Cheap Car Insurance in 2026 (Secure Low Rates With These 10 Companies)

The top companies for cheap car insurance are Nationwide, Geico, and State Farm. Nationwide has the cheapest car insurance rates, with an average rate of $35/mo for minimum coverage. The cheapest car insurance companies also offer good driver discounts that can save up to 30% at some companies.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Licensed Insurance Agent

Jeffrey Manola is an experienced insurance agent who founded TopQuoteLifeInsurance.com and NoMedicalExamQuotes.com. His mission when creating these sites was to provide online consumers searching for insurance with the most affordable rates available. Not only does he strive to provide consumers with the best prices for insurance coverage, but he also wants those on the market for insurance to ...

Jeffrey Manola

Licensed Insurance Agent

Justin Wright has been a licensed insurance broker for over 9 years. After graduating from Southeastern Seminary with a Masters in Philosophy, Justin started his career as a professor, teaching Philosophy and Ethics. Later, Justin obtained both his Property & Casualty license and his Life and Health license and began working for State Farm and Allstate. In 2020, Justin began working as an i...

Justin Wright

Updated May 2024

Company Facts

Min. Coverage for Cheap Car Insurance

A.M. Best Rating

Complaint Level

19,116 reviews

19,116 reviewsCompany Facts

Min. Coverage for Cheap Car Insurance

A.M. Best Rating

Complaint Level

Pros & Cons

19,116 reviews

19,116 reviews 18,155 reviews

18,155 reviewsCompany Facts

Min. Coverage for Cheap Car Insurance

A.M. Best Rating

Complaint Level

Pros & Cons

18,155 reviews

18,155 reviewsNationwide, Geico, and State Farm offer cheap car insurance rates.

How do you get cheaper car insurance quotes? Finding cheap auto insurance coverage doesn’t have to be time-consuming. Generally, the companies listed below offer affordable car insurance rates to the majority of drivers.

| Company | Rank | Monthly Rates | A.M. Best | Best For | Jump to Pros/Cons |

|---|---|---|---|---|---|

| #1 | $35 | A+ | Simple Claims | Nationwide |

| #2 | $39 | A++ | Cheap Rates | Geico | |

| #3 | $40 | A++ | Student Savings | State Farm | |

| #4 | $41 | A+ | UBI Discount | Allstate | |

| #5 | $42 | A | Policy Options | Liberty Mutual |

| #6 | $45 | A | Discount Options | American Family | |

| #7 | $49 | A+ | Budget Shopping | Progressive | |

| #8 | $52 | A | High-Risk Coverage | The General | |

| #9 | $55 | A+ | Online Convenience | Esurance | |

| #10 | $56 | A | Various Discounts | Farmers |

Enter your zip code in our tool right now and start comparing cheap online car insurance quotes from many top companies.

- Nationwide has the cheapest car insurance for most drivers

- Comparison shopping can save you hundreds a month in auto insurance premiums

- Check companies’ ratings on sites like AM Best, JD Powers, and the BBB

#1 – Nationwide: Top Pick Overall

Pros

- Simple Claims: Nationwide offers a simple claims process after an accident.

- Mileage-Based Insurance: Low mileage drivers can get cheap auto insurance rates with Nationwide’s SmartMiles insurance.

- Discount Variety: Customers can get affordable auto insurance by applying for Nationwide car insurance discounts.

Cons

- Telematics Tracking: Nationwide’s mileage-based insurance and UBI discount track driving data.

- Availability: A few select states don’t sell insurance.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#2 – Geico: Best for Government Discounts

Pros

- Government Discounts: Geico offers affiliation discounts for government employees.

- Multi-Vehicle Discount: Insuring more than one car at Geico will be cheaper than insuring vehicles at separate companies.

- Coverage Options: Carry the bare minimum for cheaper car insurance rates, or add on extras for more protection.

Cons

- In-Person Assistance: Services are mostly provided virtually.

- DUI Rates: Geico’s policies are less cheap for DUIs. Learn more about rates in our Geico review.

