10 Best Classic Car Insurance Companies in 2026

Safeco, State Farm, and The General are the best classic car insurance companies, offering specialized coverage and competitive rates starting at $27/month, making them the most affordable. These companies provide customizable plans and extensive global coverage to cater to the unique needs of classic car owners.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Licensed Insurance Agent

Scott W Johnson is an independent insurance agent in California. Principal Broker and founder of Marindependent Insurance Services, Scott brings over 25 years of experience to his clients. His Five President’s Council awards prove he uses all he learned at Avocet, Sprint Nextel, and Farmers Insurance to the benefit of his clients. Scott quickly grasped the unique insurance requirements of his...

Scott W. Johnson

Commercial Lines Coverage Specialist

Michael Vereecke is the president of Customers First Insurance Group. He has been a licensed insurance agent for over 13 years. He also carries a Commercial Lines Coverage Specialist (CLCS) Designation, providing him the expertise to spot holes in businesses’ coverage. Since 2009, he has worked with many insurance providers, giving him unique insight into the insurance market, differences in ...

Michael Vereecke

Updated May 2024

1,278 reviews

1,278 reviewsCompany Facts

Full Coverage for Classic Car

A.M. Best Rating

Complaint Level

Pros & Cons

1,278 reviews

1,278 reviews 18,155 reviews

18,155 reviewsCompany Facts

Full Coverage for Classic Car

A.M. Best Rating

Complaint Level

Pros & Cons

18,155 reviews

18,155 reviews 843 reviews

843 reviewsCompany Facts

Full Coverage for Classic Car

A.M. Best Rating

Complaint Level

843 reviews

843 reviewsThe top picks for the best classic car insurance companies are Safeco, State Farm, and The General. These providers offer specialized coverage for classic car owners’ unique needs. If you’re wondering how to get car insurance fast, these companies ensure prompt protection.

Whether you seek customizable plans or global protection, these companies have you covered. Compare your options to find the perfect policy for your vintage vehicle.

Our Top 10 Picks: Best Classic Car Insurance Companies

| Company | Rank | Multi-Policy Discount | Low-Mileage Discount | Best For | Jump to Pros/Cons |

|---|---|---|---|---|---|

| #1 | 20% | 15% | Specialized Coverage | Safeco | |

| #2 | 10% | 8% | Customizable Policies | State Farm | |

| #3 | 15% | 12% | Worldwide Coverage | The General | |

| #4 | 15% | 10% | Local Agents | Chubb | |

| #5 | 12% | 7% | Low Premiums | Grundy |

| #6 | 8% | 5% | Restoration Coverage | Allstate | |

| #7 | 10% | 6% | Roadside Assistance | Nationwide |

| #8 | 12% | 8% | Customized Coverage | Progressive | |

| #9 | 10% | 7% | Flexible Usage | Farmers | |

| #10 | 8% | 5% | Restoration Coverage | Liberty Mutual |

Securing the right insurance is essential for ensuring your classic car is well-protected and can be enjoyed for years to come.

Get the right car insurance at the best price — enter your ZIP code above to shop for coverage from the top insurers.

#1 – Safeco: Top Overall Pick

Pros

- Cost-Effective Rates: Safeco offers competitive rates, making classic car insurance affordable. Read more about Safeco car insurance review.

- Tailored Policies: Specialized coverage ensures your classic vehicle gets the protection it deserves.

- Reputable Company: As a well-known insurer, Safeco provides reliability and trust in the classic car insurance market.

Cons

- Limited Discounts: Safeco may have fewer discounts compared to some competitors.

- Availability: Coverage options may vary by location, limiting accessibility for some customers.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#2 – State Farm: Best for Tailor-Made Policies

Pros

- Flexibility: Allows for highly customizable policies, letting you tailor coverage to your specific needs.

- Wide Range of Services: Beyond standard coverage, offers additional services and benefits.

- Excellent Customer Service: Known for its responsive and helpful customer service. Explore our State Farm car insurance review.

Cons

- Potentially Higher Rates: While customizable, policies might be pricier for some customers.

- Complexity: The multitude of customization options may be overwhelming for those seeking a straightforward policy.

#3 – The General: Best for Global Coverage

Pros

- Global Protection: The General provides coverage worldwide, ideal for classic car enthusiasts with international travel plans.

- Accessibility: The General is known for making insurance accessible to drivers with various backgrounds and histories.

