Cheap Car Insurance With Breakdown Coverage in 2026 (Save With These 8 Companies!)

The top companies for cheap car insurance with breakdown coverage are Geico, Mercury, and AAA. At Geico, the average cost for insurance with breakdown coverage is $33/mo. Breakdown car insurance covers more than warranties do, as it helps to cover towing and repair costs for common breakdown issues.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Insurance & Finance Analyst

Zach Fagiano has been in the insurance industry for over 10 years, specializing in property and casualty and risk management consulting. He started out specializing in small businesses and moved up to large commercial real estate risks. During that time, he acquired property & casualty, life & health, and surplus lines brokers licenses. He’s now the Senior Vice President overseeing globa...

Zach Fagiano

Licensed Insurance Agent

Scott W Johnson is an independent insurance agent in California. Principal Broker and founder of Marindependent Insurance Services, Scott brings over 25 years of experience to his clients. His Five President’s Council awards prove he uses all he learned at Avocet, Sprint Nextel, and Farmers Insurance to the benefit of his clients. Scott quickly grasped the unique insurance requirements of his...

Scott W. Johnson

Updated May 2024

19,116 reviews

19,116 reviewsCompany Facts

Min. Coverage With Breakdown Coverage

A.M. Best Rating

Complaint Level

Pros & Cons

19,116 reviews

19,116 reviews 667 reviews

667 reviewsCompany Facts

Min. Coverage With Breakdown Coverage

A.M. Best Rating

Complaint Level

667 reviews

667 reviews 3,027 reviews

3,027 reviewsCompany Facts

Min. Coverage With Breakdown Coverage

A.M. Best Rating

Complaint Level

3,027 reviews

3,027 reviewsThe top companies for cheap car insurance with breakdown coverage include Geico, Mercury, and AAA.

There is just no way to tell when or why your automobile may begin to have problems; this makes traveling safely so important. Car troubles can happen out of nowhere, so plan ahead to prevent being stranded by buying breakdown insurance.

Our Top 8 Company Picks: Cheap Car Insurance With Breakdown Coverage

| Company | Rank | Multi-Policy Discount | A.M. Best | Best For | Jump to Pros/Cons |

|---|---|---|---|---|---|

| #1 | 25% | A++ | National Coverage | Geico | |

| #2 | 15% | A | Multiple Discounts | Mercury | |

| #3 | 20% | A | Roadside Assistance | AAA |

| #4 | 17% | A++ | Customer Service | State Farm | |

| #5 | 12% | A+ | Policy Flexibility | Progressive | |

| #6 | 29% | A | Coverage Options | American Family | |

| #7 | 20% | A | Family Plans | Farmers | |

| #8 | 25% | A+ | Pay-Per-Mile Rates | Allstate |

Without breakdown coverage, getting a repair or being towed is expensive, so it’s much better to get cheap car insurance coverage in advance. Compare rates now with our free tool.

- Geico has the cheapest breakdown car insurance rates on average

- Breakdown car insurance is not the same thing as an extended warranty

- Warranties usually do not include all the options that breakdown car insurance does

#1 – Geico: Top Pick Overall

Pros

- National Coverage: Buy cheap car insurance with breakdown coverage included in any state. Learn more in our Geico review.

- Roadside Assistance: Geico offers roadside assistance in addition to mechanical breakdown insurance.

- Military Discount: Service members can save on breakdown insurance.

Cons

- In-Person Assistance: Physical locations with agents are limited.

- Discount Availability: Some states don’t carry all of Geico’s discounts.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#2 – Mercury: Best for Multiple Discounts

Pros

- Multiple Discounts: Mercury offers car insurance discounts like anti-theft discounts.

- Roadside Assistance: 24/7 roadside assistance offers help with breakdowns and towing.

- Mobile App: Mercury’s app helps customers manage policies online.

Cons

- Availability: Mercury insurance is not available nationwide yet.

- Customer Reviews: Some customers have complained about difficulty talking to a representative.

#3 – AAA: Best for Roadside Assistance

Pros

- Roadside Assistance: Choose from different levels of assistance for your car. Learn more in our AAA car insurance review.

- Membership Benefits: An AAA membership comes with discounts for traveling and shopping.

- Bundling Discount: Save up to 20% with a bundling discount.

Cons

- Annual Fees: You will need to pay an annual fee for membership.

- AAA Club Services: Coverage, discounts, and customer service will be different among AAA clubs.

