Best Domino’s Delivery Insurance in 2026 (Top 10 Companies)

The best Domino's delivery insurance provided by Progressive, USAA, and State Farm. These companies excel in offering discounts of up to 35%, distinctive benefits, and customized coverage options specifically designed for delivery drivers.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Licensed Insurance Agent

Daniel Walker graduated with a BS in Administrative Management in 2005 and has run his family’s insurance agency, FCI Agency, for over 15 years (BBB A+). He is licensed as an insurance agent to write property and casualty insurance, including home, life, auto, umbrella, and dwelling fire insurance. He’s also been featured on sites like Reviews.com and Safeco. To ensure our content is accura...

Daniel Walker

Licensed Insurance Producer

Dani Best has been a licensed insurance producer for nearly 10 years. Dani began her insurance career in a sales role with State Farm in 2014. During her time in sales, she graduated with her Bachelors in Psychology from Capella University and is currently earning her Masters in Marriage and Family Therapy. Since 2014, Dani has held and maintains licenses in Life, Disability, Property, and Casualt...

Dani Best

Updated May 2024

13,283 reviews

13,283 reviewsCompany Facts

Full Coverage for Domino’s Delivery

A.M. Best Rating

Complaint Level

13,283 reviews

13,283 reviews 6,589 reviews

6,589 reviewsCompany Facts

Full Coverage for Domino’s Delivery

A.M. Best Rating

Complaint Level

6,589 reviews

6,589 reviews 18,155 reviews

18,155 reviewsCompany Facts

Full Coverage for Domino’s Delivery

A.M. Best Rating

Complaint Level

Pros & Cons

18,155 reviews

18,155 reviewsSo what kind of coverage do you need? Will liability auto insurance coverage be required? Can you buy Domino’s Pizza car insurance? What’s the difference between personal and commercial coverage? What are the average Domino’s Pizza car insurance rates? Read this article to find out everything you need to know about Domino’s Pizza car insurance.

Our Top 10 Picks: Domino's Pizza Car Insurance

| Company | Rank | Multi-Policy Discount | Low-Mileage Discount | Best For | Jump to Pros/Cons |

|---|---|---|---|---|---|

| #1 | 10% | 20% | Online Convenience | Progressive | |

| #2 | 10% | 20% | Military Savings | USAA | |

| #3 | 17% | 30% | Many Discounts | State Farm | |

| #4 | 25% | 35% | Add-on Coverages | Allstate | |

| #5 | 15% | 20% | Local Agents | Farmers | |

| #6 | 20% | 20% | Usage Discount | Nationwide |

| #7 | 25% | 30% | Customizable Polices | Liberty Mutual |

| #8 | 8% | 10% | Accident Forgiveness | Travelers | |

| #9 | 20% | 20% | Student Savings | American Family | |

| #10 | 5% | 10% | Deductible Reduction | The Hartford |

If you’re ready to start shopping for car insurance as a Domino’s Pizza delivery driver, take a minute to use your ZIP code in our free tool to start comparing rates right now.

