Best Car Insurance for Students in 2026 (Top 10 Companies)

Top companies like State Farm, Progressive, and Allstate offer the best car insurance for students. State Farm provides up to a 25% discount for good students, making coverage affordable. This guide helps students make informed and budget-friendly choices about student's insurance rates.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Insurance and Finance Writer

Merriya Valleri is a skilled insurance writer with over a decade of professional writing experience. Merriya has a strong desire to make understanding insurance an easy task while providing readers with accurate and up-to-date information. Merriya has written articles focusing on health, life, and auto insurance. She enjoys working in the insurance field, and is constantly learning in order to ...

Merriya Valleri

Insurance & Finance Analyst

Zach Fagiano has been in the insurance industry for over 10 years, specializing in property and casualty and risk management consulting. He started out specializing in small businesses and moved up to large commercial real estate risks. During that time, he acquired property & casualty, life & health, and surplus lines brokers licenses. He’s now the Senior Vice President overseeing globa...

Zach Fagiano

Updated May 2024

18,155 reviews

18,155 reviewsCompany Facts

Full Coverage for Students

A.M. Best Rating

Complaint Level

Pros & Cons

18,155 reviews

18,155 reviews 13,283 reviews

13,283 reviewsCompany Facts

Full Coverage for Students

A.M. Best Rating

Complaint Level

13,283 reviews

13,283 reviews 11,638 reviews

11,638 reviewsCompany Facts

Full Coverage for Students

A.M. Best Rating

Complaint Level

Pros & Cons

11,638 reviews

11,638 reviewsBest car insurance for students is offered by the top pick State Farm, followed by Progressive, and Allstate. Analyze credit score, mileage, coverage level, and driving record.

There are many factors that determine student car insurance rates. Many students would be surprised to learn that they won’t be charged as much for insurance as they thought.

Our Top 10 Best Companies: Best Car Insurance for Students

| Company | Rank | Student Driver Discount | Good Student Discount | Best For | Jump to Pros/Cons |

|---|---|---|---|---|---|

| #1 | 10% | 25% | Good-Student Discounts | State Farm | |

| #2 | 12% | 20% | Multi-Policy Discounts | Progressive | |

| #3 | 15% | 20% | Personalized Coverage | Allstate | |

| #4 | 8% | 15% | Customizable Coverage | Liberty Mutual |

| #5 | 10% | 20% | Vanishing Deductible | Nationwide |

| #6 | 9% | 15% | Safe-Driving Discounts | Farmers | |

| #7 | 10% | 20% | Bundle Discounts | American Family | |

| #8 | 11% | 20% | Add-on Coverages | Travelers | |

| #9 | 8% | 15% | Student Savings | Erie | |

| #10 | 10% | 20% | Online Convenience | Esurance |

In fact, in a recent ranking of car insurance rates by occupation, students came in with the ninth-lowest rate among more than 60 occupations. A student refers to college students who either live at home and commute or who live on campus, not high school students.

High school students are classified as minors on their parents’ insurance policies. Once a student graduates from high school and enters college, an insurance company views him or her as an adult. Get the right car insurance at the best price — enter your ZIP code below to shop for coverage from the top insurers.

#1 – State Farm: Top Overall Pick

Pros

- Good Student Discount: State Farm car insurance review offers good student discount for up to 25% discount for students with good grades.

- Bundling Policies: Offers significant discounts for bundling multiple insurance policies.

- High Low-Mileage discount: Provides a substantial discount for low-mileage usage.

- Wide Coverage Options: Offers various coverage options tailored for different business needs.

Cons

- Limited Multi-Policy Discount: The multi-policy discount is not as high compared to some competitors.

- Potential Premium Costs: Despite discounts, premiums might still be relatively higher for certain coverage levels.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#2 – Progressive: Best for Multi-Policy Discounts

Pros

- Multi-Policy Discounts: Progressive car insurance review offers substantial discounts for bundling various insurance policies.

- Generous Student Driver Discount: Up to 12% discount for student drivers.

