Best Car Insurance for Young Female Drivers in 2026 (Top 10 Companies)

Progressive, State Farm, and Allstate lead the pack for the best car insurance for young female drivers, with rates starting as low as $39/month. With its innovative concept, it could potentially lower rates by demonstrating safe driving habits without compromising coverage. Maintaining comprehensive coverage

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Licensed Insurance Agent

Justin Wright has been a licensed insurance broker for over 9 years. After graduating from Southeastern Seminary with a Masters in Philosophy, Justin started his career as a professor, teaching Philosophy and Ethics. Later, Justin obtained both his Property & Casualty license and his Life and Health license and began working for State Farm and Allstate. In 2020, Justin began working as an i...

Justin Wright

Licensed Insurance Agent

Kristen is a licensed insurance agent working in the greater Boston area. She has over 20 years of experience counseling individuals and businesses on which insurance policies best fit their needs and budgets. She knows everyone has their own unique needs and circumstances, and she is passionate about counseling others on which policy is right for them. Licensed in Massachusetts, New Hampshire,...

Kristen Gryglik

Updated May 2024

13,283 reviews

13,283 reviewsCompany Facts

Full Coverage for Young Female Drivers

A.M. Best Rating

Complaint Level

13,283 reviews

13,283 reviews 18,155 reviews

18,155 reviewsCompany Facts

Full Coverage for Young Female Drivers

A.M. Best Rating

Complaint Level

Pros & Cons

18,155 reviews

18,155 reviews 11,638 reviews

11,638 reviewsCompany Facts

Full Coverage for Young Female Drivers

A.M. Best Rating

Complaint Level

Pros & Cons

11,638 reviews

11,638 reviewsProgressive, State Farm, and Allstate stand out as the top picks overall for the best car insurance for young female drivers, offering discounted rates and comprehensive coverage options.

Delve into their insurance plans to gain valuable insights into protecting yourself on the road effectively. This article highlights the significance of comprehensive insurance solutions for young female drivers, emphasizing the importance of tailored coverage.

Our Top 10 Company Picks: Best Car Insurance for Young Female Drivers

| Company | Rank | Multi-Policy Discount | Low-Mileage Discount | Best For | Jump Pros/Cons |

|---|---|---|---|---|---|

| #1 | 10% | 5% | Online Convenience | Progressive | |

| #2 | 17% | 30% | Many Discounts | State Farm | |

| #3 | 10% | 5% | Add-on Coverages | Allstate | |

| #4 | 20% | 30% | Usage Discount | Nationwide |

| #5 | 25% | 7.5% | Customizable Polices | Liberty Mutual |

| #6 | 13% | 10% | Accident Forgiveness | Travelers | |

| #7 | 20% | 30% | Student Savings | American Family | |

| #8 | 10% | 15% | Local Agents | Farmers | |

| #9 | 10% | 15% | Policy Options | Esurance | |

| #10 | 5% | 12% | Local Agents | AAA |

These companies offer insights into car insurance complexities. Explore their offerings to make informed decisions and secure suitable coverage. Young female drivers can find cost-effective and tailored insurance solutions with these leading companies.

Find the best comprehensive car insurance quotes by entering your ZIP code above into our free comparison tool today.

- Progressive offers discounted rates for young female drivers

- Tailored coverage options cater to unique needs

- Minimum rates start as low as $39/month

#1 – Progressive: Top Overall Pick

Pros

- User-Friendly Online Tools: Streamlines policy management and claims processing.

- Competitive Rates: Often lower than the industry average for young female drivers.

- Strong Customer Service: Our Progressive car insurance review highlights the company’s responsive and helpful support.

Cons

- Limited Physical Presence: Fewer local offices compared to competitors.

- Variability in Customer Experience: Some reports of inconsistent service quality.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#2 – State Farm: Best for Many Discounts

Pros

- Strong Financial Stability: High ratings for financial health and claim payout reliability.

- Nationwide Network: A large number of agents and offices across the country.

- Tailored to Young Drivers: State Farm car insurance review offers programs specifically for young drivers.

Cons

- Higher Premiums Without Discounts: Base rates can be higher than some competitors.

- Online Platform Less Robust: Not as user-friendly as some digital-first insurers.

