Best Car Insurance for Security and Prison Workers in 2026 (Top 10 Companies)

USAA, State Farm, and Progressive are the top picks for the best car insurance for security and prison workers, offering competitive rates starting at $30/month. These companies prioritize security and prison workers, offering not only competitive rates but also tailored coverage options and substantial savings.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Licensed Insurance Agent

Scott W Johnson is an independent insurance agent in California. Principal Broker and founder of Marindependent Insurance Services, Scott brings over 25 years of experience to his clients. His Five President’s Council awards prove he uses all he learned at Avocet, Sprint Nextel, and Farmers Insurance to the benefit of his clients. Scott quickly grasped the unique insurance requirements of his...

Scott W. Johnson

Licensed Insurance Agent

Michelle Robbins has been a licensed insurance agent for over 13 years. Her career began in the real estate industry, supporting local realtors with title Insurance. After several years, Michelle shifted to real estate home warranty insurance, where she managed a territory of over 100 miles of real estate professionals. Later, Agent Robbins obtained more licensing and experience serving families a...

Michelle Robbins

Updated May 2024

6,589 reviews

6,589 reviewsCompany Facts

Full Coverage for Security and Prison Workers

A.M. Best Rating

Complaint Level

6,589 reviews

6,589 reviews 18,155 reviews

18,155 reviewsCompany Facts

Full Coverage for Security and Prison Workers

A.M. Best Rating

Complaint Level

Pros & Cons

18,155 reviews

18,155 reviews 13,283 reviews

13,283 reviewsCompany Facts

Full Coverage for Security and Prison Workers

A.M. Best Rating

Complaint Level

13,283 reviews

13,283 reviewsUSAA, State Farm and Progressive emerges as the top picks for the best car insurance for security and prison workers, offering tailored coverage options and substantial savings.

These companies ensure that security and prison workers receive the protection they deserve not only during their work hours but also in their daily lives.

Our Top 10 Company Picks: Best Car Insurance for Security and Prison Workers

| Company | Rank | Security & Prison Employee Discount | Multi-Policy Discount | Best For | Jump to Pros/Cons |

|---|---|---|---|---|---|

| #1 | 15% | 20% | Customer Service | USAA | |

| #2 | 10% | 15% | Big Discounts | State Farm | |

| #3 | 12% | 12% | Safe-Driving Discounts | Progressive | |

| #4 | 8% | 10% | Online Convenience | Geico | |

| #5 | 10% | 15% | Bundle Discounts | Farmers | |

| #6 | 9% | 14% | Multi-Policy Discounts | Nationwide |

| #7 | 12% | 18% | Add-on Coverages | Liberty Mutual |

| #8 | 11% | 16% | Usage Discount | Travelers | |

| #9 | 7% | 13% | Policy Options | American Family | |

| #10 | 9% | 14% | Quick Claims | Esurance |

With policies designed to meet the unique needs of these essential professionals, they ensure comprehensive coverage on and off the job. Explore your car insurance options by entering your ZIP code above and finding which companies have the lowest rates.

#1 – USAA: Top Overall Pick

Pros

- Generous Discounts: USAA car insurance review reveals significant savings opportunities through multi-policy discounts of up to 15% and safe-driving rewards reaching up to 20%, benefiting policyholders considerably.

- Top-Notch Customer Service: Recognized for exceptional customer service, USAA ensures that security and prison employees receive prompt and reliable support.

- Comprehensive coverage: Beyond discounts, USAA provides a wide range of coverage options, allowing for tailored protection to meet individual needs.

Cons

- Membership Requirement: USAA is limited to military members and their families, excluding a significant portion of potential customers.

- Limited Physical Presence: Some may find the lack of physical branch locations inconvenient for in-person interactions.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#2 – State Farm: Best for Unlocking Discounts

Pros

- Flexible Discounts: State Farm offers a range of discounts, including up to 10% for security and prison employees, ensuring customizable savings.