- Quick Quotes: The company is praised for its efficient process in providing quick insurance quotes. Take a look at our The General car insurance review.

Cons

- Limited Specialty Coverage: While offering worldwide coverage, The General might lack certain specialized options for classic cars.

- Varied Customer Service: Customer service reviews can be mixed, with some customers reporting less satisfactory experiences.

#4 – Chubb: Best for Personalized Service

Pros

- Personalized Service: Chubb’s local agents offer personalized assistance, understanding the unique needs of classic car owners.

- Highly Rated: The company is well-regarded for its customer satisfaction and financial strength.

- Global Presence: Chubb’s global presence adds an extra layer of support for those with international interests.

Cons

- Potentially Higher Premiums: Chubb’s personalized service might come with higher car insurance premiums compared to some competitors.

- Limited Online Presence: The reliance on local agents may result in a less streamlined online experience for customers.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#5 – Grundy: Best for Low Premiums

Pros

- Affordability: Grundy is known for providing classic car insurance with low premiums, appealing to budget-conscious customers looking for monthly car insurance.

- Agreed Value Coverage: Policies often include agreed value coverage, ensuring fair compensation in case of a total loss.

- Coverage Variety: Grundy offers coverage for various types of classic vehicles beyond just cars.

Cons

- Limited Discounts: Grundy may not offer as many discounts as larger insurers.

- Age Restrictions: Some of Grundy’s policies might have age restrictions for eligible vehicles.

#6 – Allstate: Best for Comprehensive Coverage

Pros

- Comprehensive Restoration Coverage: Allstate offers specialized coverage for classic car restoration, ensuring protection during the restoration process.

- Nationwide Network: The company’s extensive network allows for convenient access to services and support.

- Multiple Policy Discounts: Allstate often provides discounts for bundling multiple policies. View our Allstate car insurance review.

Cons

- Potentially Higher Premiums: Premiums may be higher compared to some competitors due to the comprehensive restoration coverage.

- Limited Specialty Options: While offering restoration coverage, Allstate may not have as many specialized options for classic cars as dedicated insurers.

#7 – Nationwide: Best for Roadside Assistance

Pros

- Inclusive Roadside Assistance: Nationwide includes roadside assistance in its classic car policies, providing peace of mind during travels.

- Flexible Coverage: Customers can customize their coverage based on individual needs and preferences. Explore our Nationwide car insurance discounts.

- Strong Financial Ratings: Nationwide’s financial strength adds reliability to its services.

Cons

- Premium Costs: The inclusion of roadside assistance might impact premiums, potentially making them higher.

- Varied Customer Service: Customer service experiences may vary, with some customers reporting less satisfaction.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#8 – Progressive: Best for Coverage Customization

Pros

- Highly Customizable Policies: Progressive allows customers to tailor coverage according to their unique preferences and usage.

- Innovative Tools: The company offers advanced online tools for a streamlined and convenient insurance experience.

- Discount Opportunities: Progressive provides various discounts, potentially reducing overall premium costs. According to our Progressive car insurance review, these savings can be significant.

Cons

- Complex Options: The abundance of customization options may be overwhelming for those seeking a straightforward policy.

- Potential for Higher Rates: While offering customization, Progressive’s rates may not be the most competitive for all customer profiles.

#9 – Farmers: Best for Flexibility Coverage

Pros

- Usage Flexibility: Farmers cater to various usage patterns, allowing for flexible coverage based on how the classic car is used.

- Discount Options: Farmers provide different discounts, offering potential savings for policyholders. Our Farmers car insurance review highlights these opportunities.

- Strong Customer Support: The company is known for its responsive and supportive customer service.

Cons

- Possible Premium Variations: Premiums may vary based on usage patterns, potentially resulting in higher costs for certain usage scenarios.

- Limited Specialty Coverage: Farmers may have fewer specialized coverage options compared to some dedicated classic car insurers.

#10 – Liberty Mutual: Best for Specialized Coverage

Pros

- Dedicated Restoration Coverage: Liberty Mutual offers coverage specifically designed for classic car restoration, ensuring protection during the restoration process.

- Discount Opportunities: The company often provides discounts for various factors, contributing to potential cost savings.

- Digital Tools: Liberty Mutual offers online tools for a convenient and modern insurance experience. Our Liberty Mutual car insurance review shows the company is highly regarded for these innovations.

Cons

- Premium Considerations: Restoration coverage might impact premiums, potentially making them higher than competitors without such specialized coverage.

