10 Cheapest Car Insurance Companies for New Drivers in 2026

The cheapest car insurance companies for new drivers are State Farm, Progressive, and Allstate offering tailored and affordable coverage with exceptional service to new drivers with discounts up to 15%. These top companies provide affordable options for those just starting out on the road.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Sr. Director of Content

Sara Routhier, Managing Editor and Outreach Director, has professional experience as an educator, SEO specialist, and content marketer. She has over five years of experience in the insurance industry. As a researcher, data nerd, writer, and editor she strives to curate educational, enlightening articles that provide you with the must-know facts and best-kept secrets within the overwhelming world o...

Sara Routhier

Licensed Insurance Producer

Dani Best has been a licensed insurance producer for nearly 10 years. Dani began her insurance career in a sales role with State Farm in 2014. During her time in sales, she graduated with her Bachelors in Psychology from Capella University and is currently earning her Masters in Marriage and Family Therapy. Since 2014, Dani has held and maintains licenses in Life, Disability, Property, and Casualt...

Dani Best

Updated May 2024

Company Facts

Min. Coverage for New Drivers

A.M. Best Rating

Complaint Level

Pros & Cons

Company Facts

Min. Coverage for New Drivers

A.M. Best Rating

Complaint Level

Company Facts

Min. Coverage for New Drivers

A.M. Best Rating

Complaint Level

Pros & Cons

Discover the cheapest car insurance companies for new drivers with State Farm, Progressive, and Allstate as these top companies offer tailored coverage, exceptional service, and affordable car insurance rates to new drivers, with average monthly rates for good drivers. State Farm stands out as the top choice, offering comprehensive coverage tailored to new drivers’ needs with competitive rates and reliable customer service.

With discounts up to 15%, State Farm provides affordable options for those just starting out on the road. Progressive and Allstate also offer competitive rates and valuable support, making them excellent choices for new drivers looking for reliable coverage.

Our Top 10 Company Picks: Cheapest Car Insurance Companies for New Drivers

| Company | Rank | Monthly Rates | Multi-Policy Discount | Best For | Jump to Pros/Cons |

|---|---|---|---|---|---|

| #1 | $180 | 17% | Steer Clear | State Farm | |

| #2 | $200 | 10% | Snapshot Program | Progressive | |

| #3 | $220 | 25% | TeenSMART | Allstate | |

| #4 | $190 | 25% | Driver's Ed | Geico | |

| #5 | $230 | 25% | TeenSMART | Liberty Mutual |

| #6 | $210 | 20% | SmartRide | Nationwide |

| #7 | $200 | 10% | Signal App | Farmers | |

| #8 | $220 | 25% | KnowYourDrive | American Family | |

| #9 | $190 | 8% | IntelliDrive | Travelers | |

| #10 | $210 | 10% | DriveSense | Esurance |

Whether you’re a teenage driver, an adult driving for the first time, or a foreign national with driving experience, these companies have you covered. Get the right car insurance at the best price — enter your ZIP code above to shop for coverage from the top insurers.

#1 – State Farm: Top Overall Pick

Pros

- Bundling Discounts: Offers substantial discounts for bundling multiple insurance policies.

- High Low-Mileage Discount: Provides significant discounts for low-mileage usage.

- Wide Coverage Options: State Farm car insurance review showcase various coverage options tailored to different business needs.

Cons

- Limited Multi-Policy Discount: The multi-policy discount may not be as high compared to some competitors.

- Potential Premium Costs: Despite discounts, premiums might still be relatively higher for certain coverage levels.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#2 – Progressive: Best for Innovation in Insurance

Pros

- Snapshot Program: Offers up to 10% discounts through the Snapshot Program.

- Competitive Pricing: Generally competitive pricing compared to industry standards.

- Innovative Technology: Progressive car insurance review highlight utilization of technology-driven approaches for policy management.

Cons

- Limited Discount Options: Discount options might be relatively limited compared to some competitors.

- Customer Service Concerns: Some customers report issues with customer service responsiveness.

#3 – Allstate: Best for Personalized Protection

Pros

- TeenSMART Program: Offers up to 25% discounts through the TeenSMART program.

- Comprehensive Coverage: Provides a wide range of coverage options for various needs.

- Strong Financial Stability: Allstate car insurance review boast a solid financial stability rating.

Cons

- Potentially Higher Premiums: Premiums might be higher compared to some competitors.