#4 – State Farm: Best for Customer Service

Pros

- Customer Service: Read our State Farm car insurance review to learn about the company’s great customer service ratings.

- Multi-Policy Discount: You may be able to save 17% on your insurance by bundling.

- Financial Stability: State Farm was awarded the highest rating possible from A.M. Best.

Cons

- High-Risk Rates: Safe drivers will get the best deals on car breakdown insurance at State Farm, not high-risk drivers.

- Accident Forgiveness Qualifications: It is more difficult to get accident forgiveness at State Farm than at other companies.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#5 – Progressive: Best for Policy Flexibility

Pros

- Policy Flexibility: Progressive offers great flexibility with policy coverages and deductibles. Read our Progressive review to find out more.

- Coverage Options: Progressive has less common options. For example, Progressive has rideshare insurance.

- Budgeting Tools: Progressive offers tools to help those with budget constraints.

Cons

- Claim Experiences: Some customers left negative feedback after filing a claim.

- Young Driver Rates: Expect higher monthly insurance costs if insuring a teen at Progressive.

#6 – American Family: Best for Coverage Options

Pros

- Coverage Options: Learn what is offered, from roadside assistance to comprehensive insurance, in our American Family review.

- Customer Service: Most customers have written positive reviews about the customer service.

- Accident Forgiveness: American Family is great for safe drivers due to its accident forgiveness.

Cons

- Limited Availability: You may not be able to get car breakdown coverage in your state, as American Family doesn’t sell everywhere in the U.S.

- High-Risk Rates: Rates at American Family are best for safe drivers, not high-risk drivers.

#7 – Farmers: Best for Family Plans

Pros

- Family Plans: Farmers is great for family car breakdown coverage, as it has multi-vehicle discounts.

- Safety Discounts: Farmers offers a discounted rate if your cars are equipped with the latest safety features. Read our Farmers insurance review to learn more.

- Online Management: In most cases, you won’t need to contact an agent to make policy changes or file claims.

Cons

- High-Risk Driver Rates: Farmers’ rates are the cheapest for safe drivers.

- Claim Experience: Some customers have negative feedback after filing a claim.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#8 – Allstate: Best for Pay-Per-Mile Rates

Pros

- Pay-Per-Mile Rates: Usage-based insurance offers huge savings for some drivers at Allstate.

- Claim Satisfaction Guarantee: Customers can file a complaint and may receive a discounted rate.

- Safe Driver Discounts: Get a discounted rate at Allstate for safe driving. Learn more in our Allstate review.

Cons

- Young Driver Rates: Allstate is expensive for young drivers purchasing their own policy. Breakdown coverage for a family is still affordable if teens are added to a family policy.

- Customer Complaints: Customers have lodged a number of complaints against Allstate, a number that is slightly more than at other companies.

Extended Warranties vs Breakdown Car Insurance

You may wonder if car insurance pays for engine failure or other gear replacements. Many people confuse extended warranties with breakdown insurance, but they are not the same thing.

Learn more: Does car insurance cover a bad engine?

Warranties usually come from the manufacturer of the vehicle. It is their way of reassuring you that they have created a good product, one that you can count on, at least for a certain amount of time. Car warranties can cover everything from faulty shift gears to engine replacement. On the other hand, auto insurance is about helping keep the car on the road and protecting the owner.

However, if your car breaks down before you get it to the shop, you will have to figure out how to get it there. Then, you will need to call a friend or a taxi to shuttle you around until the car eventually gets fixed. Breakdown coverage can provide peace of mind for people who commute, families on vacation, or new or young drivers.

Depending on what type of breakdown car insurance is purchased for the vehicle, breakdown insurance can cover replacement rentals, towing, and the auto shop of your choice.

Dani Best Licensed Insurance Producer

Breakdown coverage provides help if your vehicle breaks down and includes roadside assistance as standard coverage. It’s available for most vehicles, including cars, motorbikes and vans. Your vehicle will be covered regardless of who’s driving. You will get help from a trained mechanic if your vehicle breaks down on the spot. If they can’t, they will help you get it in a garage.

For some people, having this kind of insurance is better than having to take the car back to the dealer if something goes wrong. If you have an older car, an extended warranty is not a possibility.

Who Should Purchase Breakdown Coverage

There are several reasons for purchasing breakdown coverage, including:

- Long Distance Road Trips: If you and your family decide to take a trip in your car, breakdown coverage will give you assurance and lessen stress (learn more: Best Car Insurance for Road Trips).