- Policy Options: Liberty Mutual’s classic car insurance options may not be as extensive as some dedicated classic car insurers.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

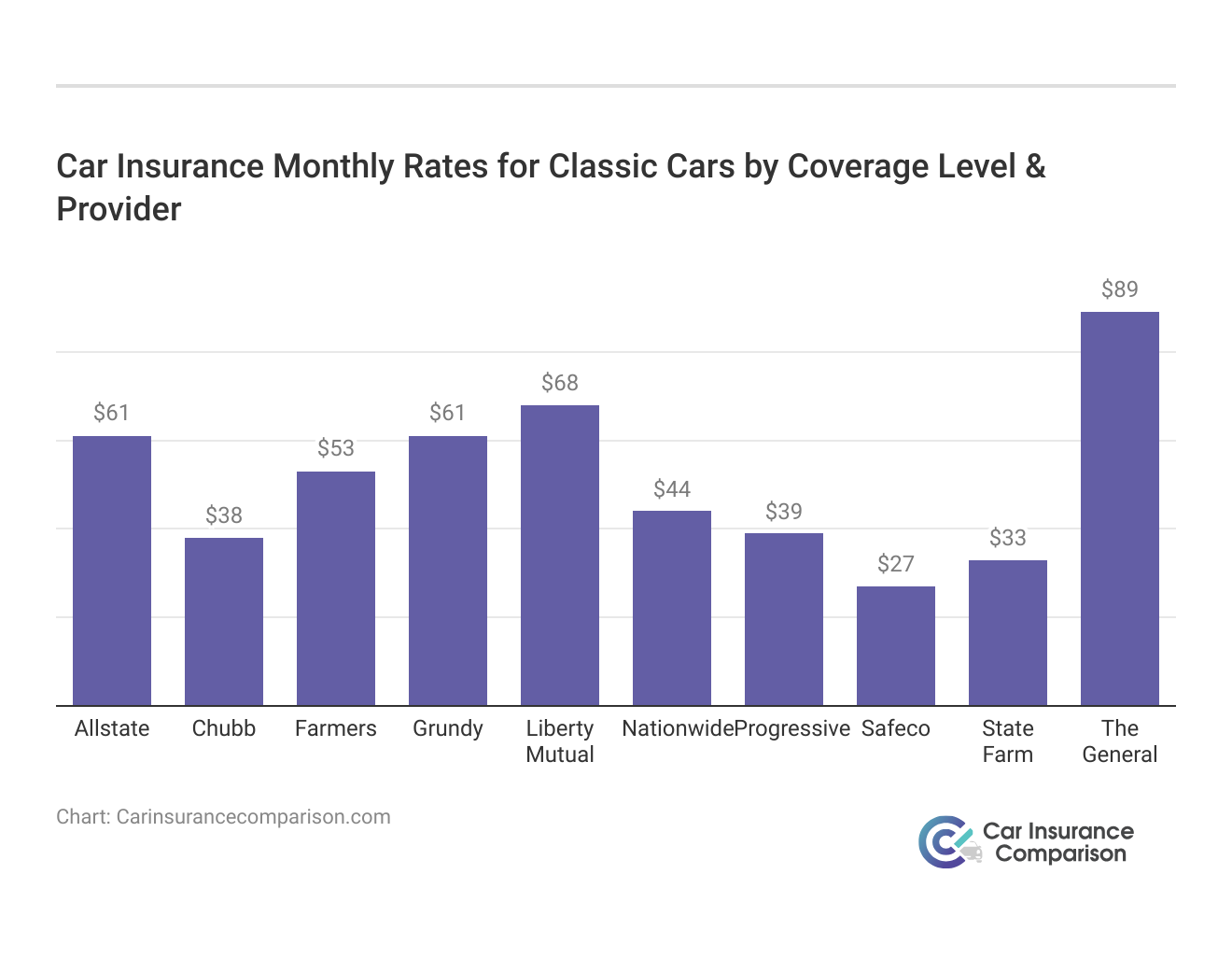

Coverage Rate for Classic Car Insurance

When considering insurance options for classic cars, it’s crucial to assess both the minimum and full coverage car insurance rates offered by different companies. This comparison provides a comprehensive overview of the monthly rates from various insurers, aiding classic car owners in making informed decisions.