- Innovative Coverage Options: Provides personalized coverage options to meet diverse needs.

Cons

- Limited Good Student Discount: The good student discount is lower compared to some competitors.

- Possible Complex Claims Process: Claims process might be cumbersome for some customers.

#3 – Allstate: Best for Personalized Coverage

Pros

- Personalized Coverage: Allstate car insurance review offers personalized coverage options to suit individual needs.

- Attractive Student Discounts: Up to 15% discount for student drivers.

- Strong Financial Stability: Known for its reliable financial strength and stability.

Cons

- Higher Premiums: Premiums may be relatively higher compared to competitors.

- Limited Discounts: Offers fewer discounts compared to some competitors.

#4 – Liberty Mutual: Best for Customizable Coverage

Pros

- Customizable Coverage: Liberty Mutual car insurance review allows customers to tailor coverage to their specific needs.

- Good Student Discount: Up to 15% discount for students with good grades.

- Strong Customer Service: Known for its responsive and helpful customer service.

Cons

- Limited Student Driver Discount: The student driver discount is lower compared to some competitors.

- Complex Pricing Structure: Pricing structure may be confusing for some customers.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#5 – Nationwide: Best for Vanishing Deductible

Pros

- Vanishing Deductible: Offers the opportunity for deductibles to decrease over time with safe driving.

- Solid Good Student Discount: Up to 20% discount for students with good grades.

- Nationwide Network: Wide network of agents and offices for convenient service. To learn more, read our comprehension guide titled “Nationwide car insurance discounts“.

Cons

- Limited Student Driver Discount: The student driver discount is relatively lower compared to some competitors.

- Possible Limited Coverage Options: Some customers may find coverage options lacking for specific needs.

#6 – Farmers: Best for Safe-Driving Discounts

Pros

- Safe-Driving Discounts: Offers discounts for safe driving habits, promoting road safety.

- Good Student Discount: Up to 15% discount for students with good grades.

- Comprehensive Coverage Options: Farmers car insurance review provides a range of coverage options to meet various needs.

Cons

- Limited Student Driver Discount: The student driver discount is lower compared to some competitors.

- Potential Higher Premiums: Premiums may be relatively higher for certain coverage levels.

#7 – American Family: Best for Bundle Discounts

Pros

- Bundle Discounts: American Family car insurance review offers significant discounts for bundling multiple insurance policies.

- Attractive Good Student Discount: Up to 20% discount for students with good grades.

- Strong Community Involvement: Known for its community-focused initiatives and support.

Cons

- Limited Coverage Options: Offers fewer coverage options compared to some competitors.

- Potentially Complex Claims Process: Claims process may be more involved for some customers.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#8 – Travelers: Best for Add-on Coverages

Pros

- Add-on Coverages: Travelers car insurance review offers various additional coverages to enhance protection.

- Good Student Discount: Up to 20% discount for students with good grades.

- Solid Financial Stability: Known for its strong financial standing and reliability.

Cons

- Limited Student Driver Discount: The student driver discount is lower compared to some competitors.

- Possibly Higher Premiums: Premiums may be relatively higher for certain coverage levels.

#9 – Erie: Best for Student Savings

Pros

- Generous Student Savings: Erie car insurance review offers up to 8% discount for student drivers.

- Solid Good Student Discount: Up to 15% discount for students with good grades.

- Strong Regional Presence: Known for its strong presence in specific regions, offering localized service.

Cons

- Limited Coverage Options: Offers fewer coverage options compared to some competitors.

- Potentially Limited Availability: Availability may be limited to certain regions, restricting accessibility.

#10 – Esurance: Best for Online Convenience

Pros

- Online Convenience: Offers easy-to-use online platforms for policy management and claims.

- Good Student Discount: Up to 20% discount for students with good grades. For more information read our “how do you get an Esurance quote?”

- Competitive Rates: Known for offering competitive rates for various coverage options.

Cons

- Limited Personalized Service: Lacks the personal touch of traditional agents for some customers.

