Compare Car Insurance Rates for New Drivers in 2026 (Top 10 Companies)

Compare car insurance rates for new drivers with Progressive, State Farm, and Allstate, offering discounts of up to 30%. These companies prioritize affordability and comprehensive coverage to ensure protection for new drivers on the road. Choose them for tailored discounts and peace of mind behind the wheel.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Insurance Operations Specialist

Michael earned a degree in Business Management degree with an insurance focus, which led to a successful 25-year career in insurance claims operations and support. He possesses a high-level of business acumen across multiple areas of the insurance industry. Over the course of his career, he served in multiple roles supporting claims operations including: Claims Specialist, Claims Trainer, Claim Au...

Michael Leotta

Insurance Claims Support & Sr. Adjuster

Kalyn grew up in an insurance family with a grandfather, aunt, and uncle leading successful careers as insurance agents. She soon found she has similar interests and followed in their footsteps. After spending about ten years working in the insurance industry as both an appraiser dispatcher and a senior property claims adjuster, she decided to combine her years of insurance experience with another...

Kalyn Johnson

Updated May 2024

13,283 reviews

13,283 reviewsCompany Facts

Average Monthly Rate For Good Drivers

A.M. Best Rating

Complaint Level

13,283 reviews

13,283 reviews 18,155 reviews

18,155 reviewsCompany Facts

Average Monthly Rate For Good Drivers

A.M. Best Rating

Complaint Level

Pros & Cons

18,155 reviews

18,155 reviews 11,638 reviews

11,638 reviewsCompany Facts

Average Monthly Rate For Good Drivers

A.M. Best Rating

Complaint Level

Pros & Cons

11,638 reviews

11,638 reviews

Finding cheap car insurance for new drivers can be difficult. Although insurance companies want to see time behind the wheel, new drivers just don’t have the experience and are more likely to be in accidents.

Our Top 10 Company Picks: Compare Car Insurance Rates for New Drivers

| Company | Rank | Usage-Based Discount | Multi-Policy Discount | Best For | Jump to Pros/Cons |

|---|---|---|---|---|---|

| #1 | 30% | 10% | Tech-Savvy Drivers | Progressive | |

| #2 | 15% | 17% | Comprehensive Coverage | State Farm | |

| #3 | 25% | 25% | Personalized Discounts | Allstate | |

| #4 | 40% | 20% | Safe Drivers | Nationwide |

| #5 | 20% | 25% | New Cars | Liberty Mutual |

| #6 | 15% | 15% | Flexible Options | Farmers | |

| #7 | 20% | 13% | Smart Driving Practices | Travelers | |

| #8 | 30% | 22% | Personalized Discounts | American Family | |

| #9 | 30% | 25% | Online Tools | Esurance | |

| #10 | 15% | 10% | Long-Term Benefits | The Hartford |

However, you can find the best insurance for new drivers by shopping around. Lower rates by adding discounts, lowering coverage amounts, and increasing deductibles. Being a new driver doesn’t have to come with scary car insurance rates.

With the right insurance, new drivers can drive confidently knowing they have the necessary protection. Take the first step today to compare and find the ideal car insurance for your journey ahead.

When you’re ready to see how much you can save on your car insurance, enter your ZIP code above into our free comparison tool.

#1 – Progressive: Top Overall Pick

Pros

- Up to 30% discount for tech-savvy drivers.

- Learn more about the Progressive car insurance review and its up to 10% discount for safe driving.

- Appeals to modern drivers with a focus on technology.

Cons

- Discounts might not be as high for non-tech-savvy customers.

- Long-term benefits may not be as competitive.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#2 – State Farm: Best for Comprehensive Coverage

Pros

- Up to 15% discount on comprehensive coverage.

- For insights on State Farm car insurance review, discover their up to 17% discount for safe driving.

- Offers comprehensive coverage for various driver needs.

Cons

- Discounts may not be as high compared to some competitors.

- Limited focus on tech-related discounts.

#3 – Allstate: Best for Personalized Discounts

Pros

- Up to 25% discount on personalized discounts.

- Explore our Allstate car insurance review to learn about the up to 25% discount for safe drivers.

- Offers tailored discounts based on individual profiles.

Cons

- Discounts may vary, and not all customers may qualify for the maximum.

- Some competitors may offer higher overall discounts.

