Best Low-Mileage Car Insurance in 2026 (Your Guide to the Top 10 Providers)

The best low-mileage car insurance are Geico, Allstate, and Erie, offering rates as low as $35 per month due to their competitive pricing and extensive coverage options. These companies stand out by providing significant discounts for drivers who travel fewer miles annually.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Insurance Operations Specialist

Michael earned a degree in Business Management degree with an insurance focus, which led to a successful 25-year career in insurance claims operations and support. He possesses a high-level of business acumen across multiple areas of the insurance industry. Over the course of his career, he served in multiple roles supporting claims operations including: Claims Specialist, Claims Trainer, Claim Au...

Michael Leotta

Licensed Insurance Agent

Justin Wright has been a licensed insurance broker for over 9 years. After graduating from Southeastern Seminary with a Masters in Philosophy, Justin started his career as a professor, teaching Philosophy and Ethics. Later, Justin obtained both his Property & Casualty license and his Life and Health license and began working for State Farm and Allstate. In 2020, Justin began working as an i...

Justin Wright

Updated May 2024

Company Facts

Full Coverage for Low-Mileage

A.M. Best Rating

Complaint Level

Pros & Cons

Company Facts

Full Coverage for Low-Mileage

A.M. Best Rating

Complaint Level

Pros & Cons

Company Facts

Full Coverage for Low-Mileage

A.M. Best Rating

Complaint Level

Pros & Cons

The top picks for the best low-mileage car insurance are Geico, Allstate, and Erie, known for their affordable rates and comprehensive coverage options. Geico stands out as the overall best with rates starting at $35 per month, offering excellent discounts for low-mileage drivers. Allstate and Erie also provide competitive rates and personalized coverage plans, making them ideal for those who frequently drive less affecting rates to go lower.

By choosing these providers, you can benefit from significant savings and tailored insurance policies that meet your specific needs. Retirees and those with short commutes can particularly take advantage of these low-mileage discounts. Shopping around and comparing quotes from these top companies ensures you get the best deal.

