Best Temporary Car Insurance for Drivers Under 21 in 2026 (Top 10 Companies)

State Farm, USAA, and Progressive are the top contenders for the best temporary car insurance for drivers under 21. Offering rates as low as $32 per month, these companies provide comprehensive coverage tailored to the unique needs of young drivers, ensuring they stay protected on the road.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Feature Writer

Chris Tepedino is a feature writer that has written extensively about car insurance for numerous websites. He has a college degree in communication from the University of Tennessee and has experience reporting, researching investigative pieces, and crafting detailed, data-driven features. His works have been featured on CB Blog Nation, Healing Law, WIBW Kansas, and Cinncinati.com. He has been a...

Chris Tepedino

Insurance & Finance Analyst

Zach Fagiano has been in the insurance industry for over 10 years, specializing in property and casualty and risk management consulting. He started out specializing in small businesses and moved up to large commercial real estate risks. During that time, he acquired property & casualty, life & health, and surplus lines brokers licenses. He’s now the Senior Vice President overseeing globa...

Zach Fagiano

Updated May 2024

Company Facts

Full Coverage for Drivers Under 21

A.M. Best Rating

Complaint Level

Pros & Cons

Company Facts

Full Coverage for Drivers Under 21

A.M. Best Rating

Complaint Level

Company Facts

Full Coverage for Drivers Under 21

A.M. Best Rating

Complaint Level

When exploring temporary insurance, consider coverage limits and customer service quality. Known for their extensive agent networks and reliable support, these companies offer peace of mind for young drivers. Their focus on families and service members, along with a user-friendly online platform, adds convenience and flexibility.

Our Top 10 Company Picks: Best Temporary Car Insurance for Drivers Under 21

| Company | Rank | Multi-Policy Discount | Low-Mileage Discount | Best For | Jump to Pros/Cons |

|---|---|---|---|---|---|

| #1 | 17% | 25% | Many Discounts | State Farm | |

| #2 | 10% | 25% | Military Savings | USAA |

|

| #3 | 10% | 30% | Online Convenience | Progressive |

|

| #4 | 25% | 30% | Add-on Coverages | Allstate |

|

| #5 | 20% | 30% | Usage Discount | Nationwide |

| #6 | 25% | 30% | Customizable Polices | Liberty Mutual |

| #7 | 10% | 15% | Local Agents | AAA |

| #8 | 10% | 30% | Policy Options | Esurance |

|

| #9 | 10% | 15% | Usage Discount | The General |

|

| #10 | 10% | 15% | Local Agents | Farmers |

By comparing these top contenders, drivers under 21 can secure affordable and reliable temporary car insurance coverage.

Get the right car insurance at the best price — enter your ZIP code above to shop for coverage from the top insurers.

- State Farm offers competitive rates for temporary car insurance for drivers under 21

- Temporary coverage helps young drivers transitioning into independent insurance

- Rates as low as $32 per month ensure affordability for young drivers

#1 – State Farm: Top Overall Pick

Pros

- Diverse Discount Options: Caters to various customer profiles with a wide range of discounts.

- Strong Customer Service: Known for efficient claims handling and customer support.

- Local Agent Network: Explore the extensive availability of local agents for personalized service in our State Farm car insurance review.

Cons

- Higher Rates for Some: May have higher premiums for certain demographics compared to competitors.

- State-Specific Discounts: Some discounts not available in all states.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#2 – USAA: Best for Military Focus

Pros

- Military and Family Benefits: Specialized services and discounts for military members and their families.

- Exceptional Customer Service: Highly rated for customer satisfaction and support.

- Strong Financial Stability: Learn more about USAA car insurance review, known for reliable claims processing and financial strength.

Cons

- Limited Eligibility: Only available to military members, veterans, and their families.

- Geographic Availability: Coverage and discounts may vary by location.

#3 – Progressive: Best for Online Convenience

Pros

- Customizable Policies: Wide range of options for tailoring coverage to individual needs.

- Competitive Rates for Diverse Drivers: Explore how Progressive car insurance review often offers lower rates for high-risk drivers.