- Complex Discount Structure: Discount programs may be intricate and challenging to navigate for some customers.

#4 – Geico: Best for Budget-Friendly Coverage

Pros

- Driver’s Ed: Offers up to 25% discounts through Driver’s Ed programs.

- Competitive Pricing: Geico car insurance review underscore being known for competitive pricing and discounts.

- Ease of Access: Geico has a user-friendly website and mobile app for policy management.

Cons

- Limited Customization: Coverage options might be relatively less customizable compared to some competitors.

- Mixed Customer Service Reviews: Some customers report dissatisfaction with customer service experiences.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#5 – Liberty Mutual: Best for Flexible Coverage Solutions

Pros

- TeenSMART Program: Offers up to 25% discounts through the TeenSMART program.

- Flexible Coverage Options: Provides customizable coverage solutions to meet individual needs.

- Strong Financial Stability: Liberty Mutual car insurance review accentuate its solid financial stability rating.

Cons

- Potentially Higher Premiums: Premiums might be higher compared to some competitors.

- Complex Claims Process: Some customers report challenges with the claims process and reimbursement.

#6 – Nationwide: Best for Trusted Protection Partner

Pros

- SmartRide: Offers up to 20% discounts through the SmartRide program. Discover more Nationwide car insurance discounts for more savings.

- Solid Financial Stability: Nationwide has a strong financial stability rating.

- Variety of Coverage Options: Provides a wide range of coverage options to suit different needs.

Cons

- Limited Discount Availability: Some customers may find the discount options relatively limited.

- Coverage Limitations: Coverage options might not be as comprehensive compared to some competitors.

#7 – Farmers: Best for Modern Insurance Solutions

Pros

- Signal App: Offers up to 10% discounts through the Signal App program.

- Variety of Coverage Options: Farmers car insurance review provide a wide range of coverage options to suit different needs.

- Ease of Access: Farmers offers an intuitive online platform for policy management.

Cons

- Limited Discount Options: Discount options might be relatively limited compared to some competitors.

- Higher Premiums: Premiums might be higher compared to some competitors.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#8 – American Family: Best for Technology-Driven Coverage

Pros

- KnowYourDrive Program: Offers up to 25% discounts through the KnowYourDrive program.

- Innovative Technology: Utilizes technology for personalized coverage solutions.

- Strong Customer Service: American Family car insurance review is known for its excellent customer service.

Cons

- Potentially Higher Premiums: Premiums might be higher compared to some competitors.

- Limited Discount Availability: Some customers may find the discount options relatively limited.

#9 – Travelers: Best for Intelligent Insurance

Pros

- IntelliDrive Program: Offers up to 8% discounts through the IntelliDrive program.

- Wide Range of Coverage: Provides a comprehensive range of coverage options for various needs.

- Reputable Company: Travelers car insurance review has a long-standing reputation for reliability.

Cons

- Limited Discount Options: Discount options might be relatively limited compared to some competitors.

- Complex Underwriting Process: Some customers report challenges with the underwriting process.

#10 – Esurance: Best for Effortless Insurance Solutions

Pros

- DriveSense Program: Offers up to 10% discounts through the DriveSense program. Learn more on our “How do you get an Esurance car insurance quote?“

- Streamlined Processes: Known for its user-friendly online platform and streamlined processes.

- Quick Claims Handling: Esurance is praised for its efficient claims handling.

Cons

- Limited Discount Availability: Some customers may find the discount options relatively limited.

