Best Car Insurance for Welfare Recipients in 2026 (Top 10 Companies)

Discover the best car insurance for welfare recipients, with exclusive 10% discounts from Progressive, State Farm, and Allstate. These industry leaders offer tailored coverage, ensuring welfare recipients receive competitive rates and personalized benefits that accommodate their financial circumstances.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Insurance Content Team Lead

Tonya Sisler has been a technical insurance writer for over five years. She uses her extensive insurance and finance knowledge to write informative articles that answer readers' top questions. Her mission is to provide readers with timely, accurate information that allows them to determine their insurance needs and choose the best coverage. Tonya currently leads a team of 10 insurance copywrite...

Tonya Sisler

Licensed Insurance Producer

Dani Best has been a licensed insurance producer for nearly 10 years. Dani began her insurance career in a sales role with State Farm in 2014. During her time in sales, she graduated with her Bachelors in Psychology from Capella University and is currently earning her Masters in Marriage and Family Therapy. Since 2014, Dani has held and maintains licenses in Life, Disability, Property, and Casualt...

Dani Best

Updated May 2024

13,283 reviews

13,283 reviewsCompany Facts

Full Coverage for Welfare Recipients

A.M. Best Rating

Complaint Level

13,283 reviews

13,283 reviews 18,155 reviews

18,155 reviewsCompany Facts

Full Coverage for Welfare Recipients

A.M. Best Rating

Complaint Level

Pros & Cons

18,155 reviews

18,155 reviews 11,638 reviews

11,638 reviewsCompany Facts

Full Coverage for Welfare Recipients

A.M. Best Rating

Complaint Level

Pros & Cons

11,638 reviews

11,638 reviews

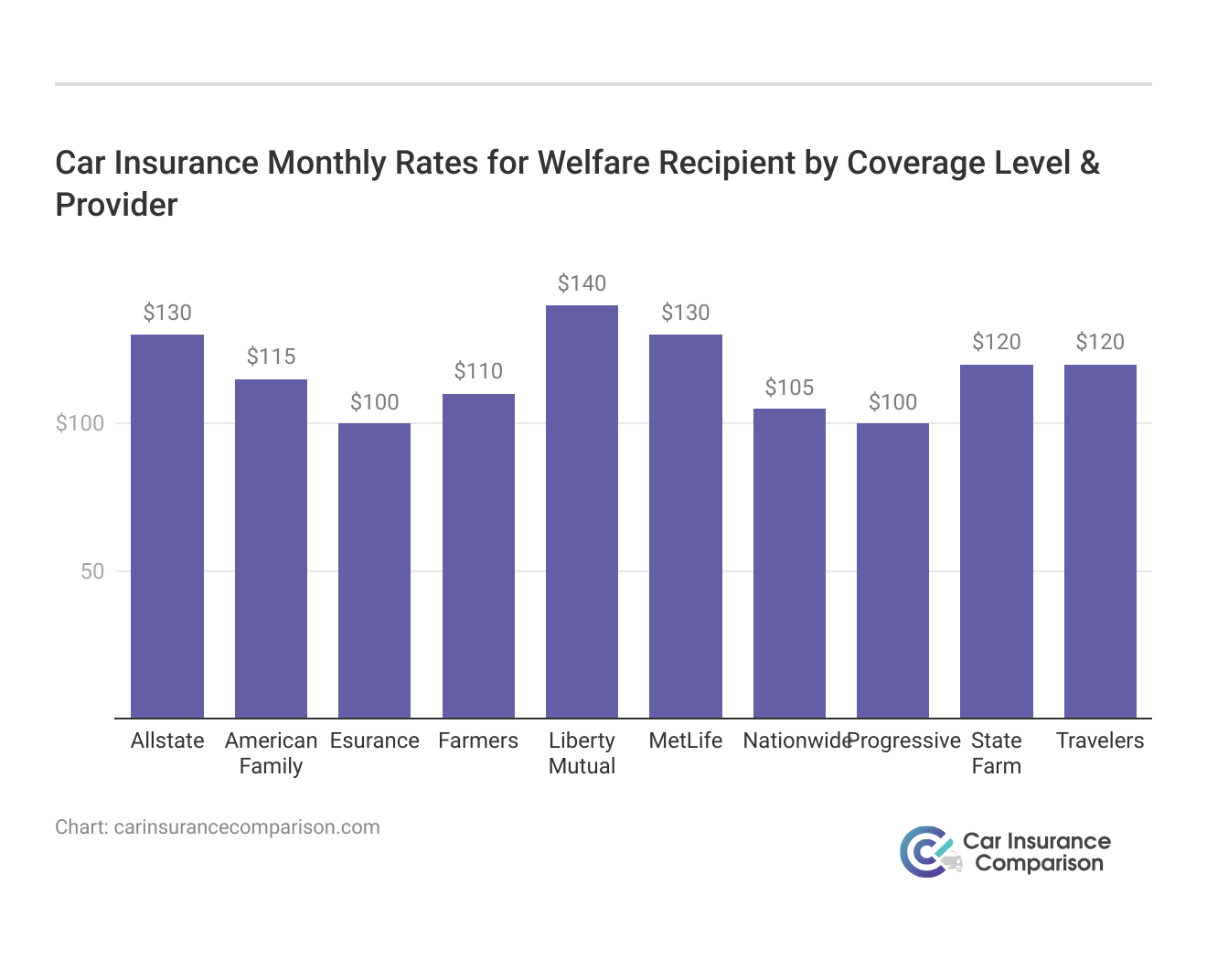

Among these, Progressive emerges as the clear winner, providing budget-friendly rates starting as low as $100 for minimum coverage, ensuring both financial security and legal compliance on the road.

Our Top 10 Company Picks: Best Car Insurance for Welfare Recipients

| Company | Rank | Multi-Policy Discount | Safety Feature Discount | Best For | Jump to Pros/Cons |

|---|---|---|---|---|---|

| #1 | 10% | 30% | Customizable Coverage | Progressive | |

| #2 | 30% | 20% | Customer Service | State Farm | |

| #3 | 20% | 10% | Comprehensive Coverage | Allstate | |

| #4 | 20% | 5% | Personalized Policies | Farmers | |

| #5 | 25% | 15% | Extended Reimbursement | Liberty Mutual |

| #6 | 15% | 20% | Adjustable Deductibles | Nationwide |

| #7 | 10% | 15% | Customer Loyalty | American Family | |

| #8 | 20% | 10% | Driver Assistance | Travelers | |

| #9 | 5% | 10% | Online Convenience | Esurance | |

