Best Car Insurance for Union Members in 2026 (Top 10 Companies)

Uncover the best car insurance for union members with top companies like State Farm, Progressive, and Allstate. Their competitive rates for as low as $90, tailored benefits, and exceptional service make them leaders in ensuring savings and satisfaction.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Licensed Insurance Agent

Brad Larson has been in the insurance industry for over 16 years. He specializes in helping clients navigate the claims process, with a particular emphasis on coverage analysis. He received his bachelor’s degree from the University of Utah in Political Science. He also holds an Associate in Claims (AIC) and Associate in General Insurance (AINS) designations, as well as a Utah Property and Casual...

Brad Larson

Insurance Claims Support & Sr. Adjuster

Kalyn grew up in an insurance family with a grandfather, aunt, and uncle leading successful careers as insurance agents. She soon found she has similar interests and followed in their footsteps. After spending about ten years working in the insurance industry as both an appraiser dispatcher and a senior property claims adjuster, she decided to combine her years of insurance experience with another...

Kalyn Johnson

Updated May 2024

18,155 reviews

18,155 reviewsCompany Facts

Full Coverage for Union Members

A.M. Best Rating

Complaint Level

Pros & Cons

18,155 reviews

18,155 reviews 13,283 reviews

13,283 reviewsCompany Facts

Full Coverage for Union Members

A.M. Best Rating

Complaint Level

13,283 reviews

13,283 reviews 11,638 reviews

11,638 reviewsCompany Facts

Full Coverage for Union Members

A.M. Best Rating

Complaint Level

Pros & Cons

11,638 reviews

11,638 reviewsAnalyze the best car insurance for union members with leading companies like State Farm, Progressive, and Allstate. Considering factors such as credit score, mileage, coverage, and driving record.

By doing a little bit of research online and comparing car insurance quotes, consumers can quickly review the different union-based car insurance opportunities offered by various car insurance companies in their area.

Our Top 10 Company Picks: Best Car Insurance for Union Members

| Company | Rank | Multi-Policy Discount | Safe Driver Discount | Best For | Jump to Pros/Cons |

|---|---|---|---|---|---|

| #1 | 17% | 15% | Customer Service | State Farm | |

| #2 | 30% | 10% | Customizable Policies | Progressive | |

| #3 | 10% | 15% | Accident Forgiveness | Allstate | |

| #4 | 10% | 12% | Military Members | USAA | |

| #5 | 10% | 12% | Enhanced Replacement | Liberty Mutual |

| #6 | 20% | 10% | Vanishing Deductible | Nationwide |

| #7 | 15% | 12% | Signal App | Farmers | |

| #8 | 20% | 10% | Smart Coverage | Travelers | |

| #9 | 20% | 12% | Safe Driving | American Family | |

| #10 | 10% | 15% | Member Discounts | AAA |

It is important, of course, to understand the fundamental car insurance benefits that accompany insurance union quotes. Enter your ZIP code above to compare free car insurance quotes from multiple companies today.

- State Farm, Progressive, and Allstate emerge as top choices for union members

- Savings and tailored coverage address unique work-related driving situations

- Highlight providers cater to union members’ diverse needs

#1 – State Farm: Top Overall Pick

Pros

- Multi-Policy Discount: Offers up to 17% for combining different insurance policies.

- Safe Driver Discount: Provides up to 15% off for maintaining a good driving record.

- Customer Service: Known for strong customer service, ensuring assistance when needed.

Cons

- Limited Military Discount: Compared to some competitors, State Farm’s military discount is relatively lower.

- Premium Rates: While competitive, premium rates may not always be the lowest available. Learn more about their rates in our State Farm car insurance review.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#2 – Progressive: Best for Innovative Technology

Pros

- High Multi-Policy Discount: Progressive offers up to 30% savings for bundling multiple policies. Read more about their discounts in our Progressive car insurance review.

- Customizable Policies: Known for flexibility, allowing customers to tailor policies based on individual needs.

- Innovative Snapshot App: Offers a unique Signal App for safe drivers, potentially leading to additional discounts.