- Potential for Higher Premiums: Premiums might be higher compared to some

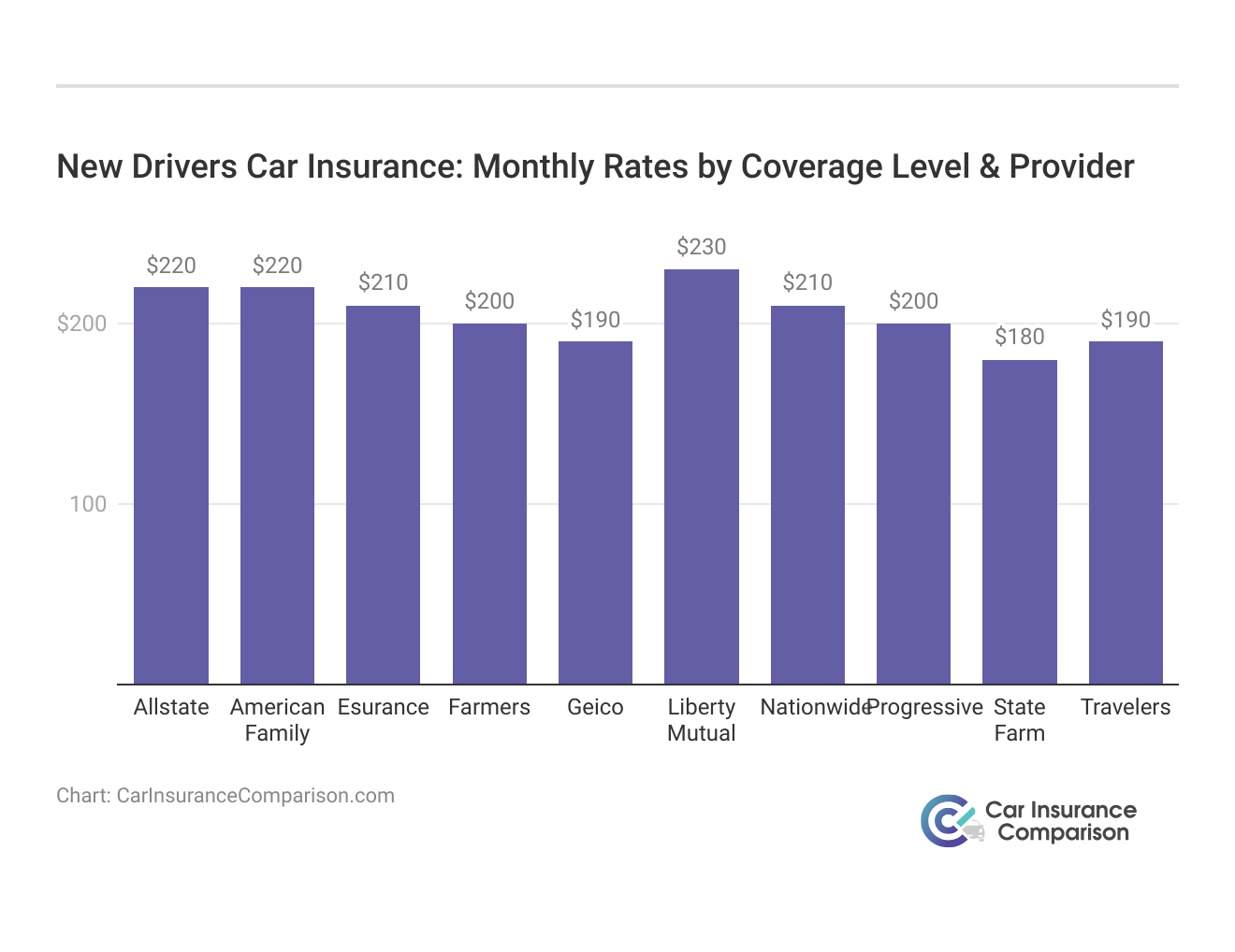

New Drivers Car Insurance: Monthly Rates by Coverage Level & Provider

| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| Allstate | $220 | $330 |

| American Family | $220 | $320 |

| Esurance | $210 | $310 |

| Farmers | $200 | $330 |

| Geico | $190 | $290 |

| Liberty Mutual | $230 | $350 |

| Nationwide | $210 | $310 |

| Progressive | $200 | $320 |

| State Farm | $180 | $300 |

| Travelers | $190 | $340 |

First-Time Car Insurance: Who Needs It

Drivers needing first-time car insurance come from various backgrounds, but they all have one thing in common: They’re about to get behind the wheel for the first time. As a result, insurance providers typically classify first-time drivers as those belonging to the following categories:

- Teenage Drivers: New drivers, especially young ones, face higher insurance rates. Adding a teen driver to an existing family policy is often what is the cheapest auto insurance for new drivers way to save, with rates typically decreasing over time with a safe driving record. Comparing car insurance rates for teen drivers can help you get the best deal when adding new drivers to your policy.

- Adults Driving for the First Time: For new adult drivers, insurance rates can be higher compared to those with extensive accident-free driving histories. Insurers perceive new drivers without a safe driving record as riskier to insure, regardless of age. However, rates should decrease over time as you establish a safe driving record.