| #10 | 10% | 15% | Comprehensive Protection | MetLife |

With a commitment to meeting the unique needs of welfare recipients, Progressive sets the standard for affordable and comprehensive car insurance solutions.

Finding cheap car insurance quotes is easy. Just enter your ZIP code into our free comparison tool above to instantly compare quotes near you.

#1 – Progressive: Top Overall Pick

Pros

- Attractive Multi-Policy Discount: Progressive car insurance review highlights the opportunity to save up to 10% by bundling various insurance policies, thereby improving affordability.

- Strong Digital platform: Known for user-friendly online tools, making policy management and claims processing efficient.

- Varied Discounts and Benefits: Progressive provides a range of additional discounts, catering to diverse customer needs.

Cons

- Limited Face to Face Interaction: Less emphasis on in-person services, which might not appeal to those preferring traditional insurance interactions.

- Potentially Higher Rates for Riskier Drivers: Rates might be higher for drivers with poor driving records or other risk factors.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#2 – State Farm: Best for Customer Service

Pros

- Wide Agent Network: Renowned for its extensive network of agents, ensuring personalized and local service.

- Comprehensive Mobile App: State Farm car insurance review highlights its provision of a user-friendly application, facilitating convenient management of policies and filing of claims.

- A broad Range of Insurance Products: Provides a variety of insurance offerings, meeting diverse customer requirements.

Cons

- May be Pricier for Certain Profiles: Can be more expensive for individuals with specific risk factors or lower credit scores.

- Limited Customization in Some Areas: While offering diverse products, customization options might be limited in comparison to some competitors.

#3 – Allstate: Best for Comprehensive Coverage

Pros

- Incentives for Safe Vehicles: Provides up to a 10% discount for safety features, encouraging safer driving practices.

- Strong Local Agent Network: Maintains a robust network of local agents for personalized customer service.

- Innovative Tools and Resources: Allstate car insurance review highlights its provision of sophisticated features such as Drive Wise, which enables the monitoring of driving behaviors and the possibility of securing additional discounts.

Cons

- Potentially Higher Premiums: Some customers may find Allstate’s rates higher than those of other providers, especially without discounts.

- Varied Customer Experience: Experiences with agents and claims processing can vary, depending on the location and specific agent.

