Best Car Insurance for Parents in 2026 (Top 10 Companies)

For the best car insurance for parents, the top picks overall are State Farm, Progressive, and Allstate, offering minimum coverage rates starting at $27 per month. These companies provide comprehensive protection, customizable policies, and peace of mind for parents on the road, ensuring their family's safety.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Feature Writer

Chris Tepedino is a feature writer that has written extensively about car insurance for numerous websites. He has a college degree in communication from the University of Tennessee and has experience reporting, researching investigative pieces, and crafting detailed, data-driven features. His works have been featured on CB Blog Nation, Healing Law, WIBW Kansas, and Cinncinati.com. He has been a...

Chris Tepedino

Licensed Insurance Agent

Michelle Robbins has been a licensed insurance agent for over 13 years. Her career began in the real estate industry, supporting local realtors with title Insurance. After several years, Michelle shifted to real estate home warranty insurance, where she managed a territory of over 100 miles of real estate professionals. Later, Agent Robbins obtained more licensing and experience serving families a...

Michelle Robbins

Updated May 2024

18,155 reviews

18,155 reviewsCompany Facts

Full Coverage for Parents

A.M. Best Rating

Complaint Level

Pros & Cons

18,155 reviews

18,155 reviews 13,283 reviews

13,283 reviewsCompany Facts

Full Coverage for Parents

A.M. Best Rating

Complaint Level

13,283 reviews

13,283 reviews 11,638 reviews

11,638 reviewsCompany Facts

Full Coverage for Parents

A.M. Best Rating

Complaint Level

Pros & Cons

11,638 reviews

11,638 reviewsWhen seeking the best car insurance for parents, State Farm, Progressive, and Allstate shine, with minimum coverage rates starting at $27 per month. State Farm stands out as the top pick overall, providing competitive rates and comprehensive protection for parents on the road.

However, comparing rates goes beyond just the monthly premium; it’s about finding comprehensive coverage that suits your family’s needs.

Our Top 10 Company Picks: Best Car Insurance for Parents

| Company | Rank | Parent Discount | Multi-Vehicle Discount | Best for | Jump to Pros/Cons |

|---|---|---|---|---|---|

| #1 | 12% | 15% | Bundle Discounts | State Farm | |

| #2 | 15% | 17% | Customizable Policies | Progressive | |

| #3 | 10% | 18% | Big Discounts | Allstate | |

| #4 | 8% | 14% | Policy Options | Liberty Mutual |

| #5 | 9% | 16% | Accident Forgiveness | Farmers | |

| #6 | 11% | 15% | Online Convenience | Esurance | |

| #7 | 7% | 18% | Add-on Coverages | Safeco | |

| #8 | 6% | 13% | Customizable Coverage | Travelers | |

| #9 | 8% | 14% | Quick Claims | American Family | |

| #10 | 10% | 15% | Personalized Service | Safe Auto |

In this article, we’ll delve into the factors that make these companies the best choices for parent car insurance rates, helping you make an informed decision to protect your loved ones on the road.

Let’s review some of the basics of parent car insurance for teens and twenty-year-olds.Also, be sure to enter your ZIP code in above so that you can start comparing quotes for car insurance from many different insurance providers!

#1 – State Farm: Top Overall Pick

Pros

- Parent Discount: State Farm car insurance review highlights significant discounts tailored for parents, rendering it an appealing choice for family-focused insurance policies.

- Up to 15% Multi-Vehicle Discount: Families insuring multiple vehicles can benefit from significant savings, enhancing overall cost-effectiveness.

- Bundle Discounts: State Farm excels in providing bundled coverage options, and streamlining insurance needs for added convenience.

Cons

- Parent Discount Limitation: While the parent discount is notable, reaching a maximum of 12% may be limiting for some customers seeking higher savings.

- Competitive Multi-Vehicle Options: While the multi-vehicle discount is beneficial, other companies may offer slightly more competitive rates for insuring multiple vehicles.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#2 – Progressive: Best for Customizable Policies

Pros

- Up to 15% Parent Discount: In a Progressive car insurance review, it’s noted that Progressive extends a significant parent discount, offering considerable savings for families.