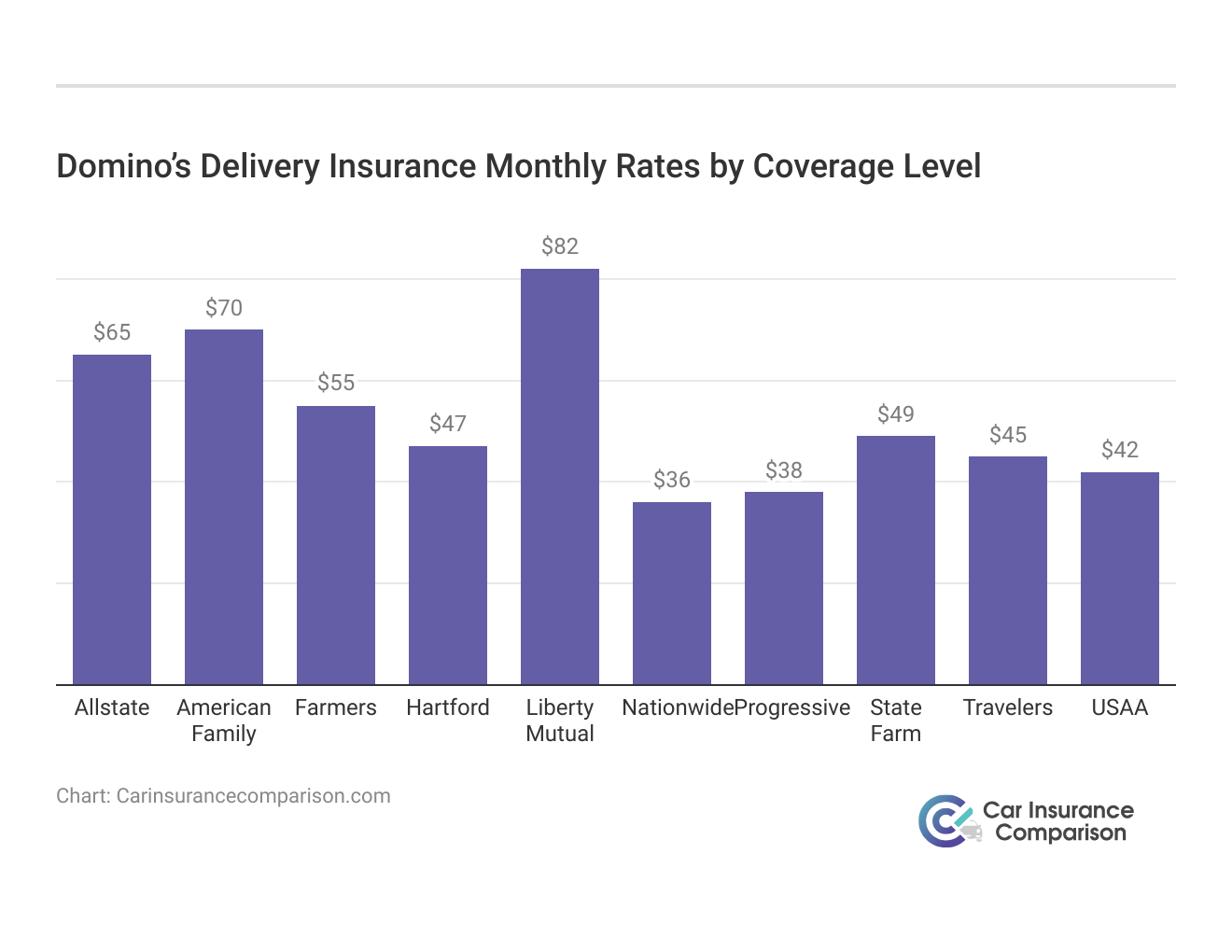

Domino’s Delivery Insurance Monthly Rates by Coverage Level

| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| Allstate | $65 | $204 |

| American Family | $70 | $179 |

| Farmers | $55 | $152 |

| Hartford | $47 | $130 |

| Liberty Mutual | $82 | $211 |

| Nationwide | $36 | $88 |

| Progressive | $38 | $115 |

| State Farm | $49 | $162 |

| Travelers | $45 | $123 |

| USAA | $42 | $118 |

Nationwide stands out with the lowest rate at $36 per month for minimum coverage, while Liberty Mutual offers the highest at $82.

Progressive stands out as the top choice for Domino's Pizza car insurance, offering competitive rates and online convenience for delivery drivers.

Melanie Musson Published Insurance Expert

For full coverage, Nationwide maintains a competitive edge with a rate of $88, while Liberty Mutual remains the highest at $211. Understanding these rates enables Domino’s Pizza delivery drivers to make informed insurance decisions. (Read more: Best Full Coverage Car Insurance)

Car Insurance Needs for Domino’s Pizza Delivery Drivers

When it comes to insuring your Domino’s Pizza delivery vehicle, choosing the right insurance is crucial. We’ve compiled a list of the top insurance providers that understand the distinct needs of delivery drivers. From Progressive’s online convenience to USAA’s military savings, these top picks offer tailored coverage to ensure you’re protected on the road.

