Best Car Insurance for Nannies in 2026 (Top 10 Companies)

State Farm, USAA, and Progressive stand out as the best car insurance for nannies, offering discounts of up to 12%. With tailored coverage, specialized discounts, and comprehensive plans that prioritize their unique needs, these companies provide nannies with the peace of mind while on the road.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Licensed Insurance Agent

Brandon Frady has been a licensed insurance agent and insurance office manager since 2018. He has experience in ventures from retail to finance, working positions from cashier to management, but it wasn’t until Brandon started working in the insurance industry that he truly felt at home in his career. In his day-to-day interactions, he aims to live out his business philosophy in how he treats hi...

Brandon Frady

Licensed Insurance Agent

Justin Wright has been a licensed insurance broker for over 9 years. After graduating from Southeastern Seminary with a Masters in Philosophy, Justin started his career as a professor, teaching Philosophy and Ethics. Later, Justin obtained both his Property & Casualty license and his Life and Health license and began working for State Farm and Allstate. In 2020, Justin began working as an i...

Justin Wright

Updated May 2024

13,283 reviews

13,283 reviewsCompany Facts

Full Coverage for Nannies

A.M. Best Rating

Complaint Level

13,283 reviews

13,283 reviews 6,589 reviews

6,589 reviewsCompany Facts

Full Coverage for Nannies

A.M. Best Rating

Complaint Level

6,589 reviews

6,589 reviews 18,155 reviews

18,155 reviewsCompany Facts

Full Coverage for Nannies

A.M. Best Rating

Complaint Level

Pros & Cons

18,155 reviews

18,155 reviewsState Farm, USAA, and Progressive are the best car insurance for nannies from industry leaders. Among these, State Farm shines as a premier choice, offering tailored coverage, discounts, and competitive rates for reliable transportation.

Working as a nanny demands a high level of commitment and dedication, as it involves not only providing care for children but also managing household tasks.

Our Top 10 Company Picks: Best Car Insurance for Nannies

| Company | Rank | Multi-Policy Discount | Low-Mileage Discount | Best For | Jump to Pros/Cons |

|---|---|---|---|---|---|

| #1 | 12% | 20% | Online Convenience | Progressive | |

| #2 | 5% | 20% | Military Savings | USAA | |

| #3 | 17% | 30% | Many Discounts | State Farm | |

| #4 | 10% | 20% | Add-on Coverages | Allstate | |

| #5 | 5% | 10% | Local Agents | Farmers | |

| #6 | 25% | 30% | Customizable Polices | Liberty Mutual |

| #7 | 20% | 30% | Usage Discount | Nationwide |

| #8 | 13% | 10% | Accident Forgiveness | Travelers | |

| #9 | 20% | 20% | Student Savings | American Family | |

| #10 | 25% | 19% | Local Agents | AAA |

Nannies play a vital role in maintaining the smooth functioning of households and providing essential support to busy families, making their job both demanding and rewarding.

Finding cheap car insurance quotes is easy. Just enter your ZIP code into our free comparison tool above to instantly compare quotes near you

- Progressive offers a 12% discount, the top choice for nanny insurance

- Tailored coverage and caregiver discounts meet nannies’ needs

- Comprehensive plans ensure peace of mind on the road

#1 – Progressive: Top Overall Pick

Pros

- User Friendly Online Platform: Progressive car insurance review demonstrates the company’s tailored coverage options for simplified policy management and streamlined claims processing.

- Competitive Pricing: Generally offers affordable rates for various driver profiles.

- Extensive Coverage Options: Wide range of customizable coverage choices.

Cons

- Customer Service Variability: Some reports of inconsistent customer support experiences.

- Coverage Limitations: Certain specialized coverages might not be available in all regions.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#2 – USAA: Best for Military Savings

Pros

- Exceptional Customer Service: Renowned for high customer satisfaction and support.

- Robust Coverage Options: USAA car insurance review highlights their comprehensive coverage tailored specifically for individuals leading military lifestyles.

- Financial Stability: Strong financial backing ensures reliability and trustworthiness.

Cons

- Limited Eligibility: Services exclusive to military members, veterans, and their families.

- Geographic Restrictions: May not be available in certain international locations.

#3 – State Farm: Best for Many Discounts

Pros

- Wide Range of Policies: State Farm car insurance review highlights a wide range of coverage choices tailored to different requirements.