- Diverse Coverage Options: State Farm provides various coverage options, allowing policyholders to tailor their plans to specific needs.

- Financial Strength: State Farm car insurance review highlights the company’s stability and reliability, evident in its A+ financial rating.

Cons

- Premium Costs: While offering discounts, State Farm’s base premiums may be higher compared to some competitors.

- Limited Online Convenience: Some customers may find State Farm’s online interface less intuitive compared to other companies.

#3 – Progressive: Best for Safe Driving

Pros

- Safe-Driving Discounts: Progressive’s emphasis on safe-driving discounts, up to 12%, rewards policyholders for responsible driving habits.

- User-Friendly Online Platform: Progressive’s online convenience ensures easy policy management, claims filing, and quick access to information.

- Flexible Discounts: Progressive car insurance review showcases an array of discounts that extend beyond just safe driving, ensuring a tailored approach to meet the needs of a diverse range of customers.

Cons

- Average Customer Service: Some customers may find Progressive’s customer service to be less personalized compared to other insurers.

- Premium Costs: While competitive, Progressive’s premiums may not always be the most affordable for every individual.

#4 – Geico: Best for Seamless Security

Pros

- Online Convenience: Geico’s emphasis on online convenience simplifies the policy management process, making it easy for security and prison employees to handle their insurance needs.

- Competitive Discounts: Geico car insurance review highlights significant savings potential, with up to 10% discounts available for customers bundling multiple policies.

- Financial Stability: Geico’s strong financial standing ensures reliability and the ability to fulfill claims promptly.

Cons

- Limited Personalized Service: Geico’s predominantly online model may result in less personalized customer service compared to companies with a stronger agent presence.

- Discount Limitations: While offering discounts, the maximum percentage may not be as high as some competitors.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#5 – Farmers: Best for Bundled Benefits

Pros

- Bundle Discounts: Farmers car insurance review highlights significant savings of up to 15% through bundle discounts, benefiting security and prison personnel who opt for multiple insurance policies.

- Policy Options: Farmers offers diverse policy options, allowing customers to customize coverage based on individual needs.

- Financial Stability: Farmers’ financial stability, reflected in its A rating, instills confidence in policyholders regarding the company’s ability to meet obligations.

Cons

- Premium Costs: While offering discounts, Farmers’ base premiums may be higher compared to some competitors.

- Online Interaction: Customers who prefer in-person interactions may find Farmers’ online-focused model less appealing.

#6 – Nationwide: Best for Multiplying Savings

Pros

- Multi-Policy Discounts: Nationwide offers up to 14% in multi-policy discounts, ensuring significant savings for security and prison employees bundling coverage.

- Coverage Options: Nationwide provides a variety of coverage options, allowing customers to tailor policies to their specific needs.

- Financial Stability: Nationwide car insurance discounts guarantee stability and dependability by maintaining a robust financial position, ensuring fulfillment of policy commitments.

Cons

- Premium Costs: While offering discounts, Nationwide’s base premiums may be higher compared to some competitors.

- Customer Service Ratings: Some customers may find Nationwide’s customer service ratings to be average compared to other insurers.

#7 – Liberty Mutual: Best for Enhanced Coverage

Pros

- Add-on Coverages: Liberty Mutual stands out with up to 18% in add-on coverages, providing enhanced protection for security and prison employees.

- Financial Stability: Liberty Mutual car insurance review highlights its dependable financial stability, ensuring prompt claim fulfillment.

- Bundle Discounts: Offering up to 12% in bundle discounts, Liberty Mutual provides substantial savings for those combining multiple insurance policies.

Cons

- Premium Costs: While offering discounts, Liberty Mutual’s base premiums may be higher compared to some competitors.

- Limited Personalized Service: Liberty Mutual’s predominantly online model may result in less personalized customer service compared to companies with a stronger agent presence.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#8 – Travelers: Best for Financial Stability

Pros

- Usage Discount: Travelers car insurance review highlights discounts of up to 16% for security and prison employees, as a reward for their safe driving behavior.

