Cheap Car Insurance for Part-Time Drivers in 2026 (Top 10 Companies)

Erie, USAA, and Progressive are the top companies that offer cheap car insurance for part-time drivers, with Eerie leading overall. Eerie’s rates start at $29/month. Part-time drivers can benefit from competitive rates and tailored coverage options, ensuring cost-effective protection.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Licensed Insurance Agent & Agency Owner

Tracey L. Wells is a licensed insurance agent and Farmers insurance agency owner with 23 years of experience. He is proud to be a local Farmers agent serving Grayson, Georgia and surrounding areas. With experience as both an underwriter and agent, he provides his customers with insight that others agents may not have. His agency offers all lines of insurance including home, life, auto, RV, busi...

Tracey L. Wells

Licensed Insurance Agent

Justin Wright has been a licensed insurance broker for over 9 years. After graduating from Southeastern Seminary with a Masters in Philosophy, Justin started his career as a professor, teaching Philosophy and Ethics. Later, Justin obtained both his Property & Casualty license and his Life and Health license and began working for State Farm and Allstate. In 2020, Justin began working as an i...

Justin Wright

Updated May 2024

Company Facts

Min. Coverage for Part-Time Drivers

A.M. Best Rating

Complaint Level

Pros & Cons

Company Facts

Min. Coverage for Part-Time Drivers

A.M. Best Rating

Complaint Level

Company Facts

Min. Coverage for Part-Time Drivers

A.M. Best Rating

Complaint Level

Erie, USAA, and Progressive stand out as the top choices for cheap car insurance for part-time drivers. Part-time drivers can benefit from these competitive rates, along with tailored coverage options to ensure they have the protection they need. Read on “How do you get competitive quotes for car insurance?” to learn more.

If you own a car but do not use it much, you may be concerned about its yearly costs. For example, you may only need the vehicle to commute a short distance and wonder if you can reduce your bills somehow.

Our Top 10 Company Picks: Cheap Car Insurance for Part-Time Drivers

Company Rank Monthly Rates A.M. Best Best For Jump to Pros/Cons

#1 $95 A+ Rate Lock Erie

#2 $103 A++ Military Discounts USAA

#3 $108 A+ Snapshot Program Progressive

#4 $116 A+ Drivewise Benefit Allstate

#5 $119 A++ Drive Safe State Farm

#6 $127 A+ SmartMiles Program Nationwide

#7 $134 A++ Low Rates Geico

#8 $138 A MySafetyValet Discount American Family

#9 $145 A++ IntelliDrive Program Travelers

#10 $153 A RightTrack Program Liberty Mutual

Is it possible to get part-time insurance? (For more information, read our “Can I get car insurance for just part of the year?“).

We understand your desire to be as frugal as possible and have investigated the subject for you. Read on below for some answers. If you’re in need of affordable auto insurance, just enter your ZIP code into our free quote tool above to start comparing quotes from multiple car insurance companies today.

- Eerie stands out as the top choice for part-time drivers

- Tailored coverage options cater to part-time driving needs

- Comparing quotes is key to finding affordable insurance

#1 – Erie: Top Overall Pick

Pros

- Rate Lock: Offers a feature that locks in your premium to protect against rate increases. To learn more, read our “Erie car insurance review“.

- High Customer Satisfaction: Known for excellent customer service and high customer satisfaction ratings.

- Affordable Premiums: Offers competitive rates and discounts, making it affordable for many customers.

Cons

- Limited Coverage Options: May not offer as many coverage options or add-ons as some larger insurers.

- Limited Availability: Available in a limited number of states, which may restrict access for some customers.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#2 – USAA: Best for Military Discounts

Pros

- Military Discounts: Offers exclusive discounts and benefits for military members and their families.

- Outstanding Customer Service: Known for exceptional customer service and high customer satisfaction. For more information, read our “USAA car insurance review“..

- Financial Stability: Has a strong financial standing, ensuring the ability to pay claims.

Cons

- Membership Restrictions: Only available to current and former military members and their families.