#4 – Nationwide: Best for Safe Drivers

Pros

- Up to 40% discount for safe drivers.

- Up to 20% discount for comprehensive coverage.

- Encourages and rewards safe driving practices with Nationwide car insurance discounts.

Cons

- Discounts heavily reliant on driving habits.

- May not be as competitive for those seeking discounts in other categories.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#5 – Liberty Mutual: Best for New Cars

Pros

- Find out more about Liberty Mutual car insurance review and discover the up to 20% discount for owners of new cars.

- Up to 25% discount for comprehensive coverage.

- Appeals to customers with recently purchased vehicles.

Cons

- Discounts are limited to a specific category of drivers.

- May not be as attractive for those with older vehicles.

#6 – Farmers: Best for Flexible Options

Pros

- Up to 15% discount for policy flexibility.

- Discover how Farmers car insurance review offers up to 15% discount for safe driving.

- Offers flexibility in coverage options.

Cons

- Discounts may not be as high compared to other providers.

- Limited emphasis on long-term benefits.

#7 – Travelers: Best for Smart Driving

Pros

- Travelers car insurance review reveals up to 20% discount for smart driving practices.

- Up to 13% discount for comprehensive coverage.

- Rewards customers for adopting safe driving habits.

Cons

- Discounts may be less appealing for those not focused on driving practices.

- Limited emphasis on online tools.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#8 – American Family: Best for Personalized Discounts

Pros

- Up to 30% discount on personalized discounts.

- Read our American Family car insurance review to discover up to 22% discount for safe drivers.

- Offers personalized discounts based on individual circumstances.

Cons

- Discounts may vary, and not all customers may qualify for the maximum.

- Some competitors may offer higher overall discounts.

#9 – Esurance: Best for Online Tools

Pros

- To learn more about how to get an Esurance car insurance quote, take advantage of up to 30% discount for utilizing online tools.

- Up to 25% discount for comprehensive coverage.

- Emphasizes the convenience of online tools for customers.

Cons

- Discounts may not be as high for those not utilizing online tools.

- May not be as competitive in other discount categories.

#10 – The Hartford: Best for Long-Term Benefits

Pros

- Up to 15% discount for long-term benefits.

- Explore The Hartford car insurance discounts and save up to 10% for safe driving.

- Focuses on providing benefits for customers over the long term.

Cons

- Discounts may not be as high compared to some competitors.

- Limited emphasis on online tools.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