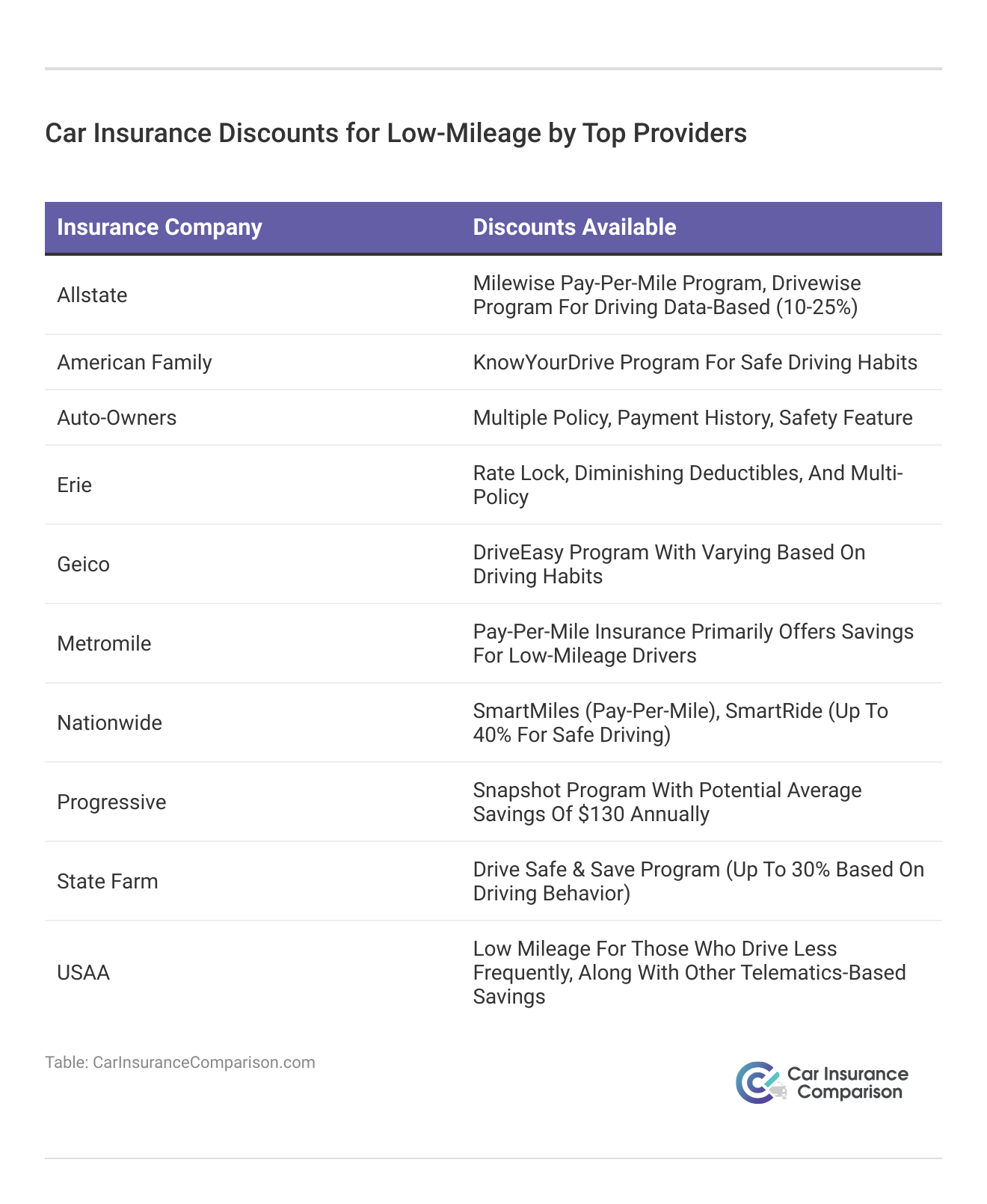

Our Top 10 Company Picks: Best Low-Mileage Car Insurance

Company Rank UBI Discount A.M. Best Best For Jump to Pros/Cons

#1 25% A++ Cost-Effective Geico

#2 20% A+ Flexible Rates Allstate

#3 20% A+ Diverse Rewards Erie

#4 40% A+ Occasional Drivers Nationwide

#5 30% A- Pay-Per-Mile MetroMile

#6 30% A++ Military Families USAA

#7 15% A+ Habit-Based Savings Progressive

#8 15% A++ Safe Drivers State Farm

#9 30% A++ Personalized Rates Auto-Owners

#10 25% A Low Usage American Family

Start your search now to find the perfect low-mileage car insurance for you. Get the right car insurance at the best price — enter your ZIP code above to shop for coverage from the top insurers.

- Geico offers the best low-mileage car insurance, rates start at $35 per month

- Low-mileage drivers gain from significant savings and tailored coverage options

- Allstate and Erie also provide competitive rates and personalized plans

#1 – Geico: Top Overall Pick

Pros

- Bundling Policies: Geico offers significant discounts for bundling multiple insurance policies.

- High UBI Discount: Geico provides a substantial discount of up to 25% for low-mileage usage.

- Cost-Effective: Geico car insurance review is known for competitive pricing, making it a cost-effective option for many drivers.

Cons

- Customer Service: Geico’s customer service is sometimes rated lower compared to some competitors.

- Limited Local Agents: Fewer local agents compared to other large insurers, which might affect personalized service.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#2 – Allstate: Best for Flexible Rates

Pros

- Customizable Coverage: Allstate offers a wide range of coverage options that can be tailored to individual needs.

- Usage-Based Insurance (UBI) Discount: Allstate provides a UBI discount of up to 20%.

- Innovative Tools: Allstate car insurance review showcase features like DriveWise app that monitors driving habits and offers rewards.

Cons

- Higher Premiums: Allstate’s premiums can be higher than some competitors, especially for full coverage.

- Mixed Reviews: Customer satisfaction can vary widely depending on the location and specific agent.

#3 – Erie: Best for Diverse Rewards

Pros

- Diverse Discounts: Erie offers a variety of discounts, including for safe driving and multi-policy bundling.

- High UBI Discount: Provides a UBI discount of up to 20%.