#3 – Allstate: Best for Add-On Coverage

Pros

- Strong Agent Network: Access to a large pool of knowledgeable agents is a key feature highlighted in our Allstate car insurance review.

- Innovative Tools: Offers unique tools like Drive wise for personalized rates.

- Solid Reputation: Well-established brand with a strong market presence.

Cons

- Premium Costs: This can be on the higher side, especially without discounts.

- Coverage Costs: Add-ons can significantly increase overall policy costs.

#4 – Nationwide: Best for Usage Discount

Pros

- Wide Coverage Options: Explore Nationwide car insurance discounts for an extensive selection catering to various insurance needs.

- Strong Online Presence: Efficient online services for tech-savvy users.

- Customer Satisfaction: Known for high levels of customer satisfaction.

Cons

- Varies by State: Coverage and discounts can differ significantly by location.

- Premiums Without Discounts: Base rates can be higher than some competitors.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#5 – Liberty Mutual: Best for Customizable Policies

Pros

- Accident Forgiveness: Offers policies that include accident forgiveness.

- Online Tools: Efficient online quote and policy management tools are key features of Liberty Mutual car insurance review.

- Global Presence: Well-established brand with international coverage options.

Cons

- Inconsistent Pricing: Rates can vary widely depending on numerous factors.

- Customer Service Variability: Some customers report variability in service quality.

#6 – Travelers: Best for Accident Forgiveness

Pros

- Wide Range of Coverage: Comprehensive options for diverse needs.

- Strong Financial Stability: Known for its strong financial background.

- Loyalty Benefits: Our Travelers car insurance review highlights the advantages for long-term customers.

Cons

- Higher Rates in Some States: Can be more expensive in certain regions.

- Mixed Customer Service Reviews: Customer satisfaction varies.

#7 – American Family – Best for Student Savings

Pros

- Customizable Coverage: Flexible policy options to suit different needs.

- Strong agent Network: American Family car insurance review highlights the wide availability of knowledgeable agents, ensuring personalized service for customers.

- Technology Integration: Offers tech tools like telematics for personalized rates.

Cons

- Availability: Not available in all states.

- Price Point: Can be expensive without qualifying for discounts.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#8 – Farmers: Best for Local Agents

Pros

- Range of Coverage Options: When exploring car insurance options, it’s crucial to consider Farmers car insurance review, which offers a variety of policy choices.

- Experience: Long-standing reputation in the insurance industry.

- Educational Resources: Provides valuable information for policyholders.

Cons

- Potentially Higher Costs: Base rates can be higher than some other insurers.

- Variable Agent Experience: Quality of service can depend on the individual agent.

#9 – Esurance: Best for Policy Options

Pros

- User-Friendly Online Experience: Strong digital platform for policy management.

- Efficient Claims Processing: Known for quick and easy claims handling, Esurance car insurance quote is a top choice for drivers seeking efficient and reliable coverage.

- Competitive Pricing: Generally offers competitive rates.

Cons

- Limited Physical Presence: Fewer local offices for in-person service.

- Customer Support: Some reports of inconsistencies in customer service.

#10 – AAA: Best for Local Agents

Pros

- Additional Member Benefits: Offers various perks for AAA members.

- Wide Acceptance: Our AAA car insurance review reveals why this well-recognized and respected brand is a top choice for drivers.

- Roadside Assistance: Renowned for its roadside assistance services.

Cons

- Membership Requirement: Insurance services tied to AAA membership.

- Variability in Services: Offerings can vary significantly by region.