#4 – Farmers: Best for Personalized Policies

Pros

- Focus on Safety Feature Discounts: Farmers car insurance review demonstrates the company’s tailored coverage options for drivers by offering discounts of up to 5% for safety-equipped vehicles, showcasing their commitment to promoting safer driving habits.

- Strong Agent Network: Known for its extensive local agent presence, ensuring personalized service.

- Variety of Coverage Choices: Offers a wide range of coverage options, including unique add-ons and features.

Cons

- Limited Safety Feature Discount: Compared to competitors, the safety feature discount is relatively lower.

- Higher Rates in Some Cases: Some customers might experience higher rates based on their specific profiles or locations.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#5 – Liberty Mutual: Best for Extended Reimbursement

Pros

- Adaptive Policy Adjustments: Provides flexibility in policy adjustments to meet changing customer needs.

- Online and Agent Support: The Liberty Mutual car insurance review illustrates the company’s tailored coverage options for strong online presence with accessible agent support.

- Global Presence: Liberty Mutual’s global footprint offers an assurance of stability and a wide range of resources.

Cons

- Varied Pricing: Rates can vary significantly based on individual circumstances and location.

- Mixed Customer Reviews: Some customers report varied experiences with claims processing and customer service.

#6 – Nationwide: Best for Adjustable Deductibles

Pros

- Wide Range of Insurance Products: Nationwide car insurance discount encompasses a wide range of insurance solutions beyond solely automobile coverage.

- Innovative Usage-Based Insurance: Features like Smart Ride reward safe driving habits with potential discounts.

- Strong Customer Support: Known for its customer-oriented service and efficient claim handling.

Cons

- Rate Fluctuations: Some customers may experience fluctuations in premiums based on policy changes and driving records.

- Coverage Limitations in Certain Areas: Nationwide may have limitations in coverage options or availability in some regions.

#7 – American Family: Best for Customer Loyalty

Pros

- Diverse Coverage Options: American Family car insurance review offers a variety of coverage choices, incorporating distinctive policy enhancements.

- Strong Local Agent Network: Maintains a robust network of local agents, ensuring personalized service.

- Customer-Centric Approach: Known for its focus on customer satisfaction and relationship building.

Cons

- Limited Geographic Availability: American Family’s services are not available in all states, limiting its reach.

- Varied Experience With Agents: Customer experiences can vary significantly depending on the individual agent and location.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#8 – Travelers: Best for Driver Assistance

Pros

- Innovative Technology Solutions: Provides advanced tools for policy management and claims processing.

- Extensive Coverage Options: Offers a wide range of customizable coverage options.

- Strong Reputation and Stability: Travelers car insurance review showcase the company’s different benefits from a long-standing reputation and financial stability in the insurance market.

Cons

- Higher Rates for Some Profiles: Certain customer profiles may face higher premiums compared to other insurers.

- Inconsistent Customer Service: Some customers report variability in the quality of customer service and claims support.

#9 – Esurance: Best for Online Convenience

Pros

- Innovative Tools: Provides unique tools like coverage counselors and online quote comparison.

- Fast Claims Processing: Known for its quick and efficient claims handling process.

- Focus on Technology Driven Solutions: Esurance uses technology to simplify and improve the insurance experience getting quote etc.

Cons

- Limited Agent Interaction: Less emphasis on in-person services, which might not suit all customers.

- Coverage Options may be Limited: Compared to larger insurers, the range of coverage options might be more restricted.

#10 – MetLife: Best for Comprehensive Protection

Pros

- Global Presence: As a global insurer, Metlife brings a wealth of experience and resources.

- Specialized Programs: Offers specialized programs like Metlife Auto & Home’s MyJourney, which focuses on safe driving.

- Strong Customer Support Network: Known for its robust customer support and efficient claims handling process.

Cons

- Potentially Higher premiums: Some customers might find Metlife’s rates to be on the higher side, especially without discounts.

- Varied Customer Experiences: As with many large insurers, customer experiences can vary, particularly in different regions or with different agents.

Welfare Coverage for Car Insurance Costs

According to a 2014 study conducted by the National Association of Insurance Commissioners (NCAIC), nearly 13 percent of drivers were uninsured. Another study by the Financial Responsibility and Insurance Committee found that among those who were driving uninsured, 82 percent indicated that they did so because they could not afford to pay the high cost of insurance.

Driving uninsured is subject to consequences. Each state has its own penalties, but just know that the consequences are not worth the risk.