- Limited Branch Locations: Has a limited number of physical branch locations, which may inconvenience some customers.

#3 – Progressive: Best for Snapshot Program

Pros

- Snapshot Program: Offers a usage-based insurance program that can lead to significant savings for safe drivers.

- Name Your Price Tool: Provides a tool that allows customers to customize their coverage and see the cost upfront.

- Variety of Discounts: Offers a wide range of discounts, including multi-policy and safe driver discounts. Read on “Progressive car insurance review” to learn more.

Cons

- Privacy Concerns: Participation in the Snapshot Program requires the use of a tracking device, which may raise privacy concerns for some customers.

- Rates May Increase: While the Snapshot Program can lead to lower rates, there’s a possibility that rates may increase based on driving habits.

#4 – Allstate: Best for Drivewise Benefit

Pros

- Drivewise Benefit: Offers a program that rewards safe driving habits with lower premiums. Check on our “Allstate car insurance review” for more information.

- Name Your Price Tool: Provides a tool that allows customers to customize their coverage and see the cost upfront.

- Strong Financial Strength: Has a strong financial standing, ensuring the ability to pay claims.

Cons

- Rates May Be Higher: While discounts are available, some customers may find Allstate’s rates to be higher compared to other insurers.

- Coverage Options: May not offer as many coverage options or add-ons as some competitors.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#5 – State Farm: Best for Drive Safe

Pros

- Drive Safe Program: Offers a program that rewards safe driving habits with lower premiums.

- Multiple Policy Discounts: Provides discounts for bundling multiple policies, such as auto and home insurance.

- Personalized Service: Offers personalized service through local agents, providing a more personal touch.

Cons

- Rates May Be Higher: While discounts are available, some customers may find State Farm’s rates to be higher compared to other insurers.

- Limited Online Options: State Farm’s online tools and resources may be less robust compared to some competitors.

#6 – Nationwide: Best for SmartMiles Program

Pros

- SmartMiles Program: Offers a pay-per-mile insurance program that can lead to lower premiums for low-mileage drivers.

- Multi-Policy Discounts: Provides discounts for bundling multiple policies, such as auto and home insurance. Check on our “Nationwide car insurance discounts” to gain further insights.

- Strong Financial Strength: Has a strong financial standing, ensuring the ability to pay claims.

Cons

- Limited Discounts: While discounts are available, Nationwide may not offer as many discounts as some competitors.

- Customer Service Concerns: Some customers have reported issues with customer service and claims processing.

#7 – Geico: Best for Low Rates

Pros

- Low Rates: Known for offering competitive rates, potentially leading to lower premiums for many customers.

- Online Experience: Provides a user-friendly website and mobile app for easy policy management. For more information, read our “Geico car insurance review“

- Strong Financial Strength: Has a strong financial standing, ensuring the ability to pay claims.

Cons

- Limited Coverage Options: Geico may have fewer coverage options compared to some competitors.

- Claims Process: Some customers have reported issues with the claims process, including delays and difficulty in communication.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#8 – American Family: Best for MySafetyValet Discount

Pros

- MySafetyValet Discount: Offers a discount for using their safe driving app, which can lead to lower premiums. Read our “” for more information.

- Personalized Service: Provides personalized service through local agents, providing a more personal touch.

- Strong Community Involvement: Actively involved in supporting local communities and charitable initiatives. To learn more, check our “American Family car insurance review“.

Cons

- Limited Availability: American Family is only available in a limited number of states, which may restrict access for some customers.

- Rates May Be Higher: While discounts are available, some customers may find American Family’s rates to be higher compared to other insurers.

#9 – Travelers: Best for IntelliDrive Program

Pros

- IntelliDrive Program: Offers a usage-based insurance program that can lead to lower premiums based on driving habits.

- Name Your Price Tool: Provides a tool that allows customers to customize their coverage and see the cost upfront. For more information, check on our “Travelers car insurance review“.

- Strong Financial Strength: Has a strong financial standing, ensuring the ability to pay claims.

Cons

- Data Privacy Concerns: Participation in the IntelliDrive Program requires the use of a tracking device, raising privacy concerns for some customers.