- Up to 17% Multi-Vehicle Discount: Families insuring multiple vehicles with Progressive can capitalize on a competitive multi-vehicle discount.

- Customizable Policies: Progressive stands out for its flexibility, allowing customers to tailor policies to their unique needs.

Cons

- Parent Discount Limitation: While Progressive offers a high parent discount, it falls short compared to some competitors with higher percentages.

- Multi-Vehicle Discount Cap: The multi-vehicle discount, while competitive, has a cap of 17%, limiting potential savings for customers with numerous vehicles.

#3 – Allstate: Best for Big Discounts

Pros

- Up to 10% Parent Discount: Allstate provides a solid parent discount, contributing to overall affordability for family policies.

- Up to 18% Multi-Vehicle Discount: Families insuring multiple vehicles can enjoy significant savings with Allstate’s high multi-vehicle discount.

- Big Discounts: In an Allstate car insurance review, the focus on generous discounts renders it an enticing option for budget-conscious parents.

Cons

- Parent Discount Limitation: Allstate’s parent discount, while decent, may be lower than what some competitors offer, impacting potential savings.

- Multi-Vehicle Discount Cap: While the multi-vehicle discount is high, it has a cap of 18%, potentially limiting savings for large families with multiple vehicles.

#4 – Liberty Mutual: Best for Policy Options

Pros

- Up to 8% Parent Discount: In Liberty Mutual car insurance review, you’ll find a notable parent discount that contributes to potential savings for families.

- Up to 14% Multi-Vehicle Discount: Families insuring multiple vehicles can benefit from a competitive multi-vehicle discount.

- Policy Options: Liberty Mutual stands out for its diverse policy options, allowing customers to choose coverage that aligns with their specific needs.

Cons

- Parent Discount Limitation: The parent discount, while available, may be lower than what some competitors offer, impacting overall affordability.

- Competitive Multi-Vehicle Options: While the multi-vehicle discount is competitive, other companies may provide slightly higher discounts for insuring multiple vehicles.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#5 – Farmers: Best for Accident Forgiveness

Pros

- Up to 9% Parent Discount: Farmers offers a solid parent discount, contributing to affordability for families seeking insurance coverage.

- Up to 16% Multi-Vehicle Discount: In the Farmers car insurance review, families owning multiple vehicles can benefit from a competitive discount tailored for multi-vehicle coverage.

- Accident Forgiveness: Farmers’ Accident Forgiveness feature is an attractive option for families, providing financial relief in case of an accident.

Cons

- Parent Discount Limitation: While Farmers provides a decent parent discount, some competitors may offer higher percentages, impacting potential savings.

- Multi-Vehicle Discount Cap: The multi-vehicle discount, while competitive, has a cap of 16%, potentially limiting savings for large families with multiple vehicles.

#6 – Esurance: Best for Online Convenience

Pros

- Up to 11% Parent Discount: Esurance vs. Allstate car insurance comparison showcases Esurance’s above-average discount for parents, improving affordability for families.

- Up to 15% Multi-Vehicle Discount: Families insuring multiple vehicles can benefit from a competitive multi-vehicle discount.

- Online Convenience: Esurance’s emphasis on online convenience makes it a convenient choice for tech-savvy parents seeking streamlined services.

Cons

- Parent Discount Limitation: Although Esurance provides a higher parent discount, some competitors may still offer slightly more substantial savings.

- Competitive Multi-Vehicle Options: While the multi-vehicle discount is competitive, other companies may provide slightly higher discounts for insuring multiple vehicles.

#7 – Safeco: Best for Add-on Coverages

Pros

- Up to 7% Parent Discount: Safeco offers a reasonable parent discount, contributing to potential savings for families.

- Up to 18% Multi-Vehicle Discount: Families with multiple vehicles can benefit from Safeco’s high multi-vehicle discount.

- Add-on Coverages: Safeco’s focus on add-on coverages provides flexibility for parents to tailor their policies based on specific needs.

Cons

- Parent Discount Limitation: While Safeco provides a parent discount, some competitors may offer higher percentages, impacting overall affordability.