- Frequent Commutes: Driving your car over large distances multiple times a week can take a serious toll on your car. Breakdown coverage can provide you with an alternate means to get to work if your car breaks down.

If you aren’t sure if breakdown insurance is right for you, take a look at what breakdown coverage does and doesn’t cover below.

What Breakdown Insurance Covers

Your plan should cover mechanical repairs and problems with the electrical system or electronic devices on your car. Breakdown car insurance also covers high-cost items such as:

- Transmission

- Engine block

- Starter

- Master cylinder

- Alternator

- Water pump

- Carburetor or fuel injector

- Prop shaft

Breakdown coverage isn’t a one-time benefit. Most policies allow you to use your coverage on multiple cars anywhere from four to six times a year. You don’t even have to be the driver to qualify. That means that you can be the passenger in someone else’s car and still use your breakdown coverage to get help. Just to be clear, standard and premium breakdown coverage does pay for all qualifying car repairs.

If your car breaks down on the side of the road, a service person will assist you in identifying the problem.

If your car cannot be jump started or otherwise fixed easily, your car will be towed to the nearest convenient location.

You will ride along in the tow truck and either get dropped off at home or at the repair shop. Premium and standard breakdown coverage will also provide you with a rental car until the necessary repairs have been made.

If you use your breakdown coverage just one time, you will find that you have already saved money. The cost of a tow can be hundreds of dollars, and if you want the service person to provide on-site analysis, that will be an additional charge.

What Breakdown Insurance Doesn’t Cover

Prior problems, if any, will not be covered. Repairs caused by misuse or deliberate damage will not be repaired. Routine vehicle maintenance, such as oil changes and alignment, is not covered by breakdown insurance

For example, the following is not covered by breakdown insurance:

- Tune-ups

- Body work

- Brakes

- Batteries

- Wiper blades

- Spark plugs

- Suspension alignment

- Balancing the wheels

- Filters

- Lubrication

- Coolant and fluids

- Tires

The cost of this coverage will vary depending on the company and policy you choose. Many companies offer different plans at differing rates. You should compare carefully to make sure of what you are getting.

What one company calls the premium plan may not be the same as another company’s plan, so discuss coverage options and get breakdown insurance quotes from companies like Geico or Mercury before committing.

In addition to getting quotes directly from your favorite companies, you can also use a free comparison tool.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

How to Save on Breakdown Coverage

The first step in saving on breakdown insurance is to get a few quotes and compare what different insurance companies have to offer. If you are a high-risk driver who has a history of accidents or an unusually high number of claims, you might end up paying more.

Read more: Best Car Insurance for High-Risk Drivers

However, shopping at the cheapest companies for breakdown family coverage will ensure you get the best deal.

Car Insurance With Breakdown Coverage: Monthly Rates by Coverage Level & Provider

| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| AAA | $37 | $90 |

| Allstate | $65 | $164 |

| American Family | $48 | $121 |

| Farmers | $59 | $145 |

| Geico | $33 | $83 |

| Mercury | $35 | $84 |

| Progressive | $44 | $110 |

| State Farm | $40 | $93 |

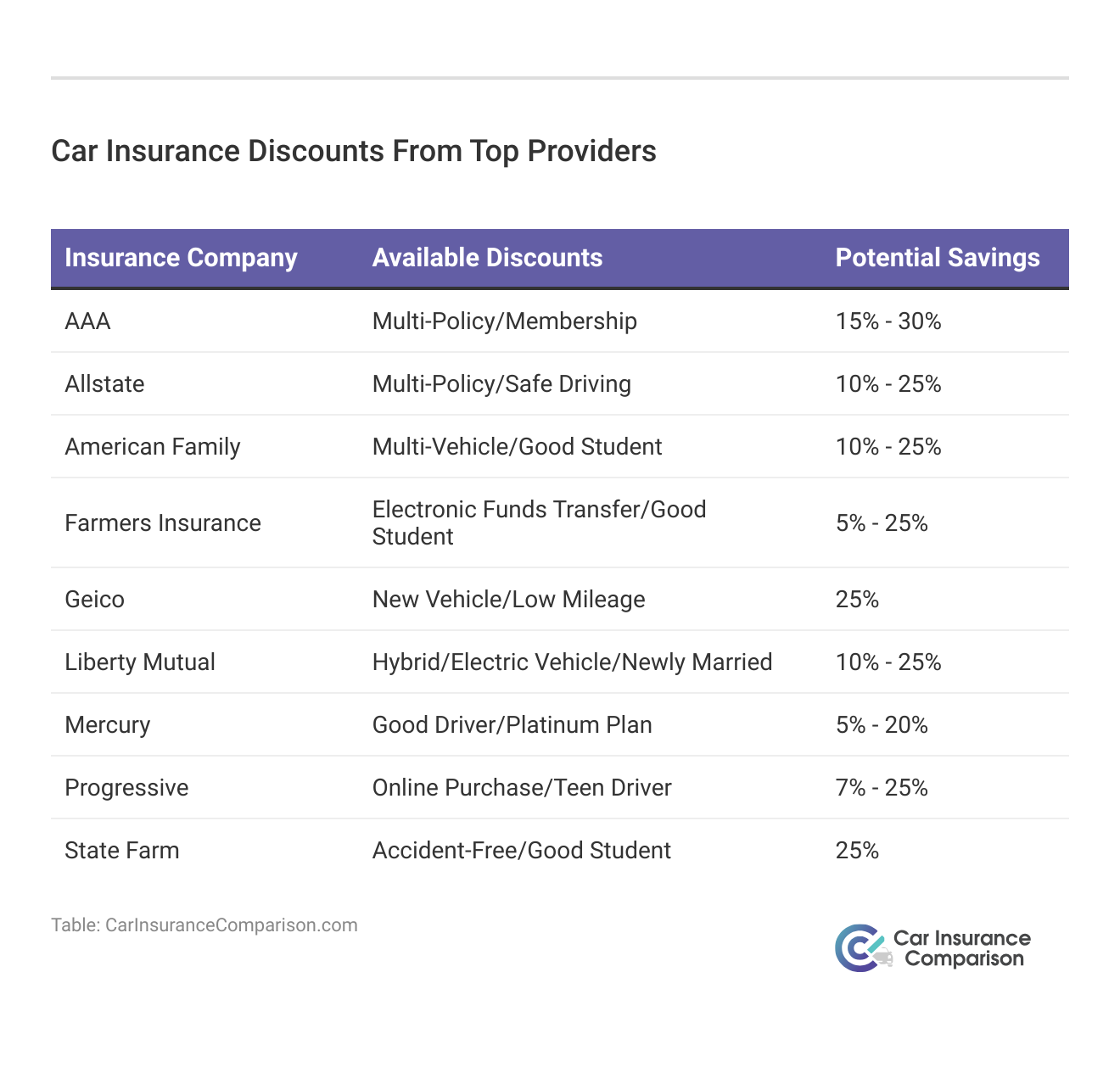

Once you’ve done a car breakdown comparison at the cheapest car insurance companies, check out what car insurance discounts they offer for additional savings.

Here are some other simple ways to save on your breakdown car insurance:

- Avoid Claims: Try your best to go at least six months without any additional penalties to qualify for a no-claims bonus discount; in the meantime, you can still get a breakdown coverage policy.

- Pay Upfront: Paying upfront for the entire year of breakdown cover is a sure way to save the most money.

You can also save lots of money on your breakdown insurance if you purchase multiple policies from the same insurer.

View this post on Instagram

Just because a company promises the most affordable rates doesn’t mean it’s the cheapest. The only way to know for sure is to compare quotes from multiple companies.

Case Studies: Breakdown Coverage

Not sure if breakdown coverage is right for you? Take a look at a few case studies where breakdown coverage came in handy.

- Case Study #1 – Road Trip Rescue: Sarah was on a cross-country road trip when her car broke down in a remote area. She contacted her insurance provider’s roadside assistance service. Since the mechanic couldn’t fix the car on the spot, they arranged for a tow truck to transport Sarah and her vehicle to the nearest repair shop (learn more: Does car insurance cover towing?).

- Case Study #2 – Commuter Convenience: Mark commuted to work every day, but one morning his car wouldn’t start. Luckily, Mark had breakdown coverage. The professional jump-started the car, allowing Mark to get to work. Later, Mark had his battery replaced at a local repair shop, and the breakdown coverage covered the repair costs.

- Case Study #3 – Family Vacation: Emma and her family were embarking on a vacation road trip. Unfortunately, their car experienced a mechanical issue while they were on the road. Emma immediately contacted her insurance provider’s roadside assistance, and they dispatched a mechanic to their location. The mechanic was able to fix the issue on the spot.

