Best Rally Car Insurance in 2026 (Find the Top 10 Companies Here!)

Discover the best rally car insurance with Farmers, State Farm, and Progressive leading the pack, offering robust coverage starting as low as $95 a month. These providers excel in comprehensive options, superior customer service, and exceptional value, ensuring your rally car receives the protection it deserves.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Insurance and Finance Writer

Dorothea Hudson has been professionally writing in many spheres since 2013. She has written on entertainment, insurance, finance, travel, technology, AI, renewable energy, crypto, fundraising, and real estate for many websites. Her work has been published for British retailer Marks and Spencer, Kroger Magazine, the Vision Group, and more. Her passions include writing, music, running, travel, te...

Dorothea Hudson

Licensed Insurance Producer

Dani Best has been a licensed insurance producer for nearly 10 years. Dani began her insurance career in a sales role with State Farm in 2014. During her time in sales, she graduated with her Bachelors in Psychology from Capella University and is currently earning her Masters in Marriage and Family Therapy. Since 2014, Dani has held and maintains licenses in Life, Disability, Property, and Casualt...

Dani Best

Updated May 2024

Company Facts

Full Coverage for Rally Car

A.M. Best Rating

Complaint Level

Pros & Cons

Company Facts

Full Coverage for Rally Car

A.M. Best Rating

Complaint Level

Pros & Cons

Company Facts

Full Coverage for Rally Car

A.M. Best Rating

Complaint Level

The top picks for the best rally car insurance are Farmers, State Farm, and Progressive, known for their comprehensive coverage and customer satisfaction.

These companies excel in protecting your classic rally cars, offering tailored policies that meet the specific needs of car enthusiasts.