- Vehicle Owners With a Driving or Coverage Gap: Vehicle owners with expired driver’s licenses and gaps in their driving or insurance coverage history are often grouped with first-time drivers. Even with some driving history, those with long gaps should expect higher insurance costs. It’s advisable to shop around for the best rates before selecting a policy.

- Foreign Nationals and Immigrants: Foreign nationals and immigrants are considered new drivers in the U.S. until they establish a domestic driving history. Driving requirements vary between states, so check with the local Department of Motor Vehicles for specific regulations.

If you are a new driver in the U.S., you can compare car insurance rates for foreigners to get the best deal from the best car insurance company for new drivers. And if you are an American citizen with foreign visitors, check with your insurance company to see if your car insurance will cover relatives with international driving permits. Anyone driving a vehicle in the U.S. must have a minimum amount of car insurance, regardless of citizenship or how long they’ve had a license.

Although the minimum level of coverage required by law varies between states, it’s important to ensure your car insurance coverage meets the required minimums where you live. In addition, new drivers should generally expect to pay more for insurance coverage than older, more experienced drivers.

Best Car Insurance for Different Group of New Drivers

First is best car insurance for new drivers under 25. Buying insurance can be expensive when you’re a new driver under 25. For example, the average monthly insurance cost for a 16-year-old male with a clean driving record is $619. However, by conducting thorough research and choosing a reputable car insurance company that offers competitive rates, you can save money while establishing a driving history.

Full Coverage Car Insurance Monthly Rates for 18-Year-Old Drivers by Gender & Provider

| Insurance Company | Male Drivers | Female Drivers |

|---|---|---|

| Allstate | $518 | $448 |

| Farmers | $628 | $597 |

| Geico | $253 | $219 |

| Liberty Mutual | $625 | $521 |

| Nationwide | $387 | $302 |

| Progressive | $661 | $590 |

| State Farm | $283 | $229 |

| Travelers | $739 | $530 |

Although it’s unlikely that a young new driver will find rates lower than more experienced drivers, consider shopping around when looking for first-time car insurance. By comparing quotes, you can get the lowest rates available as a new driver.

Discover more information on our “Average Car Insurance Rates by Age and Gender“.

Next is best car insurance for new drivers over 25. On average, a 30-year-old female driver with a clean driving record pays around $128 per month for car insurance in the U.S. Insurance rates could be higher for a new driver without a driving history. Still, some insurance companies offer competitive pricing that can potentially help new drivers save on coverage.

Because insurance rates vary between providers based on various factors, make sure to shop around and compare quotes before purchasing an car insurance policy. Some insurance providers offer competitive rates that can potentially save you money over the long run. Another is best car insurance for new drivers added to a family policy. If you’re a parent, finding affordable car insurance coverage for your new teen driver can feel tricky.

Although adding a teenage driver to your family’s car insurance policy can increase your rates significantly, it’s likely to be a less expensive solution than purchasing a separate policy.

State Farm offers the best car insurance for new drivers, providing tailored coverage and exceptional service with discounts up to 15%.

Brad Larson Licensed Insurance Agent

Make sure to shop around before adding your teen to your family policy. By comparing insurance quotes, you can ensure your family gets affordable coverage while protecting your new teen driver.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Tips for Getting Cheaper First-Time Car Insurance

If you’re a first-time driver looking for ways to save on your first car insurance policy, you can potentially take steps to lower your rates. New drivers should consider the following when looking for their first car insurance policy:

- Shop around. Many insurance companies offer competitive rates that can save you money as a new driver, but you’ll never know what’s out there unless you compare quotes. Make sure to compare quotes every 6-12 months for the best chance at saving money with the best insurance company for new drivers.

- Join a family policy. While adding a teen driver to an existing car insurance policy can result in a significant increase in an older driver’s rates, it can be more cost-effective than purchasing a separate policy for a new driver.

- Consider bundling your coverage. Many insurance companies offer discounts for bundled insurance policies. So if you need renters or homeowners insurance along with car insurance, ask your insurer if you can bundle the policies and save.

- Buy less coverage. It’s important to buy as much car insurance coverage as possible to stay protected in a serious accident. Still, if you decide you don’t need some optional coverage, purchasing less coverage — or even the state minimum — can result in lower rates. Despite the potential for savings, new drivers should know that buying less insurance can be risky.