Cons

- Potentially Higher Rates for Some Drivers: While highly customizable, rates may be higher for certain driver profiles.

- Limited Military Benefits: May not offer as extensive benefits for military members as some other providers.

#3 – Allstate: Best for Feature-Rich Policies

Pros

- Accident Forgiveness: Provides up to 15% discount with accident forgiveness, ideal for drivers with occasional mishaps.

- Multi-Policy Discount: Offers up to 10% savings for bundling different insurance policies.

- Enhanced Replacement Coverage: Includes Enhanced Replacement, covering the cost of a new car in case of a total loss. Learn more in our Allstate car insurance review.

Cons

- Limited Military Discounts: May not have as extensive military discounts as some competitors.

- Potentially Higher Premiums: Premium rates might be relatively higher for certain profiles.

#4 – USAA: Best for Military Savings

Pros

- Highly Competitive Military Discounts: Offers substantial discounts for military members, making it a top choice for this demographic.

- Multi-Policy Discount: Provides up to 10% savings for bundling multiple policies.

- Safe Driver Discount: Offers up to 12% off for maintaining a good driving record.

Cons

- Exclusive to Military Members: As mentioned in our USAA car insurance review , they are only available to military members and their families.

- Limited Accessibility: Not accessible to the general public, limiting its availability.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#5 – Liberty Mutual: Best for Multi-Policy Discounts

Pros

- Enhanced Replacement Coverage: Offers coverage for enhanced replacement, ensuring the cost of a new car in case of a total loss.

- Multi-Policy Discount: Provides up to 10% savings for bundling multiple policies.

- Safe Driver Discount: Offers up to 12% off for maintaining a good driving record.

Cons

- Potentially Higher Premiums: While competitive, premium rates may not be the lowest available.

- Varied Customer Service Reviews: Customer service experiences may vary, with some customers reporting less favorable encounters. For more information, read our Liberty Mutual car insurance review.

#6 – Nationwide: Best for Family Coverage

Pros

- High Multi-Policy Discount: Offers up to 20% savings for bundling multiple policies.

- Safe Driving Discount: Provides up to 10% off for maintaining a good driving record. Learn more about their discounts in our Nationwide car insurance discounts article.

- Vanishing Deductible: Allows for a reduction in deductible over time with safe driving.

Cons

- Varied Customer Reviews: Customer satisfaction may vary, with some mixed reviews.

- Potentially Higher Premiums: Rates may be relatively higher for specific driver profiles.

#7 – Farmers: Best for Customizable Policies

Pros

- Multi-Policy Discount: Offers up to 15% savings for bundling different insurance policies.

- Safe Driver Discount: Provides up to 12% off for maintaining a good driving record.

- Signal App: As mentioned in our Farmers car insurance review, they introduce the Signal app for potential additional discounts based on driving behavior.

Cons

- Potentially Higher Premiums: While competitive, premium rates may not be the lowest available.

- Mixed Customer Service Reviews: Customer service experiences may vary, with some customers reporting mixed reviews.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#8 – Travelers: Best for Affordability and Discounts

Pros

- High Multi-Policy Discount: Offers up to 20% savings for bundling multiple policies.

- Smart Coverage: Provides innovative smart coverage options for enhanced protection.

- Safe Driver Discount: Offers up to 10% off for maintaining a good driving record.

Cons

- Potentially Higher Premiums: Rates may be relatively higher for specific driver profiles. Learn more about their rates in our Travelers car insurance review.

- Mixed Customer Service Reviews: Customer service experiences may vary, with some customers reporting mixed reviews.

#9 – American Family: Best for Loyalty Rewards

Pros

- High Multi-Policy Discount: Offers up to 20% savings for bundling multiple policies.

- Safe Driving Discount: Provides up to 12% off for maintaining a good driving record.

- Variety of Coverage Options: As outlined in our American Family car insurance, they provide diverse coverage options for personalized protection.

Cons

- Potentially Higher Premiums: Rates may be relatively higher for specific driver profiles.

- Varied Customer Service Reviews: Customer service experiences may vary, with some mixed reviews.