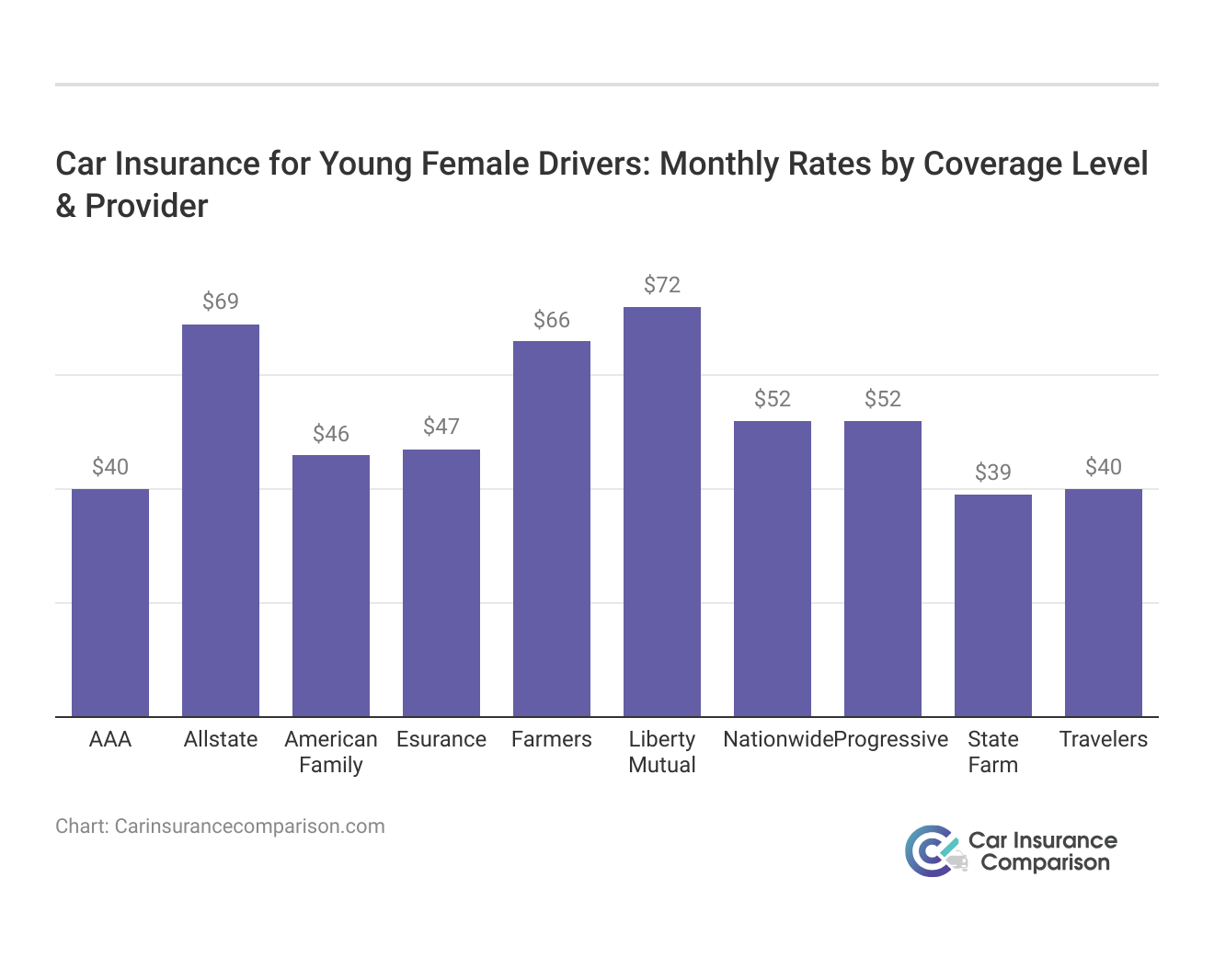

Car Insurance for Young Female Drivers: Monthly Rates by Coverage Level & Provider

| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| AAA | $40 | $107 |

| Allstate | $69 | $181 |

| American Family | $46 | $124 |

| Esurance | $47 | $108 |

| Farmers | $66 | $172 |

| Liberty Mutual | $72 | $187 |

| Nationwide | $52 | $136 |

| Progressive | $52 | $141 |

| State Farm | $39 | $101 |

| Travelers | $40 | $107 |

Getting the Best Rates on Car Insurance for Young Female Drivers

Any driver under 25 will discover that car insurance rates for teens and young drivers are high. It’s hard to find cheap car insurance for young drivers, but shopping around is your best bet. To effectively compare car insurance rates for women, thorough research is essential. The good news for this demographic is that the average cost of auto insurance is less than it is for males. Take a look at the average rates below.

Car Insurance Monthly Rates for Teens by Age & Gender

| Age/Gender | Rates |

|---|---|

| 16-Year-Old Male | $618 |

| 16-Year-Old Female | $566 |

| 17-Year-Old Male | $587 |

| 17-Year-Old Female | $536 |

| 18-Year-Old Male | $501 |

| 18-Year-Old Female | $416 |

| 19-Year-Old Male | $461 |

| 19-Year-Old Female | $386 |

There are a few different things that you may want to do in order to get the cheapest rate. The first thing to do is get an idea of what you will be offered based on your driving record. Traffic tickets should be avoided at all costs because they impact your insurance premiums. Not that you can evade one if it has already happened, but auto insurance companies will typically raise your rates if your history on the road is less than desirable.