#3 – State Farm: Best for Student Savings

Pros

- Student Savings: State Farm has discounts geared specifically towards students.

- Local Support: Drivers who want personalized assistance with getting a cheap auto insurance policy can visit local agents.

- Coverage Options: If you have extra to spend, you can add on practical coverages like roadside assistance. Learn more in our State Farm review.

Cons

- Online Functions: Policy purchases and some other tasks will have to be done with an agent rather than online.

- Credit Score Rates: In some states, having a poor credit score could raise your rates.

#4 – Allstate: Best for Pay-Per-Mile Rates

Pros

- Pay-Per-Mile Rates: Low mileage drivers can get cheaper car insurance with Milewise. Discover more in our Allstate Milewise review.

- Discount Options: If you don’t qualify for low mileage insurance, you can still save on a regular policy with discounts.

- Customizable Policies: Customize your Allstate coverage rates by adjusting deductibles and more.

Cons

- Customer Ratings: Customer complaints focus on poor claims handling.

- Young Driver Rates: Teens buying their own auto insurance will find Allstate’s rates high.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#5 – Liberty Mutual: Best for Policy Options

Pros

- Policy Options: Liberty Mutual offers plenty of policy options that can be adjusted to save on car insurance.

- Accident Forgiveness: You can qualify if you’ve been claims-free for a while.

- Discount Options: Liberty Mutual offers many saving opportunities. See what’s offered in our Liberty Mutual review.

Cons

- Claims Satisfaction: Customer claim satisfaction ratings vary.

- DUI Rates: Affordability isn’t as great for DUI drivers.

#6 – American Family: Best for Discount Options

Pros

- Discount Options: Affordable car insurance can be easily found at American Family if you qualify for its discounts.

- Personalized Service: American Family’s local agents can help customers reduce car insurance rates.

- Deductible Options: You may wish to raise your deductibles to lower your rates.

Cons

- Availability: Cheap car insurance from American Family may not be sold in your state.

- DUI Rates: American Family may be pricier than the competition.

#7 – Progressive: Best for Budget Shopping

Pros

- Budget Shopping: If you have an auto insurance budget, use Progressive’s free Name Your Price tool.

- Snapshot Program: Progressive offers up to 30% off auto insurance to good drivers.

- Adjustable Deductibles: Increase your deductibles on some coverages to save.

Cons

- Snapshot Rate Increases: Progressive’s Snapshot program may backfire if you are a bad driver.

- Customer Claim Reviews: Not always rated as satisfactory by Progressive customers. Learn more in our Progressive review.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#8 – The General: Best for High-Risk Coverage

Pros

- High-Risk Coverage: The General specializes in coverage for high-risk drivers. Learn more in our review of The General.

- Discount Options: High-risk drivers can save with the available discounts at The General.

- Online Convenience: You can do most tasks online at The General’s website.

Cons

- Good Driver Rates: Good drivers may not get the cheapest rates, as The General specializes in high-risk insurance.

- Availability: The General isn’t available to purchase in a few states.

#9 – Esurance: Best for Online Convenience

Pros

- Online Convenience: Customers can conveniently file claims, adjust coverages, and more online.

- Usage-Based Discount: Get cheaper auto insurance rates if you are a safe driver (learn more: How do you get an Esurance car insurance quote?).

- SR-22 Insurance: Esurance does insure high-risk drivers who need SR-22 insurance.

Cons

- Availability: Cheap car insurance isn’t sold in every state.

- Coverage Options: Esurance doesn’t offer as diverse of a range of add-on coverages.

#10 – Farmers: Best for Family Plans

Pros

- Family Plans: Families can get cheaper car insurance with multi-vehicle discounts, good student discounts, and more.

- Local Agents: Some states have local agents to provide support with lowering car insurance rates.

- Adjustable Deductibles: Adjust coverage deductibles to lower rates.

Cons

- Customer Reviews: Some reviewers weren’t happy with the customer service they received.