- Snapshot Program: Offers personalized rates based on driving behavior.

Cons

- Customer Service Variation: Some customers report inconsistent service experiences.

- Higher Rates for Certain Profiles: May have higher premiums for drivers with clean records.

#4 – Allstate: Best for Add-On Coverage

Pros

- Safe Driving Rewards: Discover the incentives for safe driving habits through Allstate car insurance review programs.

- Strong Local Agent Network: Offers personalized service with a robust agent presence.

- Mobile App and Online Management: Convenient policy management and claims processing.

Cons

- Premium Pricing: Can be more expensive compared to other insurers.

- Discounts Vary by State: Not all discounts are available nationwide.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#5 – Nationwide: Best for Usage-Based Discount

Pros

- Flexible Policy Options: Wide range of coverage options to suit different needs with Nationwide car insurance discounts.

- Strong Financial Stability: Known for reliability and solid financial background.

- Online Resources: Provides helpful online tools and information.

Cons

- Price Point: May have higher rates for certain customer profiles.

- Mixed Customer Service Reviews: Some variability in customer satisfaction.

#6 – Liberty Mutual: Best for Custom Policy

Pros

- Accident Forgiveness: Offers this option to prevent rate increases after the first accident.

- Online and Mobile Tools: Discover why Liberty Mutual car insurance review is praised for its user-friendly digital platforms for policy management.

- Diverse Coverage Options: Wide range of insurance products beyond car insurance.

Cons

- Higher Rates for Some Profiles: May not be the cheapest option for all drivers.

- Customer Service Experiences vary: Some customers report inconsistent experiences.

#7 – AAA: Best for Local Agent

Pros

- Additional Member Benefits: Offers various perks and discounts for AAA members.

- Roadside Assistance: Renowned for their comprehensive roadside assistance services.

- Varied Insurance Products: For AAA car insurance review, the company offers a wide range of insurance and travel-related services.

Cons

- Membership Requirement: Insurance services are exclusive to AAA members.

- Limited Coverage Options: Some regions may have fewer policy choices.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#8 – Esurance: Best for Flexible Policy

Pros

- User-Friendly Online Platform: Known for its digital-first approach and ease of use, Esurance car insurance quote is highly regarded for its user-friendly online platform.

- Innovative Tools: Offers tools like Coverage Counselor for personalized recommendations.

- Direct-To-Consumer Model: Streamlines processes and potentially lowers costs.

Cons

- Mixed Customer Reviews: Some reports of varying customer service quality.

- Limited Physical Presence: Fewer local offices for in-person support.

#9 – The General: Best for High-Risk Drivers

Pros

- Flexible Payment Options: Offers various plans to suit different budgets.

- Quick Quote Process: Check out The General car insurance review for easy and fast online quote generation.

- Wide Acceptance: Generally more accepting of diverse driving histories.

Cons

- Basic Coverage Options: More limited in terms of policy features and add-ons.

- Higher Premiums for Some: Rates can be higher for drivers with clean records.

#10 – Farmers: Best for Agent Focus

Pros

- Decent Discount Range: Offers up to 10% multi-policy and 15% low-mileage discounts.

- Strong Network of Local Agents: Farmers car insurance review showcases personalized service and community presence.

- Wide Range of Insurance Products: Offers a variety of insurance solutions beyond car insurance.

Cons

- Premium Cost: Rates can be higher compared to some other insurers.

- Variability in Agent Experience: Experience can vary based on the local agent.