Car accidents are even more costly because you have to repair your vehicle and may even need to invest in a new one. According to the Insurance Information Institute, young drivers have high fatal crash rates, raising insurance rates.

Progressive stands out as the top choice for young female drivers with its affordable rates, online convenience, and usage-based insurance program.

Melanie Musson Published Insurance Expert

A few other things that can impact your car insurance rates include the type of vehicle that you are driving and any additional features installed in your car for the purpose of ensuring security and safety.

Renewing Your Insurance Online

Ensuring the regular renewal of your car insurance is crucial to maintain both your and your vehicle’s protection, safeguarding against fines and potential accidents. Opting to renew your policy online offers several advantages: Firstly, it eliminates the need for paperwork to be physically sent to you, streamlining the process.

Additionally, online renewal allows flexibility, enabling you to renew from any location with internet access, whether you’re in a hotel or on a plane. Moreover, utilizing online platforms ensures the secure transmission of your information.

The table presents monthly car insurance rates for young female drivers, categorized by coverage level and provider. It lists ten insurance companies: AAA, Allstate, American Family, Esurance, Farmers, Liberty Mutual, Nationwide, Progressive, State Farm, and Travelers.

For minimum coverage, the rates range from $39 to $72, with AAA offering the lowest rate and Liberty Mutual the highest. For full coverage, the rates span from $101 to $187, with State Farm providing the most affordable option and Liberty Mutual the most expensive.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Finding Car Insurance for Young Female Drivers Online

One of the best places to find car insurance is the internet. Cheap car insurance for young drivers can be hard to find, but you should still look for the lowest rate.

The internet provides plenty of information on the best rates available and information on different policies, required rates, and information about price differences for different types of cars.

Many teenage drivers and young adults behind the wheel think that there is no point in trying to find better rates.

Your options online to secure affordable and suitable car insurance that meets the unique needs of young female drivers.

However, you can find cheaper rates than you’re already paying, simply by doing a little research on the internet.

Car Insurance Requirements for Young Female Drivers

When considering your automobile policy, several key components should be taken into account. Firstly, liability coverage is essential, encompassing bodily injury liability to cover potential injuries to passengers in your vehicle or others involved in an accident, as well as property damage liability for non-vehicle damages like fences or road signs.

Additionally, it’s advisable to explore supplementary coverage options for personal protection, such as rental reimbursement for vehicle breakdowns, towing coverage, and gap insurance to cover the disparity between your loan amount and your car’s value in case of a total loss.

Regularly assessing and comparing insurance options is crucial for securing affordable rates, especially for young female drivers facing higher premiums. While insurance costs may be higher initially, proactive evaluation can lead to long-term savings over your driving lifetime.

Case Study Overviews Tailored Car Insurance Solutions for Young Female Drivers

Explores the experiences of three young female drivers in their search for the right car insurance. Each story highlights how these drivers’ distinct needs and driving habits influenced their insurance choices. These real-life scenarios offer valuable insights for others seeking car insurance, covering aspects from affordability to comprehensive coverage.

- Case Study #1 – Affordable & Comprehensive Coverage: Emma, a 23-year-old in Austin, Texas, chose Progressive for its affordable rates and safe driver car insurance discounts through the Snapshot program. After six months, her premiums decreased, and she appreciated the company’s user-friendly online management and excellent customer service.

- Case Study #2 – Discounts and Comprehensive Coverage: Sarah, a 26-year-old marketing professional in Chicago, prioritized discounts and comprehensive coverage for frequent long-distance travels. She chose State Farm, bundling car and renter’s insurance for savings, and joined the Drive Safe & Save program. Sarah valued State Farm’s local agents for personalized service and savings.

- Case Study #3 – Tailored Coverage: Mia, a 28-year-old entrepreneur in Miami, opted for Allstate due to its comprehensive coverage options, such as new car replacement and roadside assistance. She also enrolled in their Drive wise program for potential discounts. Mia valued fair premiums and positive interactions with local agents, enhancing her satisfaction.