- DUI Rates: Cheap car insurance will be harder to get at Farmers for DUI drivers. Learn more about rates in our Farmers review.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

How to Get Cheap Car Insurance Quotes

At the cheapest auto insurance companies, you will see rates similar to the following:

Car Insurance Monthly Rates for Cheap Car Insurance by Coverage Level & Provider

| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| Allstate | $41 | $135 |

| American Family | $45 | $141 |

| Esurance | $55 | $155 |

| Farmers | $56 | $160 |

| Geico | $39 | $129 |

| Liberty Mutual | $42 | $138 |

| Nationwide | $35 | $124 |

| Progressive | $49 | $143 |

| State Farm | $40 | $132 |

| The General | $52 | $152 |

How do you get car insurance fast? With the development of the internet and quality car insurance websites, you can get a car insurance quote online quickly and easily. When sitting down to get some car insurance quotes online, it is important to have your information ready. Having to leave the computer to search for information can slow down your quote receiving time.

The most efficient way is to gather all pertinent information and then simply enter your zip code into the free tool on this page for quick and easy quotes. You can also go directly to a company’s website for a quote.

Some of the information that car insurance companies will require will be personal. For example: the names of all the drivers in the home, birth dates, and gender.

Companies will also want to know your address, phone number, e-mail address, and cell phone number. Some websites will ask for the social security numbers of all drivers in order to run a check of previous violations but this is not required to view quotes (learn more: Is it a bad idea to give your Social Security number when shopping for car insurance?).

This leads to the next piece of information you will need to have ready. Insurance companies base quotes on many different aspects including driving history. You will need to know the details of any accident or violation any drivers in the household have had in the past five years.

For a violation, this includes the type of violation, the date, and, in some cases, the consequences. For an accident, you will need to state whether or not you were at fault in the accident.

In addition to this, auto insurance companies want to know how long you have consistently carried auto insurance and what carrier you currently use, if any. You will have to know what type of coverage you have, including your liability amounts, collision coverage, and deductible.

Read more: What cars have the lowest car insurance rates?

If you do not have insurance, you will have to know what amounts you want to have. If there are special features you want such as roadside assistance, you will need to input that information as well.

Reviewing Cheap Car Insurance Companies Ratings

Just because a company has a website that offers quotes does not mean it is a legitimate company. You can go to your state’s Department of Insurance website and input any insurance company. This will tell you if the company is licensed to sell insurance in the state.

Choosing a licensed company allows you to go to your state’s Department of Insurance with a complaint should your insurance contract not be kept by the company.

You can also go to an independent financial rating company to find out the financial score of the company. Some independent sites to try are Standard and Poor’s or A.M. Best rating companies.

These independent rating companies rate insurance companies based on their ability to meet their financial obligations, their revenue, their trading history in the stock market (if it’s a public company), and any violations against them.

Read more: Where to Find Car Insurance Company Reviews

The rating will be in the form of a letter such as A+ or C-. Each rating company has a chart that shows viewers what the letters stand for.

Another way to check the viability of a company is through your local or state Better Business Bureau.

The BBB is independently run and takes in information about companies that register with them. A quality company typically registers with the BBB so that their reputation can be proven.

With the BBB you can inquire as to how many complaints and what type of complaints have been made against the company and how those complaints have been resolved.

How to Check Companies’ Websites

Once you have checked out the reliability of a company, search the company’s website. This will give you information on the history of the company, the vision of the company, and their mission statement.

You can see what products they offer, insurance discounts that may be available, and savings you can have by combining policies. A good website will have the most important information on the home page with easy to click on links to other pertinent information. At the cheapest companies, you’ll want to keep your eyes out for bundling discounts and good driver discounts.

The cheapest car insurance will be the minimum coverage requirements in your state. In many states, this is liability insurance, which covers property damage and medical bills for others due to accidents you cause.