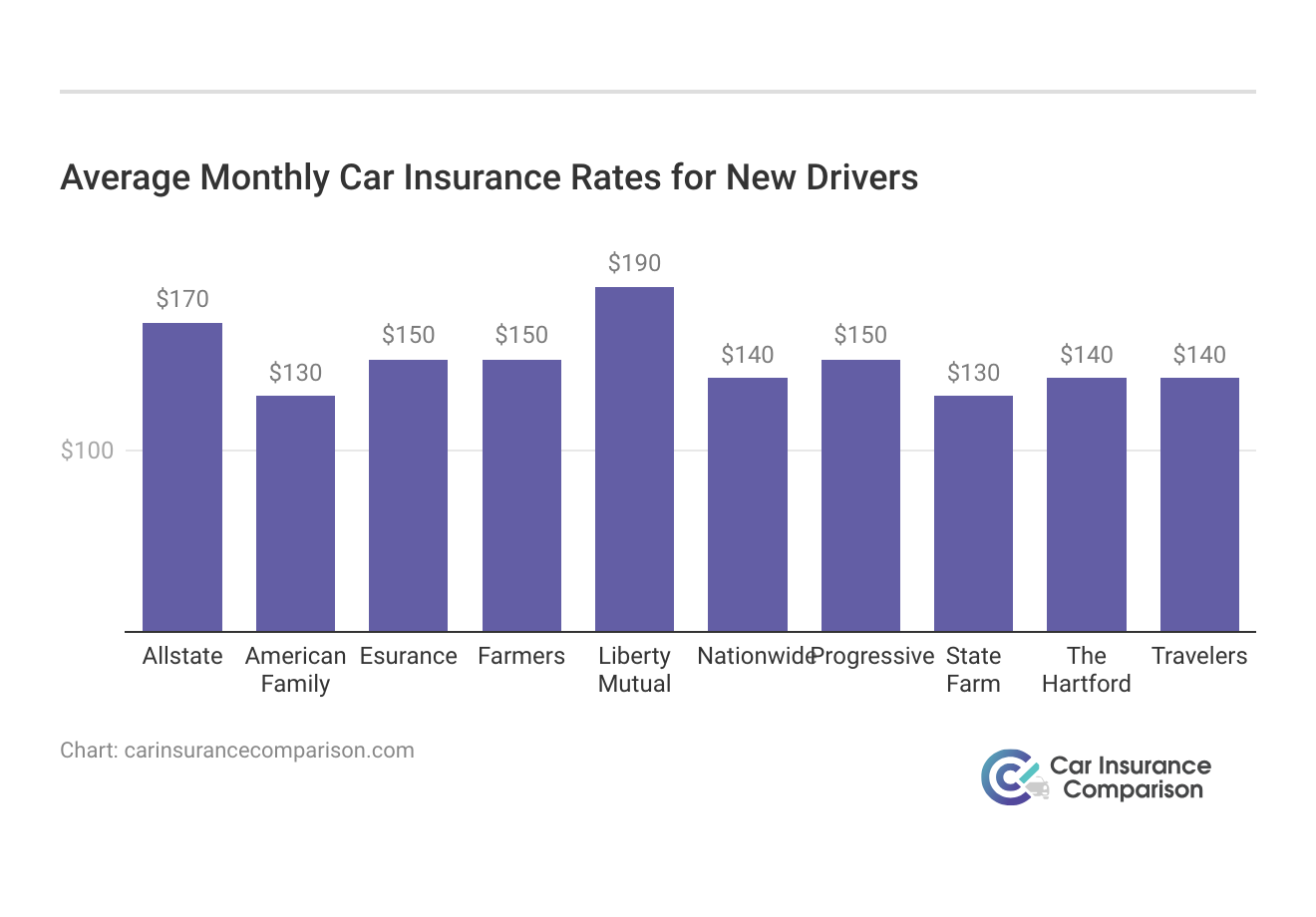

Unlocking Savings: Exploring the Specific Coverage Rates for New Drivers

For new drivers, securing the right car insurance is a crucial step in navigating the road responsibly. However, insurance rates for new drivers can vary significantly among different providers. The table below details the average monthly car insurance rates for new drivers, offering insights into both minimum and full coverage options.

Average Monthly Car Insurance Rates for New Drivers

| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| Allstate | $170 | $320 |

| American Family | $130 | $250 |

| Esurance | $150 | $300 |

| Farmers | $150 | $270 |

| Liberty Mutual | $190 | $350 |

| Nationwide | $140 | $280 |

| Progressive | $150 | $300 |

| State Farm | $130 | $250 |

| The Hartford | $140 | $270 |

| Travelers | $140 | $290 |

Examining the table reveals a range of monthly insurance rates for new drivers among various insurance companies. State Farm and American Family emerge as cost-effective options, both offering minimum coverage at $130 and full coverage at $250. Nationwide provides a competitive rate of $140 for minimum coverage and $280 for full coverage.

On the higher end, Liberty Mutual presents rates of $190 for minimum coverage and $350 for full coverage. These figures underscore the importance of shopping around for insurance as new drivers, considering not only the cost but also the coverage provided.

Progressive stands out as the best choice for new drivers, offering tailored discounts for tech-savvy individuals and a seamless integration of technology in their offerings.

Brad Larson Licensed Insurance Agent

New drivers should weigh their budget constraints against their coverage needs to select an insurance provider that aligns with their financial situation while ensuring adequate protection on the road.

Defining New Drivers: Youth, Adult Beginners, and Immigrants

Young drivers will pay the highest car insurance rates because they are much more likely to be in an accident. In fact, the Centers for Disease Control and Prevention (CDC) report that drivers between 16-19 years old are three times more likely to be in a fatal car crash. New drivers typically fall into three distinct categories:

- Young drivers

- Older adults who have never had a driver’s license

- Immigrants new to the U.S.

Perhaps the most common type of new driver is a teenager. Although each state has its own rules regarding driver’s licenses, they allow teens to begin the process. A new driver can also be an older adult who hasn’t had a driver’s license. Since millions of people use public transit in large cities, some adults have never needed a driver’s license.