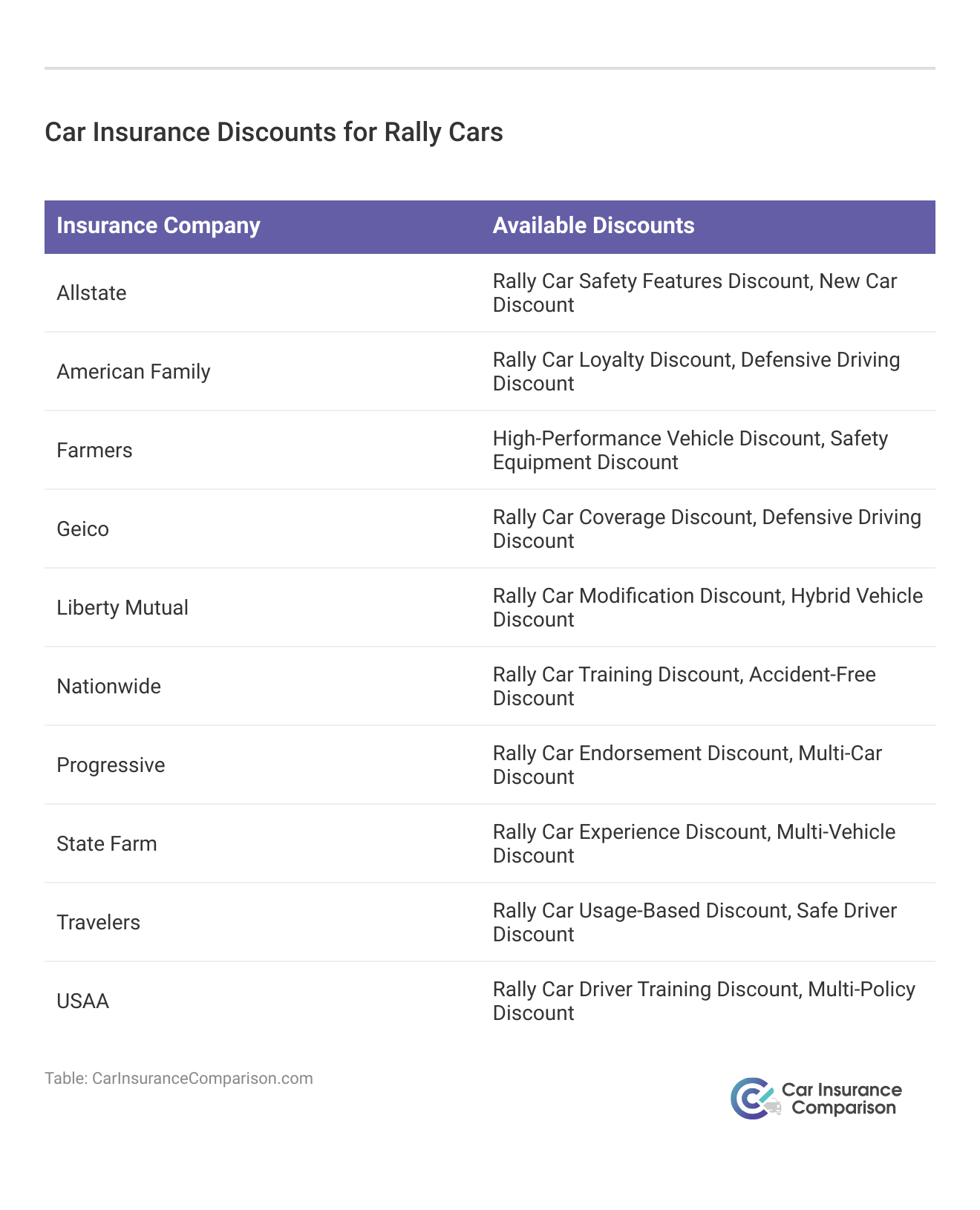

Our Top 10 Company Picks: Best Rally Car Insurance

Company Rank Multi-Policy Discount A.M. Best Best For Jump to Pros/Cons

![]()

#1 20% A Customizable Policies Farmers

![]()

#2 15% A++ Competitive Rates State Farm

![]()

#3 17% A+ Customized Coverage Progressive

#4 10% A++ Competitive Rates Geico

#5 25% A+ Safe-Driving Discounts Allstate

#6 10% A+ Specialized Coverage Nationwide

#7 20% A Accident Forgiveness Liberty Mutual

#8 12% A++ Military Savings USAA

#9 10% A++ Comprehensive Coverage Travelers

#10 15% A+ Claims Service American Family

They provide robust financial protection against accidents, theft, and other risks associated with owning valuable collector cars.

Collector cars are highly valuable and need proper insurance coverage. Without collision or comprehensive insurance, you risk significant financial loss if your collector car is damaged in an accident or other incident.

Enter your ZIP code above to request free car insurance quotes online now.

- Farmers is the top pick for best rally car insurance, offering premium services

- Rally car insurance caters to the unique needs of collector car owners

- These policies protect against specific risks like theft and storm damage

#1 – Farmers: Top Overall Pick

Pros

- High Multi-Policy Discount: Farmers offers a 20% discount for clients who bundle multiple policies.

- Superior Financial Strength: Rated A++ by A.M. Best, indicating top-tier financial stability. Learn more in our Farmers car insurance review.

- Tailored Coverage Options: Farmers specializes in offering customized insurance policies to meet unique client needs.

Cons

- Premium Pricing: Farmers’ tailored services come at a higher cost compared to standard policies.

- Selective Coverage: Not all services are available in every area, limiting accessibility for some customers.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#2 – State Farm: Best for Competitive Rates

Pros

- Bundling Policies: State Farm offers significant discounts for bundling multiple insurance policies.

- High Low-Mileage Discount: State Farm provides a substantial discount for low-mileage usage.

- Wide Coverage: State Farm offers various coverage options tailored to different business needs. Unlock details in our State Farm car insurance review.

Cons

- Limited Multi-Policy Discount: The multi-policy discount of State Farm is not as high compared to some competitors.

- Premium Costs: Despite discounts, State Farm’s premiums might still be relatively higher for certain coverage levels.

#3 – Progressive: Best for Customized Coverage

Pros

- Flexible Policy Options: Progressive offers a variety of customizable coverage options to suit different needs.

- Loyalty Rewards: Progressive rewards long-term customers with discounts and perks. Delve into our evaluation of Progressive car insurance review.

- Competitive Multi-Policy Discount: Offers a 17% discount for bundling policies, which is competitive in the industry.

Cons

- Variable Customer Service: Customer experience can vary widely depending on the region and agent.

- Rate Fluctuations: Rates may increase significantly at renewal, especially following claims.

#4 – Geico: Best for Competitive Rates

Pros

- Competitive Pricing: Geico is known for offering some of the most competitive rates in the industry.

- Fast Claim Service: Geico provides quick and efficient claim handling. Access comprehensive insights into our Geico car insurance review.

- Wide Availability: Available in all 50 states, providing broad access to potential clients.

Cons

- Basic Multi-Policy Discount: Only offers a 10% discount for multi-policy bundling, which is lower than some competitors.

- Less Personalized Service: As a large company, Geico may offer less personalized service than smaller insurers.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#5 – Allstate: Best for Safe-Driving Discounts

Pros

- High Multi-Policy Discount: Offers a 25% discount for bundling, which is the highest among the listed companies.

- Safe Driving Bonuses: Provides bonuses and discounts for safe driving, rewarding low-risk behavior.