- Multi-Policy Discounts: Providing up to 11% in multi-policy discounts, Travelers ensures additional savings for those with multiple insurance products.

- Financial Stability: With a strong financial standing, Travelers ensures stability and reliability in meeting policy obligations.

Cons

- Premium Costs: While offering discounts, Travelers’ base premiums may be higher compared to some competitors.

- Customer Service Ratings: Some customers may find Travelers’ customer service ratings to be average compared to other insurers.

#9 – American Family: Best for Policy Options

Pros

- Policy Options: American Family car insurance review presents a wide array of policy choices, enabling clients to tailor coverage according to their specific requirements.

- Bundle Discounts: Providing up to 13% in bundle discounts, American Family ensures substantial savings for those combining multiple insurance policies.

- Financial Stability: With a strong financial standing, American Family ensures stability and reliability in meeting policy obligations.

Cons

- Premium Costs: While offering discounts, American Family’s base premiums may be higher compared to some competitors.

- Customer Service Ratings: Some customers may find American Family’s customer service ratings to be average compared to other insurers.

#10 – Esurance: Best for Swift Protection

Pros

- Quick Claims: How do you get an Esurance car insurance quote? Esurance stands out with a focus on quick claims processing, ensuring security and prison employees experience efficient service during the claims process.

- Competitive Discounts: Offering up to 14% in multi-policy discounts and up to 9% for other discounts, Esurance provides attractive savings for policyholders.

- Financial Stability: Esurance’s strong financial standing ensures reliability and the ability to fulfill claims promptly.

Cons

- Limited Personalized Service: Esurance’s predominantly online model may result in less personalized customer service compared to companies with a stronger agent presence.

- Discount Limitations: The maximum percentage for certain discounts may not be as high as some competitors.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Exploring Security Guard Roles: Armed vs. Unarmed Duties

The responsibilities of security guards vary greatly depending on where the job is located. It is important to distinguish between armed guards and unarmed guards. Unarmed guards are often paid just slightly over minimum wage and have the main responsibility of patrolling or observing. To gain in-depth knowledge, consult our comprehensive resource titled “Low-Risk Jobs Car Insurance Discounts.”