- Drive safely. By establishing a history of violation- and accident-free driving, new drivers can prove to insurers that they don’t pose a high risk to others on the road and are, therefore, worthy of lower rates.

- Ask your insurer about discounts. Most insurance companies offer a variety of discounts for policyholders. You can save money on your monthly premiums by taking advantage of the discounts you’re eligible for. Other savings methods include paying your premium upfront and selecting a higher deductible.

As you navigate the process of getting your first car insurance policy, remember that being proactive can lead to significant savings. By comparing quotes, exploring family policies, bundling coverage, adjusting your coverage, driving safely, and taking advantage of available discounts, you can make your first car insurance policy more affordable. Safe driving.

Common Car Insurance Discounts for New Drivers

Discounts can be a great way to save money on car insurance. When shopping for car insurance for the first time, remember to ask about the discounts offered by the insurer you’re considering buying a policy. Common discounts offered by many insurance companies include the following:

- Good/Safe Driver Discount: Safe driver discount is for drivers with a history of being violation- and accident-free.

- Honor Roll Discount: For students enrolled in school, some insurers offer discounts for maintaining a grade point average above a specific range. This is also known as a good student discount.

- Anti-Theft Discount: Some insurers offer discounts for drivers with anti-theft devices or equipment installed on their vehicle or using a vehicle recovery service like Lojack.

- Multi-Policy Discount: For policyholders that have multiple policies through the same insurer, some insurance companies offer discounts for “bundles.”

- Multi-Car Discount: You can get cheaper car insurance coverage for a second car if you have multiple vehicles insured under the same insurance provider, you might be eligible for a multi-car discount if your insurer offers one.

- Occupational Discount: Some insurance providers offer occupation-based discounts for those in professions such as education, medicine, or public safety. Insurers that offer these discounts will typically require proof of employment in the required field.

- Defensive Driver Discount: Some insurers offer discounts for policyholders that provide proof of attending a defensive driving course, which can teach you safer driving skills.

Before buying your first car insurance policy, ask your insurance agent or provider about the discounts available. Then, check the eligibility requirements associated with each discount before requesting to add it to your policy. Even if you aren’t eligible for all the discounts available, every little bit can reduce your monthly insurance payment.

How to Get Car Insurance for the First Time

The process can feel overwhelming when shopping for first-time car insurance. However, buying a car insurance policy is relatively straightforward, and after you’ve done it once, you’ll be familiar with the process for the rest of your time behind the wheel. You should be on the road in no time by following the steps below.

- Get your documents in order. Follow state and local requirements to obtain your driver’s license.

- Compare quotes. Shop around and compare quotes for car insurance policies. You may also get insurance quotes online. Make sure to ask about any discounts that the insurer might offer.

- Contact the insurance agent or company of your choice. Once you’ve found the best coverage and rates available, get in touch with your insurance agent or provider and start the process of obtaining insurance.

- Provide the requested information. Your insurance agent or provider will walk you through the process of applying for coverage. Usually, you’ll need to provide your personal identification information and information about your vehicle and driving history.

- Pay your premium and receive your insurance documents. Most insurance companies will allow you to choose between paying monthly installments toward your premium or paying in a lump sum.

- Print out (or download) your proof of insurance and keep it on hand. Make sure to keep your proof of insurance to provide it to the necessary people if you’re ever pulled over or involved in an accident.

With these steps, you’ll be on the road in no time. Don’t hesitate to ask your insurance agent any questions you may have along the way. Check out our “How do you get car insurance fast?” for more details.

Remember, having the right car insurance brings peace of mind on every journey. So, take your time, understand your policy, and drive confidently knowing you’re protected.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Case Studies: Car Insurance for New Drivers

Let’s explore some real-life scenarios of individuals obtaining car insurance as new drivers. These case studies provide insight into the experiences of new drivers and how they navigated the process of getting their first car insurance policies.

- Case Study #1 – Teenage Driver: Emma, 16, is eager to get her driver’s license. Her parents compare insurance quotes and find an affordable policy for teenage drivers, ensuring Emma has necessary coverage without breaking the bank.

- Case Study #2 – Adult First-Time Driver: Michael, a recent immigrant, needs car insurance for the first time in the U.S. Despite his lack of driving history, he finds competitive rates by comparing different insurance companies and policies.

