Best Car Insurance for Unlicensed Drivers in 2026 (Top 10 Providers)

Progressive, State Farm, and Allstate shine as the top choices for the best car Insurance companies that insure unlicensed drivers. Offering rates as low as $68 per month, they provide tailored options, ensuring comprehensive coverage and peace of mind for unlicensed drivers.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Licensed Insurance Agent

Brandon Frady has been a licensed insurance agent and insurance office manager since 2018. He has experience in ventures from retail to finance, working positions from cashier to management, but it wasn’t until Brandon started working in the insurance industry that he truly felt at home in his career. In his day-to-day interactions, he aims to live out his business philosophy in how he treats hi...

Brandon Frady

Insurance Operations Specialist

Michael earned a degree in Business Management degree with an insurance focus, which led to a successful 25-year career in insurance claims operations and support. He possesses a high-level of business acumen across multiple areas of the insurance industry. Over the course of his career, he served in multiple roles supporting claims operations including: Claims Specialist, Claims Trainer, Claim Au...

Michael Leotta

Updated May 2024

13,283 reviews

13,283 reviewsCompany Facts

Full Coverage for Unlicensed Drivers

A.M. Best Rating

Complaint Level

13,283 reviews

13,283 reviews 18,155 reviews

18,155 reviewsCompany Facts

Full Coverage for Unlicensed Drivers

A.M. Best Rating

Complaint Level

Pros & Cons

18,155 reviews

18,155 reviews 11,638 reviews

11,638 reviewsCompany Facts

Full Coverage for Unlicensed Drivers

A.M. Best Rating

Complaint Level

Pros & Cons

11,638 reviews

11,638 reviewsAmong them, Progressive shines with its innovative approach and commitment to providing reliable insurance solutions for all drivers, regardless of their licensing status.

Our Top 10 Picks: Best Car Insurance Companies That Insure Unlicensed Drivers

| Company | Rank | Multi-Policy Discount | Low-Mileage Discount | Best For | Jump to Pros/Cons |

|---|---|---|---|---|---|

| #1 | 10% | 30% | Online Convenience | Progressive | |

| #2 | 17% | 30% | Many Discounts | State Farm | |

| #3 | 10% | 30% | Add-on Coverages | Allstate | |

| #4 | 15% | 20% | Local Agents | Farmers | |

| #5 | 20% | 30% | Usage Discount | Nationwide |

| #6 | 25% | 30% | Customizable Polices | Liberty Mutual |

| #7 | 13% | 10% | Accident Forgiveness | Travelers | |

| #8 | 20% | 15% | Student Savings | American Family | |

| #9 | 20% | 10% | Local Agents | AAA |

| #10 | 15% | 10% | Usage Discount | The General |

Unlicensed drivers face unique challenges when it comes to obtaining car insurance. Fortunately, several reputable insurance companies specialize in providing coverage tailored to their needs.

Discover how to obtain auto insurance without a license and secure coverage for unlicensed drivers. Explore affordable car insurance companies specializing in insuring drivers without licenses and learn about available car insurance discounts to lower annual rates.

Ready to buy car insurance from car insurance companies that insure unlicensed drivers? Enter your ZIP code in the online quote tool above to compare free car insurance quotes from the best companies in your area.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Exploring Car Insurance Options for Unlicensed Drivers

The best auto insurance companies for unlicensed drivers are smaller, local companies, and you may be required to work with an agent. You’ll also need to find a dealership that will allow you to drive off the lot as an unlicensed driver.