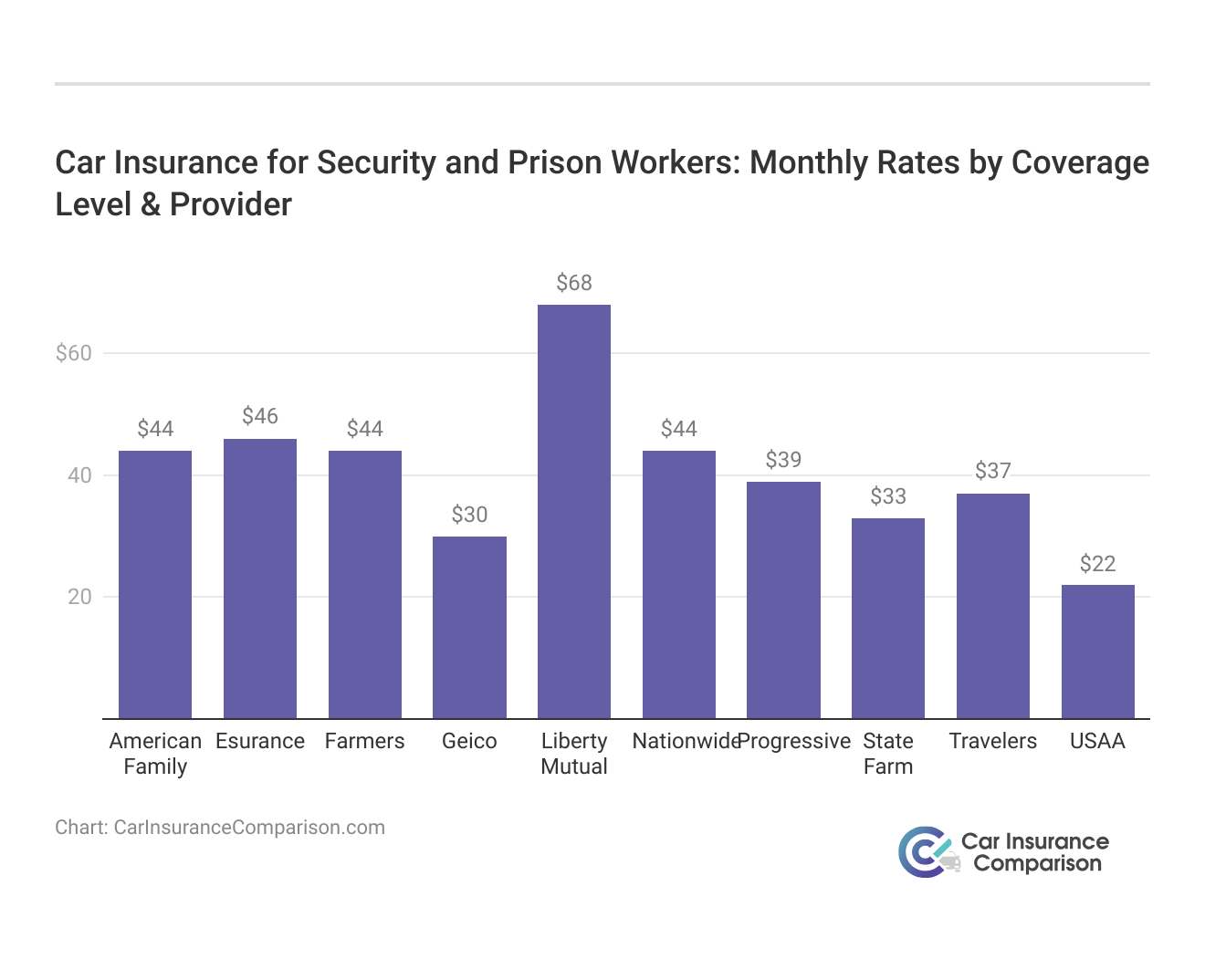

Car Insurance for Security and Prison Workers: Monthly Rates by Coverage Level & Provider

| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| American Family | $44 | $117 |

| Esurance | $46 | $114 |

| Farmers | $44 | $139 |

| Geico | $30 | $80 |

| Liberty Mutual | $68 | $174 |

| Nationwide | $44 | $115 |

| Progressive | $39 | $105 |

| State Farm | $33 | $86 |

| Travelers | $37 | $99 |

| USAA | $22 | $59 |

When considering car insurance rates tailored for security and prison employees, it’s crucial to examine the specific coverage costs offered by leading insurance providers. USAA stands out with a remarkably affordable full coverage rate at $59 per month and a minimum coverage rate of $22.

Progressive, recognized for competitive rates, presents a full coverage option at $105 and a minimum coverage rate of $39. These figures underscore the importance of exploring not only the overall cost but also the nuanced coverage options provided by each company to ensure comprehensive and cost-effective protection for security and prison employees.

An unarmed security guard typically carries pepper spray or another non-lethal item that can be used for defense. They are meant to be a deterrent. Unarmed security guards let individuals know that the area is being monitored and if trouble arises, the police will be contacted. There is no special licensing to be an unarmed guard. They typically guard areas like:

- Gated communities

- Parking lots

- Stores

- Other public venues

Armed guards have different responsibilities. Becoming an armed guard requires training in firearms, experience, and in most states, a state license.

The criminal background checks are more in depth and character references are researched.