- Case Study #3 – Expired License and Coverage Gap: Sarah returns to the U.S. after years abroad, needing car insurance again. Despite a coverage gap, she finds an insurer offering reasonable rates by demonstrating her safe driving history. Delve more information on our “Can you get car insurance with an expired license?“.

- Case Study #4 – Foreign National With Driving Experience: Juan immigrates to the U.S. with a clean driving record from his home country. Despite being considered a new driver, he finds insurance companies catering to foreign nationals, offering competitive rates. By choosing wisely, he gets the coverage he needs affordably.

These case studies demonstrate the various situations new drivers may encounter when obtaining car insurance for the first time. Whether they’re teenagers, adults, or foreign nationals, there are options available for new drivers to find affordable coverage and get on the road legally.

State Farm stands out as the top choice, offering comprehensive coverage tailored to new drivers’ needs with competitive rates and reliable customer service.

Tracey L. Wells Licensed Insurance Agent & Agency Owner

By comparing quotes, exploring coverage options, and being proactive, new drivers can find the right insurance policy to meet needs.

Car Insurance for First-Time Drivers: The Lowdown

First-time drivers — especially those of younger age groups — are often perceived as riskier to insure than older and more experienced drivers. Because of that, new drivers should expect to pay higher rates for car insurance than drivers with extensive safe driving records.

However, by shopping around and asking your insurer about the discounts you might be eligible for, you can reduce your rates while building up an accident-free driving record over time.

Check out our “Best Car Insurance for High-Risk Drivers” for more insights.

Stop overpaying for car insurance. Our free quote comparison tool allows you to shop for quotes from the top providers near you by entering your ZIP cod below.

Frequently Asked Questions

Why is car insurance for new drivers so expensive?

New drivers – especially younger ones – are statistically more likely to be involved in serious accidents than older drivers. In addition, because of the risks associated with a limited driving history, insurance rates for new drivers tend to be higher than for those with more years of experience behind the wheel.

Do new drivers need car insurance?

To legally operate a vehicle in the U.S., all drivers must carry a minimum amount of car insurance regardless of the length of time they’ve had a driver’s license. However, because the laws regarding insurance requirements and coverage minimums vary between states, it’s important to check with your insurance agent and your state’s motor vehicles department to ensure your coverage meets local requirements before hitting the road.

Explore more information on “Minimum Car Insurance Requirements by State“.

What is the best type of insurance for first-time drivers?

Because of the added protection it offers, full coverage insurance can be a great choice for first-time drivers. Full coverage includes comprehensive and collision coverage, which will pay for accident-related damage to your vehicle regardless of fault. This coverage can be especially useful for drivers under 20, who are more likely to be involved in accidents than older drivers.

By entering your ZIP code below, you can get instant car insurance quotes from top providers.

What age is car insurance the lowest?

Car insurance premiums usually decrease as you age, especially if you maintain a safe driving record for three to five years after an accident or citation, or if you switch to a more affordable insurance provider. Both men and women experience the most significant decrease in car insurance rates between the ages of 18 and 19.

Do new drivers need full coverage car insurance?

While full coverage insurance offers the most comprehensive protection, it’s not always necessary for new drivers. However, it can provide valuable coverage for damage to your own vehicle, especially if it’s financed or leased.

Uncover more on our “What car insurance is required to lease a car?” for additional details.

What factors affect car insurance rates for new drivers?

Car insurance rates for new drivers are influenced by various factors, including age, driving experience, type of vehicle, location, coverage level, and driving record.

Can new drivers get discounts for completing driver’s education courses?

Yes, many insurance companies offer discounts to new drivers who complete approved driver’s education courses. These courses can help new drivers develop safe driving habits and may lead to lower insurance premiums.

How can new drivers save money on car insurance?

New drivers can save money on car insurance by maintaining a clean driving record, taking advantage of available discounts, choosing a safe and reliable vehicle, and comparing quotes from multiple insurance companies.

Do new drivers need to be listed on their parents’ insurance policy?

If a new driver is living with their parents and driving a vehicle owned by them, it’s usually more affordable to be listed on their parents’ insurance policy as an additional driver. However, this varies depending on the insurance company and individual circumstances.

Find cheap car insurance quotes by entering your ZIP code below.

Can international students get car insurance in the United States?

Yes, international students studying in the United States can typically get car insurance, but they may face higher rates due to their lack of driving history in the country. Some insurance companies offer special policies for international students.

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.