#10 – AAA: Best for Member Discounts

Pros

- Multi-Policy Discount: Offers up to 10% savings for bundling different insurance policies.

- Safe Driver Discount: Provides up to 15% off for maintaining a good driving record.

- Member Discounts: Introduces member discounts for additional savings. Learn more in our AAA car insurance review.

Cons

- Potentially Higher Premiums: While competitive, premium rates may not be the lowest available.

- Mixed Customer Service Reviews: Customer service experiences may vary, with some customers reporting mixed reviews.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

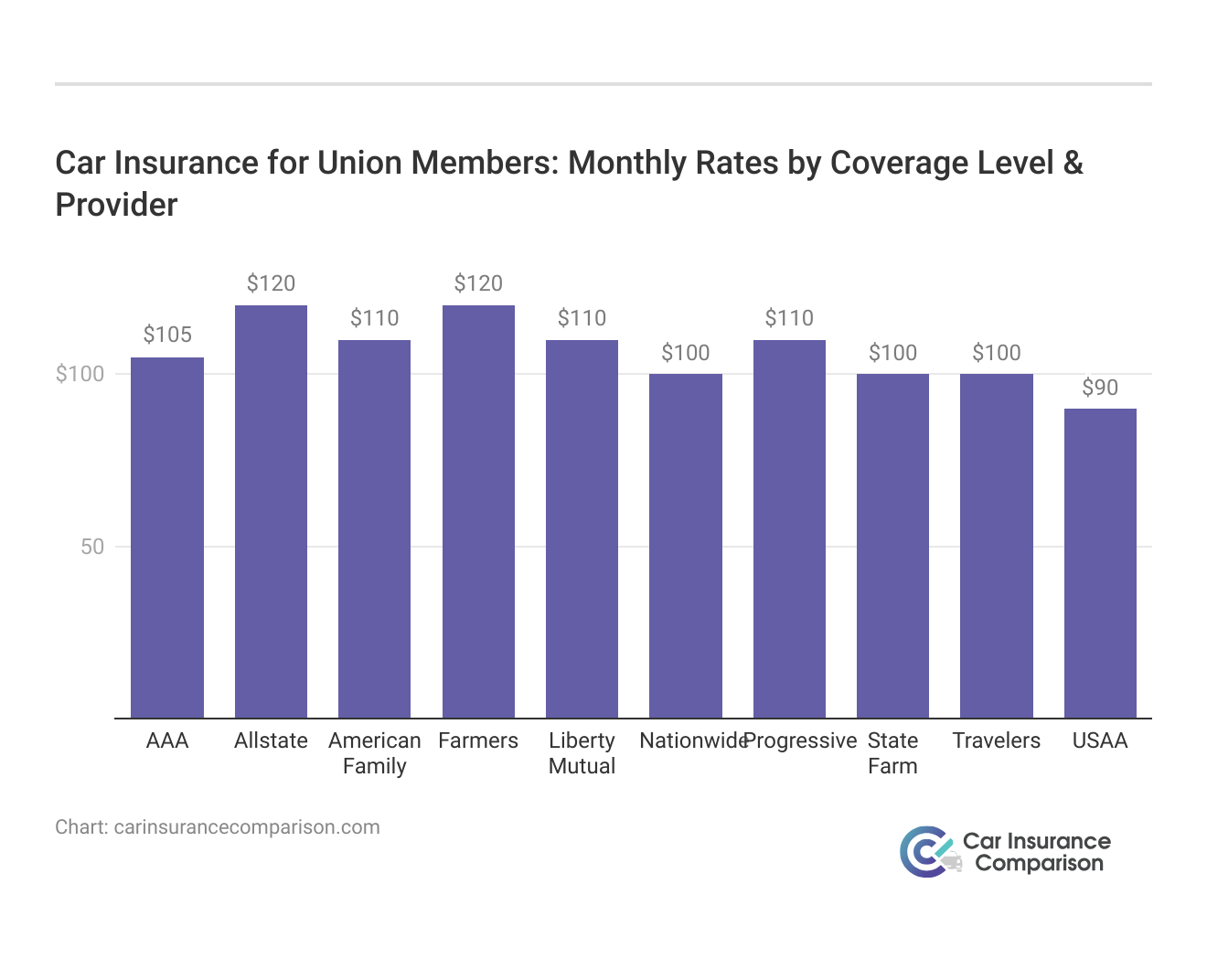

Compare Monthly Car Insurance Rates for Union Member With Industry Leaders

When it comes to securing car insurance for union members, understanding the offerings from various insurance companies is crucial. The following analysis compares monthly car insurance rates for union members among industry leaders, shedding light on the top choices and providing insights into both minimum and full coverage options.