- Rates May Increase: While the IntelliDrive Program can lead to lower rates, there’s a possibility that rates may increase based on driving habits.

#10 – Liberty Mutual: Best for RightTrack Program

Pros

- RightTrack Program: Offers a usage-based insurance program that can lead to lower premiums based on driving habits. Read our guide titled “Liberty Mutual car insurance review” to learn more.

- Name Your Price Tool: Provides a tool that allows customers to customize their coverage and see the cost upfront.

- Strong Financial Strength: Has a strong financial standing, ensuring the ability to pay claims.

Cons

- Data Privacy Concerns: Participation in the RightTrack Program requires the use of a tracking device, raising privacy concerns for some customers.

- Rates May Be Higher: While discounts are available, some customers may find Liberty Mutual’s rates to be higher compared to other insurers.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Factors Influencing Coverage Rates for Part-Time Drivers

When considering car insurance for part-time drivers, understanding how coverage rates are determined is essential. Different companies have unique methods for setting these rates, which can be influenced by various factors such as mileage, driving habits, and location.

Car Insurance Monthly Rates for Part-Time Drivers by Coverage Level

Insurance Company Minimum Coverage Full Coverage

Allstate $145 $279

American Family $134 $256

Erie $95 $195

Geico $116 $223

Liberty Mutual $153 $288

Nationwide $127 $241

Progressive $108 $218

State Farm $119 $234

Travelers $138 $267

USAA $103 $210

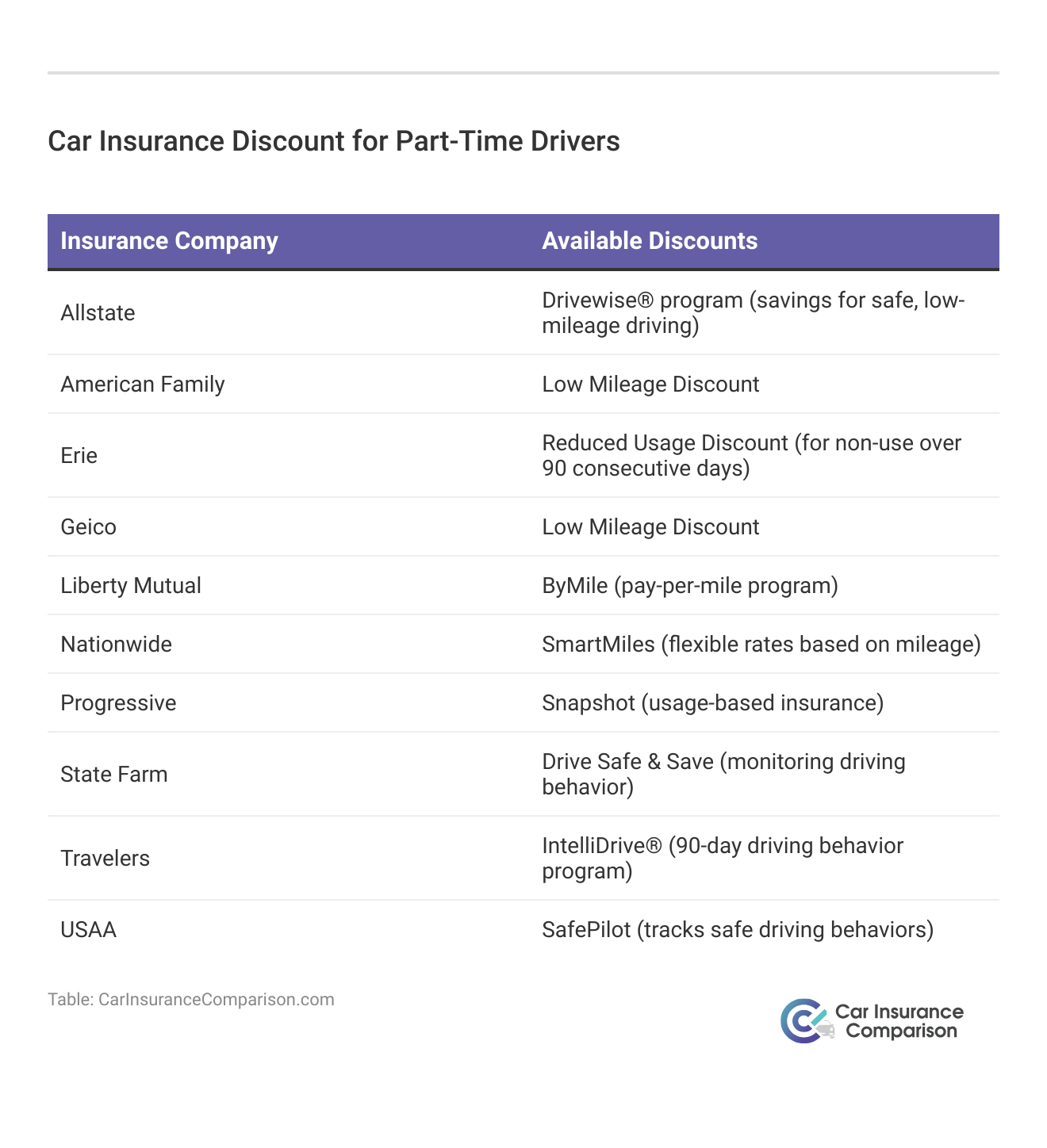

Options for Obtaining Part-Time Car Insurance

Insurance companies do not offer part-time auto insurance. Still, insurers recognize that certain people drive a vehicle far less than average. As such, some are willing to provide a lower rate to those who only occasionally use their car. For more information, read our “car insurance discounts: compare the best discounts“

How Auto Insurance Companies Deal With Risk

Remember that there is a risk whenever you get behind the wheel, no matter how short the driving distance or how occasional the driving journey is. Therefore, the insurance company needs to assume some risk, which will always be reflected in the rates it charges. (For more information, read our “Compare occasional driver car insurance rates”).

However, many companies are willing to offer a discount, but you will need to prove that you represent less of a risk due to your occasional driving habits. In this case, you should think about enrolling in a “pay-as-you-drive” program (sometimes also called pay-as-you-go car insurance).

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Understanding Pay-As-You-Drive Car Insurance Programs

