leads a team of 10 insurance copywrite...

Tonya Sisler

Updated May 2024

18,155 reviews

18,155 reviewsCompany Facts

Full Coverage for Manager & Director

A.M. Best Rating

Complaint Level

Pros & Cons

18,155 reviews

18,155 reviews 6,589 reviews

6,589 reviewsCompany Facts

Full Coverage for Manager & Director

A.M. Best Rating

Complaint Level

6,589 reviews

6,589 reviews 11,638 reviews

11,638 reviewsCompany Facts

Full Coverage for Manager & Director

A.M. Best Rating

Complaint Level

Pros & Cons

11,638 reviews

11,638 reviews

In this comprehensive guide, we delve into the intricate world of tailored car insurance, crucial for managers and directors navigating the roadways.

Our Top 10 Company Picks: Best Car Insurance for Managers and Directors

| Company | Rank | Multi-Policy Discount | Low-Mileage Discount | Best For | Jump to Pros/Cons |

|---|---|---|---|---|---|

| #1 | 17% | 10% | Many Discounts | State Farm | |

| #2 | 15% | 20% | Military Savings | USAA | |

| #3 | 25% | 30% | Add-on Coverages | Allstate | |

| #4 | 10% | 10% | Online Convenience | Progressive | |

| #5 | 20% | 10% | Usage Discount | Nationwide |

| #6 | 20% | 10% | Local Agents | Farmers | |

| #7 | 12% | 10% | Customizable Polices | Liberty Mutual |

| #8 | 27% | 10% | Local Agents | AAA |

| #9 | 29% | 10% | Student Savings | American Family | |

| #10 | 13% | 10% | Accident Forgiveness | Travelers |

From competitive rates to specialized coverage options, we explore how these industry giants excel in providing personalized insurance solutions tailored to the high-stress professions of managers and directors.

Finding cheap car insurance quotes is easy. Just enter your ZIP code into our free comparison tool above to instantly compare quotes near you

- State Farm offers 15% discounts on comprehensive coverage for executives

- Compare rates and customer reviews for informed decision-making

- Stands out with personalized policies and accident forgiveness

Manager/Director Work Environment

When we’re speaking of managers and directors we are assuming that the survey is referring to senior management level positions.

These individuals might be department heads, regional managers, vice presidents, or directors of various institutions. This type of work lends itself to a specific environment which may cause these drivers to be a bit riskier.

- Develop Clear Contracts and Monitor Compliance: Establish transparent agreements with legal oversight, track driver activity using GPS and telematics, and ensure adherence to industry standards.

- Assess Operational Risks and Enhance Cybersecurity: Evaluate potential hazards regularly while implementing robust cybersecurity measures to protect sensitive data.

- Seek Expert Guidance: Consult legal and insurance professionals for comprehensive advice.

There are many different factors that go into determining how much an individual pays for car insurance. Believe it or not, one of those factors is your occupation.

State Farm stands out as the top choice for managers and directors, offering diverse discounts of 17% and tailored coverage for high-stress professions.

Dani Best Licensed Insurance Producer

Manager/Director Stress

It seems as though the higher up the management chain we climb, the more stressful our daily lives become, especially in the workplace. While it’s true that senior managers and directors do receive higher pay than blue-collar workers, they also endure a tremendous amount of stress.

- Compensation Linked to Company Performance: Pay is frequently contingent on company achievements rather than an hourly wage.

- Pressure to Yield Positive Results for Shareholders: Job security hinges on delivering favorable outcomes for shareholders.

- Intense Stress Amid Economic Instability: In a precarious economy, the pressure becomes overwhelming for managers and directors.

It’s already documented that stressed individuals do not drive as safely as those who are calm and relaxed. It goes without saying that when an employee leaves his workplace at the end of the day, the more stressed out he is, the less patient he will be with other drivers.

In a high-stress environment such as what the manager or director is involved, it’s easy to see why they could pose a greater risk as drivers. Not that they always will, but the potential is there.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Tailoring Car Insurance to Individual Needs: A Look at Three Case Studies

In the dynamic world of car insurance, finding the right fit can be a challenge. These case studies showcase how individuals and businesses with unique needs navigated the market to find insurance solutions that worked best for them.

- Case Study #1 – Passenger Safety: During a limousine service, a client suffers an injury while exiting the vehicle. General liability insurance steps in to cover medical costs and potential legal expenses, ensuring protection against bodily harm claims. To gain in-depth knowledge, consult our comprehensive resource titled “Compare Liability Car Insurance: Rates, Discounts, & Requirements.”