Car Insurance for Union Members: Monthly Rates by Coverage Level & Provider

| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| AAA | $105 | $230 |

| Allstate | $120 | $300 |

| American Family | $110 | $260 |

| Farmers | $120 | $280 |

| Liberty Mutual | $110 | $250 |

| Nationwide | $100 | $220 |

| Progressive | $110 | $250 |

| State Farm | $100 | $200 |

| Travelers | $100 | $240 |

| USAA | $90 | $180 |

Three standout choices are State Farm, Progressive, and Allstate. State Farm offers a balanced mix of affordability and reliability, with minimum coverage at $100 and full coverage at $200. Progressive impresses with competitive rates—$110 for minimum coverage and $250 for full coverage—alongside innovative policies.

State Farm stands out as the top choice for union members, offering a balanced mix of affordability, reliability, and exceptional service.

Dani Best Licensed Insurance Producer

Allstate, a premium option at $120 for minimum coverage and $300 for full coverage, caters to those prioritizing extensive coverage and additional features. Union members can choose between these options based on their specific preferences and priorities.

Read more: Compare Professional Group Member Car Insurance Rates

Saving Money for Union Members

Consumers will be surprised to learn of the cost saving opportunity of group-based car insurance.

- Average annual savings reported at $458.

- Union members can increase coverage amounts significantly and pay no more in rates.

- Group-based car insurance will allow consumers to afford a car they have always wanted but could not pay the high cost of car insurance.

By following these cost saving opportunity, you’ll save money with a peace of mind.

Union Car Insurance for Couples With Teenage Children

Many scientific studies have been conducted to ascertain why teenagers exhibit so much irresponsibility behind the wheel of an automobile.

The results reveal that parental guidance and competent driver education will result in fewer traffic fatalities involving teenagers.

How can group-based car insurance help?

- Many of the low car insurance quotes for unions offer car insurance educational grants of up to $250.

- Parents are encouraged to take these grants and apply them to the best student driver training classes available.

- In turn, insurance rates for the family remain low as fewer traffic violations amount to reduced risk assumed by the car insurance company.

Read more: Compare Best Car Insurance Companies for Families

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Rates and Coverage During Strikes

The purpose of a union has always been to fight for the right of people to work for good pay, in safe environments, and for equality in healthcare and quality of life.

- When getting a free car insurance union quote, be sure the insurance extends into strikes and labor lockouts

- This is a deferment of payment.

- Several car insurance companies will extend the premium two months or more while the labor union. negotiates a better contract with the company they work for. Learn more in our article called “Can I extend my car insurance for a month?“.

When a company fails to hold up their end of the bargain, the union is obligated to strike or hold a lockout. Many group-based car insurance companies are prepared to be on the side of the consumer in times such as these.

Additional Benefits Available for Union Car Insurance Members

When saving nearly $500 a month sounds like a lovely idea, many people worry that car insurance union will skimp on other services hard working families have come to enjoy.

- 24/7 Roadside Assistance

- Emergency Travel and Medical Assistance

- Identity Theft Restoration

- Multi-Car Premium Discounts

- Vehicle Safety Features Discounts

However, when researching the free car insurance quotes online, consumers will quickly find the same services they need are provided fully and completely, 100 percent of the time.

Car Insurance Unions Mandate Specific Repair Shops for Consumers

Car insurance companies want the customer to not notice any changes in coverage when switching into union car insurance aside from the extra dollars in the wallet at the end of the month.

Plus, insurance executives likely don’t live in your town. The way they feel, you know the best mechanic for your vehicle. (Read more: Can my car insurance company make me use a specific car repair shop?)