Car Insurance Monthly Rates for Classic Cars by Coverage Level & Provider

| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| Allstate | $61 | $160 |

| Chubb | $38 | $58 |

| Farmers | $53 | $139 |

| Grundy | $61 | $232 |

| Liberty Mutual | $68 | $174 |

| Nationwide | $44 | $115 |

| Progressive | $39 | $105 |

| Safeco | $27 | $71 |

| State Farm | $33 | $86 |

| The General | $89 | $225 |

The table reveals distinctive coverage rates for minimum and full insurance from leading providers. Safeco emerges as the most affordable with a minimum coverage rate of $27 and a full coverage rate of $71. On the other end, The General commands a higher price range, starting at $89 for minimum coverage and escalating to $225 for full coverage.

The rates from State Farm, Chubb, Grundy, Allstate, Nationwide, Progressive, Farmers, and Liberty Mutual fall within this spectrum, offering varying affordability and comprehensive coverage options.

Safeco stands out as the optimal choice for classic car insurance with its affordable rates, comprehensive coverage, and specialized protection tailored for classic car enthusiasts.

Brad Larson Licensed Insurance Agent

Choosing the right insurance for classic cars involves balancing cost and coverage. Safeco is cost-effective, while Grundy or Liberty Mutual offer broader protection at higher rates. This coverage rate comparison helps classic car enthusiasts select a plan that fits their preferences and budget.

The Best Classic Car Insurance Companies

When selecting an insurance company for your classic car, you have many choices, from major providers like State Farm and Geico to specialized companies like Hagerty, making it essential to compare plans for the perfect coverage. Enthusiasts often prefer dedicated classic car insurers for their knowledge and support. Knowing your car’s primary use, whether for pleasure drives or shows, is crucial before getting insurance.

Grundy Insurance offers coverage for cars over 25 years old and includes liability, collision, comprehensive, and more, with the Original Olde plan tailored for classic cars. Hagerty covers cars used for club functions, tours, exhibitions, and occasional cruises, offering add-ons like Hagerty Plus, instant new car coverage, flexible usage, guaranteed value, and car show reimbursement.

Safeco offers policies for cars at least ten years old, including agreed value coverage, limited use, diminishing deductible, roadside assistance, emergency assistance, and personal property coverage. Hagerty and Safeco may reject applicants with marks on their records, making State Farm or Geico more accommodating. For those seeking car insurance companies that offer agreed value, these providers are excellent options.

The table compares monthly insurance rates for classic cars from various providers, highlighting both minimum and full coverage options. Safeco offers the lowest rates at $27 for minimum and $71 for full coverage. State Farm follows with $33 for minimum and $87 for full coverage.

Chubb, Progressive, and Nationwide offer moderate rates, while The General has the highest at $89 for minimum and $225 for full coverage. Coverage options include liability, comprehensive, collision, and agreed value.

Classic Car Insurance Cost Breakdown

Classic car owners will be pleased to know that coverage usually costs less than a standard insurance policy. Most classic car insurance policies limit the number of miles you can drive, keeping your car relatively risk-free. When comparing classic and standard car insurance, it’s important to understand these differences to make an informed decision.

Some insurance companies are so strict about classic car mileage rules that you might have to prove you own another vehicle. That way, the company knows that you have a different vehicle for daily driving. Consider the following companies to get an idea of how expensive it might be to insure your classic car. Typically, the price of your insurance comes out to be between $600 and $1,000 a year. Of course, the exact price you’ll pay will depend on various factors unique to your situation.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Find the Right Insurance for Your Classic Car

From insurance giants like State Farm to specialized providers like Hagerty, you have plenty of options for classic car insurance. You should always choose a plan that works with whatever you do with your car, whether classic car clubs, shows, or pleasure cruises.

Once you’ve determined your coverage needs, your next step should be to compare companies. Look at as many quotes as possible to find the best rates for your classic car, especially if you are considering car insurance pleasure driving.

Safeguarding Classic Car: Case Studies With Leading Car Insurance Companies

Safeguarding a classic car requires specialized insurance to meet unique needs. The following case studies highlight how leading car insurance companies provide tailored solutions to protect these valuable vehicles.

- Case Study #1 – Preserving the Elegance of Ford Mustang: John Davenport, a classic car enthusiast, owns a restored 1965 Ford Mustang. He chose Safeco for comprehensive coverage, ensuring his Ford Mustang car insurance includes agreed value, theft, damage, and transport protection. This allows John to attend car shows confidently, knowing his Mustang is protected at its true value.