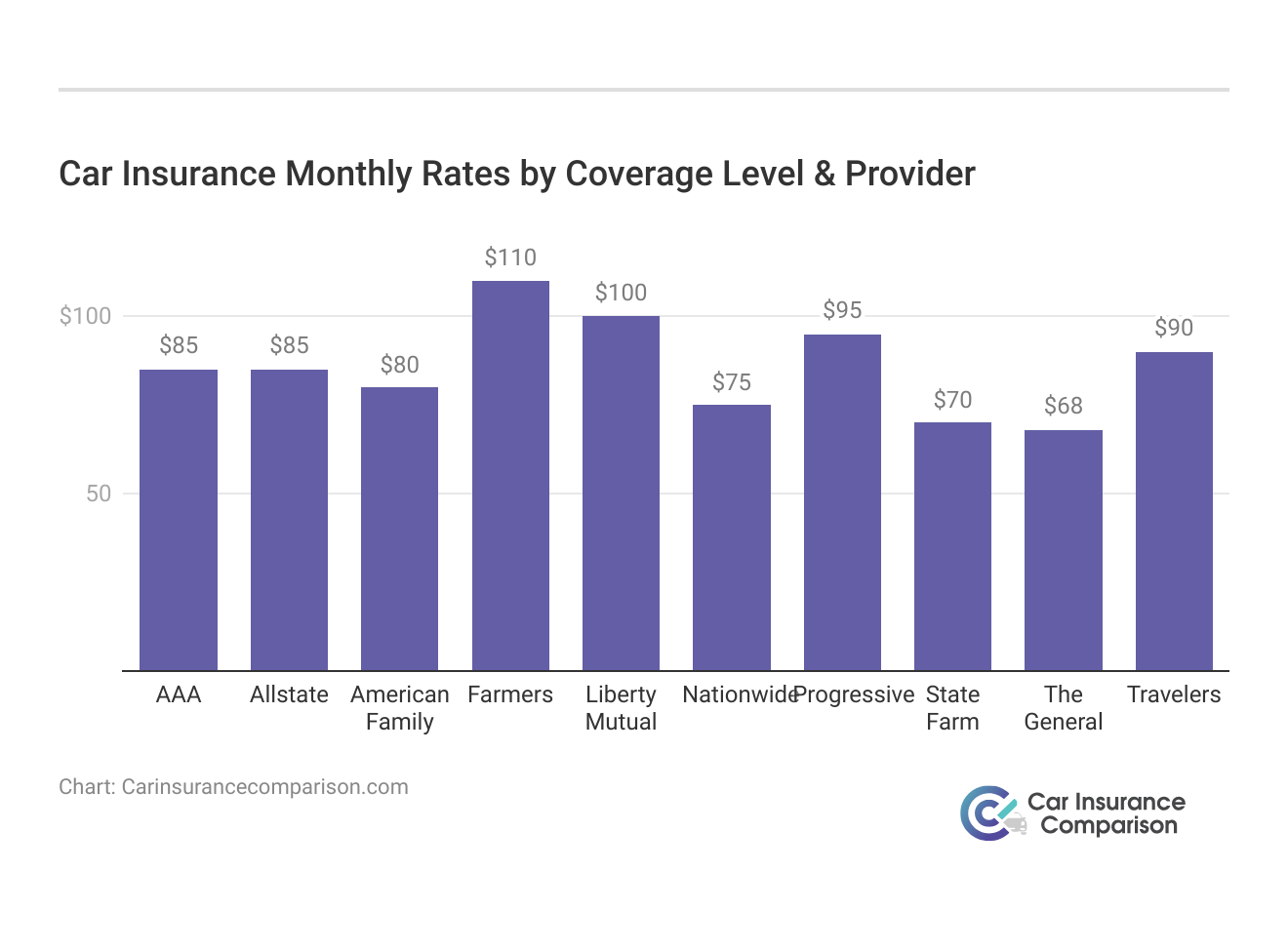

Car Insurance Monthly Rates by Coverage Level & Provider

| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| AAA | $85 | $225 |

| Allstate | $85 | $190 |

| American Family | $80 | $220 |

| Farmers | $110 | $200 |

| Liberty Mutual | $100 | $230 |

| Nationwide | $75 | $210 |

| Progressive | $95 | $180 |

| State Farm | $70 | $150 |

| The General | $68 | $195 |

| Travelers | $90 | $250 |

When opting for full coverage insurance, it’s essential to weigh the costs against the comprehensive protection it provides. Progressive stands out with a competitive rate of $180 per month, ensuring robust coverage. Liberty Mutual and Travelers also offer comprehensive plans at $230 and $250 per month, respectively. These higher premiums reflect the extended protection and peace of mind that come with full coverage policies.

Progressive stands out as the top choice for innovative coverage tailored to the unique needs of unlicensed drivers.