- Excellent Customer Service: Erie car insurance review boast highly rated customer satisfaction and claims handling.

Cons

- Availability: Erie is not available in all states, limiting its accessibility.

- Online Tools: Digital tools and online account management options are not as robust as some competitors.

#4 – Nationwide: Best for Occasional Drivers

Pros

- High UBI Discount: Nationwide offers a UBI discount of up to 40%, one of the highest in the industry. Discover more Nationwide car insurance discounts for more savings.

- Flexible Plans: Good options for drivers who use their cars infrequently.

- Strong Financial Rating: Rated A+ by A.M. Best, indicating strong financial stability.

Cons

- Premium Costs: Despite discounts, the base premiums might be higher than some competitors.

- Digital Experience: The online experience and mobile app can be less user-friendly compared to others.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#5 – MetroMile: Best for Pay-per-Mile

Pros

- Pay-per-Mile Pricing: Unique pricing model that benefits low-mileage drivers.

- High UBI Discount: Offers a UBI discount of up to 30%.

- Technology Integration: Advanced technology for tracking mileage and managing policies.

Cons

- Availability: Limited to certain states, not available nationwide. Check out our “How do you get a metromile car insurance quote online?“.

- Customer Service: Mixed reviews on customer service experiences.

#6 – USAA: Best for Military Families

Pros

- Military Focus: Tailored specifically for military families, with specialized coverage options.

- High UBI Discount: Offers a UBI discount of up to 30%.

- Excellent Customer Service: USAA car insurance review highlight consistently receiving high ratings for customer service and claims handling.

Cons

- Eligibility: Limited to military members, veterans, and their families.

- Online Tools: Some users report the mobile app could be more intuitive.

#7 – Progressive: Best for Habit-Based Savings

Pros

- Snapshot Program: Innovative usage-based insurance program that offers potential discounts.

- Wide Range of Discounts: Includes multi-policy, safe driver, and more.

- Comprehensive Coverage Options: Progressive car insurance review offer broad array of coverage options to fit different needs.

Cons

- UBI Discount: Lower UBI discount of up to 15% compared to some competitors.

- Premium Rates: Can be higher than average for high-risk drivers.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#8 – State Farm: Best for Safe Drivers

Pros

- Safe Driver Discounts: Offers significant discounts for safe driving habits.

- High UBI Discount: State Farm car insurance review underscore providing a UBI discount of up to 15%.

- Wide Coverage: Comprehensive coverage options tailored for various needs.

Cons

- Premium Costs: Despite discounts, premiums might still be relatively higher for certain coverage levels.

- Limited Multi-Policy Discount: The multi-policy discount is not as high compared to some competitors.

#9 – Auto-Owners: Best for Personalized Rates

Pros

- Personalized Service: Known for personalized customer service and agent support.

- High UBI Discount: Offers a UBI discount of up to 30%.

- Strong Financial Rating: Auto-Owners car insurance review excel with ratings A++ by A.M. Best, indicating excellent financial health.

Cons

- Availability: Not available in all states.

- Online Experience: Digital tools and mobile app can be less advanced than competitors.

#10 – American Family: Best for Low Usage

Pros

- Good UBI Discount: Provides a UBI discount of up to 25%.

- Flexible Policies: Offers a range of policies that can be customized for low-usage drivers.

- Bundling Discounts: American Family car insurance review accentuate its discounts available for bundling multiple policies.

Cons

- Coverage Area: Limited availability in some regions.

- Premium Costs: Premiums might be higher for full coverage compared to some other insurers.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Understanding Low-Mileage Car Insurance Costs

When it comes to insuring a low-mileage car, finding the right coverage at an affordable rate is essential. Here’s a comparison of monthly rates for minimum and full coverage offered by various insurance providers.

Allstate offers minimum coverage for $45 per month and full coverage for $115. Geico, on the other hand, provides the lowest rates with $35 for minimum coverage and $110 for full coverage. USAA follows closely with $40 for minimum coverage and $100 for full coverage.