If you get caught driving uninsured, you can expect one or more of the following penalties:

- Expensive fines

- Suspension of driver’s license

- Suspension of vehicle registration

- Ticket for no insurance

- Jail time for repeated offenses

These penalties are serious, but you can face even greater risk if you get in an accident while driving without insurance. The cost of insurance may seem high, but just imagine the financial impact of causing serious injury to yourself or others. Car insurance is required to drive in all states.

For welfare recipients, it can be overwhelming to afford the high annual costs of insurance. Don’t let the cost of car insurance hinder you from doing the things you need to do on a daily basis.

Progressive stands out as the champion for welfare recipients, offering customizable coverage options and budget-friendly rates, including up to a 10% discount for good drivers.

Melanie Musson Published Insurance Expert

If you don’t have the money to pay for the damages, then your assets could be taken away. As you can see, it doesn’t pay to drive uninsured. Ready to buy low-income car insurance? Compare low-income car insurance rates and options right now by entering your ZIP code above.

Three States that Offer Low-Income Car Insurance

California

California is one of the most expensive states for car insurance in the nation. To lower the rate of uninsured drivers, the state has developed California’s Low-Cost Automobile Program (CLCA), which gives low-income drivers a means to insure their vehicles at an affordable price. To qualify, you must:

- Have a valid driver’s license

- Meet income eligibility requirements

- Own a vehicle valued at $25,000 or less

- Be at least 19 years of age

- Have a clean driving record for the past three years

If you qualify, you can purchase up to:

- $10,000 of bodily injury coverage

- $20,000 per accident bodily injury or death coverage

- $3,000 for per accident property damage coverage

Other auto insurance policies such as underinsured motorist and medical payments policies are also available through CLCA. Depending on where you live, the annual premium ranges from $241 to $556 per year.

If you can’t get a government auto insurance program for low-income drivers, you’ll have to purchase a standard policy from an insurance company.

Car insurance companies won’t determine your car insurance rates based on your income. They’ll use factors such as age, location, driving history, coverage levels. To expand your knowledge, refer to our comprehensive handbook titled “Compare California Car Insurance Rates.”

Hawaii

Hawaii offers free personal injury protection and liability insurance from the state to those who received financial assistance through the Aid to Aged, Blind, and Disabled program. You must be aged 65 or older and meet at least one of the following requirements:

- You’re blind

- You have a terminal condition that prevents you from working

- You have a physical or mental disability that prevents you from working

- You live with and take care of someone who received AABD financial assistance

This initiative underscores Hawaii’s commitment to ensuring that vulnerable individuals have access to essential protections, providing a safety net for those facing financial hardship due to age, disability, or caregiving responsibilities. To gain profound insights, consult our extensive guide titled “Compare California Car Insurance Rates.”

New Jersey

New Jersey has implemented the Special Automobile Insurance Policy (SAIP) to help drivers with limited means to afford car insurance. In order to be eligible, you must have a valid New Jersey driver’s license and be currently enrolled in federal Medicaid with hospitalization.

The annual premium of SAIP is $365. Payment can either be made all at once in one lump, or it can be split into two installments. SAIP covers emergency treatment immediately following an accident and treatment of brain and spinal cord injuries up to $250,000. SAIP also provides a death benefit in the amount of $10,000.

It does not cover outpatient treatments or damage that you caused to another person or their property. If your Medicaid benefits are canceled during your standard policy term, you won’t lose your SAIP auto insurance. However, it cannot be renewed once your current policy is expired. To gain in-depth knowledge, consult our comprehensive resource titled “Compare California Car Insurance Rates”

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Exploring Real-World Scenarios in Car Insurance Case Studies

Discover how individuals from varied backgrounds tackle the challenge of finding the right car insurance. These case studies showcase personal experiences with different insurance providers, highlighting how each company meets the unique needs of welfare recipients.

- Case Study #1 – Medical Coverage: A welfare recipient experiences a minor injury in a car accident. Medical coverage insurance swiftly covers hospital expenses and rehabilitation costs, ensuring access to essential healthcare services without financial burden.

- Case Study #2 – Uninsured Motorist Protection: A welfare recipient’s vehicle is hit by an uninsured driver. Uninsured motorist protection insurance covers repair costs and medical bills, providing peace of mind and financial security in the face of unexpected accidents.

- Case Study #3 – Comprehensive Coverage: During a severe storm, a welfare recipient’s car sustains damage from falling debris. Comprehensive coverage insurance ensures repairs are covered, offering protection against various non-collision-related incidents.