- High Customer Satisfaction: Known for reliable customer service and claims handling.

- Financially Strong: Robust financial health ensures claim-paying ability.

Cons

- Higher Rates in Some Areas: Can be more expensive than competitors in certain regions.

- Less Competitive for High Risk Drivers: Rates may be higher for drivers with poor driving records.

#4 – Allstate: Best for Add-on Coverages

Pros

- Add-on Coverage Variety: Wide selection of additional coverage options for personalized protection.

- Substantial Discounts: Allstate car insurance review highlights discounts of 10% and 20% for bundling policies and maintaining low mileage, respectively.

- User Friendly Tools: Innovative tools and apps for easy policy management.

Cons

- Potentially higher premiums: Can be more expensive compared to some competitors.

- Varied customer satisfaction: Some regions report mixed experiences with customer service.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#5 – Farmers: Best for Local Agents

Pros

- Multi Policy Discounts: Up to 5% and 10% respectively, beneficial for bundling and low-mileage drivers.

- Innovative Features: The Farmers car insurance review demonstrates that the company has tailored coverage options for enhanced protection.

- Strong Financial Backing: Reliable and financially sound for claim handling.

Cons

- Higher Rates Possible: Premiums might be higher than some competitors.

- Limited Online Tools: Less robust online resources compared to others in the industry.

#6 – Liberty Mutual: Best for Customizable Polices

Pros

- Customizable Policies: The Liberty Mutual car insurance review showcases a diverse range of choices available for tailor-made coverage.

- Online Convenience: User-friendly online interface and tools.

- Strong Global Presence: Well-established reputation with a global footprint.

Cons

- Inconsistency in Customer Service: Some variability in service experiences reported.

- Price Competitiveness: May not always offer the lowest rates in the market.

#7 – Nationwide: Best for Usage Discount

Pros

- Variety of Coverage Options: Broad selection of insurance products.

- Strong Financial Ratings: The Nationwide car insurance discount illustrates the company’s tailored coverage options, indicating its focus on personalized protection for customers.

- Innovative Telematics Program: Offers discounts based on driving behavior.

Cons

- Mixed Reviews on Claim Process: Some users report varied experiences with claims.

- Premium Fluctuations: Rates can vary significantly depending on individual factors.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#8 – Travelers: Best for Accident Forgiveness

Pros

- Accident Forgiveness: Offers forgiveness programs that prevent premium spikes after an accident.

- Competitive Multi-Policy and Low-Mileage Discounts: Travelers car insurance review discuss different offers discounts of up to 13% and 10% respectively.

- Wide Coverage Options: Diverse policy choices for different needs.

Cons

- Higher Rates in Some Cases: Can be more expensive than some competitors for certain profiles.

- Limited Global Reach: Mainly focused on the U.S., with less presence internationally.

#9 – American Family: Best for Student Savings

Pros

- Tailored Family Coverage: Policies designed to meet the needs of families.

- Excellent Customer Service: Known for responsive and helpful customer support.

- Robust Policy Options: Demonstrating a diverse array of coverage options, American Family car insurance review showcases its tailored coverage for various needs.

Cons

- Limited Availability: Not accessible in all states, which might limit options for some.

- Price Variability: Premiums may vary depending on the state and individual circumstances.

#10 – AAA: Best for Local Agents

Pros

- Local Agent Expertise: Provides personalized service through a network of local agents.

- Extensive Roadside Assistance: The AAA car insurance review highlights the company’s tailored coverage options, indicating a focus on meeting individual needs.

- Diverse Insurance Products: Broad selection of insurance offerings beyond car insurance.

Cons

- Membership Requirement: Insurance services tied to AAA membership.

- Inconsistent Service Quality: Some regions may experience variability in service standards.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