Anyone that is given the power to possess a firearm with authority must meet certain requirements. Armed security guards make, on the average, $15 per hour. Armed security guards have the responsibility of guarding individuals and facilities. An armed security guard may work:

- As a personal security guard

- In a federal or state government building

- At a bank or other facility that houses money

- Drive an armored car

- At public events such as concerts or other venues that have the potential to become rowdy

Car Insurance for Security and Prison Workers: Monthly Rates by Age, Gender, & Provider

| Insurance Company | 20-Year-Old Female | 20-Year-Old Male | 30-Year-Old Female | 30-Year-Old Male | 45-Year-Old Female | 45-Year-Old Male | 60-Year-Old Female | 60-Year-Old Male |

|---|---|---|---|---|---|---|---|---|

| American Family | $150 | $160 | $140 | $150 | $180 | $190 | $200 | $210 |

| Esurance | $160 | $170 | $150 | $160 | $190 | $200 | $210 | $220 |

| Farmers | $170 | $180 | $160 | $170 | $200 | $210 | $220 | $230 |

| Geico | $140 | $150 | $130 | $140 | $170 | $180 | $190 | $200 |

| Liberty Mutual | $180 | $190 | $170 | $180 | $210 | $220 | $230 | $240 |

| Nationwide | $190 | $200 | $180 | $190 | $220 | $230 | $240 | $250 |

| Progressive | $200 | $210 | $190 | $200 | $230 | $240 | $250 | $260 |

| State Farm | $130 | $140 | $120 | $130 | $160 | $170 | $180 | $190 |

| Travelers | $220 | $230 | $210 | $220 | $250 | $260 | $270 | $280 |

| USAA | $120 | $130 | $110 | $120 | $150 | $160 | $170 | $180 |

This data provides insight into car insurance monthly rates for security and prison employees across different ages and genders. From age 20 to 60, rates fluctuate among major insurers like American Family, Esurance, and Geico, with variations based on gender as well.

Understanding these trends can help individuals in these professions make informed decisions when selecting the most suitable coverage for their needs and budget.

Inside the Walls: Unveiling the Multifaceted Role of Prison Guards

Prison guards have a variety of responsibilities depending on where in the jail they are located. No matter what part of the prison system they work in, it is imperative that protocol is followed. Some guards check prisoners in and make sure they are delivered safely to their cell. Check out our ranking of the top providers: 8 Best Car Insurance Companies That Accept Felons

USAA's dedication to tailored coverage and competitive rates makes them the top choice for security and prison workers.

Brad Larson Licensed Insurance Agent

Other guards are processors that complete all the paperwork and details of new prisoners, transfer prisoners, and releases. Some prison guards are floor guards. This means that they monitor prisoners while they are in their cells, out in the yard, or eating. They deliver items to prisoners and move them to and from their cells as needed.

Floor guards are the first line of defense if a fight or other trouble breaks out among prisoners. The third specific type of prison guards is transport guards. These guards escort prisoners from one destination to another. It could be moving a prisoner from one prison to another, driving prisoners to release points, or escorting sick prisoners to a hospital or court hearing.

Case Studies: Tailored Coverage for Security and Prison Employees

When it comes to safeguarding the well-being of security and prison employees, it’s essential to have insurance coverage that precisely addresses their unique circumstances and potential risks.

- Case Study #1 – Exceptional Service and Exceptional Savings: John, a security guard with a flawless driving history, sought tailored car insurance. USAA’s reputation for serving military and security personnel grabbed his interest. With cost-effective coverage and exceptional service, USAA offered him discounts and peace of mind, allowing him to focus on his security duties stress-free.

- Case Study #2 – Maximizing Discounts: State Farm’s diverse discounts, including up to 10% for security and prison employees and an additional 15% for bundling, met Emily’s budget constraints while offering essential protections tailored to her job’s challenges.

- Case Study #3 – Safe Driving and Smart Savings: Progressive’s emphasis on safe-driving discounts aligned perfectly with Mark’s values, offering up to 12% savings for his responsible habits, alongside convenient online services that catered to his tech-savvy preferences. To gain further insights, consult our comprehensive guide titled “Safe Driver Car Insurance Discounts.”