- Case Study #2 – Vehicle Collision: A limousine driver encounters a collision, resulting in vehicle damage and passenger injuries. Commercial auto insurance provides coverage for repairs, medical bills, and liability claims, delivering specialized protection for transportation-related accidents and property damages.

- Case Study #3 – Employee Injury Support: While on duty, a limousine driver sustains a work-related injury. Workers’ compensation insurance offers coverage for medical expenses, lost earnings, and disability benefits, delivering crucial financial assistance for employees in the event of work-related injuries or illnesses.

These case studies highlight the importance of comprehensive insurance coverage in the limousine service industry. From protecting passengers and vehicles to providing support for injured employees, insurance plays a vital role in mitigating risks and ensuring financial security.

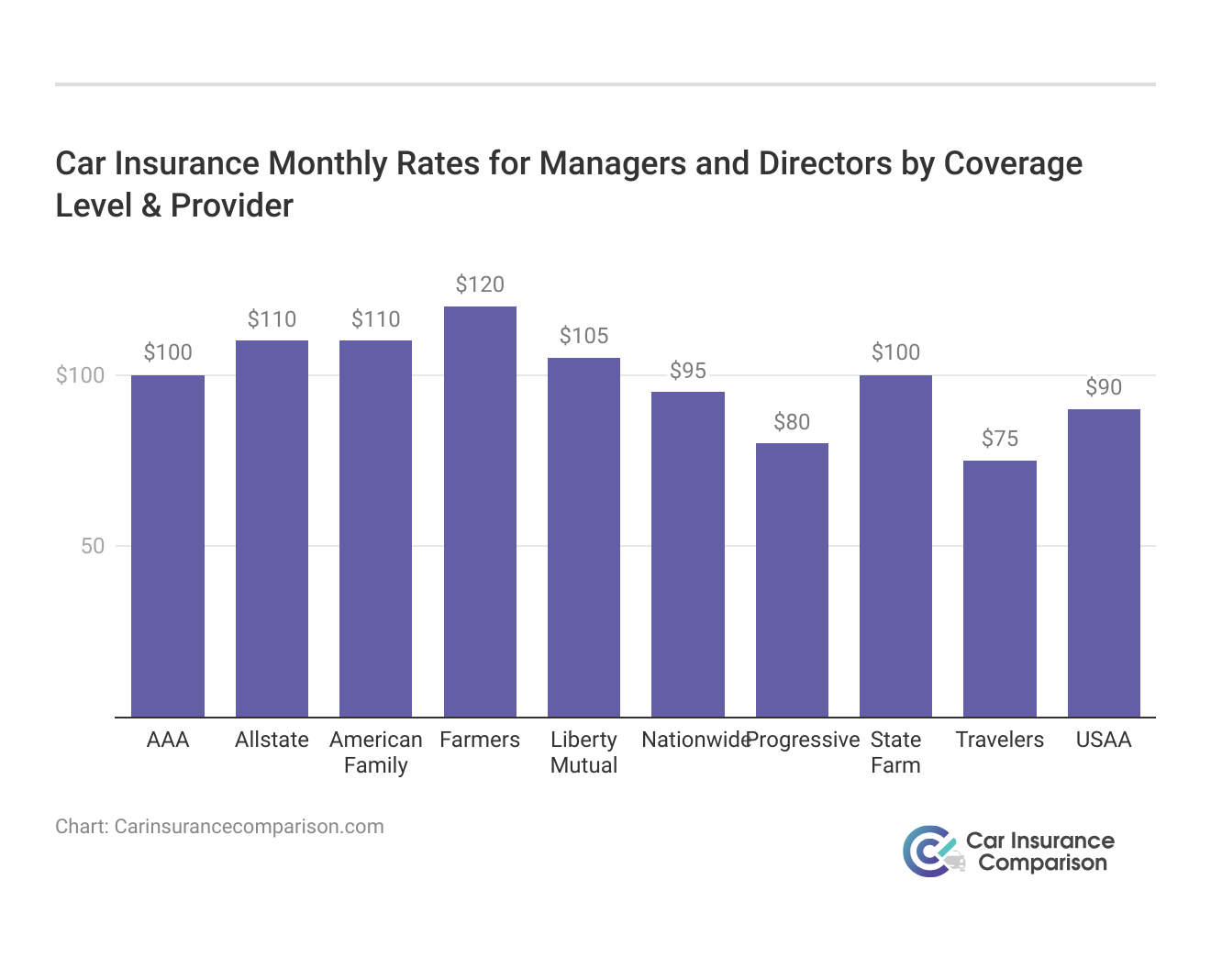

State Farm stands out as the top choice, offering competitive rates starting at $100 for minimum coverage and a generous 17% discount.