Low-Mileage Car Insurance: Monthly Rates by Coverage Level & Provider

| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| Allstate | $45 | $115 |

| American Family | $75 | $150 |

| Auto-Owners | $58 | $122 |

| Erie | $60 | $125 |

| Geico | $35 | $110 |

| Metromile | $55 | $120 |

| Nationwide | $62 | $128 |

| Progressive | $65 | $135 |

| State Farm | $50 | $120 |

| USAA | $40 | $100 |

Other notable options include Auto-Owners, Erie, Metromile, Nationwide, Progressive, and State Farm, each offering competitive rates for low-mileage car insurance. American Family stands out with $75 for minimum coverage and $150 for full coverage, making it one of the more expensive options.

Geico offers the best low-mileage car insurance with rates starting at just $35 per month, making it the top choice for budget-conscious drivers.

Brad Larson Licensed Insurance Agent

Ultimately, the choice of insurance provider and coverage level depends on individual needs, driving habits, and budget constraints. It’s important to compare car insurance rates and coverage options to find the best fit.

Driving Less: The Impact on Car Insurance Costs

When you apply for car insurance coverage, the company will pull your driving record before making a decision about how much to charge for premiums. Not only does it look at whether you have any accidents on your record, but it also checks for moving violations. If you are a person who doesn’t use his or her car often, you are less likely to have accumulated any tickets.

Tickets and accidents count when you are buying car insurance coverage. These details stay on your record for up to five years. As long as they appear, you will be paying more for your coverage.

If you can get away without using your car to go to work every day, it pays to do so. Consider using your local public transportation system through the week and save using your car for weekends. Another alternative is to start or join a carpool so that you aren’t using your own vehicle every day. Finally, pay as you go car insurance options are also starting to be offered.

Discover more information on our “Does car insurance cover carpooling?”.

Seniors Low Mileage Car Insurance Discount

Car insurance companies also offer price breaks to seniors who are buying car insurance. You may not think of it at first, but when you are retired or semi-retired, your annual mileage drops. Once the daily commute to and from work is no longer part of your daily routine, you may qualify for a low-mileage discount.

Seniors, often recognized as safe drivers, can qualify for car insurance discounts. If you’re in this age group and not receiving a discount, inquire with your current provider about better pricing. If unsatisfied, explore other providers for better rates.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Shop Around for Best Low Mileage Car Insurance Rates

Each insurance company uses its own formula for determining risk and calculating rates. While low annual mileage should qualify you for better rates, not all companies will give this factor the same weight when deciding how much to charge customers. The way to get the lowest possible pricing for your coverage is to get quotes from several companies.

Drivers of any age should make a point of shopping around for car insurance rates. The best time to start getting quotes for coverage is several weeks before your current policy is due to expire. Starting early will give you the time you need to consider the quotes you get back carefully. You can also obtain quotes online.

If you are going to start getting quotes for your car insurance coverage, you should also take the time to think about your car insurance needs. The type and level of coverage you want to have in place does change as circumstances in your life do. For example, if you are driving an older vehicle, you may not need to keep full coverage on it.

Geico offers the best low-mileage car insurance, making it the top choice for drivers who travel less frequently.

Tracey L. Wells Licensed Insurance Agent & Agency Owner

Dropping the collision coverage will save you money since the insurance company will only pay out based on the vehicle’s cash value — not its replacement value — if your car is totaled in an accident. If you make a switch, buy the new policy and get confirmation that it is in force before you cancel the old one. If you have paid your premiums in advance, the insurance company will issue a refund as of the date you canceled the policy.

Explore more insights on “When should I drop collision coverage?“.

Case Studies: Real-Life Savings With Low-Mileage Car Insurance

To illustrate the impact of low-mileage car insurance, let’s take a look at a few case studies. These real-life examples will demonstrate how drivers can benefit from reduced premiums by driving less.

- Case Study 1 – Sarah’s Savings: Sarah, a retiree, only drives her car occasionally for errands and social outings. By switching to a low-mileage car insurance policy, she saved 20% on her annual premium, putting an extra $300 back in her pocket each year.

- Case Study 2 – Mike’s Commute Solution: Mike, a software engineer, recently started working from home. With his reduced daily commute, he switched to a low-mileage insurance plan, saving 15% on his premium, equating to $200 in yearly savings.