With tailored coverage, security and prison employees can rest assured knowing they have comprehensive protection that addresses the unique risks and challenges they face in their line of work.

USAA stands out as the top choice for security and prison employees, offering remarkably affordable rates, customer-centric savings, and tailored coverage to meet the unique needs of these professionals.

Dani Best Licensed Insurance Producer

Whether it’s safeguarding against accidents during patrols or providing coverage for personal vehicles used off-duty, tailored insurance ensures that their needs are met in every situation.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Guarding the Roads: Car Insurance Insights for Security and Prison Workers

The car insurance rates for security and prison guards are at the higher range of prices when compared to other occupations. When looking for car insurance, you will be asked what your occupation is because this is part of the process in giving a final quote. The insurance industry looks at the typical driving patterns of certain occupations to determine these quotes.

Security and prison guards, accustomed to assessing surroundings and controlling situations, drive more aggressively, possibly due to feeling safer, according to recent surveys. Their irregular shift schedules also contribute to driving carelessness. For additional details, explore our comprehensive resource titled “Compare Military Personnel Car Insurance Rates.”

Protect your vehicle from whatever the road throws at it by entering your ZIP code into our free comparison tool below to see affordable car insurance quotes.

Frequently Asked Questions

What factors influence the cost of insurance for armed security guards?

Insurance costs for armed security guards depend on various factors, including the level of coverage needed, the guard’s driving record, the type of firearm training they’ve completed, and the insurer’s underwriting criteria.

How is armored car insurance priced?

Armored car insurance premiums are determined by factors such as the value of the vehicles, the level of security measures implemented, the driving records of the drivers, and the insurer’s risk assessment.

Need the cheapest car insurance possible? Enter your ZIP code below into our free comparison tool to find the most affordable rates for your vehicle.

Is there specialized car insurance for prison officers?

Yes, some insurance companies offer specialized car insurance policies tailored to the needs of prison officers, considering factors like the officer’s job-related driving habits and the security risks associated with their profession.

To delve deeper, refer to our in-depth report titled “Car Insurance Pleasure Driving: Explained Simply.”

Can prisoners get car insurance?

Yes, prisoners can obtain car insurance if they meet the insurer’s eligibility criteria. However, their premiums may be higher due to factors such as limited driving experience and higher perceived risk.

What factors affect car insurance rates for prison officers?

Car insurance rates for prison officers may be influenced by factors like their driving history, the type of vehicle they drive, their commuting distance, and any additional coverage options they choose.

How much does insurance cost for security guard companies?

The cost of insurance for security guard companies varies depending on factors such as the size of the company, the types of services offered, the number of employees, the coverage limits required, and the insurer’s assessment of risk.

For a thorough understanding, refer to our detailed analysis titled “Car Insurance Coverage Limits: Explained Simply.”

Which insurance cover is best for a car?

Comprehensive’ insurance cover provides the widest cover and covers for theft and hijacking, damages due to an accident, fire or explosion and natural disasters like hail and floods

What is the cheapest insurance for high risk drivers?

Geico has the lowest rates for high-risk drivers, with average rates that are 36% less expensive than others. If your driving history puts you into one of the high-risk categories, some companies may have cheaper car insurance rates than others. Geico consistently has the cheapest high risk car insurance.

What type of insurance is most important for cars?

Car liability coverage is mandatory in most states. Drivers are legally required to purchase at least the minimum amount of liability coverage set by state law. Liability coverage has two components: Bodily injury liability may help pay for costs related to another person’s injuries if you cause an accident.

To expand your knowledge, refer to our comprehensive handbook titled “Compare Liability Car Insurance: Rates, Discounts, & Requirements.”

What is the most basic car insurance called?

Basic car insurance is often known as liability insurance. Requirements vary by state, but basic auto insurance can be broken down into two main types of liability insurance: personal injury and property damage.

Find the best comprehensive car insurance quotes by entering your ZIP code below into our free comparison tool today.

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.