By understanding the range of available policies tailored to their needs, individuals can secure not only financial protection but also peace of mind on the road ahead.

Progressive stands out as the champion for welfare recipients, offering customizable coverage options and budget-friendly rates starting as low as $100 for minimum coverage.

Kristen Gryglik Licensed Insurance Agent

Remember, comprehensive coverage isn’t just about meeting legal requirements; it’s about safeguarding against unexpected challenges and ensuring smooth journeys towards a brighter future.

Empowering: Best Insurance Conclusion for Welfare Recipients

Unfortunately, there are only three states that offer low-cost insurance programs to those who receive state assistance. But that doesn’t mean, you can’t find affordable insurance otherwise. Shopping online is the best way to find low-cost insurance.

By using online comparison tools, you can obtain multiple quotes all at once to help you find the coverage that works best for you at a price that you can afford. For you to save the most on car insurance, it’s important to understand what factors affect car insurance rates.

Don’t expect to find cheap car insurance if you get tickets for speeding or other traffic violations. If you do get a ticket, see if there is an opportunity to get it dismissed or reduced. Keeping it off your record could save you hundreds of dollars in the long run.

Consider buying a car that’s cheap to insure. The type of vehicle you drive has a big impact on how much the insurance premium will be.

One of the biggest money-savers that drivers miss out on is car insurance discounts. All auto insurance companies offer different discounts, so make sure you ask your agent to find out everything you’re entitled to. Here are some common car insurance discounts:

- Multi-car discount

- Good student discount

- Bundling car and home insurance policies discount

- Accident-free discount

- Defensive driving course discount

- Safety features discount

So the best way to save money on car insurance is to shop around, apply for car insurance discounts, purchase pay-per mile car insurance policy, or reduce the coverage limits.

Looking for affordable low-income car insurance? Compare low-income car insurance quotes today by entering your ZIP code below.

Frequently Asked Questions

What are the available options for welfare recipients seeking welfare car insurance?

Welfare recipients can explore a range of options including affordable car insurance designed specifically for low income families, or they can seek assistance from auto insurance programs tailored to their financial situation.

How can low income families find affordable car insurance that suits their budget?

Low income families can inquire about auto insurance assistance programs or search for specific initiatives offering affordable coverage tailored to their financial needs and circumstances.

Find cheap car insurance quotes by entering your ZIP code below.

Is there specialized auto insurance available for low income individuals residing in California?

Yes, California offers specialized auto insurance programs aimed at low income drivers and families, such as the California Low Cost Auto Insurance Program, providing them with accessible and affordable coverage options.

For detailed information, refer to our comprehensive report titled “Cheapest Car Insurance in the World.”

What are the eligibility criteria for low income families applying for auto insurance assistance in California?

Eligibility criteria typically include income thresholds and residency requirements established by programs like the California Low Cost Auto Insurance Program, ensuring that assistance reaches those who need it most.

Can individuals receiving welfare purchase a car while remaining within their budget constraints?

Yes, individuals on welfare can generally purchase a car. However, it’s essential for them to carefully consider associated costs, including insurance premiums, to ensure affordability.

Are there specific regulations regarding purchasing a car while on welfare in California?

While there are typically no direct restrictions, individuals on welfare in California should be mindful of their financial situation and consider factors like insurance costs before making a car purchase.

To gain in-depth knowledge, consult our comprehensive resource titled “Car Insurance Comparison.”

How can low income drivers in California access the best car insurance options suited to their needs?

Low income drivers can research and compare various insurance providers, paying special attention to those offering specialized programs like the California Low Cost Auto Insurance Program, tailored for individuals with limited financial resources.

What exactly is the California Low Cost Auto Insurance Program and how does it help low income individuals?

The California Low Cost Auto Insurance Program provides affordable car insurance options to eligible low income drivers, ensuring they meet legal requirements while alleviating the financial burden associated with traditional insurance premiums.

What steps should low income individuals take to obtain auto insurance coverage in California?

Low income individuals can explore various avenues such as the California Low Cost Auto Insurance Program or seek assistance from insurance providers offering specialized programs tailored to their financial circumstances.

For a comprehensive analysis, refer to our detailed guide titled “How do you get car insurance fast?.”

How does participation in auto insurance assistance programs benefit low income families in California?

Participating in auto insurance assistance programs helps low income families afford essential coverage, ensuring they remain compliant with legal requirements while minimizing financial strain and providing peace of mind on the road.

Explore your car insurance options by entering your ZIP code below and finding which companies have the lowest rates.

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.