Breakdown coverage not only provides timely assistance but can also save drivers from unexpected repair expenses.

The Bottom Line: Cheap Breakdown Car Insurance

If you invest in a great breakdown coverage policy or travel car insurance, all out-of-pocket expenses associated with your car trouble will be paid. This means that if you are on a time-sensitive business trip and your car breaks down, your additional travel expenses will be paid.

Everyone doesn’t travel with the cash or credit necessary to pay for major repairs, so breakdown coverage can provide emergency cash assistance. Enter your ZIP code below in our free quote tool and receive quotes for breakdown insurance rates from companies in your area.

Frequently Asked Questions

What is mechanical breakdown insurance (MBI)?

Mechanical breakdown insurance (MBI) is an insurance policy that covers the cost of repairs or replacements for mechanical and electrical failures of a vehicle, typically after the manufacturer’s warranty has expired. It helps protect against unexpected repair expenses that can arise due to mechanical breakdowns. We recommend mechanical breakdown insurance for old cars that are prone to breaking down (read more: Cheap Car Insurance for Older Vehicles).

How does mechanical breakdown insurance differ from an extended warranty?

Mechanical breakdown insurance and extended warranties are similar in that they both provide coverage for vehicle repairs. However, MBI is typically offered by insurance companies and can be purchased separately from the vehicle purchase, while extended warranties are usually offered by the vehicle manufacturer or dealership and are often included in the purchase price. MBI may also offer more flexibility in terms of coverage options and providers.

How can you save on car insurance with breakdown coverage?

Here are some of the simplest ways to save:

- Compare quotes from multiple car insurance companies to find the best rates.

- Consider bundling your breakdown coverage with other insurance policies for potential discounts.

- Increase your car insurance deductible, if financially feasible, to lower your premium.

Maintaining a good driving record will also go a long way to helping you qualify for lower premiums.

Why do people choose car insurance with breakdown coverage?

There are several reasons for purchasing breakdown coverage, including:

- Peace of mind for people who commute, families on vacation, or new or young drivers.

- Protection against unexpected car breakdowns and expensive repair costs.

- Assistance in getting your vehicle repaired or towed to a garage.

- Availability of roadside assistance services.

Try our comparison tool today for free quotes for the best breakdown coverage.

What do you get with breakdown coverage?

Breakdown coverage provides help if your vehicle breaks down and includes roadside assistance as standard coverage. It’s available for most vehicles, including cars, motorbikes, and vans. Your vehicle will be covered regardless of who’s driving. You will get help from a trained mechanic if your vehicle breaks down on the spot. If they can’t fix it on the spot, they will help you get it to a garage.

What are the major benefits of breakdown coverage?

If you invest in a great breakdown coverage policy, all out-of-pocket expenses associated with your car trouble will be paid. Some major benefits include:

- Coverage for emergency repairs and towing services.

- Rental car reimbursement coverage until repairs are completed.

- Assistance with additional travel expenses in case of breakdowns during important trips.

- Peace of mind and financial protection against unexpected breakdown costs.

For most drivers, breakdown coverage will be worth the extra cost.

Are there any limitations or exclusions with mechanical breakdown insurance?

Yes, mechanical breakdown insurance policies often have certain limitations and exclusions. Common exclusions may include pre-existing conditions, wear and tear, routine maintenance services, cosmetic damages, and damages caused by accidents or negligence. It’s important to review the policy details carefully to understand what is covered and what is not.

How do I compare mechanical breakdown insurance policies?

When comparing mechanical breakdown insurance policies, consider the following factors:

- Coverage: Review the specific components and systems covered under each policy.

- Deductible: Determine the amount you would need to pay out of pocket for each claim.

- Limits: Check if there are any limits on the total payout or the number of claims allowed.

- Provider Network: See if the policy restricts you to specific repair facilities or if you have the freedom to choose.

- Additional Benefits: Look for any extra benefits included, such as roadside assistance or rental car coverage.

- Cost: Compare the premiums of different policies, keeping in mind the level of coverage provided.

You can compare quotes with our free tool to find the best mechanical breakdown insurance policies near you.

Who has the best roadside assistance plan?

AAA has one of the best roadside assistance plans on the market. You can get quotes online to see how much car insurance, including breakdown coverage, will cost (learn more: How do you get AAA car insurance quotes online?).

Who is cheaper, Geico or Progressive?

Geico is cheaper on average than Progressive.

Is Allstate cheaper than Geico?

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.