Find out if union insurance — or some other company — can best meet your needs. Just enter your ZIP code below and compare car insurance quotes today.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Case Studies: Empowering Union Members With Tailored Car Insurance Solutions

Through three distinct case studies, we delve into their experiences with State Farm, Progressive, and Allstate, uncovering how these insurers cater to the unique needs and preferences of union members. From remarkable discounts to customizable policies and innovative features.

- Case Study #1 – Union Powerhouse Savings With State Farm: Sarah, a dedicated union member, recently decided to explore the potential savings offered mentioned in our State Farm car insurance review. By bundling her car insurance with other policies, such as home and life insurance, she unlocked a remarkable 17% multi-policy discount.

- Case Study #2 – Tailored Protection for Union Members With Progressive: John, a union member with specific needs for his car insurance, found Progressive to be the perfect fit. With Progressive’s customizable policies, John was able to tailor his coverage to match his unique requirements. The company’s commitment to innovation, showcased through the Signal App for safe drivers, allowed John to further reduce his premiums.

- Case Study #3 – Accident Forgiveness and Enhanced Replacement Coverage With Allstate: Emily, a union member with a busy schedule, sought insurance coverage that provided extra protection and peace of mind. Allstate’s accident forgiveness feature proved to be a game-changer for Emily, offering a 15% discount in the event of an occasional mishap. Additionally, the enhanced replacement coverage ensured that Emily would be covered for the cost of a new car in case of a total loss.

Through innovative solutions and personalized service, insurers continue to demonstrate their commitment to meeting the evolving needs of union members and providing them with the protection they need to thrive.

Frequently Asked Questions

How much money can union members expect to save?

How do you get the lowest down payment on car insurance? Well, Union members can receive up to 25% off their car insurance rates. The exact savings depend on the agreement between the union and the insurance company.

How will union car insurance help couples with teenage children?

Union car insurance can provide parental guidance and competent driver education, which can result in fewer traffic fatalities involving teenagers.

Finding cheap car insurance quotes is easy. Just enter your ZIP code into our free comparison tool below to instantly compare quotes near you.

What happens to rates and coverage during strikes?

Many group-based car insurance companies support consumers during strikes by maintaining rates and coverage. They stand with the consumers when companies fail to uphold their end of the bargain.

What additional benefits are available to union car insurance members?

Union car insurance offers the same services and coverage as other providers, ensuring that hardworking families enjoy the same benefits while saving money.

Does car insurance union force consumers to go to a specific repair shop?

No, car insurance unions allow consumers to choose their preferred repair shop. They aim to provide seamless coverage without interfering in the customer’s choices.

Read more: Should I use the auto body shop my car insurance company recommends?

How can union members benefit from car insurance tailored to their needs?

Union members can benefit from car insurance tailored to their needs through specialized offerings and potential savings of up to 25%. Leading insurers collaborate to provide exclusive discounts and additional insurance products that enhance the quality of life for union members.

What key factors influence car insurance rates for union members?

factors that affect car insurance rates for union members such as credit score, mileage, coverage level, and driving record are crucial. Understand them to make informed decisions and secure favorable rates.

Are there specific discounts available for union members when it comes to car insurance?

Yes, car insurance for union members often comes with specialized discounts. Top insurers such as State Farm, Progressive, and Allstate offer exclusive multi-policy discounts, safe driver discounts, and other perks tailored to the unique needs of union members.

Ready to find cheaper car insurance coverage? Enter your ZIP code below to begin.

Can union members switch their car insurance providers easily, and what factors should be considered when making a switch?

Yes, union members can switch car insurance providers. When considering a switch, it’s important to assess factors such as coverage options, discounts, customer service, and any potential penalties or fees for canceling the existing policy.

Read more: Can I change my car insurance company mid-policy?

Are there specific coverage options designed to address the needs of union members with unique work-related driving situations?

Yes, some car insurance providers offer coverage options tailored to union members with unique work-related driving situations. This can include coverage for business use of personal vehicles or specialized policies that account for the demands of certain professions.

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.