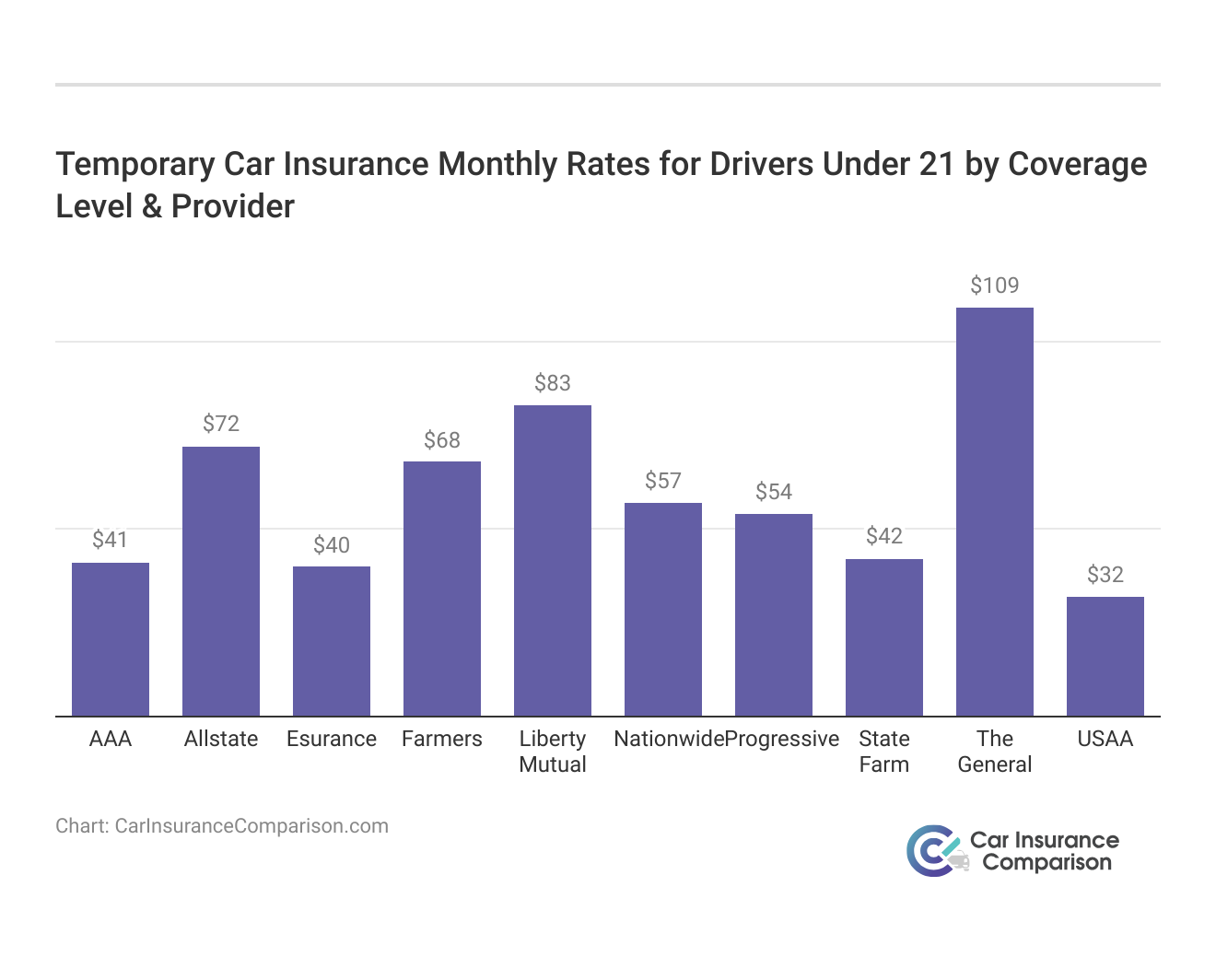

Drivers Under 21 Car Insurance: Monthly Rates by Coverage Level & Provider

| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| AAA | $41 | $110 |

| Allstate | $72 | $190 |

| Esurance | $40 | $174 |

| Farmers | $68 | $180 |

| Liberty Mutual | $83 | $215 |

| Nationwide | $57 | $150 |

| Progressive | $54 | $146 |

| State Farm | $42 | $111 |

| The General | $109 | $287 |

| USAA | $32 | $85 |

Navigating the Roads: Understanding Temporary Car Insurance

Temporary insurance is a solid choice for a driver who is moving to their coverage. For example, if you’re a driver on your parent’s policy, but you’re looking to get your auto insurance policy, you can apply for temporary insurance as long as you qualify. We’ll go over these qualifications further below.