Another option is full coverage, but it can cost more than the annual minimum policy because it carries additional coverage such as uninsured/underinsured motorist coverage, comprehensive coverage, and collision insurance. These insurance coverage options will cover the cost of repairs or reimburse the value of your vehicle.

What counts as affordable car insurance will be different depending on where you live because rates vary from state to state. Moreover, your rates depend on your driving record as well as your credit score.

In some states, insurers use credit-based scores to calculate your rates. If you have a poor credit score, improving your credit score will reduce your auto insurance rates.

Dani Best Licensed Insurance Producer

Another thing to search out on a company’s website is how to file a claim. This is important when you are involved in an accident and need immediate information or financial reimbursement. Any easy-to-file claim service is one of the most important aspects of an auto insurance company. A good company will give you more than one option to file a claim, such as calling, filing online, or going to a local office.

The Final Word on Cheap Insurance for Cars

If you want to avoid going to several different sites and spending all day hopping from one website to the next, you can use the free car insurance comparison tool on this page right now to compare rates and quotes from many different top companies (read more: How can I find affordable car insurance rates?). Seeing these results side by side will provide you with the information you need to choose a company that will be able to meet your insurance needs.

Compare the cheapest car insurance rates online now by typing your ZIP code into the box at the bottom of this page.

Frequently Asked Questions

Why should I compare car insurance rates?

Comparing car insurance rates is essential because it allows you to find the best coverage at the most affordable price. Insurance rates can vary significantly between different providers, and by comparing options, you can potentially save money on your car insurance premiums.

How can I compare car insurance rates?

To compare car insurance rates, you can follow these steps:

- Research and gather information. Collect details about your vehicle, driving history, and insurance needs.

- Obtain cheap auto insurance quotes online. Request quotes from multiple insurance providers either online or by contacting their representatives.

- Review coverage options. Evaluate the coverage levels, deductibles, and additional features offered by each insurer.

- Consider customer reviews and ratings. Research the reputation and customer satisfaction levels of the insurance companies you’re considering.

- Compare premiums. Compare the quoted premiums for the same coverage and determine the most cost-effective option.

Use our free quote tool to find cheap car insurance quotes today.

What factors should I consider when comparing car insurance?

When comparing car insurance, consider the following factors:

- Coverage Options: Assess the types and levels of coverage offered by each insurer to ensure they meet your needs.

- Deductibles: Understand the car insurance deductible amounts and choose a level that fits your budget.