- Potential Technical Glitches: Online systems may experience occasional technical issues, affecting user experience.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Monthly Car Insurance Rates for Student Drivers by Coverage Type

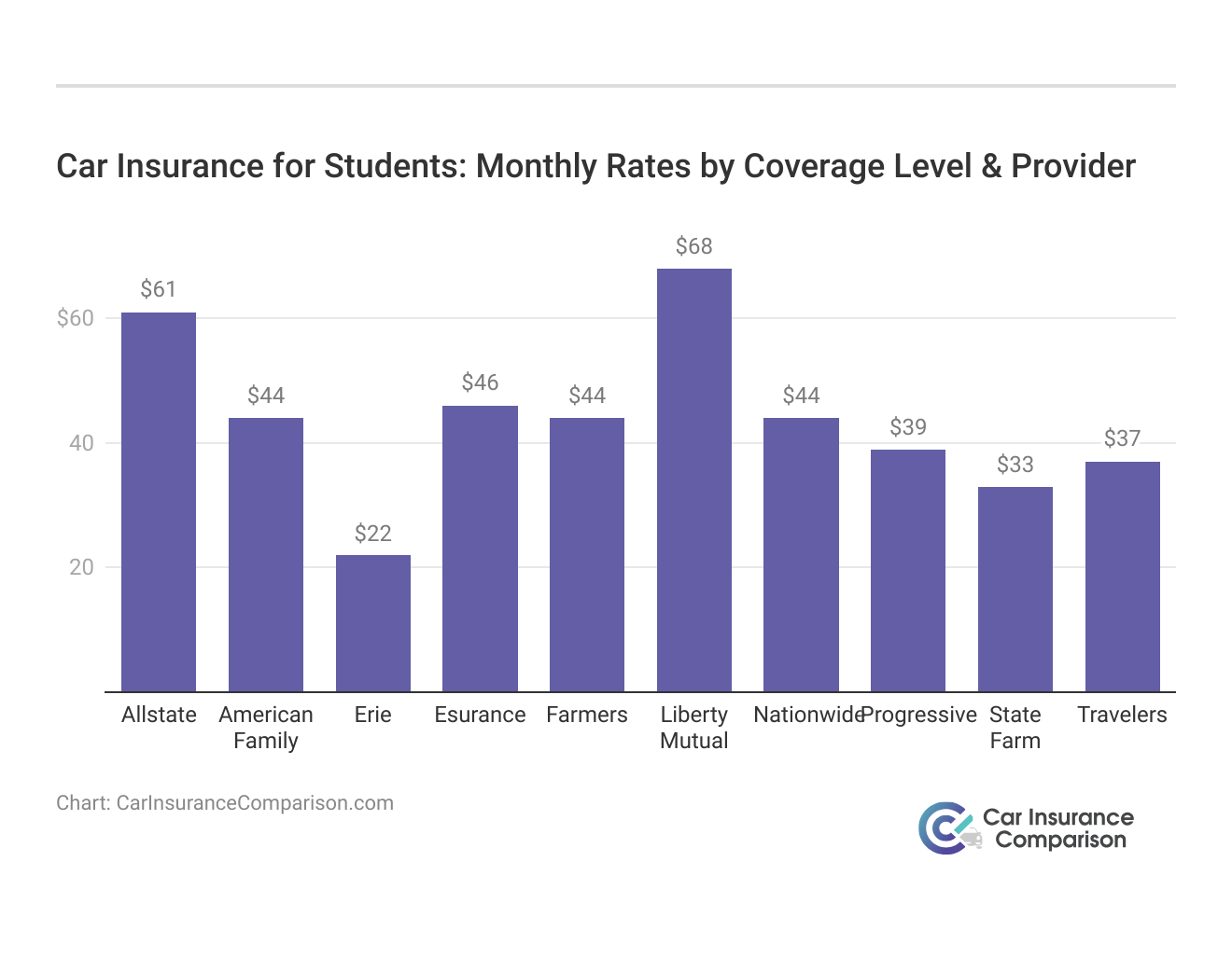

This table provides a comprehensive overview of the average monthly car insurance rates for student drivers, considering both full coverage and minimum coverage options.