Dani Best Licensed Insurance Producer

For those seeking more budget-friendly options, minimum coverage plans are worth considering. State Farm offers an economical choice at $70 per month, providing essential coverage. The General and Nationwide are also cost-effective options at $68 and $75 per month, respectively. While these plans may have lower premiums, it’s crucial to evaluate whether the minimal coverage meets your specific insurance needs.

Some car insurance companies and car dealers are flexible in various situations. Only a few companies may allow you to get insurance without a license, but parents and legal guardians who have unlicensed teen drivers may find it easier to add their teens to their current policy. Teens are often added as drivers to a parent’s auto insurance policy. Therefore, insuring unlicensed teens is more likely at more significant companies.

Exploring the High-Risk Road: Unlicensed Drivers and Car Insurance Costs

The short answer is yes. Unlicensed drivers and drivers with suspended licenses are high-risk drivers.

When a car insurance company agrees to give you a policy as an unlicensed driver, your car insurance rates could be at least 20% more expensive.

But what does that look like? Let’s look at a list that compares the average cost of auto insurance to high-risk auto insurance.

- Good Driver: $121/month

- High-Risk Driver: $230/month

Various car insurance companies produce different rates, and you could pay more at some insurance companies. To find cheaper car insurance rates, you may have better luck at companies like The General, Good2Go Auto Insurance, or Dairyland for high-risk and unlicensed drivers.

Unlicensed Drivers and Auto Insurance Discounts: Exploring Eligibility

It depends on the company. Unlicensed drivers have to pursue a valid driver’s license to keep their auto insurance policy. As you make progress, you may be eligible to receive discounts. Here are a few deals you should target.

- Good Student Discount

- Safety Features Discount

- Multi-Policy Discount

- Defensive Driver Course Discount

It’s challenging to convince a company to give you an insurance policy if you don’t have a license. You may not qualify for many car insurance discounts as long as you remain an unlicensed driver.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Navigating Insurance Without a License: What You Need to Know

It depends on the company. Some auto insurance companies allow teen drivers with a learner’s permit to be added to a policy. However, adult drivers without a license may not have that privilege. If you have a suspended license, you may be ineligible to purchase a new insurance policy.

But if you have a court order to get auto insurance, you’ll need to report to your local DMV and ask them to assign you to a company. This usually comes with SR-22 certification. SR-22 confirms that you have the minimum auto insurance requirements as a high-risk driver.

Understanding Auto Insurance Limitations for Unlicensed Drivers

The most prominent auto insurance companies may not insure unlicensed drivers. Car insurance companies use the Motor Vehicle Report (MVR) to calculate your car insurance quotes. The MVR looks at your overall driving history, prevents fraud, and protects drivers from unsafe vehicles.

A driver’s license is linked to your Motor Vehicle Record (MVR), and individuals with expired licenses may not be listed in the report. Consequently, insurance providers with the highest market share typically refrain from insuring drivers with expired licenses.

- Case Study #1 – Innovative Solutions for Tech Enthusiasts: Alex, a tech enthusiast, found his perfect match with Progressive. With a forward-thinking approach, Progressive offered tailored coverage options at $180 per month, aligning seamlessly with Alex’s tech-savvy lifestyle and providing comprehensive protection.

- Case Study #2 – Budget-Friendly Coverage for Financially Conscious Drivers: Sarah discovered State Farm as the ideal solution. State Farm offered both minimum and full coverage options at affordable rates of $70 and $150 per month, respectively. With a focus on being a trusted partner in coverage, State Farm provided Sarah with the security she needed without straining her budget.

- Case Study #3 – Safety-First Policies for Drivers with Clean Records: Emily found her top choice in Allstate. Despite a slightly higher rate of $190 for full coverage, Allstate’s commitment to safeguarding every journey mile by mile resonated with Emily, aligning perfectly with her desire for a secure driving experience.

Each case study highlights the importance of finding a car insurance provider that understands and meets individual needs. Whether it’s innovation for tech enthusiasts, budget-friendly options for financially conscious drivers, or car safety for those prioritizing security, there’s a tailored solution out there for everyone.

Progressive is the premier option for cutting-edge coverage designed for unlicensed drivers, boasting an impressive customer satisfaction rating of 92%.