- Multi-Vehicle Discount Cap: In Safeco car insurance review, the multi-vehicle discount is capped at 18%, which may restrict savings for extensive households possessing numerous vehicles.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#8 – Travelers: Best for Customizable Coverage

Pros

- Up to 6% Parent Discount: In the Travelers car insurance review, there’s a parent discount available, leading to potential savings for families.

- Up to 13% Multi-Vehicle Discount: Families with multiple vehicles can benefit from Travelers’ competitive multi-vehicle discount.

- Customizable Coverage: Travelers stands out for its customizable coverage options, allowing parents to tailor policies to meet their unique needs.

Cons

- Parent Discount Limitation: While Travelers provides a parent discount, some competitors may offer higher percentages, impacting overall affordability.

- Competitive Multi-Vehicle Options: The multi-vehicle discount, while competitive, has a cap of 13%, potentially limiting savings for large families with multiple vehicles.

#9 – American Family: Best for Quick Claims

Pros

- Up to 8% Parent Discount: American Family offers a decent parent discount, contributing to potential savings for families.

- Up to 14% Multi-Vehicle Discount: Families with multiple vehicles can benefit from American Family’s competitive multi-vehicle discount.

- Quick Claims: American Family’s emphasis on quick claims processing provides efficient service for parents in need of swift resolutions.

Cons

- Parent Discount Limitation: In the American family car insurance review, while there’s a parent discount, competitors might offer higher percentages, affecting affordability.

- Multi-Vehicle Discount Cap: The multi-vehicle discount, while competitive, has a cap of 14%, potentially limiting savings for large families with multiple vehicles.

#10 – Safe Auto: Best for Personalized Service

Pros

- Up to 10% Parent Discount: Safe Auto offers a notable parent discount, contributing to potential savings for families.

- Up to 15% Multi-vehicle Discount: Families with multiple vehicles can benefit from Safe Auto’s competitive multi-vehicle discount.

- Personalized Service: Safe Auto’s emphasis on personalized service enhances the overall customer experience for parents seeking tailored solutions.

Cons

- Parent Discount Limitation: While Safe Auto provides a parent discount, some competitors may offer higher percentages, impacting overall affordability.

- Competitive Multi-Vehicle Options: The multi-vehicle discount, while competitive, has a cap of 15%, potentially limiting savings for large families with multiple vehicles.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