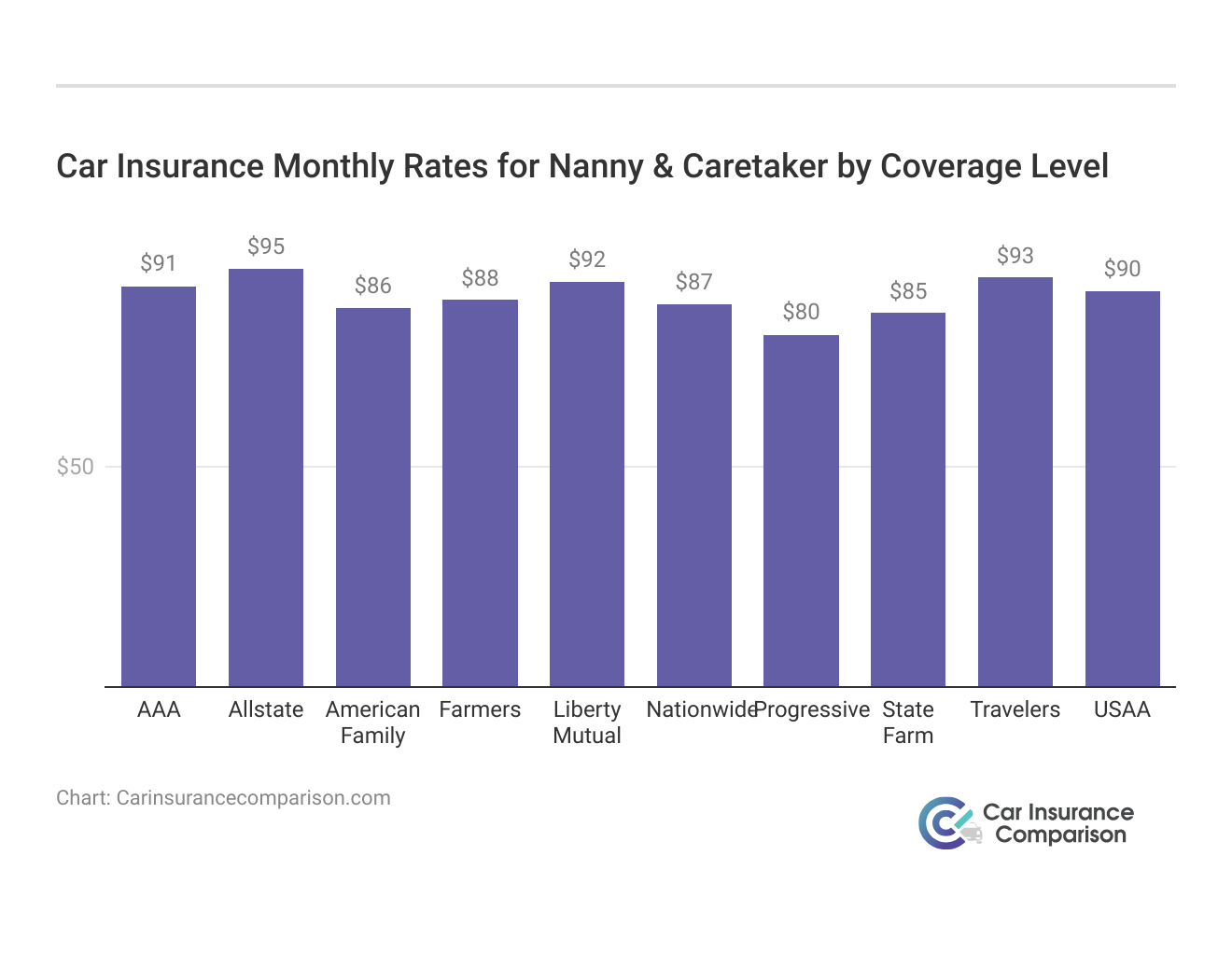

Caregiver Car Insurance Rates: A Comparative Overview

The table below provides insights into the average monthly car insurance rates tailored for individuals working as nannies and caretakers. It details both minimum and full coverage options offered by various insurance companies.

Car Insurance Monthly Rates for Nannies by Coverage Level & Provider

| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| AAA | $91 | $173 |

| Allstate | $95 | $180 |

| American Family | $86 | $162 |

| Farmers | $88 | $165 |

| Liberty Mutual | $92 | $175 |

| Nationwide | $87 | $163 |

| Progressive | $80 | $150 |

| State Farm | $85 | $160 |

| Travelers | $93 | $178 |

| USAA | $90 | $170 |

In comparing car insurance options for caregivers, it’s evident that rates vary significantly among providers. Here’s a concise breakdown of the most notable findings. For a thorough understanding, refer to our detailed analysis titled “Compare car insurance quotes.”

- Allstate: $95 (minimum), $180 (full coverage).

- Progressive: $80 (minimum).

- USAA: $90 (minimum), $170 (full coverage), competitive for caregivers.

- Travelers & American Family: Reasonable rates.