Justin Wright Licensed Insurance Agent

The search for the right car insurance provider doesn’t have to be daunting. By understanding your priorities and preferences, you can find a company like Progressive, State Farm, or Allstate that offers the coverage options and peace of mind you need to navigate the road with confidence.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

What You Need to Know About Car Insurance Companies That Insure Unlicensed Drivers

It’s not likely that you’ll get auto insurance coverage with a large, reputable company when you’re an unlicensed driver. Even small companies require you to register your car and pursue a valid driver’s license.

We recommend that you make an effort to become a licensed driver before you shop for car insurance. Now that you know more about car insurance companies that insure unlicensed drivers, use our free online quote tool to compare multiple insurance companies in your area.

Instantly compare car insurance quotes from the top providers by entering your ZIP code into our free comparison tool below.

Frequently Asked Questions

What are the best insurance options for unlicensed drivers?

The best insurance for unlicensed drivers often includes companies like Progressive, State Farm, and Allstate, which specialize in providing coverage tailored to the needs of unlicensed drivers.

To broaden your understanding, explore our comprehensive resource on insurance coverage titled “How do you get car insurance with no license?” which provides valuable insights.

Which insurance companies don’t require a license for coverage?

While most insurance companies require a valid driver’s license, some may offer coverage options for unlicensed drivers. Companies like The General and Good2Go Auto Insurance are known for providing insurance without requiring a license.

When you’re ready to see how much you can save on your car insurance, enter your ZIP code below into our free comparison tool.

How can I buy auto insurance without a license?

You can typically purchase auto insurance without a license by contacting insurance companies directly or through licensed agents. Be prepared to provide information about the vehicle and any additional drivers who will be covered under the policy.

For deeper insights, delve into our extensive guide on business insurance titled “How do I change car insurance agents?” to broaden your understanding and make informed decisions.

Can a person without a license get car insurance?

Yes, it’s possible for a person without a license to obtain car insurance, but the availability and terms of coverage may vary depending on the insurance company and state regulations.

How can I get auto insurance quotes without a license?

You can still obtain auto insurance quotes without a license by providing relevant information about the vehicle you want to insure and any additional drivers who may be covered under the policy.

For a thorough examination, consult our extensive resource named “How often should you check car insurance quotes?” which offers valuable insights into your individual requirements.

Is it possible to get cheap auto insurance without a license?

While insurance rates for unlicensed drivers may be higher due to increased risk, some companies offer competitive rates for basic coverage options. Companies like Good2Go Auto Insurance specialize in providing affordable options for unlicensed drivers.

For a thorough understanding, delve into our comprehensive guide entitled “Is basic car insurance coverage a smart choice?” with information to enhance your understanding.

Can I purchase full coverage car insurance without a license?

Yes, some insurance companies offer full coverage options for unlicensed drivers, although premiums may be higher compared to basic coverage plans. Companies like Progressive and Liberty Mutual provide comprehensive coverage options for unlicensed drivers.

For in-depth details, you can consult our thorough document, “Best Full Coverage Car Insurance,” which provides extensive insights.

Are unlicensed drivers covered by insurance policies?

Coverage for unlicensed drivers varies by insurance company and policy. Some companies may offer limited coverage for unlicensed drivers, while others may require additional documentation or restrictions.

Ready to find affordable car insurance? Use our free comparison tool below to get started.

Which are the top 10 non-standard auto insurance companies?

The top 10 non-standard auto insurance companies may include names like The General, Good2Go Auto Insurance, and Dairyland, which specialize in providing coverage for high-risk drivers, including unlicensed drivers.

Delve into our comprehensive guide, “Best Car Insurance for High-Risk Drivers,” for thorough insights into finding the best coverage tailored to your needs

Will insurance cover an unlicensed driver in case of an accident?

In most cases, insurance policies will provide coverage for accidents involving unlicensed drivers, but the extent of coverage may vary depending on the terms of the policy and state regulations. It’s essential to review your policy carefully to understand your coverage options.

For in-depth understanding, refer to our comprehensive guide “Understanding Your Car Insurance Policy (Complete Guide)” for valuable insights and clarity on your coverage.

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.