- Innovative Tools: Offers innovative tools and apps for policy management and claiming processes. Discover more about offerings in our Allstate car insurance review.

Cons

- Higher Base Rates: Base rates can be higher, potentially offsetting the benefits of discounts.

- Customer Service Variability: Customer service quality can vary, which might affect satisfaction and support during claims.

#6 – Nationwide: Best for Specialized Coverage

Pros

- Diverse Specialized Options: Nationwide offers a variety of specialized insurance options that cater to unique customer needs. Check out insurance savings in our complete Nationwide car insurance discount.

- Strong Financial Rating: With an A+ rating from A.M. Best, Nationwide is recognized for its financial stability.

- Personalized Service: Known for providing more personalized service compared to larger competitors.

Cons

- Limited Multi-Policy Discount: Offers a 10% discount on bundling, which is less competitive compared to other companies.

- Inconsistent Pricing: Customers may experience inconsistent pricing and rate increases at renewal.

#7 – Liberty Mutual: Best for Accident Forgiveness

Pros

- Accident Forgiveness: Liberty Mutual offers accident forgiveness policies, helping to prevent premium spikes after the first accident. Read up on the Liberty Mutual car insurance review for more information.

- Strong Multi-Policy Discount: Offers a 20% discount for clients who bundle multiple policies.

- Wide Range of Products: Provides a broad range of insurance products, allowing for comprehensive coverage solutions.

Cons

- Premium Costs: May have higher premiums than some of its competitors, especially for clients without bundling.

- Varied Customer Reviews: Customer satisfaction can vary significantly based on regional service levels.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#8 – USAA: Best for Military Savings

Pros

- Exclusive Military Discounts: USAA provides exclusive services and discounts for military members and their families.

- Top-Tier Customer Satisfaction: Consistently rated highly for customer service and claims satisfaction. More information is available about this provider in our USAA car insurance review.

- Comprehensive Coverage Options: Offers extensive coverage options that are tailored to the needs of military families.

Cons

- Limited Eligibility: Services are only available to military members, veterans, and their families, limiting access to the general public.

- Few Physical Locations: Most transactions are online, which might not suit everyone’s preferences.

#9 – Travelers: Best for Comprehensive Coverage

Pros

- Broad Coverage Options: Travelers offers a wide range of comprehensive coverage options for various needs.

- Strong Financial Stability: Holds an A++ rating from A.M. Best, indicating superior financial health. See more details on our Travelers car insurance review.

- Risk Management Services: Provides excellent risk management services that help clients reduce potential risks.

Cons

- Higher Pricing Tiers: Travelers’ comprehensive options often come at a higher cost.

- Complex Policy Offerings: The wide array of options can be overwhelming and complex for new insurance buyers.

#10 – American Family: Best for Claims Service

Pros

- Exceptional Claims Handling: The American Family is known for its efficient and responsive claims service.

- Flexible Coverage Options: Offers a variety of coverage options that can be tailored to specific needs. Learn more in our American Family car insurance review.

- Strong Multi-Policy Discount: Provides a 15% discount for bundling policies, enhancing overall value.

Cons

- Regional Availability: Services are more concentrated in certain regions, which might limit availability in some states.

- Rate Variability: Some customers report variability in rates, especially after filing claims.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Monthly Car Insurance Rates for Rally Vehicles: Minimum and Full Coverage Comparison

The monthly rates for rally car insurance vary significantly depending on the insurance company and the level of coverage chosen. Below is a detailed breakdown of the minimum and full coverage rates offered by various leading insurance providers.

Car Insurance Monthly Rates for Rally Cars by Coverage Level & Provider

Insurance Company Minimum Coverage Full Coverage

Allstate $115 $240

American Family $110 $230

Farmers $120 $250

Geico $95 $210

Liberty Mutual $125 $255

Nationwide $105 $225

Progressive $110 $230

State Farm $100 $220

Travelers $115 $240

USAA $98 $215

The table of monthly insurance rates for rally cars shows a range in pricing from different insurers. Geico offers the most affordable minimum coverage at $95, while Liberty Mutual presents the highest at $125. For full coverage, the rates again show Geico as the most cost-effective option at $210, with Liberty Mutual being the most expensive at $255.

Middle-range insurers like State Farm and Nationwide offer competitive rates for both minimum and full coverage, with State Farm’s rates at $100 for minimum and $220 for full coverage, and Nationwide at $105 and $225, respectively.

These rates reflect the diversity in pricing strategies among top insurance companies, catering to various needs and budgets of rally car owners (For more information, read our “Best Full Coverage Car Insurance”).

Car Rally: Car Insurance for Competitions

Although rally car insurance is available for collector cars, it does not actually have anything to do with insuring your car specifically for a car rally.