Temporary insurance will only cover you up to 30 days, but can fulfill the need for coverage if you need it temporarily or if you’re in the process of changing your insurance carrier. Before jumping into getting a temporary policy, you may want to look into whether or not it’s required by the state you live in. You may not be required to carry insurance yourself until you have your license or even a car.

State Farm stands out as the top choice for young drivers with its leader in discounts, making it the most cost-effective option among the top providers in 2024.

Dani Best Licensed Insurance Producer

They may also just need transportation for a short outing a few times each month. Not everyone depends on a vehicle for their transportation needs, but for those that want a car, insurance is going to be a must. However, an annual car insurance premium can be daunting for someone who doesn’t have a massive income.

Temporary car insurance is an effective way to reduce costs while ensuring safety for young drivers during transitional periods. Short-term coverage is often a wise investment for protection. If you need immediate car insurance, use our tool above to compare rates and plans.

The table displays monthly rates for temporary car insurance for drivers under 21, segmented by coverage level (minimum and full coverage) and insurance provider. Providers listed include AAA, Allstate, Esurance, Farmers, Liberty Mutual, Nationwide, Progressive, State Farm, The General, and USAA. Rates vary significantly, with two datasets provided showing different ranges for both coverage levels across these providers.

The Availability of Temporary Car Insurance for Young Drivers

Drivers under 21 are a high-risk group. This is a time when energy levels and a sense of adventure are high. It’s also a time in life when drivers may not make the best and most responsible decisions.

Insurance carriers determine rates based on perceived risk, identified through extensive research. While short-term car insurance for under 21-year-olds is available, it tends to be costly. For affordable car insurance for new drivers over 21, carefully compare options to ensure cost-effectiveness and adequate coverage.

Many carriers don’t even offer short-term car insurance for this age group. Some of the major car insurance providers are in a position to accept the risk, but they only offer it at rates that protect them as well.

Other insurers find this risk to be more than it’s worth in expenses. A high-risk driver is going to have a higher potential for claims, even with short-term insurance or a temporary policy. This is why the price tag is so high for this specific age bracket.

Drivers Under 21 Car Insurance: Monthly Rates by Age, Gender & Coverage Level

Age & Gender Minimum Coverage Full Coverage

16-Year-Old Female $220 $566

16-Year-Old Male $252 $618

17-Year-Old Female $200 $490

17-Year-Old Male $230 $540

18-Year-Old Female $179 $416

18-Year-Old Male $216 $501

Explore the dynamics of car insurance rates for drivers under 21 by age, gender, and coverage level. From minimum to full coverage, discover how premiums vary based on these factors.

Understanding the nuances of car insurance rates for young drivers is essential. By comparing rates by age, gender, and coverage level, drivers under 21 can make informed decisions to find the most suitable and affordable coverage for their needs.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

The Purpose of Temporary Car Insurance for Young Drivers

Many young drivers do not own a car. They may intend to borrow or rent a vehicle, choosing to go without more often to cut down on gas usage and other costs. In this case, short-term car insurance would be a good choice.

They may also ask to be added to their friend or relative’s policy to save money. Whichever temporary car insurance company is being utilized should be notified of the intent to lend a car to anyone not currently on the existing policy.

If a parent’s policy is too expensive with a young driver on it, a non-owner’s car insurance policy will be a lot cheaper for those specific times of need.

How to Qualify for Temporary Car Insurance

To qualify for a policy, a person must prove they have a clean driving record. There are quite a few ways that a young driver can prove that they’re capable of handling such a policy. Good grades can help, since there are often a lot of discounts offered for students with clean records. Avoiding things such as a DUI or other reckless driving habits can be massively beneficial, as any infraction may tarnish an otherwise clean driving record.

However, there are some things out of a driver’s control that are used to determine how much an auto policy will cost:

- ZIP code

- Age

- Make and model of the car

- Where the driver intends to drive

- The duration of the term (one to 28 days)

The type of car driven also makes a difference in what the premium will be. The premium for a young male driver behind the wheel of a red Ford Mustang is going to cost more than one behind the wheel of a white Ford Taurus.