Progressive stands out as a leading choice, providing not only competitive rates but also the ease of managing your insurance online. Their user-friendly platform makes it simple for Domino’s Pizza delivery drivers to navigate coverage options. For specific rates and details, refer to the table below to make an informed decision that suits your delivery needs and preferences.

Why is your car insurance coverage so important? Crosley Law reports that your chances of getting in an accident on the road as a delivery driver are significantly higher than individuals in other occupations. For more information, read our article titled “How much does a minor accident affect car insurance rates?“.

Read through the next section to learn more about where you can get Domino’s Pizza delivery driver insurance.

Finding Car Insurance for Domino’s Delivery Drivers

If you’re looking for commercial coverage, you can purchase it from most major car insurance companies. All you need to do to update your policy is reach out to your insurance agent.

So how much does Domino’s Pizza delivery insurance cost? With a commercial policy, you’ll find your rates will increase by an average of $150 per month.

But we know this is expensive, so if you’re looking for more affordable Domino’s Pizza car insurance, one option is a delivery driver add-on, a pizza delivery insurance program several car insurance companies offer. These companies include:

- Crump Property & Casualty

- Geico

- International Property & Casualty

- Progressive

- State Farm

- Sunderland Insurance

Another way to save on insurance is to compare at least three Domino’s Pizza car insurance quotes to make sure you’re getting the best bang for your buck.

Read more:

- Does car insurance cover food delivery vehicles?

- Uber Eats Car Insurance: Compare Rates, Discounts, & Requirements

- Case Study #1 – Saving With Progressive’s Online Convenience: Meet Alex, a Domino’s Pizza delivery driver who values efficiency and simplicity. Alex opted for Progressive’s car insurance due to its online convenience. The user-friendly interface allowed Alex to easily manage policies and access essential information on the go. Not only did Progressive offer competitive rates, but the online platform made the insurance process seamless for a busy delivery driver like Alex.

- Case Study #2 – Military Savings With USAA: Sarah, a dedicated Domino’s Pizza delivery driver and a military service member, sought insurance that understood her unique circumstances. USAA became Sarah’s top choice, providing not only specialized coverage for delivery drivers but also military savings. The tailored insurance plan not only met Sarah’s delivery needs but also aligned with her commitment to serving in the military.

- Case Study #3 – Comprehensive Coverage With State Farm: James, an experienced Domino’s Pizza delivery driver, prioritized comprehensive coverage to protect against unexpected incidents on the road. State Farm emerged as James’ go-to choice, offering a range of discounts and add-ons. With a focus on providing many discounts, State Farm tailored coverage to match James’ specific requirements. Explore our State Farm car insurance review to understand the rates and benefits that make State Farm an excellent choice for delivery drivers seeking comprehensive protection.

- Case Study #4 – Local Agents at Farmers: Emily, a Domino’s Pizza delivery driver who values personalized service, found the ideal insurance solution with Farmers. The presence of local agents provided Emily with the support and guidance she needed to navigate insurance options. Farmers’ commitment to community-based service and local presence made it a standout choice for Emily.

- Case Study #5 – Usage Discount With Nationwide: David, a part-time Domino’s Pizza delivery driver, prioritized cost-effectiveness in his insurance choice. Nationwide’s usage discount caught David’s attention, offering a practical solution for someone who primarily used their vehicle for delivery purposes.

By understanding their individual needs and exploring the benefits offered by different insurance providers, these drivers found the perfect balance of coverage, savings, and support for their delivery endeavors.