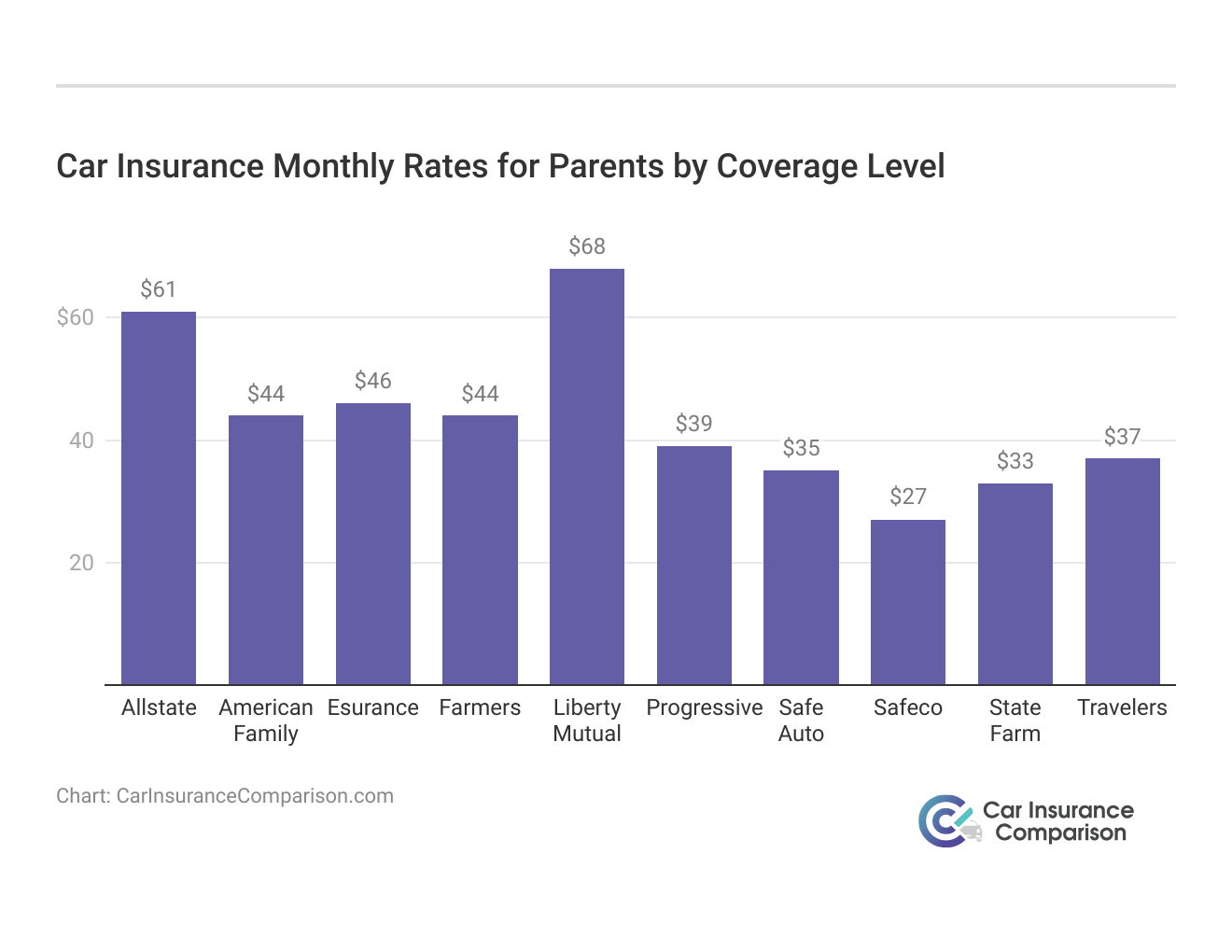

Guardians on the Go: Monthly Car Insurance Rates Tailored for Parents

The table below presents the average monthly car insurance rates tailored for parents, offering insights into both full coverage and minimum coverage options provided by various insurance companies.

Car Insurance Monthly Rates for Parents by Coverage Level

| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| Allstate | $61 | $160 |

| American Family | $44 | $117 |

| Esurance | $46 | $114 |

| Farmers | $44 | $139 |

| Liberty Mutual | $68 | $174 |

| Progressive | $39 | $105 |

| Safe Auto | $35 | $93 |

| Safeco | $27 | $71 |

| State Farm | $33 | $86 |

| Travelers | $37 | $99 |

Safeco emerges as the most affordable option for both full and minimum coverage, with rates at $71 and $27, respectively. Allstate presents the highest rates for both coverage types, showcasing the range of options available for parents seeking insurance.

State Farm excels with tailored coverage and bundle discounts, making it the top choice for parents seeking affordable and comprehensive car insurance in 2024.

Brad Larson Licensed Insurance Agent

State Farm and Travelers offer competitive rates for both full and minimum coverage, providing viable choices for parents seeking comprehensive yet affordable insurance. The data underscores the importance of considering family-oriented insurance options, and balancing affordability with the necessary coverage to meet the unique needs of parents on the road.

When You Can and Can’t be on a Parent’s Policy

The fact that there is no age limit for this type of family discount insurance (even beyond the teen years) should be of comfort to families who are struggling financially.Are there any exceptions to the standard rule? Yes, there can be, and it will depend on your local insurance provider.

For example, some companies may allow a child who lives away from home to drive the family car, even if he lives at home on a part-time basis. He can still be considered a secondary driver, provided he lives in the same general area as the parents do. Discover our guide on the best car insurance for children of divorced parents to find the most suitable coverage options for their needs.

Some insurance companies may also require that a child is enrolled in some sort of educational institution in order to accept exceptions to the rule. Even if your child attends school out of state, many providers will extend a distant student policy. In this situation it is critical to talk with an agent to make certain liability limits are met in both locations.