- Case Study #2 – Tailor-Made Policies for a Fleet of Classic Cars: Emily Rodriguez, a vintage car collector, chose State Farm for their flexible, tailor-made policies. State Farm provided comprehensive coverage, liability protection, and agreed value coverage, ensuring her diverse collection, including Chevrolet car insurance, was well-protected.

- Case Study #3 – Global Coverage for a 1978 Mercedes-Benz SL: Mark Thompson, a classic car enthusiast with a 1978 Mercedes-Benz SL, chose The General for its global coverage. The policy covered accidents, theft, and other risks, allowing Mark to confidently showcase his car worldwide. This highlighted the importance of specialized Mercedes car insurance for international protection.

These case studies demonstrate the importance of selecting the right insurance provider to protect classic cars.

Safeco stands out as the best classic car insurance company with a 95% customer satisfaction rating, offering affordable and comprehensive coverage tailored to enthusiasts' needs.

Heidi Mertlich Licensed Insurance Agent

Whether it’s for local car shows or international exhibitions, tailored car insurance policies ensure these valuable vehicles are safeguarded against various risks.

Choosing the Best Insurance for Your Classic Car

Selecting the right insurance for your classic car requires careful consideration of various factors such as coverage options, cost, and the specific needs of your vintage vehicle. With competitive rates and specialized protection available, classic car enthusiasts have multiple options to choose from.

It’s essential to compare quotes from different providers to find the best deal that offers comprehensive coverage and peace of mind. How do you get competitive quotes for car insurance is crucial in ensuring that your cherished automobile is well-protected, allowing you to enjoy it without worries.

Find the best comprehensive car insurance quotes by entering your ZIP code below into our free comparison tool today.

Frequently Asked Questions

What are the best antique car insurance companies available today?

The best antique car insurance companies include Safeco, State Farm, and The General. These providers offer specialized coverage for antique vehicles and have received positive reviews for their affordability and comprehensive plans.

To gain further insights, consult our guide titled “Compare Comprehensive Car Insurance” for more details.

Which companies are considered the best auto insurance for classic cars?

The best auto insurance for classic cars is offered by companies like Safeco, State Farm, and The General. These companies provide tailored policies that cater to the unique needs of classic car owners.

See how much you’ll pay for car insurance by entering your ZIP code below into our free comparison tool.

How do antique car insurance reviews help in selecting a provider?

Antique car insurance reviews provide insights into customer satisfaction, claims processes, and overall reliability of insurance providers. Reading these reviews can help you choose the best antique car insurance companies based on real user experiences.

For more information, check out our detailed guide titled “How do you file a car insurance claim?” for a concise summary.

What makes a company the best classic insurance provider?

The best classic insurance provider offers comprehensive coverage, affordable rates, excellent customer service, and positive classic car insurance reviews. Companies like State Farm and The General are often highlighted for their superior offerings.

Who are the top providers of the best classic auto insurance?

The top providers of the best classic auto insurance include Safeco, State Farm, and The General. These companies offer specialized coverage, competitive rates, and have strong reputations in the industry.

What factors should I consider when looking for the best car insurance for classic cars?

When searching for the best car insurance for classic cars, consider factors like coverage options, agreed value policies, customer service, and rates. Comparing classic car insurance companies can help you find the best policy for your needs.

To gain further insights, check out our extensive resource on insurance titled “Factors That Affect Car Insurance Rates,” and discover valuable information.

Which are the best collector car insurance companies?

The best collector car insurance companies include Hagerty, Grundy, and Chubb. These providers offer tailored coverage for collector cars, ensuring that your valuable vehicle is well-protected.

How can I find the best muscle car insurance?

To find the best muscle car insurance, compare policies from providers known for their specialized coverage, such as Safeco and State Farm. Look for companies that offer agreed value policies and have positive classic car insurance company ratings.

By entering your ZIP code below, you can get instant car insurance quotes from top providers.

What should I look for in the best rated classic car insurance?

The best rated classic car insurance should offer comprehensive coverage, competitive rates, and high customer satisfaction. Check classic car insurance reviews and ratings from companies like Grundy and Hagerty to make an informed decision.

To explore further, refer to our comprehensive report titled “Compare Car Insurance by Coverage Type” for more details.

Where can I find a list of classic car insurance companies?

You can find a list of classic car insurance companies by researching online resources, reviewing collector car insurance companies lists, and reading industry publications. This can help you compare different providers and choose the best insurance for your classic car.

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.