Most short-term policies will cover liability if nothing more. If there’s a lien on the car, the lender may require full coverage anyway. In this case, collision and comprehensive may be included in the amount required by the state.

Cost and Conversion

The cost to buy short-term car insurance for under-21 drivers can be a little or quite a bit more than regular car insurance. However, there are benefits:

- The flexibility of converting to a long-term policy

- Fewer obligations to long-term premiums

- The ability to cancel and pick it back up at a later time

- Modification capabilities

A short-term car insurance policy for under-21-year-old drivers usually lasts one to 28 days.

If there are no incidents and you’re interested in converting the short-term car insurance policy to a long-term one, you may be entitled to discounted rates.

Most companies will offer a conversion without a deposit or with a less expensive one.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Exploring Insurance Changes for Drivers

Drivers may need to change their insurance for various reasons. Firstly, if they are under 21 and transitioning from their parents’ insurance to their own, temporary coverage can bridge the gap while they shop for a permanent policy. Secondly, changing residency between states may necessitate temporary car insurance while seeking a long-term solution that complies with the new state’s regulations.

Thirdly, if they don’t own a car but occasionally drive a family member’s vehicle, temporary coverage can provide protection. Additionally, for those leasing a vehicle, gap coverage can fill in potential insurance gaps. Lastly, during transitional periods such as moving residences, jobs, or vehicles, temporary insurance offers a stopgap measure until a more permanent solution is found.

Navigating Temporary to Permanent Coverage

Keep in mind that, no matter how good gap insurance or temporary insurance may seem to be, your goal should be to get full coverage as soon as you have left your parents’ house or turn 21 and are on your own.

While you are under 21, you may be living in your parents’ house and may be covered by their insurance. However, thinking of long term solutions can prove to be beneficial, since there will be less stress once the time comes to look into your own policy.

Good News for Young Drivers

Young drivers, either with a learner’s permit or a license, can benefit from young driver car insurance rates through various insurance discounts. Qualifying discounts can significantly reduce premiums, such as the good student discount for maintaining a “B” average and the good driver discount for clean driving records.

Additionally, relocating out of state for school may also qualify for a discount. While discounts are optional, they present valuable benefits worth considering when selecting insurance coverage.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Types of People Who May Want Temporary Insurance

Several groups may benefit from temporary insurance coverage to meet state requirements while searching for permanent options. Young drivers under 21, including those moving out of their parents’ home, often need temporary coverage as they transition from their parents’ plan.

Classic car owners may find temporary classic car insurance adequate for occasional use. Learner drivers might need temporary insurance to comply with state mandates, and individuals requiring one-day insurance for emergencies or moving can also benefit from temporary coverage.

Case Studies in Car Insurance – Tailored Solutions for Diverse Needs

Explore the real-world scenarios in these case studies, where individuals and businesses navigate the complexities of car insurance. Each story, from a small business owner to a military family, showcases how tailored insurance solutions meet diverse needs. These narratives illuminate the decision-making processes and the impactful outcomes of choosing the right insurance policy.

- Case Study 1 – Expanding a Small Business: Emily Nguyen, a bakery owner in Austin, Texas, sought insurance as she expanded her delivery services with two new vans. Choosing State Farm’s comprehensive coverage and multi-policy discount, she received a 17% reduction by bundling her business and personal policies. Tailored service from a local agent supported her business expansion.

- Case Study 2 – Military Family Finds Ideal Coverage: Lieutenant Colonel John Abrams, stationed at Fort Bragg, chose USAA for insurance due to frequent deployments and a teenage driver at home. USAA’s focus on military families, along with discounts and tailored services, kept insurance costs manageable for the Abrams family.

- Case Study 3 – Digital Tools Aid New Entrepreneur: Seattle entrepreneur Sarah Kim opted for Progressive’s car insurance, valuing its seamless online service and low usage discounts. With Progressive’s online tools and Snapshot program, she managed insurance hassle-free, reducing rates based on her driving behavior, aligning with her lifestyle and budget as a new entrepreneur.