However, a move to an area with less convenient public transit can cause an older adult to require a license for the first time. In addition, a new driver can be an immigrant or foreign national that moves to the United States. Since car insurance companies in the U.S. don’t check driving records from other countries, drivers new to the U.S. can’t verify a clean record.

Car insurance companies have to treat foreign drivers as new drivers since they can’t evaluate the risk involved. No matter who the new driver is, they need car insurance that at least meets the state requirements. There is no specific new driver insurance, and full coverage is recommended to ensure damages to your vehicle are covered.

Understanding Car Insurance Rates for New Drivers

New drivers are very risky to insure, mainly because of limited time behind the wheel. Drivers who lack experience are much more likely to be in an accident, which costs car insurance companies money. How much is car insurance for a new driver? Unfortunately, there is not a one size fits all answer.

Besides your driving record, many other factors affect your rates. Each company weighs those factors differently. One factor that can affect new driver rates is your age. Take a look at this table that shows average annual rates from top companies to understand how much your age affects your rates.

Average Annual Car Insurance Rates Based on Age, Gender, and Marital Status

| Company | Average Annual Rates Single 17-Year-Old Female | Average Annual Rates Single 17-Year-Old Male | Average Annual Rates Single 25-Year-Old Female | Average Annual Rates Single 25-Year-Old Male | Average Annual Rates Single 35-Year-Old Female | Average Annual Rates Single 35-Year-Old Male | Average Annual Rates Single 60-Year-Old Female | Average Annual Rates Single 60-Year-Old Male |

|---|---|---|---|---|---|---|---|---|

| Allstate | $9,282.19 | $10,642.53 | $3,424.87 | $3,570.93 | $3,156.09 | $3,123.01 | $2,913.37 | $2,990.64 |

| American Family | $5,996.50 | $8,130.50 | $2,288.65 | $2,694.72 | $2,202.70 | $2,224.31 | $1,992.92 | $2,014.38 |

| Farmers | $8,521.97 | $9,144.04 | $2,946.80 | $3,041.44 | $2,556.98 | $2,557.75 | $2,336.80 | $2,448.39 |

| Geico | $5,653.55 | $6,278.96 | $2,378.89 | $2,262.87 | $2,302.89 | $2,312.38 | $2,240.60 | $2,283.45 |

| Liberty Mutual | $11,621.01 | $13,718.69 | $3,959.67 | $4,503.13 | $3,802.77 | $3,856.84 | $3,445.00 | $3,680.53 |

| Nationwide | $5,756.37 | $7,175.31 | $2,686.48 | $2,889.04 | $2,360.49 | $2,387.43 | $2,130.26 | $2,214.62 |

| Progressive | $8,689.95 | $9,625.49 | $2,697.73 | $2,758.66 | $2,296.90 | $2,175.27 | $1,991.49 | $2,048.63 |

| State Farm | $5,953.88 | $7,324.34 | $2,335.96 | $2,554.56 | $2,081.72 | $2,081.72 | $1,873.89 | $1,873.89 |

| Travelers | $9,307.32 | $12,850.91 | $2,325.25 | $2,491.21 | $2,178.66 | $2,199.51 | $2,051.98 | $2,074.41 |

| USAA | $4,807.54 | $5,385.61 | $1,988.52 | $2,126.14 | $1,551.43 | $1,540.32 | $1,449.85 | $1,448.98 |

USAA and Geico offer the lowest rates to young drivers. However, USAA is only available to veterans, members of the military, and family members. Remember that the best insurance companies for young drivers will vary because each company will offer different rates and discounts.

While young drivers undoubtedly pay the most for car insurance, a new driver who is older or just coming to the U.S. may see similar rates even if they are older. For example, the best car insurance for new drivers under 25 should be slightly lower than insurance rates for new and younger drivers. However, new drivers won’t see the lower rates that more experienced drivers see, no matter the age.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Decoding Car Insurance Costs for New Drivers

Age isn’t the only factor that is looked at to calculate car insurance rates. In fact, there are many different factors looked at, and they can vary by company. In addition to age, factors used to determine car insurance rates include:

- Driving Record. Your driving record indicates if you are a safe or risky driver. Accidents, tickets, and DUIs will cause much higher insurance rates.

- ZIP Code. If you live in an area with a lot of traffic or theft, your rates will be higher because the insurance company is more likely to pay a claim.