From prioritizing affordability and safe driving discounts to seeking comprehensive coverage for frequent travels, each story underscores the importance of tailored insurance solutions.

Progressive emerges as the top provider for young female drivers, boasting an impressive customer review rating of 90%.

Brandon Frady Licensed Insurance Agent

These real-life examples offer valuable insights for others navigating the complexities of car insurance, emphasizing factors such as discounts, coverage options, and personalized service.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Smart Choices: Navigating Car Insurance for Young Women

This guide provides a thorough comparison of car insurance for young female drivers, focusing on average car insurance rates by age and gender. Analyzing factors such as credit scores, mileage, and coverage levels helps readers make informed decisions for affordable policies tailored specifically for young female drivers.

Emphasizing the importance of research and comparison shopping, it also stresses maintaining a clean driving record and seeking available discounts. Ultimately, by understanding their specific needs, young female drivers can secure suitable car insurance that offers protection and affordability.

When you’re ready to see how much you can save on your car insurance, enter your ZIP code below into our free comparison tool.

Frequently Asked Questions

What insurance company is the cheapest for young female drivers?

State Farm offers the most affordable car insurance for young female drivers, with monthly premiums starting as low as $39. This makes State Farm a competitive choice for those seeking budget-friendly coverage options.

At what age is car insurance cheapest?

Experienced drivers are less likely to have accident claims, which means they cost less to insure. At Progressive, the average premium per driver tends to decrease significantly from 19–34 and then stabilize or decrease slightly from 34–75.

Enter your ZIP code below into our free comparison tool to see how much car insurance costs in your area.

What’s the best first car?

The easiest car to recommend to just about anyone looking for a good first car is the Honda Fit. Affordably available, solidly reliable, extremely space-efficient, and easy to drive, the Fit carries on the tradition of lightweight Honda hatchbacks from the EG and EK Civics.

Explore our exhaustive guide on commercial auto insurance entitled “Compare Honda Car Insurance Rates” to gain valuable insights, and make informed decisions.

How do I choose my first driver?

It may well help to think about your current driver’s shooting pattern. Shafts that are too stiff will struggle to offer enough flight, and the ball will have a tendency to drift right (for right-handers). Shafts that have too much flex will tend to create too much spin, and right-handed golfers may miss left more than right.

What is the best loft for a women’s driver?

In reality, many women will achieve optimum performance from a driver that has between 9° and 11° of loft—no more—and it comes down to the combination of good coaching and modern driver designs. The trend among drivers is to place the weight low and deep in the head, as this helps give a more effortlessly high launch.

What are the top 3 types of insurance?

We begin with an overview of the types of insurance from both a consumer and a business perspective. Then we examine in greater detail the three most important types of insurance: property, liability, and life.

For further exploration, consult our comprehensive analysis entitled “Compare Liability Car Insurance: Rates, Discounts, & Requirements,” concluding with essential insights.

What age is most expensive to insure?

Young drivers ages 16 to 24 tend to have the most expensive car insurance. Drivers in this age group are often inexperienced and are more likely to get into car accidents and file insurance claims. As a result, car insurance companies often charge higher premiums to young drivers.

To gain comprehensive insight, consult our in-depth examination entitled “Car Insurance Claim Investigation,” concluding with key findings.

What insurance group is best for young drivers?

Group 1 insurance cars can be a great option for younger drivers, as they’re usually the cheapest to insure and are among the cheapest to buy and repair. They also tend to have less powerful engines. If you have a large family, you might need something bigger, as Group 1 cars tend to be small hatchbacks.

By entering your ZIP code below, you can get instant car insurance quotes from top providers.

What is the cheapest car insurance for a 21 year old female?

The cheapest car insurance for 21-year-olds is USAA, which offers average rates of $134 per month. However, USAA is only available to military members, veterans, and their immediate families. Geico is the cheapest company available to any 21-year-old driver, with average rates of $154 per month.

Delve into our extensive guide titled “Cheapest Car Insurance in the World” for further insights, tips, and savings strategies.

What type insurance is best for young adults?

Try a catastrophe insurance plan. These plans focus on the worst-case scenarios, such as serious injuries or illnesses. People under 30 are eligible to purchase this type of plan. Here are other features of catastrophic insurance plans: cost: catastrophic plans have low monthly premiums but high deductibles.

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.