The best reason to look into parent insurance options for your grown children is to save money. Teenage drivers must pay very high premiums due to their age, and all the more so if they drive a new and expensive model car.

With maturity, as statistics suggest, comes safer driving and better defensive driving. Indeed, a person who is forty years of age with decades of experience in operating a motor vehicle will probably react differently than a sixteen-year-old driver who is on top of the world.

Discounts on Teen Driving Insurance

If your family is struggling with finances, then consider asking about a family insurance policy that includes your son or daughter (read our “Compare Best Car Insurance Companies for Families” for more information). Ask for discounts. Instead of letting your child buy his own car right away, convince him to stay on a family policy until he gains a few years of solid experience. Try to test your teen’s knowledge of driving. Go with him (or her) on the road and observe the manner of driving. Here are some tips so that the young driver learns safe procedures and takes a defensive stance behind the wheel:

- Explain the importance of not taking phone calls or texting while driving.

- Help him/her understand that drinking alcohol is not only illegal, it raises the risk of accident and injury.

- Show examples proving that doing anything that compromises vehicle safety could result in serious harm.

- You can also get a discount if your teen takes a driving class.

Take your driving responsibilities seriously as a parent and head of the household. If you maintain a good driving record, with few or no accidents or speeding tickets, your low-risk profile may be “passed on” to your son or daughter in terms of premium rates. You must research each company individually if you hope to take advantage of family discounts.

Not all companies are negotiable, but in this age of financial uncertainty, rest assured that many are at least willing to talk. Start searching right now by using our car insurance comparison tool online—compare and save. Enter your ZIP code into our free quote tool below to compare rates from the top providers.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Case Studies: Parent Car Insurance Solutions

Dive into the intricacies of parent car insurance with our comprehensive case studies. These real-life examples illuminate the challenges and triumphs of families as they navigate coverage options.

- Case Study 1 – The Frugal Family: Meet the Johnsons, a frugal family looking for cost-effective car insurance without compromising coverage. With State Farm’s bundle discounts, they secured both full and minimum coverage at average monthly rates of $86 and $33, respectively. The Johnsons now enjoy peace of mind, knowing their family is protected without breaking the bank.

- Case Study 2 – Tailored Protection: The Smiths needed customized coverage that aligned with their specific needs. Progressive’s customizable policies were the perfect fit. With average monthly rates of $105 for full coverage and $39 for minimum coverage, the Smiths now have a tailored insurance plan that suits their family’s unique requirements.

- Case Study 3 – Safety First With the Parkers: The Parkers prioritize safety on the road. Safeco’s add-on coverages provided the additional protection they sought. With average monthly rates of $71 for full coverage and $27 for minimum coverage, the Parkers have enhanced their policy to ensure their family is well-protected in any situation.

- Case Study 4 – The Thompsons’ Financial Strategy: The Thompsons, mindful of their budget, sought cost-effective coverage with Safe Auto’s personalized service. With average monthly rates of $93 for full coverage and $35 for minimum coverage, the Thompsons received personalized attention, proving that financial responsibility and tailored service can go hand in hand.

From adding teen drivers to securing discounts, these case studies provide valuable insights and actionable strategies for parents seeking optimal car insurance coverage tailored to their unique circumstances and needs. Explore our article on “What factors contribute to the higher cost of car insurance for teenage boys compared to teenage girls?” for deeper insights.

Overview: Parent Car Insurance Options

The content offers insights into parent car insurance rates, showcasing top companies like State Farm, Progressive, and Allstate. These companies provide discounts up to 30% with monthly rates starting at $86. Emphasis is placed on comparing rates for tailored coverage, with State Farm leading due to its bundle discounts and customizable policies.

The article addresses common queries about parent car insurance, noting that children can usually be added to policies, potentially increasing premiums. Various discounts, including family policies and safe driving rewards, are available. Thorough comparison of coverage options and rates is crucial. Explore our guide on “How do I upgrade car insurance?” for comprehensive information.