- Case Study 3 – Amanda’s Carpooling Choice: Amanda joined a carpool for her daily commute to work. By driving less, she qualified for a low-mileage discount and saved 25% on her car insurance premium, amounting to $400 in annual savings.

These case studies demonstrate how low-mileage car insurance can significantly reduce premiums for drivers who travel fewer miles annually. Whether it’s through retirement, working from home, or carpooling, driving less can lead to substantial savings on car insurance. Consider exploring low-mileage insurance options to see how much you could save.

Bottom Line: Best Low-Mileage Car Insurance

Choosing the right low-mileage car insurance can lead to significant savings and tailored coverage that meets your specific driving habits. Geico stands out as the top provider, offering exceptional discounts and comprehensive options for those who drive less frequently. Allstate and Erie also provide competitive rates and personalized plans, ensuring you get the best value.

By tracking your mileage, providing proof, and comparing quotes, you can find the ideal policy that fits your needs and budget. Stop overpaying for car insurance. Our free quote comparison tool allows you to shop for quotes from the top providers near you by entering your ZIP code below.

Frequently Asked Questions

What is low-mileage car insurance?

Low-mileage car insurance is a type of insurance policy that offers discounted rates to drivers who do not drive their vehicles as frequently as others. It is specifically designed for individuals who drive below a certain number of miles per year, typically defined as a specific mileage threshold.

How does low-mileage car insurance work?

Low-mileage car insurance works by considering the reduced risk associated with driving fewer miles. Insurance companies believe that drivers who travel fewer miles have a lower likelihood of being involved in accidents. Therefore, they offer discounted rates to reflect this reduced risk.

Delve more insights on our “How long does a car accident stay on your insurance record?“.

What is considered low-mileage for car insurance?

The specific mileage threshold to qualify for low-mileage car insurance can vary among insurance companies. Generally, low mileage is considered to be around 7,500 to 10,000 miles per year. However, it’s important to check with individual insurance providers to determine their specific mileage requirements.

See if you’re getting the best deal on car insurance by entering your ZIP code below.

How can I qualify for low-mileage car insurance?

To qualify for low-mileage car insurance, you typically need to provide proof of your annual mileage. This can be done through various methods, such as self-reporting your mileage, using a tracking device provided by the insurance company, or submitting mileage reports from vehicle inspections.

What are the benefits of low-mileage car insurance?

Low-mileage car insurance offers cost savings with discounted premiums, customized coverage options, and helps reduce your environmental impact by lowering your carbon footprint.

Learn more information on “How much does mileage affect car insurance rates?“.

What is the lowest mileage for car insurance?

To qualify for low-mileage car insurance discounts, you typically need to drive less than 7,500 to 8,000 miles per year. Some insurance companies may offer discounts if you drive fewer miles than the national average of 13,500 miles annually.

What is the best mileage for low insurance?

Insurance companies might provide reduced premiums for drivers who cover fewer miles, particularly those driving less than 7,000 or 5,000 miles per year. Typically, driving over 15,000 miles annually is classified as high mileage, but it’s advisable to consult your insurance provider to understand how your mileage could impact your premiums.

What is mileage coverage?

The standard mileage rate is designed to include all the fixed and variable expenses associated with using your vehicle for business purposes. This payment is usually made after you submit a record of your business mileage. On the other hand, FAVR involves two distinct payments: one for fixed costs and another for variable costs.

Expand your knowledge on our “10 Best Companies for Low-Mileage Car Insurance Discounts“.

How do miles work on a car?

Similar to the bicycle, the car’s computer calculates the distance traveled with each pulse and updates the odometer reading accordingly. One intriguing aspect of car odometers is the method used to transmit this information to the dashboard.

Is low mileage important?

The number of miles a car has traveled is often used as a measure of its wear and tear, and consequently, it influences its value. It’s reasonable to assume that a vehicle with high mileage has endured more use over its time on the road compared to one with lower mileage, potentially making it less reliable.

What happens if mileage is too high?

What are the two types of mileage?

Does age matter on cars?

What is the most basic car insurance?

What is the best mileage to buy a used car?

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.