Notably, Travelers and American Family also provide relatively reasonable rates across both coverage categories. The data emphasizes the importance of selecting insurance tailored to the specific needs of individuals in the caregiving profession, taking into account both affordability and comprehensive coverage for peace of mind on the road.

Nanny Responsibilities

Like other household employees, nannies and caretakers have a variety of responsibilities depending on where they work and who they care for. Nannies can be live-in, hourly, or on-call. Live-in nannies face an interesting and sometimes challenging job.

It may be hard to determine when the nanny is in charge and when the parent is in charge in a live-in situation and children can play favorites. Live-in nannies are typically responsible for the following:

- Childcare

- Getting older children off to school

- Arranging and participating in play dates

- Transporting children

In many cases, live-in nannies are also responsible for cleaning, shopping, and preparing meals. As a live-in nanny, you have to be sure that you have scheduled time off and allow time for yourself. Hourly nannies typically look after children who are not yet ready for school. Both parents may work or one parent may work and the other may want assistance with running errands and other responsibilities.

Progressive offers the best coverage with a 12% multi-policy discount, ensuring caregivers get comprehensive protection at an affordable rate.

Brad Larson Licensed Insurance Agent

Hourly nannies are usually not live-in nannies but arrive at the home of their employer each day and leave at the end of their shift. On-call nannies may do a combination of live-in and hourly childcare. For example, they may stay with children at home while parents travel or they may be called on to take care of children when a babysitter is needed.

In most cases, a big part of the nanny’s responsibilities include driving, so adequate car insurance for nannies is important.

You need to make sure your nanny follows all local, state, and federal laws, including minimum insurance coverage. Review your insurance options as different coverage levels will affect your insurance premium. To expand your knowledge, refer to our comprehensive handbook titled “Minimum car insurance requirements by state.”

There are several different types of auto insurance policies that can be helpful for a domestic worker position such as a nanny.

There are certainly other precautions you want to take with your child’s nanny, such as making sure they understand the dangers of children suffering heatstroke’s in cars and where you feel comfortable having your children driven.

Caretaker Responsibilities

There are many different responsibilities that a caretaker can have. Caretakers can take care of the following people:

- Elderly

- Children

- Those with physical disabilities

- Those with mental disabilities

- Special needs children

- Those with permanent or temporary illnesses

The caretaking often takes place at the client’s home, a school, a daycare, or a live-in care facility. Caretakers are different than nurses or licensed practical nurses. Caretakers care for the physical needs of the individual, not the medical needs.

Whatever the specific circumstance of the caretaker, it generally requires driving to and from work, driving for errands, driving clients to doctor appointments, and more.

Because of this frequent driving, car insurance needs to be more than adequate to cover both the driver and the clients that are being driven around. To gain further insights, consult our comprehensive guide titled “Compare Monthly Car Insurance: Rates, Discounts, & Requirements.”

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Case Studies: Car Insurance for Nannies and Caretakers

In today’s fast-paced world, nannies play a crucial role in providing care and support for families. As they navigate their responsibilities, ensuring adequate insurance coverage is essential for both their protection and the well-being of those under their care.

- Case Study #1 – Child Safety: During childcare services, a child experiences a minor accident requiring medical attention. Liability insurance steps in to cover medical expenses and potential legal fees, ensuring protection against claims related to child safety.

- Case Study #2 – Transportation Incident: A nanny encounters a minor car accident while driving with children in her care, resulting in vehicle damage and minor injuries. Nanny car insurance provides coverage for repairs, medical expenses, and liability claims, offering specialized protection for transportation-related incidents and property damages.

- Case Study #3 – Work-Related Injury: While performing household duties, a nanny sustains a work-related injury. Workers’ compensation insurance offers coverage for medical treatments, lost wages, and rehabilitation services. For additional details, explore our comprehensive resource titled “Best Personal Injury Protection (PIP) Car Insurance“

As caregivers, nannies deserve peace of mind knowing they have comprehensive insurance coverage tailored to their unique needs.

Progressive offers the most affordable minimum coverage at $80, making it the top choice for caregivers.

Tracey L. Wells Licensed Insurance Agent & Agency Owner

By selecting the right insurance options, nannies can confidently focus on their duties, knowing they are prepared for any unexpected situations that may arise.