Furthermore, insights into coverage options tailored for parents are provided, highlighting accessibility to the same choices as any policyholder. The article aims to be a concise resource for parents navigating the complexities of securing car insurance for their children, offering guidance on finding affordable and comprehensive coverage options. Find cheap car insurance quotes by entering your ZIP code below.

Frequently Asked Questions

Can parents add their children to their car insurance policy?

Yes, parents can typically add their children to their car insurance policy. However, this is dependent on the insurance provider’s policies and guidelines. Adding a young or inexperienced driver to a parent’s policy may result in higher premiums due to the increased risk associated with less experienced drivers.

Are there any discounts available for parents on car insurance?

Many insurance companies offer discounts specifically for parents. These discounts may include:

- Multi-Vehicle Discount: If a parent insures multiple vehicles under the same policy, they may qualify for a multi-vehicle discount.

- Safe Driver Discount: Parents with a clean driving record may be eligible for a safe driver discount.

- Good Student Discount: If a parent’s child maintains good grades, they may be eligible for a good student discount.

- Parental Discounts: Some insurance providers offer discounts for being a parent, as they consider parents to be more responsible drivers.

How can I compare car insurance options for my vehicle in Bristol, PA?

To find the best car insurance rates as a parent, consider the following tips:

- Shop Around: Obtain quotes from multiple insurance providers to compare rates and coverage options.

- Review Coverage Needs: Assess your specific coverage needs and choose the appropriate policy options.

- Consider Bundled policies: Some insurance companies offer discounts when you bundle multiple insurance policies, such as auto and home insurance.

- Maintain a Good Driving Record: A clean driving record can help lower your insurance premiums.

- Look for Discounts: Inquire about available discounts, such as safe driver discounts or good student discounts, which can help reduce your premiums.

Are there any exceptions or special considerations for children of divorced parents when it comes to car insurance coverage?

Some insurance companies may have specific policies regarding children of divorced parents, particularly concerning which parent’s policy the child can be added to. It’s essential for divorced parents to communicate with their insurance provider to understand any special considerations or requirements.

Are there insurance companies that specialize in providing coverage for parents?

Insurance companies don’t specialize solely in providing coverage for parents. However, many insurance providers offer policies suitable for families and parents. It’s advisable to research and compare quotes from different companies to find the best coverage and rates based on your individual circumstances and the needs of your family. Explore our guide on comparing multiple car insurance quotes online for valuable insights.

What factors contribute to the higher cost of car insurance for teenage boys compared to teenage girls?

Insurance companies typically base premiums on statistical risk factors, and teenage boys statistically tend to engage in riskier driving behaviors compared to teenage girls. This increased risk of accidents and violations leads to higher insurance premiums for teenage boys.

Are there any coverage options specifically tailored for parents?

While there are no specific coverage options exclusively for parents, they have access to the same coverage options as any other policyholder. These options typically include liability coverage, collision coverage, comprehensive coverage, uninsured/underinsured motorist coverage, and more. It’s important to choose coverage that aligns with your specific needs and circumstances.

How can parents ensure that their grown children maintain affordable insurance rates as they gain driving experience?

Parents can help their grown children maintain affordable insurance rates by encouraging safe driving habits, maintaining a good driving record themselves, and exploring insurance discounts available for young drivers, such as good student discounts or completing defensive driving courses.

What are some strategies for parents to save money on car insurance while ensuring adequate coverage for their family?

Some strategies for parents to save money on car insurance include bundling policies, maintaining a good driving record, opting for higher deductibles, and regularly reviewing and comparing insurance quotes to ensure they’re getting the best rates for their coverage needs.

Enter your ZIP code into our free quote tool below to compare rates from the top providers.

How do insurance companies assess the risk associated with adding a young or inexperienced driver to a parent’s policy, and how does it affect premiums?

Insurance companies assess the risk associated with adding a young or inexperienced driver based on factors such as their age, driving record (if any), type of vehicle, and location. Adding a young driver typically increases the overall risk profile of the policy, leading to higher premiums to account for the increased likelihood of accidents or claims involving the young driver.

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.