For full coverage, Erie car insurance review stands out as the most cost-effective option, offering a remarkably low monthly rate of $58, while Liberty Mutual presents the highest rate at $174. When considering minimum coverage, Erie maintains its affordability with a rate of $22 per month, while Liberty Mutual once again leads with the highest cost at $68.

Car Insurance for Students: Monthly Rates by Coverage Level & Provider

| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| Allstate | $61 | $160 |

| American Family | $44 | $117 |

| Erie | $22 | $58 |

| Esurance | $46 | $114 |

| Farmers | $44 | $139 |

| Liberty Mutual | $68 | $174 |

| Nationwide | $44 | $115 |

| Progressive | $39 | $105 |

| State Farm | $33 | $86 |

| Travelers | $37 | $99 |

State Farm car insurance review consistently provides competitive rates for both full and minimum coverage, making it an appealing choice for student drivers seeking a balance between cost and comprehensive protection.

The data underscores the importance of careful consideration and comparison when selecting car insurance for student drivers, allowing individuals to make well-informed decisions based on their unique needs and budget constraints.

Student Discounts for Car Insurance

The insurance company takes into account two main factors regarding students’ driving habits. Firstly, students tend to drive less compared to other adults, particularly for leisure activities, which lowers the probability of being involved in accidents caused by reckless driving behaviors. To gain further insights, read our guide “10 States with the most reckless drivers”

Secondly, students are generally perceived to have a more serious mindset due to their pursuit of higher education. As a result, they are often given the benefit of the doubt regarding their responsibility on the road.

Whether it’s true or not, it is generally assumed that students will be a lot less risky in their behavior in all areas. A driver who is less risky behind the wheel is also one who is less likely to file an accident claim.

Another part of the equation is the fact that student economics generally dictate that these types of individuals don’t have a lot of disposable income. Usually, students drive old, beaten up jalopies which are obviously less expensive to insure.

The idea of student economics and car insurance rates is as much a benefit to students as it is to insurance carriers.

Between the high cost of tuition, textbooks, and everything else a student is paying for, having lower insurance premiums is obviously a big benefit.

Case Studies in Car Insurance Discounts

Explore real-life examples showcasing how leading car insurance providers offer discounts tailored to individual needs and behaviors. From academic achievements to policy bundling, these case studies highlight the diverse ways drivers can save on premiums.

- Case Study #1 – State Farm’s Good-Student Discounts: Meet Sarah, a diligent student who secured a student driver discount of up to 10% and a remarkably good student discount of up to 25% with State Farm car insurance review. Through her commitment to academics and responsible driving, Sarah maximized the potential savings offered by State Farm’s focus on rewarding good students.

- Case Study #2 – Progressive’s Multi-Policy Discounts: John, a savvy insurance shopper, opted for Progressive and took advantage of their multi-policy discounts. By bundling his car insurance with another policy, John enjoyed savings of up to 12%, demonstrating how combining insurance needs can lead to financial benefits with Progressive.

- Case Study #3 – Allstate’s Personalized Coverage: Emily, with a keen interest in tailoring her insurance coverage, found Allstate to be the perfect fit. With a student driver discount of up to 15% and a good student discount of up to 20%, Emily appreciated Allstate’s commitment to providing personalized coverage that met her specific needs and preferences.

Discover how Sarah, John, and Emily benefited from State Farm, Progressive, and Allstate’s unique discount programs. From maximizing good student discounts to bundling policies for additional savings, these case studies illustrate the importance of choosing the right insurer to meet specific coverage needs while enjoying financial incentives.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Students at Home

Student car insurance rates can be made even less expensive if a student lives at home and commutes a very short distance to school. Furthermore, if he drives a parent’s car rather than owning his own, his insurance will be even less expensive.