Domino’s Pizza Car Insurance: The Bottom Line

As a Domino’s Pizza delivery driver, you’ll need to provide proof of insurance, but your personal policy probably won’t be enough coverage. In addition to your personal policy, you’ll need commercial coverage or a delivery driver add-on to make sure you’re protected while out on delivery. (Read more: Understanding Your Car Insurance Policy)

Before you go, enter your ZIP code in the free tool on this page to start comparing quotes for car insurance for Domino’s Pizza delivery drivers.

Frequently Asked Questions

What makes Domino’s Pizza car insurance different from regular car insurance?

Domino’s Pizza car insurance is tailored to the unique needs of delivery drivers. While personal car insurance may not cover commercial activities like pizza delivery, specialized coverage accounts for the increased risks associated with this occupation.

Is personal car insurance enough for Domino’s Pizza delivery drivers?

While Domino’s requires drivers to have personal coverage, it may not suffice during pizza deliveries. Delivery drivers should consider obtaining commercial coverage or a specific delivery driver add-on to ensure adequate protection while on the job.

How much does Domino’s Pizza car insurance cost on average?

The cost of Domino’s Pizza car insurance varies, but on average, commercial policies may increase rates by around $150 per month. The actual cost depends on factors such as coverage level, driving record, and the insurance provider

Ready to find affordable car insurance? Use our free comparison tool below to get started.

Can I get discounts on Domino’s Pizza car insurance?

Yes, many insurance providers offer discounts for Domino’s Pizza car insurance. Common discounts include safe driving incentives, multi-policy discounts, and reductions for completing defensive driving courses. Each provider may have different discount options, so it’s advisable to inquire about available discounts.

What factors determine the cost of Domino’s Pizza car insurance?

The cost of Domino’s Pizza car insurance is influenced by various factors, including the driver’s age, driving history, vehicle type, coverage limits, location, and the insurance provider’s pricing structure. Additionally, factors such as the frequency of deliveries and the distance traveled during deliveries may also impact the premium.

Does Domino’s Pizza provide car insurance for its delivery drivers?

No, Domino’s Pizza does not directly provide car insurance for its delivery drivers. However, they may have partnerships with insurance providers to offer specialized programs. It’s recommended to inquire with your local Domino’s Pizza franchise or contact insurance providers directly to explore available options.

Are there specific requirements or restrictions for vehicles insured under Domino’s Pizza delivery insurance?

Insurance policies for Domino’s Pizza delivery drivers may have specific requirements or restrictions regarding the type and condition of vehicles covered. Some insurers may require vehicles to meet certain safety standards and have commercial-grade equipment installed, while others may have restrictions on vehicle age or mileage.

Explore your car insurance options by entering your ZIP code below and finding which companies have the lowest rates.

How does a delivery driver add-on differ from a standard commercial insurance policy?

A delivery driver add-on is a specialized insurance endorsement designed to provide coverage for delivery drivers using their personal vehicles for commercial purposes, such as delivering pizzas. Unlike a standard commercial insurance policy, which covers vehicles primarily used for business purposes, a delivery driver add-on extends coverage to personal vehicles used for occasional commercial activities, typically at a more affordable rate.

Can Domino’s Pizza delivery drivers insure multiple vehicles under the same policy?

In most cases, Domino’s Pizza delivery drivers can insure multiple vehicles under the same policy, provided they meet the insurer’s eligibility criteria. Insurers may offer multi-vehicle discounts for drivers insuring more than one vehicle under the same policy, potentially reducing overall insurance costs.

Are there any specialized coverage options available for Domino’s Pizza delivery drivers, such as coverage for vehicle modifications or equipment used for deliveries?

Some insurance providers offer specialized coverage options tailored to the unique needs of Domino’s Pizza delivery drivers. These options may include coverage for vehicle modifications necessary for delivery purposes, such as custom racks or signage, as well as coverage for specialized equipment used during deliveries, such as hot bags or GPS devices. It’s important for drivers to discuss their specific needs with their insurance agent to ensure they have adequate coverage.

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.