You will probably have to install a GPS tracking device in your vehicle to be eligible for a pay-as-you-drive program. These will typically plug into the car’s on-board diagnostic system and relay information about your driving to the insurance company. The company will then use this data to set your specific rates. Read our “pay-as-you-go car insurance” for more information.

How Companies Determine Rates for Part-Time Car Insurance

While your insurance company will not offer part-time insurance, it may establish a base rate for you, which also includes other factors such as:

- Age

- Gender

- ZIP code

- Driving record

- Vehicle

- Credit history

Your insurance company may add additional charges based on how many miles you drive. The company may alter these rates depending on where and when you operate the vehicle. For example, if you do most of your driving during rush hour and on congested freeways, your risk of an accident might be considered higher.

Read more: Compare Car Insurance Rates by Vehicle Make and Model

Differences Between Part-Time and Occasional Drivers

An occasional driver is someone who is not the principal operator of the vehicle but who the policy owner might name as a permissive driver. To read more about how to add someone to your car insurance for a day, consider our article here.

For example, the occasional driver could be a teenager who spends most of their time away at college and is only back at home occasionally. If the policy owner names that student as a permissive driver, the insurance company will provide coverage in the event of an accident.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

How much can you save with pay-as-you-go car insurance?

You may need to shop around with different insurance companies to determine whether pay-as-you-drive or pay-as-you-go insurance options are offered.

If an insurer asks you to install a tracking device, your rate will depend on many factors (including your age and driving record) as well as the number of miles you are likely to cover. It would be best if you got an idea of how each company calculates the rate before deciding. To gain further insights, read on our “How much does mileage affect car insurance rates?“

Case Studies: Real-World Scenarios with Top Car Insurance Companies

When choosing car insurance, customers often prioritize different features based on their unique needs and circumstances. To illustrate how the top three car insurance companies—Erie, USAA, and Progressive—cater to various customer preferences, we present three fictional case studies based on real-world scenarios. These examples highlight how each company’s offerings can provide specific benefits to their policyholders.