- Credit Score. Although a few states don’t allow insurance companies to look at your credit score, most states do allow it. Insurance companies believe that drivers with a lower credit score are more likely to file a claim instead of paying for damages themselves.

- Vehicle. New or expensive cars cost more to repair and will see higher car insurance rates.

- Type of Car Insurance Coverage. More coverage equals higher rates. While full coverage offers the most protection, it’s also the most expensive.

Each car insurance company determines what factors it looks at and how it weighs those factors. For example, while one company may be willing to overlook your speeding ticket, another company may charge you higher rates.

By grasping the significance of variables like driving record, location, credit score, vehicle type, and coverage options, individuals can make informed decisions to secure the most suitable and cost-effective insurance coverage.

Tips to Save on Car Insurance for New Drivers

The good news is that cheap car insurance for first-time drivers is possible. In addition, there are some practical ways to quickly lower rates for new drivers. First, take advantage of car insurance discounts. Insurance companies offer various discounts based on the driver, policy, and vehicle. Even new drivers can take advantage of savings, such as a good student, safe driving, or defensive driving discount.

Car Insurance Discounts by Company

| Discount Name | Allstate | American Family | Farmers | Geico | Liberty Mutual | Nationwide | Progressive | State Farm | Travelers | USAA |

|---|---|---|---|---|---|---|---|---|---|---|

| Adaptive Cruise Control | ✓ | ✓ | ✓ | ✓ | 5% | ✓ | ✓ | ✓ | ✓ | ✓ |

| Adaptive Headlights | ✓ | ✓ | ✓ | ✓ | 5% | ✓ | ✓ | ✓ | ✓ | ✓ |

| Anti-lock Brakes | 10% | ✓ | ✓ | 5% | 5% | 5% | ✓ | 5% | ||

| Anti-Theft | 10% | ✓ | 23% | 20% | 25% | ✓ | 15% | |||

| Claim Free | 35% | ✓ | ✓ | 26% | ✓ | 10% | ✓ | 15% | 23% | 12% |

| Continuous Coverage | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | 15% | ✓ | ||

| Daytime Running Lights | 2% | ✓ | 3% | 5% | 5% | ✓ | ✓ | |||

| Defensive Driver | 10% | 10% | ✓ | ✓ | 10% | 5% | 10% | 5% | 10% | 3% |

| Distant Student | 35% | ✓ | ✓ | ✓ | ✓ | 10% | ✓ | 7% | ||

| Driver's Ed | 10% | ✓ | ✓ | ✓ | 10% | ✓ | 10% | 15% | 8% | 3% |

| Driving Device/App | 20% | 40% | ✓ | ✓ | 30% | 40% | 20% | 50% | 30% | 5% |

| Early Signing | 10% | ✓ | ✓ | ✓ | ✓ | 8% | ✓ | ✓ | 10% | 12% |

| Electronic Stability Control | 2% | ✓ | ✓ | ✓ | 5% | ✓ | ✓ | ✓ | ✓ | |

| Emergency Deployment | ✓ | ✓ | ✓ | 25% | ✓ | ✓ | ✓ | ✓ | ✓ | |

| Engaged Couple | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ |

| Family Legacy | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | 10% |

| Family Plan | ✓ | ✓ | ✓ | ✓ | ✓ | 25% | ✓ | ✓ | ✓ | ✓ |

| Farm Vehicle | 10% | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ||

| Fast 5 | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ |

| Federal Employee | ✓ | ✓ | 12% | 10% | ✓ | ✓ | ✓ | ✓ | ||

| Forward Collision Warning | ✓ | ✓ | ✓ | ✓ | 5% | ✓ | ✓ | ✓ | ✓ | |

| Full Payment | 10% | ✓ | ✓ | $50 | ✓ | ✓ | ✓ | 8% | ✓ | |

| Further Education | ✓ | ✓ | 10% | 15% | ✓ | ✓ | ||||

| Garaging/Storing | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | 90% | ||

| Good Credit | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ||||

| Good Student | 20% | ✓ | 15% | 23% | 10% | ✓ | 25% | 8% | 3% | |

| Green Vehicle | 10% | ✓ | 5% | ✓ | 10% | ✓ | ✓ | ✓ | 10% | ✓ |

| Homeowner | ✓ | ✓ | ✓ | ✓ | 5% | ✓ | 3% | 5% | ✓ | |

| Lane Departure Warning | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | |

| Life Insurance | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ |

| Low Mileage | ✓ | ✓ | ✓ | 30% | ||||||

| Loyalty | ✓ | ✓ | ✓ | ✓ | ✓ | 5% | ✓ | ✓ | ✓ | |

| Married | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ||||

| Membership/Group | ✓ | ✓ | ✓ | 10% | 7% | ✓ | ✓ | |||

| Military | ✓ | ✓ | 15% | 4% | ✓ | ✓ | ||||

| Military Garaging | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | 15% |

| Multiple Drivers | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ |

| Multiple Policies | 10% | 29% | ✓ | 10% | 20% | 10% | 12% | 17% | 13% | |

| Multiple Vehicles | ✓ | ✓ | 25% | 10% | 20% | 10% | 20% | 8% | ||

| New Address | ✓ | ✓ | ✓ | ✓ | 5% | ✓ | ✓ | ✓ | ✓ | ✓ |

| New Customer/New Plan | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | |

| New Graduate | ✓ | ✓ | ✓ | ✓ | 5% | ✓ | ✓ | ✓ | ✓ | ✓ |

| New Vehicle | 30% | ✓ | ✓ | 15% | ✓ | 40% | 10% | 12% | ||

| Newly Licensed | ✓ | ✓ | ✓ | ✓ | 5% | ✓ | ✓ | ✓ | ✓ | ✓ |

| Newlyweds | ✓ | ✓ | ✓ | ✓ | 5% | ✓ | ✓ | ✓ | ✓ | ✓ |

| Non-Smoker/Non-Drinker | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ |

| Occasional Operator | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | |

| Occupation | ✓ | 10% | 15% | ✓ | ✓ | ✓ | ||||

| On-Time Payments | 5% | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | 15% | ✓ | |

| Online Shopper | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | 7% | ✓ | ✓ | ✓ |

| Paperless Documents | 10% | ✓ | ✓ | ✓ | 5% | $50 | ✓ | ✓ | ✓ | |

| Paperless/Auto Billing | 5% | ✓ | ✓ | ✓ | $30 | ✓ | $20 | 3% | 3% | |

| Passive Restraint | 30% | 30% | 40% | 20% | ✓ | 40% | ||||

| Recent Retirees | ✓ | ✓ | ✓ | ✓ | 4% | ✓ | ✓ | ✓ | ✓ | ✓ |

| Renter | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ |

| Roadside Assistance | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ |

| Safe Driver | 45% | ✓ | 15% | ✓ | 35% | 31% | 15% | 23% | 12% | |

| Seat Belt Use | ✓ | ✓ | ✓ | 15% | ✓ | ✓ | ✓ | ✓ | ✓ | |

| Senior Driver | 10% | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ||

| Stable Residence | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | |

| Students & Alumni | ✓ | ✓ | ✓ | 10% | 7% | ✓ | ✓ | ✓ | ||

| Switching Provider | ✓ | ✓ | 10% | ✓ | ✓ | ✓ | ✓ | |||

| Utility Vehicle | 15% | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ||

| Vehicle Recovery | 10% | ✓ | ✓ | 15% | 35% | 25% | ✓ | 5% | ||

| VIN Etching | ✓ | ✓ | ✓ | ✓ | 5% | ✓ | ✓ | |||

| Volunteer | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ |

| Young Driver | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | $75 |

Read more:

New drivers can also save money by lowering coverages and raising deductibles. Although making these changes will lower your rates, you will have to pay more out of pocket for any damages to your car.

In addition, if someone in your home already has a car insurance policy, consider being added to that policy. Then, you’ll be able to take advantage of savings like a multi-policy discount.

Case Studies: Empowering New Drivers

As new drivers embark on their journey behind the wheel, selecting the right car insurance provider is paramount. Explore three case studies showcasing how new drivers found tailored solutions to meet their unique needs, ensuring confidence and savings on the road.

- Case Study #1 – A Tech-Savvy Start: Sara, a tech-savvy new driver, chose Progressive for its up to 30% discounts tailored for tech-savvy drivers, resonating with her modern lifestyle and ensuring a smooth start to her driving journey.