These case studies underscore the significance of choosing insurance that aligns with specific needs and circumstances.

State Farm emerges as the leading option for young drivers, boasting customer review ratings consistently exceeding 90% satisfaction.

Brad Larson Licensed Insurance Agent

Whether it’s navigating business expansions, military deployments, or entrepreneurial ventures, the right insurance coverage can make all the difference in ensuring peace of mind and financial security.

Steering Your Future: Smart Insurance Decisions for Young Drivers

This is an exciting time for young drivers as they gain independence and learn responsibilities. Taking even a short-term car insurance policy seriously is crucial.

Auto insurance companies consider a young driver’s record to determine rates, preferring low-risk customers. Maintain a clean driving record by practicing safe and defensive driving, compare multiple companies, and always focus on the road.

See if you’re getting the best deal on car insurance by entering your ZIP code below.

Frequently Asked Questions

What is the cheapest car insurance for people in their 20s?

USAA offers the cheapest car insurance for young drivers in their 20s, starting at an average rate of $32 per month for minimum coverage and $85 per month for full coverage. Geico, Auto-Owners, and Erie Insurance are also affordable options.

To expand your knowledge, delve into our extensive guide on insurance coverage titled “Compare Young Driver Car Insurance Rates” for informed decisions.

What is the cheapest car insurance for a 21 year old female?

USAA offers the most affordable car insurance for a 21-year-old female, with average rates starting at $32 per month for minimum coverage and $85 per month for full coverage. It’s important to note that USAA is only available to military members, veterans, and their families.

Ready to shop around for the best car insurance company? Enter your ZIP code below and see which one offers the coverage you need.

Who typically has the cheapest car insurance?

The top 10 cheapest car insurance companies are Nationwide, Geico, State Farm, Travelers, Progressive, AAA, Allstate, Chubb, Farmers and USAA.

For a thorough examination, delve into our extensive guide titled “Cheapest Car Insurance in the World,” offering invaluable insights.

What is the youngest age to get car insurance?

Your child may feel like they have a clear path to freedom after obtaining their driver’s license, but not until you add them to your car insurance policy. In fact, most providers do not allow drivers under the age of 18 to purchase their own policy due to legal and financial reasons.

For a thorough examination, consult our comprehensive guide entitled “Understanding Your Car Insurance Policy,” ensuring clarity and confidence.

What are the top 3 types of insurance?

We begin with an overview of the types of insurance, from both a consumer and a business perspective. Then we examine in greater detail the three most important types of insurance: property, liability, and life.

What is the best insurance for first time car owners?

We chose State Farm, USAA, Geico, Erie Insurance and Liberty Mutual as the best providers for new drivers. Depending on their location, vehicle, age and other factors, new drivers can pay $3,000 per year or more for car insurance.

What age is car insurance most expensive?

Young drivers ages 16 to 24 tend to have the most expensive car insurance. Drivers in this age group are often inexperienced and are more likely to get into car accidents and file insurance claims. As a result, car insurance companies often charge higher premiums to young drivers.

For comprehensive guidance on filing a car insurance claim, consult our extensive report titled “How do you file a car insurance claim?” for expert insights and advice.

How to identify the best insurance cover?

Check out the premium, the administration and fund management fees, the mortality charges, the riders and how much you need to pay for them. Make sure you compare similar kind of products before you decide one that is best for you.

See if you’re getting the best deal on car insurance by entering your ZIP code below.

What is the most basic car insurance?

You can buy many different types of car insurance policies. However, most basic car insurance includes liability protection. In fact, most states require a certain limit for these policies. They may also want you to have uninsured/underinsured protection and comprehensive coverage.

Gain deeper insights by exploring our extensive guide on business insurance titled “Compare Uninsured/Underinsured Motorist (UM/UIM) Coverage: Rates, Discounts, & Requirements,” ensuring informed decisions.

Why is car insurance in New York so expensive?

New York drivers pay high auto insurance costs because of the state’s no-fault insurance laws. These laws require drivers to have personal injury protection (PIP) coverage. PIP covers medical bills for anyone hurt in an accident, no matter who caused it.

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.