Final Thoughts: Best Car Insurance for Nannies

There is not a required training or certification for nannies or caretakers, but there are several things that can set someone apart when applying for jobs in these areas. The first thing is CPR and first aid training. This training is a must when working with children or those who are sick. Anyone can sign up and take a CPR or first aid class through a local agency, the Red Cross, a fire department, or a local college.

Not many people will want someone taking care of their children if that person has never worked with children before. The same is true for caretakers.

Practical experience doesn’t have to be paid experience. It can be as simple as taking care of your younger siblings or your grandparents.

Anyone can gain some practical experience by volunteering at a local shelter, a church, a summer camp, or other organizations. Even babysitting for children in your family or in your neighborhood can count as experience. Practical experience will give you an edge over someone who has not yet had any practical experience. To delve deeper, refer to our in-depth report titled “Best Car Insurance for Church Employees.”

Enter your ZIP code below to see instant auto insurance quotes by carriers in your state.

Frequently Asked Questions

How much does it cost to add a nanny to car insurance?

The cost of adding a nanny to your car insurance policy varies based on several factors, including the nanny’s driving history, the coverage options you choose, and the insurance provider’s rates. Factors such as the type of vehicle they’ll be driving and their driving frequency can also impact the cost. To determine the exact cost, it’s advisable to contact your insurance provider for a personalized quote tailored to your specific situation.

What is nanny car insurance?

Nanny car insurance is a specialized type of auto insurance designed to provide coverage for individuals employed as nannies or caregivers who drive as part of their job duties. This type of insurance ensures that nannies have the necessary coverage while operating a vehicle for work-related purposes, such as transporting children to school or activities.

Affordable car insurance rates are just a click away. Enter your ZIP code into our free quote tool below to find the best policy for you.

How can I get car insurance for a nanny?

Getting car insurance for a nanny involves adding them as an additional driver to your existing auto insurance policy. You’ll need to provide information about the nanny, such as their name, date of birth, driver’s license number, and driving history. Once added to the policy, the nanny will be covered while driving your vehicle.

For a comprehensive analysis, refer to our detailed guide titled “Understanding Your Car Insurance Policy.”

What is the cost to add an au pair to car insurance?

Adding an au pair to your car insurance policy incurs similar costs to adding a nanny. The cost depends on various factors, including the au pair’s driving record, the coverage options selected, and the insurance company’s rates. It’s recommended to contact your insurance provider for a personalized quote to determine the exact cost.

Do I need to add my nanny to my car insurance?

If your nanny regularly drives your vehicle as part of their job duties, it’s generally advisable to add them to your car insurance policy. Doing so ensures that they are adequately covered in the event of an accident while driving your vehicle. Adding your nanny to your policy helps mitigate financial risks and provides peace of mind.

How do I add a nanny to my car insurance?

To add a nanny to your car insurance policy, you’ll need to contact your insurance provider and inform them of your intention to add an additional driver. You’ll be required to provide the nanny’s information, such as their name, date of birth, driver’s license number, and driving history. Once added, the nanny will have coverage while driving your vehicle.

For a comprehensive overview, explore our detailed resource titled “Does car insurance cover all the drivers in a single home?.”

Does a nanny need business car insurance?

Nannies typically do not require business car insurance unless they use their own vehicle for work-related purposes unrelated to their employment as a nanny. If a nanny uses their vehicle to transport children or perform other work-related tasks, they may need to obtain business car insurance for adequate coverage.

How much does nanny insurance cost?

The cost of nanny insurance varies depending on factors such as the nanny’s driving record, the coverage options chosen, and the insurance company’s rates. Additional factors like the type of vehicle being driven and the frequency of driving can also affect the cost. To determine the exact cost, it’s recommended to obtain quotes from multiple insurance providers.

Take the first step toward cheaper car insurance rates. Enter your ZIP code below to see how much you could save.

What is the best car insurance for nannies?

The best car insurance for nannies depends on various factors, including coverage options, rates, and customer service. Popular insurance companies known for providing coverage tailored to nannies’ needs include Progressive, USAA, and State Farm. It’s essential to compare quotes and coverage options to find the best policy for your specific requirements.

For a thorough understanding, refer to our detailed analysis:

Can I compare nanny insurance quotes?

Yes, you can compare insurance quotes from different providers to find the best coverage and rates for your nanny insurance needs. By obtaining quotes from multiple insurance companies, you can evaluate coverage options, premiums, and discounts to make an informed decision. Comparing quotes allows you to find a policy that meets your specific requirements at a competitive price.

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.