- Case Study #2 – Comprehensive Confidence: Alex, a new driver seeking comprehensive coverage, chose State Farm for its commitment to providing up to 15% discounts on comprehensive coverage, offering him the assurance he needed.

- Case Study #3 – Personalized Savings: Emily, a new driver, found her match with up to 25% discounts on personalized savings, showcasing a commitment to understanding and meeting the distinct needs of each driver.

These case studies illustrate the importance of finding a car insurance provider that aligns with individual preferences and requirements.

Progressive emerges as the preferred option for new drivers, with impressive customer review ratings reaching 90%.

Dani Best Licensed Insurance Producer

Whether it’s discounts for tech-savvy drivers, comprehensive coverage options, or personalized savings, there’s a perfect fit for every new driver’s journey.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Car Insurance for New Drivers: The Bottom Line

Drivers who are young, older but never had a license, or immigrants can all be considered new drivers. While car insurance rates are much higher for new drivers, there are ways to save. Cheap insurance for new drivers is possible if you shop around and take advantage of discounts.

Because every car insurance company will look at you differently, compare multiple companies to find your best deal. Enter your ZIP code now to compare car insurance quotes for new drivers from companies near you for free.

Frequently Asked Questions

How do I compare car insurance quotes for new drivers?

Comparing car insurance quotes for new drivers involves entering relevant information, such as age, location, and driving history, into online comparison tools provided by insurance companies. These tools allow new drivers to view and compare quotes from multiple insurers easily.

Which are the best car insurance companies for new drivers?

The best car insurance companies for new drivers often offer competitive rates, tailored discounts, and comprehensive coverage options. Progressive, State Farm, and Allstate are among the top choices known for prioritizing affordability and personalized discounts for new drivers.

Protect your vehicle from whatever the road throws at it by entering your ZIP code into our free comparison tool below to see affordable car insurance quotes.

What are the best cheap insurance cars for new drivers?

When searching for the best cheap insurance cars for new drivers, factors such as safety ratings, affordability, and maintenance costs come into play. Vehicles like Honda Civic, Toyota Corolla, and Subaru Impreza are often considered good options due to their reliability and relatively low insurance costs.

For comprehensive guidance on securing affordable auto coverage, refer to our in-depth resource entitled “Cheap Car Insurance,” ensuring you find the best rates available.

How do I get cheap car insurance as a new driver?

As a new driver, there are several strategies to secure cheap car insurance, including maintaining a clean driving record, opting for a safe and affordable vehicle, and taking advantage of available discounts offered by insurance companies.

What are the best car insurance deals for new drivers?

The best car insurance deals for new drivers often include discounts for safe driving habits, bundling policies, and completing driver education courses. Insurance companies like Progressive, State Farm, and Allstate frequently offer attractive deals and discounts specifically tailored for new drivers.

How can I find the best insurance rates for new drivers?

To find the best insurance rates for new drivers, it’s essential to shop around and compare quotes from multiple insurance companies. Additionally, taking advantage of discounts for new drivers, such as good student discounts or safe driving discounts, can help lower insurance premiums.

Explore our in-depth guide titled “How long does a car insurance quote last?” for a thorough understanding of this topic.

Which cars have cheap insurance for new drivers?

Cars with cheap insurance for new drivers typically include models known for their safety features, low repair costs, and lower risk of theft. Examples of such vehicles include Ford Fiesta, Chevrolet Spark, and Kia Rio.

What are the cheapest car insurance options for new drivers?

The cheapest car insurance options for new drivers often involve policies with minimum coverage requirements and discounts tailored for inexperienced drivers. It’s advisable for new drivers to explore quotes from different insurance providers to find the most affordable option.

Find the best comprehensive car insurance quotes by entering your ZIP code below into our free comparison tool today.

What are the average car insurance rates for new drivers?

The average car insurance rates for new drivers can vary depending on factors such as age, driving record, and the type of coverage needed. It’s recommended for new drivers to compare quotes from different insurance companies to find the best rates.

To broaden your understanding, consult our extensive guide titled “Compare Car Insurance by Coverage Type” for valuable insights.

Are there specific discounts available for new drivers with auto insurance?

Yes, many insurance companies offer specific discounts for new drivers, such as good student discounts, defensive driving course discounts, and discounts for completing driver education programs. These discounts can help new drivers save on their auto insurance premiums.

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.