Brad Larson Licensed Insurance Agent

By understanding the various types of insurance available and selecting the right coverage for their needs, limousine service providers can safeguard their business, employees, and clients against unforeseen circumstances. It’s crucial for providers to compare car insurance rates and policies to ensure they’re getting the best coverage for their specific needs.

Manager/Director Vehicles

One final aspect of this type of work is the fact that these types of individuals tend to drive more expensive vehicles. Again, the higher we go up the management scale, the more compensation the individual earns. With higher paycheck workers tend to drive more expensive cars which are, obviously, more expensive to replace or repair after an accident. Even without a manager/director job, you still pay more insurance for a more expensive vehicle.

Managers and directors have a work environment, daily stresses, and more expensive vehicles that all add up to higher insurance rates.

Interestingly enough, there are some professions where the income is much higher but insurance rates lower. There are a number of factors behind this, including the tendency for the more wealthy among us to pay for accident claims out-of-pocket, but for some reason, these factors don’t seem to apply to managers and directors. For a comprehensive analysis, refer to our detailed guide titled “Average car insurance rates by age and gender.”

Enter your ZIP code below to see instant auto insurance quotes by carriers in your state.

Frequently Asked Questions

Can the choice of vehicle affect insurance rates for managers and directors?

Yes, the choice of vehicle can significantly impact insurance rates. Managers and directors often prefer high-end vehicles, which can be more expensive to insure. Opting for a less expensive or a safer vehicle model can help in reducing premium costs.

How does frequent business travel impact car insurance rates for managers and directors?

Frequent business travel can increase car insurance rates as it often leads to higher mileage and extended time on the road, which insurers may view as increased risk. Managers and directors should look for insurance companies that offer favorable terms for high-mileage drivers or consider usage-based insurance options.

Get the right car insurance at the best price — enter your ZIP code below to shop for coverage from the top insurers.

What factors make car insurance rates higher for managers and directors?

Managers and directors often face higher car insurance rates due to the high-stress nature of their jobs, the likelihood of driving more expensive vehicles, and frequent traveling for work. These factors can increase perceived risk, leading to higher premiums.

To gain further insights, consult our comprehensive guide titled “What Is a Car Insurance Premium?.”

Who is the most trusted insurance company, and what is the strongest insurance brand in the world for mangers and directors?

State Farm is often regarded as the most trusted insurance company, and Allstate is considered one of the strongest insurance brands globally for managers and directors.

What are the benefits of State Farm’s insurance policies, and how do they compare to Allstate’s offerings?

State Farm’s policies offer comprehensive coverage, while Allstate provides competitive rates for managers and directors.

How can managers and directors find the best car insurance rates?

To find the best rates, managers and directors should compare car insurance companies that offer specialized rates or discounts that cater to their specific needs. Companies like State Farm, USAA, and Allstate are often ranked highly for providing competitive rates and coverage options suitable for professionals in managerial or directorial positions.

For additional details, explore our comprehensive resource titled “Compare Car Insurance Rates by Vehicle Make and Model“

How does USAA’s insurance stack up against Nationwide’s coverage for managers and directors?

USAA offers personalized policies, whereas Nationwide provides extensive protection tailored to the needs of managers and directors.

What discounts does Progressive offer for executives, and how do they differ from Travelers’ offerings?

Progressive provides discounts on tailored coverage, while Travelers offers comprehensive protection for managers and directors.

Stop overpaying for car insurance. Our free quote comparison tool allows you to shop for quotes from the top providers near you by entering your ZIP code below.

Are there any discounts available specifically for managers and directors in car insurance policies?

While there may not be discounts specifically labeled for managers and directors, many car insurance companies offer discounts that can benefit them. These include multi-policy discounts, low-mileage discounts, and discounts for good driving records. It’s important to inquire about all available discounts when comparing rates.

What factors should managers and directors consider when comparing car insurance rates, and how can they ensure they’re getting the best coverage?

Managers and directors should consider coverage options and customer satisfaction ratings to make informed decisions about their insurance policies.

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.