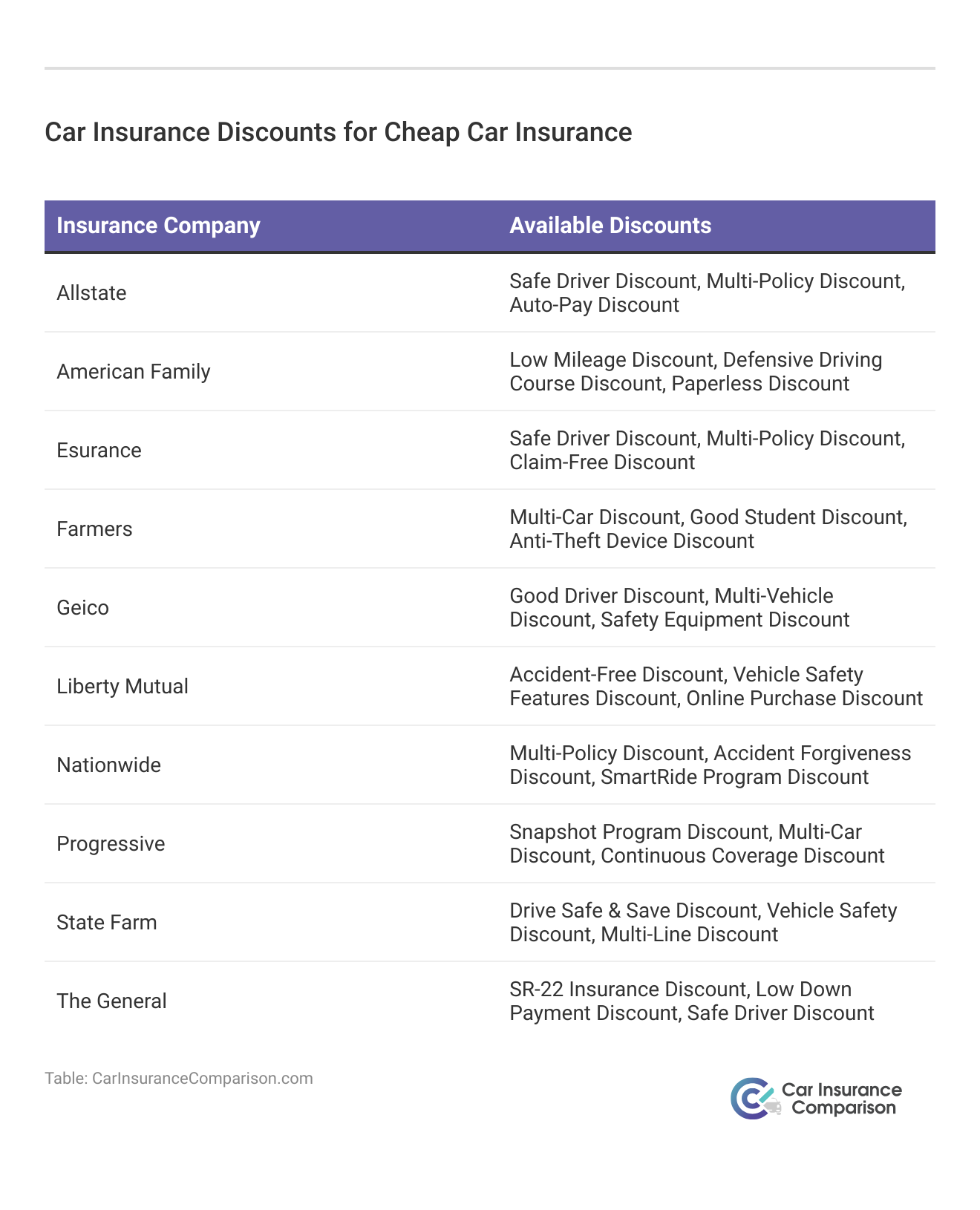

- Discounts: Inquire about available discounts, such as safe driver discounts or multi-policy discounts, as they can reduce your premiums.

- Customer Service: Research the customer service reputation of each insurer to ensure they provide efficient claims handling and support.

- Financial Stability: Check the financial strength ratings of insurers to ensure they can meet their claims obligations.

Considering these factors will help you find the best insurance for your vehicle.

Are there any risks in opting for cheap car insurance?

While finding cheapest car insurance rates is desirable, it’s important to balance affordability with adequate coverage. Cheaper policies may offer limited coverage, higher deductibles, or fewer benefits, which could leave you financially vulnerable in the event of an accident or damage. Carefully review the policy terms and ensure it provides the necessary protection for your specific needs.

Are online comparison websites reliable for comparing car insurance rates?

Online comparison websites can be a useful tool for comparing car insurance rates. However, it’s essential to verify the reliability and credibility of the comparison site you choose when you find cheap auto insurance.

Look for reputable websites that partner with multiple insurers and provide accurate and up-to-date information. It’s always a good idea to cross-reference the quotes obtained from comparison websites with individual insurance company websites for accuracy.

Can you buy car insurance online?

Yes, you can buy cheap auto insurance online from most companies (learn more: Finding Free Car Insurance Quotes Online).

What is the cheapest car insurance coverage?

Minimum coverage is the cheapest car insurance coverage.

What is the best car insurance coverage?

Full coverage is the best available, but it costs more than minimum coverage (learn more: Best Full Coverage Car Insurance).

How much is car insurance at Geico?

Minimum coverage at Geico is an average of $39/mo.

How do I buy Geico insurance?

You can purchase Geico insurance directly from its website.

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.