One thing to remember is that states differ in how long a student can remain on his or her parent’s policy. Many have an age limit of 26. In other words, as long as a person remains a college student he can stay on his parents policy up until his 26th birthday.

State Farm stands out as the top choice for student drivers, offering competitive rates and a range of discounts, including a remarkable good student discount of up to 25%.

Brad Larson Licensed Insurance Agent

After that, the person will be required to purchase his own car insurance, whether he remains a student or enters the workforce. Enjoy those lower rates while you can, because you may not have them forever. Compare car insurance rates online by entering your ZIP code into the free box now.

Frequently Asked Questions

What is student driver car insurance?

Student driving insurance, also known as student driver car insurance, is a specialized type of auto insurance tailored for young drivers who are either learning to drive or have recently obtained their driver’s license. It offers coverage for the student driver’s vehicle, safeguarding against various risks and accidents while on the road.

Why is car insurance more expensive for student drivers?

Car insurance tends to be more expensive for student drivers due to their lack of driving experience and higher likelihood of being involved in accidents. Statistically, young and inexperienced drivers are considered higher risk by insurance companies, leading to higher premiums. However, there are ways for student drivers to mitigate these costs.

What factors influence the cost of student driver car insurance?

Several factors influence the cost of student driver car insurance, including:

- Age: Younger drivers generally pay higher premiums.

- Driving experience: Lack of driving experience may result in higher rates.

- Type of vehicle: The make, model, and age of the vehicle can impact insurance costs.

- Location: Insurance rates may vary based on the location of the student driver’s residence.

- Academic performance: Some insurers offer discounts for good grades.

To gain further insights, read our “Factors That Affect Car Insurance Rates“.

How can student drivers find affordable car insurance rates?

To find affordable car insurance rates as a student driver, consider the following tips:

- Compare quotes: Obtain quotes from multiple insurance providers to compare rates and coverage options.

- Take driver’s education courses: Completing a driver’s education course can often lead to lower premiums.

- Maintain good grades: Many insurers offer discounts for students who achieve good academic performance.

- Consider a safe vehicle: Choosing a safe and reliable vehicle can help lower insurance costs.

- Stay claims-free: Avoiding accidents and traffic violations can help keep insurance rates down.

Find cheap car insurance quotes by entering your ZIP code below.

Are there any specialized insurance programs for student drivers?

Some insurance companies offer specialized programs for student drivers, such as safe driving programs or usage-based insurance. These programs may involve installing a device in the vehicle that monitors driving habits and offers discounts based on safe driving behaviors. It’s worth exploring such programs to potentially reduce insurance costs for student drivers.

What discounts are available for student drivers?

Student drivers may qualify for various discounts, including:

Good student discount

Safe driving discount

Multi-policy discount (if bundling with other types of insurance)

Low-mileage discount

Vehicle safety feature discount

How long can a student remain on their parents’ insurance policy?

The length of time a student can remain on their parents’ insurance policy varies by state. Many states have an age limit of 26, meaning that as long as a person remains a college student, they can stay on their parents’ policy up until their 26th birthday.

Delve deeper into our “compare car insurance rates by state” for further insights.

What types of coverage are typically included in student driver car insurance?

Student driver car insurance typically includes the same types of coverage as standard auto insurance policies, such as:

Liability coverage

Collision coverage

Comprehensive coverage

Personal injury protection (PIP) or medical payments coverage

Can student car insurance rates be reduced if the student lives at home?

Yes, student car insurance rates can often be reduced if the student lives at home and commutes a short distance to school. Additionally, if the student drives a parent’s car rather than owning their own, their insurance may be less expensive.

How can students save on car insurance while in college?

Students can save on car insurance while in college by:

- Maintaining good grades to qualify for a good student discount

- Completing driving courses or defensive driving programs

- Choosing a safe and practical vehicle

- Comparing quotes from multiple insurance providers

- Taking advantage of discounts and incentives offered by insurance companies

Instantly compare car insurance quotes from the top providers by entering your ZIP code into our free comparison tool below.

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.