If you are going to compete with your collector car in a car rally, then your standard car insurance policy will most likely be sufficient coverage.

Unlike a race car (read our “Compare Race Car Insurance Rates” for more information), a car rally is a legal car competition. It does not usually require any special car insurance because there is no speeding or risk of crashes like you may expect in a car race. Car rallies are open to amateurs and don’t require any special equipment or car, although most people with collector cars like to participate in rallies.

In a car rally, you are expected to arrive at various checkpoints along a specific route. Timing in a rally is everything, and arriving too early or too late will affect your score.

For this very reason, car rallies are considered safe since scoring is all about timely arrival and not reckless driving.

Although it might not seem very exciting, the real challenge lies in navigating the route and maintaining the correct course. It’s somewhat akin to participating in a puzzle and maneuvering through a maze unknowingly, which is essential for effective rally insurance cover.

To participate in a rally, you must have car insurance, including rally cover insurance. Always required is liability or another form of financial responsibility proof. However, opting for collision and comprehensive insurance depends on your personal needs.

Insuring Your Collector Car: Rally Car Insurance Specialty

Although Rally Insurance Group is not an insurance company, it is a group of independent agents who specialize in helping you find the best car insurance policy for your collector car.

Independent insurance agents are like brokers and they earn a commission fee for every policy they help to sell. Rally Insurance Group is licensed to sell car insurance products in 47 states.

Collector cars are typically antique or vintage, ranging in age from 45 years to 100 years respectively.

Once a car ages 25 years, however, it can be considered a classic car.

While there are few steadfast rules on what warrants a collector car if your car has any value, it needs to be insured accordingly.

Well-maintained cars can appreciate in value as they age, despite the initial depreciation experienced when new cars are driven off the dealership lot. As cars grow older, they can potentially increase in value, highlighting the importance of insurance for rally cars. Insuring your car keeps your investment protected against financial loss.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Insuring your Daily Use Car: Rally Car Insurance Agents

In addition to specializing in collector car insurance, Rally car insurance can help you find car insurance for your everyday use vehicle as well. Since they don’t sell any car insurance directly, they actually just assist you in finding a policy that suits your needs and then get paid by commission.

Opting for Farmers means choosing a top-tier insurer known for its dedication to serving the unique needs of the motorsport community.

Brad Larson Licensed Insurance Agent

They are able to help you secure car insurance with various options such as a diminishing deductible or help you get coverage that is accepted worldwide.

In addition to new vehicle replacement coverage, Rally Insurance Group is also able to provide coverage for:

- Audio Equipment

- Visual Equipment

- Custom Equipment

If you are enjoying your car without competition, you need car insurance to protect your assets. If you are competing in a rally, car insurance is a must.

Get free car insurance quotes right now by entering your ZIP code below.

Frequently Asked Questions

What is rally car insurance?

Insurance for collector cars aged 45 to 100 years old.

For additional details, explore our comprehensive resource titled “Classic vs. Standard Car Insurance.”

Which company offers rally car insurance?

Rally Insurance Group is the main provider in 47 U.S. states.

Why is rally car insurance Do I need rally car insurance for car rallies??

It protects valuable collector cars from accidents, theft, and damage.

Why is rally car insurance important?

No, regular car insurance should be enough for participating in car rallies.

What does Rally Insurance Group do?

They help find the best insurance policy for collector cars.

To find out more, explore our guide titled “Best Classic Car Insurance.”

What is motorsport vehicle insurance?

Motorsport vehicle insurance is designed to cover vehicles used in competitive racing, including coverage for damages and liability during events.

What coverage does rally racing car insurance provide?

Rally racing car insurance typically includes damage protection, liability coverage, and sometimes roadside assistance specifically for rally racing events.

Why is competitive auto insurance for racers important?

Competitive auto insurance for racers provides tailored coverage to meet the high-risk nature of racing, including accident damage and liability.

What is included in insurance for rally events?

Insurance for rally events generally covers liability for injuries and damages, protection for participating vehicles, and event cancellation insurance.

To learn more, explore our comprehensive resource on “Compare Liability Car Insurance: Rates, Discounts, & Requirements.”

How does rally car insurance differ from standard auto insurance?

Rally car insurance offers specialized coverage for rally cars, addressing the unique risks of off-road and competitive driving conditions.

What is rally insurance?

What does competition car insurance cover?

What should you consider when choosing car rally insurance?

How can I get a rally car insurance quote?

Where can I find a rally insurance quote?

Who ensures rally cars?

Do rally cars need insurance?

What happens to wrecked rally cars?

Why is rally so expensive?

Are race car drivers insured?

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.