- Case Study #1: Erie Insurance’s Rate Lock: John, a 35-year-old teacher from Pennsylvania, chose Erie Insurance for its $95 monthly rate and rate lock feature, ensuring his premiums wouldn’t increase. Erie’s A+ rating from A.M. Best gave him confidence in the company’s reliability.

- Case Study 2: USAA’s Military Discounts: Sarah, a 28-year-old Navy officer in California, selected USAA for its military discounts and a $103 monthly rate. USAA’s A++ rating assured her of their financial strength and reliability, meeting her needs during deployments.

- Case Study 3: Progressive’s the Snapshot Program: Alex, a 40-year-old tech consultant from Texas, opted for Progressive and their Snapshot program. Initially quoted $108 monthly, his rate decreased due to safe driving. Progressive’s A+ rating confirmed the insurer’s solid standing and service quality.

These fictional case studies demonstrate how Erie, USAA, and Progressive provide tailored solutions to meet diverse customer needs. Whether it’s the stability of Erie’s rate lock, the military benefits of USAA, or the safe driving rewards from Progressive’s Snapshot program, each company offers unique advantages that can appeal to different drivers.

The Bottom Line on Getting Part-Time Car Insurance

Insurance companies do not offer part-time car insurance. If you drive your vehicle for less than the average motorist, you may be able to get a reduced rate from certain companies. In order to qualify, your insurer may ask you to install a GPS tracking device in your vehicle’s diagnostic system. This device will transmit data to the company, which will help set your rates.

Your rate will depend on a variety of factors including your age, vehicle, ZIP code, driving record, and gender. Further adjustments may be necessary to account for mileage and other factors, like when and where you drive. For more information, read our “Do all car insurance companies check your driving records?“

Enter your ZIP code into our free quote comparison tool below to get quotes from multiple auto insurance providers today.

Frequently Asked Questions

What is considered a part-time driver?

A part-time driver is someone who does not drive as frequently as a full-time driver. This can include individuals who only drive on certain days of the week, weekends, or for specific purposes such as commuting to work or running errands.

Can I get car insurance as a part-time driver?

Yes, part-time drivers can obtain car insurance. Insurance providers typically offer coverage options for drivers regardless of their driving frequency. It’s important to accurately disclose your driving habits to the insurance company, including how often and for what purposes you drive.

Are there specific insurance policies for part-time drivers?

There are no specific insurance policies designed exclusively for part-time drivers. However, insurance providers offer various types of coverage that can be customized to your specific needs. You can choose the coverage options and policy limits that align with your driving habits and requirements.

How does car insurance for part-time drivers differ from full-time drivers?

Car insurance for part-time drivers does not differ significantly from coverage for full-time drivers. The main difference lies in the frequency of driving. Insurance premiums are typically based on various factors, including driving record, age, location, and the type of vehicle. Therefore, as a part-time driver, your premium may be influenced by your driving history and the limited time spent on the road.

Can I save money on car insurance as a part-time driver?

Part-time drivers may have opportunities to save money on car insurance. Here are a few potential ways to reduce costs:

- Low-mileage discount: If you drive fewer miles than the average driver, you may qualify for a low-mileage discount. Insurance providers often offer reduced premiums for drivers with lower annual mileage.

- Usage-based insurance: Some insurance companies offer usage-based insurance programs that track your driving habits using telematics devices or smartphone apps. By demonstrating safe driving behaviors and limited driving frequency, you may receive discounts or customized premium rates.

- Bundling policies: If you have other insurance policies, such as homeowners or renters insurance, consider bundling them with your car insurance. Many insurance providers offer discounts for customers who have multiple policies with them.

- Good driving record: Maintaining a clean driving record is important for all drivers, regardless of their driving frequency. By avoiding accidents and traffic violations, you can potentially qualify for lower premiums.

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.